In this in-depth analysis we will explore Colombia’s broader economic landscape, the real estate investment market in Medellin, real-life property investment case studies, complete with detailed financials and I’ll also take you through my own experience of buying a penthouse in Medellin.

Whether you’re a seasoned investor or just curious about the potential of Medellin’s real estate market, join me in this comprehensive article to explore a world of opportunity with a real estate investment in Medellin.

Table of Contents

I spent a month in Colombia to investigate investment opportunities. This article is part of my intellectual exercise to gain a better macro-understanding of the country’s economic situation, and outlook.

To be fair, I started off my trip in the Amazon. So only after having hung out with my monkey friends and taking a few naps did I head out to dig deep into investments.

And then nap 1 and nap 2

Macro overview of Colombia

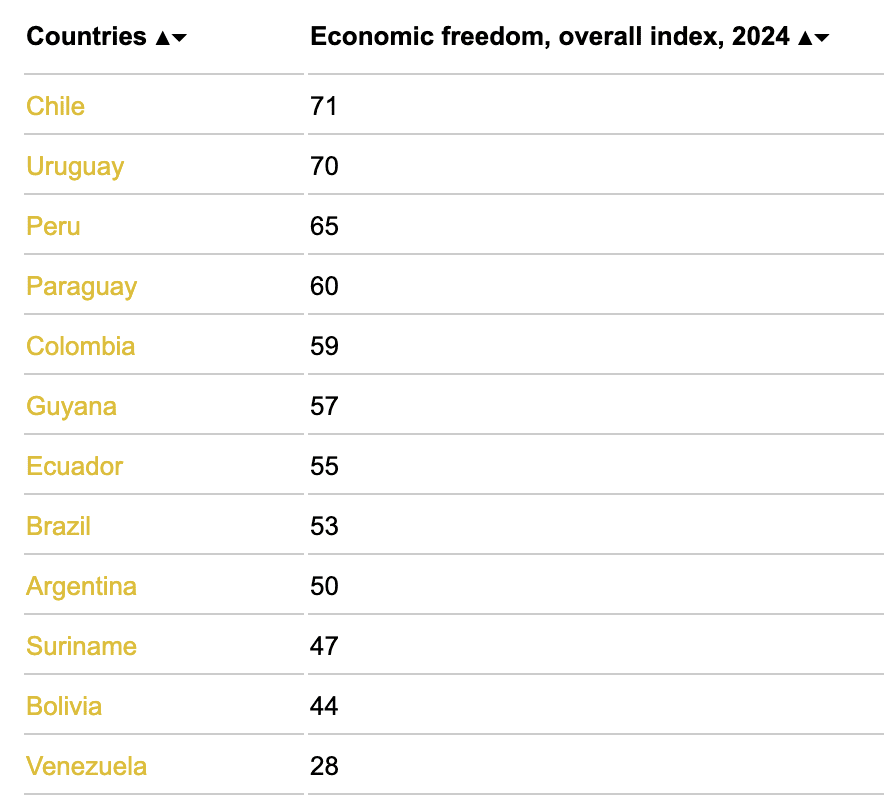

Colombia ranks decent within South America for economic freedom

The Heritage Foundation ranks Colombia fifth in South America in terms of economic freedom in its 2023 index, behind Chile, Uruguay, and Peru.

Colombia boasts attractive demographics for investors

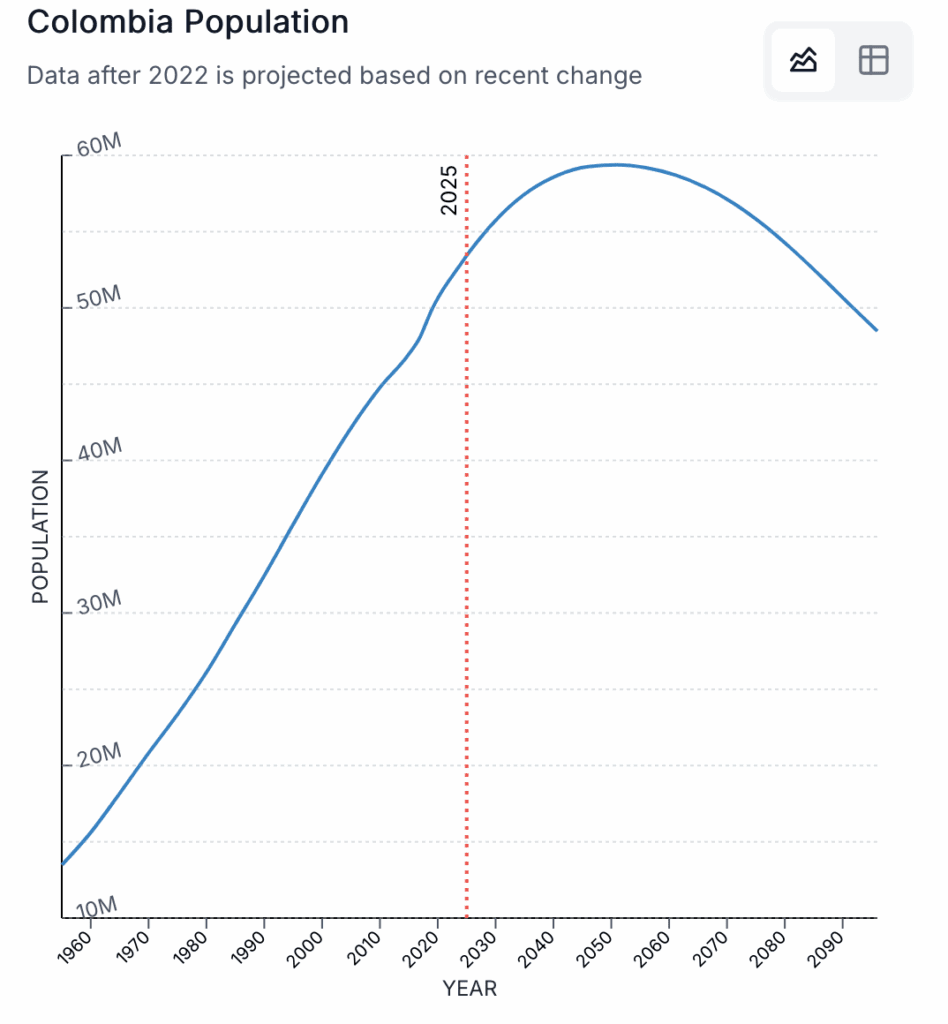

In spite of a fertility rate below replacement level (1.8 per woman), Colombia has an appealing demographic curve due to past fertility rates, which will result in the population expanding over the next 30 years.

A growing population is a key driver of growth. Also, Colombia is a magnet for immigration thanks to easy residency options. The country currently has almost 2 million socialism-fleeing Venezuelans living within its borders.

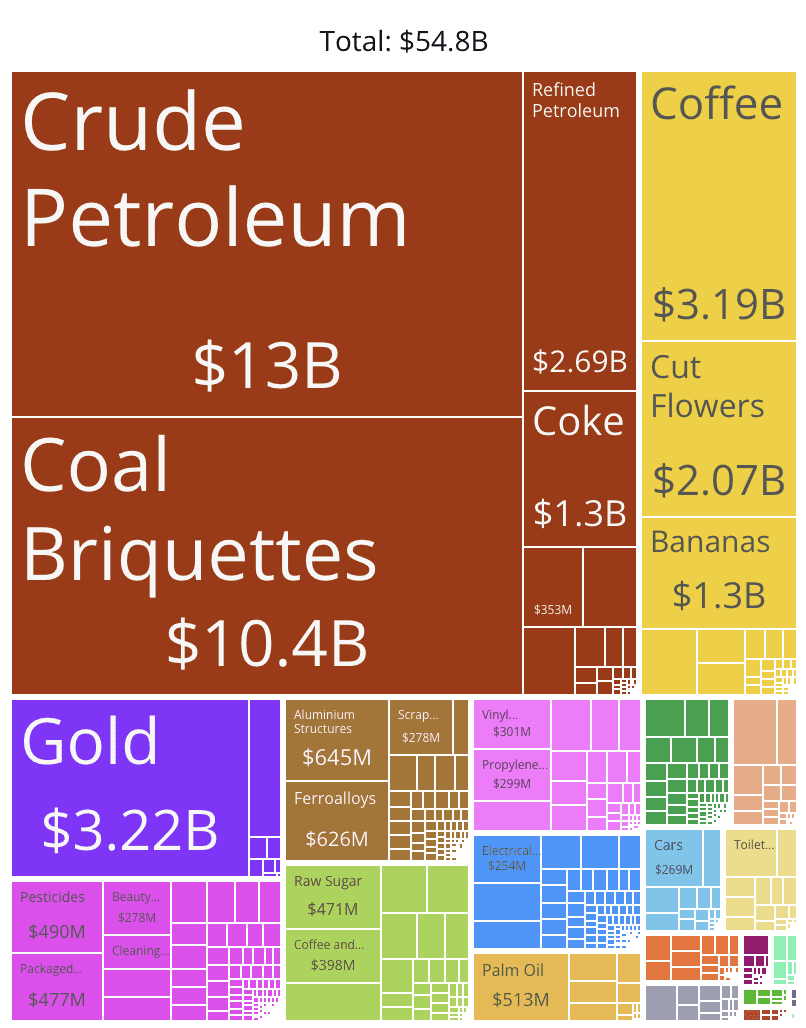

Similar to most of Latin America – a relatively unsophisticated economy

In spite of being one of Latin America’s freest economies, with a local market of over 53 million people, and with access to both the Caribbean and the Pacific, Colombia’s export profile is relatively primitive. It essentially pulls things out of the ground and exports them, with minimal local value creation. Add tourism, and these are the main exports.

Non-commodities exports are growing fast, which is great. However, if you are of the view that we are on the cusp of a commodities bull market, I don’t mind seeing such a commodities-heavy export profile. It does point however to a potentially very cyclical economy.

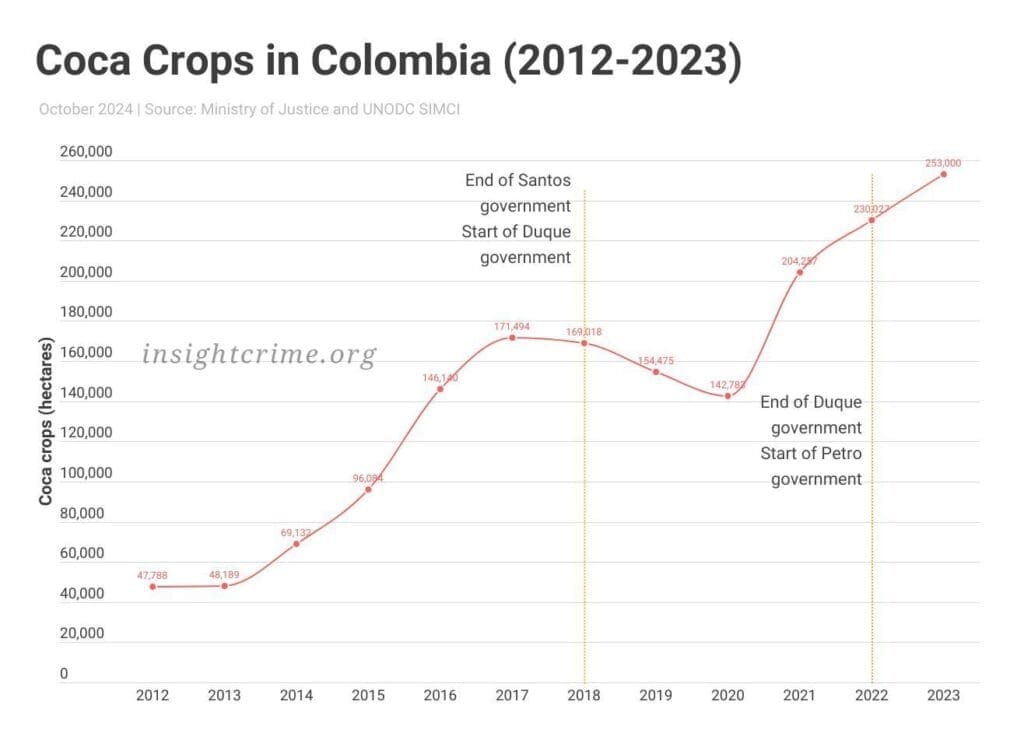

Booming coca leafs and processed cocaine production

According to Bloomberg Economics, oil and cocaine are battling for the top spot in terms of Colombia’s exports.

I know it’s a little odd to mention this as part of a macro analysis, but the reality is that drug money is generally quite positive for a country IF the drug habit is exported, which it mostly is in Colombia. All this coca and processed cocaine exports are high value and money that go straight into the economy. Drug money is typically a big driver for the local real estate and construction industries.

Remember, importing a drug problem such as in the US or Europe is a problem, but exporting a drug problem is not.

A relatively stable macro picture emerges

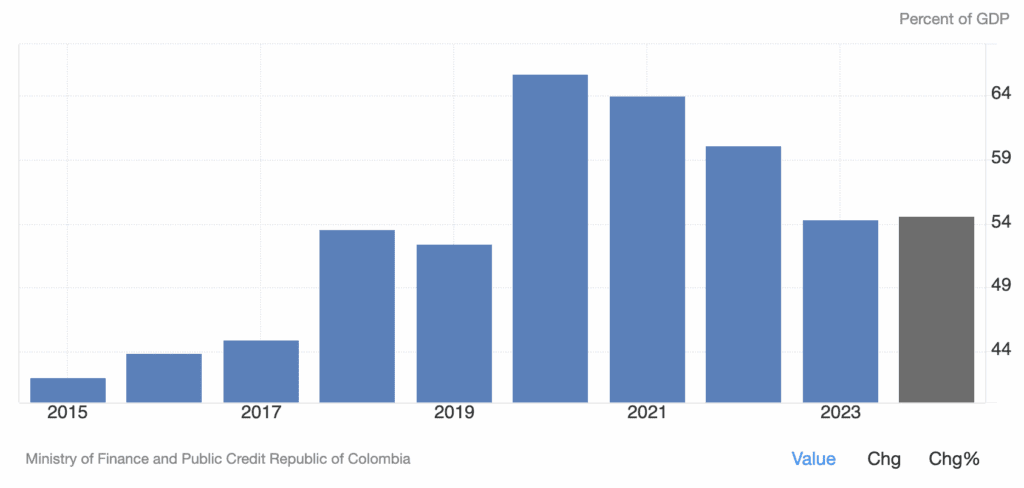

Colombia’s current account deficit is small and stable, foreign direct investment has been stable, and the debt to GDP levels remain at very reasonable levels.

A move to the right will be a big catalyst for Colombia

President Petro was elected in 2022 on the thinnest of margins.

It’s true that the optics were not favourable at all. During his campaign he talked about wealth redistribution, higher taxes, and even a ban on oil, gas and mining exploration, which are crucial to the local economy.

He made a few reforms that were a net negative, such as social security reforms, but overall the volatily of the market that his election triggered was not justified. He didn’t achieve much, and if anything the macro situation, as shown in the numbers previously, was stable.

Petro’s reign is nearing its end. The Colombian people are not impressed with him and delivered his party a big loss in the October 2023 local and regional elections by electing the business-friendly opposition.

The upcoming presidential elections in 2026 are expected to give the business friendly center-right a big win which will be a big boost for the investment climate.

Is Colombia a good investment?

The first objective is to find a Medellin real estate investment that will not just beat currency depreciation, but also bring attractive returns in hard currency equivalent

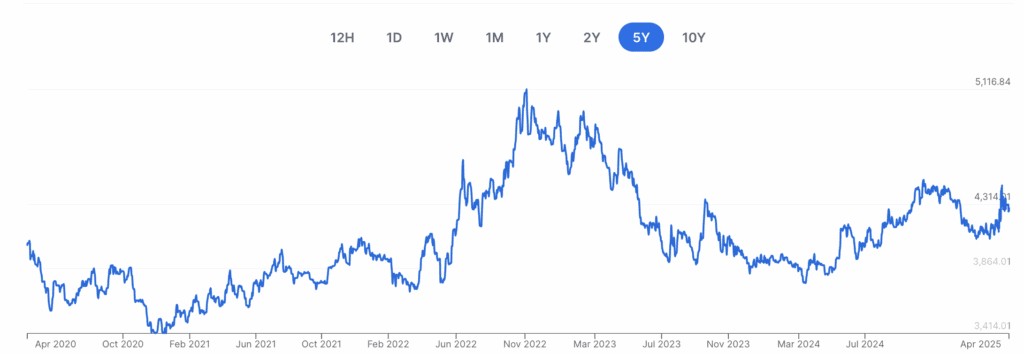

This chart of the Colombian peso is what your investments will be racing against, and hopefully be exceeding.

What is important to note is that when you invest in core Bogota or Medellin real estate, the reality is that real estate prices track the USD as both buyers and sellers in such neighbourhoods think in dollar terms. When the currency devaluates, sellers typically raise their COP prices accordingly. If they don’t it offers an arbitrage opportunity.

It’s one of the core theses for investing in core real estate in Medellin – its inherent hedge against COP devaluation.

Why make a real estate investment in Medellin?

Though Bogota is the capital city, Medellin, Colombia’s second city, is by far people’s favorite place to live in and visit. Its 2.5 million inhabitants are blessed with “eternal spring” weather which almost never requires one to wear a sweater, nor to use indoor heating and air conditioning.

Medellin has a seen a true surge in foreign tourism thanks to sharp marketing, a unique lifestyle, and affordability.

Not only is the city itself very pleasant with a wide variety of dining and drinking options, but the surroundings are known to be breathtaking as well.

Unsurprisingly, Medellin comes out top in various worldwide rankings of best places in the world to be a digital nomad, to backpack, to retire, and even to conduct medical tourism.

Medellin has a strong and diversified economy

This is a huge plus when making a real estate investment in Colombia.

Medellin is not just about tourism. When you walk around Medellin you can tell that the city does not cater exclusively to tourists unlike Cartagena. The locals go about their lives in various industries.

There are many mines in the area surrounding Medellin, and the city has been successful at attracting foreign FDI in the tech space. It has even been dubbed the “Software Valley“.

Major tech players such as Alibaba and South American giant Mercado Libre have invested in Medellin.

Medellin is the most dynamic city in Colombia from a local economy point of view. Locals love investing here as well. Unlike Cartagena, it is not a city that is entirely dependent on tourism.

Medellin Real Estate Investment Market

What is crucial to understand for people who want to make a real estate investment in Medellin, is that because the COP depreciates over time, it is hard to make substantial capital gains in USD terms. The play in Medellin is:

- The absolute value you pay. The average price per square meter in Medellin currently stands at around 6 million COP, which is roughly $1,400 per m2 ($130 per ft2). This is an attractive price for such an increasingly world-class destination. Smaller units (below 80m2) command a premium; higher end neighborhoods such as Laureles and Poblado also.

- In Poblado you’re looking at an average of 8 million COP ($1,900 per m2 or $176 per m2)

- In Laureles you’re looking at an average of 6.5 million COP ($1,500 per m2 or $140 per m2)

- The high rental yields / capitalization rates that can be obtained in some segments of the market.

The local market is relatively uninteresting. When speaking to agents and checking prices online, it becomes clear that gross rental yields, on the long term, unfurnished, local market stand at about 4-5%. The real money is to be made by renting to foreigners.

I generally dislike targeting foreigners, as it is a market that is more fickle

Destinations are cool one day, and then not so much a few years later. Or people realize the opportunity and the segment quickly becomes overcrowded, thus depressing yields. This is extremely common in markets where agents tell you to target “embassies” and “diplomatic” staff.

However, in Medellin’s case, I am bullish on this segment.

American digital nomads will be the driving force for strong real estate rental yields in Medellin

The reality is that a few hours flight away from Colombia is a massive market of high-earning Americans who simultaneously realized a few things:

- They can work almost entirely remotely.

- They can work from abroad, thus leaving behind an increasingly toxic environment. This perception of toxicity applies to Americans of all political stripes.

- They can live a cheaper, nicer life abroad and in many cases can save on taxes if structured properly.

Though there has been a trend of “back to office” in Western markets, the reality is that work-from-abroad is still a very recent phenomenon and it will increase its share amongst work-from-home types.

Americans have high standards for housing, can afford it, and don’t mind paying

I don’t mean to come across as rude, but I need to make a clear comparison between European digital nomads and American ones. I don’t have exact data to back it up, but rather many data points from having met hundreds of digital nomads as I travel around the world. People like to open up to me about their personal finances :).

European digital nomads typically earn €2,500-€3,000 after taxes. For Europe, this is a decent salary. Most are content with these figures.

American digital nomads in contrast would probably not get out of bed for such an amount ($3,000-$3,500 per month). Earning $6,000-$7,000 per month is fairly standard, as well as 6 figures.

Also, let’s face it, Europeans are often budget-conscious, and have traditionally lived in housing that is less opulent than Americans’.

The result is that Americans have the means, the “want”, and the “need” to pay for superior housing.

A limited supply of well-designed, well-managed, and furnished apartments makes for an ideal combo of relatively low per m2 pricing, and high rental rates for digital nomads who rent for a few weeks to a few months at a time.

First-time American digital nomads will stick to the name brands, which is bullish for making a real estate investment in Medellin, Colombia

Medellin is one of the world’s top digital nomad destinations, along with other places such as Chiang-mai, Bali, Budapest and Mexico.

Medellin will be a huge winner, because it’s not just marketing, but actually really nice too. I must admit that I came here with low expectations. Being well traveled, maybe I became a little arrogant thinking along the lines of “if it’s that popular it’s can’t be that nice. It’s probably basic”.

I was wrong. Medellin and its surroundings are lovely.

And this is why I travel full-time looking at investments worldwide, because traveling so often exposes how wrong I am.

To top it off…

Medellin airport is undergoing a true boom

Medellin is becoming a major regional air transport hub. Internationally, there are many flights to Miami, as well as to Lima, Mexico city, Cancun, Orlando, Buenos Aires, Sao Paolo, Santiago de Chile, etc.

All of these connections will bring in more tourism, more business, more nomads and Medellin will increasingly become a playing ground for those with money.

Rio Negro airport (Medellin airport) saw its 2022 domestic traffic grow 37% versus pre-Covid 2019.

Its international traffic went up an astonishing 53% over the same period. Just imagine the impact on rentals.

Colombian tourism in general grew 25% in 2023 vs 2022, and Medellin is now the second destination ahead of the coastal city of Cartagena. This is a big deal.

In which neighborhoods should you invest?

Two neighborhoods are particularly investable when considering a real estate investment in Medellin, Colombia.

El Poblado

Most the area is comprised of private complexes, whether composed of individual homes or large buildings. This is also where all the offices and the best malls are located.

Parque Lleras and Provenza

Technically these neighbourhoods are part of El Poblado, but they are so notorious that they deserve a special mention. Essentially, they are where most tourists spend time, and where wealthy locals like to go eating and partying. This map below is crucial for you to understand.

“Girls”: This is the area with a lot of prostitution. Walk around there in the evenings and girls (mostly) litter the streets and pack the girly bars. Small-time drug dealers abound as well. If you’re into this that’s fine, but I’d be very wary of buying real estate in this area due to the type of clientele it might attract.

“Cool Bars and Restaurants”: This is the really cool area. Tons of exquisite restaurants, cool bars, and nightclubs. The wealthy locals want to be seen around here. Expands a bit north as well.

The real challenge is that during the day it is not too visible, so make sure you go for an evening walk before making an offer. One street might have cool restaurants and great vibes, while the next street could be a sex den.

Overall though, rental demand in this area is extremely high.

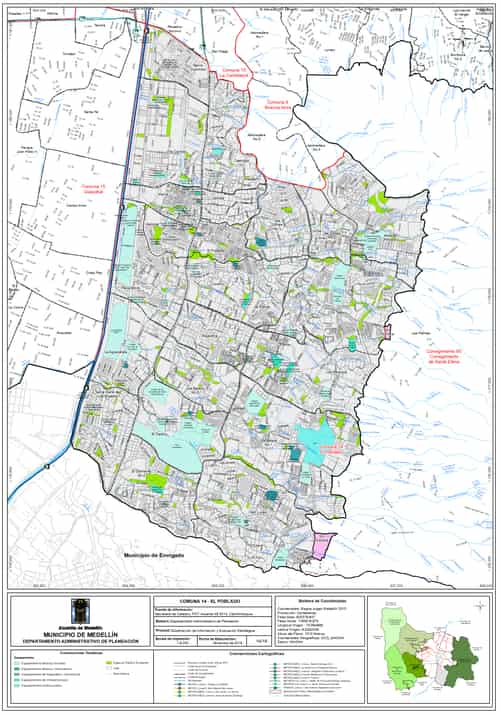

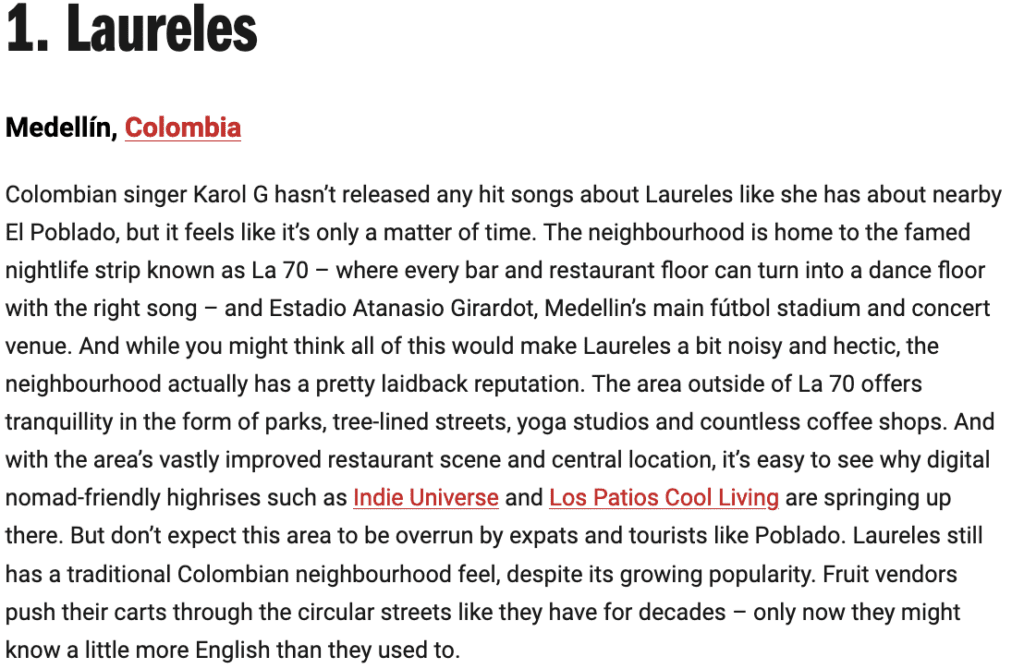

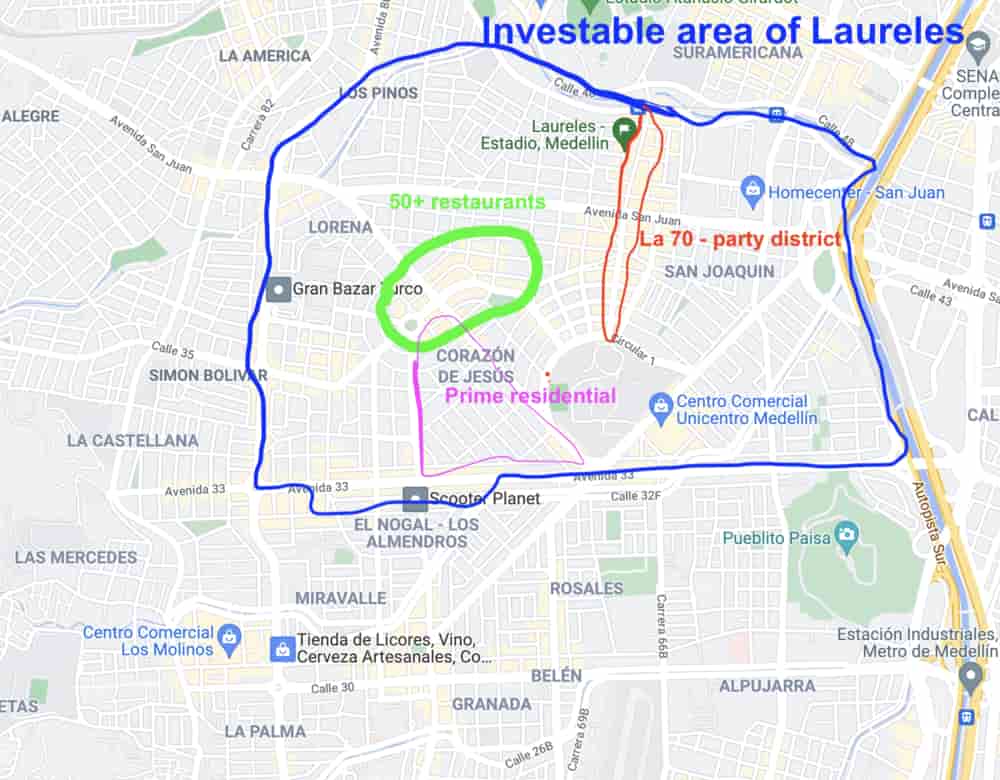

Laureles

A bit farther to the north-west from El Poblado, or a 15 minute cab-ride away, is the gentrifying neighborhood of Laureles which was recently crowned a “top 40 coolest neighborhood in the world” by Time Out magazine.

Foreigner-wise, when people stay for not too long in Medellin, they typically tend to stick around Parque Lleras and that area. However, people who stay in Medellin for a few months often prefer to stay in Laureles because it is better value, calmer, more walkable as it is flat as opposed to hilly in El Poblado, and has equally good amenities.

I personally like this area a lot, and it comes at a 20%-25% discount to El Poblado.

However the city is building a lot of public transport in this area. Medellin is widely known in Latin America for having some of the best public transport. This will further catalyze Laureles as a central neighbourhood.

What are the rental returns of real estate in Medellin?

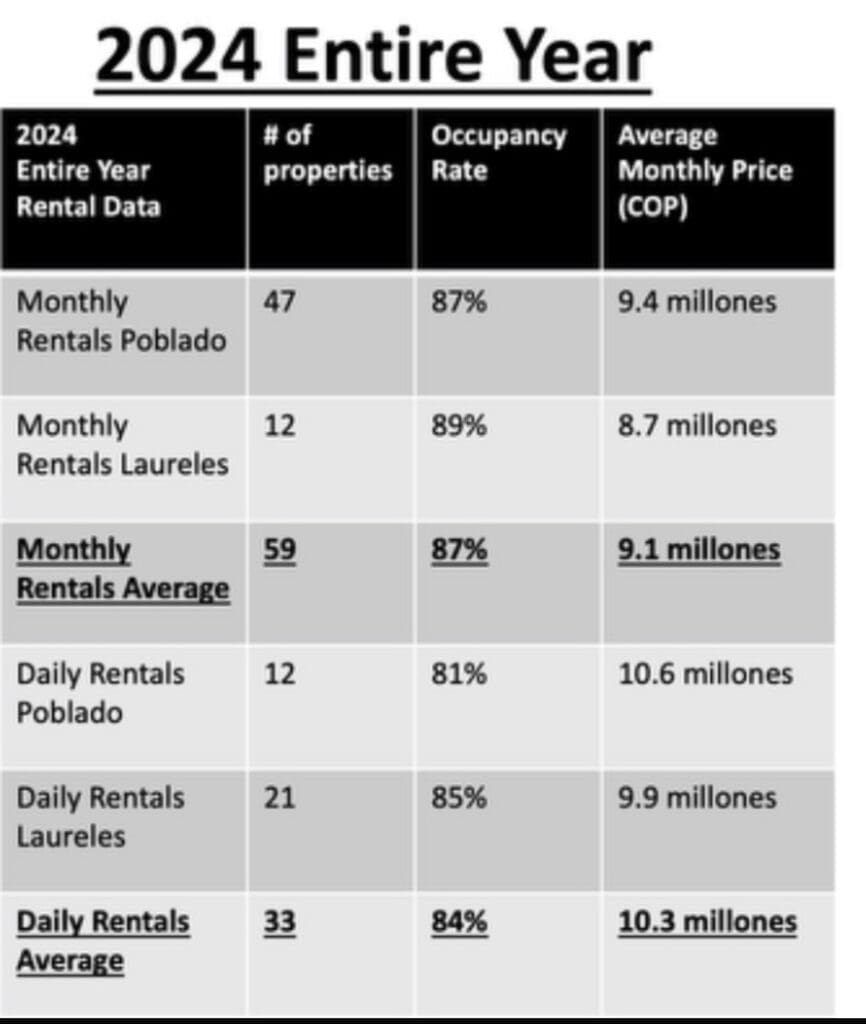

Mauricio my realtor in Medellin also does property management. His company manages close to one hundred properties on both the short term and long term markets.

Here were his statistics in terms of occupancy for 2024.

These are very high occupancy rates compared to other markets in the world. However it must be mentioned that though tourism is booming, so is construction. New stock of rentals is coming into the market which may have a negative impact on pricing and/or occupancy rates. If it does happen, it will be from a base of high rental yields and occupancy rates.

A concrete example of a Real Estate Investment in Medellin, Colombia

This is an actual case study of a lovely apartment that Mauricio, my Swedish real estate agent here in Medellin, helped a friend of mine buy and rent out. He essentially managed the project, and has access to all the numbers.

This is why you follow The Wandering Investor, because of on-the-ground research such as this.

This particular apartment did not require a renovation job, but these typically cost about $500 per m2 ($46 per ft2) depending the the depth and luxury of the remodeling. As part of his services, Mauricio connects his investors with the right interior designers, architects, and project managers.

Do note that my friend decided to turn the third bedroom into a home office, with two desks, high-end chairs, and monitors. He is targeting the digital nomad market.

Here is the exact breakdown. We are assuming a conservative occupancy rate of 83%. In reality, it has been over 88% using contracts of a month up to a year. All the actuals are from Mauricio’s numbers. I just changed the occupancy rate, and added relatively high maintenance costs.

Essentially, there is buffer in these numbers.

| Purchase price | $218,000 |

| + Purchasing costs 2% | $4,360 |

| + Exchange fees (0.6%) + financial transaction tax (0.4%) | $2,180 |

| Total purchase price | $224,540 |

| Renovation costs | $0 |

| Furniture | $8,300 |

| Total investment | $232,840 |

| Monthly rent of $2,500 (based on actuals) x 12 = gross yield of 12.9% | $30,000 |

| – Vacancy of 17% (in reality Mauricio has a vacancy rate of 12%) | $5,100 |

| = Yearly rent | $24,900 |

| – Yearly HOA (Home owners association) – $170 per month | $2,040 |

| – Yearly Property tax | $1,064 |

| – Property management 10% of rent | $2,490 |

| – EPM (electricity, water, sewage) – about $150 per month | $1,800 |

| – Internet – $35 per month | $420 |

| – Maintenance (assume 5% of rent) | $1,245 |

| Net, net yearly rental income | $15,841 |

| Net, net rental yield before tax | 6.8% |

Taxes on rental income in Colombia

I wish I could write more confidently here. I spoke to a few accountants, as well as agents. Everyone tells a different story.

- Some accountants say you should pay a 35% tax after expenses.

- Some say that you must pay based on the normal Colombian income tax rates, which would mean that the overall tax would probably not be very high as the first brackets are low (if you have one property).

- Others claim that the property manager must withhold 20% on payments made abroad and that no income tax is due if this methodology is used.

All sides of the story are very confident in their method, and back it up with legal analysis. In practice, it would appear that few people, including foreigners, pay much tax at all, whether they declare or not.

If I were to make an investment, I would simply choose an accountant I am comfortable with, that seems to make sense, and not stress too much about it. I’d also check with my country of tax residency, and ask my accountant back home to check which method would be best for me to use so that I could benefit from double tax treaty benefits if there are any.

I like Medellin so much, I bought a Penthouse in Laureles

As a free bonus, a real estate investment in Medellin qualifies you and your family for a long term visa in Colombia

If you spend 350 times the minimum wage (about $93,000 at an exchange rate of 4,000 COP to the USD) on real estate in Colombia, you and your family are entitled to a 3 year migrant visa.

To maintain the visa active, you must show up for at least a day every 6 months, which implies regular trips to Colombia if you don’t plan on living there. You can renew the visa as long as you still hold the property. At year 5, you can apply for full residency.

I sat down with Alan, a US lawyer based in Colombia. You can get more information on how to obtain residency in Colombia by clicking on this link.

Video: A Real Estate Investment in Medellin, Colombia. Includes Capitalization Rate Calculations

Conclusions on making a real estate investment in Medellin, Colombia

I travel around the world full-time looking for investment and immigration options. I must say that I came to Medellin with low expectations because it had been so well-marketed. The reality is that there is a strong market for mid-term rentals. The overall price per m2 is affordable for a vibrant city of 2.5 million people, and the rental yields are attractive.

Due to a number of macro factors I certainly would not go all-in Colombia, but having a bit of exposure to this market is a great geopolitical hedge in a world of rising tensions.

If you need a good lawyer for your real estate transaction in Colombia, feel free to contact my lawyer Alan.

My Real Estate Agent in Medellin

Contact Mauricio to learn more about buying real estate in Medellin, Colombia. Mauricio provides excellent market insights and promising deals. He stands out for not only selling real estate but also managing rentals for real estate investors, renovations and ensuring accountability. This approach is key to setting realistic expectations, avoiding situations where a promised 12% yield turns into just 5%.

Contact Mauricio to Invest in Medellin

Services in Colombia:

- Real Estate Lawyer in Colombia

- How to obtain residency in Colombia

- My favourite real estate agent in Medellin

- My favourite real estate agent in Bogota

Articles on Colombia:

- Medellin, Colombia, Real Estate Market: 2025 Investor Guide

- Bogota Real Estate Market: 2025 Investor Guide

- Making a Real Estate Investment in Cali, Colombia – the next frontier?

- Penthouse Investing with High Yields in Medellin

- Actual Capitalization Rates / Rental yields in Medellin

- Double-digit yields in Bogota for Airbnb multifamily units

- Afternoon trip to a Finca for sale near Medellin – with ROI numbers

- I bought a Penthouse in Medellin, Colombia

- Cap rate analysis of condo in Medellin – decent real estate rental yields in El Poblado

- How to get Residency in Colombia in 2025

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Great content! I’m a digital nomad and looking for international real estate investments. Glad I found your site and I look forward to more research.

Thank you 🙂

Thank you well informative and written, answered most of my questions.

Great info, thank you!

Very good article – I have family in Medellin and spend time there. Your facts are well researched and your observations accurate.

Great breakdown, thank you!

Do you take the depreciation or appreciation of the property into account? It’s probably hard to make an estimation given all the variables, but can you say anything about that?