Many people have been asking me about the real estate investment market in Bogota, Colombia, a growing metropolis of over 10 million inhabitants. I previously wrote an extensive analysis of the real estate investment market in Medellin, but also made a point of spending time in Bogota to explore investment opportunities.

Is now a good time to make a real estate investment in Bogota?

We’ll be exploring the following topics:

Table of Contents

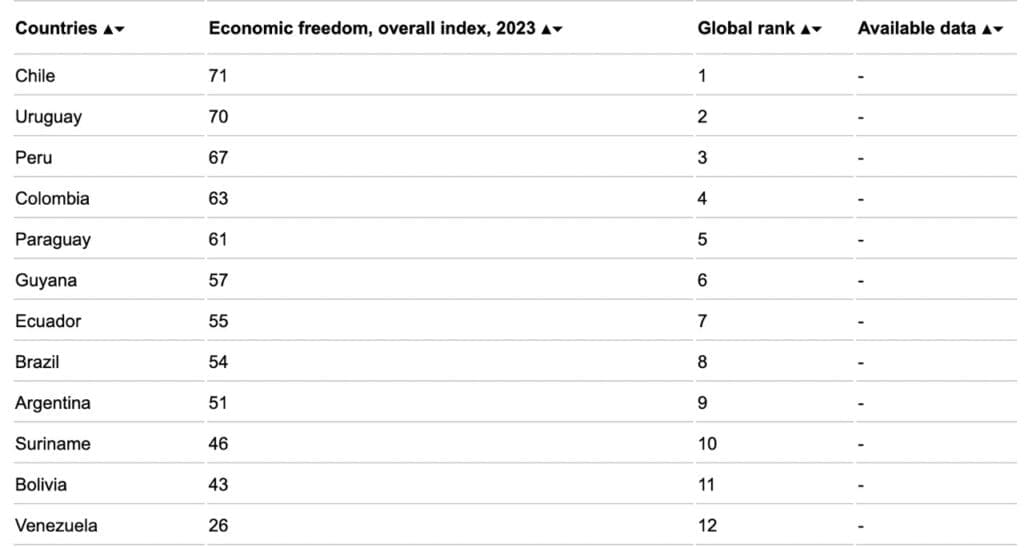

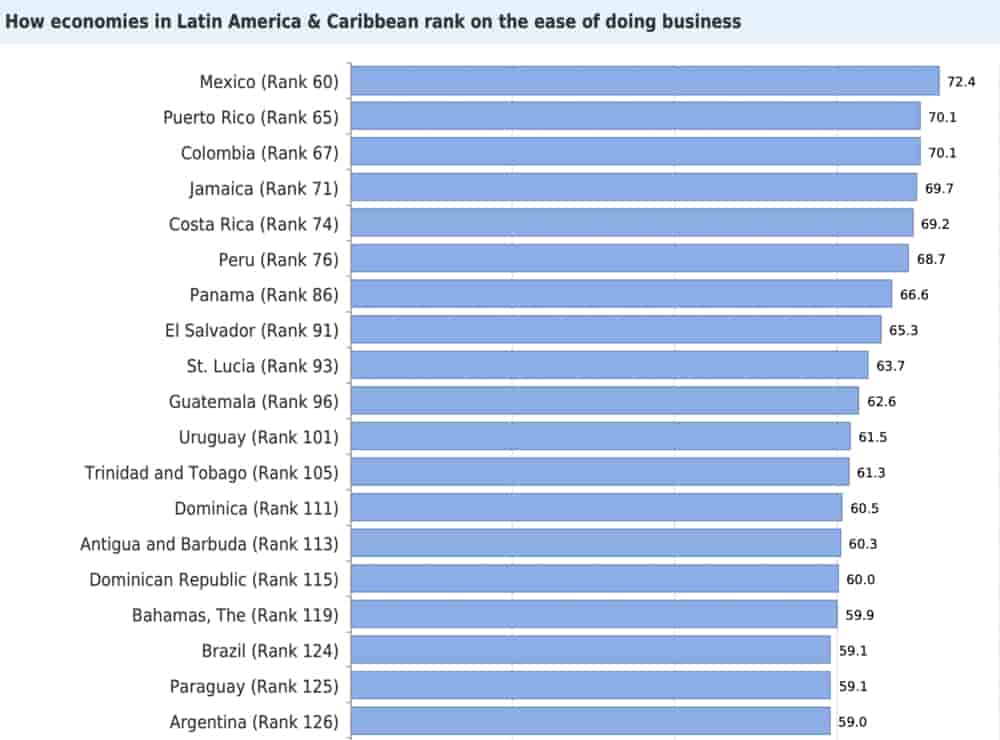

Colombia is consistently at the top of various Latin American rankings

The Heritage Foundation ranks Colombia fourth in South America in terms of economic freedom in its 2023 index, behind Chile, Uruguay, and Peru.

Similarly, the World Bank ranks Colombia as one of the regional leaders in its Ease of Doing Business 2020 ranking.

So far so good. Colombia is one of Latin America’s freest economies, in a generally business-unfriendly region. Overall, we can talk of relative economic freedom.

Colombia boasts attractive demographics for investors

In spite of a fertility rate below replacement level (1.8 per woman), Colombia has an appealing demographic curve due to past fertility rates, which will result in the population expanding over the next 30 years.

A growing population is a key driver of growth. Also, Colombia is a magnet for immigration thanks to easy residency.

Similar to most of Latin America – a relatively unsophisticated economy

In spite of being one of Latin America’s freest economies, with a local market of over 51 million people, and with access to both the Caribbean and the Pacific, Colombia’s export profile is relatively primitive. It essentially pulls things out of the ground and exports them, with minimal local value creation. Add tourism, and these are the main exports.

Non-commodities exports are growing fast, which is great. However, if you are of the view that we are on the cusp of a commodities bull market, I don’t mind seeing such a commodities-heavy export profile. It does point to a potentially very cyclical economy though. Additionally, the lack of CAPEX in the oil industry in the last few years is visible in its production numbers.

Are we at the top or the bottom of this cyclical economy?

A key export, energy, is likely to do very well

On the one hand, commodities have started doing well, and we are likely to see a worldwide structural deficit in oil production which should lead to much higher energy prices. Seeing that over 50% of Colombia’s exports are energy, this should be very growth-positive.

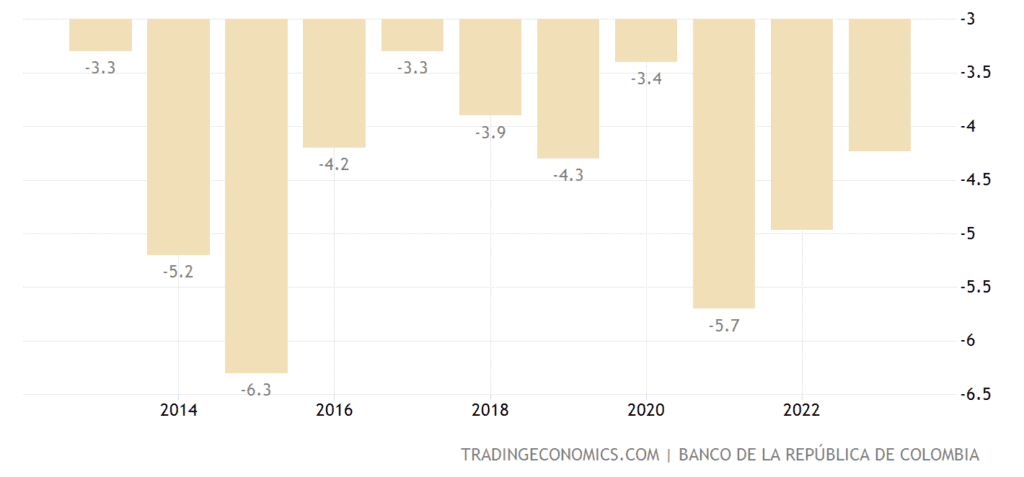

A boom in energy prices would solve Colombia’s persistent current account deficit, because let’s face it, the current account deficit has not been covered by growing FDI.

If anything, Colombia has managed to achieve a decrease in FDI.

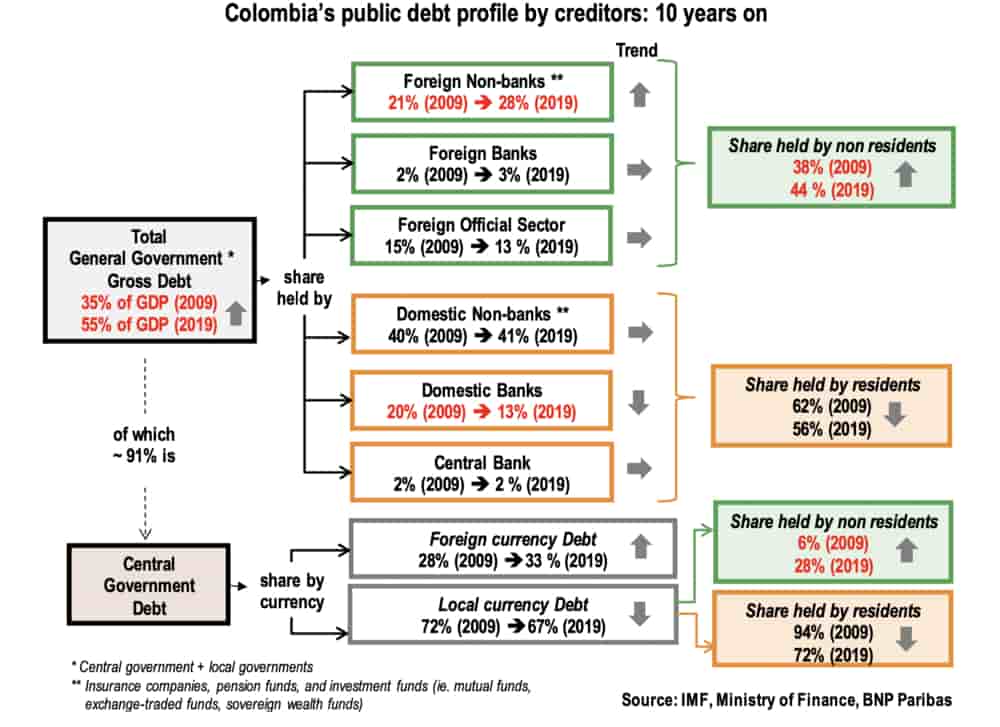

Colombia has been financing itself through external debt

A lot of the debt seems to be held by the government

Luckily, most of the government debt is held locally, and it seems to be on a downward trajectory. But the amount of foreign currency, and externally-held debt has been growing.

Is Colombia going to hit a wall?

If Colombia were to continue on its current path, it would face issues. A persistent current account deficit, relatively high government debt, declining FDI, and a refugee crisis. The only way out of it would be through radical, free-market structural reforms to attract FDI and take advantage of its natural resources and great geographic location.

But there haven’t been many reforms. And let’s not forget that Colombia has been particularly peaceful in the past few years, as many guerillas and paramilitary groups signed peace deals with the government. Yet, FDI did not flow in massively.

There are deep social issues in Colombia

I won’t talk about the various internal conflicts with guerillas and paramilitaries that keep popping up, but will just focus on the social side of things. Throughout 2021 there were massive, violent and violently-suppressed protests across the country.

People want jobs, better services, and better security.

Petro’s election

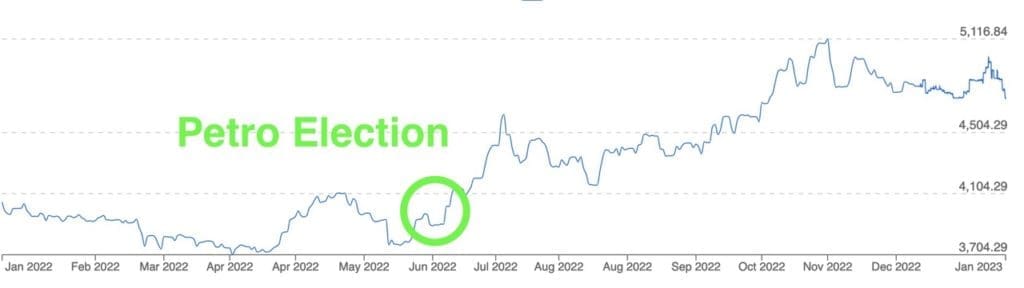

President Petro was elected in June on the thinnest of margins.

It’s true that the optics are not favourable at all. During his campaign he talked about wealth redistribution, higher taxes, and even a ban on oil, gas and mining exploration, which are crucial to the local economy.

As a result, as soon as he was elected, the Colombian Peso (COP) took a massive hit.

Same thing with Colombian equities. They took a huge hit.

However, what has since transpired is that Petro does not control the local congress, so laws need negotiations with the opposition parties. What was expected to be radical left wing policies has since been very much watered down:

- Increase in income tax for high earners and a wealth tax (a net negative)

- An opening of the border with Venezuela (a net positive – sanctions against Venezuela never did Colombia an economic favour)

- A peace deal with a number of violent marxist guerillas (a net positive)

- Extra windfall taxes on oil and gas companies that are much lower than had been expected. Effectively, these windfall taxes are lower than the windfall taxes imposed by Western governments such as the UK and Ireland. I discussed this in detail using Ecopetrol’s example in this video.

Overall, though Petro is absolutely not a positive, the currency overreacted to his election. He’s a negative, but not to such an extent, which offers an arbitrage opportunity.

So is Colombia a good investment?

Looking at it purely from a macro point of view, and not digging into the specific asset classes:

- If the commodities bull market does not materialize, I see too many headwinds, and not enough tailwinds.

- If the commodities bull market happens, the inflow of cash will cover a lot of the issues in the short and medium term.

- The government should use this opportunity to implement structural reforms, which may or may not happen. Realistically, some will take place but not enough.

- This looks to me like a market that I would not want to be overweight. However, it is a very interesting diversification play away from the geopolitical hotspots of the West, the Middle East, and Asia.

- In the current day & age, I want geopolitical diversification. Colombia offers this, with attractive rental yields if one invests in real estate in Medellin and in some cases Cali and Bogota.

- Therefore, how to play this market?

The first objective is to find a Bogota real estate investment that will not just beat currency depreciation, but also bring attractive returns in hard currency equivalent

This chart of the Colombian peso is what your investments will be racing against, and hopefully be exceeding.

What is important to note is that when you invest in core Bogota or Medellin real estate, the reality is that real estate prices track the USD as both buyers and sellers in such neighbourhoods think in dollar terms. When the currency devaluates, sellers typically raise their COP prices accordingly. If they don’t it offers an arbitrage opportunity.

It’s one of the core theses for investing in core real estate in Bogota – its inherent hedge against COP devaluation.

The local stock market does not appear to have been a great hedge against currency depreciation

There are obviously out-performers in there, but as a whole, the Colombian stock market has been a disappointment. I’ll want to dig into this to understand whether there is a potential upside after years of under-performance. Is making a real estate investment in Bogota a better option?

Rental yields in some niches in Colombia can be high

This is particularly the case for Medellin. Essentially, because Medellin is so attractive from a tourism and lifestyle point of view, the city is gushing with tourists and digital nomads staying there for a few months. The market to serve these customers is tight due to a number of factors, so yields are exceptionally high. It’s possible to obtain net rental yields of 7+% after all expenses and vacancy.

But the local long-term market is unappealing. Gross yields of 4%-5% are the norm, and expelling local tenants who don’t pay is a long process.

This report is the result of a few days of riding all over Bogota on a scooter and visiting many apartments

Bogota has little touristic appeal

The weather is unpleasant as it rains a lot and is often rather cold. There isn’t much to see apart from a decaying old town. Notwithstanding the weather issue, it’s the sort of city that is probably very pleasant to live in due to a generally low cost of living, good infrastructure, and great entertainment and food options.

But it’s not the sort of destination where you would want to spend time as a tourist, or for a few months, when there is a Medellin a short $30 flight away, with its eternal spring weather and fun-on-tap.

This is for conventional tourism. For single people who want to mingle, practice their Spanish and have a good time, Bogota is underrated and probably even a better destination than Medellin due to the sheer size of the city and the relative absence of other foreigners.

But as we will see later in this article, there is a recent trend at play which can be exploited for decent returns.

Hotels in Bogota are incredibly cheap

Hotels are easily 2 times cheaper than in Medellin. You can find brand name 5* hotel rooms going for $90 a night, and small hotels in decent neighbourhoods for $30 a night.

Good luck making money with your individual, small Airbnb in such a competitive landscape.

These figures are in the context of strong local and international tourism numbers in Colombia. It’s a structural issue.

Which neighbourhoods to look at from an investment point of view?

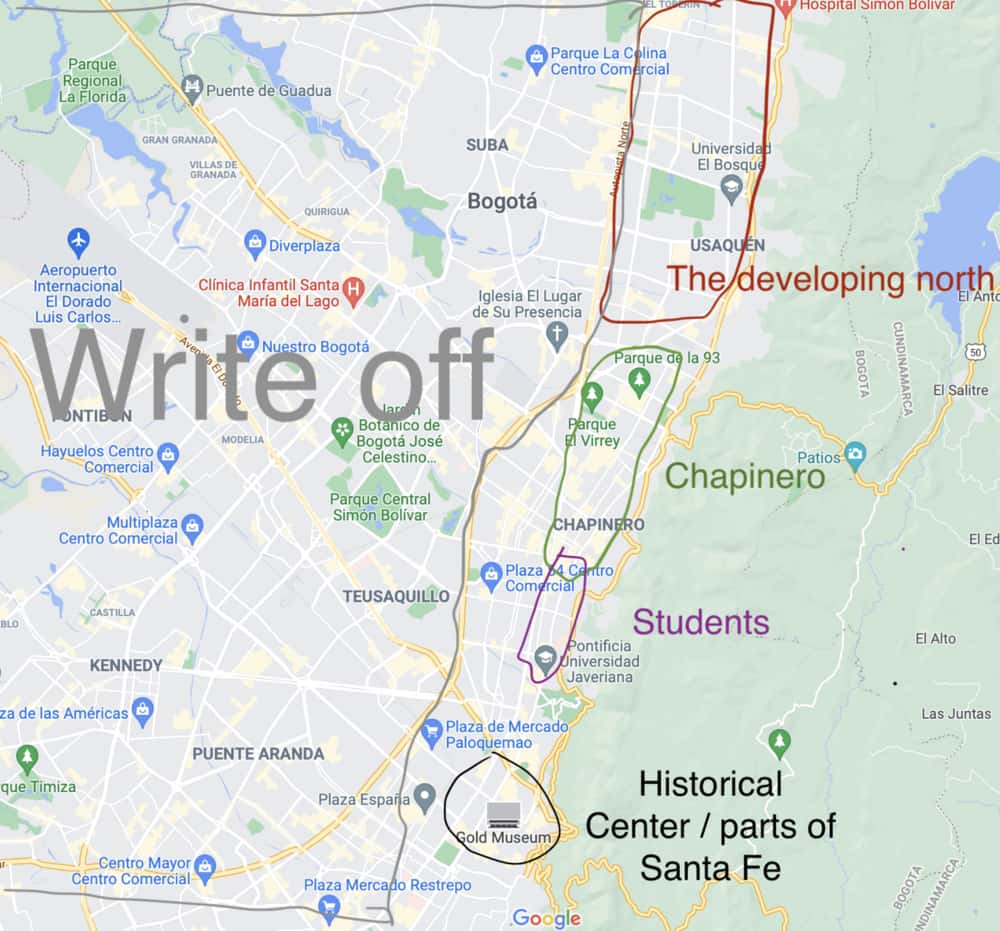

Historical Center / Parts of Santa Fe

This is the historical part of Bogota, where tourists will invariably go walk around for a few hours. It’s pretty, but nothing spectacular. Apart from beggars, students and some hipsters, people don’t really hang out there too much. I generally like the idea of investing in historical areas as the architectural value of my investments increases over time. However, in this particular case I would stay away from investing in this area due to the fact that the city is developing towards the north. The more north it goes, the less appealing this area will become to the moneyed class.

Students

An area of Bogota with a number of universities, and thus a high concentration of student housing, bars and clubs. The area feels like it’s past its prime, but it’s a local investment hotspot due to relatively high rental yields. In the video later in this article I visit an apartment and we do the rental yield numbers with my real estate agent and friend Arcesio.

Chapinero

A large area where the upper crust of Bogota like to live and play. There are a few distinct neighbourhoods within this large area, some more commercial and others more residential. Overall, I found this neighbourhood to be very pleasant.

The brick architecture is pretty and evergreen. These buildings are strong, look good, and the tree-lined side streets are charming. These residential areas of Chapinero have staying power. If I had to live or invest long term in Bogota, this would be my preferred area, though the gross yields of +-4% are not interesting. Depending on the building, you can pay anywhere from $1,500 to $3,000 per m2.

Most foreigners coming on international assignments for mutlinationals and embassies typically stay in this area.

The Developing North

Centered around the neighbourhood of Usaquén, this area is another area where the moneyed class likes to live and play. Unlike in Chapinero, which is built-out, there is a fair amount of construction in this area as there is still available land.

Though people from this area like to brag about how high-end it is, the reality is that it lacks charm. Some neighbourhoods, such as those south the golf course, are pretty, but the rest is a bit of a mixed basket. Because new buildings keep popping up everywhere, the area lacks an overall vibe. It feels distinctly inferior to the nicer areas of Chapinero.

I went to see a new development to get an idea of prices. The development is close to the golf course, but near one of the main roads. The development does not come across as high-end.

The prices were around $1,800 per m2, including kitchen furniture. I couldn’t justify paying this for an apartment of medium quality relatively far away from the center, with very low yields, and an almost endless supply of comparable units.

The West “Write off”

Once you cross the highway into the West of Bogota, it becomes a mish-mash of everything from middle-income to lower-income areas.

This side of Bogota is where the majority of people live. I’m sure there are opportunities in single projects if you understand the market dynamics, but as a long-term investor living overseas this area is of no interest. Potential supply of new buildings is literally endless, especially taking the very loose zoning laws into account.

The oversupply of real estate in Bogota is decreasing

Two years, I observed not only a fair amount of construction, but that the existing housing stock had high vacancy rates for rentals with a lot for sale on the secondary market.

Everywhere in Bogota there were apartments for rent and for sale, in all neighbourhoods.

Bogota is still a buyer’s market, but given that prices haven’t budged in ten years, it seems like there is evidence of bottoming. There is not an immediate catalyst for prices to boom, but this could be a good entry point if you seek capital preservation, or a cheap foothold in one of Latin America’s largest capital cities.

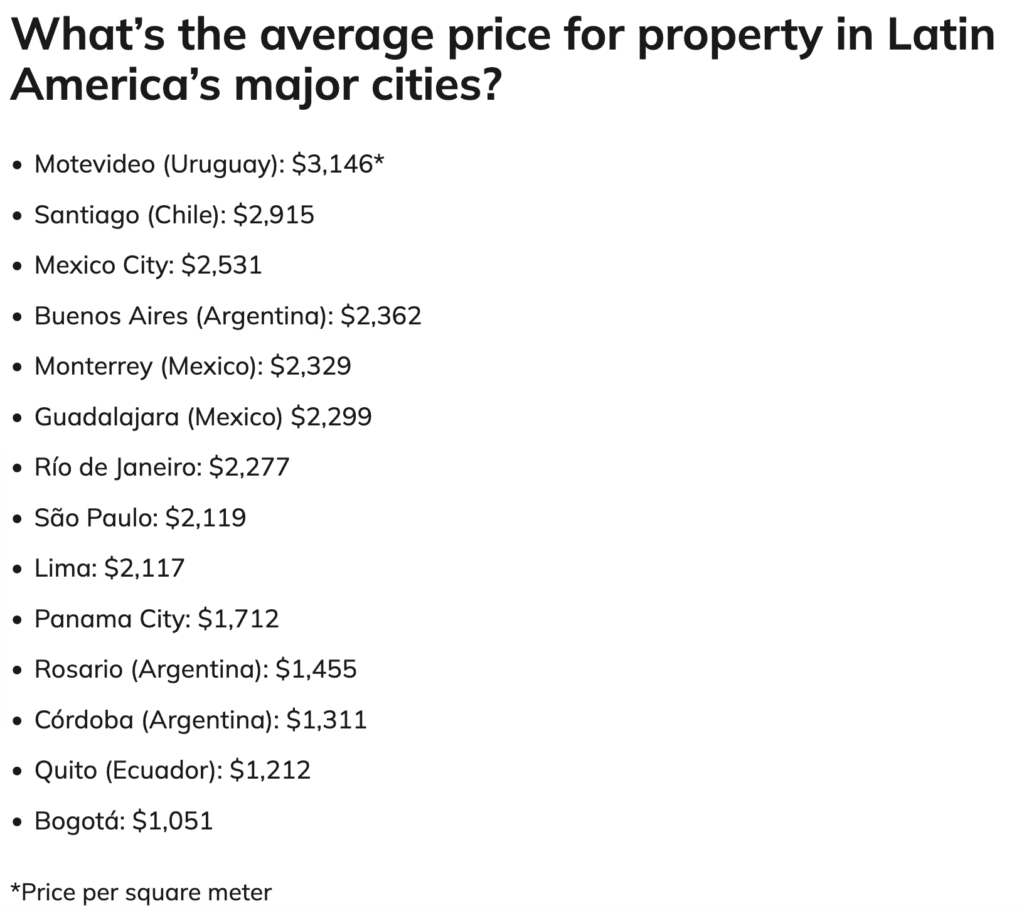

Bogota is one of Latin America’s cheapest large city real estate markets

A graph sometimes says a thousand words:

Obviously, the investable neighborhoods are priced higher higher ($2,000 – $3,000 per m2), but the comparative analysis is self-explanatory. Bogota real estate is cheap and undervalued.

A new trend is emerging in Bogota

Medellin and Cartagena were always the main destination for lifestyle tourism, and Cali to some extent.

However what is starting to emerge is that an increasing amount of foreign single males are moving to Bogota mid-term / long-term to increase their lifestyle and dating options. Bogota is a larger city, with arguably more options for dining, eating out, and meeting people. For an increasing amount of people, this makes up for the bad famously poor Bogota weather.

The supply of high-end, well-furnished, large apartments on platforms such as Airbnb is limited. I believe that with the right execution, once could obtain similar yields as in Medellin.

The current state of the real estate investment market in Bogota

I met up with Arcesio, a good friend of mine I met back in Hungary who happens to be a real estate agent in Bogota. He specializes in commercial real estate, but has helped investors with residential and turnkey projects as well.

In this video we discuss the current residential, commercial and industrial real estate market in Bogota:

- The impact of the elections on the economy and investment, as well as the interest rate environment.

- The viability of commercial and industrial real estate versus residential properties.

- General per square meter calculations on purchases and renovations of different qualities of real estate.

Here’s another video about investing in an Airbnb multifamily unit, where capitalization rates are more attractive

Arcesio and I made this case study of an old building we can tear down and replace with a multifamily unit of sixteen Airbnbs and two retail stores for the surprisingly low amount of $650,000. In this video we discuss the investment thesis and all the numbers in details including how we can reach double digit capitalization rates and rental yields.

Contact Arcesio for your real estate plans in Bogota

Make a real estate investment in Bogota with Arcesio. He can help with the entire process.

Conclusion: Who should consider making a Real Estate Investment in Bogota?

If you plan on living there, then sure, buying an apartment makes more sense than paying rent, especially if you prefer to own the places where you live. Single people seem to particularly enjoy spending time in Bogota.

I’ve seen worse investments than buying below $2,500 per m2 and obtaining net, net yields of 3%-4% in the good neighbourhoods of a growing capital city of 10 million people. It’s an option for patient, long-term investors.

If executed properly, I believe that it is now possible to reach similar high rental yields as in Medellin when targeting the mid-term market. The city does not have enough real estate that fit the criteria (large, bright, nice furniture, jacuzzi, etc)

Finally, from a lifestyle point of view, some people prefer Bogota to Medellin because it is bigger, more business happens there, and because there are better flight connections. I understand. Personally, I still prefer Medellin’s combination of weather, cheaper real estate, outdoors activities, and fun lifestyle.

Personally, I chose to invest in Medellin real estate, but I understand why some people would prefer to opt for Bogota.

Other articles on Colombia:

- Making a Real Estate Investment in Medellin, Colombia – unusually high yields

- Making a Real Estate Investment in Cali, Colombia – the next frontier?

- Actual Capitalization Rates / Rental yields in Medellin

- Penthouse Investing with High Yields in Medellin

- $100,000 investment house in Medellin, Colombia

- Is Colombian real estate still investable following the election of Gustavo Petro?

- Double-digit yields in Bogota for Airbnb multifamily units

- 12% net capitalization rate and rental yield in Cali, Colombia

- Afternoon trip to a Finca for sale near Medellin – with ROI numbers

- Pros and Cons of living in Medellin, Colombia

- I bought a Penthouse in Medellin, Colombia

Other services in Colombia:

- My favourite real estate agent in Bogota

- Real Estate Lawyer in Colombia

- How to obtain residency in Colombia

- My favourite real estate agent in Medellin

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Buying in a capital city has never been a bad investment. Now you are seduced by Medellin with its gringoland entertainment and sweet weather, but as it comes to real economy and growth, Bogotà cannot be a bad investment, anytime. In 10 years will be the NYC of Latam and will be absolutarly impossible to buy. Look at the aiport growth! Medellin is still a pueblo sometimes, and Rionegro needs to be completely redone.

NYC of Latam is probably Sao Paulo.

What views do you have on the Brazilian market ?

Out of scope here, but any views on Morocco ?

With regards to Colombia, Bogota North has hundreds of empty nice building, looks like some of the Chinese cities with no inhabitants. And prices in Colombia have increased far too much in recent years, I’ll probably wait for a setback.

The core areas of Chapinero etc don’t sit on plenty of empty inventory. The North does yes. But generally speaking, even in the best areas of Bogota at less than $2000 per m2 it is really affordable for such a massive city, by global standards.

Interesting study, just a correction, when you say “A large building in a low-rise area? This means loose zoning laws and endless supply” you are wrong, the maximum floors you can build is defined by the POT regulation which covers whole neighborhoods. Any of those little homes can be built up to, at least, the neighboring highest building.

What a local investor knows is that those little properties can be acquired relatively cheap, unified and developed into a bigger project, not necessarily for living, that is already slowing down; big industrial warehouses will be the next boom. Your writeoff zones are where the affluent construction will move eventually once the slim strip of land in the East dries up.