Playa del Carmen is a small beach city on the Riviera Maya, close to Cancun. It is popular with digital nomads and is known for being fun and charming. Some people say it is too late to make an investment here. I don’t think that’s true, let’s dive into my in-depth case study on the Playa Del Carmen real estate market in detail!

This comprehensive real estate market analysis covers Mexico’s demographics and economy, which, despite growing at a modest pace, holds potential in key areas. We study the real estate market in Playa del Carmen, including the popular 5th Avenue and nearby areas. Our analysis includes long-term rentals and Airbnb properties, catering to various investor types—from those seeking a semi-permanent residence in Mexico to Westerners in search of a secure, geopolitically stable place to invest.

Personally, I like Playa del Carmen a lot, obtained residency in the Riviera Maya and even bought a house in Playa del Carmen 🙂

Table of Contents

Mexico’s Economy: Macro Overview

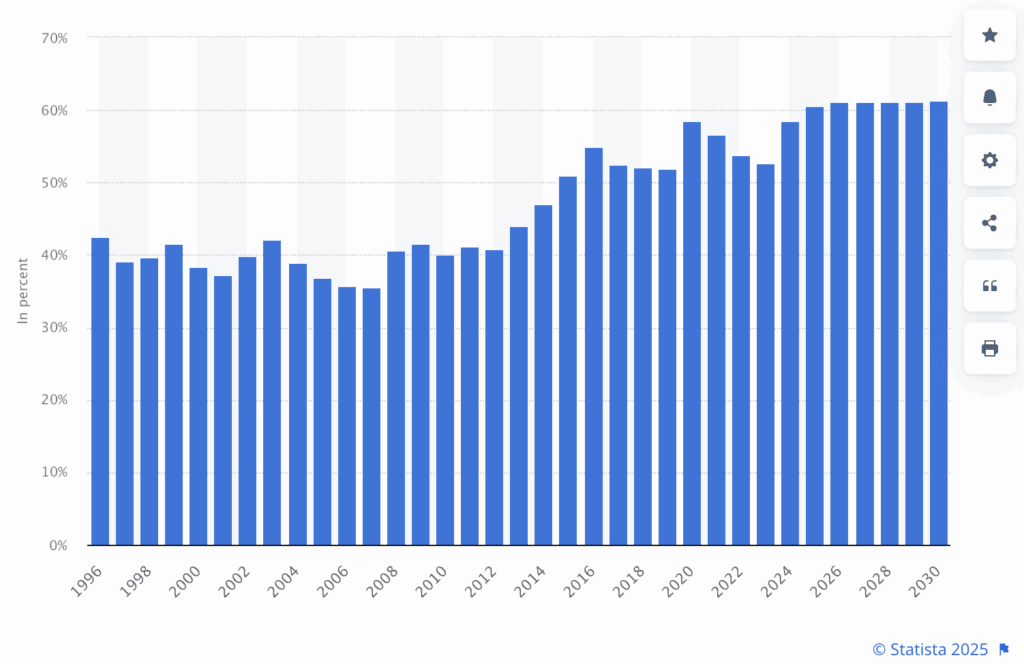

Mexico has attractive demographics

People tend to forget that Mexico is an absolute ogre population-wise, with its 131 million inhabitants. It is the second most populous Latin American country after Brazil, with 212 million people, and well ahead of the third, Colombia, with 53 million people.

A large economy that has been growing steadily, but somewhat sluggishly

The most objective way to look at the country’s growth is on a per capita PPP basis, to capture how much people are really gaining from GDP growth.

These numbers are decent, but in all honesty, they are a bit disappointing when considering the (mostly) free trade agreement with the US and Canada. A massive country with such a surplus of affordable labor, should objectively be doing better.

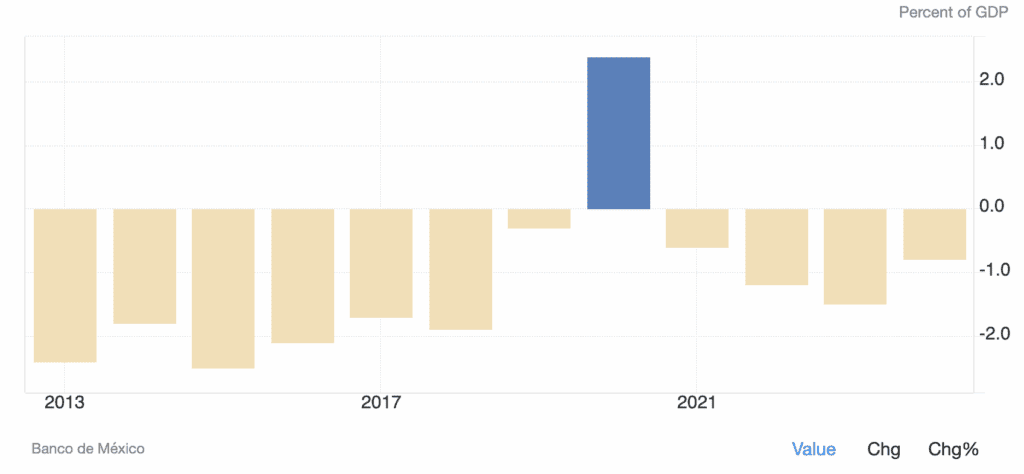

A slightly disappointing current account for such a large manufacturer

Again, with the free trade agreement with the US, Mexico should be doing better.

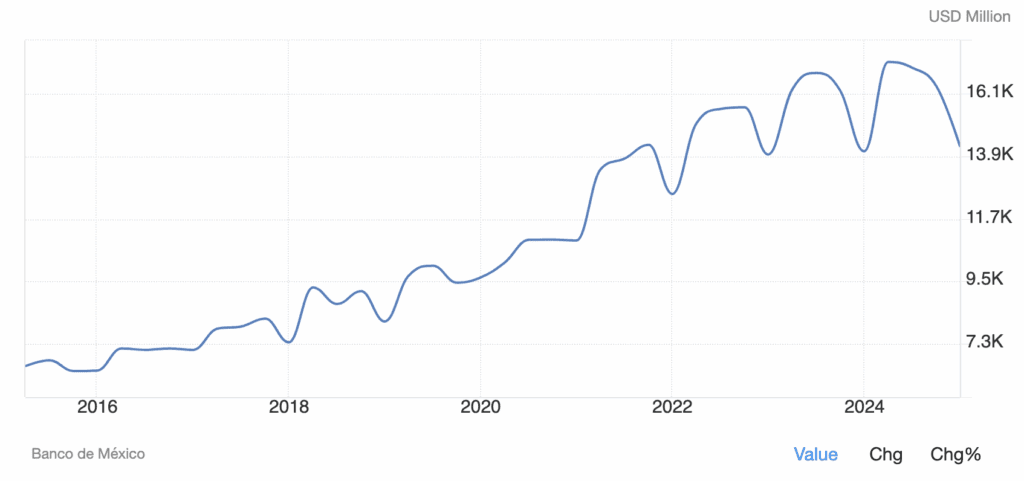

This is in spite of booming remittances

Remittances from Mexicans working in the US represent 4% of Mexican GDP, and are a lifeboat for many families. Uncle Juan in Oakland is more of a safety net than the Mexican government. It also demonstrates the hard work of Mexicans in the US, considering the amount of Mexicans did not grow by such an amount proportionally over time.

Clearly, Mexicans in the US have been gradually moving up the food chain in terms of income.

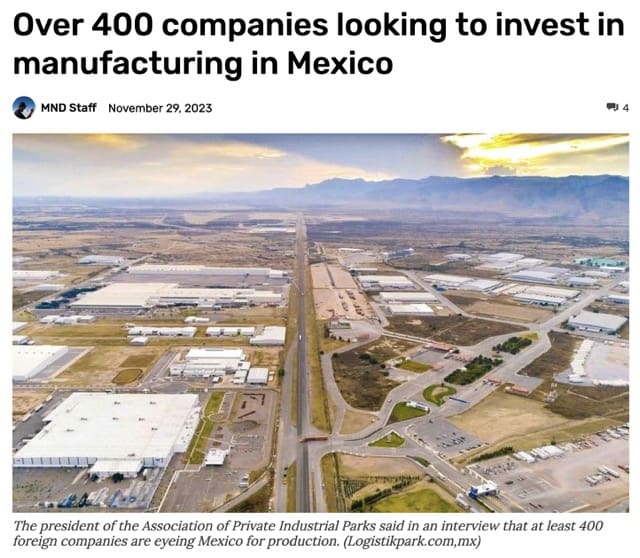

Near-shoring in Mexico, a bedrock of the Mexican middle class

The world is bifurcating between East and West, with a third, more neutral block in-between just as during the Cold War (Mexico is in this latter block).

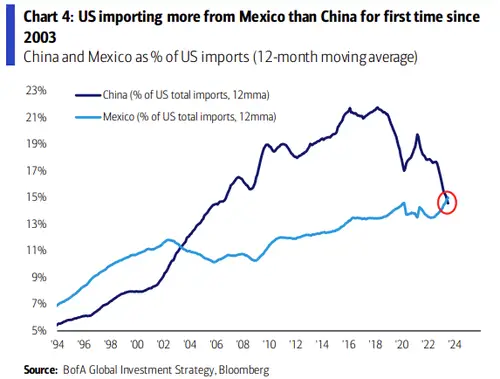

The inevitable result of all of this drama is that re-shoring will become a top priority for Western companies and governments. After having outsourced most of its production of goods to China over the past 20 years, the US finds itself in a situation where it is choosing to re-shore production and reduce its exposure to China.

Western companies, whether they like it or not, will have to diversify away from China. A lot of this production with go to the likes to Vietnam, etc. But an obvious candidate is just across the border. Mexico will be in a prime position to massively benefit from this de-globalization and re-shoring trend.

This is a net positive for the Mexican economy, which will translate into more local tourism internally and investment in the local real estate sector.

Trump’s election is a negative for Mexico

Trump is clearly triggered by this here:

Trump is known for his Mexico bashing. The next four years will be tough for Mexico, especially with the current left-wing administration in place in Mexico, though president Sheinbaum has for now managed the relationship with Trump quite well. Trump will most likely make life tough for Mexico, which will negatively impact the country’s economy and incoming foreign investment.

Mexico elected a government in favour of more regulation

In the presidential elections left candidate Claudia Sheinbaum was elected.

She ran on an anti-mining, higher tax and more state involvement platform.

Having said this Mexico is a complex country. Just as the government does not have the monopoly on violence (which it shares with cartels), it also does not completely control the economy.

However she has made some very expensive commitments such a massive scholarship program and government price fixing of basic goods.

The state owned oil company which has been chronically mismanaged by all Mexican government is in real trouble. Its liabilities amount to $120 billion, which amounts to over half of the country’s foreign exchange reserves of $200 billion.

Mexico used to be a net exporter of energy, but is now a net energy importer with no viable plan to change this.

Mexico is a country with decent government finances for now

In a world of government debt to GDPs in the Western world of mostly 100%+, Mexico’s figures are quite sobering.

Mexico has an economy that will muddle through, but with pockets of excellence

I don’t expect explosive growth in Mexico, just the usual below potential, but steady growth that Mexico is used to. The policies of the current government, and the election of Trump will just lower the growth of Mexico but are unlikely, unto themselves, to lead to any short-term recession, barring a worldwide slump.

The pockets of excellence driving the Mexican economy will undoubtedly be in the North close to the US border in wealthy cities such as Monterrey, which benefit in full force from the near-shoring trend.

However, I believe that Playa del Carmen, Tulum, and Puerto Vallarta will also be key beneficiaries as the rising middle- and upper-classes of Mexico will seek lifestyle housing, investment properties, and themselves spend time in the nicest resort/beach towns of Mexico.

The real estate market in Playa del Carmen

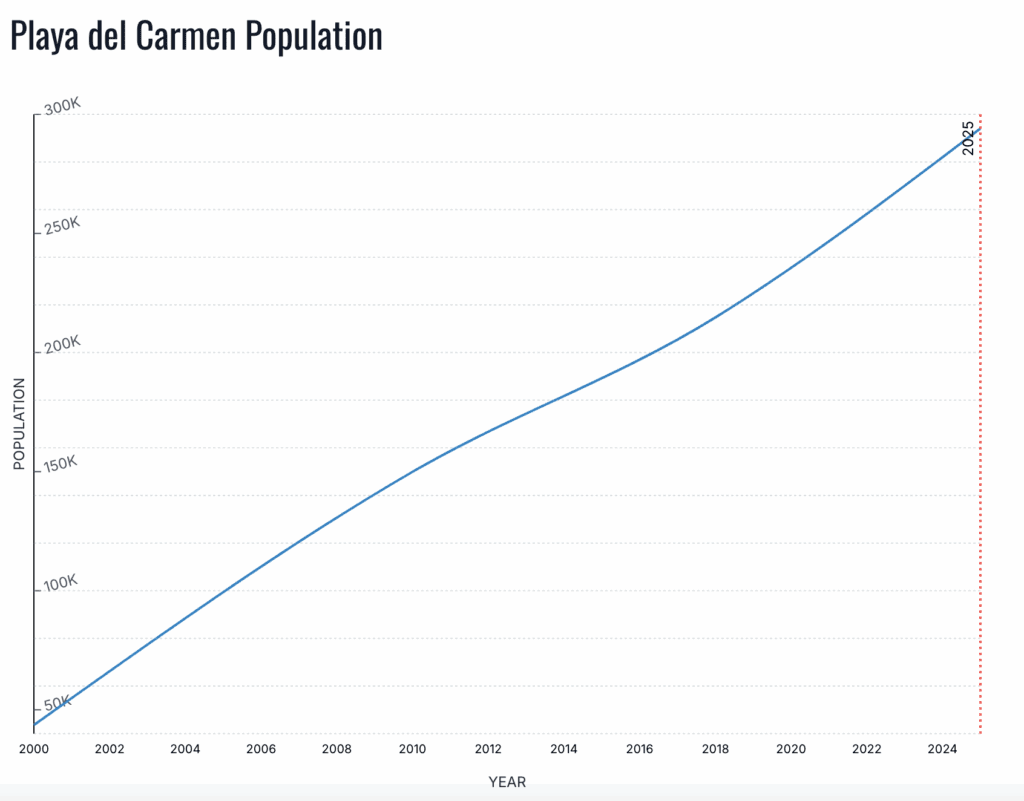

A booming city

It important to note that Playa del Carmen is a city that has been booming for the past few decades. The population grew from about 50,000 in 2000 to almost 300,000 souls in 2025. The growth of Playa del Carmen is staggering and there is no end in sight.

Essentially, as the neighborhood review a bit below will demonstrate, there are two Playa del Carmens. One on the side of the beach where the tourists go and where people with money like to stay, and the other side which is the city proper.

Real estate prices went up a lot in Playa del Carmen and are staying there

Price have gone up over 50% in the past few years and are now consolidation at a high level as there is a constant flow of foreigners and Mexicans investing in the Playa del Carmen real estate.

Sales by developers in Playa del Carmen

Sales are going well. The projects look great, offer amazing lifestyle, and in many cases have payment plans. Buying remotely is easy so a lot of people buy them up especially with the “promises” of high returns. In most cases one can find better deals nowadays on the secondary market, except if the development in question has unique features, such as this one below that has sea-views, park-views, and is walking distance to the beach.

The resale real estate market in Playa del Carmen

Buying condos on the resale market is now a nice opportunity. The situation is not like in Tulum where people are trying to offload their real estate because they are disappointed, but rather because the market in Playa del Carmen is inefficient.

The problem is that developers offer high commissions to agents, and selling off-plan is easier than dealing with a resale market transaction, so agents rarely orient their clients to the resale market, especially as the commissions are much smaller.

But if you get a Playa del Carmen realtor such as Luigi who is willing to find resale market listings, there are good deals simply because most people don’t get orientated towards the secondary market.

A few years ago pre-construction was similarly priced as secondary market, which made sense as these projects were new and came with payment plans, but not anymore. They are now much more expensive than the secondary market.

The rental market in Playa del Carmen

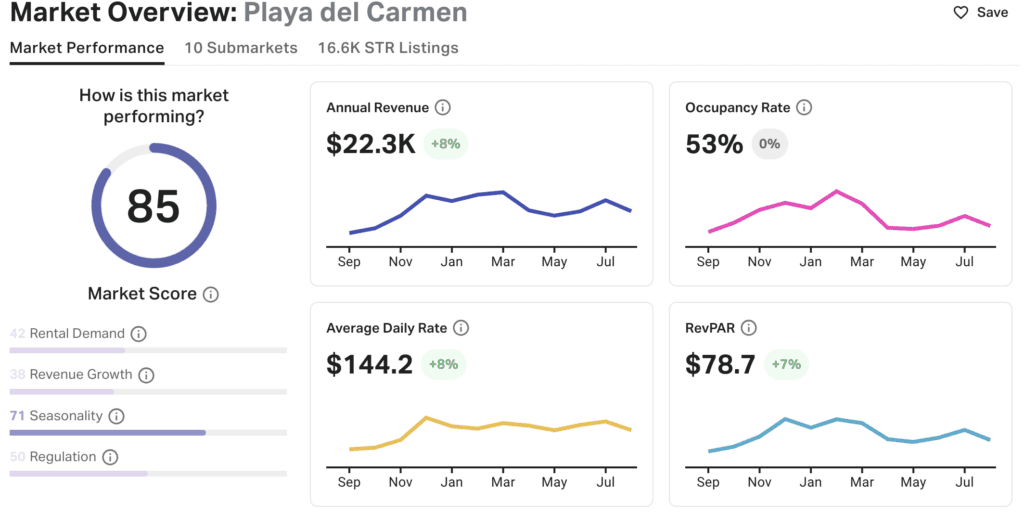

As per Airdna the market is relatively average as a short term market. You won’t get rich by renting out your property short term, which is visible in the fact that the number of listings is actually decreasing.

Higher returns can actually be earned on the long term market, as thousands of people are moving down to Playa del Carmen to live full time. Short term rentals are generally better for people who really want to diversify internationally, and want a place to use for part of the year.

Top 4 Reasons to Invest in Playa del Carmen Real Estate

There are 4 key catalysts that make a real estate investment in Playa del Carmen interesting long term:

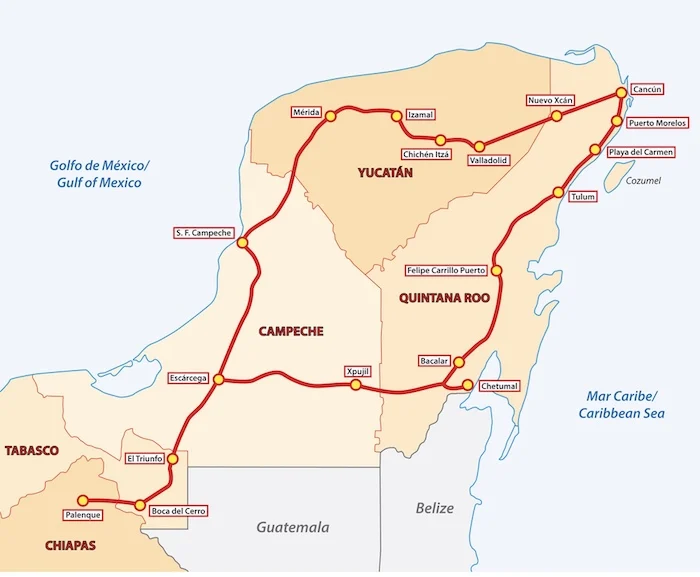

1. Rapid Infrastructure Development in Riviera Maya

The government has made it a key national priority to develop this region. I don’t need to elaborate too much on Cancun airport, Latin America’s 4th largest by passenger volume (after Mexico City, Bogota, and Sao Paulo). Almost 15 million (mostly tourists) flock through its terminals every year. Cancun Airport is even better connected to Europe than Mexico City.

Let’s not forget that, originally, Cancun was nothing. It was just a stretch of pretty coast. In the 1970s, the Mexican government decided to create a resort city there, and national funds were used to develop infrastructure and hotels.

So yes, the Mexican government can be rather inefficient in many regards, but it pulls this one off as Cancun is now one of the world’s top beach destinations.

The Mexican government has doubled down. It built a whole railway system linking Cancun to the rest of the Southern coast and Yucatan.

Importantly, Playa del Carmen is one of the key stops. The line opened early 2024. Previously, people had to take a one-hour taxi or bad public transport to get from Cancun to Playa del Carmen, a turn-off for many people. People can now zip between the two cities, and directly from Cancun airport.

The government has recently opened an international airport in Tulum.

The airport is already operational and is a 1h45 drive from Playa del Carmen. There are direct flights to Chicago, Dallas, Panama, Mexico City, Houston, Toronto, Frankfurt, etc.

Henceforth, Playa del Carmen is now close to international airports, and connected to both by rail.

2. Digital Nomads

The reality is that a few hour’s flight away from Playa del Carmen is a massive market of high-earning Americans who simultaneously realized a few things:

- They can work almost entirely remotely.

- They can work from abroad, thus leaving behind an increasingly toxic environment. This perception of toxicity applies to Americans of all political stripes.

- They can live a quality life for less money abroad and in many cases can save on taxes if structured properly.

Millions of Americans have either reached these conclusions, or soon will. Europeans too, but the main market in Playa del Carmen will be North Americans as they are closer, the time zones are the same, and they earn more than Europeans so are inherently more interesting target customers.

First-time American digital nomads will stick to the name brands in terms of travel destinations, which is bullish for making a real estate investment in Playa del Carmen

Playa del Carmen is one of the world’s top digital nomad destinations, along with places like Chiang Mai, Bali, Budapest and Medellin.

3. North American Politics & Cost-Of-Living Refugees

North American political and cost-of-living refugees. The influx has already started, and is bound to grow. I am not referring to digital nomads who move here for a few months or a year before bouncing off somewhere else. I am referring to people, of all political stripes and ages, who move down to Mexico full-time. They sometimes have online businesses, but often they still have businesses back home which someone manages for them, they are retired, they live off passive income, or start actual businesses in Mexico.

Liberals escaping Trump

Unhappy with the trajectory of the US, they are moving in droves to places such as Europe, Panama, and Mexico.

Conservatives

This is the previous batch of Americans and Canadians. Typically they left during Covid and settled in Mexico. Some went back after not managing to make things work for themselves in Mexico, but many have stayed and formed communities. This type of immigration has slowed down with Trump’s election but Canadians are still going strong.

Apolitical Americans who are sick of all the politics in America

They just want to live in peace away from all the nonsense. The beach in Mexico is a good destination for this.

Europeans who flee conflict

Playa del Carmen has a lot of Ukrainians who fled the conflict, and Russians who relocated to flee the sanctions. Increasingly, forward-thinking Western Europeans are preparing Plan Bs outside of Europe as they feel their governments are behaving too aggressively. They fear that their governments will draw them into yet another war as they did many times in the past.

Cost of Living refugees

As inflation eats away people’s savings in Western Europe and North America, and as the healthcare systems gradually fall into decay (Europe and Canada) or become too expensive (America), many people will move down South where the cost of living is lower.

Granted, Playa del Carmen is not the cheapest destination in Mexico, let alone in Latin America. But it is conveniently located, English is relatively widely spoken, and it is nevertheless affordable and comfortable. We can expect tens of millions of such Westerners to leave the West in the coming decades. Playa del Carmen will attract quite a few of them, especially as obtaining residency in Mexico is easy.

Investors must understand that not all such people are “cheap”. If you earn $70,000 in Illinois you can live a decent enough life, but in Mexico you will live extremely well.

For Europeans the calculus is different. Many Europeans I met in Playa del Carmen claim they spend more here than back in Europe.

4. Walkability is a true competitive advantage

This is one of the key selling points of the Play del Carmen real estate investment market compared to Tulum and especially Cancun.

If you live in the center or near the center, Playa del Carmen is very walkable. You can lead a bit of a village life without having to buy or rent a car. For people who just want to stay a few months, or plan to stay for a week on holidays, walkability is a key factor to avoid hassling with taxis. Playa del Carmen is also bicycle-friendly.

Why did I not mention tourism?

Tourism is obviously the number one target market for your real estate investment in Playa del Carmen with the millions of travelers landing at Cancun airport and that will land at Tulum airport in the future.

However, we must not ignore the macro environment. The reality is tourism is volatile. People that could once afford to go on vacation might not next year, or might go on vacation to Mexico for one week instead of two weeks.

The macro environment we are in will most likely be a net negative for tourism in most places in the world.

This being said, domestic Mexican tourism is gradually waking up to the Riviera Maya, and there are these other catalysts that should help make up for a loss of organic tourism growth. All these digital nomads and refugees of various types will help fill the properties of real estate investors in Playa del Carmen.

In many cases tourism is a zero-sum game. A tourist has only X number of days to spend every year. You must remain attractive to stay ahead of the competing destinations.

Neighborhood Insights: Where to Invest and Avoid

This is crucial to understand. As much as I love Playa del Carmen, there are only a few areas that I would view as a good investment. There are many great neighborhoods for lifestyle options, but a few are also good as a pure real estate investment.

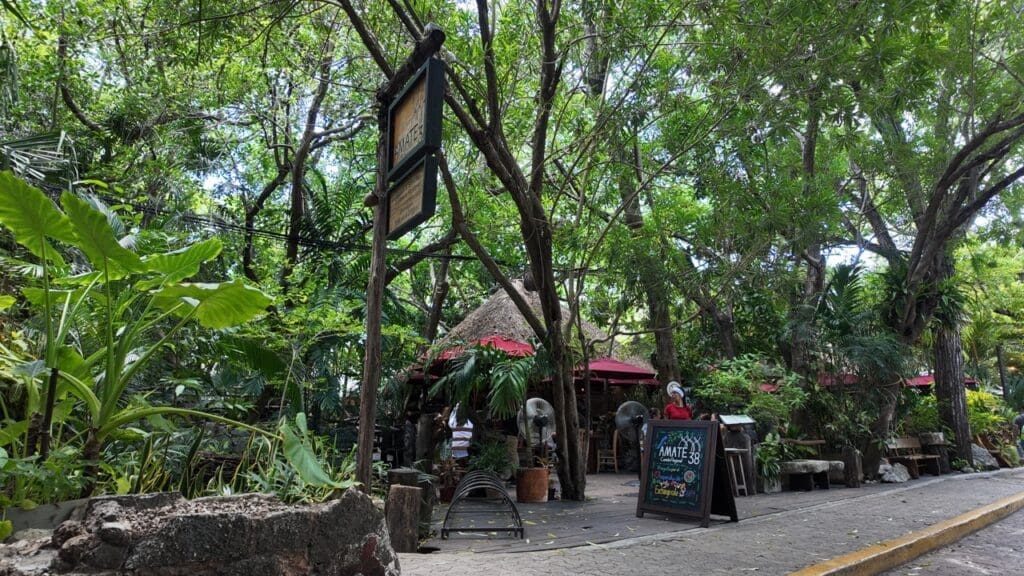

5th Avenue – Core hotspot

The first thing to know is that tourism revolves around 5th avenue in Playa del Carmen. It’s a long stretch close to the beach, where all the tourist shops, restaurants, bars, cafes, and clubs are located. It’s, in many ways, the heart of Playa del Carmen’s tourist life. Foreigners generally want to stay close to 5th avenue, but not directly on it due to noise.

Playacar – Popular gated community

Playacar: A formerly high-end gated community that is within walking distance of the town center, making it unique among gated communities that are farther away. There is golf, a mall, and a variety of dining options. When walking around the community, one can tell that it is past its prime. However, overall, it is a very decent option for people looking to live somewhere long-term. It’s very pleasant and has a decent bilingual school with a lot of expat children.

As an investment I find the prices a little too high for a gated community that is fully developed and getting a little old. I don’t see much upside, and the yields won’t be as good as in the center of town. But from a lifestyle point of view it’s great.

Centro – where it all started

This is the area with the most restaurants, bars, clubs, shops, etc, and where first-timers will typically look to book an Airbnb. It includes much of 5th avenue as well. If you buy in this area, your occupancy rate will higher than in other areas. Bear in mind that, unlike Europeans, Americans have 2-3 weeks of vacation per year, so when they go overseas, they splurge. They want to be in a nice building in the best area and can afford it.

Europeans on the other hand have much more time, and less money, so they tend to spend less on accommodation. For Europeans and future growth, you should rather invest on the fringes.

However the Centro is quite large. There are many different neighbourhoods within Centro, so having a good realtor in Playa del Carmen is crucial as it is easy to make a mistake. A few notable areas:

- The commercial center along Avenida Benita Juarez: Low end, noisy, without much potential for upside. Avoid.

- Around the stadium: the most premium area within the Centro. Lots of cute roads with trees, cafes and nice restaurants.

- Close to the beach: some areas are premium, but others are just loud due to nightclubs. Make sure to go walk around on a Friday night before buying there!

- Between the highway and Avenida 30: Still low-end, but high-end buildings are being built. This area is a decent speculation and improves year on year.

Zazil-ha – Premium area

This area has become the most premium neighborhood in the non-gated areas of Playa del Carmen, with one of the best beach accesses. It has all the amenities one can wish for, but without the crowds and riff-raff of mass tourism. Rentals do well here, particularly amongst monied people who know Playa del Carmen and want to stay for longer periods of time

Personally, this is my preferred area to hang out.

The Colosio – Gentrification play

Fifth avenue can only go North. For now this area is still a bit rough but new luxury buildings have started popping up, and more will come for sure. 5th avenue is the beating heart of the city, so expansion in this direction is all but inevitable.

However, the further away you go from 5th avenue and CTM, the rougher this area becomes. It’s really important to calibrate your investment. Here, the play is not Airbnb as there isn’t much demand, but rather long-term and mid-term rentals to people who either live there or spend part of the year in Playa del Carmen.

Additionally, as a kicker, the play is to sell later on for capital gains seeing that development is coming this way. For pure investors, without any lifestyle component whatsoever, who want to make the bet that Playa del Carmen will continue to grow, this is an interesting speculation.

Ten years ago this area was a no-go with a lot of gang violence. Times change.

Mixed-use developments on the other side of the highway

Generally the other side of the highway isn’t that interesting for foreigners. However there are two exceptions. This area here, surrounding the Plaza Las Americas mall, is developing fast. You’ll find gyms, movie theaters, a Starbucks drive-through, etc. What’s interesting to note is that there is still a lot of land open for development. A lot of it.

So while the rest of Playa del Carmen on the other side of the highway is generally ugly and low-end apart from a few gated communities, this area will attract development. Land has become too expensive in Playa del Carmen for investors to buy up the available land to make low-end housing.

This area is set to see a boom in the coming years. It’s visible. The government has even built brand-new roads in areas with barely any traffic in preparation for all the development.

Would I buy here for an Airbnb? No. This area is for people who want to live long-term and are fine with the suburban lifestyle and having a car.

Corasol – Super premium

This is a gated community with all amenities and the most expensive housing in Playa del Carmen. You don’t come here chasing yield, but rather lifestyle and a top notch environment. Houses go into the millions.

Affordable luxury in the jungle

There are nice developments on the other side of the highway in the jungle, a mere 15 minute drive to town. We featured one such community in this video.

Case Study: Long-Term Rental Market in Playa del Carmen

This real estate investment case study features a 2-bedroom, 2-bathroom condo in an older building in the core center of Playa Del Carmen, a three-minute walk from the beach. It is currently being sold with long-term tenants that are paying $1,500 per month. Here is a breakdown of the numbers.

The Numbers: Playa Del Carmen Real Estate Investment

| Purchase price | $260,000 |

| Closing costs (+-6% notary + $2,600 for local trust) | $18,200 |

| Total purchase price | $278,000 |

| Yearly rental income ($1,500 per month @ 90% occupancy) | $16,200 |

| Administration / Property management ($200 per month) | $2,400 |

| Yearly HOA / Common charges ($100 per month) | $1,200 |

| Maintenance allowance | $600 |

| Yearly property tax | $200 |

| Yearly trust renewal costs | $600 |

| Total yearly costs for a long term let | $5,000 |

| Net pre-tax income | $11,200 |

| Net rental yield ($11,200 / $278,000) | 4% |

Case Study Results: Are higher returns possible?

Yes. At about $2,000 per m2 ($180 per ft2) it is much cheaper than new developments due to the age of the building and lack of amenities such as a pool. However, the location trumps it all. Your rental yields on Airbnb would be equivalent or even a bit lower due to more expensive management and higher taxes.

If you want to get higher yields for long term rentals, it is possible to earn 5%-6% net if you aim for renovating older units in the area that I tagged as “Future Development”. I heard of condos going for $1,500 – $1,700 per m2 (+-$150 per ft2). Such units invariably need a renovation job done, but then do well on the long-term market as the price points are affordable, the condos are spacious, and the location is close to all the shops and stores. Foreigners on slightly lower budgets prefer renting in this area due to the good value and short ten-minute walk to the beach and 5th avenue.

Video: Speculative Real Estate Investment in Playa del Carmen targeting the long term market

This video is a detailed case study investing in local multifamily real estate to rent to locals. In some cases the numbers can be surprisingly good. My #1 realtor in Playa del Carmen, Luigi took me to such a property and we ran the exact numbers together.

Who should make a real estate investment in Playa del Carmen?

People who want to spend part of the year in Mexico would do very well making a real estate investment in Playa Del Carmen

People who want to mix lifestyle and a place they can rent out. Playa del Carmen is an amazing beach destination, there is a lot to like about it, and it is absolutely possible to spend a few months of the year there as a tourist, or even obtain Mexican residency, and then rent out the apartment on Airbnb for the remainder of the year. If people want to maximize their ROI, I recommend they list the condo on Airbnb from mid-December until end April, which is the peak season.

A real estate investment of a minimum of $290,000 using the right structure qualifies the investor for residency in Mexico, and there are many other ways to qualify.

Westerners who want to diversify without taking on too much geopolitical risk, in a very established destination

People who want to diversify away from Western countries, without taking geopolitical risk. Mexico is unlikely to get involved in any war, and investments are welcome from all over the world. In many ways it is a bit of a safe haven. Granted, Playa del Carmen is not the cheapest of destinations, but it is very established, and importantly comes with minimal currency risk on rental income as rents are often set in USD, not in Mexican Pesos. The yields are lower than in Medellin for example, but the risk is lower as well.

Conclusion: Playa del Carmen Real Estate Market

Investors should not expect massive capital gains and returns. Overall I view the real estate investment in Playa del Carmen as relatively safe diversification with acceptable cash flow and a great lifestyle component.

I particularly like the secondary market, and some very select off-plan real estate. I believe that this is where the best value is to be found.

Contact Luigi to Invest in Playa del Carmen

Luigi, originally from Montreal, has been living in Mexico for many years. What I like about him is that he also does the secondary market in addition to selling new developments. This gives investors the full spectrum of opportunities on the market.

Contact Luigi to Invest in Playa del Carmen

FAQs

-

What is the economic outlook for Mexico?

Mexico has a growing population and a steadily growing economy, though its growth is somewhat slow and there is now uncertainty because of the new government and Trump’s election.

-

Is Playa del Carmen real estate a good investment?

Its increasing popularity among digital nomads and significant governmental investment in infrastructure development make it notable. Key catalysts include infrastructure development, the influx of North American digital nomads and political “refugees”, walkability, and changing tourism trends.

-

Can foreigners buy real estate in Mexico

Yes, foreigners can buy real estate in Mexico, but with certain restrictions. In areas near the border and coast, they must purchase through a “fideicomiso” (bank trust), while in other regions they can own directly. It’s essential for buyers to follow legal procedures and consider hiring a real estate expert for guidance.

-

How does Playa del Carmen real estate prices compare to other areas?

Playa del Carmen is relatively expensive compared to other Latin American locations but offers unique advantages linked to the North American market.

-

Which neighborhoods offer the best real estate investment opportunities in Playa del Carmen?

It absolutely depends on your precise objectives. You want to discuss this with Luigi in details.

-

What rental yields are expected in Playa del Carmen?

Our case study showed a 4% net rental yield for long-term rentals. For short term rentals the numbers are relatively similar if you have good execution.

-

Who should consider investing in Playa del Carmen’s real estate market?

Those who wish to combine lifestyle benefits with investment opportunities, particularly individuals looking to spend part of the year in Mexico.

-

How does global tourism impact Playa del Carmen’s real estate?

Despite challenges in global tourism, the region’s appeal to a diverse group of visitors and residents could offset potential declines in international tourism.

- My Real Estate Buyer’s Agent in Tulum and Playa del Carmen

- Give Birth in Mexico for Citizenship

- My Favourite Realtor in Puerto Vallarta, Mexico

- How to Obtain Residency in Mexico

Articles on Mexico:

- Playa del Carmen Real Estate Market: 2026 Investor Guide

- Full Analysis of the Tulum Real Estate Crash

- 6 reasons against a Real Estate Investment in Cancun

- Investing in Multifamily Housing in Playa del Carmen

- Puerto Vallarta Real Estate Market: 2026 Investor Guide

- What is a Lock Off Condo & Crazy Architecture in Tulum, Mexico

- Giving birth in Mexico as a foreigner – the complete guide

- Pros and Cons of living in Playa del Carmen, Mexico

- Puerto Vallarta real estate – a Plan B destination for liberals

- Why are Families Moving to Playa del Carmen, Mexico? Real Estate Edition

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Hi, I have purchased a condo in Ciudad Mayakoba and am planning to live there for part of the year and rent it out for the rest. I’d be curious to learn more about the returns I can expect and when, especially as they develop Mayakoba more. Do you have insights on that development? Thank you.

Hello Mark. I actually stayed there for a few months. You can get decentish returns on Airbnb. The only issue is that as supply grows you will have more competition but balanced by the fact that the development will become more livable. You made a nice lifestyle decision, with some cashflow on the side. Try to target the Russian market, tons of Russians moving into this development.

I’d sell once the entire development is near completion as capital gains will be limited in this area.

Hi – Am looking into a pre-construction condo in 240k range in Corasol, on the Gran Coyote golf. There will be 344 other units in the development. I see a few other condos in the same price range in other Corasol projects that are available for sale. Corasol looks attractive to golfers, has access to 5th avenue, lots of amenities and could be attractive as development moves north. What is your take on this as an investment and for cash flow, given that it comes online in 2025? Thank you.

I’m looking at the same location (Punta Laguna Apartments) as Terry Carter who commented. Delivery in ~ 2 years. 2- and 3-bedroom condos – 9 floors. There appears to be many amenities such as coworking, large pool, tennis, pickleball, etc. Located next to Gran Coyote Golf. Shuttle access to the beach – the walk would be ~30 min. Not walkable to the core of the city. 2-bedroom condos selling for ~245k-290k depending on tower floor.

I would appreciate your quick take on this as well!

Excellent article. We are considering buying investment condo in PDC so I really appreciate you sharing your knowledge. Thanks