There are many reasons why anyone with even a little bit of money should diversify their banking and learn how to open an offshore bank account in Panama. It’s a process I went through myself.

Opening a bank account in Panama as a non-resident is an option however banking as a resident is much better and getting residency in Panama has many benefits, especially for those looking to open a bank account.

I spent some time on the ground in Panama in November and went to few banks. Let’s look at the pros and cons of opening a bank account in Panama as a non-resident. I’ll then explain how to open an offshore bank account in Panama remotely. We’ll also see that there have been recent changes that make this open less viable.

Table of Contents

The Pros of having a panama bank account for non residents

- A few banks in Panama accept non-residents, unlike most banks in most countries in the world.

- Even Americans are accepted, which is not that common due to FATCA.

- Higher interest rates on your USD deposits than in other countries.

- A fully dollarized economy.

- Easily accessible.

- Credit cards are available, even for non residents.

- Low barriers to entry; some banks let you open an account with only USD3,000.

- No capital controls.

- The compliance departments of local banks are familiar with Latin America, so channeling funds through a bank in Panama for deals in places like Colombia and Nicaragua could make sense in case your bank in Asia or Europe doesn’t want to go ahead with the deal.

- Transfers to and from Canada and the US are seamless.

- Bank accounts can be opened remotely in some cases

The Cons of opening a bank account in Panama as a non-resident

- Physical presence is required in most cases, unless if you use specific agents.

- The bank account opening requirements at the vast majority of banks have become exceptionally tedious for non-residents.

- High rejection rates for account openings for non-residents.

- The customer service levels are not fantastic, and can be quite slow. That said, online banking is improving, thus resulting in less “human” interaction.

- The stigma associated with a bank account in Panama; Panama is on various blacklists for still being perceived as a tax haven, most notably on an EU money laundering blacklist. However, Panama was recently removed from the FATF GAFI grey-list, which is a big positive. It will make international banking out of Panama easier, but not with Europe.

- In many countries, you have to declare your foreign bank accounts to the authorities, which is fine, but if you add Panama to the list you might get a higher chance of being audited.

- Some banks, mostly in Europe, will completely refuse to accept money coming from a Panama bank account.

Panama bank account requirements for non residents

Different banks have different procedures, but generally you need the following for those that do accept non-residents:

- Your physical presence or well connected agents who can open the account remotely for you

- 2 national identification documents (passport + ID). If your country does not have IDs, then the second document can be your driving license. These documents should be from the SAME country.

- Source of income; a work contract, an income tax declaration, etc. They’ll want a few such documents.

- A bank reference letter from your current bank mentioning since when you’ve had an account with them, and confirming that you are in good standing.

What interest rates should you expect on your term deposits?

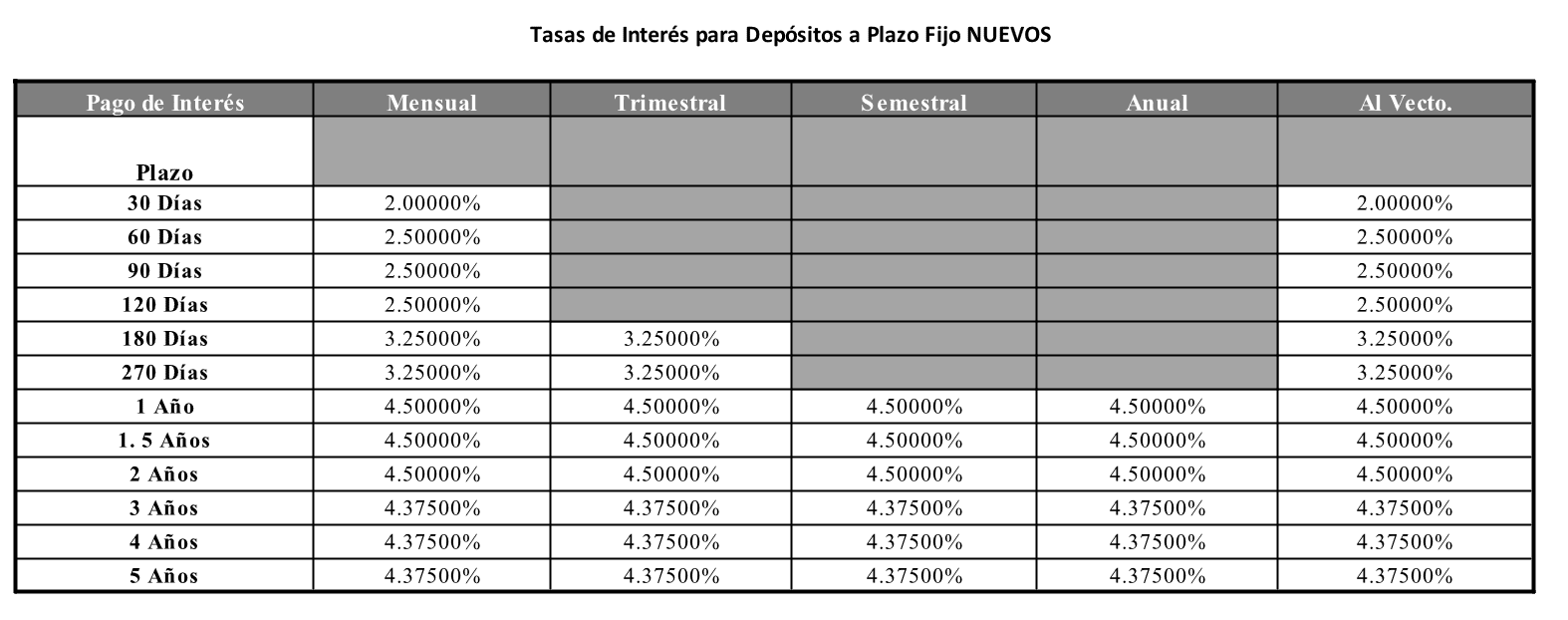

Here were the rates as of October 2024 in the bank I would say was the most suitable for non-residents. The rows are for the term deposit duration (days and years), and the columns for the payout frequency.

Should you open a bank account in Panama as a non-resident?

The credit card option is very interesting, as getting one can sometimes be a struggle for Digital Nomads, meaning activities like booking rental cars can be near impossible. If you want, say, $2,500 credit, the bank will ask you to block approximately $3,000.

However the account opening process for non-resident has become so tedious, and the account freezes for non-residents so common that many service providers have stopped offering account opening services for non-residents because they know they cannot guarantee quality.

If you are willing to deposit at least $100,000 then yes you can have decent banking as a non-resident because you’ll be classified as a “premium client”, but then you are much better off just adding another $100,000 to the deposit and getting residency through term deposit if you are from a Friendly Nations country.

In summary, opening a bank account in Panama as a non-resident is doable, and in some cases even remotely. However the quality of the banking you will get as a non-resident has become of poor quality over time, especially since Panama got removed from the FATF grey list due to its higher compliance standards.

How to open a panama bank account remotely

Giovanna and Wi Men run a small family office in Panama used to help people open bank accounts remotely in Panama. In this video they explained the requirements, as well as compliance in Panama back then. But things have changed. Like many other service providers they now rather offer residency + banking packages, which lead to much superior banking.

Video: How to open an offshore bank account remotely in Panama

So what are my options if I want to open a bank account online in Panama?

- You can go to banks of subpart quality such as Towerbank which open accounts remotely but because they have been labeled as “too crypto-friendly” other banks often refuse transfers coming from this bank, effectively making this bank not very useful and even trapping your money. If you want to turn crypto into fiat in Panama you are much better off either getting residency in Panama or creating a crypto company locally and sending the money to a local, “normal” bank.

- Get residency in Panama and have a much better experience banking as a resident.

- Ignore Panama and rather opt for another jurisdiction. We can also help you open a bank account remotely in Mauritius for example.

Contact Giovanna to Open a Bank Account in Panama

They can also help you open a Panama corporation to trade crypto on major exchanges. Details here.

We can help you with an international bank account strategy

At The Wandering Investor, we have opened dozens of bank accounts all over the world, and we have helped dozens of clients optimize their international banking. We offer personalized consulting calls for individuals who wish to open international bank accounts. During the call we discuss the most appropriate international banking solutions for you as an individual.

We help you with:

- Selecting the right bank for your unique situation, and in some cases we can help you open bank accounts directly.

- Save you weeks of research, failed applications and fees.

- This is a highly focused strategy call that should take less than 30 minutes.

We charge $250 for this international banking strategy call.

We help individuals with North American, European, South African, Singaporean, South Korean, Japanese, Australian and Kiwi passports. This service is only for personal banking, not for business banking.

Services in Panama

- How to obtain Residency in Panama

- Real estate lawyer in Panama

- My Realtor in Panama City

- Create a corporation in Panama

Articles on Panama

- Panama City Real Estate Market: 2026 Investor Guide

- Affordable Tax-Free Caribbean Lifestyle and Real Estate

- The Pros and Cons of investing in the Boquete Real Estate Market in Panama

- How to Obtain the Panama Retirement Visa

- Panama Permanent Residency in ONE trip

- What is the Panama Travel Passport and how to get it?

- The Pros and Cons of living in Panama

- The Secret Third Way to Get Panama Residency – Company Formation for Friendly Nations Visa

- How to buy a gun in Panama – Gun rights in Panama

- Real estate for Friendly Nations Visa in Panama City – case studies

- Buying real estate in Casco Viejo of Panama City – Things to know

- Panama Tax Guide

- Remotely opening a bank account in Panama

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Can you translate the photo of the interest rate table?

The rows are the term deposit duration, and the columns are how often you want you interest paid (monthly, quarterly, biannually, early). These interest rates are from early March. The Fed has since cut interest rates, so they must be lower now.

Thanks very much for your advice. Could you may-be recommend a bank in Panama that accepts a non-resident to open an account?

Multibank

We will be residents in Panama as of October 2022 . Is this markedly easier and more safe than being a non-resident opening a bank account?

Much easier

Good day

I need someone to check if I really have a bank account in my name in Panama. Can you help me please.

You say that you wouldnt use it as your primary country but rather as plan B or C. Which country is first for you? your plan A.

Thanks!

It depends on citizenship, residency, business activities, geography of activities, etc.

If your reside in Panama it’s fine as Plan A banking for example.

Can my savings account with Banistmo Bank be closed remotely from the US without being in Panama?

I don’t know, sorry.

I have a company in Nevis and would like to open a bank account for the company outside Nevis. my company accept Credit card payments from clients. I will then need to transfer the funds to Canada. or open a visa or master card out of that account. where do you suggest I open a bank account