I’ve been active in Montenegro real estate since 2017 and have repeatedly discussed this market on my blog and channel.

In the past year real estate prices in Montenegro have gone up about 25%. In some towns such as Tivat prices are up by as much as 50%.

You’d expect rental returns to have decreased, but actually they have been rising. Why?

Rents are up even more because so many people are moving to Montenegro full-time or for a few months per year, even though tourism is down.

It’s a really interesting case study. I wrote a whole article on investing in real estate in Montenegro. This article is very thorough and includes a lot of market data.

You can also watch this video above of Ksenija and I going through the ROI numbers for an apartment near Budva. Is this particular apartment something I would invest in? No. But the point of this video is to show realistic numbers, highlight risks, issues, and how to maximize revenue from a unit that needs a bit of work.

Montenegro has proven to be a safe haven

A ton of people have been moving full-time to Montenegro:

- Russians who flee conscription or who want to avoid sanctions

- Ukrainians fleeing war

- Liberal Turks who don’t like the politics back home

- Conservative Europeans who don’t like the direction the EU is taking

- Anglos from North America, the UK, Australia who want to live in Europe but who see that the EU makes it quite complicated and/or that the taxes are higher than they would like

- “Normal people” who just love the Mediterranean lifestyle combined with ski slopes and low cost of living

Many of these people get to live in Montenegro because they own real estate. Being a property owner in Montenegro entitles one to residency. It’s a great deal.

Will Montenegro always be a safe haven? In this world of growing uncertainty, I don’t know. The Balkans have historically been a hotspot for conflict. But Montenegro seems to want to stay out of any potential issues.

Again, read the article. You’ll know if this is something for you or not.

To a World of Opportunities,

The Wandering Investor.

Other articles on Montenegro:

- How to flip a house for a 50% gain in Montenegro

- Decent rental yields for Real Estate in Montenegro

- Full Guide to buying and investing in Montenegro Real Estate

- The Pros and Cons of living in Montenegro

Available services in Montenegro:

- My Favourite Real Estate Agents in Montenegro

- How to obtain Residency in Montenegro

- Create a Company in Montenegro

- Real Estate Lawyer in Montenegro

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, Twitter, Linkedin, Youtube, Facebook, Rumble, and Odysee.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “Buying Montenegro Real Estate – a Case Study with ROI figures”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. So today, I’m in beautiful Becici, near Budva in Montenegro, with charming Ksenija. Ksenija, how are you?

KSENIJA: Hi, I’m good. Hello, everyone. Nice to have you here again.

LADISLAS MAURICE: Yes. So we are going to go to an apartment. We’re going to have a look at it. We’re going to do all the numbers in terms of expected rental income on Airbnb per month, occupancy rates, and all of the costs to really get realistic numbers in terms of rental yields here in Montenegro. So before we go see the apartment, can you tell us a little bit about why here, Becici near Budva?

Why invest in Becici, Budva?

KSENIJA: For all those who haven’t been to Montenegro or haven’t visited still Becici, Becici is part of Budva Riviera, and it’s only five minutes’ drive from city of Budva. But what makes it really unique is that here you have one of the cleanest beaches, which was also pronounced, got award for one of the cleanest beaches in Europe, where you have the promenade going from Old Town of Budva up to the end of Becici Beach. This is more like a family place. People who like to spend, usually, they stay not less than seven days, up to 14 days, depending, where they like to spend time, have their own peace. They have the beach very close by. They can walk. We have really nice restaurants on the Promenade, one of them who actually have generations running them for years and years. Usually, domestic food and fish that is freshly caught. So it’s also an amazing place because you have hotels, also, hotel infrastructure, which is quite rich.

LADISLAS MAURICE: And beautiful places like this. I mean here, we’re on a little hill right next to the beach. There’s a beautiful little Orthodox Church. We just had beers. I guess this belongs to the Orthodox Church, the bar here, because it’s on their land.

KSENIJA: Yeah.

LADISLAS MAURICE: So they’re selling beer. So it’s really lovely, really peaceful. I like it a lot. But I think the apartment that we’re going to look at, how much is it being sold for?

Overview of the investment property in Becici

KSENIJA: It’s €295,000. It’s 108 square meters and with a garage space included in the price.

LADISLAS MAURICE: Okay, which is really important in Montenegro, because parking is an issue. And this is a relatively big apartment, so three bedrooms, right?

KSENIJA: Yeah, quite spacious, three bedrooms.

LADISLAS MAURICE: So generally, if you buy studio or one bedroom, you can get away with not having a parking space because people fly in, a lot of people, or just traveling around. But once you start going into bigger apartments, you definitely need at least a parking spot. And here, parking is complicated. So that’s a plus. But I think what’s going to be interesting about this is not necessarily the apartment itself. This is not a video about pitching an apartment, but rather about a case study. You’ll see the apartment. It’s a bit underwhelming when you see it, but what is really interesting is the fact that the space has been completely underutilized. We’ll be doing all the numbers in terms of what the ROI is now, then we’ll have a discussion around everything that can be improved to increase the ROI. And we’ll be highlighting some of the risks as well in terms of the property.

KSENIJA: Why we decide actually to show this apartment because it’s, besides the fact that it’s quite spacious, it’s actually very unique location because you don’t get to see a lot of residential properties on sale on this kind of location, literally, sea front.

LADISLAS MAURICE: Yeah, first line.

KSENIJA: So you saw, four minutes to the beach. And it has quite the potential, with a bit of investment in order to furnish it nicely, it is quite investment potential.

LADISLAS MAURICE: Cool. So we’re going to go there, do all the numbers, look at the pros, the cons. Personally, it’s not a purchase I would make as an investment, and we’ll see why when we highlight some of the risk. But again, this is more for people who are looking to invest in Montenegro and who just want to be able to see a case study of looking at an apartment in a critical manner, doing realistic numbers, and being more ready for when they want to make an investment here in Montenegro.

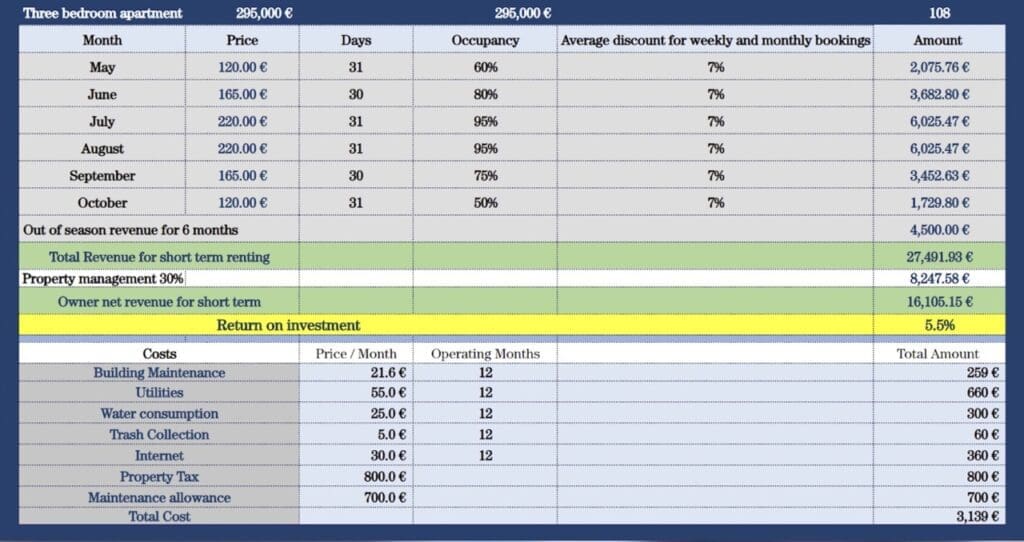

Capitalization rate figures for an investment property in Montenegro

So what we did is, Ksenija’s team also has a whole Airbnb management unit. How many Airbnbs do you guys manage, roughly?

KSENIJA: Well, more than 115 units.

LADISLAS MAURICE: Okay, cool. So you guys have a lot of data, etc.?

KSENIJA: Yeah.

LADISLAS MAURICE: We took her data and we made estimates for the apartment as is, from a conservative point of view. So essentially, whatever the Airbnb management team gave us, we actually lowered the numbers just to be on the safe side. So can you tell us about essentially how much we can expect to earn per month, roughly, the occupancy rate per month, how you do the numbers, etc.?

KSENIJA: So what we have here is our estimation on a yearly basis, how much you can expect in the season. So we’re talking about short-term renting, which starts from May to October. And then we separate–

Seasonality in Montenegro

LADISLAS MAURICE: So you’re saying six months of peak season, essentially, and then the rest is slower?

KSENIJA: Yes, the rest is slower and we can, here, count on renting it out of the season on a monthly basis, but basically the peak of the season we are talking about from May to October. Of course, the occupancy, in May, is slightly less, we’re talking about 60%. In June, it’s already going up to 80%. And here, you can see also that the price is going up. So in the June, we are talking about €165 is the nightly price. And as the occupancy also is going higher, in July, we have 95% occupancy rate, and the numbers for July and August, we’re talking about €220 per night.

LADISLAS MAURICE: So just as a bit of background, 95% occupancy rate does sound quite high. But the reality is we’re frontline right next to the beach. So yes, essentially, this apartment will be busy all the time.

KSENIJA: Because it’s premium location. Here, we also calculated September, where we have also quite a lot of tourists. It’s definitely less than in August, but it’s still a season here, and the weather, basically, until the end of September it’s quite warm. October as well, depending, of course, on the climate, but generally, first half of October is quite nice. So we expect, as we put here, 50% occupancy rate in that period.

Real Estate transaction fees and costs in Montenegro

LADISLAS MAURICE: Cool. So I think let’s also discuss the price. So you said €295,000 for this three-bedroom apartment, as is, including the furniture. What are typically the extra costs, buying costs, closing costs that investors have here in Montenegro, so in terms of taxes, lawyers, etc.?

KSENIJA: So since this is a pre-owned property by a physical entity, we are talking about 3% real estate transfer tax that you need to pay. If you’re buying the new newly developed, you don’t pay the tax. But here, the tax is applicable. So the 3% tax. And then, on top of this, there are notary costs, which is from €500 up to €600 per contract, translation on top of it, €50 per an oral translator during the signing of the contract. And then if you want to have, it’s not obligatory, the written translation of the contract, which is around €250. This is basically the necessary things.

LADISLAS MAURICE: And a lawyer?

KSENIJA: And a lawyer or also services of our company, which is on top of this, if you want help with paying the tax, registering the property, changing the electricity bills, utility bills on your name, this is €500 on top of it. So we’re talking about €1,500.

LADISLAS MAURICE: Extra costs.

KSENIJA: Extra costs, exactly.

LADISLAS MAURICE: Cool. I mean, €295,000, extra costs of like 4%, I would just keep the price as €295,000 because the reality is, there’s always you can always negotiate here in Montenegro. This will be negotiating 4%. Generally, in Montenegro, it’s quite standard for pre-owned property to negotiate 5% or so. So just in the numbers, we’ll keep the €295,000, which is relatively conservative for the apartments as is. So can you tell us about the low season?

Digital Nomads moving to Montenegro during the low season

KSENIJA: So we put here six months, from November actually to May, because we have quite a lot of people also coming here out of the season, so during the year to spend here time for a month or two to get away from big cities, from, again, cold winters, depending from where people come. But here, it’s Mediterranean climate, so people even during the wintertime can enjoy spending time here, on the balcony, sitting outside, or even on the beach, in the cafe, working online. We have, especially in the last few years after COVID, quite a lot of digital nomads.

LADISLAS MAURICE: And I think that’s really important. I’ll hop onto this, because also a big catalyst for digital nomads coming here off season is a lot of North Americans, Canadians, Australians, New Zealanders, UK people as well, like to spend time in the European Union within the Schengen zone, but they are essentially limited to two times 90 days per year. So what a lot of people did before was they would spend three months in Italy, or Spain, or wherever, and then they would come down to Croatia, hang out in Croatia for three months and then go back, so that their numbers would kind of recharge.

Now that Croatia has entered the Schengen zone, that is not a possibility anymore. So what we’re seeing here is an increasing amount of North American, UK, Australian digital nomads who come to Montenegro for a few months to recharge their Schengen days, and then go back. Because when you actually look at the opportunities to be in Europe outside of Schengen, be close to Schengen, there aren’t that many possibilities. So it’s been a real boon for real estate in the low season for Montenegro.

KSENIJA: Yeah. We have here the price of €750 per month. Though, in my opinion, it is also something that is pessimistic because this is quite spacious. I mean 108 square meters’ apartment with three beds, with this location, with these views.

LADISLAS MAURICE: Yeah. Her team had put €1,000 a month for the numbers. I just wanted to put it less because I want to account for personal usage as well. I mean, the reality is if you have an apartment in Montenegro, you want to spend time here. A one-bedroom apartment, for example, in Tivat on not frontline at all, is roughly €600, €700 a month for a yearlong contract. This would just be low season for a three-bedroom frontline. It’s a bit cheaper than Tivat but, still, €750, that’s way too low. But I want to account for personal usage. And also, we’ll discuss, for personal usage, I think that a lot of people watching this are not impressed with the inside of the apartment, but then we’ll discuss that afterwards.

So here’s just really the numbers for the apartments as is. You don’t really change anything and you just put it on the market. But we can definitely optimize it. What we have to see here is the amount of space, the relatively low cost per square meter for something that is frontline with a nice terrace. Okay, so what about your fee for managing the Airbnb?

Airbnb property management in Montenegro

KSENIJA: So our fee is 30% from the revenue. What this includes, it’s managing the property, promoting it on Booking, Airbnb, Expedia. We also have quite a big database of our clients who are coming, who are returning, who are also coming for purchase purposes. So they’re also being placed in these accommodation that we offer. Then it’s also check in, checkout of the guests, cleaning after them, before them. Also, we–

LADISLAS MAURICE: Cool. Everything?

KSENIJA: Everything, basically. You don’t have to take–

LADISLAS MAURICE: Okay. And taxes, and blah, blah, all that?

KSENIJA: Everything, yeah.

Costs of owning real estate in Montenegro

LADISLAS MAURICE: Okay, cool. What about the actual cost? Because I think that this is interesting, the carry costs of property, of real estate here in Montenegro are very low. So I mean, we’re going through the numbers, I could barely believe it. The HOA or the common charges of the apartment for the building are how much per month?

KSENIJA: Twenty cents per square meter per month.

LADISLAS MAURICE: So in total?

KSENIJA: We are talking about €21.6 per month.

LADISLAS MAURICE: Cool. So less than $25 per month for the HOA for this apartment. Imagine in the US, etc., how much more that would be. But yeah, $25 of HOA per month, so really low. Then again, there’s no elevator, there’s no swimming pool, all of that. But still, it’s incredibly low.

KSENIJA: Yeah. Adding up on that, we also have the utilities, like electricity, which is €55 per month, water consumption, €25, trash collection, €5, internet, €30. So it’s also quite affordable comparing to any European countries, in my opinion.

LADISLAS MAURICE: Yeah. Objectively, it’s amongst the most affordable utilities in the world, really. It’s hard to find, in Europe, cheaper than that, apart from, I don’t know, Bosnia, maybe. But even when you go to Latin America, for example, the costs are a lot higher for electricity, etc. Montenegro produces a lot of electricity of its own through hydro. It’s got like a huge dam and exports electricity as well. So electricity is generally very affordable in Montenegro. What about the property tax?

KSENIJA: Property tax is also around 0.25% up to 0.5%. But here, approximately, we can expect €800 per year on this apartment.

LADISLAS MAURICE: Okay, so relatively low. And in terms of how much would you budget for just maintenance, when something goes wrong, you guys need to call the plumber, or, I don’t know, there’s like a leak or something?

KSENIJA: Here, we have something that is, let’s say, realistic, around €700. But in general, we also take deposits from our clients. So in case people, before they enter, we take a deposit, and if something gets broken, this deposit you use for purposes of repairing it.

LADISLAS MAURICE: It’s also one of the issues of frontline property, it’s people go swimming, and then they come back, they’re still wet, they sit everywhere, the couches get dirty. I see here, there’s some cigarette burns on the couches. So when you go into holiday rentals, like, specifically, really beach frontline holiday rentals, you do have a bit more maintenance. I mean, you say you get the deposit, but is the cleaning lady going to notice every single issue? No, the reality is wear and tear is a bit higher than it usually would be.

KSENIJA: The good thing is that we have our rental managers who are constantly on the field, and they are the ones checking the property before guests are entering and after they’re exiting, so.

LADISLAS MAURICE: Cool. So essentially, in terms of net rental income, when we take this net rental income, after all the costs, etc., pretax, we are at, I see 5.5% net. And in there, again, the numbers are conservative, one, and, two, there’s also private usage. So you would have the apartment for a few weeks every year and you’d still be earning that money. So these were the numbers for the apartment as is, with the furniture, etc. Personally, I’m not a fan of it, of rather the current state of the apartment. I like the space of the apartment, I like the location. But my issue here is that the current owners were absolutely under-utilizing the space. What they have here is what is, objectively, a premium location, but inside, the renovation is completely mid. So having premium location with a very, actually, not even mid, a bit underwhelming renovation is a waste of potential and money.