Tulum’s real estate market is making headlines for crashing in recent years, with prices down, desperate sellers and a substantial oversupply in the real estate market. Despite this, there is still a lot of construction happening in town with appealing architecture.

But, is Tulum real estate a good investment or is it now a financial trap? We’ll explore in detail the oversupply issue with updated analysis, neighborhood breakdowns, ROI data, and buying strategies to uncover the best opportunities for investors in 2025.

Table of Contents

Mexico’s Economy: Macro Overview

Mexico has attractive demographics

People tend to forget that Mexico is an absolute behemoth population-wise, with its 131 million inhabitants. It is the second most populous Latin American country after Brazil, with 212 million people, and well ahead of the third, Colombia, with 53 million people.

A large economy that has been growing steadily, but somewhat sluggishly

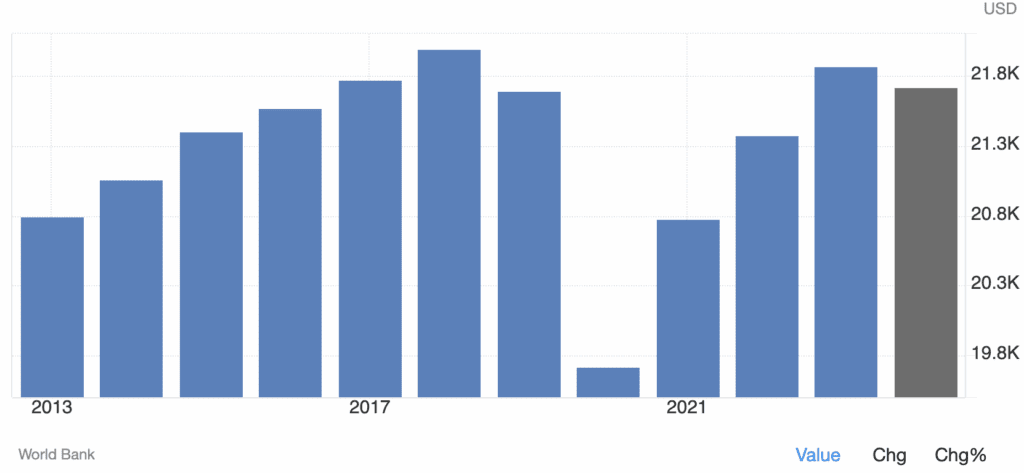

The most objective way to look at the country’s growth is on a per capita PPP basis, to capture how much people are really gaining from GDP growth.

These numbers are decent, but in all honesty, they are a bit disappointing when considering the (mostly) free trade agreement with the US and Canada. A massive country with such a surplus of affordable labor, should objectively be doing better.

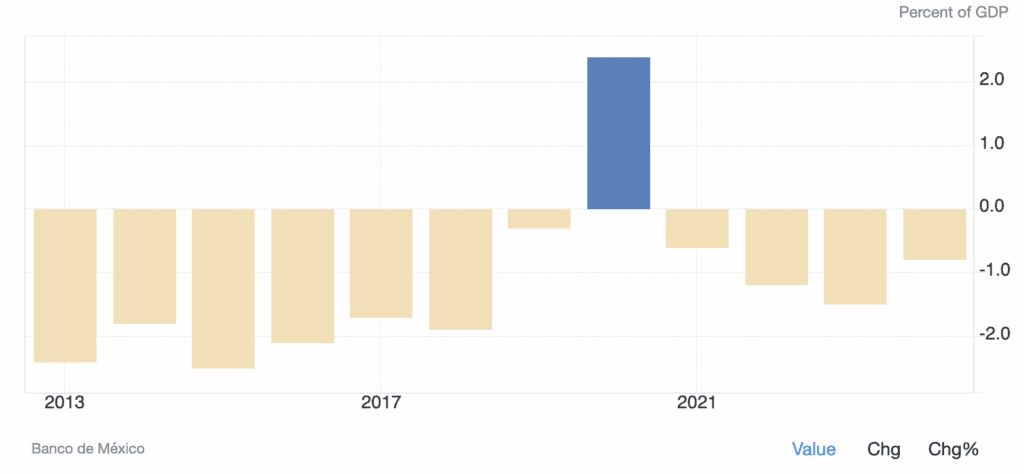

A slightly disappointing current account for such a large manufacturer

Again, with the free trade agreement with the US, Mexico should be doing better.

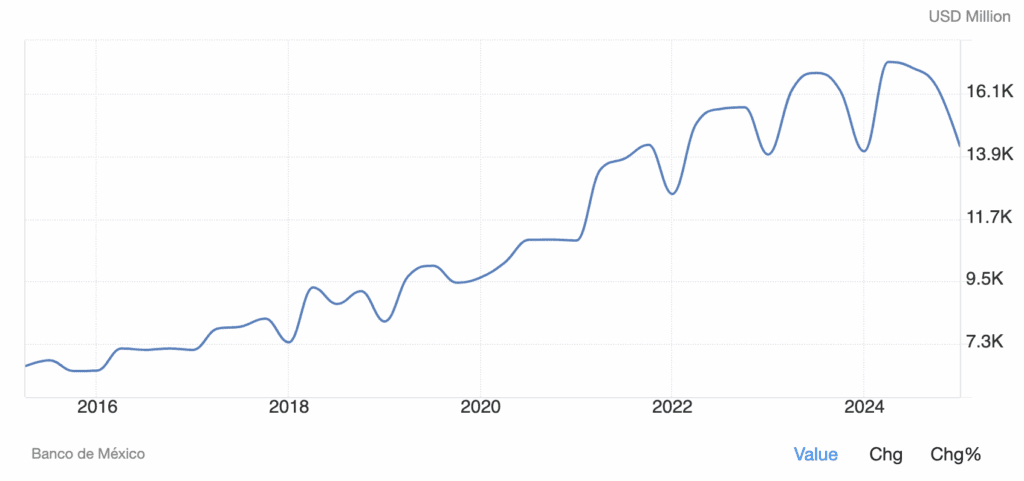

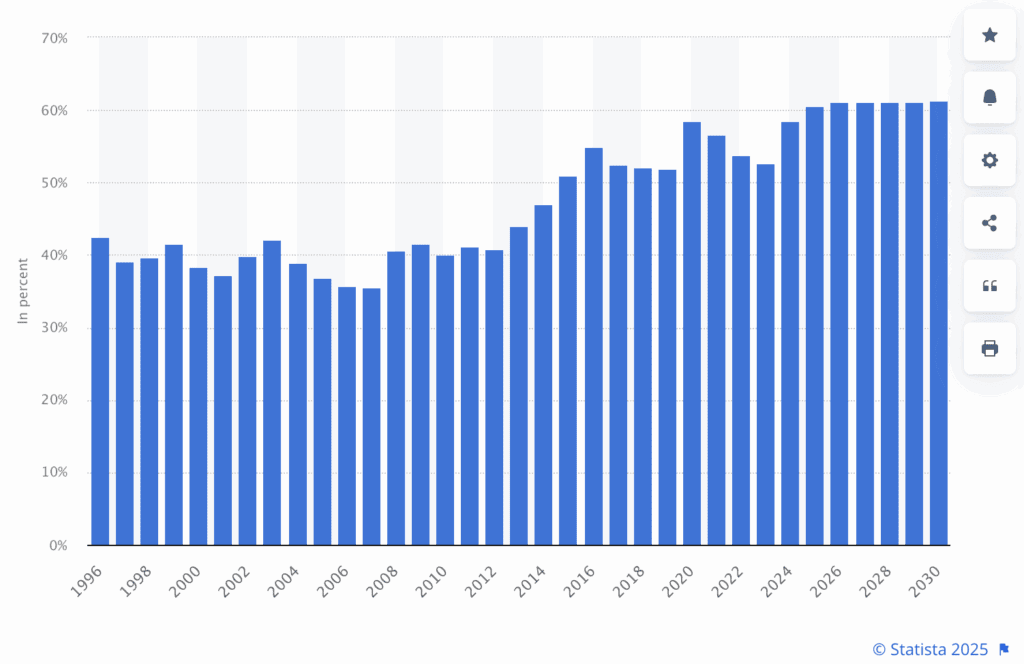

This is in spite of booming remittances

Remittances from Mexicans working in the US represent 4% of Mexican GDP, and are a lifeboat for many families. Uncle Juan in Oakland provides more of a safety net than the Mexican government does. It also demonstrates the industrious work of Mexicans in the US, considering the amount of Mexicans did not grow by such an amount proportionally over time.

Clearly, Mexicans in the US have been gradually moving up the food chain in terms of income.

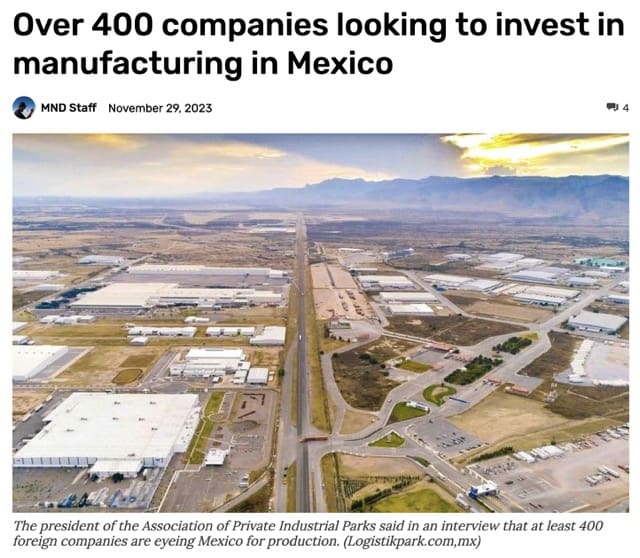

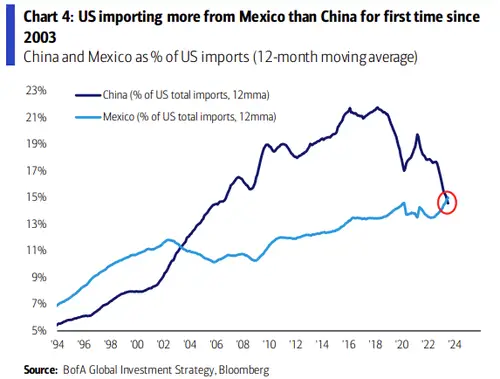

Near-shoring in Mexico, a bedrock of the Mexican middle class

The world is bifurcating between East and West, with a third, more neutral block in-between just as during the Cold War (Mexico is in this latter block).

The inevitable result of all of this drama is that re-shoring will become a top priority for Western companies and governments. After outsourcing most of its production of goods to China over the past 20 years, the US finds itself in a situation where it is choosing to re-shore production and reduce its exposure to China.

Western companies, whether they like it or not, will have to diversify away from China. A lot of this production will go to the likes of Vietnam, etc. But an obvious candidate is just across the border. Mexico will be in a prime position to massively benefit from this de-globalization and re-shoring trend.

This is a net positive for the Mexican economy, and it will translate into more local tourism internally and investment in the local real estate sector.

Trump’s election is a negative for Mexico

Trump is clearly triggered by this here:

Trump is known for his Mexico bashing. The next four years will be tough for Mexico, especially with the current left-wing administration in place, though president Sheinbaum has for now managed the relationship with Trump quite well. Trump will most likely make life tough for Mexico, which will negatively impact the country’s economy and incoming foreign investment.

Mexico elected a government in favour of more regulation

In the presidential elections left candidate Claudia Sheinbaum was elected.

She ran on an anti-mining, higher tax and greater state involvement platform.

Having said this, Mexico is a complex country. Just as the government does not have the monopoly on violence (which it shares with cartels), it also does not completely control the economy.

However she has made some very expensive commitments such a massive scholarship program and government price fixing of basic goods.

The state owned oil company, which has been chronically mismanaged by all Mexican governments, is in real trouble. Its liabilities total $120 billion, which amount to over half of the country’s foreign exchange reserves of $200 billion.

Mexico used to be a net exporter of energy, but is now a net energy importer with no viable plan to change this.

Mexico is a country with decent government finances for now

In a world where Western government debt to GDPs ratios hover around 100%+, Mexico’s figures are quite sobering.

Mexico has an economy that will muddle through, but with pockets of excellence

I don’t expect explosive growth in Mexico, just the usual below potential, yet steady growth that Mexico is used to. The policies of the current government, and the election of Trump will just lower the growth of Mexico but are unlikely, unto themselves, to lead to any short-term recession, barring a worldwide slump.

The pockets of excellence driving the Mexican economy will undoubtedly be in the North close to the US border in wealthy cities such as Monterrey, which benefit in full force from the near-shoring trend.

However, I believe that Playa del Carmen, Tulum, and Puerto Vallarta will also be key beneficiaries as the rising middle- and upper-classes of Mexico seek lifestyle housing, investment properties, and themselves spend time in the nicest resort/beach towns of Mexico.

The Tulum real estate market crash

During the pandemic there was a massive boom in Tulum as the Riviera Maya was one of the few places in the world where things remained open with relatively limited restrictions. This led to landlords making a killing because the inventory of housing back then was quite limited.

Naturally, this led to many developers starting projects. Too many.

Fast forward a few years and while tourism in Tulum far exceeds pre-pandemic figures, it has not matched arrivals during the Covid-era peak. This combined with the increased supply of real estate means rental yields have absolutely crashed. In turn, investors are increasingly skeptical of Tulum real estate for rental returns, and are refraining from investing.3

The construction industry in Tulum

Even though one can see a lot of construction in Tulum, the reality is that sales are not keeping up with the amount of units developers have put on the market in pre-sales . Therefore:

- quite a few developers have gone bankrupt

- many are in arrears, are late with construction, and could very well go bakrupt in the next year or two

- a few developers are still doing ok because of good, unique projects and a track record

But it doesn’t change the fact that there is oversupply

There is a clear case of oversupply in the Tulum rental market. Supply is still increasing faster than tourism. This glut of supply could very well last for a few years.

The result is that rental yields have absolutely crashed. Condos are hard to let both on the long-term and short-term markets due to an ongoing price war and supply glut. Only in some segments, very high-end villas, can one get net rental yields of about 8%. Otherwise, expect your rental income to just cover your expenses.

Luxury villas in Tulum are performing decently on the rental market as there is limited supply. Tulum airport is attracting a high-end clientele that formerly did not want to hassle with a two-hour drive from Cancún airport.

The resale real estate market in Tulum

Buying condos on the resale market is now a nice opportunity. Investors who had bought Tulum real estate being promised very high returns by developers are now disappointed. Many are looking to sell.

The problem is that developers offer high commissions to agents, and selling off-plan is easier than dealing with a resale market transaction, so agents rarely orient their clients to the resale market, especially because the commissions are much smaller.

But if you work with a Tulum realtor such as Luigi who is willing to find resale market listings, there are great deals to be made as the buyers are few, and the sellers keen.

The play here is for two types of investors:

- If you are a lifestyle investor, you can find great deals on the secondary market without having to wait for the construction of a new condo.

- If you are a long-term investor, you can buy cheap, rent out to cover expenses, and wait long term for the market to improve thanks to multiple catalysts in place. It won’t happen overnight. Objectively though, if you are a pure investor Playa del Carmen real estate is a better option.

5 Long-Term Catalysts for the Tulum Real Estate Market

Again, this real estate crash could last a few years. I am not trying to make the case that things are about to pick up anytime soon. The following are just long-term catalysts that will help Tulum recover in the long run after it has solves its current issues.

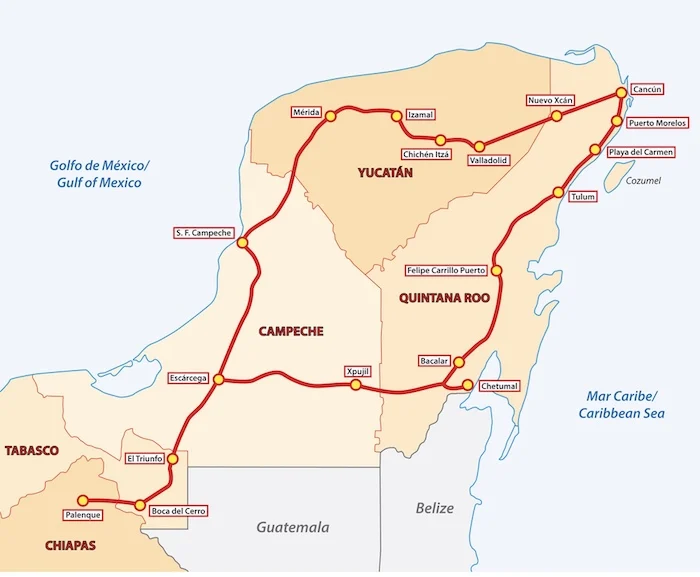

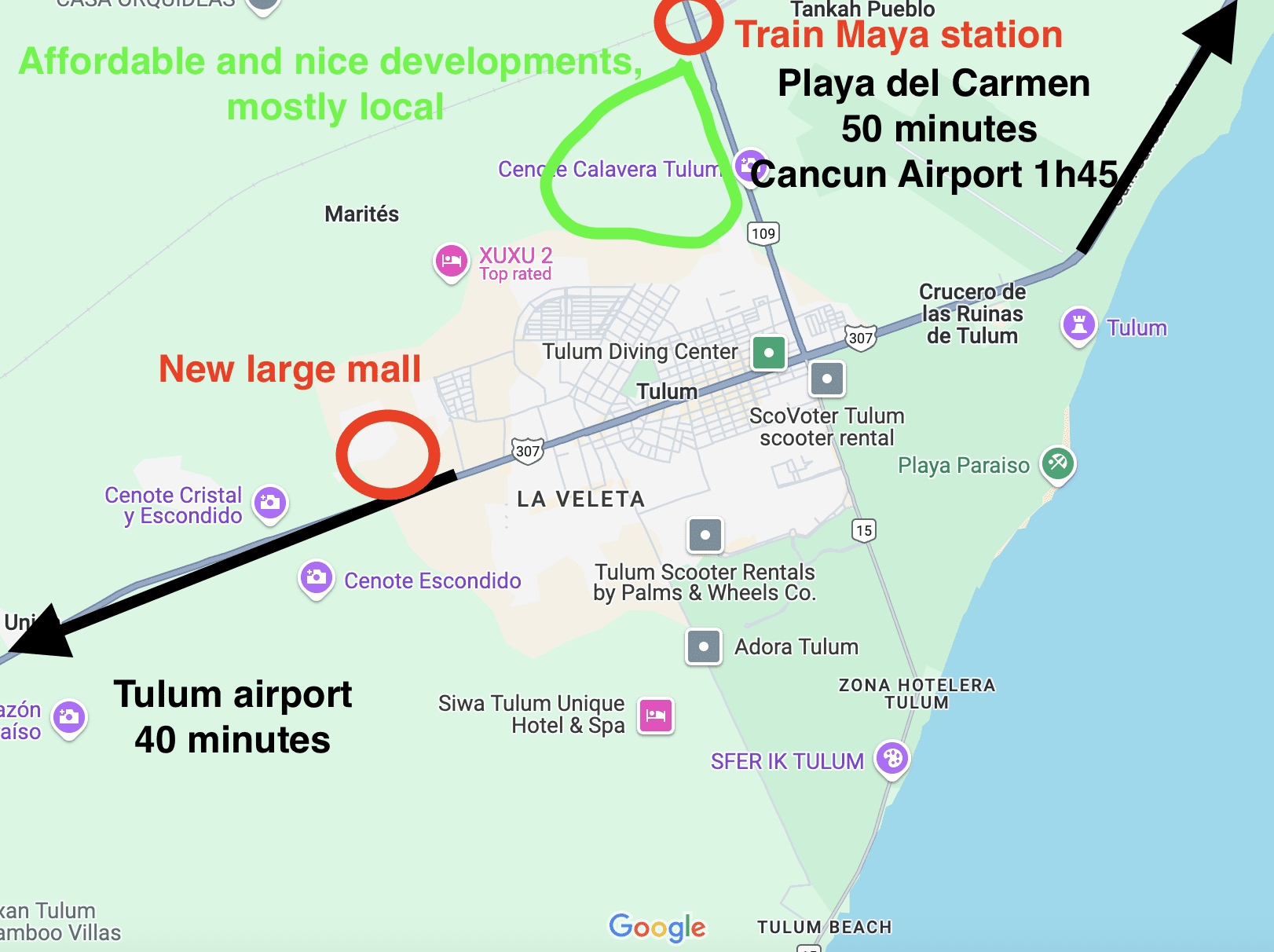

1. Staggering development in the Riviera Maya

The government has made it a key national priority to develop this whole region. I don’t need to elaborate too much on Cancún airport, which is Latin America’s 4th largest by passenger volume (after Mexico City, Bogotá, and São Paulo). Almost 15 million (mostly tourists) flock through its terminals every year. Cancún Airport is even better connected to Europe than Mexico City for example.

Let’s not forget that originally, Cancún was nothing. It was just a stretch of picturesque coastline. In the 1970s the Mexican government decided to create a resort city there and national funds were used to develop infrastructure and hotels.

So yes, the Mexican government can be rather inefficient in many regards, but it pulled this one-off as Cancún is now one of the world’s top beach destinations.

The Mexican government is doubling down. It has built an extensive railway system linking Cancún to the rest of the Southern coast and Yucatán. People call it the “Maya train” as it covers all the main tourist attractions such as nice beach towns, airports, Maya ruins, and colonial cities such as Valladolid and Mérida.

Importantly, Tulum is be one of the key stops.

Right now the location of the station is a disappointment, as it is relatively far from the center of Tulum, but long term as the city develops this issue will diminish. This extra accessibility is a long term catalyst.

Additionally, the government has recently opened a second international airport in the region, in Tulum.

The airport is already operational and is a 40 minute drive from Tulum. There are flights to Chicago, Dallas, Panama, Mexico City, Houston, Toronto, Frankfurt etc. and is a good catalyst for the Tulum real estate market.

Overall for now these projects are bigger than Tulum needs, which is visible as they are partially empty. But the key point is that the government has planned for scale and growth.

2. Digital Nomads

The reality is that a few hour’s flight away from Playa del Carmen is a massive market of high-earning Americans who simultaneously realized a few things:

- They can work almost entirely remotely.

- They can work from abroad, thus leaving behind an increasingly toxic environment. This perception of toxicity applies to Americans of all political stripes.

- They can live a quality life for less money abroad and in many cases can save on taxes if structured properly.

Millions of Americans have either reached these conclusions, or soon will. Europeans too, but the main market in Playa del Carmen will be North Americans as they are closer, the time zones are the same, and they earn more than Europeans so are inherently more interesting target customers.

First-time American digital nomads will stick to the name brands in terms of travel destinations, which is bullish for making a real estate investment in Playa del Carmen

Tulum is one of the world’s top digital nomad destinations, along with places like Chiang Mai, Playa del Carmen, Bali, Budapest and Medellín.

3. Refugees of North American toxic politics

The influx has already started, and is bound to grow. I am not referring to digital nomads who move here for a few months or a year before bouncing off somewhere else. I am referring to people, of all political stripes and ages, who move down to Mexico full-time. They sometimes have online businesses, but often they still have businesses back home which someone manages for them. They are retired, they live off passive income, or start actual businesses in Mexico.

Liberals escaping Trump

Unhappy with the trajectory of the US, they are moving in droves to places such as Europe, Panama, and Mexico.

Conservatives

This is the previous batch of Americans and Canadians. Typically they left during Covid and settled in Mexico. Some went back after not managing to make things work for themselves in Mexico, but many have stayed and formed communities. This type of immigration has slowed down with Trump’s election but Canadians are still going strong.

Apolitical Americans who are sick of the divisive politics in America

They just want to live in peace away from all the nonsense. The beach in Mexico is a good destination for this.

Europeans who flee conflict

Tulum has a lot of Ukrainians who fled the conflict, and Russians who relocated to flee the sanctions. Increasingly, forward-thinking Western Europeans are preparing Plan Bs outside of Europe as they feel their governments are behaving too aggressively. They fear that their governments will draw them into yet another war as they did many times in the past.

Cost of Living refugees

As inflation eats away people’s savings in Western Europe and North America, and as the healthcare systems gradually fall into decay (Europe and Canada) or become too expensive (America), many people will move down South where the cost of living is lower.

Though many such people move to Mexico, they typically do not move to Tulum as it is objectively quite an expensive destination.

4. Walkability and cycle-ability

Cancún is all about driving a car and taking cabs. This is not what people want nowadays. They want to fly into their destination, and once they settle in they want to be able to walk and / or cycle around.

Playa del Carmen is known for its walkability. Tulum on the other hand, is know for both walkability and all its cycle paths.

Looking at Tulum’s geography, there are a few clusters where people can just walk around such as in the Centro and in the Aldea Zama and Selva Zama areas. However, going between areas, or heading down to the beach by foot is a bit much.

This being said, it’s close enough that you don’t really need to take a cab. This is why many scooters, ATVs and bicycles can be seen in Tulum. This gives the town nice holiday vibes.

Many cycle lanes are being built, which demonstrates the city’s commitment to such a vision.

5. Tulum as a health and spiritual destination

Tulum is quite unique in the world in terms of its positioning with regards to health and alternative spirituality.

Sure, we have all seen the pictures of wonderful beaches, cool beach clubs packed with “influencers”, and Mayan ruins, but Tulum is also widely known as a place where people go to recharge.

Health bars, vegan restaurants, yoga classes and secular spiritual experiences of all kinds await young Gen Zs and Millennials.

Whether you personally like this lifestyle or not is besides the point. As real estate investors we must recognize that these are huge growth sectors.

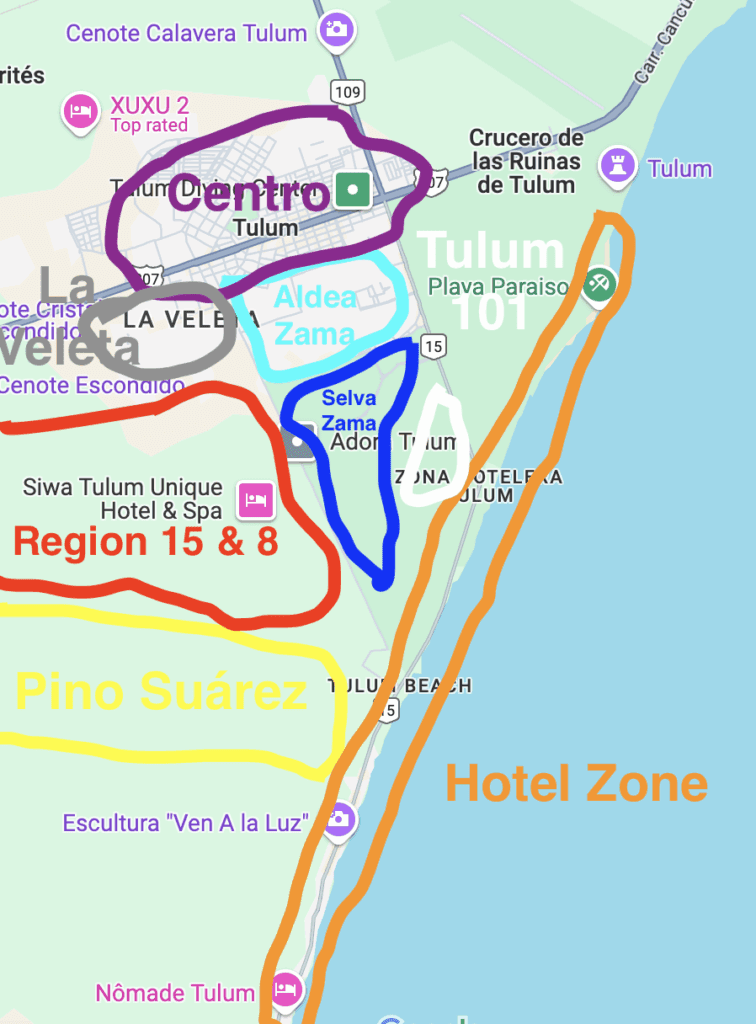

Which neighborhood is best to make a Tulum real estate investment?

As Tulum is developing fast, it’s important to have proper guidance to ensure you don’t buy in the “wrong” areas. Though Tulum doesn’t look very confusing on a map, in reality, it’s easy to get lost there due to the many circular roads and an ever-changing environment.

What is unique about Tulum is that the city is expanding in every single direction.

- To the north towards the Maya Train station

- To the east towards Playa del Carmen (major highway)

- To the West towards the airport and the new mall

- To the south towards the beach areas

Investing in the North of Tulum

This area is developing fast. It goes along the road from the Centro to the Train Maya. There are quite a few developments, a few of which seem to have gone bust, but not all. A large new supermarket has just opened, and there is a lot of infrastructure development.

It’s predominantly an area for locals and for people who work full time in Tulum seeking an affordable place with decent amenities. A car is absolutely needed to live here, and it’s far from the beach. The demand for housing from foreigners is weak in this area.

Investing in the Centro of Tulum

The Centro is where most locals live but also where you find longer-term ex-pats hanging out. It’s the main strip where you can find shops, restaurants, and bars that are not beach clubs. It’s much more affordable to eat, drink, and have fun there than on the beach.

For this reason, there is demand for rentals, particularly from backpackers, budget travelers, and long-term digital nomads.

I would be careful to not venture more than a block or two north of the highway, as this area will never become premium. It is destined to be mostly developments for locals, which are cheap to build and plentiful. I don’t see prospects for interesting capital gains north of there.

The core Centro is investable however, though hardly anything to write home about. Just make sure to check your target investment on weekends, as there is a number of loud bars in the area.

Hotel Zone

Absolutely lovely area; the reason people go to Tulum. But barely anything is for sale here. It’s all high-end boutique hotels, beach clubs, and cute shops.

People often wonder why it’s not possible to build anything on the third and fourth lines behind the beach. The reason is that most of the area cannot be built due to environmental restrictions and issues with aquifers. This is the core reason why the beach area is so far removed from the rest of Tulum.

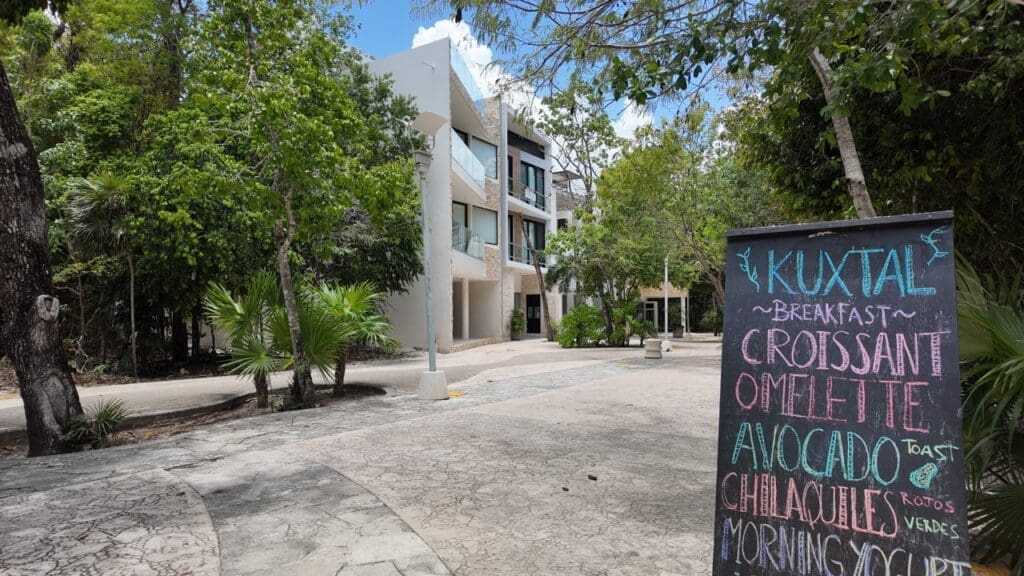

Aldea Zama

This is my one of my preferred neighbourhoods for investment purposes. Why?

This area has cute cafes, co-working spaces, cycle lanes, and cool buildings with amazing architecture. It is extremely livable and is halfway between the Centro and the beaches. There is a lot of construction going on, and many people are living mid to long-term in this area.

Probably the best areas for families as well.

La Veleta

Interesting growth area that is visually halfway between Centro and Aldea Zama. One can see a mix of old and new buildings. Many mid- to long-term visitors choose this neighborhood because it is pleasant and more affordable than Aldea Zama. In this area you’ll find a younger contingent of Digital Nomads.

Region 15 & 8

This is the epicenter of the real estate crash. Apart from one or two roads that are investable, I would completely avoid this area. Why?

One can find massive developments with hundreds of generic apartments in the middle of the jungle without paved roads and signal. These units are impossible to rent out. And if you want to live there, you might as well go to La Veleta for similar prices. A lot of the projects are in trouble here. Some buildings are nice, but the reality remains that there is practically 0 demand for such apartments at this stage.

I would really avoid it for many years to come.

Pino Suaréz

The whole area is a gated community, with further independent gated communities inside.

It’s a super early stage investment. Here the play is land. It is not very expensive for land that is very close to the beach and the hotel zone. Some villas have already been built, but it is still very early days. I see this as a land bank for very patient investors.

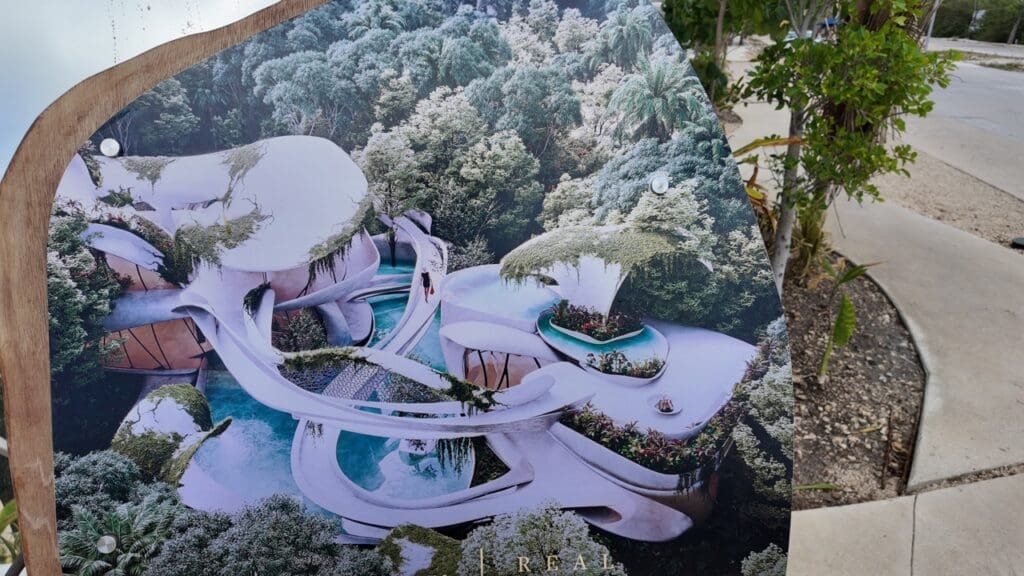

Selva Zama

I see this area as an early stage Aldea Zama, but with a long road to maturity. It will take years and years before a similar vibe can be achieved. The infrastructure, unlike in regions 15 & 8, is respectable, but there isn’t much development at all. Some projects seem to be failing. Although, a few of the projects are pretty crazy looking, and those typically do a bit better.

If I were to invest here I would invest either close to Aldea Zama or close to the beach. Not in-between.

Tulum 101

Beautiful project which is unique in the sense that it is the only masterplanned community in Tulum. The advantage is that you are guaranteed to know what you neighbor will look like. In other areas, if there is an empty lot next to your place you never know what could be built there.

Tulum 101 is definitely a very premium project and has a great location. The finished units are very nice. There is a still a lot of construction going on. It’s a huge project in its infancy.

Would I buy this for rental income? No. At the current valuation this is mostly a lifestyle play.

Conclusion: Who Should Invest in Tulum Real Estate?

People who want to spend part of the year in Mexico would do very well making a real estate investment in Tulum

It is great for those who want both a lifestyle option plus a place they can rent out. Tulum is an amazing destination, there is a lot to like about it, and it is absolutely possible to spend a few months of the year there as a tourist, or even obtain Mexican residency, and then rent out the apartment on Airbnb for the remainder of the year. If people want to maximize their ROI, I recommend they list the condo on Airbnb from mid-December until the end of April, which is the peak season.

A real estate investment of at minimum $300,000 using the right structure qualifies the investor for residency in Mexico, and there are many other ways to qualify.

People who like buying from desperate sellers

The Tulum real estate market is inefficient. Agents are incentivized to sell new developments as the commissions are higher and the transactions easier. If you are patient, and work with Luigi, one of the few realtors in Tulum working on the secondary market, you can find great deals.

Land banking is also a decent option for people with a very long term outlook. Sellers of land are quite flexible these days as few new projects are starting from scratch.

People who want rental yields should aim for very high-end Tulum villas

It’s a very niche market, but people are making good yields from very specific villas.

Overall I see the Tulum real estate investment market as a diversification and lifestyle play for people who know exactly what their objectives are and are realistic. Just be very careful with pre-construction as a lot of developers have cash flow issues and bankruptcies are set to increase.

Contact Luigi to invest in Tulum Mexico

Luigi, originally from Montreal, has been living in Mexico for many years. What I like about him is that he also does the secondary market in addition to selling new developments. This offers investors the full spectrum of opportunities on the market.

Contact Luigi to buy real estate in Tulum

Frequently Asked Questions

-

is Tulum real estate a good investment?

For people who want a lifestyle property, Tulum can be a great investment in the sense that prices are down and there are some desperate sellers. Just be very careful with pre-construction as a lot of developers have cash flow issues and the number of bankruptcies is set to increase.

-

Who Should Invest in Tulum Real Estate?

Ideal investors in Tulum real estate include part-time residents, lifestyle investors, digital nomads, and investors seeking deals on the secondary market.

-

Can a foreigner buy property in Tulum?

Yes, foreigners have the ability to purchase property in Tulum through a ‘fideicomiso’, a trust arrangement facilitated by a notary with a Mexican bank. In this setup, the bank serves as the trustee and carries out the instructions of the property owner.

-

What is the average ROI in Tulum?

Due to oversupply, rental yields/ROI have crashed in Tulum for condos. One can get decent rental yields on net on high-end villas, but for normal condos investors generally just cover their expenses. Don’t come to Tulum for rental income.

-

Which areas in Tulum are a good investment?

Good investment areas in Tulum include the Centro and la Veleta for its local and expat appeal, the exclusive but limited Hotel Zone, Aldea Zama and Tulum 101 for their infrastructure and livability.

- My Real Estate Buyer’s Agent in Tulum and Playa del Carmen

- Give Birth in Mexico for Citizenship

- My Favourite Realtor in Puerto Vallarta, Mexico

Articles on Mexico:

- Making a Real Estate Investment in Playa del Carmen – decent diversification

- Full Analysis of the Tulum Real Estate Crash

- 6 reasons against a Real Estate Investment in Cancun

- Investing in Multifamily Housing in Playa del Carmen

- Full Guide to Making a Real Estate Investment in Puerto Vallarta

- What is a Lock Off Condo & Crazy Architecture in Tulum, Mexico

- Puerto Vallarta Investment Case Study with Numbers

- Is a house in Puerto Vallarta a good investment? Case study with capitalization rates

- We bought a house in Playa del Carmen, Mexico!

- Giving birth in Mexico as a foreigner – the complete guide

- How to Obtain Residency in Mexico

- Pros and Cons of living in Playa del Carmen, Mexico

- Puerto Vallarta Real Estate Market: 2025 Investor Guide

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “Tulum real estate CRASH. What happened?”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice of The Wandering Investor. Today, we’ll be discussing the great Tulum real estate crash. Luigi, you’ve been in the business here on the Riviera Maya for a long time.

LUIGI: Yeah.

LADISLAS MAURICE: What has happened? Because you go around Tulum and you see a decent amount of projects like this. And whenever I see this, my heart is just broken for investors that lost their life savings in there.

LUIGI: Yeah. We had a big boom. We had a lot of developers that came into town and they started all these developments, and the municipality gave out a lot of permits. Problem is, is that during COVID, the demand was high. After COVID, the demand dropped, so you had a lot of projects that started, but then the sales stopped. And if the sales stop, the revenue stops. Any of these developments that had bridge loans or any type of financing from the banks and weren’t able to make their payments had to walk away from the project, or, if they were mismanaged, and that’s what you’re left with. There’s obviously, like you see here, they started, they’ve gone up to almost the third floor. Obviously, they started using the first sales of this project, those first buyers, they used their money, they started, and they ran out of money, and this is what you have.

It’s a shame. I feel for those that lost their money. And there are also a lot of projects that got started, and they’re about 50%, 60%, 70% complete, that can still be saved. And maybe those projects, they’re looking to sell the entire project to an investor that can come in and pick up that project for a great price, continue, and then sell it out. And so that the investors can still get their units delivered. There are some of those projects happening. But we will say this, we did do an analysis with one of the banks. As a foreigner, you need to go through a trust to own in Mexico, in the restricted zone, which is 50 kilometers from the beach. And one of those major banks saw, in 2024, a 40% drop in the amount of trusts that are being opened by foreigners.

That’s not a good number, especially since we have a lot of supply and a lot of projects, we need trusts being opened, which means buyers are opening trusts to take on these properties, and that’s not happening. I don’t know what’s going to happen. I don’t know if the correction is going to take five years, two years, or 10 years, but I hope it corrects faster or sooner than later, so we can see some of this taken care of and so this doesn’t become the landscape in Tulum.

LADISLAS MAURICE: When we go around, a lot of projects seem to be continuing, there’s work, but they’re working at reduced capacity. When you’re a developer and you’re having financial issues, you don’t just suddenly stop construction. What you do is you pace yourself. Instead of having five construction crews working on any given day, you’ll just have maybe one, so that when potential investors come through, etc., they see that there’s activity, and it helps you sell. A lot of projects are currently in this particularly dangerous phase. You, as an investor, you come, you’re like, “Oh, they’re still building.” But actually, they’re not building as fast as they should, and there are delays, and you might know and not know about it. Pre-construction at this stage is quite risky, right?

LUIGI: Pre-construction is risky. You’ve got to really know who you’re dealing with, and even at that point, you still don’t really know all the nitty-gritty that’s happening behind the scenes with their financing. And so, we do have a lot of projects that are delayed because of this. They’re just not finishing the development fast enough. And so, clients are a little upset. They’re delaying and delaying and delaying, they’re a year, two years, three years, and some of these investors and buyers who have financing are missing out on these high seasons where they could potentially get some of that revenue to pay down some of these loans that they’ve taken to buy these properties here. It’s just not a good situation.

There’s still some positive notes in Tulum, but we’re going to discuss that a little further in this video. But you just have to be aware of these types of situations.

LADISLAS MAURICE: Cool. Because we’re going to go look at three potential opportunities.

LUIGI: We’re looking at the resale market, so fire sales, distressed sellers, where you can come in and pick up a unit below market value, especially if you’re interested in lifestyle, and you want to occupy the unit, you want to live there, even part-time, that’s fine, or maybe do a little bit of rental, make a little bit of money to pay some of your bills. We have land by the beach, which is hard to get in Tulum. We have a good land opportunity which is still viable if you have five, six, seven years more long-term investor. And then we also have some of these projects, not like this, but projects that are 60%, 70% complete, they’re missing that final capitalization, that final push, where an investor can come in, buy the whole project, complete the project, and then make a return. That’s also a potential play as an investor.

Those are kind of the three that I can identify in Tulum. But certainly, just the regular rental market, Airbnb and buying a pre-sale like this is probably not the best strategy.

LADISLAS MAURICE: All right, insightful. Let’s go look at some of these opportunities. All right.

LUIGI: Let’s go.

LADISLAS MAURICE: Let’s go.

Tour of developments in Region 15 in Tulum

LUIGI: We’re in Region 15 right now, which is a large region in Tulum, all in the middle of a jungle. And what they’ve done is they’ve, obviously, cut out roads, which aren’t paved yet. 99% of the roads are not paved yet. And this is just a project which is an example of what they’re building, really big projects, but they’re very unattractive. Like this, I don’t even know what this looks like. Looks like a mini storage container to me. And I actually did bring a client to see this, and I was embarrassed, because the renders look good, but–

LADISLAS MAURICE: [laughs]

LUIGI: but it was very embarrassing. The quality of the build was very low and the distribution was terrible. And so, I’m very happy we didn’t move forward with this project, just because I see the finished product now. And this is one of the things I just want to mention, is that you have to be very, very, very careful. You have to be ultra, ultra picky, do your due diligence, and really, really, really stay away from, I’d say, a lot of these projects that look good on renders in the middle of the jungle, but then they might deliver something that is not rentable and something that you’re not going to be happy with. And I really don’t know, and I don’t think anybody knows, how long it’s going to take for these roads to be paved. Very unattractive building. Stay away from these things.

LADISLAS MAURICE: I think a key lesson here is that if you want to buy something in Tulum for lifestyle purposes or whatever, just make sure that you go into these projects that are a bit unique and that have something special, because generic projects like this, I mean, there is literally a whole jungle where you can just build, so supply is almost unlimited, so you want to make sure that you get something a bit unique, even if it’s a bit more expensive, that’s not an issue. Don’t be too focused on the fact that a project may be a bit more expensive per square foot, just make sure that it’s got something unique, or else you end up in a situation like this. And then the maintenance, I mean, you can tell, just like the bamboo stuff–

LUIGI: It’s all falling apart already.

LADISLAS MAURICE: Yeah.

LUIGI: This stuff doesn’t last in the sun. It’s getting blasted every day. It’s hot today, it’s 35 degrees. This just doesn’t last, and it doesn’t look good. And unfortunately, who pays for that? The owners. And then if the owners aren’t doing any rental, because, I mean, take a look around, who’s coming here to rent these places? If you’re not getting a rental yield, and then you’re paying out of your pocket, the owners eventually don’t want to spend any more money. They don’t want to pay their HOA. No one’s paying their HOA. And then the building just starts to fall apart. And now you’re left with a half-abandoned building or a building that’s not well-maintained in the middle of a jungle with no paved roads. It’s not a good situation to be in.

LADISLAS MAURICE: Like, this project, this just looks like something you shouldn’t really buy.

LUIGI: No, this looks like a hotel, almost. I mean, these railings are horrendous. And again, this is just to show what to stay away from, because there are some beautiful projects in Tulum, and there’s some beautiful locations. But when you start to get yourselves into these types of projects, this is where you can run into problems. One thing to mention, how many units do you think are in this, just this project alone? I mean, you’re looking at the internal competition to get these things rented out, you’re competing with everybody in Region 15, but you’re also competing with every single other property owner in this building. And if everything looks exactly the same, I just don’t see how you could be making a lot of money here.

Rental demand in Tulum

LADISLAS MAURICE: When I go on Airbnb, I don’t actually see that many listings. It’s a little surprising.

LUIGI: Well, none of these are delivered yet. But, I mean, yeah, the ones that are, there is a huge supply and demand issue. There’s a lot of supply, not enough demand. And so, I think there’s a lot of property owners maybe have taken their listings off.

LADISLAS MAURICE: It just didn’t work?

LUIGI: It didn’t work. There’s a lot of property managers here that no longer take one-bedrooms and studios, so they’re not willing to run Airbnbs for these units. I think a lot of owners are having to do their own work with their own listing to try to save money of property managers, and maybe try to keep that 25% in their pocket, and are maybe doing off-bookings, and that’s the only way they can kind of generate an income to pay some of these HOAs so they’re not paying out of the pocket every month. And those who got it financing to get into any one of these units out here, they’re losing money every month.

LADISLAS MAURICE: I think, generally speaking, getting financing back home in a different currency, in a different country to go speculate overseas is very risky on multiple levels, one of which is currency, but you just add so much complexity and potential issues. People should be really careful when they engage in cross border financing like this.

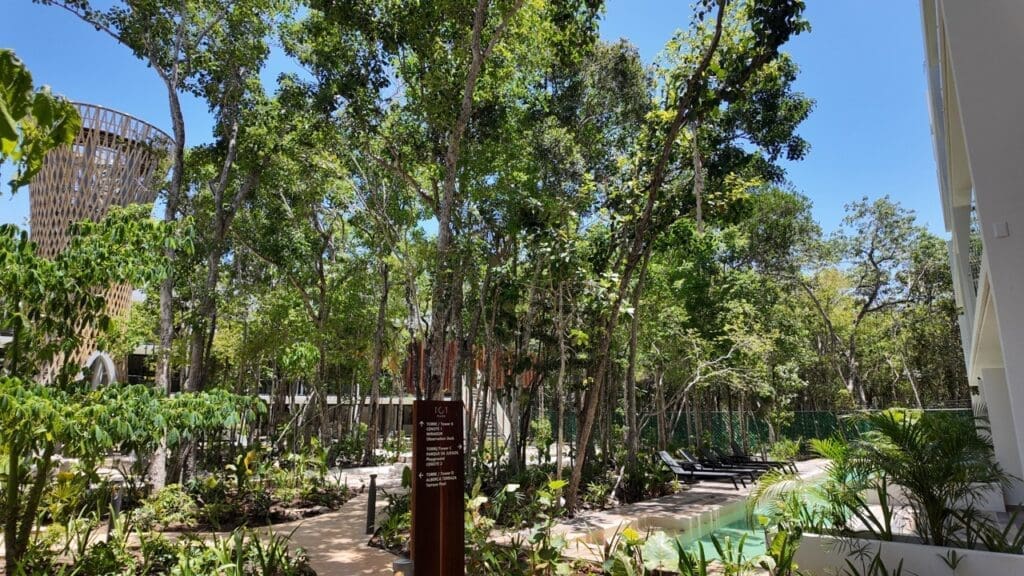

LUIGI: Okay, so we left Region 15. We’re now in Aldea Zama. Aldea Zama is a master planned community, so drainage, streets, electricity, obviously, Wi-Fi. It’s a community about three kilometers from the beach. And here, you have boutiques, you have hotels, mix of commercial, restaurants, cafes. It’s actually really charming. And it’s safe, there’s security here, and so you can actually get out, walk around. This is great for digital nomads, if they want to live here part-time. We have coffee shops here, restaurants. It’s really, really nice. And you can pretty much live here. This would be the place that you could live, or at least vacation, because it is more developed.

LADISLAS MAURICE: How has the Tulum crash impacted this area? Are there opportunities here to buy, or?

LUIGI: Yeah. Obviously, here, the rents still do a little bit better than, say, like, if you were in Region 15, but the Tulum crash still has caused prices here to come down a little bit. You can still find off-market deals, or maybe stress sellers that need to get out. I think you could do better in terms of a rental potential here, because it is already developed. And if you were going to stay in Tulum, this would probably be the place you would stay. There is some potential. If you really are passionate about hosting and doing short-term rentals, I think you could still do a little bit of rentals here. You’d have a higher probability in Aldea Zama than you would in Region 15, in my opinion.

Long-term rental market in Tulum

LADISLAS MAURICE: Isn’t the play here rather long-term rentals?

LUIGI: Well, it’s hard to find long-term renters here, because most people, when they come to Tulum, there are some people that enjoy and want to live here long-term, but most people, when they come to Tulum, they’ll live here for a little while, and then they get bored, or they find Playa might be a little bit more attractive to live long-term, so they leave. It’s hard to keep a six-month or a one-year lease, it’s hard to keep these kind of renters, especially if you have multiple units. But not saying it’s impossible. If there was a place in Tulum where you could do that, I think La Veleta and Aldea Zama would be the two places.

LADISLAS MAURICE: And here, because, I mean, there’s still a fair amount of land to build. Does the thesis still stand, whereby you need to invest in projects that are wow, or is this area all right to just buy a normal project with a rooftop pool and whatever?

LUIGI: I think you could still get away with buying a good unit that’s well-finished, and has a nice rooftop pool, that is maybe more modern, and maybe more generic, you might still be able to do some type of revenue. But if you’re going out of this area and you’re going in the middle of the jungle, yeah, it needs to be something very unique and more like the Tulum style, which Tulum has become its own brand, and it’s known to have these crazy little Avatar, out of the movie Avatar style. You don’t necessarily need that here. As you can see, there’s a lot of buildings that are just pretty generic. Of course, it’s still nice to see something a little bit more unique, but you can get away with it here.

I think, where people gather, you’re always going to do better. And there’s always people gathered around here, going to restaurants and co-working spaces.

Secondary real estate market opportunities in Tulum

LADISLAS MAURICE: Luigi, so what are the opportunities here in Tulum, in the midst of all this chaos and trash?

LUIGI: There are buyers that are coming to Tulum still, because they know that there are some sellers that either got financing for their unit, and they’re not doing well in terms of rentals, so they need to offload that burden, and so they’re able to get a good deal below market value.

LADISLAS MAURICE: That’s the one we’re going to go see now?

LUIGI: Yeah, and then the one we’re going to see now is also an interesting play, because those buyers that came in during COVID and were able to get into pre-sales and buy multiple units got incredible prices during COVID, and their units were completed, and they’re really beautiful, are able to exit their property at a very, very good price and still make a profit, which means the buyer can still come in and pick up some of these properties at a fair, very good price in terms of the market, and the seller’s still happy because they have a really, really good spread, because they bought during COVID at incredible prices.

There’s some of those deals as well, and that’s what we’re going to go see. We’re going to see a buyer that has multiple units bought in pre-sale long time ago, is making really good money on the exit, but can still offer a really, really good price.

LADISLAS MAURICE: Cheaper than buying new right now?

LUIGI: That’s correct.

LADISLAS MAURICE: And I think that’s something that we see in a lot of markets in the world, because construction costs have gone up so much since COVID all over the world, there’s now a situation where buying on the secondary market, in many markets, is a much better deal than in the primary market.

LUIGI: If you can find a seller that kept their unit impeccable, put some love into it, and got a really, really, really good price several years ago, and is willing to exit at a fair price for the new buyer–

LADISLAS MAURICE: And needs to exit, rather.

LUIGI: And needs to exit, and has made their money, and they’re good, and they’re good to exit, I think that you can do well.

Buying distressed real estate projects in Tulum

LADISLAS MAURICE: Any other opportunities?

LUIGI: As we talked about, some of these projects that have maybe failed, where they might have run out of funds, whatever the case may be, there are opportunities to actually come in as an investor and pick up these projects that are three quarters of the way finished, pick them up at a very, very good price, and then complete the project, and then continue selling them off. There’s an opportunity there. Here, in Tulum, if you know the distribution of how Tulum is, to get close to the beach is very difficult, so there is some land very close to the beach that is still, in my opinion, a good opportunity.

LADISLAS MAURICE: Okay, cool. We’ll go check those out, right?

LUIGI: Yeah, we’ll go check that also.

LADISLAS MAURICE: All right.

Tour of resale apartment in Tulum

LUIGI: This is an example. We were talking about a secondary market or a resale market. This particular unit was purchased before COVID, in 2018, something like that. The increase in value, the price, also this owner, again, if you can find these deals, which is where we’re finding, because the prices were so accessible, some of these owners purchased multiple units, and because they purchased multiple units, they got even better discount several years ago. Now they can exit below market value. And so, someone can come into this market, buy this resale under the market value, and get a ton of space in Aldea Zama in Tulum.

LADISLAS MAURICE: How many square meters is this place?

LUIGI: 341 square meters. It’s just under 200 square meters of interior and about 141 square meters of exterior.

LADISLAS MAURICE: And there’s a lock-off there. Can you explain quickly what a lock-off unit is?

LUIGI: Yes, it’s a bedroom with a full bathroom. It’s got a beautiful little terrace with a big bathtub. And the lock-off is its own separate entrance, so you can actually lock the door that comes into the main part of the condo, and you can rent that as a separate unit. And they actually did outfit it for fridge, cutlery, coffee maker and that, so someone can actually live in there, stay, can generate revenue, while the owners can live in the main part. And what I love about this is just it feels like a little home. You have two bedrooms, two bathrooms, and then you have this huge upstairs area, which is kind of a flex room. You can use this for whatever you want.

What they’ve done to maximize the amount of people that can stay, they put bunk beds up here. But this could be anything you want it to be.

LADISLAS MAURICE: Yeah, work area.

LUIGI: Work area, laundry. And then you have a full bathroom. High, high ceilings. I mean, this is the Tulum style.

LADISLAS MAURICE: What’s the price point of this unit?

LUIGI: This is $435,000.

LADISLAS MAURICE: If this were new, pre-sale, pre-construction, how much would a similar unit go for?

LUIGI: I mean, for the amount of square, private rooftop you’re looking at, probably over $600,000, $700,000 at the low end. Just because this is a penthouse with all this space, pretty hard to get that.

LADISLAS MAURICE: And the water is so warm here. Gosh.

LUIGI: We’re in the summer now, almost.

LADISLAS MAURICE: But you can hear all the noise, and that’s just construction. There are all these, like, cement trucks and all that, because they’re building something here. That’s a bit of a recurring theme in Tulum. Even though there is a real estate crash, there’s still a lot of construction. I mean, it’s not like most projects are failing at all. It’s just that there’s a few very notable projects that are failing and others that are delayed, but there’s still a lot of construction going on. All right, so this is effectively at a 35% to 40% discount to new build.

LUIGI: Absolutely. And like I said, if this owner were to have purchased this unit, let’s say, last year, in a pre-sale, and is trying to exit now, this unit would be in the $700,000 range, but because she bought a long time ago, and that’s why you’re able to get some of these deals. You’ve got to look for these kind of deals, otherwise, for this kind of space, you’re paying.

LADISLAS MAURICE: If I were to come to you and I said, “Luigi, okay, this is a 35%, 40% discount to essentially the new market.” And I ask you, “Can I flip this place, or can I make good rental yields?” What would your answer be?

LUIGI: Honestly, we don’t recommend the flip strategy in Tulum. Or, like we’ve said many times, Tulum is more of a long-term play at this moment. And if you can get into the market at a great price, and you have time on your side, that’s the strategy, I wouldn’t flip it. And then rentals, honestly, right now, there’s a lot of supply. I wouldn’t play the rental game either. You can rent this out, and if you are passionate about hosting people, maybe you can make it work. There is that lock-off that can also generate a little bit of an income. If you want to occupy the unit, enjoy the lifestyle of Tulum, really, this is the place that you want to be for half the year or most of the year, then you can enjoy this unit, it’s great, and then have that lock-off that can generate income and pay for your HOA and some of your expenses. I think that’s the play.

I, honestly, wouldn’t look at this as an investment to make really good cash flow, or to flip, or to get in and out of the market. It’s not really that style, and I don’t think that’s the strategy at all in Tulum. It’s buy and hold, same with the land. Buy, hold, wait till the market recovers. As Playa Del Carmen had to recover 20 years ago, Tulum is going to do the same. I think that’s the strategy. That’s what I would do.

LADISLAS MAURICE: Yeah, and choosing the right projects.

LUIGI: And choosing the right projects, yeah, and the locations.

Conversation with a typical Tulum tenant

LADISLAS MAURICE: Yeah. And I interviewed the lovely couple that lives in this apartment, so the tenants, and what’s really interesting about them is that they are really the typical archetype of people that want to live in Tulum, right? I know this channel is about money, investing, etc., but here, we’ll talk to a couple. And that’s essentially your target market, in many respects. From an investor point of view, I found this conversation very interesting. All right. And then we’re going to check out some–?

LUIGI: Properties, or some projects that might have been 60%, 70% completed, ran out of money, or sales stop, that are available for someone to come in and take over, and also some land close to the beach, which I find appealing.

LADISLAS MAURICE: Yeah, those numbers were quite interesting for the land.

LUIGI: Absolutely, yeah.

LADISLAS MAURICE: All right, enjoy that interview. And then let’s continue with the viewings.

How long have you been living here in Tulum?

FIRST TENANT: Personally, I’ve been here since 2020, officially. Very stable as my primary home base.

LADISLAS MAURICE: Okay, and originally, you’re from?

FIRST TENANT: I’m from Canada, from Quebec.

LADISLAS MAURICE: Okay, a lot of Canadians here, right?

FIRST TENANT: Yes.

LADISLAS MAURICE: What specifically do you like about Tulum?

FIRST TENANT: It’s a very special place. I mean, it’s a very special vortex. It’s just, for me, freedom. That’s the word that comes when I think of Tulum. It just feels much freer than in Canada, for example.

LADISLAS MAURICE: Yeah, fair enough.

FIRST TENANT: Yeah. [laughs]

LADISLAS MAURICE: How about yourself?

SECOND TENANT: I’ve been here since December. I’m originally from Monterrey, Mexico, but I was in Vancouver for 14 years till December. This is a fresh start for me to be here.

LADISLAS MAURICE: Tulum is almost as different from Monterrey as it is from Vancouver, right?

SECOND TENANT: Vancouver, yeah, it’s quite different. All of them have very different attributes. I agree with her, it’s a much more free space. And I like meeting people here organically, and the environment around the community that you get to see in Tulum, and the fact that I can speak my language, and the food, and sunny all year long, perfect.

LADISLAS MAURICE: Are there a lot of Mexicans moving here, not just for business and construction and all of that, but for lifestyle as well?

SECOND TENANT: Yes, I do see a lot of internationals, mainly, but a lot of Mexicans are starting to see what is the lifestyle in Tulum and notice and starting to plan their move, whether it’s for living or for business.

LADISLAS MAURICE: Okay.

SECOND TENANT: Yeah, that’s what I see.

LADISLAS MAURICE: Do you see yourselves living here for a long time in Tulum?

FIRST TENANT: I thought, after all these years in Tulum, I was ready for the city life. I was planning my way to Miami, and then I feel like Tulum was not ready for me to leave, so gave me this man. [laughs] And then he was planning to settle here for a year, so I reevaluated my options. I was just in a retreat in Akumal, about 30 minutes out of Tulum, in a jungle.

LADISLAS MAURICE: What sort of retreat?

FIRST TENANT: It was just like a transformational retreat, you can call it, with Temescal, and sound healings, and meditations, and movement practices, and cacao ceremonies, and all the Tulum classic things, essentially, things that are normal here, but that the people from all over the world come. I was co-facilitating it, so I was around these people. And he was one of the facilitators, actually, teaching his skills, and–

LADISLAS MAURICE: What skills?

SECOND TENANT: I was guiding expression through movement, through a method that I call emotion, similar to ecstatic dance, to help people free their expression, and I was also guiding sound healing.

FIRST TENANT: And meditation.

SECOND TENANT: And meditation, and giving some massages.

FIRST TENANT: And so, being there also made me realize, because the people that were there that paid for this transformation are from the cities, from the States, from all over. And for them, they’re coming there, and they’re like, “Oh my god,” like, “I want more of this.” They’re not ready to leave. And they’re just tasting the transformation, they’re just starting to peel the layers, essentially, day after day after day, and they’re shedding, and they’re shedding. And now they’re just returning back to this noise, and the stress, and the fast pace, and the matrix, [laughs] the system. And then that reminded me how we’re so blessed to be here, and that this gets to be our life, this gets to be the everyday, this gets to be our norm.

There’s just, like, less noise pollution. I mean, there’s construction a lot in Tulum, because it’s still developing so much, but so much less noise pollution, light pollution. We’re in the jungle. We’re in nature. I think I was ready for the city luxury, and then I just reminded myself, like, this is a real luxury, actually. And the slow life, it’s slow-paced here, everything is moving slow. For businesspeople, it’s not ideal, because then everything gets delayed, or it’s like the Tulum timing, but I think the slow life is the real luxury.

SECOND TENANT: I agree.

LADISLAS MAURICE: Fantastic. And thanks for letting us view your beautiful apartment.

FIRST TENANT: It’s our pleasure.

Example of an incomplete development in Tulum

LUIGI: Here’s an example. We have some projects that are almost completely finished, some that are 50%, 60% finished, and they’re selling the whole building like this. I don’t know if they ran out of money, if they don’t have the money to complete the paperwork to get title, I don’t know what’s going on, but obviously, this developer is like, “Hey, I need to sell the whole building.” Maybe they need the money to complete another building. This is what’s happening. If you are an investor, you could probably pick up a building like this under market value.

LADISLAS MAURICE: Or, the bank is selling it.

LUIGI: Or, the bank is foreclosed on it, is selling it. That’s another option. This one’s almost completed, but there’s some just down the street that are literally not even halfway through completion.

LADISLAS MAURICE: Do you have a few listings like that?

LUIGI: We do have a couple of listings. We have some that are completed, and then we have some that are, you can see that the developer is in turmoil. He’ll take a deal.

Infrastructure development in Tulum

LADISLAS MAURICE: Okay. Luigi, tell us about some of the infrastructure development that’s happened here, like the Tren Maya, the Tulum Airport, all that. What’s been the impact?

LUIGI: Well, I mean, the Tulum Airport, obviously, had a good impact in the first year. They were expecting 700,000, 800,000 passengers. I think they broke a million. There was a lot of buzz and a lot of excitement. It’s a nice airport. The problem is, is that the demand has dropped, and so some of these flights that were with some of the major airlines from the United States and Canada, some of them have been canceled, and that’s unfortunate. I think it’s going to take a little while for the demand to come back, and for the Tulum Airport to have more of an impact. I mean, it doesn’t happen overnight, so I think that will eventually help. And then the Tren Maya was a little bit of a disappointment for me, because it does–

LADISLAS MAURICE: That’s the turn-off to the land, right?

LUIGI: Yeah, that’s correct.

LADISLAS MAURICE: Gated community in here?

LUIGI: That’s correct, this is a gated community. This is where the land is. This is the first gate, where we’re going, it’s actually triple-gated community. And this is just a few hundred meters away from the beach and the hotel zone.

LADISLAS MAURICE: If you were to walk from here and actually get access to the beach, how long? Because it’s hard to find accesses to the beach.

LUIGI: That’s right, it’s exactly one kilometer from the—I’ve just got to show my ID to get into the gate. Again, this is secure. This is the first gate of three gates that we have to go through to get to the land. Once you are an owner, then you have the pass, and they know you, you’re fine. But as I’m a guest today, so I have to show my ID. I think going back to the airport, it’s a beautiful airport, it’s going to take a little time. And then going to the train, I was a little disappointed. I thought the train was going to come right to the city centers, and it doesn’t.

And actually, goes far away from the center, which means, it’s not useless, but it’s kind of disappointing, in a sense, that when you get to your destination, you still have to find transportation and taxis to get to the city center or to your hotel.

LADISLAS MAURICE: Which you don’t want to deal with when you’re in Tulum, because one of the biggest negative reviews that you find about Tulum, and which is scaring off and keeping potential tourists away, is the fact that the taxis are extremely scammy here. They will overcharge you. They’re not nice. They’re aggressive at times. A lot of people get totally overcharged and abused by taxi drivers. You land there, you’re with your suitcases, you’re at the train station, and then you have to deal with the cab driver. That’s just not pleasant.

LUIGI: It’s not. And that’s why I was disappointed, I thought we would be able to get right to the city center.

LADISLAS MAURICE: Yeah. And then the reality is, it’s cheap to rent cars here in Mexico. People should rent a car anyways to get around. And talking about the Tulum Airport, because it’s pretty funny, because you go online and you hear, yes, the first year, the numbers exceeded expectations, but then they didn’t meet the expectations of the airlines.

LUIGI: That’s right.

LADISLAS MAURICE: Somehow, the government and the airlines had different expectations. [laughs]

LUIGI: Yeah.

LADISLAS MAURICE: And then the reality fell in the middle.

LUIGI: That’s right. I think the government was, like, “Okay, if we can get 800,000 or a million passengers, we’re doing okay.” The problem is, is that the airline that’s now put out that money to create the routes, and to change their schedules, and to pay for the fees and the port fees, and then put the staff on those flights didn’t get enough demand, and so that’s disappointing. But again, that could all recover over the next few years, and hopefully, that will happen.

LADISLAS MAURICE: Cool. When we’re looking at gated communities like this, so no one’s living here yet? What’s the situation?

LUIGI: There’s three or four different projects in this gated community, and there are some beautiful luxury homes that have been built, and there are some people renting those homes, or actually moving into those homes. And then there’s a lot more homes that are in the process of being built, that are in construction right now.

Living close to the beach in Tulum

LUIGI: I think as the infrastructure gets better, as they put in more electricity, and the front gates are completed, and more people are completing their homes, I think this is going to be a nice draw for those, again, lifestyle-related people who want to live in a nice home and be close to the beach.

One of the attractive things about this land, again, it’s hard to get close to the beach in Tulum. Most properties are a few kilometers away. This land, within the gated community, there are private roads that go to the hotel zone and then through the hotels onto the beach. And so being able to stay within the gated community and not having to go back to the public roads, having your own private road within to get to the beach is attractive, especially for those high-net-worth individuals who want privacy. They don’t want to go back out to the roads and the traffic. They just stay in their gated community and they get to the beach. It’s about a kilometer away from the front gate of this land that we’re going to. That’s attractive. And eventually, as more and more people are building their homes here.

LADISLAS MAURICE: I mean, right now, you have a lot of privacy.

LUIGI: Yeah, you have a lot of privacy. This land has just started to reach the market, because this is all land that was owned by, basically, like, agriculture, farm owners, land owners, and just recently have they started to now allow developments in this area, so it’s relatively new. There’s only so much land, and once this land is gone, that’s pretty much it in terms of the closest proximity to the beach.

LADISLAS MAURICE: Yeah, in a market where there is essentially limitless jungle and where Tulum can expand a lot of directions, buying close to the beach is probably one of the better decisions you can make as a long-term investor. I mean, this is clearly not a play for buy now, flip in six months. And I mean, clearly not. But for long-term investors, yeah. I mean, I’m looking forward to seeing what it looks like.

LUIGI: If you want to take a look at the vegetation, see how this is very low vegetation, and there’s kind of, it dips down, like, mangroves, some wetland, not stable to build on. As a matter of fact, you can’t build in this area. Even we’re in the area where this land is available, there’s still unbuildable land here. It’s limited. Where the land we’re going to go see has tall, beautiful, mature trees, and is perfect for building homes.

MAN: Where that chain is right there is a parking lot that’s right on the beach road. Right now, we’re, like, 100 meters from the beach or less.

LADISLAS MAURICE: Cool. All right. And people have direct access here?

MAN: Yeah.

LUIGI: Only the owners in here, yeah. Basically, when you’re driving in the hotel zone, there’s the beach side, and then on this side you see all these little buildings, sometimes, and like stores, and then they have parking lots. This is it. And that there, that’s the beach. That’s the beach road. That’s just been paved, by the way.

Gated communities and land in the Tulum jungle

LUIGI: We went through the main gate. This is now driving into the cluster. And then, within that cluster, there are many different gated communities. This would be the second gate that you would get through. And then this road here actually connects to a highway that they’re building that takes you directly to the airport. The difference is, is that if you were to go through this private road that connects to the highway to get to the airport, you avoid the entire downtown section of Tulum to get to the airport, which is traffic and speed bumps. It takes forever. People who own in here will be able to just drive out of their place, connect to the highway without going through the public area, and go straight to the airport, which is fantastic.

Imagine there’s going to be a gate here. Inside this gate, there’s 25 parcels of land, and each parcel can be subdivided to up to 20 lots, and each parcel can be its own gated community, which is what we have. When you drive down this road, and you drive up to the first parcel, this was subdivided into 20 lots, and all 20 lots were sold. Some buyers bought two or three lots, combined two or three lots to build mega large mansions, villas. And so, we have some buyers that bought two or three lots at a time, some bought just one lot. Still, can build a beautiful home.

LADISLAS MAURICE: It’s a beautiful jungle here.

LUIGI: These are beautifully mature trees. This is dense.

LADISLAS MAURICE: You can essentially build your house, integrate the trees into the architecture, the landscaping, all of that.

LUIGI: For example, this would be the gate now going into one private parcel of land, where you would have 20 lots here. And so essentially, you could have up to maybe 13 or 14 owners, because some owners purchased several lots, from 20 lots. And already part of the master plan, it’s already been landscaped that each home and their driveway has a Green Belt, and the green has been left for landscaping purposes. And you can already see here, one home is starting to be built.

Land costs per square meter in Tulum jungle

LADISLAS MAURICE: Okay, let’s talk numbers. What are the numbers here, per square meter?

LUIGI: Okay, so here, they’re $300 a square meter.

LADISLAS MAURICE: About $30 a square foot?

LUIGI: Approximate, just under, yeah. And if you were to compare, there are other lots that are similar, but further away from the beach in other regions, more towards the center of town, which is about a 15-minute drive to the beach, and those are going for around the same price. They’re further ahead in terms of the development. They have a little bit more milestones that they’ve reached. They have the front gates already finished, and the perimeter walls, and the electricity is already brought in, which this area is in the process. Once those milestones have been hit, these prices will be above $300 a square meter.

And just next door, there’s a project that has already reached those milestones, that has the electricity, and there are several homes already completed, and they’re at $500 a square meter.

LADISLAS MAURICE: Again, because it’s close to the beach.

LUIGI: Again, because it’s close to the beach. And so, the play here is that if you were to buy a lot now, or if you would like to buy a parcel, which is another option, you can actually buy an entire hectare and subdivide the lots, and put out 20 lots, and sell those lots.

LADISLAS MAURICE: And the hectares are cheaper if you buy them by the hectare?

LUIGI: Yeah, you’re looking anywhere between $130, $140 square meter. And then you can subdivide and then put those individual lots onto the market at $300 or $400. The longer you wait, the higher those numbers can go.

LADISLAS MAURICE: Cool. I see how this could work as an investment for potential capital gains, but it’s really for patient investors. Because, I mean, liquidity, [laughs] I mean, there’s not a lot going on here for now. I mean, you just look around, it’s, literally, just jungle. We saw one house being built. I’m sure if we come back in 10 years, there’ll be a bunch of homes here.

LUIGI: Well, there’s 10 homes right next door at the next project, finished homes between $1.5 million to $3 million. Those homes are already completed, and that same developer is also building, adjacent to that development, another development with several homes. It’s already started. However, in a year or two, when the front gates are all completed, and electricity is completed here, and the perimeter walls are all done, you’re not going to be able to see those prices anymore, especially since this is the last real land close to the beach.

Summary of Tulum real estate investment opportunities

LADISLAS MAURICE: All right. Overall, look, the real estate market crash here in Tulum is ugly. Corrections like this in markets can last a while, right? No one is saying here that the crash is just the past 18 months, and now we’re fine. But in the midst of all of this, there are a few key learnings. One, you want to be very careful with regards to the projects. You want to buy either projects that have something unique, really unique, from an architectural and lifestyle point of view, or you want to buy in the areas that are already very developed, so that there’s always some level of demand.

And then there are micro-opportunities, if you go on to the secondary market, fire sales, and then also entire buildings that have gone bankrupt and they’re looking for a new project manager, if you’re into that. I mean, that’s really going up the risk curve, or potentially some land plays like here, again, for very patient investors. But I think the message is that, overall, in Tulum, if you want to come here, just come here more with a lifestyle mindset, knowing that you can get some good deals if you take your time and find the right opportunity. If you’re a pure, pure investor and you’re trying to maximize things, Tulum right now is probably not the best market. Is this a fair assessment?

LUIGI: I think, generally speaking, it may not be the best market for real investors. Again, I see the land, holding onto this land by the beach, anything in the Caribbean by the beach, over time, I think could be a good play if you can get in at a good price. And I think now is a good price. But by the time all this gets developed, you would have missed that opportunity as well. But it’s a pretty fair analysis in terms of the market here. Definitely, the rentability. The rental game is not the best play. And you need to have a long-term vision here, for sure.

How to contact Luigi

LADISLAS MAURICE: Okay, cool. All right, fantastic. I wrote a whole article on the Tulum real estate market, the areas to look into, the areas to avoid, some key learnings, etc. There’s a link below. And if you’re looking at Tulum real estate, or any Riviera Maya real estate, so Playa del Carmen, Cancun, all of that, feel free to get in touch with Luigi and his team. There is a link below as well.

LUIGI: Perfect.

LADISLAS MAURICE: Luigi, always a pleasure.

LUIGI: Amazing. Thanks for taking the time, Ladislas.

LADISLAS MAURICE: Thank you.

LUIGI: All right, well, see you soon.

Very good article man!!

Great article. I feel some key points should have been discussed.

1. There is so much growth and yes they are building cycle lanes, trains, and airport. BUT, the sewage system and water systems are not established. Water is being contaminated. You can’t even boil pasta with tap waster or brush your teeth. Studies show many traces of E. Coli in the water. Traces of cocaine and E.Coli in the cenotes. There is no main sewage system in any areas and each building needs its own sewage treatment and water well.

2. Just a side note that the government takes ages to pave the roads and developers are having to do this out of their own pockets to satisfy buyers. It took 2 years for my roads to get paved and the developer had to do it.

3. The sargasum piling on the beaches for nearly 6 months of the year is deterring some visitors and makes the sea un-swimmable.

4. There is no recycling facility and all garbage/rubbish is being dumped in jungle sites, and also contaminating the water beds.

I LOVE TULUM, but I am very worried about these issues and I think more should be done to tackle them before building airports, trains, and complexes in areas they said they would never develop….side note too that some developers are cutting corners and making things look nice, but poor quality. Def really look and ask the right questions. I saw so many properties where they do not put moskito screens with the sliding doors, plunge pools with no circulating water and filter systems (basically a concrete tub), kitchens without ovens or a hob.

ALSO, in ‘WEST’ of Tulum there are great neighbourhoods. La Veleta has great expat community, coworking places, walkable shops, holistic centres, etc. More of a vibe than Aldea Zama. Region 15 and below is very jungle like and unpaved still, but La Veleta has a lot of old and new to offer.

Great input. Thank you very much.

Great article! Would love to see something like this for Bacalar.

Thank you