Real estate in Panama City, Panama is often touted online as a prime real estate investment destination with great ROIs.

But is this really the case?

This article will make the argument that although the Panama City real estate market provides investors with interesting diversification and visa options, the actual ROI is generally lower than advertised. Some neighborhoods are also to be avoided outright from an investment point of view.

I have residency in Panama and took extensive time to criss-cross Panama City to meet with agents and developers in order to conduct this analysis.

Table of Contents

Latin America’s most developed economy

First things first, investing in Panama means investing in a relatively developed economy; it isn’t a typical developing country. A lot of the upside has already been priced in; you are buying into a relatively mature market.

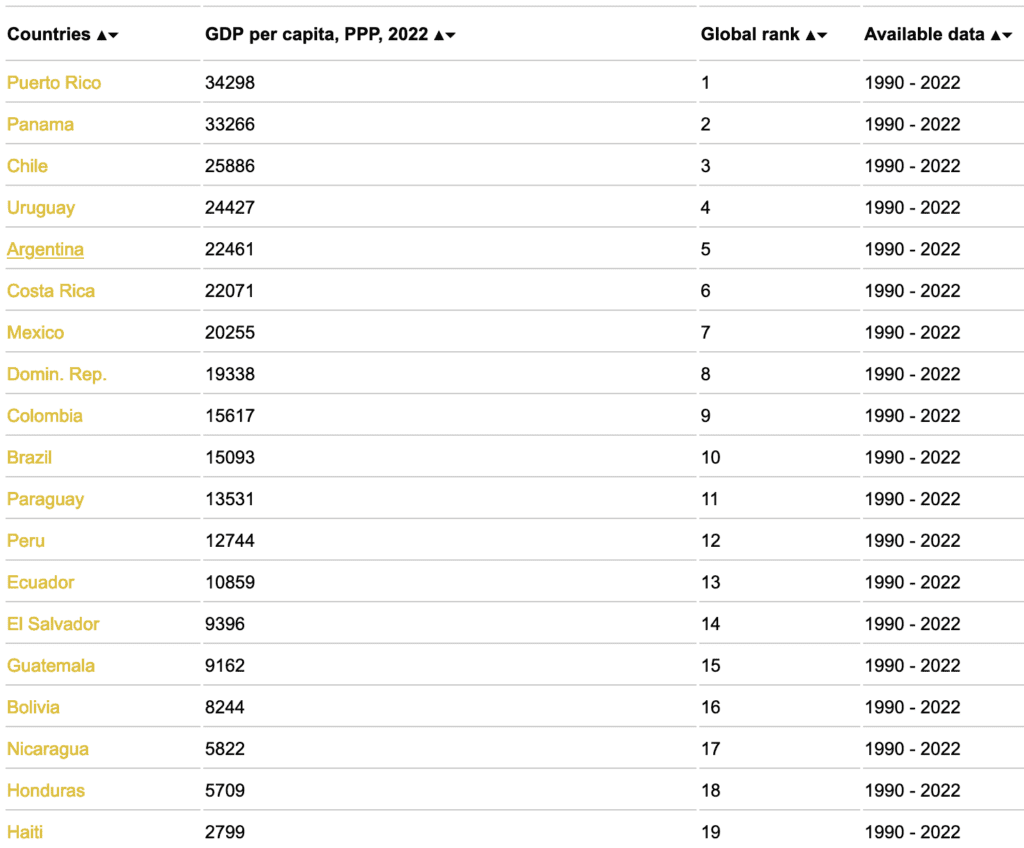

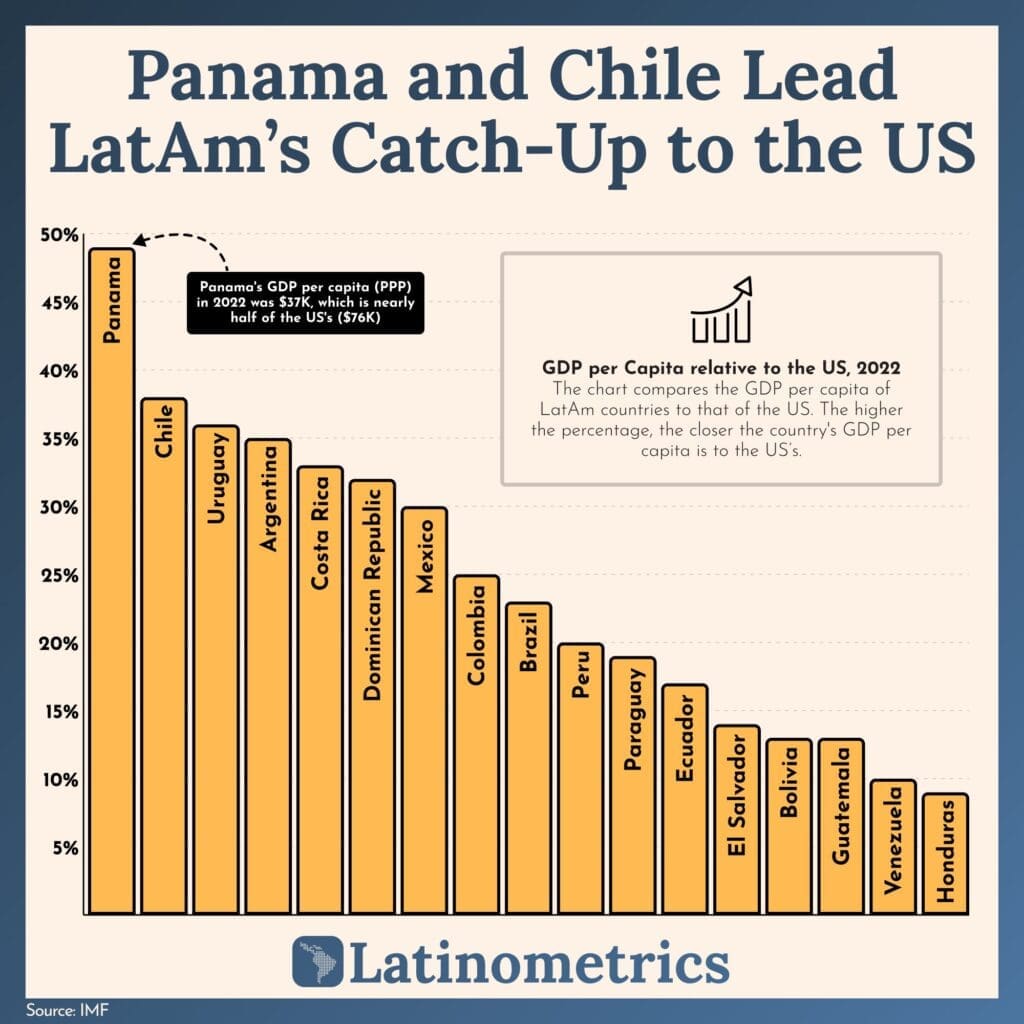

Panama is Latin America’s richest country, given that Puerto Rico is a US territory.

It stands at about half the per capita GDP at PPP of the US.

Astonishingly, if this graph were to also include Canada, it would show that Panama’s GDP per capita (PPP) is at 67% of Canada’s.

Why is Panama so developed?

People might think the reason is tourism, agriculture, etc, but no. Panama has the profile of a developed economy with services comprising 80% of its GDP.

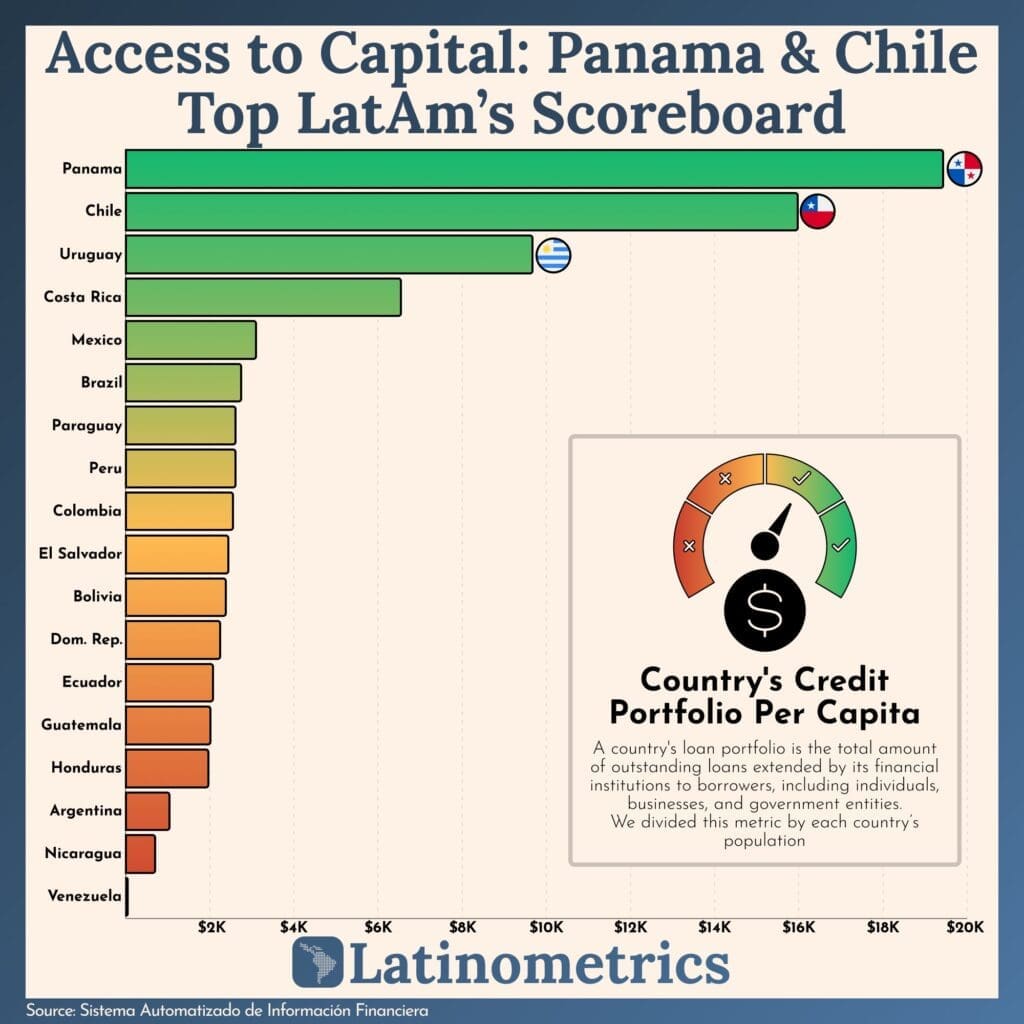

1. The financial services industry

Panama is a well-known offshore jurisdiction with a historically bad reputation, though the country is gradually being removed from grey- and blacklists. Dozens of banks are domiciled in Panama City and it is Latin America’s principal banking hub. While still behind Miami, it is well ahead of other financial hubs like Uruguay and Chile.

2. The Panama Canal and related activities

Having the Panama Canal is like sitting on gigantic oil fields. The alternative is expensive shipping through Mexico or the US, or going around the southernmost point of South America. Needless to say, paying toll fees to Panama is cheaper and faster.

This means that Panama, like Gulf countries such as Saudi Arabia and Qatar or Asian ones such as Brunei, can sit back and collect free rent money. It just needs to satisfactorily manage the process and money rolls into government coffers. The Panama Canal net toll income equated to about 3% of GDP in 2021.

However this is only one aspect. Many auxiliary services have been developed around the Panama Canal. For example the Panamanian flag is flying on 16% of the world’s shipping fleet, which results in income for the government-owned Panama Ship Registry.

Panama has excelled at exploiting its unique geographic position beyond the Canal. It has created entire adjacent industries that contribute even more to GDP that the Canal itself. For example, the Colon Free Trade Zone is now the country’s second largest employer. It specializes in repackaging and reselling products from all over the world. It now adds up to 8.5% of GDP.

3. Mining

Panama is endowed with beautiful terrain stretching from jungles in the east, a stunning Caribbean coast, Pacific Surf beaches as well as the mountainous west. However, Panama also bears subterranean riches. It is blessed with copper and has a mine pumping 1% of worldwide supply, which until last year represented 5% of GDP. More on this topic later in the article.

Positive demographics in Panama

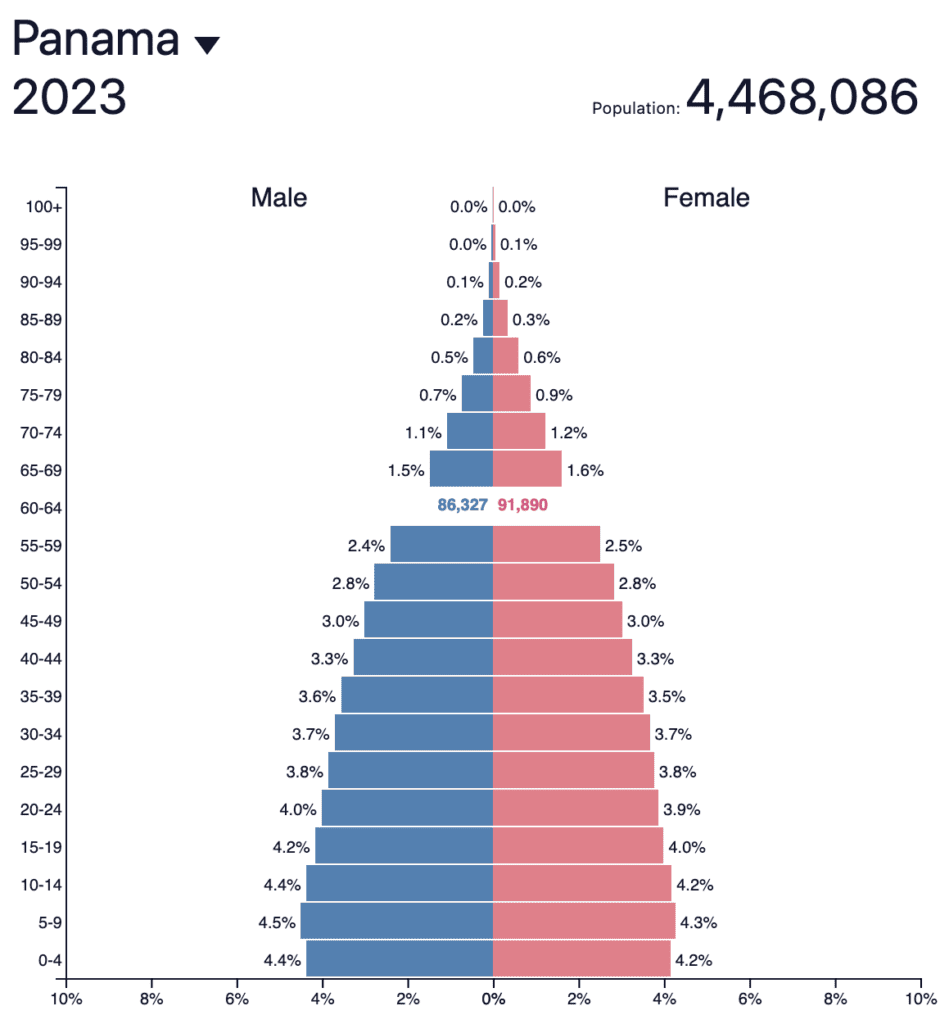

Panama has a healthy population pyramid thanks in part to one of Latin America’s highest fertility rates at 2.3 childen per woman, which implies many future tenants, on top of positive migration figures.

However Panama is facing a few headwinds

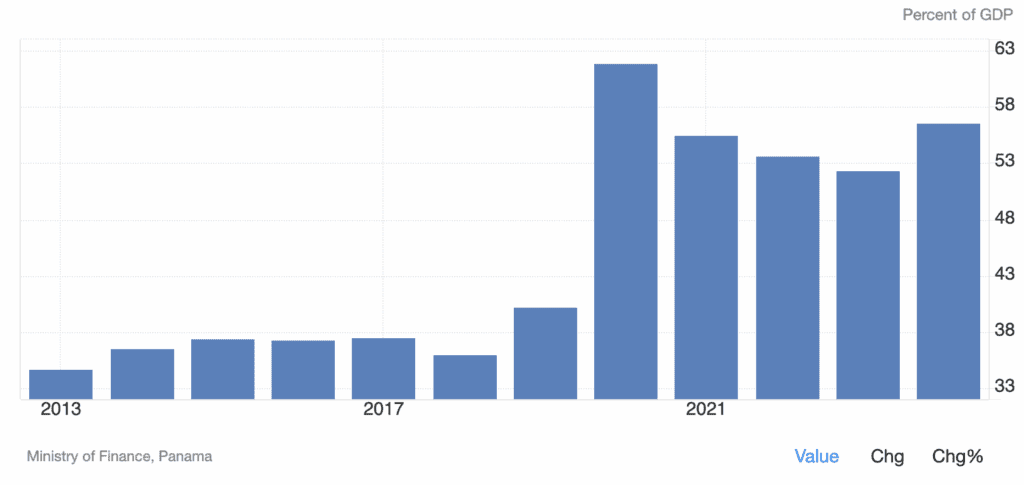

Historically Panama was known for well-run government finances. Recently, things have deteriorated.

1. Panama shut down its largest mine

The mine that contributed to 5% of GDP was shut down by the government in 2023 following large-scale environmental protests.

This effectively chopped 5% off GDP. The projection for 2024 is now 1% GDP growth versus 6% in 2023. It is a very negative development. Additionally, Cobre Mine the company is suing the Panamanian government to the tune of $20 billion for breach of contract and damages. However there are ongoing talks with the government to solve the problem.

2. Environmental troubles at the Panama Canal

Due to a combination of large expansion works and unfavorable weather patterns, the Panama Canal suffers from a lack of water. This has reduced throughput by over a third on a chronic basis, depending on the season.

However, Canal revenue is stable as the Canal authorities have simply raised prices for the boats that can make the passage, through an auction system.

Manageable government debt levels

Panama mismanaged the Covid crisis with some of the world’s harshest lock-downs which clobbered the economy. Debt to GDP shot up, but has been on a downward trend since the end of the crisis.

The mine closure will have a negative impact on this chart by reducing GDP growth, and by putting pressure on government finances as it won’t be distributing royalties anymore.

All that said, the situation is not entirely dire.

Three positive catalysts for Panama

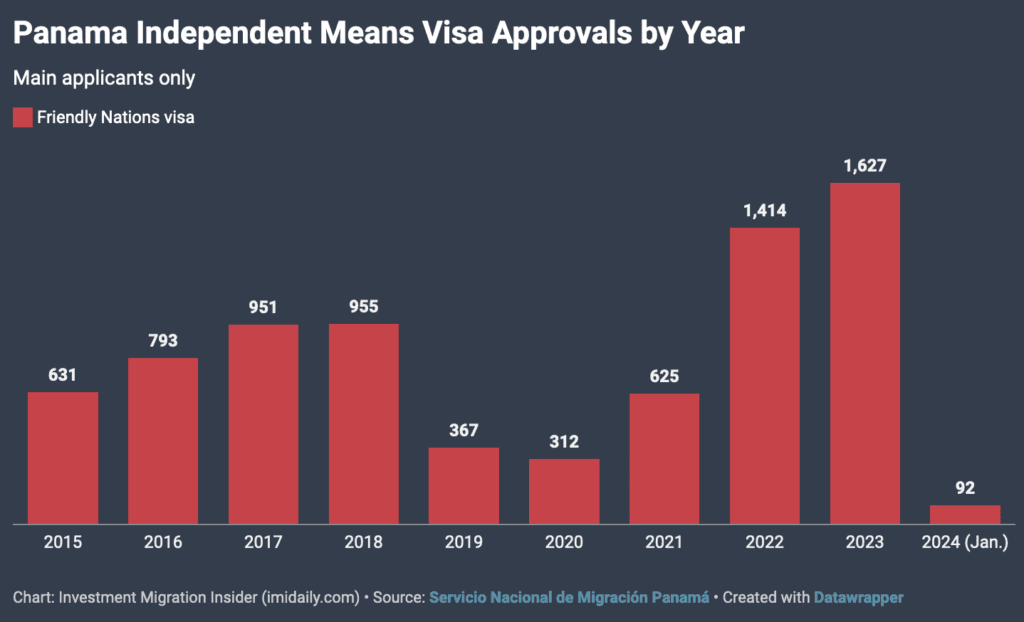

1. Quality immigration

In a world of increasing tax pressure, many high net worth individuals (HNWIs) are looking for greener pastures where they can get a combination of low taxes, sunshine, beaches, good healthcare, and decent infrastructure.

Panama fits the bill.

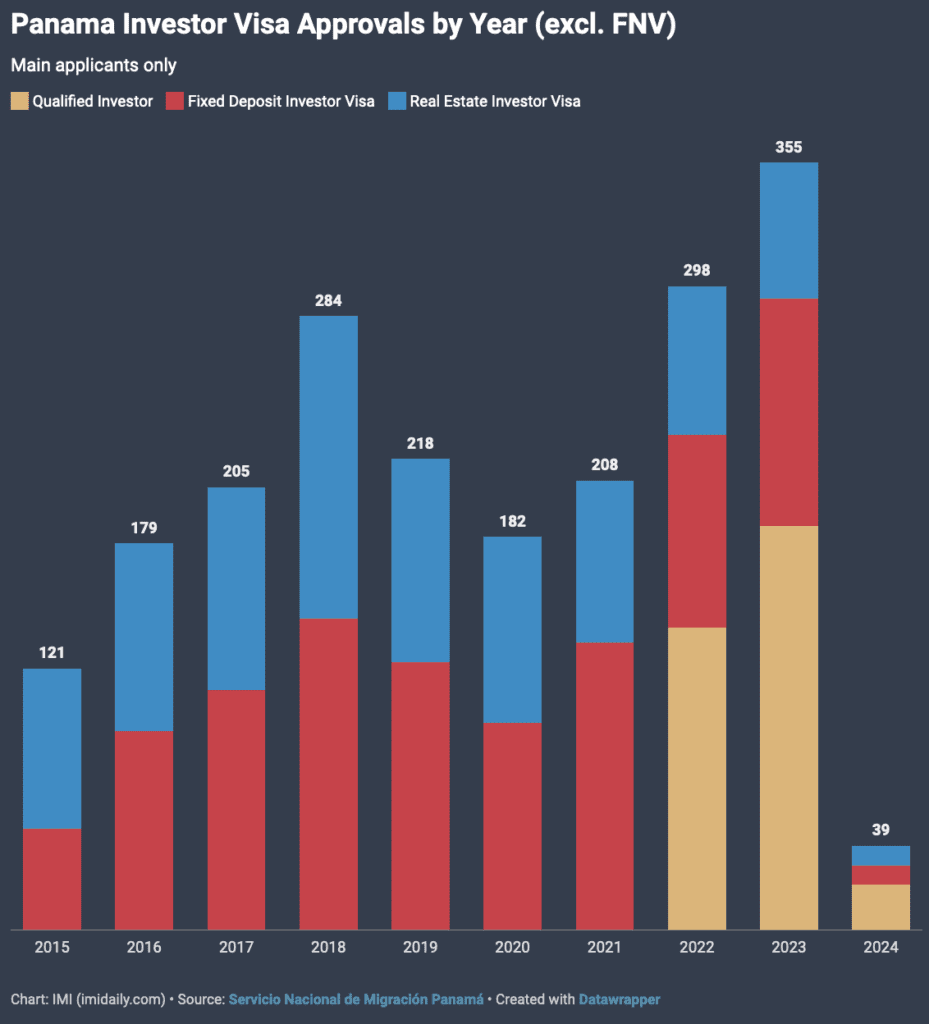

The list of HNWIs moving to Panama, mostly Westerners, keeps increasing in spite of the requirements becoming ever more stringent.

The more expensive Qualified Investor Visa is also seeing good growth.

Such immigration helps drive the economy. Though they may not pay much in headline taxes, they spend their money, pay sales tax/VAT, start businesses, employ locals, etc. Being able to attract such high-end immigration is a privilege, which also happens to be great for real estate investors as most newcomers are potential tenants or buyers.

2. Chinese investment into Panama

Panama made the diplomatic recognition switch from Taiwan to mainland China in 2016. Economic relations between the two have been growing ever since. China is now Panama’s number one trading partner.

For now, China does not even register in the top 10 sources of foreign direct investment into Panama. It is notably even smaller a contributor than Taiwan.

The low Chinese FDI figures are at odds with the substantial amount of Chinese immigration into Panama. Every city in Panama has a very large Chinese community, and growing.

China seems to be focusing on anti-American governments such as Nicaragua, which is set to receive a massive flood of Chinese FDI in the coming years. However, the fact that Panama manages to be Central America’s second recipient of FDI in Central America after Costa Rica, with barely any Chinese contribution, points to the potential for FDI growth into the country.

Also, it must be said that Panama’s FDI is typically of higher quality than other countries‘; it typically goes into actual businesses, infrastructure, and financial services, rather than just real estate.

China’s investment into Panama is so low-key yet substantial that it caused diplomatic rift with the US a few months ago when the US tried to force Panama into pushing China-linked businesses to sell various Canal concessions to Blackrock. The current situation is in litigation, and did not impress China. Time will tell how this will impact Chinese investment into Panama.

3. Panama’s position as a safe haven

Though its reputation as a safe haven took a hit following the mine protests, the reality is that nobody in Latin America can compete with Panama in terms of financial services, ease of access and control over key international infrastructure such as the Panama Canal. Uruguay is a distant third. Miami is the obvious number one.

This means two things:

- When times are good in Latin America, money flows through the Panama financial system to cut deals, stash money away, etc

- When times are bad in Latin America, money flees to Panama the safe haven

As long as Panama keeps its safe haven status, it will do just fine.

What Panama did demonstrate though, is that it is incapable of having its own independent foreign policy. It got completely bullied by the US.

Panama is no Switzerland. Panama is no Singapore.

But as long as trade keeps flowing through the Canal in spite of US/China tensions, Panama will do alright. The country serves a specific function and probably won’t be able to go beyond that.

The peak of Panama growth is over

It must be said that the good times of 7%+ yearly GDP growth for almost a decade are over. Panama is approaching developed market status and will be limited by the relatively low quality of its human capital, as well as heavy demands on its public sector.

But as long as:

- it keeps its safe haven status

- the Panama Canal exists

- it doesn’t get too large a fine for the mining issue

Panama will be just fine and will continue to attract capital and high-end immigration which is good for real estate investors in Panama City.

The Panama City Panama Real Estate Market

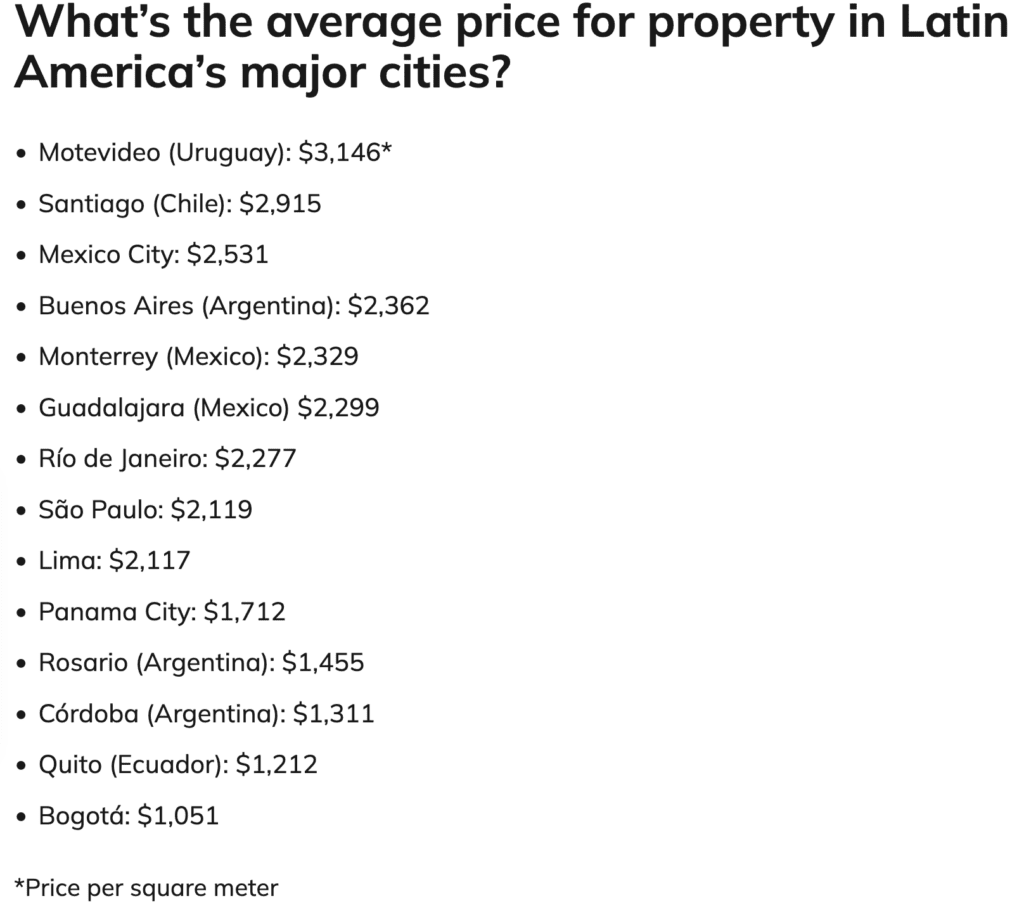

Real estate in Panama City is not particularly expensive compared to other Latin American cities.

Price per square meter of real estate in major Latam cities. Source: Boomberg Lineo

The issue isn’t pricing; it is the supply. There has traditionally been an oversupply of rentals in Panama City. Why? Because of Panama’s status as a safe haven, a lot of people buy real estate in Panama City due to this, and don’t really care about cap rates / rental yields. They just want capital preservation.

This means a lot of apartments are sitting empty. Counterintuitively, many of these apartments are not even trying to find tenants. Many wealthy owners just want to keep their apartments new so that they are easier to resell later on and simply don’t care about rental returns. Many other apartments may appear to be empty, but in fact have a lease in place which is used for money laundering. How does it work? Rent gets paid in cash every month, the owner declares this income, pays taxes on it, and now the money is clean.

So when you walk in Panama City at night and see entire buildings with barely any lights, they are not all looking for tenants. Quite the contrary. Panama City is a unique real estate market in this regard.

So yes, there is an element of oversupply on the rental market, but absolutely not by as much as one could think by just walking around. The dynamics are very different. If your price is right, you will find a tenant. Make sure to have a good realtor in Panama City who not only helps you purchase, but also manages rentals so that you get honest advice in terms of rentability.

In which neighborhoods to invest in Panama City real estate?

Here is a full analysis of the various neighborhoods which are potentially interesting for real estate investing in Panama City.

Buying real estate in San Francisco, Panama City

San Francisco is a classic among expats and upper class locals. It is easily accessible from various parts of the city and has both older and newer buildings. It’s a low-risk choice for a real estate investment in Panama City, and it is easy to find tenants.

Buying real estate in Coco del Mar, Panama City

Coco del Mar is essentially the more modern version of San Francisco. The buildings are typically more recent and more high-end. Some of them have rooftop swimming pools, rooftop tennis courts, rooftop running paths, etc. Many buildings also have gorgeous views on the bay. There are constantly new developments in this area. Finding tenants here is easy due to the quality of the new buildings, and ease of access of this area.

Buying real estate in Costa del Este, Panama City

Costa del Este is the new economic center of Panama City. It is an entirely new neighborhood home to most corporate headquarters and banks. The urban planning and infrastructure are on point. All the malls, shops and restaurants are modern and upmarket. It is prime real estate. International schools are also located here. It is generally easy to find tenants, particularly corporate expat tenants. Both houses and condos can be bought here.

Buying real estate in Punta Pacifica, Panama City

Punta Pacifica is a neighborhood where many realtors sell real estate to unsuspecting foreigners because it’s invariably one of the first places they end up visiting on their their first trip to Panama City.

If I were to explain it in one sentence, I would say that Punta Pacifica is what Costa del Este used to be, but 15 years ago. A lot of the condominiums are starting to look quite old. A few are well-maintained and perform well as rentals, but apart from those I would avoid this neighborhood. It’s past its prime in many regards.

Buying real estate on Ocean Reef Island “The Islands”, Panama City

I find this development offensive.

Why? Because the developer managed to pull off the extraordinary feat of creating an artificial island in Panama City just for his development. The potential was endless. The developer could have gone full Dubai with proper luxury and attracted show-off capital from all over the Americas.

Instead, the developer pinched pennies and is selling average looking homes and condos for high prices. Had he gone for absolute luxury at extremely high prices he would be all the richer, and would have done the city a favour.

But he was instead myopic and close-fisted and his market analysis focused on what he thought the Panama market could adsorb, instead of thinking bigger and creating an entirely new category. The result is that it’s overpriced for what it is, isn’t even that nice, and sales are slow. Sure, it’s unique due to its location, but it’s architecturally disappointing. The amenities are absolutely not impressive, and the quality does not seem to be in line with what one would expect.

I should have taken pictures when I went there last year, but I was so unimpressed I didn’t even feel like taking any.

Personally, I’d stay away.

Jewish District

This is the Jewish district of Panama City. Unbeknownst to most people who go to Panama City for the first time, Panama has a sizable Jewish population of about 10,000 members. The community is very prominent in local business and politics.

This neighborhood has many of the attributes of Punta Pacifica, meaning that the buildings are starting to look a bit old and the maintenance is not always great, but seeing that the main synagogues are there this neighborhood will have more staying power than Punta Pacifica.

Many of the buildings have “Shabbat elevators” which run continuously during Shabbat, and the neighborhood has a lot of private Jewish security. It’s by far one of the safest neighborhoods in town, not that Panama City is particularly dangerous.

Unless you want to live here, I would generally avoid this neighborhood because it’s past it’s prime. Also, the market here is more liquid than others, and good deals get snapped up quickly by locals. Generally speaking, foreigners are left with the leftovers.

This being said, I expect more Jews to leave Western Europe and the Middle East. This is a clear long-term catalyst for this neighbourhood.

This can be a good lifestyle purchase for some, but strictly from an investment point of view I’d look elsewhere if you are not well-connected.

Buying real estate on Balboa Avenue in Panama City Panama

This is the main avenue of Panama City. Investing here is very building-dependent, so you need a knowledgeable Panama City realtor to guide you. Some buildings are loud and have a very bad reputation from a quality point of view, while others are investable.

Hit or miss.

Buying real estate in the Casco Viejo of Panama City

If you want a safe investment, this is a no-brainer. The area of Casco Viejo is still a little rough around the edges, but keeps improving. It is the main tourist attraction of Panama City so there is high demand for short-term rentals, which aren’t allowed everywhere. Additionally, the neighborhood hosts many trendy bars, restaurants and nightclubs.

Overall, as new buildings in Panama City depreciate with time, Casco Viejo does the opposite due to the inherent value of colonial architecture, and the restrictions on new supply. I believe Casco Viejo is a good, low-risk investment for people wanting to invest in Panama City real estate. Read and watch my real estate market case study on Casco Viejo.

Buying real estate in Santa Maria, Panama City

Santa Maria is a large gated community beside Costa del Este. It’s a bit more high-end than Costa del Este, but offers full security and amenities. There is very high rental demand for real estate there as many families want to live in such an environment.

Its location right between the international airport, the highway, and Costa del Este makes it prime from a location point of view. Some of Panama City’s more expensive real estate is located here.

Tenants are easy to find, but yields are relatively low.

Buying real estate in El Congrejo, Panama City

This is an older district, but one of the few areas in Panama City that is truly walkable with cute cafés and shops to peruse. The architecture is nothing to write home about, but the vibe is pleasant. For this reason it is easy to find quality tenants. If you want to live without a car, and be able to walk around without being in Casco Viejo, el Congrejo is worth looking into.

“No”

This is a lower middle-class area mixed with some commercial / industrial buildings. It won’t get better as this is not where the growth of the city is. You can buy cheap, but you’ll attract a cheap market as well. I’d avoid.

“Gentrifying Ghetto”

This area is still very much ghetto but the government has been pumping a lot of money into it. One can see the new roads, redevelopments, etc. This area will eventually match Casco Viejo, but still comes at a significant discount. I think this is a good investment especially since the architecture is beautiful and historical.

“China”

This area is known as the Chinatown of Panama City. Unbeknownst to most, there is substantial Chinese immigration to Panama, so this part of town is growing fast. There are also many Koreans and people from other Asian countries. It’s a hotspot for delicious and affordable food. There are entire malls dedicated to Asian products.

I like this area. Occupancy rates are very high due to constant Asian immigration.

“NGO and embassy workers”

This area corresponds to the grounds of the US army when the Panama Canal was still controlled by the US.

It’s a fascinating area as one can see “colonial U.S. architecture”. It’s certainly not as glorious as Spanish, Portuguese, British or French Colonial architecture, but it does have a unique character and appearance.

It’s pretty much the only neighborhood in town that is green and well integrated with nature. The housing looks a little dated, but the tenants are of high quality. This is where most people working for embassies and NGOs end up staying, and where some of the best international schools are located.

The homes don’t look like much, but they are far from cheap. However, it’s easy to find corporate or embassy staff lets. This means near-zero risk of delinquent tenants.

Investing in real estate on the other side of the Canal in Panama City

What you see here is Panama City’s low-cost airport. A former US air-force base, it now hosts low-cost flights to Colombia, Costa Rica, etc.

There are plans to build another bridge over the Panama Canal to allow Panama City to expand beyond the bridge and alleviate congestion. The metro will also extend into this area from Panama City, which is a huge deal.

For now there is barely anything apart from a nice country club and a few random developments of questionable value such as the Marriot.

I see a land play here. But long-term this is definitely an investible area.

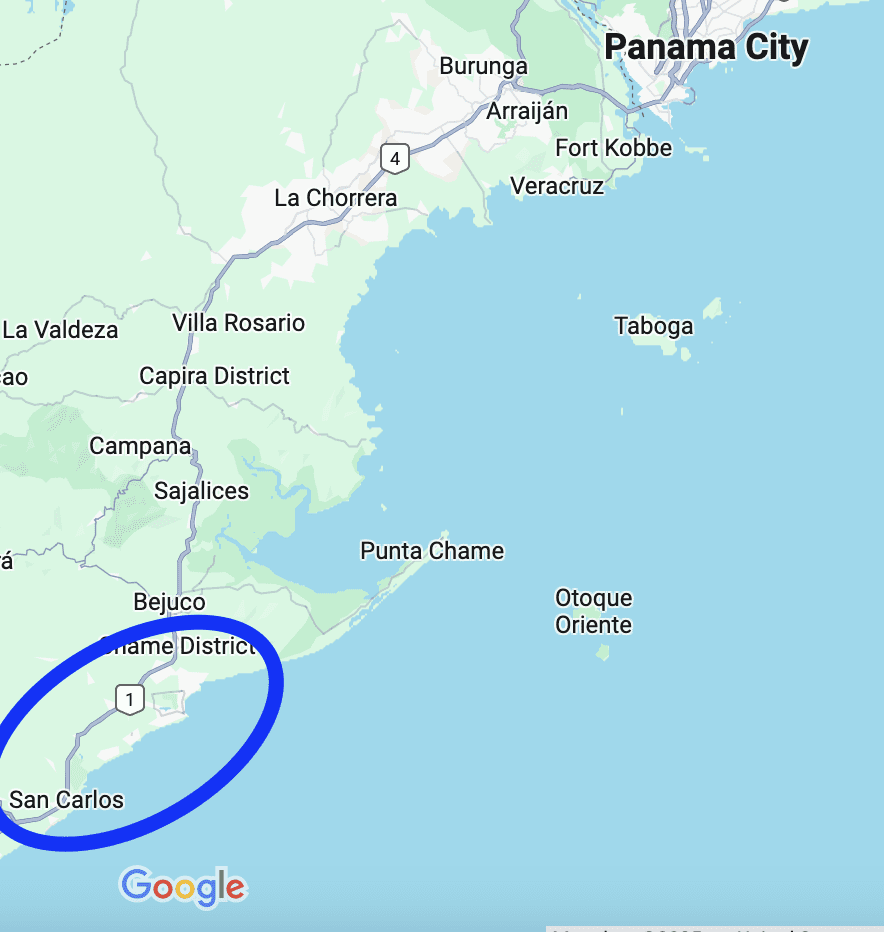

Investing a bit farther away from Panama City

About a 2 hour drive west of Panama City is a number of beach and mountain communities. The areas are semi rural and semi urban, but have a number of English schools which is an indication of the number of expats living there. Real estate there is generally quite affordable, and decent value for money can be found.

A two bedroom two bathroom condo with sea-views in such an ocean-front community with nice amenities can be found for a bit over $200,000. Just don’t believe the promoters promising you high returns as the coast has oversupply of real estate.

But overall, the lifestyle is very relaxed, you are close to a major city, the infrastructure is decent, and there is value to be found.

Matt has a whole team in that area as well.

An example of cap rates / ROI of a real estate investment in Panama City

Though the average m2 price in good areas of Panama City hovers around $2,000 (~$185 per ft2), some apartments may cost more on a m2 basis but also yield a greater ROI percentage wise.

Why? Because of the specific building quality, reputation, amenities, and maintenance.

The example below is of a one bedroom apartment, 97m2 (~1045 ft2) in Punta Pacifica, which is not my favorite area, but the building is well-maintained, has great amenities such as an infinity pool with amazing views, and a good reputation.

It was formerly called “Trump Tower” before controversy resulted in a name change 🙂

Here are the numbers if you were to purchase it and rent it out on the long-term rental market.

| List price | $310,000 |

| Potential closing price after negotiations | $290,000 |

| Closing costs | $3,500 |

| All-in price | $293,500 |

| Monthly rental | $2,000 |

| Gross yearly rental income @ 90% occupancy | $21,600 |

| Property management 10% | $2,160 |

| Rental commission (1 month rental @ 90% for numbers) | $1,800 |

| Yearly property tax | $720 |

| HOA / Common charges @ $347 per month | $4,164 |

| Incidentals / maintenance allowance | $1,000 |

| Total expenses | $9,844 |

| Net yearly income | $11,756 |

| Net rental yield / capitalization rate | 4% |

Video case study of real estate in Panama City for the Friendly Nations Visa – with ROI figures

I went with my realtor Matt to check out two decent real estate investments in Panama City that would be suitable for the Friendly Nations Visa to get residency.

We viewed a new apartment near the Casco Viejo, and a larger but older apartment in San Francisco, a neighborhood of Panama City.

For both apartments we ran the full numbers in terms of ROI, rental yields and capitalization rates.

What are the transaction costs for a real estate transaction in Panama?

The buyer must pay:

- His or her attorney. Giovanna and Wi Men have good attorneys on their team; they helped me with all my legal matters in Panama.

- Registration taxes and fees of about 0.5%

The seller must pay:

- His or her attorney

- A transfer tax of 3%

- Capital gains taxes

How are real estate capital gains taxes calculated in Panama?

Online you will find websites claiming that the seller must pay a flat 3% of the transaction value. This is technically correct during the transaction, but the seller can claim a lot of that money back. Technically speaking, this 3% is just an advance.

The actual capital gains tax rate is 10%. So if 10% of your actual capital gains (difference between purchase and sales price) is less than the 3% you had prepaid, you can then ask for the balance to be reimbursed during the next tax year.

Many people don’t do this because their Panama attorneys and accountants don’t care. But it can represent a significant chunk of money.

Conclusion: Who should buy real estate in Panama City?

First of all, let’s be clear in terms of who should NOT invest in Panama City real estate:

- People who want very high net rental yields. No matter what developers or agent will try to tell you, they do not exist.

- People who want to make quick money and capital gains.

The Panama City real estate market is great for:

- People who want a Plan B residency. In many cases buying real estate in Panama City can grant the owner and his family residency in Panama.

- People who want to move to Panama full-time and live in their house or condo.

- People who want to diversify into a suitable jurisdiction, to avoid having all assets concentrated back home.

- People who want access to decent offshore banking. Though absolutely not a prerequisite to opening a bank account in Panama, owning property there makes the process a lot smoother.

- People who want to play the long game and invest in a growing and strategically important economy.

Contact Matt to buy in Panama City, Panama

Matt is originally from Florida and has been living in Panama for over 15 years. He is married to a Panamanian and has been dedicated to real estate all the while.

He’ll be happy to help you find an investment property, real estate for residency or a lifestyle property here in Panama City. His specialty is doing ROI numbers for investors. You can find out more about his Panama City realtor services.

His team also does property management. He runs a full service agency.

Articles on Panama

- Panama City Real Estate Market: Investor Guide

- Affordable Tax-Free Caribbean Lifestyle and Real Estate

- The Pros and Cons of investing in the Boquete Real Estate Market in Panama

- How to Obtain the Panama Retirement Visa

- Panama Permanent Residency in ONE trip

- What is the Panama Travel Passport and how to get it?

- The Pros and Cons of living in Panama

- Panama Friendly Nations Visa through Work Permit and Company Formation

- How to buy a gun in Panama – Gun rights in Panama

- Real estate for Friendly Nations Visa in Panama City – case studies

- Create a corporation in Panama

- Buying real estate in Casco Viejo of Panama City – Things to know

Services in Panama

- Remotely opening a bank account in Panama

- How to obtain Residency in Panama

- Real estate lawyer in Panama

- My Realtor in Panama City

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.