Video: Real Estate cap rates and rental yields in Medellin, Colombia

Last year I spent a few weeks traveling around Colombia investigating real estate investment opportunities. I wrote about Bogota, Cali, and Medellin.

I particularly liked Medellin as the returns on mid-term rentals were quite high, and the purchase prices low.

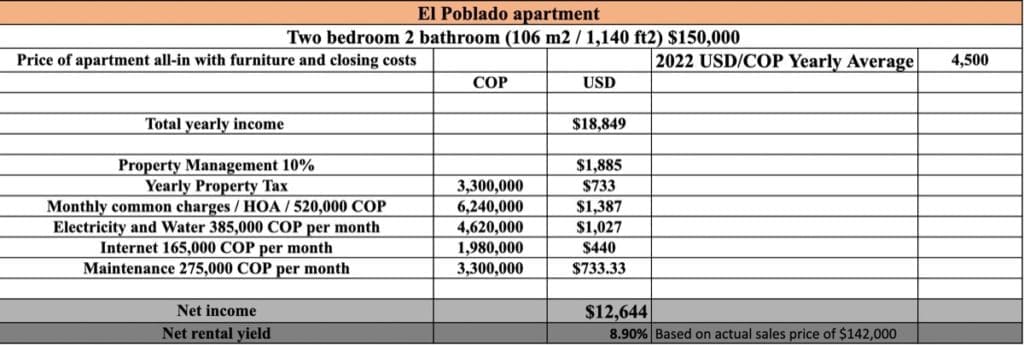

I even did a video with Mauricio from Sweden, who runs an agency specializing in helping people invest in the Medellin real estate market. He showed me an apartment that was for sale for $150,000 all-in and which he estimated would net investors a 6.7% cap rate / rental yield after expenses and vacancy.

In today’s world, these are very appealing numbers.

I came back to Medellin and asked to calculate the actual capitalization rate as he told me the new buyer kept him as the property manager

I logged into his records to go through the numbers, and the results surprised me. In this video we compare Mauricio’s projected net returns for investors, versus the actual net returns this very apartment delivered in 2022.

- Holding Mauricio accountable for his commitments

- Breakdown of Airbnb earnings per month in Medellin

- Depreciation of the Colombian Peso

- Occupancy rates Airbnb Medellin

- Airbnb regulations in Colombia

- Impact of Colombia Digital Nomad visa on real estate in Medellin

- Expenses linked to an Airbnb apartment in Medellin

- Actual capitalization rates for real estate in Medellin

- Risks of investing in Colombian real estate

- Impact of Petro election on real estate in Colombia

- Impact of Peso depreciation on Colombian real estate

- Low price per square foot / square meter in Medellin

I am in Medellin for a few weeks enjoying the city’s famous eternal Spring and helping a close family member of mine invest in a high cash-flowing property here.

If you want to get in touch with Mauricio to discuss investing in real estate in Medellin, use the contact form at the bottom of this page (here).

To a World of Opportunities,

The Wandering Investor

Other Articles on Colombia:

- Making a Real Estate Investment in Medellin, Colombia

- Making a Real Estate Investment in Cali, Colombia – the next frontier?

- Is it too early to make a Real Estate Investment in Bogota, Colombia

- Penthouse Investing with High Yields in Medellin

- $100,000 investment house in Medellin, Colombia

- Is Colombian real estate still investable following the election of Gustavo Petro?

- Double-digit yields in Bogota for Airbnb multifamily units

- 12% net capitalization rate and rental yield in Cali, Colombia

- Afternoon trip to a Finca for sale near Medellin – with ROI numbers

- Pros and Cons of living in Medellin, Colombia

- Investing in Bogota real estate – Possible bottom? Market update

- I bought a Penthouse in Medellin, Colombia

Services in Colombia:

- How to obtain residency in Colombia

- Real Estate Lawyer in Colombia

- My Favourite Real Estate Agent in Medellin, Colombia

- My favourite real estate agent in Bogota

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Full transcript of “Actual Capitalization Rates / Rental yields in Medellin, Colombia”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. So today, I’m in beautiful Medellín with my favorite agent, Mauricio. Mauricio, how are you?

MAURICIO: I’m doing great, thanks. And you?

LADISLAS MAURICE: Good, good.

MAURICIO: Nice.

LADISLAS MAURICE: So you’re happy to be here in Medellín and not back in Sweden?

MAURICIO: Yeah, I’m extremely happy here in Medellín, and it’s always nice to be here.

LADISLAS MAURICE: Fantastic.

MAURICIO: Sweden, good two, three months of the year and rest Colombia.

LADISLAS MAURICE: [laughs] 100%.

MAURICIO: [laughs] For sure.

LADISLAS MAURICE: So today, we’re here to hold Mauricio accountable. So last year, in December, around the same time, I was in Medellín, and then he showed me a stunning apartment in El Poblado.

MAURICIO: 13th floor.

LADISLAS MAURICE: 13th floor, 106 square meters. And in dollar terms, back then at the exchange rate, it was going for $150,000. And that was before negotiations.

MAURICIO: The asking price.

LADISLAS MAURICE: Yeah, asking price. And we did all of the numbers together last year. And then he said that he could essentially commit, because he not only helps you purchase investment properties here in Medellín, but he then also manages them for you, he said he could commit to delivering a 6.7% net yield after all expenses, and maintenance, and vacancy, etc. So one year later, we’re back here, Mauricio. And you sold the apartment.

MAURICIO: Yes.

LADISLAS MAURICE: You sold it for how much in the end?

MAURICIO: We negotiated down 5%, sold for about 142,000 USD with furniture.

LADISLAS MAURICE: With furniture.

MAURICIO: Yeah.

LADISLAS MAURICE: So $142,000 with furniture, essentially turnkey.

MAURICIO: Turnkey.

Occupancy rates in Medellin

LADISLAS MAURICE: All right. Now, here, we’re looking at the monthly breakdown of how much your investor actually earned. So we see it, so the investor essentially took a few months to sell the property, and the investor started getting money starting from April. And this is in dollar terms. So those are the actual payouts, taking into account the depreciation of the Colombian peso, which has not done well at all this year. Essentially, when we were talking last year, it was at 4,000 pesos to the dollar, and now we’re at around 4,800. So down almost 25%. So quite a big drop. So we see the numbers here in dollars net at the exchange rate, so how much the investor actually got.

And it was pretty much a full house. So we have all the numbers until January, like the coming January, because it’s already booked. For February and for March, we did a forecast, essentially, you just copy-pasted the January numbers. So June is a zero. Can you elaborate on why?

MAURICIO: Yes, because of the apartment, it’s a lifestyle apartment. So the owner, when she’s in the country, she stays in the apartment herself. So she blocks off the dates and tell us, “Hey, guys, in June, I’m going to be in the place. Block it off.” And then we try, as soon as she leaves, we try to make it so client moves in immediately. And that’s what happened in June.

LADISLAS MAURICE: So essentially, the apartment is fully booked, I mean was fully booked the whole year, except for the month where the owner decided to stay there. So pretty much full house. But these numbers are essentially based on 92% occupancy. And when we talked last year, we had based the numbers on 80% occupancy. So obviously, this makes a big difference for the numbers. In terms of your overall portfolio, so you manage a lot of properties now.

MAURICIO: Thirty-five at the moment.

LADISLAS MAURICE: Thirty-five properties, all typically a bit higher end like this one?

MAURICIO: Yeah.

LADISLAS MAURICE: And what is your average occupancy rate?

MAURICIO: The average is about 90% for monthly rentals. When it’s daily rentals, it’s closer to 84%.

LADISLAS MAURICE: Okay.

MAURICIO: Overall.

Airbnb rules in Colombia

LADISLAS MAURICE: And again, it’s important to understand here, in Colombia, you can’t just do short-term Airbnb rentals in any building. Most buildings do not allow it. So in most cases, when you make an investment here, you go from monthly rental, so rentals of at least 30 days. But the reality is that with all of the, I mean, hundreds of thousands of Americans and Canadians that are leaving North America in droves, they’re moving down to Mexico, they’re moving down to Colombia, they’re going to all of these places, staying a few months at a time, working remotely, earning US dollars, spending pesos, there is a lot of people that need monthly rentals. And that’s how you get these massive occupancy rates.

MAURICIO: Yeah.

LADISLAS MAURICE: And it’s not like when you come here as a tourist, you can’t just sign a long-term lease agreement, you have to go through agencies that offer such services. And a big catalyst is the new Colombian digital nomad visa, which will allow people to come here and stay for a year, possibly two years if they extend it at a go. And before, this wasn’t possible, people could only stay for three months and then, maybe later in the year, another three months, but maximum six months per year, or they had to get residency, which is a whole process. So we’re going to see a whole new crowd of people that will come down here to Colombia with the money to rent such apartments.

Cool. So in terms of the total income for the year, we’re at almost $19,000. And then going into the costs, so your property management for midterm is roughly 10%. We’re looking at a property tax of about $700 per year for this apartment. Monthly charges, so HOA for the whole year of $1,400. So a bit over $100 a month. And again, let’s not forget, in the video, there was a pool, there was a whole rooftop–

MAURICIO: Gym on the rooftop.

LADISLAS MAURICE: Gym.

MAURICIO: There’s a sun deck, there’s a pool on the first floor, parking spot.

LADISLAS MAURICE: Yeah.

MAURICIO: Visitor parking and 24-hour security.

Exact capitalization rate / rental yield of an Airbnb apartment in Medellin

LADISLAS MAURICE: Which is important. So you get a lot for the roughly $120 you spend a month. About $1,000 in utilities, internet as well, almost $500. Again, you want to make sure you get the most expensive and best package because the target market is, typically, European or, preferably, North American digital nomads. And then maintenance, so we took the numbers from last year, in terms of maintenance, you didn’t really even have any maintenance, but we still put it in there. We increased it by 10% to take into account inflation, and about $700 of maintenance per year. So all in, that is essentially $1,000 net a month in the pocket before income tax for the investors. So the net rental yield is 8.9%.

So I verified all these numbers. I went into Mauricio’s database and to his Airbnb profile, we pulled the numbers. I looked at the contracts because, sometimes, you also, you don’t just do Airbnb rentals through your website, you get midterm rentals as well. We looked at the contracts. So I verified all these figures. And the investor received 8.9% net yield using the apartment for a whole month.

MAURICIO: Yeah. And also what I would like to add there is from the client perspective, the tenant in the apartment, there are only five stars’ review, and the tenants are super happy with everything. So it’s a win-win. It’s good for the investor, the tenants are super happy in the apartment, don’t thinking they’re overpaying, which they’re not. And it’s just a great service.

LADISLAS MAURICE: Perfect. So can you deliver more such properties to investors? So if, following this video, people get in touch with you. There’s a link below with more information on Mauricio’s services. They say, “Hey, Mauricio. I have $200,000 to invest. I’d like to get at least that 9% net yield. Can you deliver this? Do you have properties in your books, or can you find properties that can deliver these numbers?”

MAURICIO: Yes, we can definitely do that. And we already are, the 10 the last clients they are looking at return of investment around the same numbers.

LADISLAS MAURICE: Yeah, I confirm. I’m here with a very close family member of mine who’s looking to make an investment for his retirement. And I brought him here. And now we’re here in Medellín for a few weeks, with Mauricio with his team, looking at a whole bunch of properties, running all of the numbers. And we’re going to start putting offers through in the next few days. So these numbers are actually happening here in Medellín. The yields are extremely high. It’s hard to find markets with such net yields, and conservative figures, and a number of positive catalysts in terms of the amount of digital nomads that are expected to come down to Colombia.

Impact of Peso depreciation on real estate in Medellin

So obviously, there are risks associated with Colombia. The country just elected a socialist government, so taxes are probably going to go up a bit. The currency immediately took a 20% hit as soon as the guy was elected. Did this have any impact on actual prices of real estate?

MAURICIO: Well, we saw was that prices on real estate went up but not all the deals. Depends on the owner. If the owner is a high-end, rich Colombian, they normally think USD terms. So they were the quickest to raise their prices. But if you find a property that sits about the same price in Colombia terms, and you come in as an investor by USD, we found some really good deals for our investors, they bought at a good price. And then the rental prices tend to go up in Colombian peso terms, but in USD, it stays about the same. So there’s a good opportunity to make when you have the right seller and the right buyer and combine them. And that’s how we make this 9%, 10%.

LADISLAS MAURICE: This is very important. So people need to be very conscious of this when they invest in a Colombia, they’re investing in a currency that will probably be going down over the years. The country has a current account deficit. It hasn’t been able to solve it. So there are no short or medium term catalysts for things to improve significantly from a currency point of view. But, same as with Turkey, where I made a few real estate investments there, you need to be very cognizant of which market you choose to enter when you go into a Colombia.

So for example, in Turkey, if you were, which I did, I bought into core Istanbul real estate, and there, the prices were essentially just following the dollar. So the prices, as the lira was crashing, the actual prices of the apartments were not going down in USD terms. Owners just kept increasing the price of the apartment in lira terms. Sometimes, you could find arbitrage where people were a few days late, or a few weeks late, and then you could make a good deal. But generally speaking, apartments in core areas like the ones that you specialize in El Poblado, in Laureles, the two areas that I’m focusing our search on with my family member, these areas track the USD in terms of real estate prices. If you start going a bit farther away into places that are also quite nice, like Envigado, etc., they are less correlated to the US dollar. So when the currency goes down, then you potentially have better deals, but then you’re buying real estate that has less of a hedge against the USD.

And in terms of rentals, because you’re targeting, typically, North American digital nomads, Europeans, to a smaller extent, but mostly North American digital nomads, when they look on Airbnb, when they contact you directly through your website–

MAURICIO: They think in USD.

LADISLAS MAURICE: They think in USD. So essentially, the prices are set in USD, the rental prices. From that point of view, investors are quite hedged. Now, again, you know, Colombia comes with a whole set of macro risks, but you’re getting paid for the risk that you’re taking here in Medellín. And again, the price per square foot, and the price per square meter that you’re buying for such a world class city with direct flights to pretty much everywhere in Latin America, as well as directly to the US, and Mexico, and Panama, all of that–

MAURICIO: And adding new routes.

LADISLAS MAURICE: And constantly adding new routes, the prices are very, very competitive. So in many ways, it’s not only a value play, because of the low price that you pay, the low absolute price that you pay in US dollars, but it’s also a yield play because of the high yields that you earn. So I find it very interesting for people who can stomach the currency and political volatility that is inherent to Colombia. So, Mauricio, your agency grew quite a lot in the last year, you went from quite a lot of–

MAURICIO: From six.

LADISLAS MAURICE: people that work with you, from five, six–

MAURICIO: And now we are 13.

LADISLAS MAURICE: Thirteen, okay. So you have a number of independent agents, contractors that work directly with you and that help source all these properties. So you constantly have people literally–

MAURICIO: Looking for new deals, too.

LADISLAS MAURICE: walking the streets–

MAURICIO: [laughs] Yeah.

LADISLAS MAURICE: and calling all the numbers and sourcing the properties.

MAURICIO: Yeah.

LADISLAS MAURICE: So great. So everyone, if you’re interested in investing in real estate here in Medellín, there is a link below. Do get in touch with Mauricio directly, and then him or someone in his team will be able to help you with your property search. All right.

MAURICIO: Okay, thanks a lot.

LADISLAS MAURICE: Mauricio, thank you.

MAURICIO: Yeah. Looking forward to hear from you.