When people think of beach destinations in Mexico, two immediately come to mind: Cancun with its Caribbean coast, and Puerto Vallarta with its choice section of Pacific coast. I have done a lot of research on the Playa del Carmen real estate market, and the Tulum real estate market, having personally invested in real estate in Playa del Carmen.

However, I was curious about real estate investment opportunities in Puerto Vallarta. So I took a flight to Puerto Vallarta and stayed there for two weeks to research the local Puerto Vallarta real estate market.

Table of Contents

Mexico’s Economy: Macro Overview

Mexico has attractive demographics

People tend to forget that Mexico is an absolute behemoth population-wise, with its 131 million inhabitants. It is the second most populous Latin American country after Brazil, with 212 million people, and well ahead of the third, Colombia, with 53 million people.

A large economy that has been growing steadily, but somewhat sluggishly

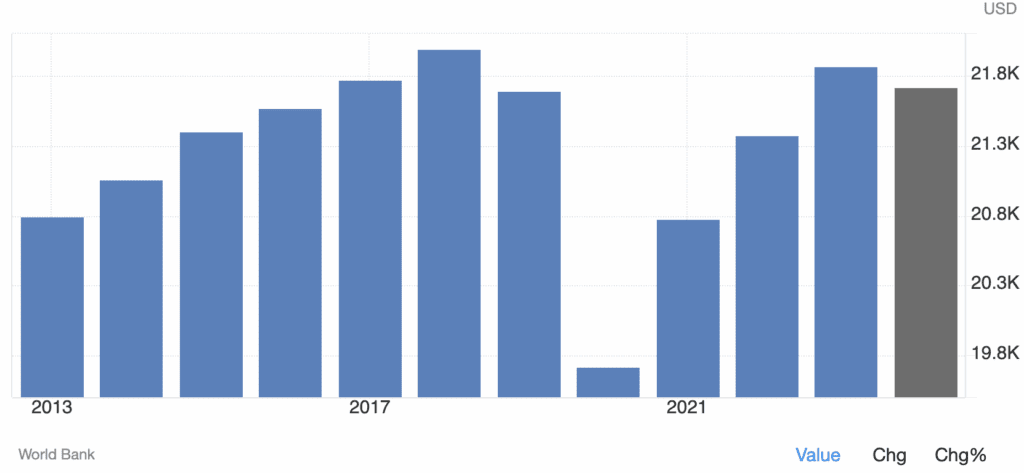

The most objective way to look at the country’s growth is on a per capita PPP basis, to capture how much people are really gaining from GDP growth.

These numbers are decent, but in all honesty, they are a bit disappointing when considering the (mostly) free trade agreement with the US and Canada. A massive country with such a surplus of affordable labor, should objectively be doing better.

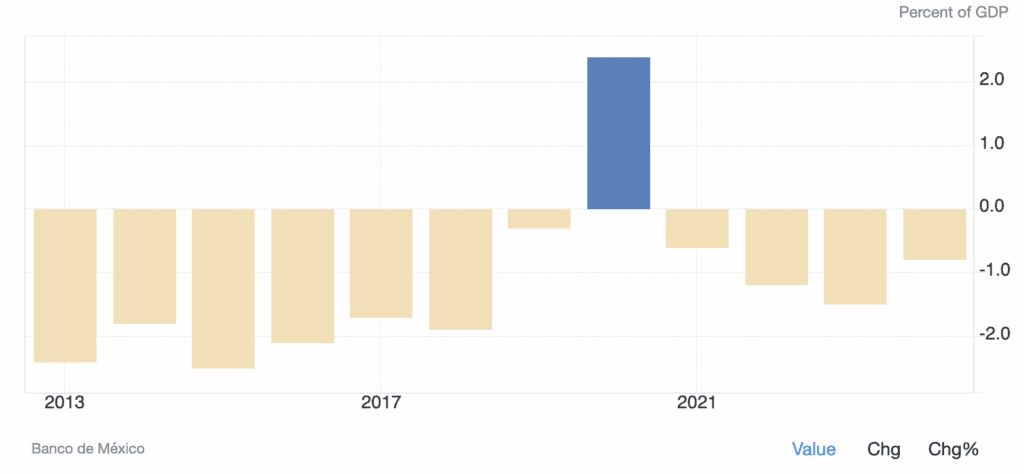

A slightly disappointing current account for such a large manufacturer

Again, with the free trade agreement with the US, Mexico should be doing better.

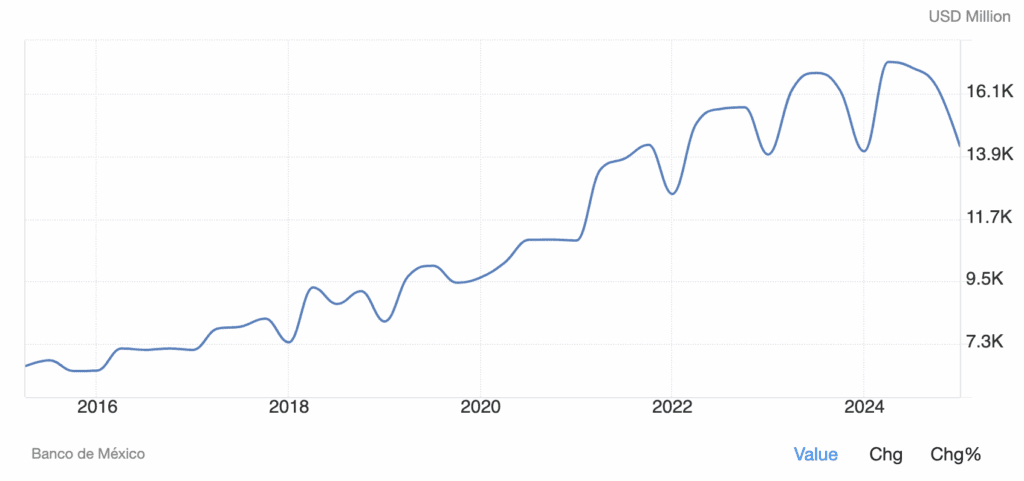

This is in spite of booming remittances

Remittances from Mexicans working in the US represent 4% of Mexican GDP, and are a lifeboat for many families. Uncle Juan in Oakland provides more of a safety net than the Mexican government does. It also demonstrates the industrious work of Mexicans in the US, considering the amount of Mexicans did not grow by such an amount proportionally over time.

Clearly, Mexicans in the US have been gradually moving up the food chain in terms of income.

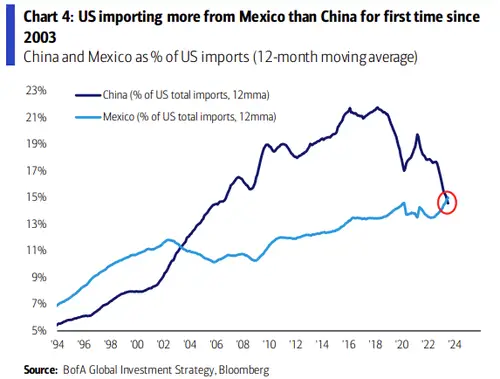

Near-shoring in Mexico, a bedrock of the Mexican middle class

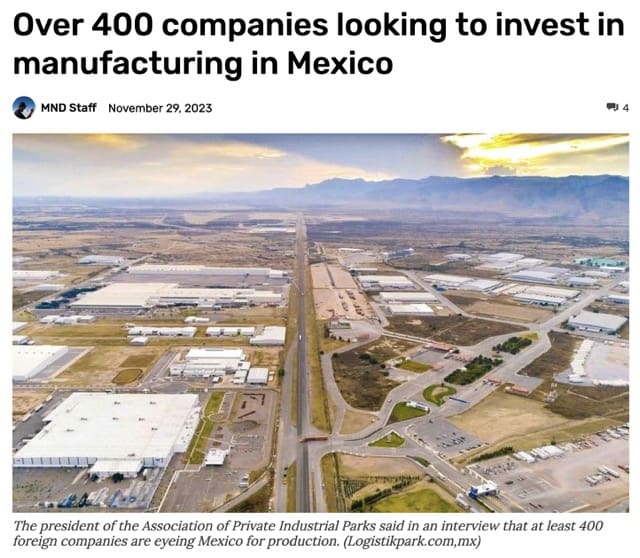

The world is bifurcating between East and West, with a third, more neutral block in-between just as during the Cold War (Mexico is in this latter block).

The inevitable result of all of this drama is that re-shoring will become a top priority for Western companies and governments. After outsourcing most of its production of goods to China over the past 20 years, the US finds itself in a situation where it is choosing to re-shore production and reduce its exposure to China.

Western companies, whether they like it or not, will have to diversify away from China. A lot of this production will go to the likes of Vietnam, etc. But an obvious candidate is just across the border. Mexico will be in a prime position to massively benefit from this de-globalization and re-shoring trend.

This is a net positive for the Mexican economy, and it will translate into more local tourism internally and investment in the local real estate sector.

Trump’s election is a negative for Mexico

Trump is clearly triggered by this here:

Trump is known for his Mexico bashing. The next four years will be tough for Mexico, especially with the current left-wing administration in place, though president Sheinbaum has for now managed the relationship with Trump quite well. Trump will most likely make life tough for Mexico, which will negatively impact the country’s economy and incoming foreign investment.

Mexico elected a government in favour of more regulation

In the presidential elections left candidate Claudia Sheinbaum was elected.

She ran on an anti-mining, higher tax and greater state involvement platform.

Having said this, Mexico is a complex country. Just as the government does not have the monopoly on violence (which it shares with cartels), it also does not completely control the economy.

However she has made some very expensive commitments such a massive scholarship program and government price fixing of basic goods.

The state owned oil company, which has been chronically mismanaged by all Mexican governments, is in real trouble. Its liabilities total $120 billion, which amount to over half of the country’s foreign exchange reserves of $200 billion.

Mexico used to be a net exporter of energy, but is now a net energy importer with no viable plan to change this.

Mexico is a country with decent government finances for now

In a world where Western government debt to GDPs ratios hover around 100%+, Mexico’s figures are quite sobering.

Mexico has an economy that will muddle through, but with pockets of excellence

I don’t expect explosive growth in Mexico, just the usual below potential, yet steady growth that Mexico is used to. The policies of the current government, and the election of Trump will just lower the growth of Mexico but are unlikely, unto themselves, to lead to any short-term recession, barring a worldwide slump.

The pockets of excellence driving the Mexican economy will undoubtedly be in the North close to the US border in wealthy cities such as Monterrey, which benefit in full force from the near-shoring trend.

However, I believe that Playa del Carmen, Tulum, and Puerto Vallarta will also be key beneficiaries as the rising middle- and upper-classes of Mexico seek lifestyle housing, investment properties, and themselves spend time in the nicest resort/beach towns of Mexico.

The current state of the real estate market in Puerto Vallarta

Covid led a massive boom in Puerto Vallarta real estate, particularly in new construction. Why? Nobody wanted to sell their condo by the beach in a city that was still relatively open, so people had to buy into pre-sales.

Also, as the West Coasts of the US and Canada had a lot of restrictions, Puerto Vallarta was a short flight away and was open. This led to a boom of people investing in real estate or just settling in PV, from anti-vaxxers wanting freedom to gays wanting to party and boomers who just wanted to play golf.

The market is now experiencing a slight correction. People on social media like to exaggerate the state of the market, it’s absolutely not a crash like we are seeing in Tulum; it’s simply a consolidation at a new level.

However what is risky is going in pre-construction right now. There are many inexperienced and under-capitalized developers that started their project planning during Covid and are now struggling to sell in a more normal market. So be very careful out there. Paul helps investors sort good from bad, and also digs into the secondary market for his buyers in order to minimize risk.

The market for the next few years is likely to be characterized by relative price stability.

6 Key Catalysts That Make Investing in Puerto Vallarta Interesting

1. Staggering development in Puerto Vallarta

Puerto Vallarta International Airport

Puerto Vallarta airport is absolutely booming. In 2022 it was the Mexican airport with the most passenger growth versus 2021. Passenger numbers grew a staggering 51%, so much so that the airport is expanding. The main terminal is being renovated and a second terminal is being built. This will increase capacity, comfort, and drive even more volume of tourists and nomads.

The new terminal is expected to open its doors in late 2026, and is set to become Latin America’s first net-zero airport. The net-zero element is interesting in the sense that the city seems to be targeting higher-end tourism, which is more sensitive to such matters.

In 2024 and Q1 2025 passenger volumes have been relatively flat, which is much better than Cancun which has seen passenger declines. Puerto Vallarta is a more resilient market.

New highway to Guadalajara

The new highway was finally completed end 2024 after 13 years of planning and construction. It’s a massive catalyst from a local tourism point of view. Few foreigners are aware, but Guadalajara metro has a population of 5.5 million people.

These people previously had to travel over 5 hours each way. They can now get to Puerto Vallarta in 3 hours or so. This has brought a healthy boost to weekend tourism. As Mexico continues to develop thanks to re-shoring activity, the new Mexican middle and upper classes will be happy to go to the beach for the weekend.

Though this is bullish for Puerto Vallarta in general, it is even more so for small beach towns near the highway on the way to Guadalajara. More on this topic below.

2. Digital Nomads

The reality is that one short flight away from Puerto Vallarta is a massive market of high-earning Americans who simultaneously realized a few things:

- They can work almost entirely remotely.

- They can work from abroad, thus leaving behind an increasingly toxic environment. This perception of toxicity applies to Americans of all political stripes.

- They can live a quality life for less money abroad and in many cases can save on taxes if structured properly (feel free to get in touch with my tax consultants here)

Millions of Americans have either reached these conclusions, or soon will. The reality is that in spite of back-to-the-office mandates, many more entrepreneurs and people work online than before.

First-time American digital nomads will stick to the name brands in terms of travel destinations, which is bullish for making a real estate investment in Puerto Vallarta.

Puerto Vallarta is a top digital nomad destinations, along with places like Chiang Mai, Playa del Carmen, Bali, Budapest, Tulum, and Medellin.

3. Refugees of North American toxic politics

The influx has already started, and is bound to grow. I am not referring to digital nomads who move here for a few months or a year before bouncing off somewhere else. I am referring to people, of all political stripes and ages, who move down to Mexico full-time. They sometimes have online businesses, but often they still have businesses back home which someone manages for them. They are retired, they live off passive income, or start actual businesses in Mexico.

Liberals escaping Trump

Unhappy with the trajectory of the US, they are moving in droves to places such as Europe, Panama, and Mexico. Puerto Vallarta due to its closeness to the West Coast and its large gay scene, attracts many liberals.

Conservatives

This is the previous batch of Americans and Canadians. Typically they left during Covid and settled in Mexico. Some went back after not managing to make things work for themselves in Mexico, but many have stayed and formed communities. This type of immigration has slowed down with Trump’s election but Canadians are still going strong.

Apolitical Americans who are sick of the divisive politics in America

They just want to live in peace away from all the nonsense. The beach in Mexico is a good destination for this.

Europeans who flee conflict

Riviera Maya lately hosts an increasing number of Ukrainians and Russians, but not Puerto Vallarta as it is farther away from Europe and does not have many direct flights to the old continent. There aren’t many Europeans in Puerto Vallarta. For example many exchange offices will not even display Euro conversion rates as an option.

4. Walkability is a true competitive advantage for the real estate investment market in Puerto Vallarta

This is one of the key selling points of Puerto Vallarta real estate compared to many other destinations in Latin America. The walkability of the city is great, not just on the famous boardwalk but in town as well. And as soon as you want to venture farther way, there are cycle lanes on the main arteries as well as a bus system that is easy to understand and use. It’s cheap, and you also see wealthy Gringos taking the bus because of how convenient it is. This contrasts with Playa del Carmen and Tulum where wealthy Gringos do not use the local bus network.

If you live in the center or near the center, Puerto Vallarta is very walkable. You can live a bit of a village life without having to buy or rent a car. In an age of inflation and high gas prices, this makes a difference. Also, for people who just want to stay for a few months, or plan to stay for a week on holidays, walkability is a key factor to avoid hassling with taxis.

Going to the nearby towns is easy as well with buses departing on a hourly basis.

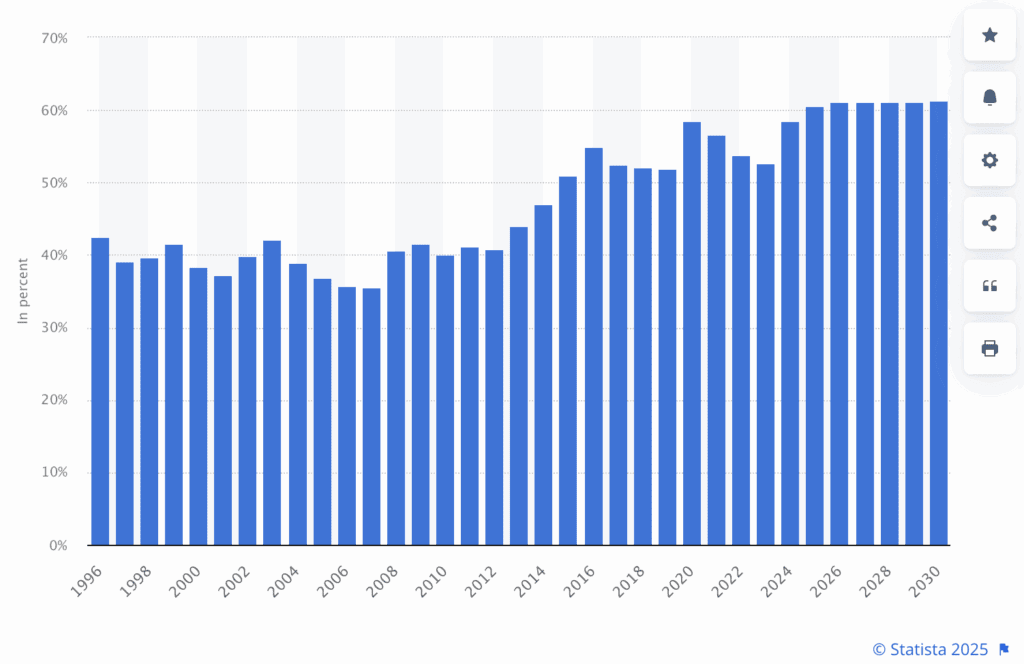

5. LGBTQ

This again is a topic that gets people politically heated. Just looking at facts, whether you like it or not, the US and Canada are experimenting big shifts.

Gen Z self identifies at a rate of 20% as LGBTQ, versus less than 5% of boomers. This is a generational sea change.

Puerto Vallarta, and more specifically the Zona Romantica, is a world-renowned gay destination. This is a big growth market.

However, there is space for everyone. Venture outside of that area and you’ll meet plenty of Canadian families who fled what they perceive as LGBTQ ideology in the school system in Canada.

Mexico is a land of contrasts.

6. Safety

Puerto Vallarta feels very safe. Unlike in some other Latin American destinations, I wasn’t looking over my shoulders when walking around at night, and felt comfortable going out with an expensive phone without sticking it into my boxers.

Mexicans feel the same about Puerto Vallarta. They like its reputation for safety. I remember meeting a group of young Mexicans in their 20s from Mexico City. I asked them why they chose Puerto Vallarta for the weekend instead of Playa del Carmen. They replied that for Mexicans Puerto Vallarta is safer.

Insightful, and very positive for the local element of the local real estate investment market in Puerto Vallarta.

Video case study of real estate market in Puerto Vallarta

Which areas to invest in Puerto Vallarta

Region Guide: Where to Make A Property Investment

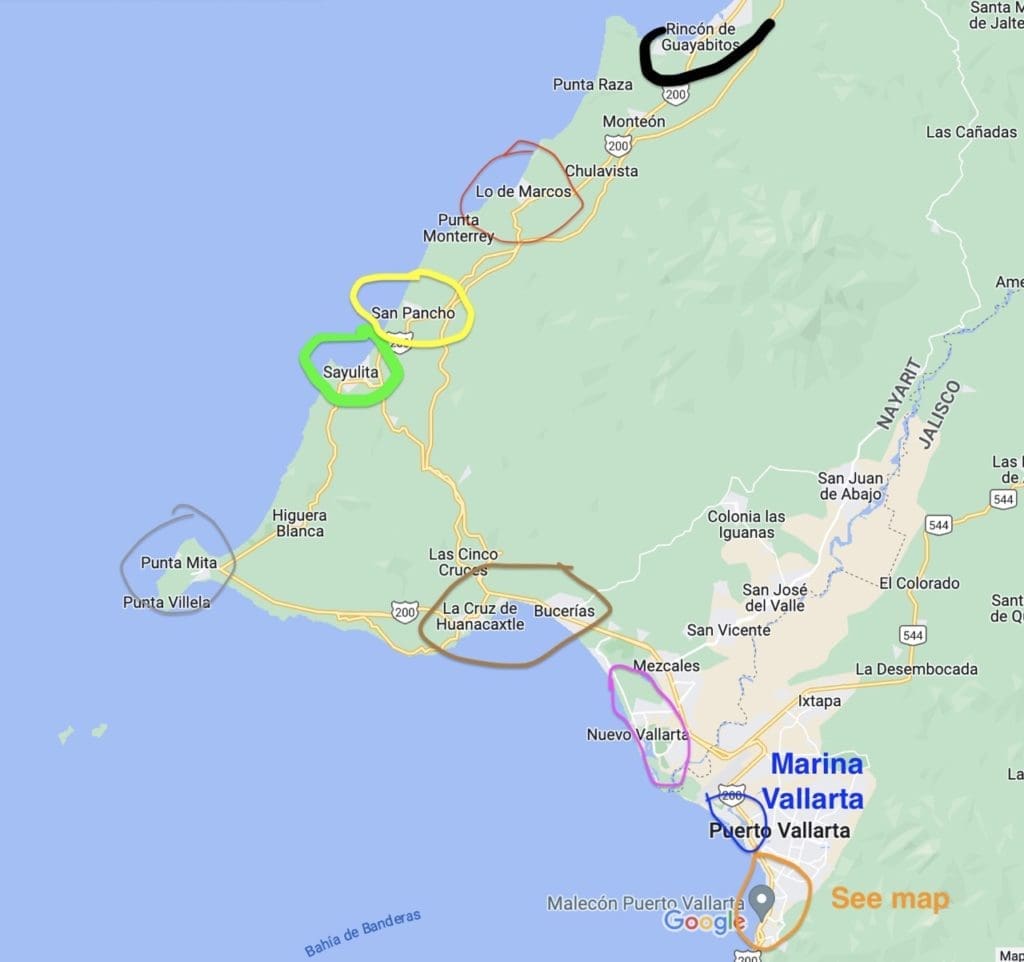

First, let’s start with the region, and we shall delve into the city and its neighborhoods a bit later.

I would generally ignore the coast south of Puerto Vallarta given that the regional development is more focused northward towards the highway and the expanding airport, two key drivers for the real estate market in Puerto Vallarta.

Marina Vallarta

This neighbourhood is very comfortable for living. And many expats live here. Walk around any morning and the restaurants will be packed with North Americans having brunch. However, as a pure investment I avoid it due to one chief reason; the area has peaked. It’s nice, but there isn’t any further growth planned. It is starting to look a little old. It’s past its prime. Lifestyle? Yes. Investment? No

Nuevo Vallarta

Nuevo Vallarta is absolutely fascinating in the sense that you could forget you’re in Mexico if there weren’t so many Mexican workers around. It’s essentially a large, gated community with hotels, malls, private clinics, private schools, and its own prime beach. The infrastructure is great, though you must have a car as it isn’t pedestrian friendly in the sense that it is very big.

In some respects it’s a little kitsch (think fake Mayan pyramids), but in many ways it offers all the comforts of back home. You see Mexican, American, and Canadian flags everywhere. The supermarkets have imported products from back home. And it’s very safe.

I talked to a few expats here. They are quite different from expats in other parts of Puerto Vallarta in the sense that they seem to mingle a lot less with locals. For many it’s just a great beach destination, with great weather, safety, and affordable help and food.

As a pure investment I would stay away from it as it is already rather built out. You’re looking at easily $400 per square foot for new construction. I can find better value with more upside potential in other neighbourhoods and nearby towns, with less HOA fees if I were to rent the property out.

Having said this, it’s a great lifestyle play.

Bucerias and La Cruz

Growing area. There is still much space for construction. The infrastructure is absolutely not “there” yet. Dirt roads, constructions sites, and the marina is not that appealing, nor are the boats premium. But this will change. The highway lays nearby and the airport is close so this area will definitely develop over time. I doubt the rental yields are very interesting for now, as living there without a car is not that appealing and many of the retirees and digital nomads would prefer to be somewhere livelier, but for capital gains this is probably not a bad play.

Punta Mita

Sorry, you’re late. Extremely expensive already. Lifestyle play. Very high-end developments, and extremely pleasant area with gorgeous views and decent infrastructure. It was even hard to take pictures of anything pretty because everything is behind the walls of luxury gated communities housing multimillion dollar properties.

Sayulita

Really cool surf village that has turned into Puerto Vallarta’s Tulum. Even in low season it is PACKED with young digital nomads. There is even a Selina hostel, which says much about the destination given how selective Selina are when choosing their destinations.

If you walk around Puerto Vallarta in the low season during the day it feels a little dead. However, in Sayulita the cafes are teeming with young digital nomads who pass their time working, drinking at cool bars, shopping in cute stores, hanging out at the beach or surfing the waves. It’s a fun year-round destination.

But real estate is already expensive. I don’t know how much more upside there is. Objectively, it’s not like you’d be getting in early on a trend. You missed it as a pure real estate investment. It’s a lifestyle play now.

San Pancho

The next Sayulita. If you want Sayulita-ish vibes at a discount with potential upside, this is where you go. It’s a mere 15-minute cab ride away if you want to go have fun in Sayulita every once in a while. If I had to invest I would rather do so here to capture more potential upside.

Lo de Marcos

If I had to speculate anywhere on the coast, it would be in this village. For now, there are still barely any tourists and the beach is pristine. The tourism infrastructure is almost non-existent, but it feels quaint as a result. If you bought something here, finding a decent Airbnb manager would probably be a bit challenging. You’d probably have to find a neighbour or one of the few expats living in town.

But, I believe that this village represents the best speculation and odds of strong capital appreciation. Development will inevitably arrive in this area, with the new highway being a big catalyst, as well as prices that went up significantly in Sayulita and San Pancho. Things can only get better in this village. It’s a decent long-term speculation.

I believe that Lo de Marcos will offer the most upside for real estate investments on the coast near Puerto Vallarta.

La Peñita / Ricón de Guayabitos

Relatively large ugly town targeting lower- and middle-income Mexicans. This would be a bet on the Mexican middle class, and the highway has made it even more accessible to Guadalajara. The beach is nice, but all the buildings in town look like they got their last remodeling done in the mid 90s. You find a few North American retirees on a budget living here.

Overall it would probably be a decent investment over the long term due to the highway and Guadalajara which keeps growing. But it’s certainly not a place you’d want to spend time in for now.

Neighborhood Guide: Where to Invest in Puerto Vallarta Real Estate

Puerto Vallarta is now a city of close to 300,000 souls. Before making a real estate investment in Puerto Vallarta, it is crucial to have a good understanding of its key neighbourhoods.

Centro

This is a classic area with the famous boardwalk, cobbled streets, boutique hotels, bars, clubs and art galleries. If you want to buy core location, this is the best that Puerto Vallarta has to offer. However, prices are expensive. It’ll be hard to make a decent capitalization rate on real estate investments in this area, however your occupancy rate will be very high. Overall I see it as a lifestyle play, with some of the best leisure Puerto Vallarta has to offer.

Even run-down houses are expensive. When I called to inquire about this house, it had already been sold for $230,000. It wasn’t a large plot of land either.

Zone Romantica

Known to be the best area in Puerto Vallarta, together with Centro. It’s a big LGTBQ destination, but only a small section of the area is dedicated to this crowd. You’ll also find plenty of retired North Americans, digital nomads, etc. Due to the price of real estate though, it’s hard to make high capitalization rates, and I don’t think you’ll be making amazing capital gains. The thesis here has already played out. As with the Centro, this is a lifestyle play which you can combine with being able to list the condo on Airbnb when you are not in town.

Fluvial

Just a normal residential area with an increasing population of expats who move there because of general affordability. It’s not particularly pretty, nor close to the beaches. Upside is limited here, as well as rental yields.

5 de Diciembre

Most digital nomads I met stay in this area because it is close to Centro, is more affordable, has good beach access, and is increasingly dotted with cute cafes and restaurants. This area is not cheap, but comes at a 20% discount to the centro. There is probably a bit of upside in this area still as businesses move in. It’s a convenient area and is where I stayed myself. But I find that both Versalles and Lazaro Cardenas offer more upside potential.

Versalles

I really like this area from an investment standpoint. Why? Because cute cafes and restaurants keep popping up, and people “in the know” are increasingly going for dinner and drinks here. It’s absolutely not on the tourist map, and is only really known by some people who live full-time in Puerto Vallarta. People living in the Centro and Zona Romantico now occasionally go to Versalles in the evening for dinner.

It’s a trend, but it’s still early in the game. The neighbourhood doesn’t look great yet, and there are a lot of mean looking buildings. This, combined with its relative proximity to the beach and airport makes it a stand-out from an upside point of view. This is my favourite spot to make a real estate investment in Puerto Vallarta together with Lazaro Cardenas

Lazaro Cardenas

This area is one notch below Versalles. Not much is happening here, but the occasional nice new building emerges as well as the odd cute cafe. It is sandwiched between 5 de Diciembre with all its digital nomads and Versalles with its cool restaurants and bars. As Puerto Vallarta continues to grow, it is inevitable that Lazaro Cardenas will grow. For long term capital gains when making a real estate investment in Puerto Vallarta, this is a very good bet.

Zona Hotalera

As the name implies, there are mostly hotels in this section of town, though there are more residential towers than in the Cancun hotel zone for example. I wouldn’t buy there as an investment. Prices are high as it is and I don’t see much upside.

Case Study: Long-Term Rental Market in Puerto Vallarta

This two bedroom, two bathroom condo near Versalles is being sold for $449,000 fully furnished.

| Purchase price | $449,000 |

| Closing costs (+-6% notary + $2,600 for local trust) | $29,540 |

| Total purchase price | $478,540 |

| Yearly rental income $1,700 per month @ 90% occupancy | $18,360 |

| Administration / Property Management ($200 per month) | $2,400 |

| Yearly HOA / Common charges ($330 per month) | $3,960 |

| Property tax | $500 |

| Yearly maintenance allowance | $1,000 |

| Total yearly costs for a long term let | $4,260 |

| Net pre-tax income | $10,500 |

| Net rental yield and capitalization rate ($10,500 / $478,540) | 2.2% |

This is for the long-term market, which is absolutely not attractive. It would be better to put it on Airbnb and have the apartment available for when you want to use it.

Case Study: Short-Term Rental Market in Puerto Vallarta

| Purchase price | $449,000 |

| Closing costs (+-6% notary + $2,600 for local trust) | $29,540 |

| Total purchase price | $478,540 |

| High season $150 with 75% occupancy for 5 months | $17,156 |

| Low season $95 with 60% occupancy for 7 months | $12,169 |

| Total gross yearly income | $29,325 |

| Administration / Property Management ($200 per month + 20% of turnover) | $8,265 |

| Yearly HOA / Common charges ($330 per month) | $3,960 |

| Utilities and internet ($200 per month) | $2,400 |

| Property tax | $500 |

| Yearly maintenance allowance | $1,000 |

| Total yearly costs for a long term let | $16,125 |

| Net pre-tax income | $13,200 |

| Net rental yield and capitalization rate ($12,034 / $478,540) | 2.8% |

This allows you use the apartment for parts of the year, cover all your expenses and still make a bit of cash flow.

Case Study: Zona Romantica Real Estate Investment

Because rental demand is so strong in Zone Romantica, the rental yields are higher.

Who Should Invest? Puerto Vallarta Real Estate Market

People who want to spend part of the year in Puerto Vallarta

Many people wish to mix lifestyle and a place they can rent out. Puerto Vallarta is a lovely lifestyle destination, right in the West Coast time zone. If people want to maximize their ROI, I recommend they list the condo on Airbnb from mid-November until the end of April, which is the peak season.

A real estate investment in Puerto Vallarta of a minimum of $300,000 using the right structure qualifies the investor for residency in Mexico. There are many other ways to qualify for residency in Mexico (more details here). Making a real estate investment in Puerto Vallarta is an easy way to qualify for residency in Mexico.

People who want to spend the whole year in Puerto Vallarta

Puerto Vallarta has shifted from a seasonal destination to a full-blown year-round destination. It’s a very pleasant place for both retirees and younger people. The fact that it is increasingly well-connected to the US and Canada makes Puerto Vallarta increasingly livable for people.

Americans and Canadians who want to spend time in Mexico and diversify without taking on too much geopolitical risk, in an established destination

People who want to diversify away from Western countries, without taking geopolitical risk. Mexico is unlikely to get involved in any war, and investments are welcomed from all over the world. In many ways it is a bit of a safe haven. Granted, Puerto Vallarta is not a cheap destination, but it is very established, and importantly comes with minimal currency risk on rental income as rents are often set in USD, not in Mexican Pesos. The rental yields are not particularly attractive. It really is an investment destination for people who actually want to spend time there.

The Bottom Line: Puerto Vallarta Real Estate Market

Overall I see the Puerto Vallarta Real Estate Market as mostly a lifestyle decision, with a bit of cash flow on the side for people who want to rent out their property for parts of the year.

Compared to Playa del Carmen, I would say there that there is less potential for capital appreciation as the prices are higher. However, there is probably less downside risk as well due to the fact that Puerto Vallarta is a much more established destination and is very close to major money centers in California. It’s a more resilient market.

People love Puerto Vallarta and its surroundings for the beauty of the nature, the lifestyle opportunities, the surfing, and decent connectivity. This is not about to change. The new highway and airport terminal will only consolidate Puerto Vallarta as a premium and well-connected destination.

Contact Paul to buy Puerto Vallarta Real Estate

I talked to many realtors in Puerto Vallarta but immediately liked Paul as he was very honest with regards to numbers and setting expectations. Paul, originally from New Zealand, has been living in Mexico for a number of years and immediately fell in love with Puerto Vallarta. He can help you find your dream home in PV.

Frequently Asked Questions

Is it good to buy property in Puerto Vallarta?

Puerto Vallarta property is a good way to diversify internationally, and a spectacular place to spend time. Though the net cap rates are generally relatively low, it still makes sense for people who people who want to live there all year or for parts of the year.

How much money do you need to live comfortably in Puerto Vallarta?

A monthly budget of $3,000 for an expat couple should be enough to live relatively comfortably but it really depends on where you choose to live in Puerto Vallarta. One can live cheap in Mexico, but Puerto Vallarta is not the destination for this.

Is Puerto Vallarta real estate expensive?

Puerto Vallarta is one of the most expensive real estate in Mexico along with Cabo and central parts of Mexico City. Puerto Vallarta real estate is expensive locally, but nevertheless a bargain compared to some large US and Canadian cities.

Are home prices dropping in Mexico?

Home prices in Mexico are relatively stable after a few years of strong growth. But it is important to note that Mexico is a very large country and dynamics vary from market to market.

- My Real Estate Buyer’s Agent in Tulum and Playa del Carmen

- Give Birth in Mexico for Citizenship

- My Favourite Realtor in Puerto Vallarta, Mexico

- How to Obtain Residency in Mexico

Articles on Mexico:

- Playa del Carmen Real Estate Market: 2025 Investor Guide

- Full Analysis of the Tulum Real Estate Crash

- 6 reasons against a Real Estate Investment in Cancun

- Investing in Multifamily Housing in Playa del Carmen

- Puerto Vallarta Real Estate Market: 2025 Investor Guide

- What is a Lock Off Condo & Crazy Architecture in Tulum, Mexico

- Giving birth in Mexico as a foreigner – the complete guide

- Pros and Cons of living in Playa del Carmen, Mexico

- Puerto Vallarta real estate – a Plan B destination for liberals

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.