Can you make any money by investing in the Montenegro real estate Market in 2026? The short answer is yes, but one needs to have a very targeted approach.

I’ve been involved in Montenegro’s real estate market since 2017 and typically spend my Summers with my relatives who have decided to retire in Montenegro. It’s one of my bases as I travel around the world and I absolutely love spending time here.

We’ll have a look at the following topics:

Table of Contents

Overview of Montenegro: Real Estate and Economy

Most people haven’t even heard of this little Adriatic country of 630,000 souls which got its independence from Serbia in 2006. It joined NATO in 2017 and is widely expected to be welcomed into the EU, with 2028 being the latest estimate.

Montenegro’s GDP per capita is a bit over half the EU average, and it enjoys high GDP growth rates by European standards of 3%+ per year.

Montenegro has a Tourism-centric economy

Being a small country of 630,000 people, the reality is that the fixed costs of running a government are relatively high. It is hard to be efficient when running full government institutions for such a small population.

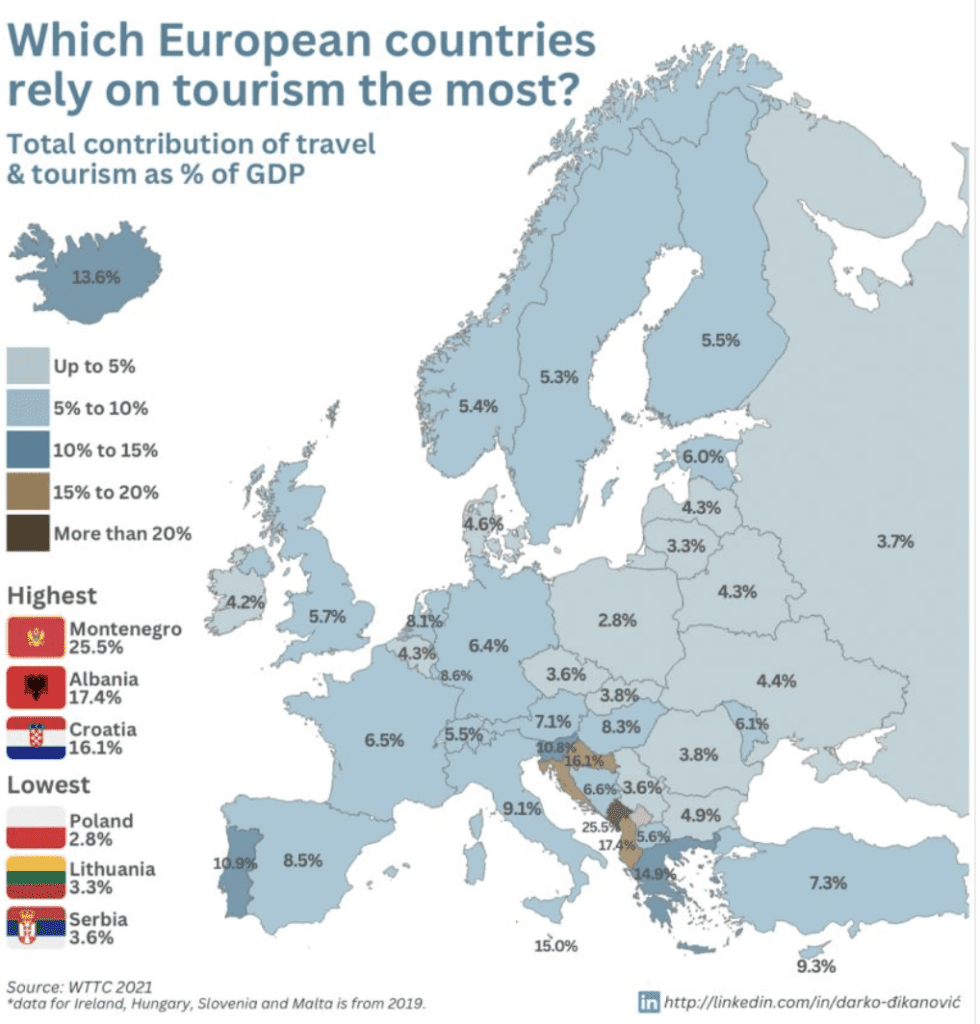

25% of the economy is tourism, which makes Montenegro one of the most tourism-dependent economies in the world.

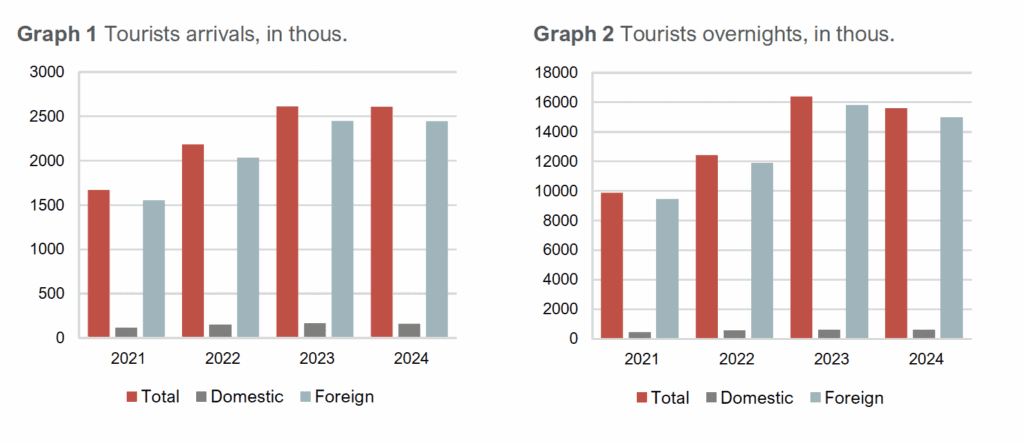

Tourism numbers grew steadily until 2019, and then crashed heavily in 2020. Numbers started growing again in 2021, 2022 and finally breached their 2019 peak in 2023. Since 2024 tourism is stable.

80% of exports of the country are travel and tourism. Other than that, the economy consists mostly of construction, exports of hydroelectricity and aluminum, a vestige of its Yugoslavian days.

The debt to GDP ratio is relatively stable.

Importantly, the country has a significant current account deficit. Foreign direct investment into Montenegro helps cover this current account deficit.

The point is that Montenegro is an economy prone to external shocks due to its reliance on tourism, real estate and external financing, but that the situation is improving year after year. The trend is positive.

Risks of investing in Montenegro

Before going into detail about the key catalysts for investing in real estate in Montenegro, it is important to really understand the risks.

- External shocks as mentioned in the previous section.

- Chronically weak European economy with the European middle-class being squeezed by ever-higher prices and taxes. Most Europeans are feeling poorer now than in 2019, and thus have to cut back on discretionary spending (such as holidays in lovely Montenegro).

- The potential for conflict in the Balkans. Montenegro seems to be staying away from the potential drama in Bosnia and Kosovo, but one cannot ignore the region’s history of volatility.

- Recent changes to immigration law which we discuss below in the article.

Key drivers for real estate investment in Montenegro

The typical argument that you will hear from real estate agents in Montenegro is that “tourism is booming” and that “Montenegro is booming”. I would tend to say both yes and no to both. It’s important to understand the key trends. The numbers for 2025 show that tourism was flat, just as 2024 barely grew versus 2023.

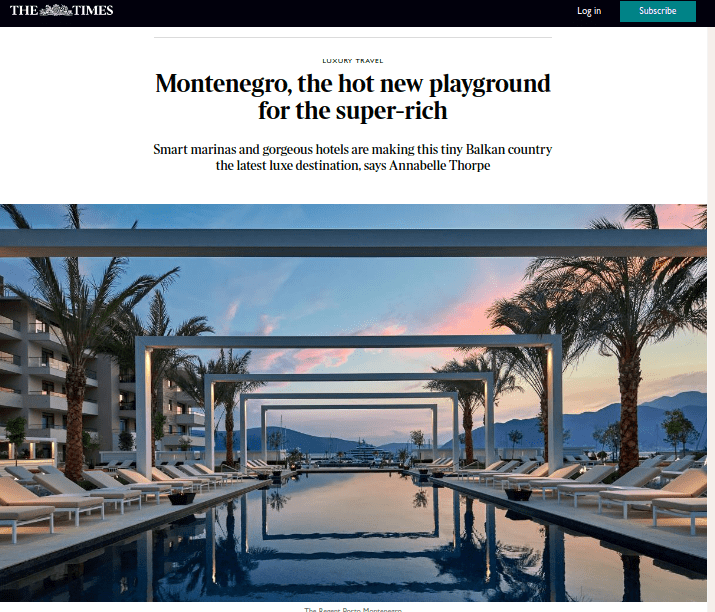

1. Decline in lower and middle-class tourism, surge in luxury tourism

It’s not something that appears in official statistics, but it is apparent in everyday life. Normal restaurants seem emptier than in 2019, but high-end restaurants are packed. Same situation with 5-star hotels being fully booked, while mass-market tourism is down.

A big source of the drop in tourism numbers is that Russians, Ukrainians, and Belorussians used to account for a significant proportion of tourists pre-Covid and pre-war. Now, all these charter flights are gone. Tivat Internatinal Airport, for example, had direct charter flights from Siberia. This tourism is now gone, but it was mostly low-value tourism that focused on very local, affordable accommodation.

Wealthy Russians, Belorussians and Ukrainians are still traveling and can be seen in the luxury developments. Gulf Arabs, Turks, Israelis and wealthy Americans are increasingly visible.

Also, while the European middle class is being squeezed, the European high-end market still has disposable income and hasn’t cut back on vacations.

2. Attraction of global luxury brands to top cities

For such a tiny country, Montenegro attracts a lot of foreign direct investment (FDI) into luxury complexes. Despite being amazing lifestyle plays, such luxury developments are rarely good financial investments for retail investors.

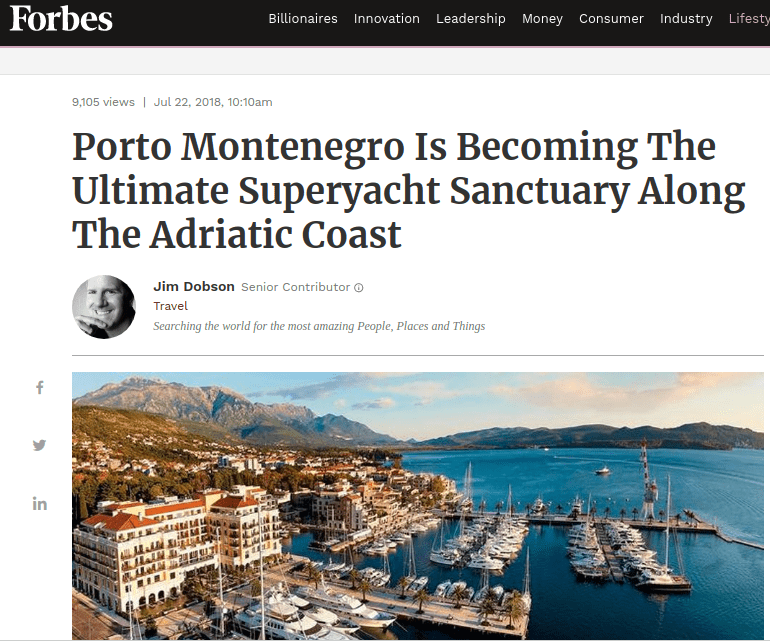

Port Montenegro

A former Yugoslavian Navy base that was bought over in 2007 by a consortium composed of a Russian Oligarch, LVMH chairman Arnault, and the Rothschild family. The Canadian Founder of Barrick Gold embarked on a mission to turn this part of the Adriatic into the next Monaco and super yacht destination, which the government then turned into its own strategy for the country.

Porto Montenegro, conveniently located 5 minutes away from Tivat International Airport, with direct flights to Europe and even Dubai, was recently bought over by the Dubai Investment Corporation. Expect to pay about €14,000 + / m2 to have a stunning apartment with sea views in this complex with hundreds of yacht berths, including for super yachts. Non first-line can be had for about €8,000 / m2

Gulf Royal families park several of their super yachts there all year round. These are valued in the hundreds of millions of Dollars. The complex also houses a 5-star Regent hotel.

I live walking distance from there and constantly see Gulf Arabs with shopping bags full of Dior, Fendi, and Balenciaga, all of which have boutiques in Porto Montenegro

Porto Novi

The latest addition to these luxury complexes focused on yachts is Porto Novi, located near Herceg Novi. It opened its gates in 2020 with hundreds of berths, including deep water berths with all the usual luxury amenities. It even has an international school.

Europe’s first 5-star One & Only Resort is the anchor tenant. The principal financial backers are from Azerbaijan. Count about €12,000 /m2 depending on the location/floor. Basic bedrooms with bay views go for upwards of €2,000 per night in peak summer

Lustica Bay

Lustica Bay is an impressive long-term joint venture between the Egyptian developer Orascom (90%) and the Montenegrin government (10%); this project was started over eight years ago and is now open to the public. The total investment is set to be about 1 billion Euros over 15 years, which is a rather substantial number for a country with a GDP of a bit over 5 billion euros.

Europe’s second 5-star Chedi opened its doors in 2019. They have plans for 500 villas, 1000 apartments, seven hotels, an 18-hole Gary Player course which opened this year, two marinas, a school, medical facilities, etc. to make it a year-long destination. Prices range from €6,000 /m2 to over €15,000 /m2.

Various other luxury hotel brands

On top of the Regent, One & Only resorts, the Chedi, more hotel brands are entering the market, which will result in Montenegro having a higher concentration of luxury resorts than world-famous Croatia:

- The Intercontinental Hotel and Resorts is working on a project near Bar.

- The same hotel group recently announced it will open a Crown Plaza in the north of the country near the ski slopes of Kolasin

- Hyatt Regency inaugurated a resort in Kotor Bay in 2023.

- Hilton is working on a second Montenegrin hotel in Ulcinj after its first project in the capital city of Podgorica

- Marriott has plans for a Ritz Carlton on Lustica peninsula, though there are delays. But it’s clearly on their mind with pre-agreements having been signed.

I wouldn’t recommend buying into these developments, as capital gains are often limited and rental yields low. Having said this, the lifestyle on offer is amazing. If you’re interested in any of these developments feel free to get in touch with my real estate agents in Montenegro, they can help you.

But nevertheless, these developments’ success demonstrates that serious money is flowing into Montenegro. This little country has a big vision and is implementing it step by step.

While Croatia built too early and is attracting mostly middle-class Europeans, Montenegro has a global vision, and has kept prime land for massive developments that target the 1%.

Even Qatar is looking to open an embassy in Podgorica and is discussing direct flights to Doha. Big money incoming.

3. Increasing number of residents in Montenegro

There is a big shift in demographics happening in Montenegro that isn’t quite captured by government statistics, but which is extremely important to understand.

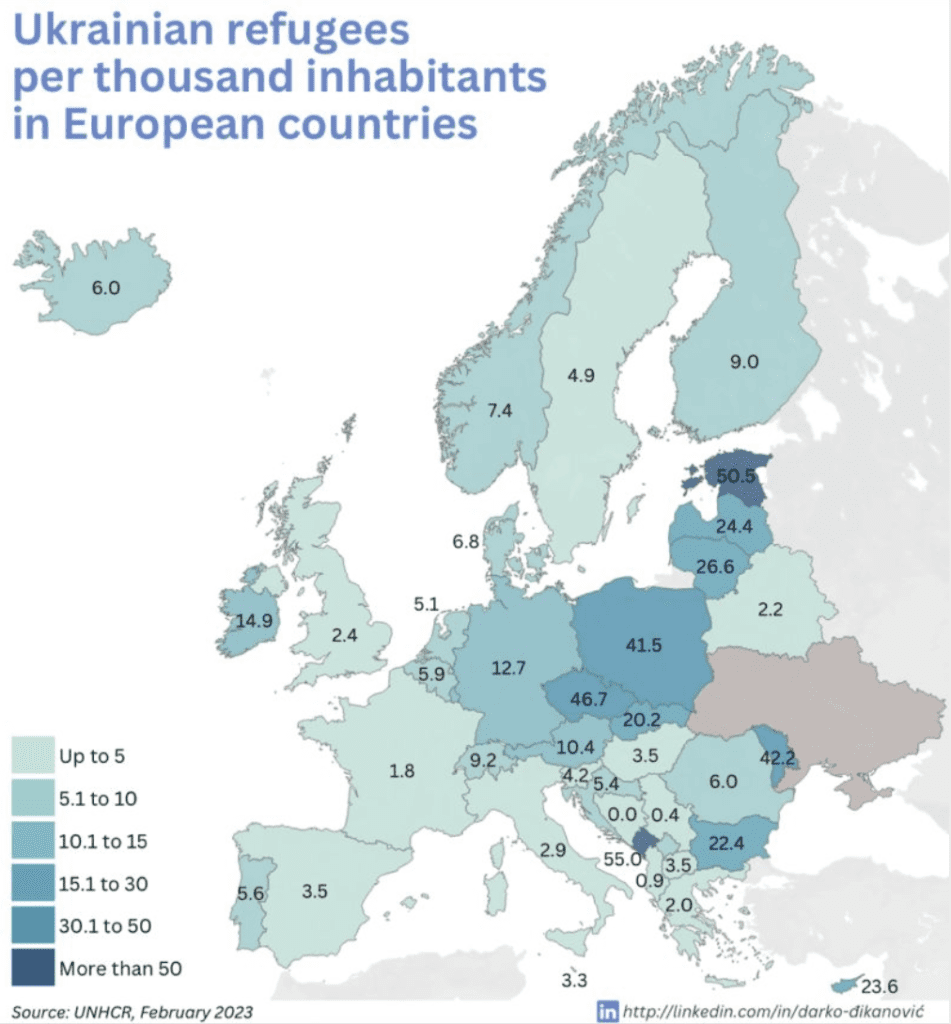

Though Montenegro is very dependent on tourism, it is becoming less so. Why? Because an increasing amount of people are moving to Montenegro full-time. The full-time population of Montenegro unofficially grew about 10% since the start of the war in Ukraine.

These are the typical archetypes:

- Russians fleeing conscription or who want to work online without getting banned from payment processors and online platforms due to Russian residency. Many entrepreneurs as well are starting local businesses.

- Ukrainians who are independently wealthy or work online. Ukrainians who want free government money or a job move to Western countries. But people who are independently wealthy or work online prefer low tax countries such as Montenegro. Montenegro has the highest number of Ukrainian refugees per thousand inhabitants in all of Europe.

- Turks who disagree with politics back home. All are entrepreneurial and are starting local businesses.

- Right-leaning Western Europeans who disagree with politics back home and want to live in a country that leaves them alone. Many moved to Montenegro during Covid as the restriction were minimal and poorly enforced. Many more moved after the Ukraine war started. They flee what they perceive to be censorship in their countries.

- Western Europeans who want lower taxes and/or a lower cost of living. As inflation ate away at people’s savings in Western Europe, many realized that one way to beat inflation is to lower one’s tax bill and living expenses. It’s important to note that Montenegro offers both low taxes and a low cost of living as long as one avoids the luxury resorts mentioned earlier.

- Anglos (Americans, Canadians, Australians, Brits, South Africans, etc) who want to live in Europe but realize that obtaining residency in the EU is often hard and/or not tax friendly. In comparison, it is relatively easy to obtain residency in Montenegro as this article demonstrates.

All these people are much better than tourists. Some pay income tax, social security taxes, but all pay VAT and drive the local economy through year-round consumption. These immigrants are all a net positive for the economy. They barely use any social services and instead consume locally, pay taxes, start businesses and are overall a true blessing for the Montenegrin economy which is now much more vibrant. The international school business is booming in Montenegro with several private English and Russian schools along the coast.

Effectively, the Montenegrin economy has become a lot less seasonal. We’ll see this in some real estate figures a bit below.

Also important to note is that all these people are fleeing something. If you believe that we are in an increasingly chaotic world with more people leaving their home countries, Montenegro is set to become a net beneficiary of such a trend.

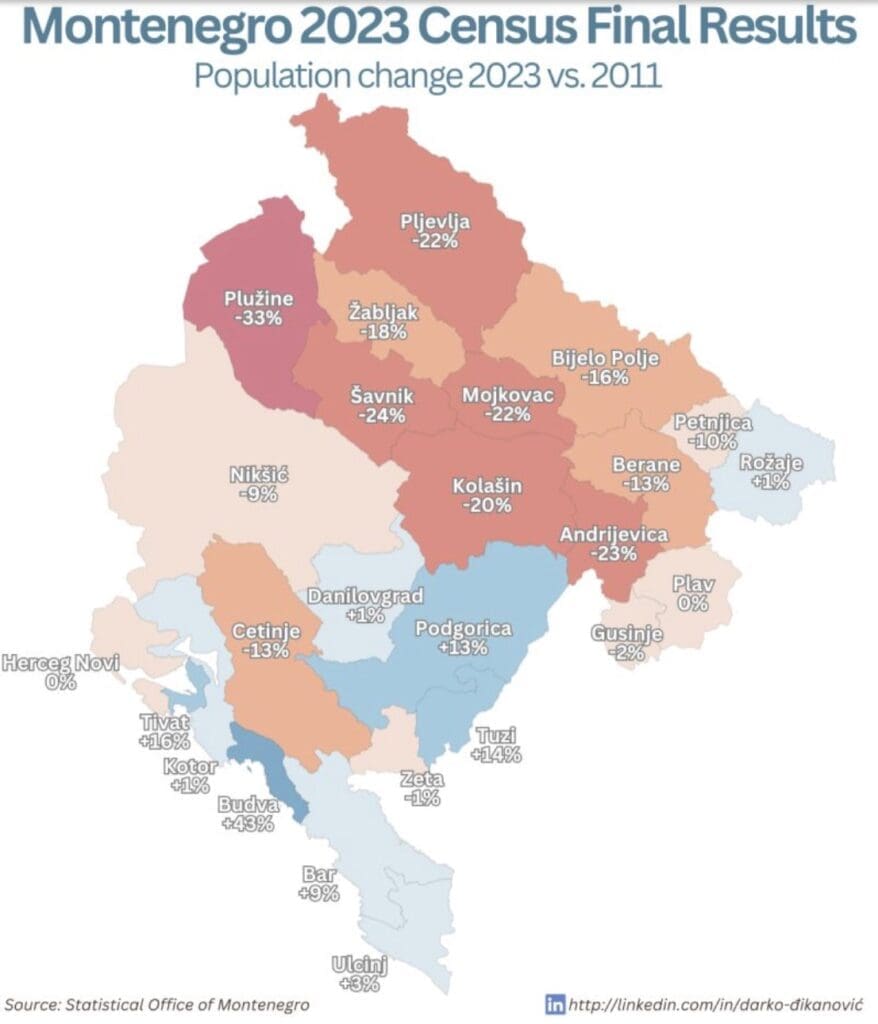

Importantly, the Montenegrin cost is booming in terms of demographics. While the rest of the country is mostly seeing declining demographics except for the capital city, regions such as Tivat and Budva are seeing huge increases in population.

However in early 2026 Montenegro enacted some residency changes due be more in line with the EU.

- Visa-free access will gradually be removed for countries that don’t have visa-free access to the Schengen area. Countries like Azerbaijan, Russia and Turkey that have visa-free are actually an important source of higher-end tourism. That will gradually disappear. Even countries like Kazakhstan which has visa-waiver in Summer only. Such flexibility will be removed from the Montenegrin authorities.

- Residency used to be granted to almost anyone from preferred countries with any real estate or a company. This led to many people moving to Montenegro. The requirement has been raised to a minimum investment of €150,000 for real estate. For company formation, EU people can still have shell companies, but non-EU people will need to demonstrate yearly taxes and social security contributions of at least €5,000 to be able to renew.

This will reduce the number of tourists and residents from these countries and make the country more dependent on the EU for its tourism. However, it is acting accordingly and Wizz Air is opening a base in Podgorica airport with 17 new routes in 2026. Podgorica airport is thus expected to see a surge in passenger numbers of 50% in 2026.

4. Great for Digital Nomads

This is a big boon for Montenegro. Many digital nomads are very happy to spend a few months every year in Montenegro. It’s affordable, the weather is great, and there is a lot to do.

Importantly, Montenegro is outside of the Schengen zone. Effectively, this attracts a lot of relatively high-earning digital nomads from North America and other countries who cannot spent more than half the year in the Schengen zone. They thus come down to countries such as Montenegro to recharge their “Schengen days.”

This digital nomad effect can be seen in the average length of stay in Montenegro being much higher than in neighboring countries:

Seeing that most accommodation does not declare declare/pay taxes, the number for Montenegro is vastly under-counted.

5. Prospective EU membership and extensive infrastructure development

Ever since I’ve been coming to Montenegro people have been saying Montenegro will join the EU. First I was told 2022, then 2023, then 2025, and now 2028

The lesson being, don’t listen to real estate agents when they come up with overly optimistic forecasts.

I was always very skeptical of this seeing how far behind Montenegro with regards to completing “EU chapters”.

However now I really believe it’ll happen in the near future.

Why?

The EU as an institution is not doing well and needs to show that it is still in expansion mode. Taking in a small country of 630,000 souls won’t put a dent in the budget yet will send a strong message of self-confidence. I expect Montenegro to join by 2028, regardless of how much, or not, it has progressed with the chapters.

A clear sign of this happening is the massive free publicity that Montenegro is receiving in the form of very positive documentaries appearing all over state-owned TV channels in Europe. Europeans are being prepared for a resumption of EU expansion.

6. Montenegro joined the SEPA zone in 2025

This is a huge deal that only Europeans really understand. What is the Single European Payments Area (SEPA)? SEPA is an integrated payment system within Europe that makes payments in Euros very easy, cheap. and fast.

Traditionally Europeans, like everyone else, had to send a proper international wire which took a few days, led to banks asking for documents, and which could be expensive.

Since October 2025 transfers to and from Montenegro and EU countries have been seamless (same-day or next day, in most cases free, and rarely any paperwork demanded).

This is a significant catalyst for EU investors wishing to invest in Montenegro and is one of the steps towards EU accession.

Important, this means having a bank account in Montenegro will also become a lot more attractive as it’ll open up all of the EU from a banking point of view. Owners of real estate in Montenegro can easily open a bank account in the country.

However for now, banks have been catching up on compliance and banking in Montenegro is very complicated. This will evolved over time as they sort out their compliance backlog.

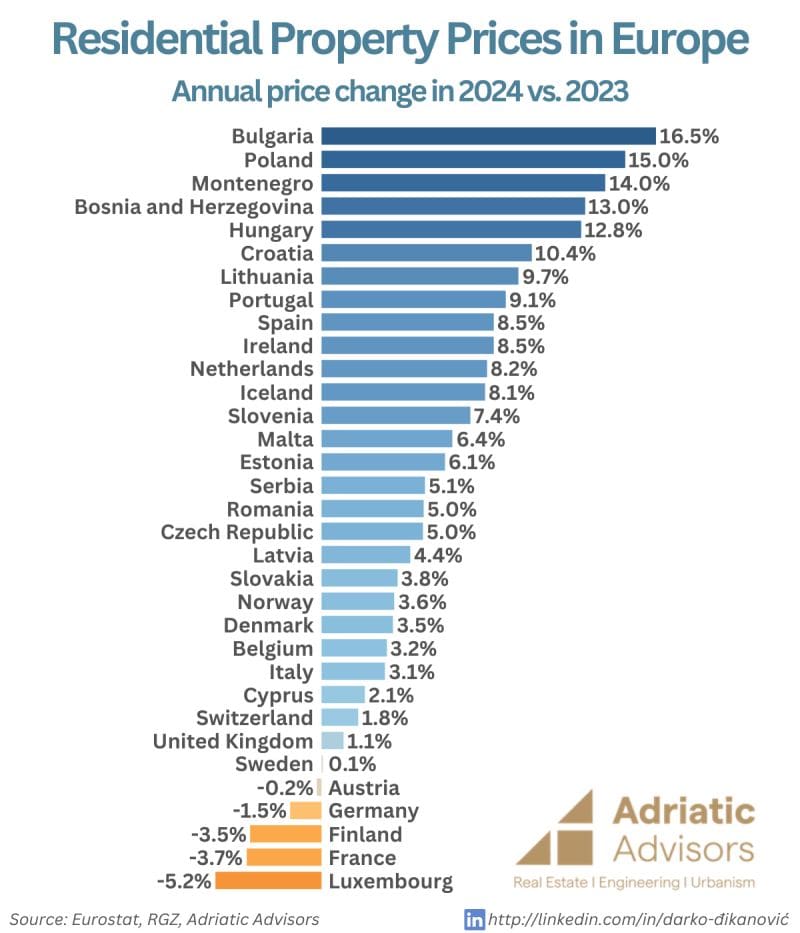

Thriving Real Estate Investment Market in Montenegro

Real estate prices have been shooting up in Montenegro. You would expect that because of rising prices the rental yields or capitalization rates would be decreasing.

Wrong.

Although property prices rose a lot, rents experienced a similar increase.

Essentially, despite booming prices rental yields are stable, which is quite a statement to make.

Where to buy real estate in Montenegro?

1. Real Estate Investment in the Bay of Kotor (Tivat, Kotor, Lustica)

When investing somewhere, I always ask myself, what is the growth story? And here, in the Bay of Kotor, the growth story is self-evident.

First, the place is as gorgeous as Norwegian Fjords, and secondly people are starting to notice.

This is where I chose to invest and where I made most of my real estate deals. It’s the most premium region of Montenegro, and is the one I want to keep betting on. People come to Montenegro primarily for Kotor Bay, especially the rich. It’s where you’ll get more premium tenants, and where you will have the privilege to own real estate in what is objectively one of the most beautiful bays in the world.

The whole area is investible; Kotor, Dobrota, Tivat, Lustica peninsula, etc.

The fact that Tivat has an international airport with many European flights bolsters the strong case for Kotor Bay. Connectivity, in today’s world, is priceless.

I love to spend my Summers here. My relatives love living all-year round enjoying the mild climate and a calm life in a uniquely beautiful setting. There will always be demand for real estate in such a setting.

I did some case studies with my realtor Peter Square Meter.

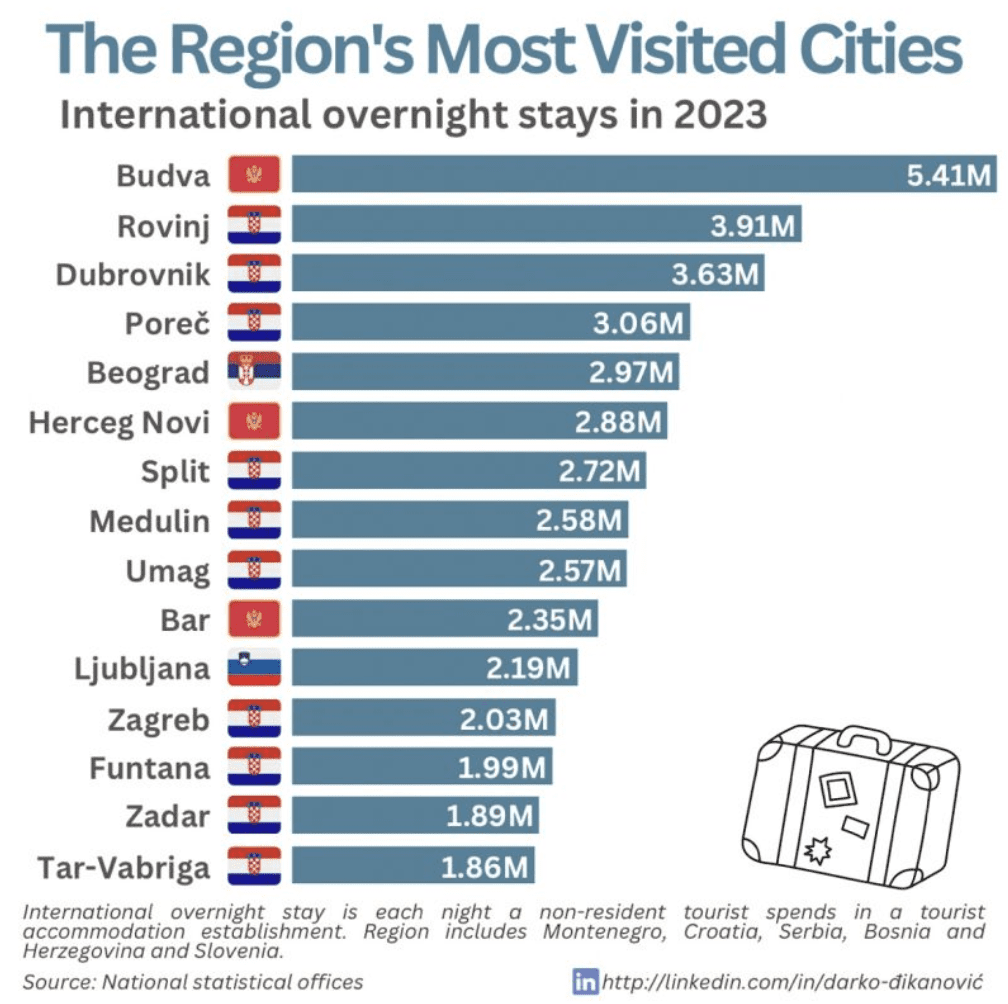

2. Real Estate Investment in Budva

Budva is the real ogre of mass tourism in Montenegro. Though Kotor Bay attracts luxury and is more widely known in the outside world, Budva is a regional heavyweight and attracts the most tourists due to its old town, big beach, and party atmosphere. It’s the preferred destination for higher-end Balkan tourism from Serbian and Bosnia. In my opinion it’s overbuilt but regional tourists love it as well as Eastern Europeans. I prefer smaller towns nearby such a Becici. But from an investment point of view, there is always rental demand there.

Budva is the most visited city in the Balkans in terms of overnight stays by international visitors. This is truly impressive.

So yes, there is (very) strong rental demand for real estate in Budva.

3. Real Estate Investment in Podgorica

Nothing to see here. Probably Europe’s least interesting capital city. No need to even go there unless you’re shopping for furniture or have a flight to catch.

4. Real Estate Investment in Bar

This city is more of a commercial destination due to its big port and railway infrastructure. However, it is becoming increasingly popular amongst foreigners moving full-time to Montenegro. Why? Because you still get to benefit from the beautiful Montenegrin coastline and beaches, but at a much lower price point. Most foreigners who have moved here are Germans, Ukrainians and Russians on lower budgets. Not a bad investment as there is room for this city to improve over time.

Investors looking for value are increasingly looking at the Southern coast of Montenegro. People have to understand that the lifestyle is very different down there, and there are less expats. Most expats in this area are German looking for value.

We also did a full case study with numbers together with Ksenija.

Feel free to get in touch with Ksenija per email.

5. Real Estate Investment in Northern Montenegro

When Montenegrins refer to the “North” of the country, they are referring to the Mountainous areas. The two top investment destinations are Kolasin and Zhabljak near Durmitor National Park.

Both destinations have amazing hiking during the Summer and decent skiing in Winter. However, I find that there is too much real estate supply already in these areas and that the ski seasons are short. Finding quality property management is also a bit of a challenge in those areas, and liquidity is very low.

Personally, I bought a house near Niksic as a pure lifestyle decision as it is 90 minutes away from the coast and an hour away from the breathtaking Durmitor National Park.

The North of Montenegro offers great lifestyle, but it’s not a particularly compelling investment destination in most cases.

6. Real Estate Investment in Herceg Novi

Yes. Interesting investment story with upside.

Herceg Novi is essentially like the rest of Kotor Bay, but at a significant discount. For the moment it seems to attract people who love Kotor Bay but who can’t quite afford Tivat and Kotor. It’s a different crowd from Bar people who are on the cheap side.

Objectively, Herceg Novi is almost as beautiful as other parts of the bay. Prices are much lower, but I see upside. More and more premium developers are working on projects there, including the massive luxury Porto Novi development I mentioned earlier.

This part of the Montenegrin coast will gentrify quicker than other areas. For now, tourism is still mostly domestic and regional (Bosnian and Serbian) but an increasing number of Westerners and Croats priced out of Croatia end up here because it is right on the Croatian border.

EU accession would prove to be a massive catalyst for Herceg Novi.

7. Real Estate Investment in Ulcinj

It’s by far the cheapest on the coast in Montenegro because the ethnic element is crucial to understand. Ulcinj is populated by ethnic Albanians. They speak Albanian, have their own political parties, and wave Albanian flags more than Montenegrin ones. The tourism dynamics are quite distinct, with few tourists that are not from Kosovo. For years Ulcinj was essentially a play on Kosovo tourism. You couldn’t find many Serbs or Westerners here.

However recently there were major announcements. The Dubai developer of the Burj Khalifa tower and another developer have committed to investing around €35 billion near Ulcinj, including potentially a new airport.

Following local protests the project was cancelled but the Gulf investors are now working on a new proposal.

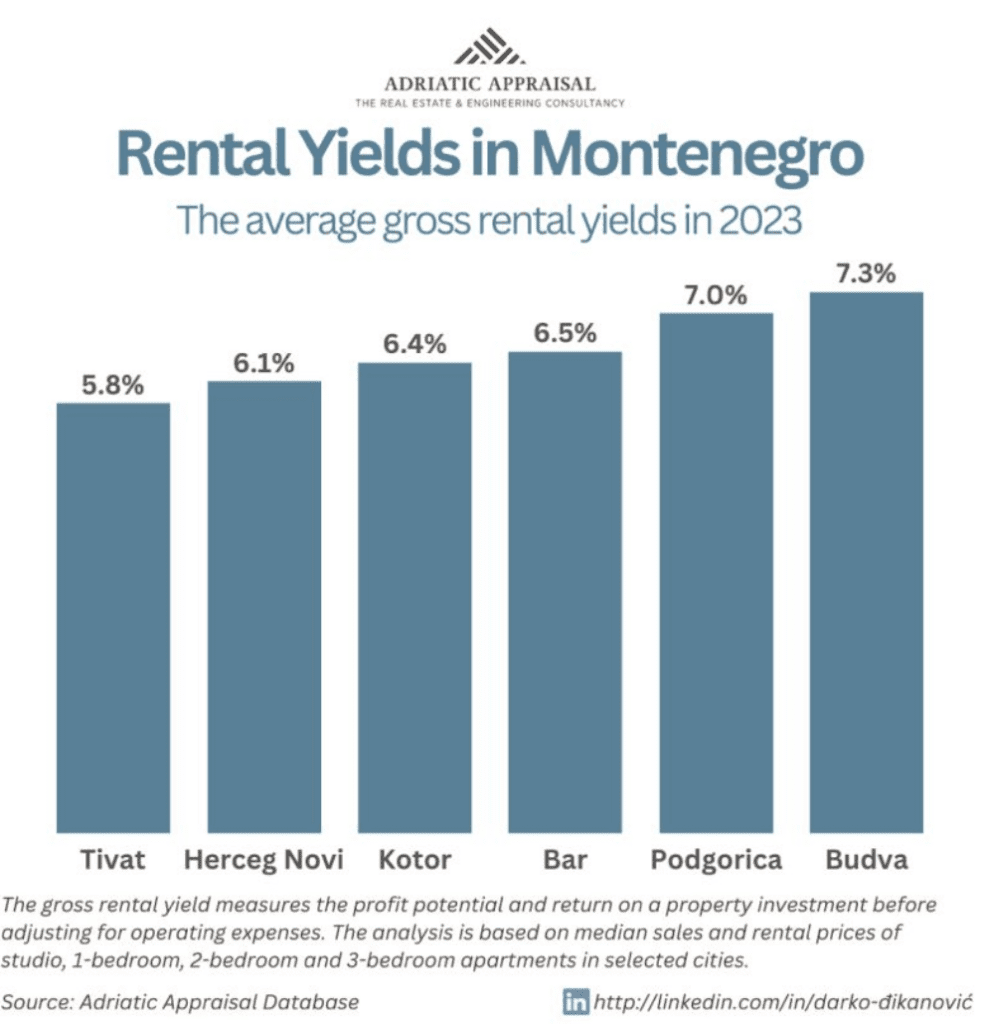

What are the rental yields / capitalization rates on real estate in Montenegro?

Real estate rental yields differ depending on where you invest in Montenegro.

Montenegro Real Estate Market: 4 case studies

1. Long Term rental in Kotor Old Town

About €3,000 /m2 for a 51m2 apartment within the fortifications of UNESCO heritage Kotor Old Town. With negotiation, a 3% stamp duty tax, some lawyer fees, and renovation of bathroom + kitchen, one ends up at a round €170,000. Property taxes would probably be about €700 a year. This apartment could go for about €800 a month. Expect 85% occupancy. Deduct the property tax and some maintenance and you end up with 4%+ net rental yield.

2. Lustica villa flip – earning 50% profit on a house flip

In this video below one of my favourite agents Peter Square Meter showed me this failed construction project in Lustica.

The numbers are attractive. You buy a horrible looking 300m2 brown-phase villa. The list price was €220,000 but I would have gone in there negotiating hard as such assets have low liquidity.

I would have then added about €300,000 in renovations and back-taxes, which would be enough to make a stunning, contemporary villa out of it. I would have then aimed to flip it for €750,000 – €800,000. The whole operation would have taken about 18 months.

Amazing views by the way.

Peter Square Meter specializes in helping people invest in the Bay of Kotor area, feel free to get in touch with him.

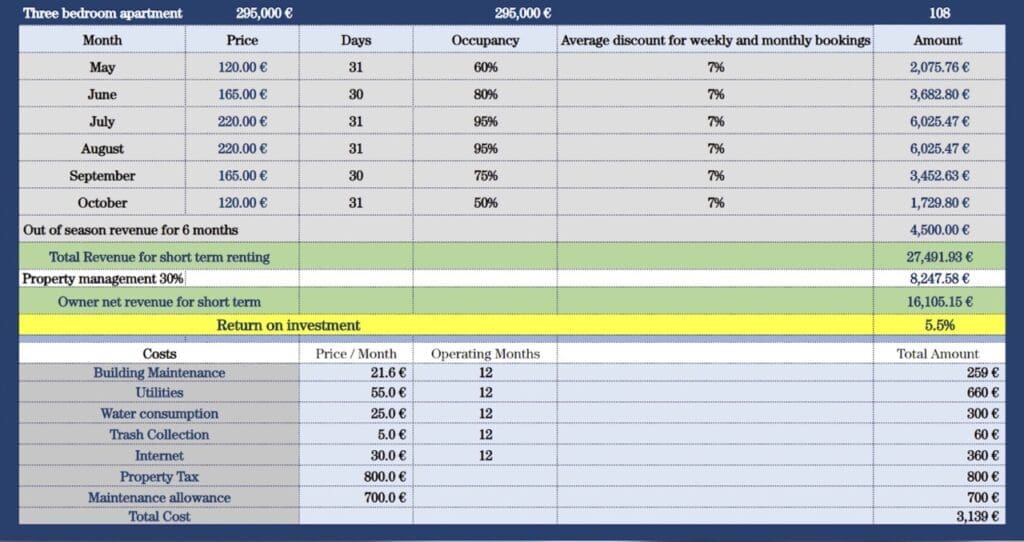

3. Airbnb business in Becici, near Sveti Stefan and Budva

The most popular investment model in Montenegro is to run an Airbnb operation. This apartment below is a case study I did with Ksenija, who helps people invest all over Montenegro.

Her agency is a full-service agency, so her team helps you buy real estate in Montenegro, does the renovations if required, and does the Airbnb management.

You can watch the video case study below. We discuss all the expenses.

If you are looking for a full-servicereal estate agent in Montenegro to invest in renovations, construction, or Airbnb management, feel free to get in touch with Ksenija.

4. Buying plots / lots of land to build in Montenegro

Peter Square Meter took me around to have a look at various good value land plots in Lustica and Herceg Novi. We proceeded to calculate the ROI numbers for people who would like to buy land, build, and then sell the real estate. Overall, buying land and building can lead to interesting capital gains, and most importantly can lead to better lifestyle for those who want something specific.

Peter Square Meter specializes in helping people invest in the Bay of Kotor area, feel free to get in touch with him.

Common mistakes to avoid when investing in Montenegro’s Real Estate

- For easy resale go for new-builds, or for old stone houses/apartments. This is what people are looking for. Few people are interested in structures from the 90s & 2000s anymore, though these could be good for personal use as they often offer the best value. For yield these other structures are typically better.

- Don’t forget to negotiate, especially on the secondary market. Some sellers are hungry for a deal.

- Some areas of the Kotor Bay have almost zero sunshine all year round due to the angle of the mountains. Typically, the sellers wouldn’t warn you 🙂

- Get a good lawyer. A lot of houses and developments were built illegally, which can lead to quagmires down the line

- I repeat: Get a good lawyer. Title deeds oftentimes have oddities happening on them, like people owning strips of your garden, or lawsuits/claims by family members. If you want, feel free to use my team of real estate lawyers in Montenegro.

A decent tax and regulatory environment by European standards

The tax system in Montenegro is decent. 15% capital gains, 9-15% income tax, 9-15% corporate tax rate, and low property taxes, usually less than 0.5% of the property’s actual value, and much less if one resides there. Montenegro also offers residency to real estate owners who invested at least €150,000.

Real estate transfer tax / stamp duty in Montenegro

There is a transfer tax to be paid by the buyer that was recently updated in January 2024:

- Real estate < €150,000 = 3%

- Real estate €150,000 to €500,000 = €4,500 + 5% of amount above €150,000

- Real estate > €500,000 = €22,000 + 6% of amount above €500,000

Montenegro is ascendant and beautiful, and there is significant upside in certain pockets. However, it’s not a market where everything will go up as it would in a booming city. It’s important to target the investment properly, to be clear on one’s objective, and to not be all in. Montenegro is a decent market, but due to the risks, staying diversified is crucial.

Connect with the right realtors in Montenegro

If you are looking at investing in real estate in Montenegro, feel free to get in touch with my two favorite realtors in Montenegro who I have worked with and trust.

Peter Square Meter

Peter is from the UK and specializes in the areas of Kotor Bay (Tivat, Kotor, Lustica, Herceg Novi).

Learn more about Peter

Ksenija

Ksenija is from Montenegro and her agency covers the whole coast + does renovations + property management.

Learn more about Ksenija

Services in Montenegro:

- My Favourite Real Estate Agents in Montenegro

- How to obtain Residency in Montenegro

- Create a Company in Montenegro

- Real Estate Lawyer in Montenegro

Articles on Montenegro:

- How to flip a house for a 50% gain in Montenegro

- Montenegro Real Estate Market: 2026 Investor Guide

- Decent rental yields for Real Estate in Montenegro

- Buying Montenegro Real Estate – a Case Study with ROI figures

- The Pros and Cons of living in Montenegro

- Investment and lifestyle real estate in Tivat, Montenegro – a top European low-tax safe haven

- Seaview Properties near Budva, Montenegro: Investment Options

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Excellent article, it is rare to see such good understanding of local situation from non-resident. The ony thing missing is the sewage problem, which should be the first thing to inquire about, as some municipilies have treatment plants and some dont.

Very good point. Thank you. Even if some municipalities do have treatment plants, some houses are not connected to the municipal sewage system which means a septic tank is necessary. Some septic tanks are easy to maintain, and others are not.

kotor (old Town) look good for investment. Besides porto Montenegro and Porto Navi the other 2. I am a tourism professional (Inbound Travel Director) from India and into this work for the last 2+ decades. Have a budget of 150kEuro and would like to start a business say a super market in Kotor or any other daily need store. I am although open to investing in real estate provided the returns are good. Willing to go for the citizenship as a reward for investing. I see huge potential in this Monaco of Russians once!

Very nice article. I spent 2 weeks in Boka Bay recently and I am already planning to go back in September. As a real estate investor, I also saw sooo much potential in there and since I can work from home, I would definetly love to have a property in such a beautiful and peaceful place. I’m already contacting some agencies in order to find a nice apartment to buy ( < 150k). I'm looking for something near by old town, maybe Dobrota or Risan. Based on your experience, do you think it would be nice towns/villages to invest? They seem so raw yet but full of potential.

Congrats again for the article.

Thank you Miguel. Dobrota is well established, whilst Risan has the cheapest real estate in the Bay. They both have very different investment theses.

Happy house hunting!

Thank you for the informative article. Just starting my research into ME and Kotor Bay from a long distance in lockdown. A few questions: You mention ‘people are looking for news builds or old stone houses/apartments’. Are you referring to short/long term renters or for potential re-sales and capital gains?

‘No one is interested in 90’s and 2000’s houses’, does this include apartments in small buildings built during that period. Reason I ask is that I’ve noticed some affordable small apartments (sub €2000/Sam with spectacular views in places like Krasici (and Dobrota) with some interesting/unique features, eg. large balconies, lofts etc. They could make interesting first ‘toe in water’ investment for residency purposes and suitable for vacation rentals/personal use? Because of the earthquakes in the 1970’s that destroyed the old village in the hills I assume that the re-building of the town near the sea would have taken place over the next few decades. Do you have any thoughts on this idea or this part of Kotor? Interesting comment you make regarding sunshine on the bay, thank you.

My name is Spiro Jankovich and I was born in Igalo. My family home is still there, my family has resided there for 3 to 4 hundred years. The country is a unique and beautiful place but is run by the Milo gang like a mob family. We had to leave, my father was going to be executed by the communist liberators(?). We lost everything and ironically much of the property(s) has been sold or being to be sold. We have received no restitution. The one property (after 50 years) we have received restitution but we will never get the money. Need your confirmation.

It is wonderful but it is a very dangerous country.

Spiro J.

Interesting article. You don’t mention the significant infrastructure problems causing massive traffic issues during the summer. Plans are afoot to widen the coast road, (heaven knows when), but it will still form a bottle neck into Tivat or Budva. Have you any info about plans to improve the road capacity? It’s impossible to drive through Kotor in the summer in reasonable time, so it’s to be avoided!

Thanks. They have started building the new 4 lane road between Tivat and Budva.

Do you usually buy property cash or mortgage? If mortgage, is it a pain to get a mortgage in montenegro as a US citizen?

It’s almost impossible to get a mortgage in Montenegro as a non-resident foreigner. It’s a cash market.

Great summary. A couple of things:

1) ppl need to understand just how small the country is and that there are No big cities/populations nearby. It’s quite a drive from anywhere. That’s a big difference from say coastal Spain, France or Italy.

2) Don’t agree on Kotor. The location at the end of the bay squeezed in by mountains means less sunshine and the cruise ships mean it gets flooded by day trippers which restaurants then adapt to. Plus, it means there are No real good swimmingpool areas.

3) Tivat and Herceg Novi are castles better since they offer better sun exposure, less crowds and better access to the water for swimmers. Of the two, Herceg Novi wins on charm.

Why are you presenting statistics from Croatia and not comparing them with Albania? Albania is booming right now.