Are you ready to Leave Canada?

Introducing ‘Leave Canada’

A guided service that delivers highly personalized planning and execution support for Canadians seeking to expatriate and live a better, lower-tax life abroad.

How we create a holistic plan specifically for you.

Find the right jurisdictions for your family, business, taxes and lifestyle.

✅ Strategic Planning

Get clarity on your current state of affairs and develop a plan of action based on your values.

✅ Tax

CPA to address your unique situation and strategies for an efficient Canadian Exit Tax.

✅ Residency

Where you spend your time and implementing your financial strategies abroad.

A note from The Wandering Investor

After graduating from Bishop’s University in Québec, I took a one-way flight out of Canada. I completed my post-grad in international business and law at The University of Sydney in Australia, and then joined Nestlé for an expat career in Switzerland and Africa which led me to the executive board of Nestlé Ghana running operations in a few West African countries.

After 7 years of climbing the corporate ladder, I left and have since then been traveling with my family actively managing my money by doing real estate deals all over the world. Over my lifetime, I’ve traveled to over 100 countries, lived in over a dozen, and conducted business in dozens.

I now have multiple citizenships, residencies, as well as bank accounts and real estate all over the world. Importantly, I am structured in a way that I legally pay very little taxes.

I know many Canadians want to leave Canada for a host of reasons, but it can be confusing. The process can be a bit scary, and there are so many options out there that it is overwhelming at times.

- Where should I move?

- What are the tax implications in Canada of leaving the country?

- What will my tax situation look like in my new country of tax residency?

- Do I need multiple residencies and citizenships or should I keep things simple?

- Where should I bank?

These are just some of the questions and why we’ve launched a dedicated consulting service for Canadians to free themselves from the various monkeys (tax, freedoms, weather..) on their back.

From navigating Canada’s exit tax to establishing a global presence with strategic investments. Whether you’re aiming for an early retirement, seeking financial efficiency, or longing for a life in a more fulfilling culture, we can help facilitate your process.

We will help you find the right place(s) for your financial and lifestyle objectives.

To get started, request a call!

Ladislas Maurice

The Wandering Investor

Have you considered the opportunities and freedom beyond Canada’s borders, but feel overwhelmed about where to start?

… Are you dreaming of a better quality of life abroad but unsure how to navigate the complex process of expatriation?

… Struggling to find the right path to minimize your tax burden while maximizing your financial potential internationally?

… Concerned about staying tax-compliant with both Canadian and international tax laws while living your dream abroad?

… Are the cold Canadian winters and high tax rates prompting you to seek out a warmer, more cost-effective place to call home?

… Have you ever thought about what your life could be like with a second passport or residency in a more tax-friendly country with better lifestyle?

Discover your holistic strategy to leave Canada.

Inquire about a free discovery call to discuss tax structure, international investments and alternative residency. Request a Call

Leave Canada is for you if…

- You’re independently wealthy or have passive income and want lower taxes and a better quality of life abroad.

- You’re an entrepreneur with a location-independent business or anticipating the sale of your business.

- You’re a homeowner looking to sell your home and explore the world during the housing bubble in Canada.

- You’ve received or are expecting a significant liquidity event and wish to maximize it and improve your lifestyle.

- You’re motivated by political reasons, seeking personal freedom, or simply want to diversify globally.

Expatriation is a multi-step process.

The Leave Canada consultation service will help with…

Assessing your departure and exploring your global options.

Fully understanding the process of leaving Canada.

Exiting the Canadian tax system with full compliance.

Going abroad, planting flags, establishing international life.

Ensuring long-term compliance while avoiding legal issues.

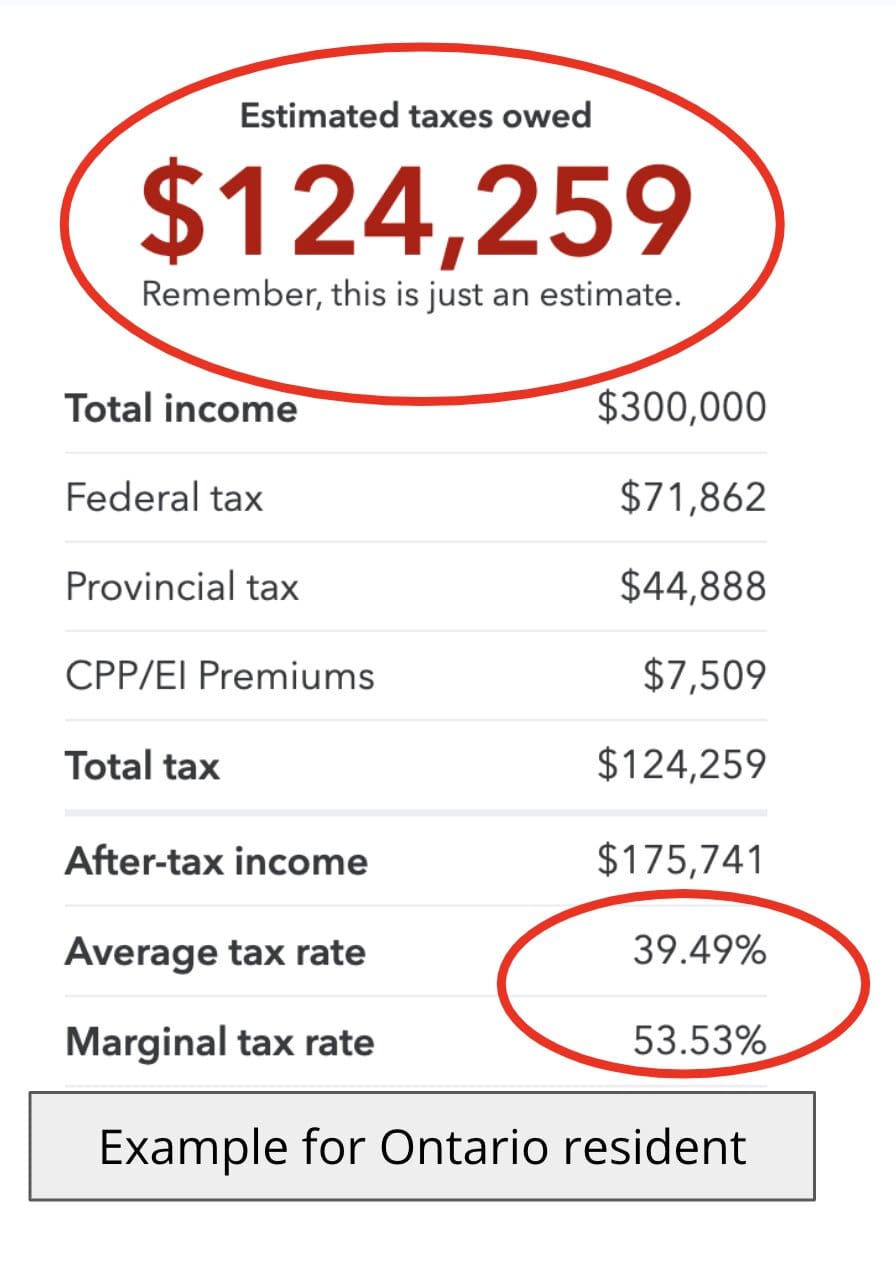

Why people are leaving Canada?

Concerns about government, freedom, and the future of Canada

Unhappy with quality of life, culture, weather in Canada

Really want to reduce tax burden for financial uptick

Looking to establish a Plan B and be better prepared

Ready to upgrade their lifestyle and seek out new experiences

5 hesitations Canadians have about leaving Canada

…and how we support you in facing and overcoming them.

Don’t know what’s out there, if it’s possible, or where to go

We offer you a customized plan with support from start to finish

Scared of issues on departure from the Canada side including fees

We work with a Canadian tax CPA who ensures exit is done right

Cannot find the expertise you need to handle tax situation

Get specialized help for your unique tax situation

Don’t know how to stay compliant abroad and avoid legal issues

Get expert legal advice in destination to fully assist you

Big firms do not want to take on the cases, providers siloed

We help with residency, real estate, banking, for holistic view

What will you do with the extra savings?

… Real estate investments in new places?

… Stocks, bonds, savings/term deposits, crypto, other new assets?

… Simply more savings in your pocket?

… A second or third passport or residency?

… Early retirement for you or family?

… Upgrade your lifestyle and enjoy life more?

The Leave Canada process includes a CPA to ensure compliance

How to Leave Canada

Inquire now

Engage in an exploration call where we assess your current situation, discuss your goals for expatriation, and outline the initial considerations for your tax planning and residency options. Initiate your journey by expressing your interest in leaving Canada and to explore tax-efficient expatriation.

Step #1: Planning

Personalized Expatriation

Based on an initial consultation, we’ll present you with a tailored expatriation plan. This plan addresses your unique situation and strategies for a tax-efficient move.

Step #2: Execution

Execution Strategy

Upon agreeing to the personalized plan, we move forward with an execution strategy. This includes step-by-step support for navigating the Canadian exit tax process, establishing global residency, and implementing your financial strategies abroad.

Step #3: Support

Ongoing Support

Our service extends to ongoing support to ensure you remain compliant with tax obligations and make the most of your expatriation. This includes working with providers in destinations you choose to reside or invest in and liaising ongoing compliance.

I believe in the powerful ROI of good planning and building a diverse strategy and I invite you to a step into this for yourself and see how we can help you with your unique situation.

Submit the form to get started!

Request A Call

FAQ

What will the LEAVE CANADA consulting provide me?

LEAVE CANADA offers personalized planning and execution support for Canadians aiming to expatriate for a better, lower-tax life abroad. Our services include navigating Canada’s exit tax, establishing global residency, and strategic investment planning to maximize your financial potential and lifestyle quality in your new home country.

How will the LEAVE CANADA consultation simplify my exit tax process?

Our consultation streamlines the Canadian exit tax process by leveraging expert knowledge and a tailored approach. We work closely with Canadian tax consultants to ensure your exit strategy is both tax-efficient and compliant, addressing your specific financial situation and goals.

How will you identify the best countries for my expatriation based on my goals?

We customize your expatriation plan by evaluating a comprehensive set of criteria tailored to your lifestyle preferences, financial goals, and tax optimization needs. This holistic approach ensures we recommend countries that align perfectly with your aspirations for a new life abroad.

Can I live abroad without severing all my Canadian ties?

Yes, you can live abroad without severing all Canadian ties. Our consultation guides you on how to maintain your Canadian citizenship, manage assets, and stay connected to Canada, ensuring you enjoy the benefits of expatriation without losing your roots.

What steps will I take with your help to establish a tax-efficient residency abroad?

With our support, you’ll navigate the steps to establish a tax-efficient residency abroad, including selecting the optimal location, understanding and complying with local tax laws, and making strategic investments. We provide guidance on global residency establishment, ensuring your move maximizes financial efficiency and aligns with your long-term goals.

What happens to my RSPs, TFSAs, and other Canadian bank accounts when I exit Canada?

Your RRSPs remain tax-deferred, and TFSAs keep their tax-free status, though international tax implications vary. You can keep Canadian bank accounts, but must update your residency status. Our experienced tax consultant specializes in this entire process, optimizing your financial strategy post-expatriation to ensure compliance and financial efficiency as you embark on your new life abroad.

Have any of these thoughts occurred to you as you think about your life in Canada?

I don’t agree with the path that Canada is going down

Why am I even still living here?

What if I ran my life and business from abroad?

What about getting a place somewhere warmer?

Should I just get a Caribbean passport?

Should I use neobanks (like Revolut, Wise, etc.)?

Should I just try to leave on my own or wing it?

What if my bank account gets shut down?

What other taxes are they going to come out with?

Get your burning questions answered…

How do I navigate the Canadian exit tax process?

What are the best countries for Canadians to expatriate to?

Can I maintain Canadian citizenship while living abroad?

How do I establish residency abroad in tax-free countries?

What are the financial implications upon expatriating from Canada?

How can I manage my investments internationally?

Do I neeed to sell my property in Canada before I leave?

How do I ensure I stay compliant with taxes while living abroad?

What’s the process for obtaining a second passport?

Will I owe new taxes if I work remotely as a digital nomad abroad?

Chart Your Course to a Tax-Efficient and International Life

Inquire about a free consultation to determine if we can help you with your tax structure, international investments and residency. Request a Call