Budapest is among the most exquisite cities in Europe and it’s a market I know well, having invested in real estate here for several years.

However, is investing in the Budapest real estate market still a good idea? More importantly, is 2025 the right time to buy property in Hungary?

We will explore these questions by delving into the Budapest real estate market, offering property investors an in-depth analysis, key insights, top neighborhoods and the potential yields of rental properties.

Table of Contents

Overview of Hungary’s Economy

Hungary has had a spectacular run on the economic front

In 2010, the opposition led by Victor Orban came to power. He was elected on a free-market and populist platform. Orban suffers a notoriously bad reputation in international circles and in the Western press for his anti-immigration stance, but he did enact economic reforms that boosted the economy.

On the back of economic reforms and (free) money from European Union cohesion funds, Hungary boomed between 2014 and 2019 and became one of the top-performing economies in Europe. Its real GDP growth was almost 5% in both 2018 and 2019, which is reminiscent of booming South East Asian economies. Since Covid and the Ukraine war, Hungary, along with much of Europe, has been stagnating, though it is doing better than most of its neighbours.

The European Union (EU) Played a Large Role

It’s all too easy to give Orban full credit for the economic boom. While you can’t deny that his policies played a significant role, the flow of free EU money cannot be underestimated.

In 2018, Hungary contributed €1.1 billion to the EU budget (0.7% of Hungarian GDP), but received a cool €6.3 billion from the EU (5% of Hungarian GDP).

When you drive around Hungary and marvel at all the new highways, stadiums, hospitals, schools, and great infrastructure, rest assured that it is not because Hungarians are so productive, but rather because their politicians were very good at getting EU money. German, Austrian, Dutch, and Scandinavian taxpayers have played a disproportionate role in the rebuilding of Hungary.

Nationalistic Hungarians claim it as their own work and proof of their genius. European liberals claim it as a demonstration of their solidarity and moral superiority. In reality, the small business owners of Utrecht and Stuttgart contributed more than their fair share to rebuilding Hungary.

There is now constant haggling between Hungary and the EU to release more funds.

The impact of COVID and the war in Ukraine on the Budapest real estate market.

When Covid hit, Hungary was one of the harshest countries in the EU regarding border control, effectively shutting itself off from other EU countries for non-business-related trips. Its internal measures were less harsh than most, but from a real estate point of view, the market took a severe hit in the central areas of Pest.

Pest, unlike the other bank Buda, is where most foreigners tend to live and congregate. It is also where most accommodation for tourists is located.

This meant that thousands of furnished Airbnb apartments were empty, and found their way to the long term rental market, thus depressing yields for all involved. At the same time, less students and people moved to Hungary due to all the restrictions.

Conversely, prices boomed in the outskirts of Budapest as Hungarians wanted to buy houses with gardens away from the city center. We saw a similar phenomenon in many other markets in the world, so just to keep in mind, the real estate market in Budapest is not the only example.

Now that tourism is booming again, Airbnb yields are actually up. Tourism has reached pre-covid levels and there has been supply destruction due to Covid and more Airbnb regulations by the various districts. Depending on the district and building you invest in, it may or may not be possible to obtain a short-term let license. This is why using a competent buyer’s agent in Budapest such as Benedek is important, as normal agents will tell you whatever it takes to sell you the apartment you are looking at.

In some districts it is impossible to obtain a license for short term rentals. In others, a license is not even needed.

The war in Ukraine has been a net positive for the Hungarian rental market due to tens of thousands of Ukrainians moving to Hungary. Not all are poor. Many are upper middle class and don’t mind paying rents in Budapest that are effectively more affordable than Kyiv before the war (yes, rents in Kyiv before the war were more expensive than in Budapest and Warsaw).

One of my tenants is a Ukrainian IT guy living with his family who earns about $4,000 USD per month after tax. This is a higher post-tax salary than that of most Western Europeans.

The outlook for the Hungarian economy is neutral, which is better than for most other European countries

Sure, the outlook for all of Europe is negative. On the one hand:

- Europe has a serious problem. By boycotting Russian energy and antagonizing Russia in general, the EU has cut itself off from its primary energy source. This is not an article about being pro- or anti-Russia or pro- or anti-Ukraine; I just want to focus on the facts.

- The fact is that there’s a reason the EU used Russian energy. Why? Because it was cheap and plentiful.

- Now, the EU must compete in world markets to obtain US LNG or energy from the Middle East, Africa, and South America.

- The result is that not only is the EU paying way more than before for energy, but its main competitors are now at a structural advantage. The US produces its own energy and will make fat profits exporting energy to Europe, which is now dependent on it. China buys Russian energy at a discount. So Europeans pay more than before and the Chinese less.

- This situation is hitting European industry very hard, mainly German.

- Hungary is very dependent on industrial exports to Germany and Austria. For instance, exports of vehicles represent 12% of goods exported in 2022. European car-makers are not doing well these days. This reliance on car exports is a critical risk, though it isn’t as bad as in Slovakia, an extreme case (31% of its exports are cars).

BUT

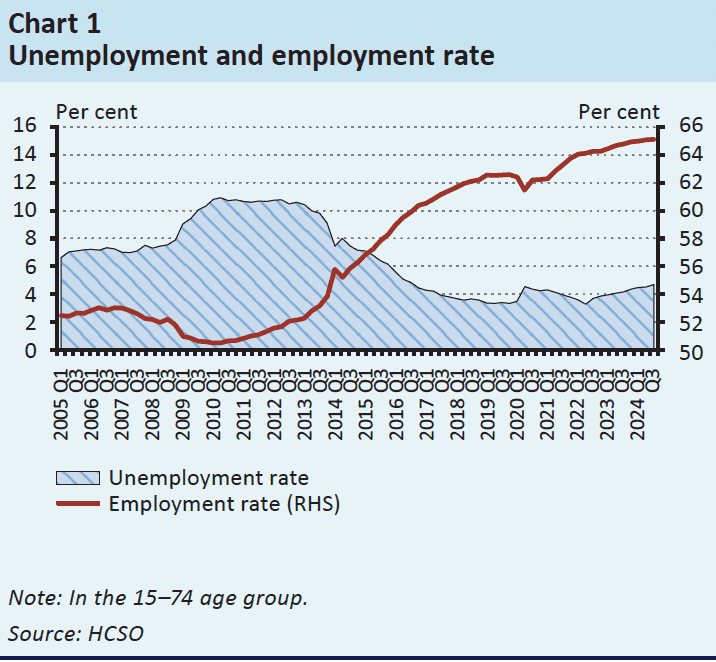

- Pre-virus, the Hungarian economy was overheating and there were labour shortages. This was unsustainable, so the current situation is less harmful than in Southern European economies which were running way below capacity.

- Hungary is trying to conduct an independent foreign policy, which is paying large dividends in the form of foreign direct investment from non-Western countries. The UAE will invest 5 billion euros in the coming years in Hungarian infrastructure. A large Chinese battery maker is building a 1 billion euro manufacturing facility in Hungary.

- Momentum is on Orban’s side. The last few years were challenging due to constant fighting with the EU and withheld funds. Now that Trump is in power, this is a big tailwind for Orban and his type of policy. It’s also likely that the double-tax treaty with the US that has been suspended by the previous administration will be reinstated.

The Budapest Real Estate Market: Full Analysis

Your biggest risk when making a real estate investment in Budapest, Hungary, is the Hungarian Forint

Even during the boom years, the Hungarian Forint (HUF) kept dropping.

And this is in spite of improving fundamentals.

The reality is simply that the government and central bank are very happy to let the currency devalue. It’s an easy way for the export and tourism dependent economy to remain competitive, while allowing substantial nominal wage increases, which voters love.

The external shock that is the virus hit two key forex earners – tourism and car manufacturing. This increased pressure on the HUF. Expect the HUF to continue its overall downward slide, with volatility. A key question for any astute real estate investment in Budapest Hungary, is therefore “will the HUF depreciate faster than my investment increases in nominal value?”

Having said this, the fact that the Hungarian Central Bank CAN devalue its currency is one of the main points that makes Hungary attractive from a macro point of view. This gives the country flexibility to choose its monetary policy in a highly volatile and uncertain world, as opposed to depending on bureaucrats sitting at the European Central Bank in Frankfurt who think of Germany and France first, not Hungary.

Personally, I see this as a positive. It allows for solid entry points into the Hungarian real estate market. Budapest offers great value compered to other EU capitals. Additionally, most rental income can be set in Euros. All of my tenants pay in Euros, or in HUF but indexed to the Euro, so my yields are not impacted.

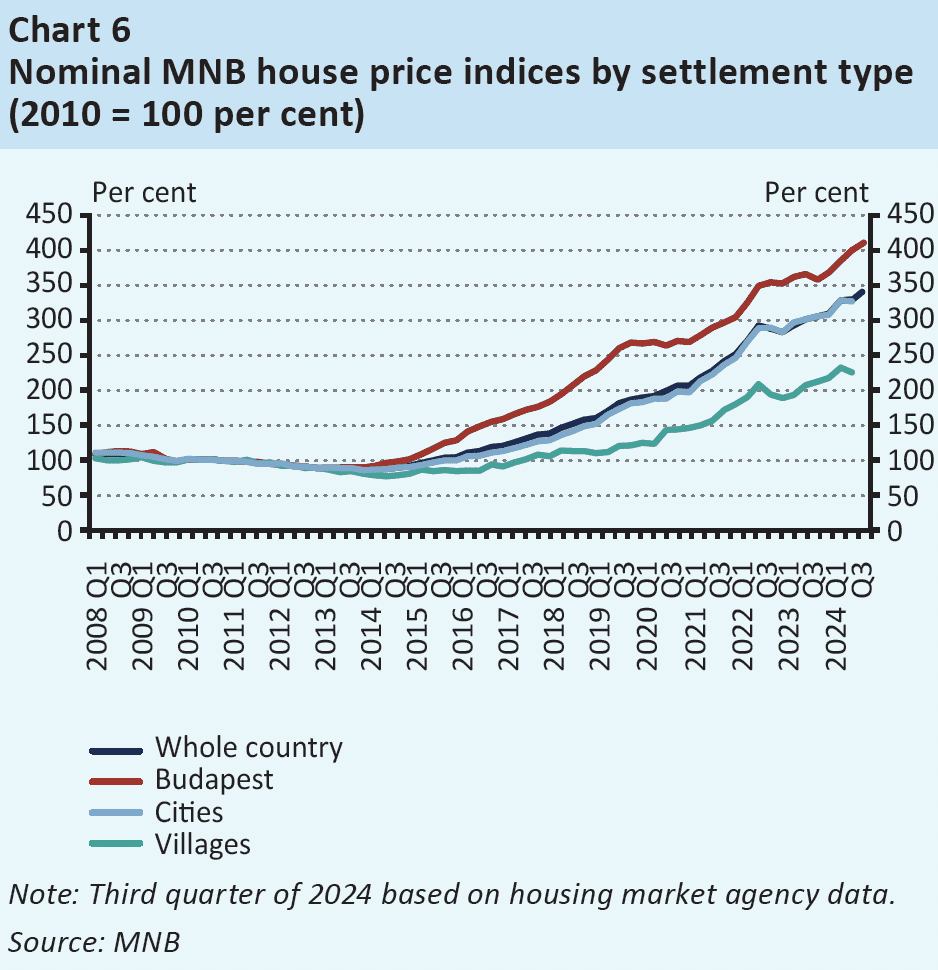

Historical prices of the Budapest real estate market

The real estate investment market in Budapest, Hungary, absolutely boomed from 2015 to 2019 before dropping in real terms during Covid. The market is now experiencing a strong comeback. Be mindful that these numbers are in HUF and look a lot less spectacular in EUR and especially USD terms.

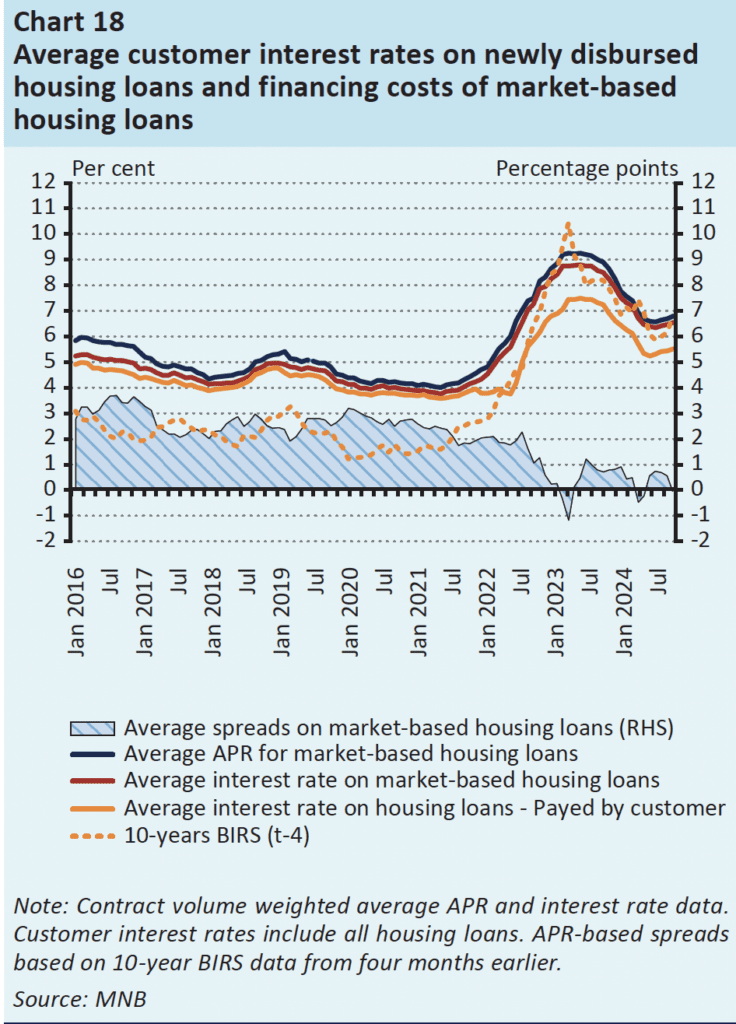

More reasonable interest rates are bullish for the real estate investment market in Hungary

Interest rates shot up substantially in 2022 and 2023 in light of the inflation crisis. Mortgage rates went north of 10%, up from 4% two years prior. Needless to say, lending was down in the local market. However, interest rates have decreased and consequently lending is up.

The line that matters in this graph is the one in black which shows the real rate. The other ones are subsidized rates. About subsidized mortgages:

- They are for lower income Hungarians or families and typically do not impact the markets where foreigners invest (core Budapest)

- The government is gradually decreasing the number of such loans as it is proving to be fiscally challenging.

This is a big catalyst for housing in Hungary.

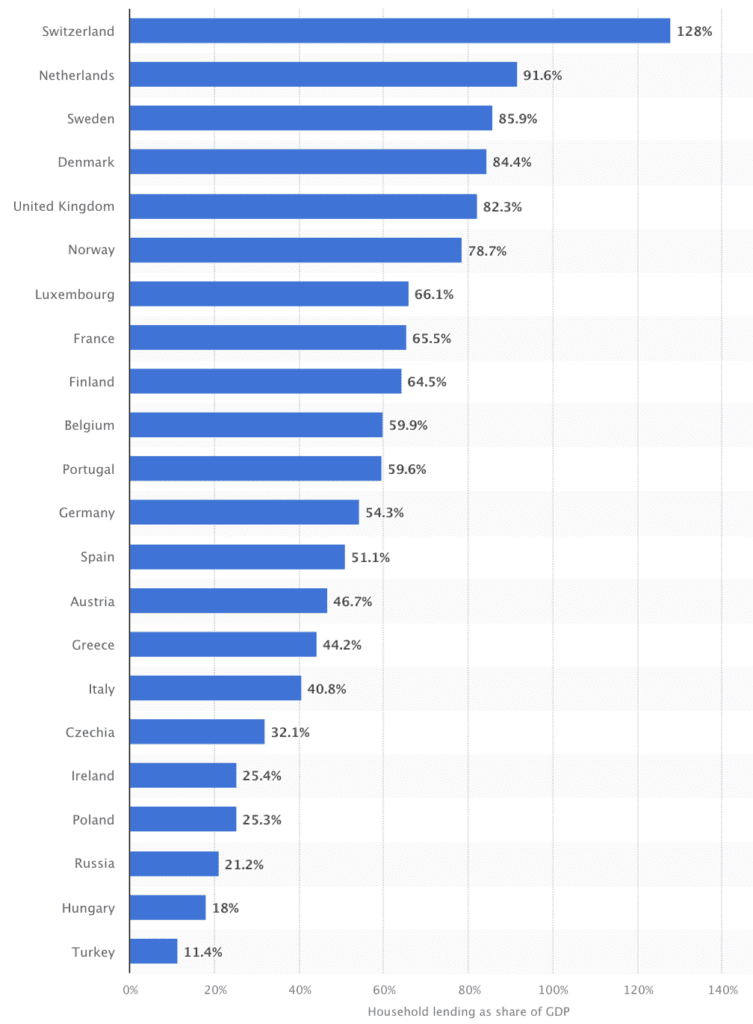

The reality is that Hungary still has an severely under-levered real estate market. As mentioned, most leverage is in outer areas where foreigners would not invest. Those areas generally have low gross yields, and only local tenants.

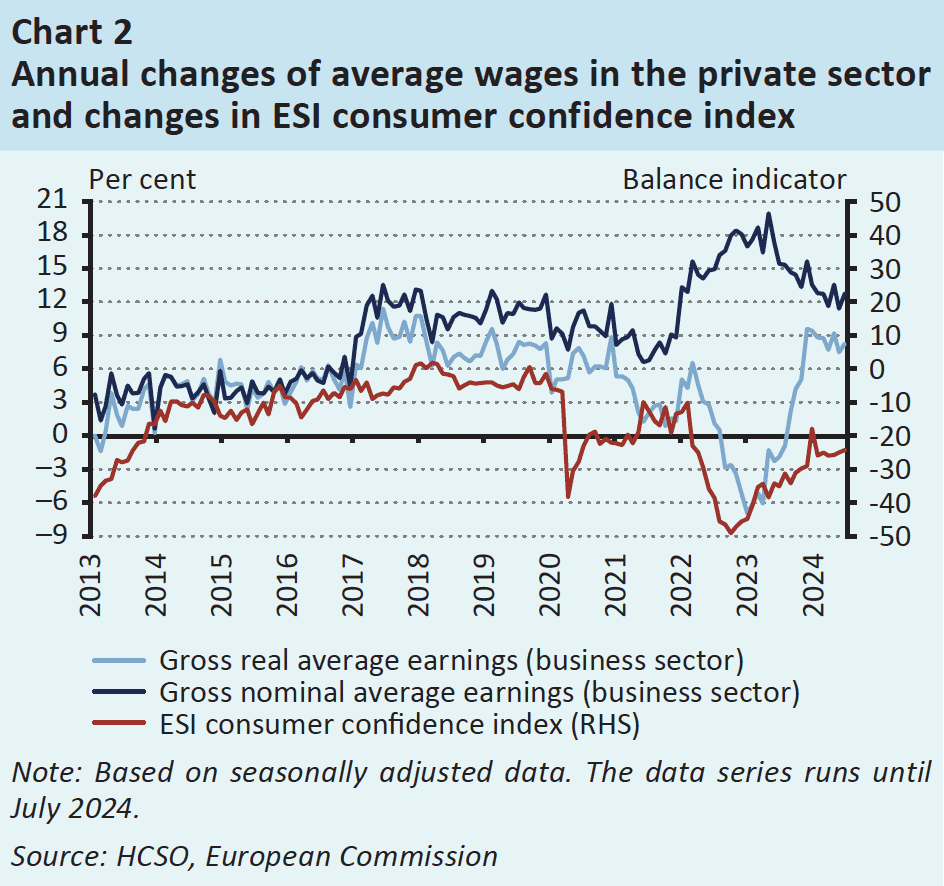

After a tough bout of inflation, real wages are now surging

Consumer confidence is up and interest rates are down. More flows into real estate are inevitable.

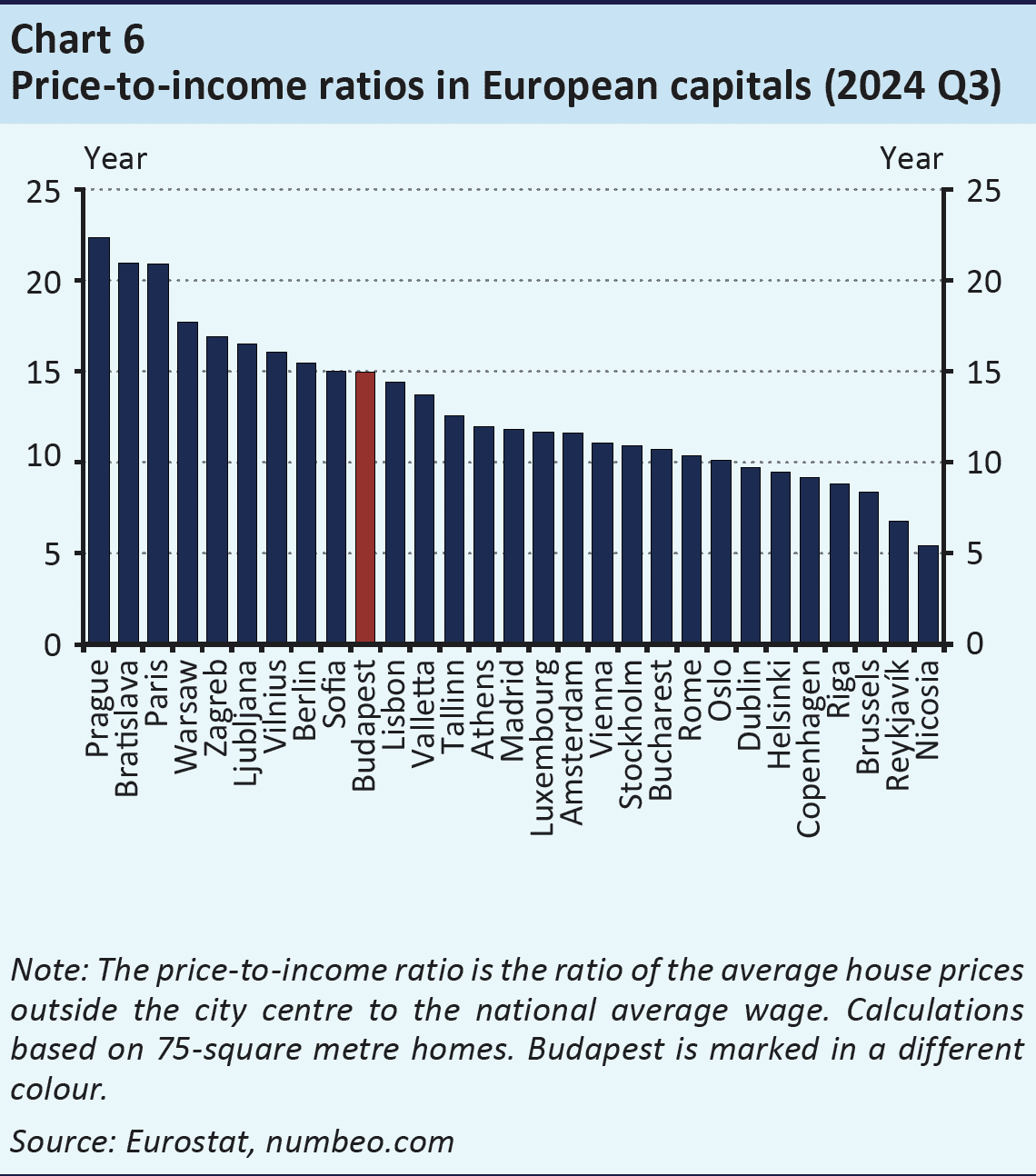

Though affordable in absolute terms, prices are stretched for locals

Real estate prices in Budapest are cheap in absolute terms but have become somewhat disconnected from local purchasing power, though there has been an improvement is the last 3 years.

As an investor, this is not the only factor to consider. Much of the housing stock in downtown Pest, for example, targets higher-income foreigners who stay short and/or long-term in Budapest. Also, the low regulatory and tax environments make Budapest attractive to investors.

For example, for my 2-bedroom apartment in the 5th district right next to parliament, I pay yearly property taxes of about 200 euros. This amount is fixed in HUF and hasn’t changed for a few years.

So sure, Brussels may have a better price-to-income ratio, but good luck with property taxes, income taxes, kicking tenants out when they don’t pay, and with all the Green policies that can be very expensive for landlords.

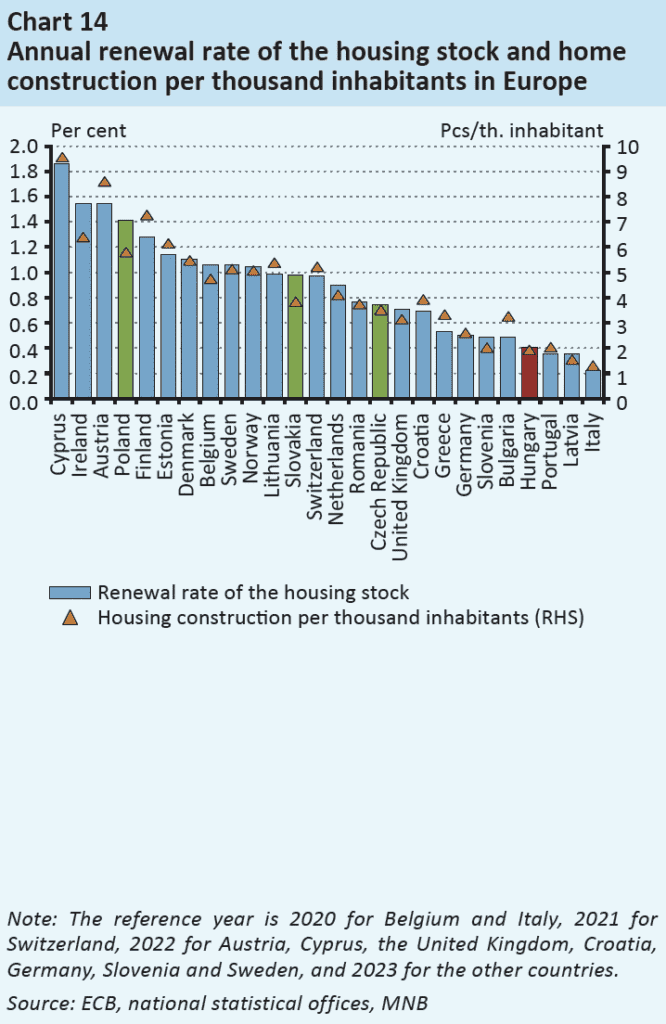

Not enough real estate supply available

On the other hand, Hungary has a very low new housing construction rate by European standards.

This is one of the core advantages of investing in the center of a city such as Budapest. Because of extremely strict zoning laws to preserve the gorgeous historical character of the core city, supply is inherently limited. This contrasts with cities such as Warsaw where high-rises keep popping up everywhere.

Limited supply is inherently bullish for real estate investors in Budapest.

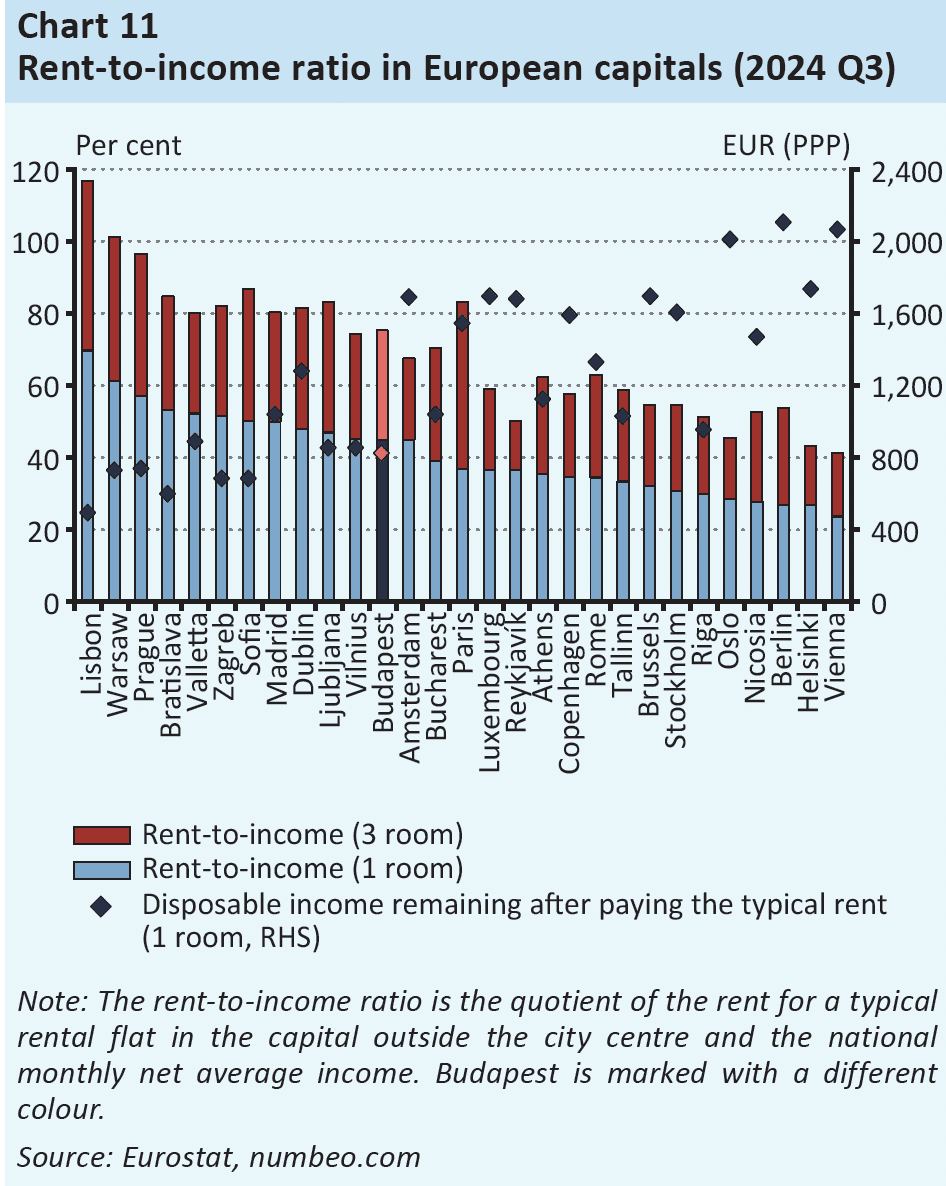

Budapest is middle of the range in terms of rent affordability in Europe

Rent eats a large chunk of locals’ incomes. Having said this, when you buy in the center of Budapest and target foreigners, you live in a different reality. International people moving to Budapest generally have higher incomes.

In my 9 years of owning real estate in Budapest, I never had Hungarian tenants. I’ve had Westerners, Koreans, well-off Eastern-bloc people, wealthy Africans and Middle Easterners.

New Airbnb restrictions

The reality is that Budapest lacked adequate hotel capacity to satisfy international arrivals, so the government let the Airbnb boom take place. However, as capacity increased and housing affordability became an issue for locals, it became politically wise to implement Airbnb restrictions. Anti-Airbnb laws of various degrees were passed.

It varies based on the districts. Some districts are strict, and others are not. Some require a permit, others require that your homeowner’s association allows short-term lets in your building, and the rest ban it outright.

Gone are the days when you could just show up in Budapest, buy an apartment, and put it on Airbnb. This is one of the biggest pitfalls to avoid when making a real estate investment in Budapest.

There has recently been a lot of activism against Airbnb in Budapest. This trend is set to continue.

For example, in September 2024 a local referendum in the 6th district resulted in an Airbnb ban to come into effect from 2026 onward. An agent could easily sell you an apartment in the 6th district with an active Airbnb license telling you you are allowed to do Airbnb…

These Airbnb restrictions will have a slight cooling effect on long term rents and sales as they get implemented. There could be a few panic sales as well by some Airbnb owners.

Again, this is why you need a good agent in Budapest. Most agents will tell you Airbnb is fine when in fact it’s not. A good agent will know the restrictions per district, know how to handle the home owners association, and how to get the municipal approval if required. This is why I work with Benedek my Budapest real estate buyer’s agent.

Overall though, I would be wary of making a real estate investment in Budapest that is purely focused on Airbnb, as the likelihood of further restrictions or outright bans remains significant.

Expected Yields

Beware of agents who make claims about net yields of 6-7%.

Once you take into account ALL real costs (maintenance, taxes, vacancy, etc) as well as the REAL purchasing costs (with taxes, legal fees, stamp duty, etc) the real returns on your investment are lower.

You can get such numbers on Airbnb, but not on the long-term market.

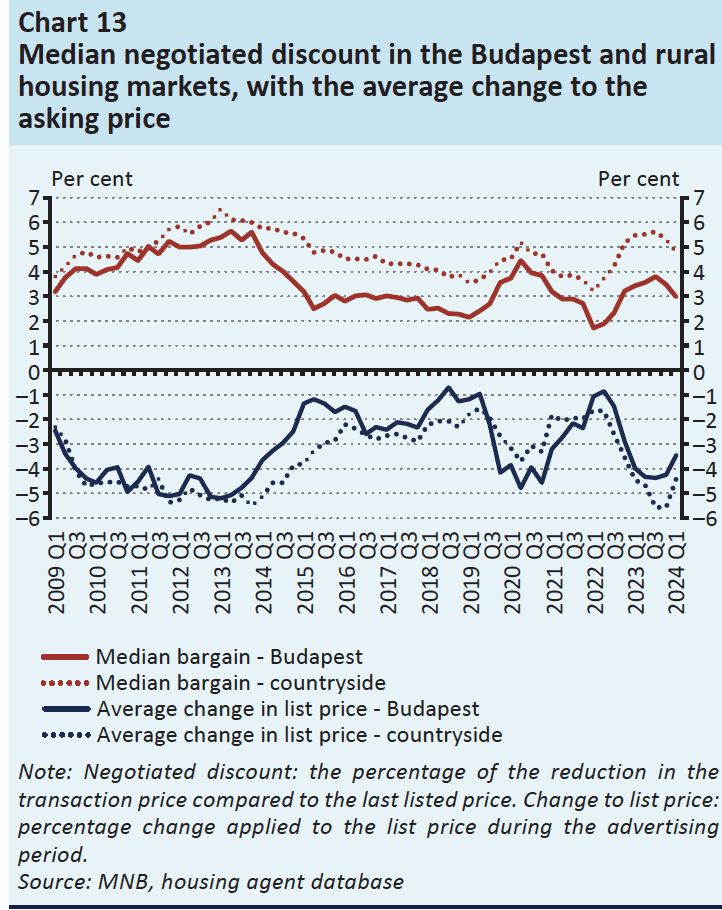

How much to negotiate when buying real estate in Hungary

On average listings go down 3% during their lifecycle, and people negotiate an extra 3% off. Speaking to Benedek, as he helps people find special opportunities, he generally gets 5%-6% off for his clients as he hunts for deals as a buyer’s agent, more than offsetting his fee.

Where to Invest in Budapest?

In which districts should you make a real estate investment in Budapest, Hungary?

If you were to make a real estate investment in Budapest, Hungary, it is important to have an understanding of the overall dynamics.

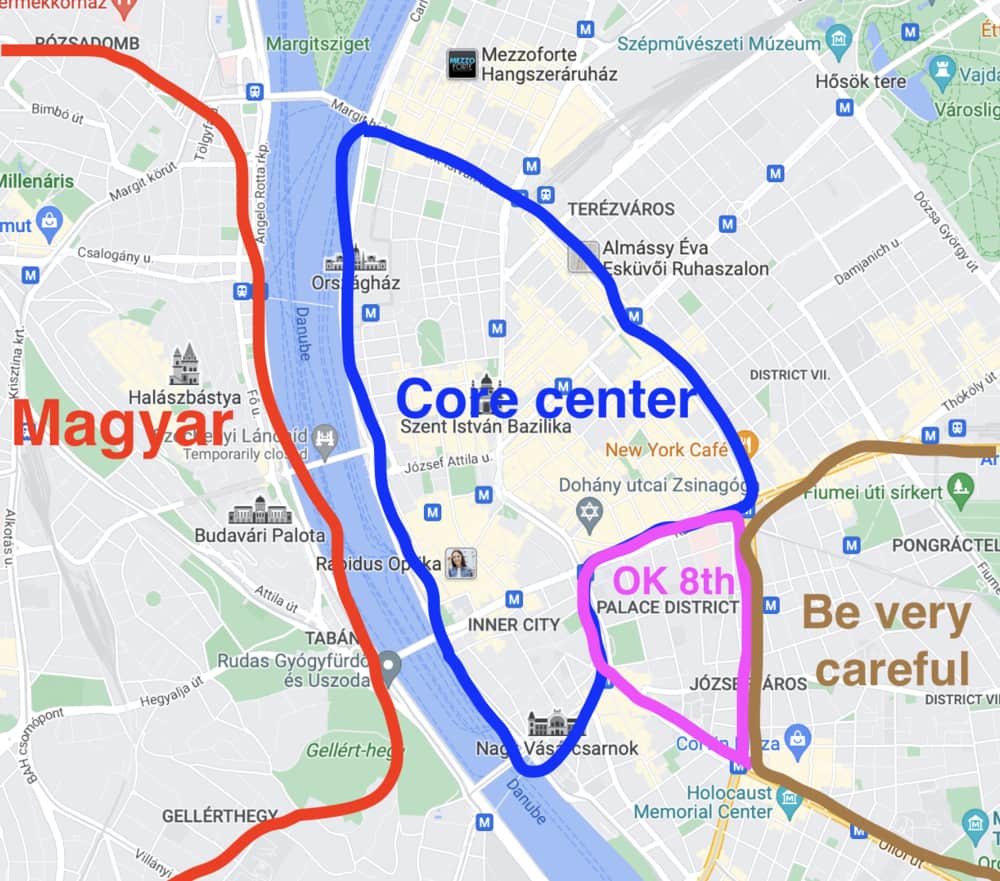

The Danube divides the city into two – Buda on the left and Pest on the right.

- “Magyar”: This is where Hungarians aspire to live. Proportionately fewer foreigners live on this side of the Danube, though this is where international schools are located. Overall, you’d tap into the local market here. It’s a good thing if you are bullish on Hungary in the long run.

- “Core center”: I am referring to the 5th, 6th, and 7th districts within the ring road. This is where you’ll find the Parliament, the Basilica, all the shopping areas, bars, clubs, Opera, Synagogues, etc. It’s generally where tourists spend most of their time sightseeing, eating, and drinking. This area has the highest concentration of Airbnb lets and foreigners living there to study, work and play. I firmly believe this is where the best opportunities are to be found along with some parts of the 8th.

A warning about the 8th district

“Be very careful”: The 8th district is controversial and hugely speculative. To be fair, it’s a speculation I missed out on. Had I invested there when I took my first positions in Budapest, I would have made an absolute killing. It’s known locally as the “dangerous” area mostly due to a higher concentration of the Roma people minority. Various government initiatives were put into place to “renovate” and “gentrify” the area. Parks and roads were rebuilt, street lighting was improved, cameras installed, etc. The area became nicer, and students from universities in the nearby districts moved in. Prices doubled and even tripled after a few years.

HOWEVER, I believe there is less upside here than in the “Core city” area because of recent developments. The 8th district is now the landing spot for immigrants from Africa, the Middle East and South Asia. Immigration from these countries is fast accelerating, albeit from a low base. Their numbers have been increasing lately, in spite of official government policy against immigration. In reality, there are probably backroom deals with the EU for refugee intake. Looking back, if you take the example of Western European capital cities, would you have wanted to invest in the beautiful core center districts 20 years ago, or in the districts that would become the first base for refugees and developing world immigration?

If you are offended by this analysis, then go ahead and invest in the 8th district. I’m observing facts and trends.

With that said, I must add that some specific streets in the 8th district are fine to invest in. But you really need local, unbiased insight to play this game, which you won’t get from a normal real estate agent in Budapest.

A $5 billion project from the UAE nicknamed “Mini-Dubai” and “Grand Budapest”

The UAE has committed to investing $5 billion in a massive new development that is to take over the grounds of an old train station on the Pest side. It is expected to host Europe’s tallest skyscraper; a complete game-changer for the city and a source of jobs and economic growth.

However, there is drama afoot. The left-wing opposition, which controls the city of Budapest, is blocking the project as it would prefer to see more affordable housing.

This battle will brew in the courts for quite a while.

However, if you are a keen speculator, this is where the project is set to be located.

Anywhere close to the project is set to surge in value if the project were to go ahead.

Video: Benedek’s Favourite Areas to Invest in Real Estate

Case Study: Real Estate Investment in Budapest

This apartment is located on Paulay Ede utca in the Jewish quarter, close to the Opera, and one street behind Andrassy ut, the Champs-Elysees of Budapest. It is a 74m2 two-bedroom apartment on the first floor (not the ground floor) of a gorgeous historical building. It’s a triple-A location. I owned this apartment for a few years and sold it last it to increase my allocation to Latin America.

This apartment would be currently valued at ~ €250,000.

The market value of the rent is €1050 per month + utilities and standard charges. Tenants pay the common charges of HUF 25,500 per month, which include water. They also pay for gas, internet, and electricity. The owner is liable for a yearly property tax of HUF 144,000 (~€354).

Here’s the breakdown of the yield calculation.

| Price of apartment | €250,000 |

| Price of apartment with closing costs (4% stamp duty +1.2% legal fees) | €263,000 |

| Rent of €1050 x 12 | €12,600 |

| Gross yield INCLUDING buying costs (4% stamp duty +1.2% legal fees) | 4.8% |

| Yearly rent at 95% occupancy | €11,970 |

| Management + tenant finders fees 15% | €1,796 |

| Maintenance 5% | €599 |

| Property tax | €354 |

| Net income before income tax | €9,221 |

| Net yield | 3.5% |

A net yield of 3.5% for historical, core property in a European capital city is actually a decent yield these days. If you were to invest in a similar apartment in a district that allows Airbnb, you could expect a net yield of about 5%-6%.

Case Study: Renovation Project & Real Estate Investment

In this video Benedek shows one of his renovation projects, in which he chopped an apartment into multiple tiny studios to maximize yields and capitalization rates. It is still possible to do in some districts, but in others Airbnb is banned. If you do go ahead with it, make sure the tiny studios would be acceptable for the student long-term market in case your district were to ban short-term rentals as well.

What is the current state of the real estate investment market in Budapest?

To recap, let’s look at the key points considering a real estate investment in Budapest:

- There are dark clouds in the EU due to its foreign policy, but the situation is likely to be better in Hungary than in the rest of the block thanks to an independent foreign policy and more flexibility due to having its own currency.

- Trump in power is a big catalyst for Orban’s influence within Europe.

- Interest rates have gone down, which is a clear catalyst.

- Real wages are up after a few years of strong inflation.

- Budapest offers tremendous absolute value for gorgeous historical real estate in the heart of a European capital city. The ongoing HUF weakness offers foreign investors a great entry point.

- Long term gross rental yields of 5-6% are achievable, and the underlying asset will withstand the test of time due to the inherent historical value of real estate in Budapest.

- Net yields of 6%-7% on Airbnb can be achieved due to a decrease in supply and increased regulations. To play this game, you absolutely need a good buyer’s agent to guide you through and manage the bureaucracy. Personally, seeing the anti-Airbnb trend this is not a market that I would want to be solely focused on.

- Overall, along with Sofia and Bucharest, which are not particularly beautiful, Budapest is the cheapest capital city in the European Union. Prices are lower than in tiny Bratislava in nearby Slovakia, and half the price of Prague in the Czech Republic. Budapest does NOT warrant such a discount.

- Prices bottomed, consolidated, and are now on the rise again. The Airbnb restrictions will have a small cooling effect on the market but will offer patient buyers an opportunity to buy from some investors looking for a quick exit. It looks like a good entry point.

Overall, I feel that Budapest is one of the most investible markets in Europe. It is far from perfect, but it is a very decent long-term investment. In spite of having reduced my exposure, I still own real estate in Budapest, and do not plan on selling.

If you have cash in your bank account, with the proper due diligence, you can find great deals by throwing low-balls around. It’s a buyer’s market.

When you are ready to pull the trigger, feel free to get in touch with Benedek my buyer’s agent and property manager in Budapest. He works with a number of agencies across Budapest and can help you source a property based on your requirements. It’s much easier to use him than going to different agencies who just try to sell the properties on their books.

Additionally, he and his partners do renovations and rental management. So he can offer you a turnkey solution.

You can find out more about Benedek’s real estate buyer’s agent services in Budapest.

Legal and Tax considerations when making a real estate investment in Budapest

It’s essential to use a good lawyer in Hungary. There can be quite a few issues with buildings, such as debt and failed rooftop projects. Also, an apartment can have a number of claims and liens against it.

The purchase contract is typically signed at a lawyer’s office, and preferably, the contract should be bilingual in English/Hungarian so that you are not only not clueless, but you have the proper paperwork to present to your bank back home to make the transfer. The first step is typically to deposit 10% in an escrow account following the signature of a pre-contract and a few weeks later to wire the final 90% once the lawyers have cleared the paperwork.

Be sure to negotiate 4-5 weeks in between payments, as sometimes your bank can cause you problems. There are many instances of banks’ compliance departments delaying the transfer, thus resulting in the 90% arriving late. Some Hungarian sellers then keep the 10% for themselves because they can (you were late contractually).

I’ve done a number of successful real estate transactions in Budapest. Feel free to get in touch with my real estate lawyer in Budapest. He is fluent in English, and has a flawless reputation in the industry. He specializes in commercial and residential real estate transactions in Hungary.

More details on the purchasing process and purchase related taxes in Hungary.

As for ongoing taxes, once you own your real estate investment in Budapest, Hungary, you’ll have to pay property taxes IF you rent the apartment out. If you live there or if the property remains empty, there is no property tax to be paid. To receive your property tax bill, you must go register the property at the local district office.

The tax rate on rental income is a flat 15%, and almost all expenses can be deducted (even your trips to Hungary!). There is also a capital gains tax of 15%, which decreases by the year. After year five, no capital gains taxes are due.

Whether you want to buy property or not, go to Budapest!

Budapest has been one of my part-time bases in Europe for a few years now. I absolutely love it. It’s a stunning city, it’s cheap, the beer and wine are plentiful, the weather is surprisingly good, its history is rich, and there are amazing bicycle trips to be done along the Danube and around Lake Balaton. So, If you are asking yourself if real estate investment in Budapest is a good idea, I highly recommend it.

Meet my trusted realtor in the Budapest real estate market

It’s easy to overpay for Budapest real estate if you don’t understand all the subtleties of the market. 99.5% of agents in Hungary just sell what is on their books, so they are inherently biased.

Benedek operates a unique business model. He searches across the whole Budapest real estate market for the best deals, acting as a buyer’s agent representing the best interests of his client real estate investors.

Frequently Asked Questions

Is it a good time to buy a property in Hungary in 2025?

Yes, Budapest real estate has been stagnating for a few years and now offers good value compared to other European capital cities. The market is now perking up.

How is the real estate market in Budapest?

The real estate market in Budapest is heavily divided between the core center of the city, where many foreigners invest, and the other districts which are largely driven by local demand. Budapest real estate has historically been quite volatile.

Is Budapest a good place to invest in property?

Budapest is one of the most affordable capital cities in the European Union, yet it is a major city in central Europe with gorgeous architecture, a great airport, and a booming tourism industry. Budapest real estate offers great value for money.

Is Budapest affordable to live in?

Budapest is one of the most affordable capital cities in the European Union. It is also one of the most affordable EU capital cities to eat out and drink.

Can I get a mortgage in Hungary as a foreigner?

Generally speaking, no. It’s extremely complicated, even for foreigners that have temporary residency in Hungary.

Available services in Hungary:

- A Real Estate Lawyer in Budapest, Hungary

- My favourite buyer’s agent in Budapest, Hungary

- Golden Visa in Hungary through real estate investment

Other articles on Hungary:

- Why did I sell my Budapest Apartment?

- A cheap Plan B in rural Hungary

- Investing in the Stock Market in HUNGARY, good value or value trap?

- BREAKING NEWS: Hungary Golden Visa – what we know so far

- Airbnb regulations and potential ban in Budapest, Hungary

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Super informative post, thank you!

Are you planning to review Riga, Latvia as well in future?

Thank you Anzelika. I will next time I go there :). Subscribe to the free private list to not miss out future such articles.

nice and balanced article

but 1.2% for a lawyer? paid not even half of that on my last purchase.

Thank you. Yes, I use an expensive lawyer. I always go for the best when operating abroad.

I have rarely seen so many lies in a single article …

Thank you for the constructive feedback Andras.

Thank you for this insight, which is as fair and balanced as ever.

There seems to be 5% missing in the amount of Income tax of 15% on rental income, whence 0,02% in excess on the bottom yield – but that’s just to show how close I read your analysis, Ladislas 🙂

Thank you Bertrand. You have a point – I need to make these numbers a bit clearer next time around. Cheers 🙂

Good in-depth article, thank you.

I do think though that the way you look at the relation between the EU and Hungary is way off, or biased in some way. There is no such thing as ‘free money’, thus the EU is obviously not giving alms to Hungary. They have their own agenda. You not seeing this puts a shadow on the rest of the information in the article for me.

This is good insight. Living here for 15 years and this is spot on. If anyone tells you otherwise, there’s an agenda behind.

My only caveat is the ‘ you can deduct almost every expense out of the rental income’. It might have been so in the past, but nowadays we can barely get cleaning expenses without NAV coming with questions.

Thank you Andre.

Hello Ladislas,

I just stumbled across your website. Thank you so much for this very informative article – it’s clear, lucid and contains clear information without jargon or any ‘spin’. I’ll definitely be back to read much more on this site!

All the best for 2021!

Thank you for a great article. Extremely helpful and insightful. Thank you for the hard work.

Thank you Dilippo 🙂

Thank you for the article. Did your friend already sell the property mentioned in the article?

Thank you Tibor. He hasn’t. Send me an email if you’re interested.

I appreciate your candid article Very informative to a 1956 refugee who is interested in acquiring property in his former homeland. One question sir, does the IRS penalize a puchase in Hungary or anywhere for that matter?

Hello Sandor. Thank you. You’ll have to report any income deriving from your Hungarian assets to the IRS. But kindly speak to your CPA for all the details as I am not accredited to speak about US taxes.

Thanks for the quick response. This is a little depressing. If one dies ? How does the property transfer to heirs in Hungary?

You have to read the various treaties between the US and Hungary for both taxes and estate matters.

Hello, I am a property lawyer and investor here in Budapest and I found your article very informative and precise, thank you. The only disturbing part is your comment about the EU-subsidies: this is not a gift, but the price Western countries agreed to pay in exchange for our opening of our markets, where Western companies made fortunes in the past decades – so it simply did not and does not cost the Western taxpayers anything. It was a contract: we open up the markets and they finance the development of our countries. We have done our part of the agreement, so it is very annoying when anyone wants to put new conditions on any payment or tries to show such as a gift.

Hello Zoltan, thank you. I completely understand your point of view. Western taxpayers paid for all the subsidies, Hungary benefited from them, and large Western corporations gained new markets.

Andreas the accountant from Bremen and Luuk the construction worker from Rotterdam didn’t get much in return for the taxes they paid. They are left holding the bag.

Hello, not really. Western companies repatriated their profits as dividends which were taxed in their home countries, so the governments there could afford more spending so the small guy there had better healthcare, etc There were times when Deutsche Telekom charged 5 times more for mobile phone sevices in Hungary than in Germany, i.e. profits in Eastern-Europe enabled the companies to sell their services in their home market cheaper, thus benefiting their local

small guys. Before the 2008 crises, the Austrian bank Raiffeisen made 80-90 % of their operating profits in Eastern-Europe, thus enabling them to offer free banking to their Austrian clients, so yes, all the Western taxpayers benefited and still benefit from subsidies to this region (I hope you don’t believe that Western countries are doing this for any motivation other than pure self-interest…). Anyway, back to your article: Q1 2021 shows an increase in housing prices, as in most parts of the OECD

@Zoltan Vincze:

Your interpretation or equation of Hungary joining the EU (=we open our economy and in return the EU needs to fund our infrastructure etc) is lacking a few very important parameters and historical facts. Not only were the Hungarian markets opened to Western companies but likewise were all the EU economies opened to Hungary (free movement of goods, services, workers etc). Certainly, in the early 2000s the Hungarian economy was not that competitive to make substantial use of that access. However, especially the free movement of workers helped a lot of Hungarian employees and their families.

Secondly, big western companies like Deutsche Telekom or Eerste Bank Austria started their investments long before the joining of the EU by Hungary in 2004. Many of these companies were present in Hungary from the mid-90s onward or even earlier (e.g. , Audi: 1993). Also, it is a bid short-sided to argue that only these Western companies benefited from their involvement in Hungary: A worker in a car factory in Györ or Kecskemet even in the late 1990s found himself making 4-times more than the median local salary…

Then, the example with the Austrian bank offering free bank accounts to clients in Austria powered by the profits in Hungary. As a former banker let me clarify: It is true that Western companies charged (and some still do) more for their goods and services than in Western EU-Countries. However, this has little or nothing to do with their profits abroad. The reason for higher charges in Eastern EU-countries is obvious and simple: No or little competition in emerging markets. In the 1990s and 2000s many sectors in Eastern EU-Countries were Eldorados for Western companies. The same thing can be observed nowadays in African countries or elsewhere. As for your above banking example, the reason for the Austrian bank overcharging was just the same: lack of competition in the Hungarian banking sector. But again, these free-of-charge bank accounts in Austria had nothing to do with the bank`s performance in Hungary. In the late 2000s the EU banking sector underwent deep changes. Cost-effective online banks like ING came into the market putting a lot of pressure on long-established banks with costly physical branches …

Lastly, what I find a bit disconcerting (and probably many others too) at times is the negation of the political dimension of Hungary joining the EU. Apart from the obvious economic benefits and opportunities for both Hungary and Western Eu countries, the joining of the EU was meant to leave behind for good an era (1949-1991) that was not that favourable for many Hungarians and the country itself. One central idea was to gain long-term political and geo-strategic stability. It seems to me that Hungarian politicians and Hungarian media overlook this historical fact too easily when they criticise the EU. Do not get we wrong, I am not at at all saying the EU and its institutions are flawless, though I just wanted to express my observation with regards to the non-economic benefits of a EU-membership.

@The Wandering Investor:

Very good in-depth article yet easy to read at the same time

I love DVIII. My apartment is in a beautiful residential block. I love being away from all the tourists. I love Rakoczi Ter and the cafe’s there. I’m from Central London and don’t feel at all intimidated in the area. It’s very close to the metro and trams and 10 minutes walk into the centre. DVIII has a lot of atmosphere and character. Rakoczi Market is a great place to shop and Teleki Piac is a fabuous place to buy cheap produce and wine

I guess the difference for me is that I am not a pure investor. Budapest is a home from home

I’m glad that you enjoy living in Budapest Sara. I agree, it’s one of the most pleasant cities in Europe.

Sara, feel exactly the same “a home from home”. Bet more a fan of the quieter Buda side.

Franz, thank you for this very good response.

Apologies Zoltan, but some of your lines are just rubbish. E.g. compare German and Hungarian network (Telekom) prices and you find an amazing advantage for consumers on the Hungarian market. Price and Product wise.

Is this flat still available in this article?

No. But feel free to get in touch with Benedek. He can source god flats for you. https://thewanderinginvestor.com/services/international-real-estate-services/a-buyers-agent-in-budapest-and-renovation-manager/