I previously wrote a lengthy article on real estate investment in Medellin, which I found very attractive from an investment point of view, for those who are willing to take Colombia risk. I encourage you to read the first part of that article as it gives a macro overview of the situation in Colombia (click on the link above). After you read these articles, I kindly suggest you move on to this thorough real estate investment in Cali overview.

Here you will find a lot of information about Cali real estate, including a detailed case study.

Cali has a terrible reputation, but it is improving

Whenever one mentions Cali, people have images of violence and drug cartels. At a point in time this was true. However, though still ranked number in Colombia in terms of violent crime, the overall situation has now improved.

Looking at homicide rates, Cali ranks lower than St Louis and Baltimore. The reality is that crime is concentrated in the poor areas of the city, where foreign real estate investors don’t tend to hang out much.

Nowadays, Cali’s image is improving. It is the capital of Salsa dancing and is a big destination for medical tourism, particularly plastic surgery and dental work. The region also has a lot to offer regarding hiking and nature.

Also, with Medellin becoming very popular with foreigners, Cali is increasingly seen as a great alternative love tourism destination.

The reality is that the two cities are fairly similar in size. Medellin metro has about 4 million inhabitants, and Cali metro almost 3 million.

But Cali is not just about tourism

Traditionally, the ports on Colombia’s Caribbean coast were the main drivers of the economy due to the country’s deep trade links with North America and Europe.

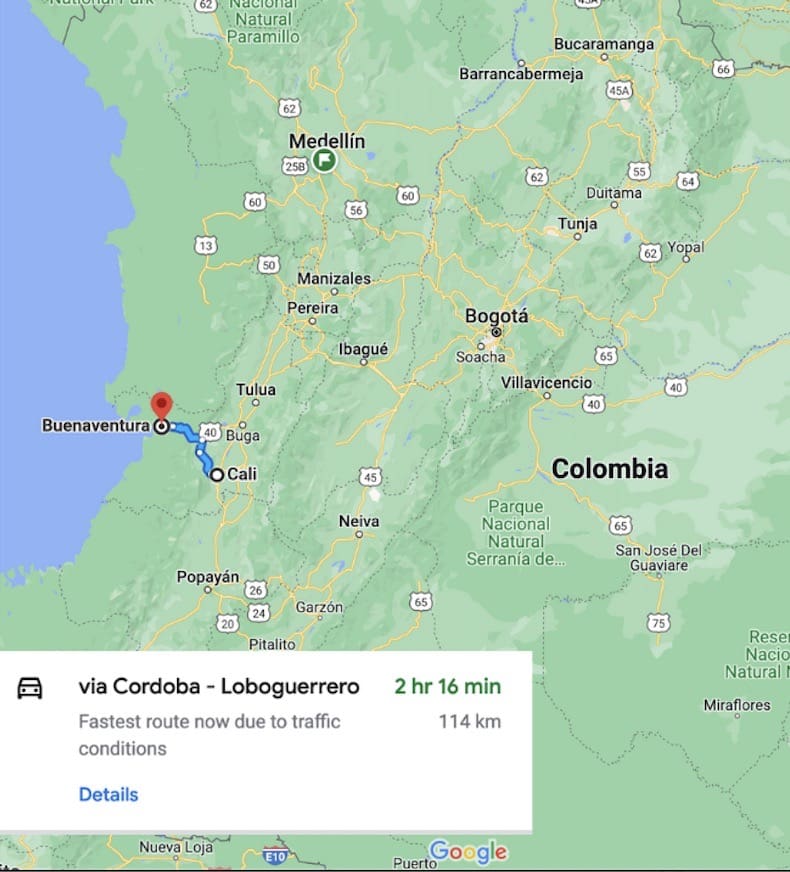

However, as the West starts its gradual relative decline, the reality is that Colombia’s trade will increasingly move East, which is great for the country’s central Pacific port Buenaventura.

Buenaventura is a mere 2h30 hours drive away from Cali, and is rather crime-ridden, so many logistics companies choose to have their headquarters in Cali rather than Buenaventura as attracting talent there is very challenging. As Colombia continues to develop its road infrastructure, Cali becomes ever more accessible by road.

Short-term rentals are fully booked

As discussed in the video below, the reality is that doing short-term rentals in Colombia is complicated due toregulations. To rent out an apartment for less than a month, the owner must have the approval of most homeowners associations, which never happens.

This leaves investors with two options for short-term rentals.

- Buy a small house. The issue with this option is that small houses are typically farther away from the main touristic areas, and not many are for sale. Also, the lack of security can be an issue for some tenants.

- Buy a whole building, and make your own rules.

Occupancy rates of 85%+

I sat down with my friend Patrick, a Dane living in Cali, and he showed his statistics for rentals in Cali. I was impressed with these numbers. He managed to get his investors net yearly rental yields of more than 10%.

Long-term rentals are not a good real estate investment in Cali, Colombia

Just as in Bogota on which I also wrote a report, Medellin, and every other city in Colombia, long-term rental are absolutely not interesting. You can generally expect gross yields of about 4% before any deductions.

If I were to make a real estate investment in Colombia, I would just be looking at the short-term market, or the mid-term market targeting the booming North American digital nomad influx.

So where should I make a real estate investment in Cali?

Most locals will tell you to go to the South of Cali. I agree that the south is much nicer from a lifestyle point of view, with a lot of trees, more space, private compounds with security and gardens, relatively modern malls, better infrastructure, less traffic, etc.

However, what makes a good lifestyle decision does not necessarily mean a sound investment decision. The reality is that tourism is primarily in the North/North West of the city. Additionally, we’ll see more development in the North as the city develops, as this is where the road connections are located, and future logistics hubs will be built.

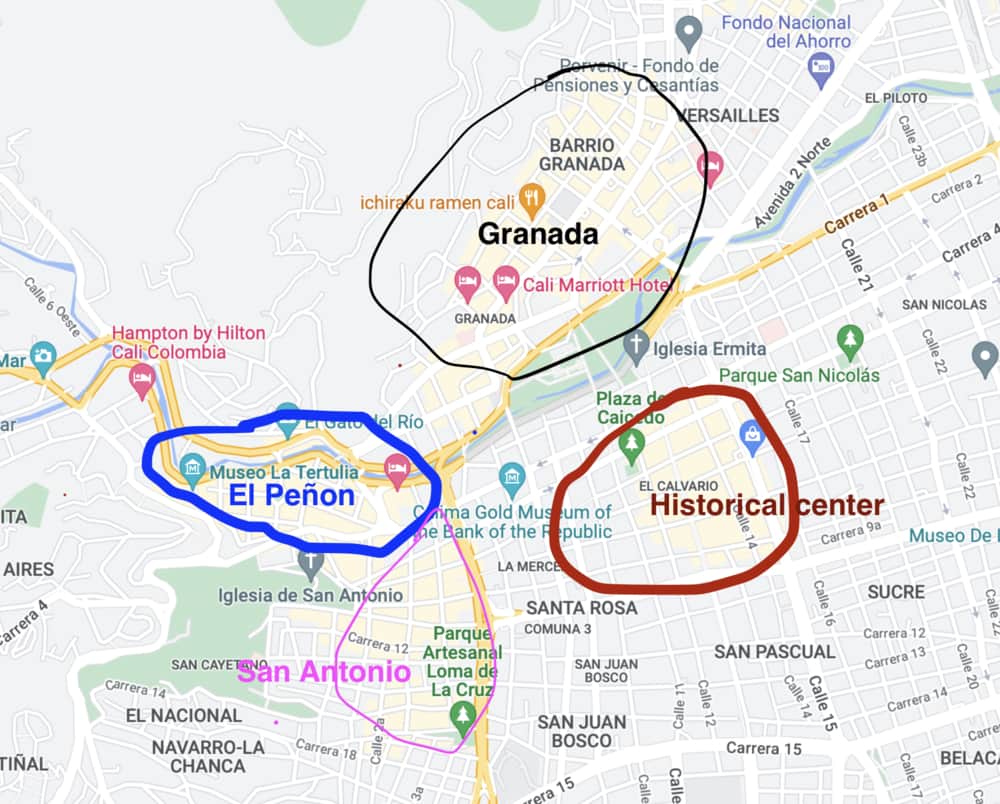

Granada

All the cool bars and restaurants are there. There’s a really cool and fun road called Avenida 9 Norte. If you’re in town for a few months or weeks and want to hang out, meet people, and have fun, this will be the default area. Strong demand for rentals.

San Antonio

Cute district of historical, colonial houses. It might not be a bad plan to make an investment there long term. For now it’s mostly relatively cheap hostels and such, but I can definitely see how this area could gentrify. It’s a good place to buy a whole house.

El Peñon

Premium area in the North West with bars and restaurants. Locals like it. People who have lived in Cali for a long time say it’s very nice due to green areas, museums and walk-ability to Granada and San Antonio. Personally I didn’t quite see the value proposition versus Granada, but this is from the perspective of someone who only spent a few days in Cali.

Historical center

The area looks beaten-down and is certainly rough, and not just around the edges. But wow, some of the buildings are absolutely gorgeous, and are sold for next to nothing. Long term, I think this could be a great investment for patient investors.

The best real estate investment in Cali, Colombia, is to buy a WHOLE building

I spent a lot of time with Patrick. He’s a Danish national who has been living in Cali for many years, and helps foreigners enter the Cali market.

He has undergone a few projects whereby he buys a whole building for investors, renovates it completely, and then rents out the units in the short and medium term. Patrick and his partner also offer property management services, so the investments are turnkey.

He was showing me the numbers, and they were quite spectacular; Patrick is able to get 10-12% capitalization rates, before income tax, on such investments.

How much does it cost to buy a whole building in Cali?

In the prime areas of the north, Patrick can source buildings for$300-$350 per m2 (+-$30 per ft2). He then adds about $700 per m2 (+-$63 per ft2) for a complete, high-end renovation, including furniture.

So for about $1,000 per m2 (+-90 per ft2) you make a real estate investment in Cali and have an ENTIRE building right in the center, fully renovated with high-end specs and net yields of 10%-12%.

This is a unique proposition.

Are individual apartments also a good real estate investment in Cali, Colombia?

Compared to Medellin, I find that though Cali real estate is cheaper, there is much less demand for rentals. Cali might have more upside for capital gains, but the cash flow on individual units is generally lower due to lower daily prices but a similar cos structure to Medellin.

At the end of the day, real estate in Medellin is still cheap, the mass market flocks there, the international airport is expanding fast, and the market is much more liquid. So unless you find an extremely good deal in Cali, I would stick to Medellin.

Having said this, referring to extremely good deals, what I find unique about Cali is the price for full buildings. Typically, in most markets, buying a whole building comes at a premium. In Cali they come at a heavy discount. All in, Patrick was able to offer one of his investors a full building, with 7 fully renovated luxury apartments in the core center of the city for about $1 million.

This is a steal.

What are the risks of making a real estate investment in Cali?

I mentioned all of the risks I see in my article on Medellin. Colombia is not risk free. But when you’re buying whole buildings for $300 per m2 in the core center of a city of over 2 million people, the downside risk is objectively rather limited.

Watch this video I did with Patrick on making a real estate investment in Cali, Colombia

In this video he showed me one of his development projects with net capitalization rates of over 10%.

Patrick offers the following services:

- Putting you in touch with competent local agents to find a good apartment or house for investment or lifestyle purposes in Cali – and making sure you don’t overpay.

- Consulting if you just want to talk to him.

- Turnkey projects for large investors who want to buy a whole building (his main occupation).

- Property management.

You can reach Patrick by sending him an email: patrick@thewanderinginvestor.com.

Much more Colombia content…

Other articles on Colombia:

- Making a Real Estate Investment in Medellin, Colombia – unusually high yields

- Is it too early to make a Real Estate Investment in Bogota, Colombia?

- Actual Capitalization Rates / Rental yields in Medellin

- Penthouse Investing with High Yields in Medellin

- $100,000 investment house in Medellin, Colombia

- Is Colombian real estate still investable following the election of Gustavo Petro?

- Double-digit yields in Bogota for Airbnb multifamily units

- Afternoon trip to a Finca for sale near Medellin – with ROI numbers

- Pros and Cons of living in Medellin, Colombia

- Investing in Bogota real estate – Possible bottom? Market update

- I bought a Penthouse in Medellin, Colombia

Other services in Colombia:

- Real Estate Lawyer in Colombia

- How to obtain residency in Colombia

- My favourite real estate agent in Medellin

- My favourite real estate agent in Bogota

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

good job, thankyou!