I’ve seen too many newsletters promising amazing returns in Panama City real estate due to its “rising middle class”.

The reality is that more people lose money than make money in Panama real estate, especially foreigners. It is a very peculiar market with a lot of traps and hidden issues.

However, if you play your cards right you can make a decent enough investment and get free residency out of it for you and your family.

The most well-known version of this is the Friendly Nations Visa. You just need to:

- invest $200,000 in a term deposit for 3 years

- buy $200,000 of real estate in Panama and hold it for at least 3 years

- or combine the two

This residency option is available to North Americans, most Europeans, South Africans and citizens of a few other developed countries.

In this video with my friendly realtor Matt, we went to view two apartments that are a decent fit for the Friendly Nations Visa, and ran all the ROI calculations to get to realistic numbers.

Be clear with your objectives

Such an investment can get you a great plan B or even plan A for you and your family. Additionally, it provides you with geographic diversification in a relatively safe jurisdiction.

Panama is not perfect, far from it, but it offers exposure to a different set of risks than we are exposed to in Western countries.

- I wrote a full guide to investing in Panama City real estate. It’s very thorough.

- You can also get in touch with Matt my Panama City realtor

- Giovanna and Wi Men can help you process your Friendly Nations Visa application

To a World of Opportunities,

The Wandering Investor.

Articles on Panama

- Panama City Real Estate Market: Investor Guide

- Affordable Tax-Free Caribbean Lifestyle and Real Estate

- The Pros and Cons of investing in the Boquete Real Estate Market in Panama

- How to Obtain the Panama Retirement Visa

- Panama Permanent Residency in ONE trip

- What is the Panama Travel Passport and how to get it?

- The Pros and Cons of living in Panama

- Panama Friendly Nations Visa through Work Permit and Company Formation

- How to buy a gun in Panama – Gun rights in Panama

- Real estate for Friendly Nations Visa in Panama City – case studies

- Create a corporation in Panama

- Buying real estate in Casco Viejo of Panama City – Things to know

Services in Panama

- Remotely opening a bank account in Panama

- How to obtain Residency in Panama

- Real estate lawyer in Panama

- My Realtor in Panama City

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “Real estate for Friendly Nations Visa in Panama City – case studies”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com, today, in Panama City, and I’m with Matt. Matt, how are you?

MATT: I’m doing well, thank you. Yourself?

LADISLAS MAURICE: Good, good. We will be checking out real estate that is at the $200,000 mark, which qualifies people for the Friendly Nations Visa, because that’s a request that comes on a regular basis. Correct?

MATT: It comes pretty regularly for people that are looking for an escape plan, just to get residency in Panama, it’s a very low threshold to get in.

LADISLAS MAURICE: Look, and it’s easy to make a mistake when buying real estate in Panama. There are entire neighborhoods where essentially everything is empty, where it’s actually really hard to find tenants. Essentially, the two apartments that we selected will have a good occupancy rate.

MATT: We were very judgmental with where we were going to choose the properties. We went with Casco Viejo, somewhere where you going to get a lot of tourists are coming in. And we went to San Francisco. It’s a middle class neighborhood where you’re going to get a large audience who are looking for a long-term rental option.

LADISLAS MAURICE: Cool. They have both very different value propositions. I’ll have my own thoughts on them. Now we’re going to walk to the first one, well, the more expensive one, the newer building near the Casco Viejo. You’ll see it’s quite a bad area right now.

MATT: It is. It’s what Casco looked like about 15 or 20 years ago, so you have to have a little bit of vision. It’s the path of progress. You can see what Casco is today and what it used to look like in the past.

LADISLAS MAURICE: Look, personally, when I come to Panama City, I like to stay in that area, close to the Casco Viejo because, generally, Airbnbs are more affordable, but there are new buildings that are very comfortable. But because the surroundings look quite bad for now, they come at a discount, but there is just a ton of police, so it’s actually really safe. And you’re just close to Casco Viejo, a five-minute walk, and it’s quiet. I, personally, like that area to stay. From an investment point of view, let’s just go have a unit and take it from there.

MATT: Let’s do it.

Casco Viejo overview

LADISLAS MAURICE: All right, let’s go. I like to see the contrast here. You see these new buildings right here. Well, not new, but renovated. And then, right next to it, this. And this is essentially the Casco Viejo?

MATT: That’s it. And actually, this building just sold for about a million dollars. It’s going to be renovated the next couple years.

LADISLAS MAURICE: Really?

MATT: Yeah.

LADISLAS MAURICE: Yeah. Look, each time I come back to Panama, the Casco Viejo becomes better. The way I look at Casco Viejo is lower depreciation on your real estate as opposed to all the new towers in Panama City itself, whereby they look great but after 20 years, they don’t look so great anymore. Here, your building is in prime, prime historical. It’s a bit like buying in a historical center in Europe, it’s always going to be worth something.

MATT: That’s 100% true. I always tell my investors, Casco Viejo is going to be a higher cost per square meter, but it’s also a safer play. Because Casco is defined by being in the historic district, there’s a limited amount of inventory. So there’s always going to be a value there.

LADISLAS MAURICE: Let’s talk about liquidity. Look, North Americans and Europeans are used to high liquidity real estate. If you put something up for sale, especially in the US and in Canada, within a few weeks, you can sell it quite easily. In Europe, maybe a bit more, a month or two. But here it can take longer.

MATT: It is. It does take longer. Most of that we actually see outside of the Casco Viejo area, because there’s a lot more inventory in that area. But ultimately, it does come down to price. I’ve listed properties that have sold in 24 months, and then I’ve listed properties that have sold in 24 hours. It really does come down to price and not pricing yourself out of the market.

LADISLAS MAURICE: Cool. This is fairly representative of the Casco Viejo. You have these nice, renovated historical buildings, and then these buildings with the locals that still live in there, and gradually they’re being bought over, the locals are moving somewhere else, a bit farther away, and then these eventually will get renovated or rebuilt.

MATT: Yeah. And if you swing the camera around, you’ll see an example of two buildings that have been renovated in the last 12 months.

LADISLAS MAURICE: Show us?

MATT: Yeah. You have this building here was just recently renovated into a small market and rentals upstairs, and then over here on the corner La Cuadra Market, the ground floor are all, it’s like a food truck rally, like high-end restaurants all came together. And then above it are all Airbnb rentals.

LADISLAS MAURICE: It’s beautiful. It’s beautiful. I enjoy this area. I like this place. And you can see there’s a lot of police presence, a lot of police presence. The whole area is just a little odd, but I’ve been coming to Panama City for quite a few years now. I’m used to it now. I understand the dynamic. It’s nothing to be scared of. It’s just, like you say, progress is coming, it’s a gradual thing, and safety is, though you literally see people eating out of dumpsters here in front, you look at this here, a lot of these places are squats, actually.

MATT: That’s exactly right. But then also, if you look down here, the government’s actively investing into the neighborhood as well.

LADISLAS MAURICE: Yeah, that’s true.

MATT: They are doing public road work. That’s actually going to be a new parking lot, and then entrance directly from the Amador Causeway, where all the cruise terminal is located. That’s going to be another avenue for tourists to come into Casco Viejo.

LADISLAS MAURICE: The cruise terminal is down there?

MATT: The cruise terminal is down there on the set of islands, the causeway islands. It’s a series of three islands that are connected by a land bridge. And so what the government wanted to do was create another avenue to alleviate a bottleneck, leaving those islands to come directly into the tourist zone of Casco Viejo.

LADISLAS MAURICE: Okay. In case you’re wondering where The Wandering Investor stays in Airbnbs, my Airbnb [laughs] is down there. You can’t quite see it, but it’s a new building at the end of this road. But yeah, when I come back at night from the bar, this is where I walk. But it’s actually not dangerous at all. All right, so we’re getting closer?

Casco Viejo revitalization

MATT: We are getting closer. Casco View is right over here, over my left shoulder. You can see, behind, Mr. Government is actively investing into this neighborhood. The soccer field is within the last two-and-a-half, three years. There’s also a public swimming pool back on the back side. You can actually see the vision. There is money coming into the area. They’re revitalizing the neighborhood. One of the best features about Casco View, though, is it will always be the tallest building in the neighborhood. During construction, the zoning of this neighborhood was actually changed so no one can build above six floors. That building’s 12 stories high. They had to grandfather it in.

LADISLAS MAURICE: Cool. That’s the one we’re going to go check out.

Casco Viewjo new building and apartment tour

MATT: That’s correct, that’s the one we’re going to go check out. Now we’re in front of Casco View on 16th Street. Right behind me, the white building is La Manzana. That building was completed about three years ago, and it’s being used currently for the International Film Festival, Panama Fashion Week, and many other events for the public here locally. They’re actively driving more dollars into the community.

LADISLAS MAURICE: All right, cool. Which floor are we going?

MATT: We’re going to start on the first floor, where the model is, and then we’ll shoot up to the 12th floor, where the rooftop pool is located.

LADISLAS MAURICE: We are on the 10th floor.

MATT: Yeah, we’re on the 10th floor. This is an example of a unit. It’s about 50 square meters, around that $220,000 price point. You have views out here towards the part that’s going to be growing, and then, out to the right, you do have a view of the water and downtown.

LADISLAS MAURICE: Okay. Yeah, I mean, it’s a story of contrasts here, you have the whole story here, the new building here with you were saying Fashion Week and all that?

MATT: Yeah, La Manzana, right down there, is where you would do Fashion Week, International Film Festival. You can see growth actively coming to the neighborhood.

LADISLAS MAURICE: Cool. We’re going to check out the rest of this apartment again. We’re not here to view properties. We’re going to do all the numbers in terms of ROI. We worked on the spreadsheet. There’s no lighting. I mean, they’re still finishing the building. This is one bedroom, and this is the bathroom, like, whatever. Nothing to say. Matt, let’s go on to the rooftop, because it’s a key selling point, especially if people want to do Airbnb. And then we shall sit down and do all of the ROI numbers in detail. And then we’re going to have a look at the unit that is much bigger for essentially $200k afterwards.

MATT: All right.

Airbnb permit rules in Panama City

LADISLAS MAURICE: Let’s go. Tell us about the Airbnb permits here, because it’s actually quite rare.

MATT: Yeah. The developer went out of their way to actually pull out the Airbnb permit here locally that allows them to do rentals under 45 days. In Panama City proper, there is a law against doing short-term rentals.

LADISLAS MAURICE: A poorly enforced law.

MATT: It is a poorly enforced law. This being Latin America, the President could wake up tomorrow and decide, “Hey, we’re going to start enforcing this law.” And the fines are pretty hefty, starting at $5,000 going all the way up to about $50,000.

LADISLAS MAURICE: Most people just do Airbnb and don’t care, which is fine for now, but, yeah, but being able to invest in a place where you are guaranteed to be able to do Airbnb is definitely worth the premium. Because especially a lot of people want to be able to live in their place for part of the year, come to Panama for a month or two per year, rent it out the rest of the year. Essentially, a unit like this allows you to do this, and you’re at the center of everything. I mean, the views are really nice here. Gosh. And this is the whole Casco Viejo here, Old Town. All right. And that’s about $220,000 gets you this apartment and–

MATT: Access to the rooftop.

LADISLAS MAURICE: Access to the rooftop.

MATT: This rooftop social area is actually restricted just to the two top floors as well, 10 and 11.

LADISLAS MAURICE: Oh, really?

MATT: There is a second social area down on the sixth floor that is for the rest of the building.

LADISLAS MAURICE: 10th floor that we were on and 11th floor have access to this, not the other floors?

MATT: That’s correct.

LADISLAS MAURICE: All right. This is a really interesting selling point for this apartment. Cool. Now we’re going to sit down and do all the numbers.

Investment numbers and ROI in Casco Viejo

LADISLAS MAURICE: Cool. Matt, let’s go through the numbers, so the price of the unit, the closing costs, and then the furniture package.

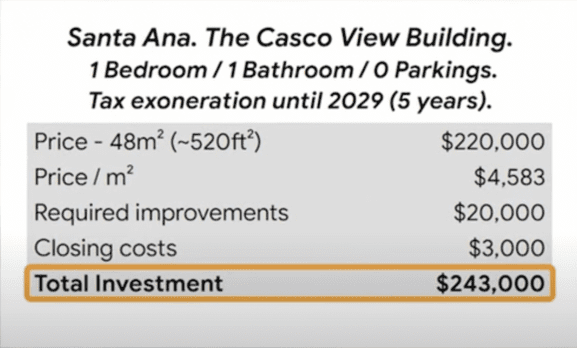

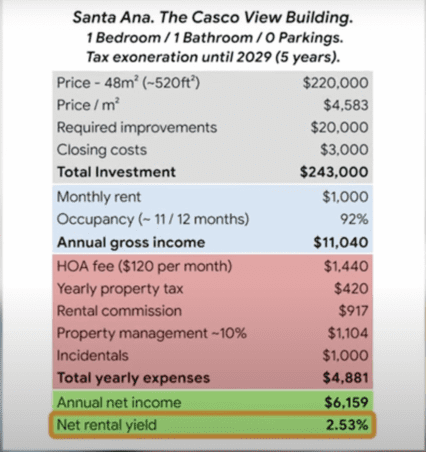

MATT: Yeah. This unit that we toured today is retailing around $220,000. If you were to add your furniture package, which includes the furniture, the appliances, the air conditioners, you’re looking at about another $20,000. Now you’re up to $240,000. Your closing costs will run you about $2,500, $3,000. Let’s call it, all in, $243,000.

LADISLAS MAURICE: Okay. Is there any scope for negotiations?

MATT: On pre-construction projects, typically, there’s not much scope for negotiations. The developer we’re meeting with today is very tight with their negotiation.

LADISLAS MAURICE: Yeah. The other unit that we’ll see afterwards, the one that offers more value for money overall, that one is negotiable. This one, yeah, pre-construction. Cool. We’re going to be running two scenarios. We’ll focus on the long-term markets, because when I make an investment, personally, I like to check the long-term rental income first, in case I were to run into issues with Airbnb, etc. Long-term market, how much could I rent this out for on a monthly basis for a 12-month contract?

MATT: I would be conservative in my speculation here and say it’s about $1,000 a month.

LADISLAS MAURICE: Cool. What would be the occupancy rate, roughly?

MATT: You’d easily be occupied over 11 months out of the year on a long-term rate. Short term, if we’re going to go that angle, you’re going to look at about, conservatively, 75% to 80% occupancy.

LADISLAS MAURICE: Cool. You do property management as well?

MATT: We do, we also do property management that includes finding a tenant, vetting a tenant. There is the fee of 10% commission per month for the property manager, and there’s also a commission with a real estate agent. That typically, on a 12-month lease, is going to be one month’s rent. And of course, that’s scalable. If they’re in for six months, then it’s only half a month’s rent.

LADISLAS MAURICE: Cool. And then when they renew, it’s a lot less. It’s not a fee that you pay necessarily every year if people stay for three years.

MATT: Actually, in most cases, when they renew, if they’re going to do another 12-month rental, we can either do a half a month commission, but typically, for a long-term client, that would be an investor who’s owned for a long time, we’ll waive that full commission.

LADISLAS MAURICE: Okay, clear. What about the HOA?

MATT: The HOA fee is about $240 per month.

LADISLAS MAURICE: Okay, clear. Any other fees, I guess property tax?

MATT: There are some property taxes. It’s going to be based off of the registered value of the property. Now, for your first five years in this property, you’re actually going to have a tax abatement. After that, it’s going to be registered off the Public Registry value, which is half a percent after the first $120,000.

LADISLAS MAURICE: Okay. So it’s really not much.

MATT: It’s not much at all. Again, if you close at around $220,000, you’re going to pay half a percent on $100,000.

LADISLAS MAURICE: In five years.

MATT: In five years, correct.

LADISLAS MAURICE: Okay, all right. For the Friendly Nations Visa, you just need to keep the property for three years. After three years, you can sell it, and then the new buyers still have the exemption for another two years. Correct?

MATT: That’s correct, the exemption does convey with the property.

LADISLAS MAURICE: Okay, so good news. We’ll still put the property tax in the numbers, just to be a bit more conservative. In Panama, when you get a long-term tenant, as the landlord, you pay the HOA, the property tax, and then the tenants pay electricity, water, internet, everything?

MATT: That’s correct. That’s correct, every other expense would be on the tenant side.

LADISLAS MAURICE: Because you do a lot of property management, how much would you allocate for incidentals per year, issues with leaks, or needing to replace furniture, or issues?

MATT: Sure. Conservatively, I would put that about $1,000 per year. That seems quite high, but let’s stretch the numbers and under-promise and over-deliver.

Long and short-term net rental yield / cap rates in Casco Viejo

LADISLAS MAURICE: Yeah, because I mean the unit is new, and there is going to be a developer warranty for quite a while, so $1,000 is conservative, for sure. But yeah, let’s put it in there. All right. When we do all of the numbers, it takes us to net rental yield before income tax of about 2.6%. Obviously, would I come here to make an investment, to buy this, to put this on the long-term market? Absolutely not. The play here, like we mentioned earlier, is going for short-term. What do you think is attainable in terms of short term in terms of net rental yields?

MATT: Sure. As a short-term investment, I’d look at netting around 4%.

LADISLAS MAURICE: Cool. 4% net, I think, is very doable. We’re probably a little conservative. Look, the reality is, the location is prime for tourists. When you walk around Panama City, you don’t see that many tourists, but when you’re in the Casco Viejo, this is where they all congregate. When you Google, “where should I stay in Panama City?” Number one, Casco Viejo. And this is pretty much one of the only units in the Casco Viejo, or close to the Casco Viejo, as we saw, not entirely the Casco Viejo, with a rooftop pool. And it’s not like the whole building will have the rooftop pool, it’s only two floors. When you actually promote your place on Airbnb and you show a rooftop pool with full views of the Casco Viejo, full views of the bay on both sides, that will get you a very high occupancy rate, I don’t doubt it at all.

Who this investment is suitable for

LADISLAS MAURICE: I think this is an investment that is decent for people who want the Friendly Nations Visa and who have two objectives, one being that they want to have access to their property because they want to spend a bit of time in Panama. This is good because they can just block the calendar and stay at home when they’re here. This is great. It’s not possible, legally speaking, in other places, though many people get away with it. It’s up to you to make your own decision. And two, in terms of having a place that’s unique and that is unlikely to drop in value. $4,000 a square meter is not cheap-cheap, but there isn’t anything like this around, and there won’t be anything like this around with these views and the pool right close to the Casco Viejo. In the Casco Viejo, new buildings are going for about $5,000 a square meter?

MATT: $5,000 on the low end. I’ve seen as high as $6,000, $6,500.

LADISLAS MAURICE: As this area becomes better, which is inevitable, we saw the road construction, we saw the new projects, etc., when you sell in two years’ time, it’s very unlikely that you’ll have to sell cheaper than you bought. Which is an issue that happens a lot to people who invest in Panama, they buy something and then when they try to sell it later, they’re actually incurring a loss, because it’s a real estate market that’s very tricky to understand. If you’re looking at a pure investment for a few years and you just want to do long-term rentals, and you don’t want to deal with Airbnb, and you want to buy something that is objectively cheap with a beautiful sea view, that’s the next unit that we’re going to go see.

MATT: That’s correct.

San Francisco Panama City overview

LADISLAS MAURICE: Cool. Can you tell us a little bit about the area we’re going to now?

MATT: Yeah. That’s in the San Francisco neighborhood. It’s very much a middle class neighborhood, walkable, a lot of shops, close to Multiplaza Mall. As far as occupancy rates go, for long-term, it’s very, very solid return on investment. Because you do have a lot of folks that are just getting into Panama, this is a price point that’s attractive.

LADISLAS MAURICE: Yeah. Look, I wrote a whole analysis on the real estate market here in Panama City, the neighborhoods that are interesting in terms of where to invest, where not to invest. Because it’s tricky, you have neighborhoods that look good when you come here, but actually at night, they’re completely empty and it’s hard to find tenants. There’s a link below with the full analysis. But yeah, Matt, thank you.

MATT: All right.

LADISLAS MAURICE: And let’s go to the other unit.

MATT: Let’s do it.

LADISLAS MAURICE: All right. Matt, this is a different vibe here.

San Francisco building and apartment tour in Panama City

MATT: Definitely a different vibe. This is more of a family type neighborhood here in San Francisco.

LADISLAS MAURICE: All right, so just towers everywhere. A few amenities. There’s a pool, there’s a gym as well.

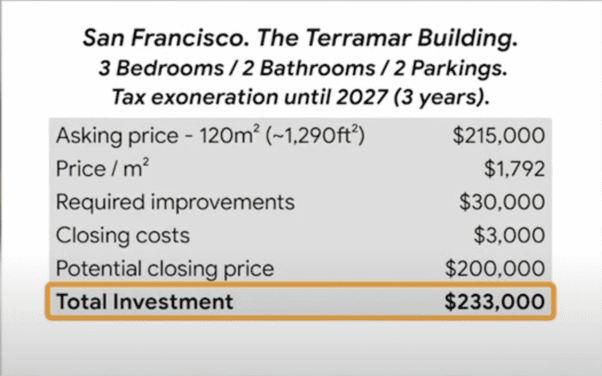

MATT: There’s a small gym, there’s a large swimming pool, party room for private events as well. Again, this is more about family style, people that have just moved to Panama. It’s more of a middle class neighborhood to get your footing, or if you want to be here long-term. All right, so now we’re on the 30th floor of the Terramar building in San Francisco. This unit’s three bedrooms, two bath, 120 square meters, which is about 1,300 square feet. And this unit does come with five years left on their tax abatement.

LADISLAS MAURICE: And the key selling point, these views. Gosh. I mean, yeah, beautiful. And then you even see, I think this is really cool. You see all the boats here lining up at the entrance of the Panama Canal.

MATT: An important note about the location is you’re only about 10 minutes from the International Airport as well.

LADISLAS MAURICE: From Tocumen International?

MATT: That’s correct.

LADISLAS MAURICE: Yeah, you are quite close.

MATT: Yeah, you have the highway right downstairs.

LADISLAS MAURICE: Cool. Would you recommend the investors do a renovation here, a bit of remodeling?

MATT: I would. I would. You’re going to want to put some money into that kitchen. Obviously, you need new appliances, and a couple fixing, updating in the bathrooms would help.

LADISLAS MAURICE: For sure. Cool. We’ll put that in the numbers. But look, I mean, the location is good, the building is all right, nothing spectacular, but these views and the overall value for money is absolutely, you’ll have a hard time finding better. Look, so someone can negotiate this down to $200,000, you think?

MATT: Yeah. Typically, on the secondary market, there’s about 10% off on the asking price. Getting that down to $200,000 would be pretty easy.

Investment numbers and ROI

LADISLAS MAURICE: Okay, cool. Fantastic. Let’s do all the numbers in detail.

MATT: All right.

LADISLAS MAURICE: Okay, so let’s run with the assumption that we buy this unit for $200,000, what would be the closing costs and the budget, approximately, for furnishing and remodeling?

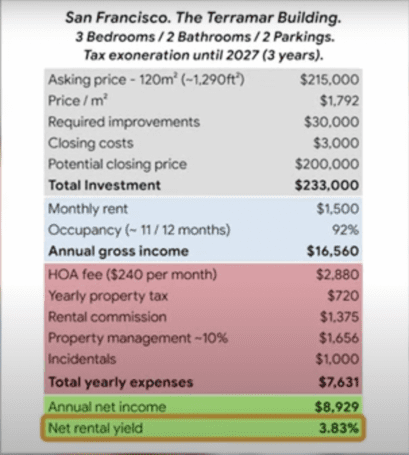

MATT: Sure. I would figure you need about $30,000 to remodel. Your closing costs are going to run you about another $3,000 on top of that. Altogether, you’re in for $233,000.

LADISLAS MAURICE: What about the rental income for a 12-month contract?

MATT: In this building, you’re averaging around $1,500 per month.

LADISLAS MAURICE: Okay. You do property management as well. How long do you think it would take you to find a tenant if I were to buy it? Let’s say, I follow your advice, I come here for the Friendly Nations Visa. I’m, like, “Matt, find me a good unit. I want some long-term rental, non-controversial.” This is it. Sea views. I buy this. I hand you over the keys. How long would it take you to find me a tenant at that price?

MATT: This building is in very high demand because of the location. Worst case scenario, let’s say, four to five weeks you’re going to have a vacancy.

LADISLAS MAURICE: Okay. We can run with the assumption that the occupancy rate would be 11 out of 12 months?

MATT: Absolutely.

LADISLAS MAURICE: Okay, clear. What about the HOA?

MATT: HOA fee here is $240 a month, and that does include all the gas in the building.

LADISLAS MAURICE: Including the gas?

MATT: It does, it includes gas, it includes access to all the common areas.

LADISLAS MAURICE: Gas for cooking?

MATT: That’s correct.

LADISLAS MAURICE: Okay, cool.

MATT: It’s a gas cook top and it’s also a gas water heater.

LADISLAS MAURICE: Okay, cool. Okay, that makes a difference for tenants, actually.

MATT: It does.

LADISLAS MAURICE: They have a lot less electricity costs.

MATT: That’s correct.

LADISLAS MAURICE: Cool. Then, as a landlord, I don’t need to pay for electricity, nor do I need to pay for internet. What about your property management fees and everything?

MATT: Yeah. That’ll be about 10% on the monthly rental. And then, of course, you do have the commission for the real estate agent, a 12-month contract, it would be a one-month commission.

LADISLAS MAURICE: And what about property tax?

MATT: Property tax, there is a five-year tax abatement on this, so you’re paying about $60 a month right now. Depending, again, on the registered value, that actually would drop at the end of the five-year tax abatement.

LADISLAS MAURICE: Okay. Why would it drop?

MATT: The way that the law works here in Panama, during the tax abatement, you do pay a 1% tax on the actual value of the land. Once that tax abatement is up, they’re assessing your taxes on the mejoras, or the improvements on the land. The property value is going to have a new registered value at $200,000 minus that first $120,000, so you’re paying half a percent on $80,000.

LADISLAS MAURICE: For the numbers for the previous apartment, we just said that we might pay zero, but actually we would still be paying 1% on the land value for the first five years?

MATT: The law changes on that. That’s a new construction. The laws changed in around 2018, more or less. Anything that was constructed before 2012 had an automatic 20-year tax abatement.

LADISLAS MAURICE: Okay, clear. All right. Yeah, because it didn’t quite add up between here and there.

MATT: Sure. For sure.

LADISLAS MAURICE: What about the budget that you would recommend your investors keep on a yearly basis for incidentals?

MATT: The same here, I put it at about $1,000. The difference being because they’re both $1,000, this building is well-established already, so you do not have the guarantee from the developer, but the concrete has already settled, you’re not going to have any of those fissures, any surprises.

LADISLAS MAURICE: Okay, cool. Fantastic. Is it easy to find deals like this in Panama City?

MATT: No. I would easily say this is probably one of the top deals that I’ve seen in my years as a real estate agent in Panama.

Liquidity of Panama City real estate

LADISLAS MAURICE: Okay, so by the time this video gets published, it’ll probably have been sold already?

MATT: That’s debatable. Our market does move a little bit slower than what we’re used to in North America. Especially, since the pandemic in North America, we know inventory is very low. Panama City, the inventory is actually very high once you leave Casco Viejo. Properties can typically stay on the market for 12 to 24 months.

LADISLAS MAURICE: And this is very important for people to understand. When you come here, you don’t invest money that you could suddenly need. Because of the lack of liquidity, real estate serves a different function in Panama than in other markets. Traditionally, real estate has served as a function of safety, specifically for people from Latin America that were in countries with dodgy governments, etc., where things could happen, they would come here to Panama, buy real estate because it’s safe. They were not looking for rental returns, they were looking for safety. That’s one. And two, traditionally, there was a lot of money laundering here, so people would buy apartments off-plan and then have fake rental contracts, and people would pay every month cash at the bank, their rental income, and then they would pay their income tax on it, and then, this way, the money would be legalized.

Buying property for investment and residency in Panama

Essentially, there is a lot of inventory, there’s a lot of apartments where people don’t actually live in Panama City, less in this neighborhood than in other neighborhoods. But people just need to be aware of this. When you come here and you want to do either the Friendly Nations Visa for $200k or if you want to do the qualified investor visa if you want immediate permanent residency, you need to be very careful and to work with the right professionals because so many people get burnt. These two examples that we gave you, would I come here specifically just for these investments? Personally, no. But when you combine it with the Friendly Nations Visa, with a residency here in Panama that can turn into, if you move here, into potentially zero tax for you, if you structure things properly, if you’re non-American, then it starts to make a lot of sense.

I think that the key message is, when you come to Panama to invest in real estate, manage your expectations, know what you’re getting yourself into, and be honest with yourself in terms of what your objectives truly are. And then, based on these objectives, I mean, Matt, you’ve been here, like you said, 15 years, in real estate most of that time, Matt will be able to find you a property that can match these requirements.

MATT: Absolutely.

LADISLAS MAURICE: Cool. Any parting words?

Who is Panama City real estate good for

MATT: I think we’ve covered it well. Go into with realistic expectations. Don’t come here with rose-colored glasses. Like you said, if it’s money that you need to be liquid, you’re going to have to do a flip, Panama is probably not the right investment for you.

LADISLAS MAURICE: Yeah. We were having this discussion a bit earlier, there are these online publications. They’re always promoting Panama, how fantastic it is, blah, blah, blah. Look, Panama is very nice, but when it comes to real estate, you just need to be careful. If you’re careful, you’ll be fine. If you’re not, you’re going to get burned. I wrote a whole article on the real estate market here in Panama City, the neighborhoods you should look into, the neighborhoods you should avoid. There is a link below. And if you want to get in touch with Matt, there is a link below as well. Matt, thank you very much.

MATT: It’s a pleasure. Thank you.