My previous piece on the Ukrainian economy, which you should read, started with the insight that residential prices are down 75% from their peak in Kiev, Ukraine. Generally speaking, a 75% drop in prices in a capital city, with a few years of consolidation at the bottom afterwards, sounds like a no-brainer real estate investment.

Is it?

*political disclaimer: this article uses “Kiev” because people Google search it more in the context of real estate, but “Kyiv” is just as valid. The Wandering Investor is not taking sides 😉

A comparative analysis of the real estate market in Kiev versus other European cities

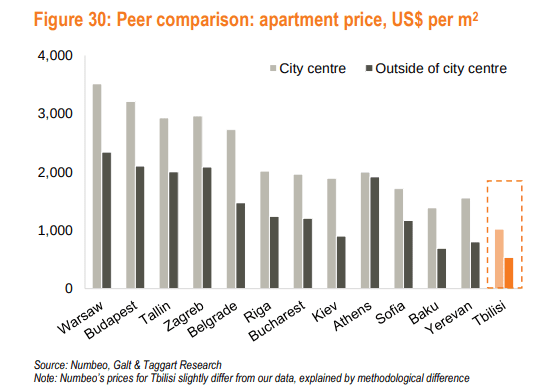

Looking at the per square meter (m2) pricing, Kiev is slightly more expensive than Sofia, and cheaper than Bucharest and Riga. Sure, the three other capitals are in the EU, but Kiev with its officially 3 million inhabitants, is a lot larger than the other three capitals. Sofia is at 1.2 million, Bucharest 1.8 million, and Riga 600,000. Kiev’s much bigger size should at least make up for it relative poverty and lack of EU membership.

Let’s look at it from another angle. The closest comparative could potentially be Belgrade. Serbia is non-EU, but borders the EU, and has had its fair share of conflict in the past. Even with a population of 1.4 million, prices are 50% above those of Kiev. Is it crazy, in spite of all the issues of Ukraine, to think that prices could go up again and reach Belgrade levels? Again, Kiev officially has 3 million inhabitants, but is widely believed to have much more due to internal migration from the conflict-ridden East. 4 million is a commonly used figure.

Mathematically, if Kiev were to get to Belgrade levels, it would be 50% upside from current levels, which would translate into prices being 37.5% down from peak. This, with a population probably twice as big as Belgrade, so there is some margin of safety. This metric alone is quite promising for a real estate investment in Kiev, Ukraine.

Bullish signals for an investment in the Kiev, Ukraine, real estate market

– A huge diaspora that has emigrated to the EU to find work. They’ve been there for a few years now and many have accumulated savings. With returns being so pitiful in Europe, many are choosing to invest back home where yields are higher, thus driving prices up. A number of developers I spoke to confirmed that Ukrainians living abroad are an important source of investment.

– A lot of dirty money being recycled into real estate. Ukraine, even with reforms, remains a country at war, with corruption, dirty politicians, and oligarchs thrown in the mix. Accordingly, real estate is an attractive asset class as it is one of the easiest ways to launder money.

– A history of real estate speculation. Culture matters. Some cultures care more about real estate than others. Ukrainian culture is one that does.

– Real estate interest rates are going down substantially along with the inflation rate. Once mortgages become even only half-viable again people will pile back into them

– Now that Hryvnia (UAH) interest rates are falling, bank deposits will become decreasingly remunerative. If bank deposits don’t remunerate much anymore Ukrainians will be quick to look for alternative investments as they don’t trust their banks. The risk/reward ratio of a bank deposit won’t make sense anymore. What are the alternatives? The stockmarket is completely illiquid. Overseas investments require a lot of cash and there are capital controls in place, so that is complicated. People will have just real estate or starting small businesses as options. They will pile into real estate as they always have.

– The Ukrainian economy is improving and optimism is back. Locals sitting with Euro & USD savings under their mattresses, in bank safes or in low yielding deposits will now feel comfortable enough to put the money to work.

– Yields in Kiev are high. You can find gross yields of 7-9%. This will attract overseas investors. Israelis, other Middle Easterners, and Europeans will start sniffing around. There is anecdotal evidence that the “early adopters” already are.

– The Kiev real estate market, for buying & selling, is done in local currency but generally indexed to the dollar, thus providing a little bit of a cushion to the ups & downs of the UAH.

This will not be an all out bull run because of some limitations

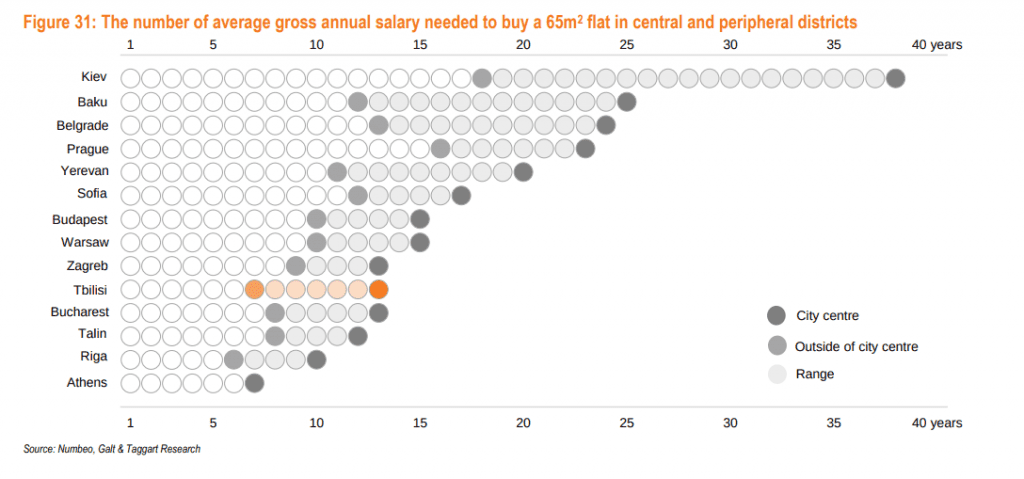

The price to income ratio is the worst in Europe, and even amongst the worst in the world. That said, a higher proportion of income is not declared, more so than in other European countries. The price to income ratio, though really bad, is probably a little less unhealthy once this is factored in.

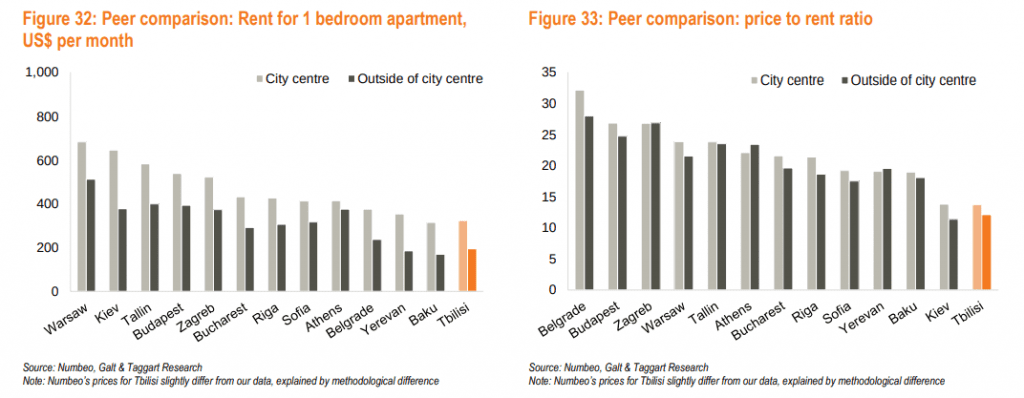

The price to income distortion is also there when it with respects to rents. The reality is that rents in Kiev are not that competitive compared to other European capitals. Renting an appartment in Kiev is a bit more expensive than in Budapest and Tallinn, cities where wages are significantly higher. Those are just the numbers, the reality is much worse in the sense that the housing stock in Kiev is a lot older and in poorer condition.

I would therefore tend to predict that rents will NOT go up significantly, and if anything there is potentially a bit of downside pressure.

There is substantial construction in the residential space, especially in the outskirts of Kiev. Construction cranes are everywhere. Usually I’d be a little worried, but seeing how old the housing stock is, it is needed and won’t necessarily lead to oversupply for a while.

Finally, there is the currency and political risk. The reality is not as rosy as Western Media would like you to think. Read my article on the matter to fully appreciate the risks involved. Unlike, buying & selling which are often linked to the USD, rentals are in the vast majority of cases entirely UAH exposure.

If there is no major Crisis, what is the likeliest scenario?

So, what you have here is a situation where if you were to make an investment in Kiev real estate now, and all things being equal, a likely scenario is that:

1. You’ll enjoy capital appreciation, with 50% being a fair target to reach Belgrade levels.

2. Your gross rents will remain stable. Yearly your yield as a % of Net Asset Value will go down, but if you get in early enough based on your initial investment it’ll be good.

Some real estate investment examples in Kiev, Ukraine

The below are just examples of apartments that I visited in December to give you an illustration of some of the opportunities. They are not recommendations, nor the best that is out there. The reality is that when you go to a country for a few days and look at real estate, the best you can hope for is an average deal. These therefore probably fall in the average deal category.

This new buidling is a 15 minute walk away from the metro station “Beresteiska”, itself a 20 minute ride to the center. Your target market would be the local middle class. A new built 33.32 studio apartment is going for $1,150 per m2 without finishes (just an empty shell) or $1,400 with the full finishes; you just need to add your furniture and kitchen. Say $5,000. All in you probably end up with a price of about $51,000. These are the prices for paying upfront, and delivery is in about 18 months.

If you want to pay in installments expect to pay about 15% more. You can then expect to rent out this apartment for 10,000 UAH (+- $400) per month, giving you a gross yield of a bit over 9%. You can add a parking space for $10,000, but I wouldn’t bother for a small studio that is walking distance from the metro.

If you go 2-3 metro stops farther away, and are willing to pay upfront and wait for 2.5 years, you can pay about $1,000 or less per m2 with finishes. The yields would probably fall in the same range.

What about the city center?

In the center, yields would typically be a bit lower, closer to the 7-8% range, but flats there are definitely better long term investments than in the outskirts.

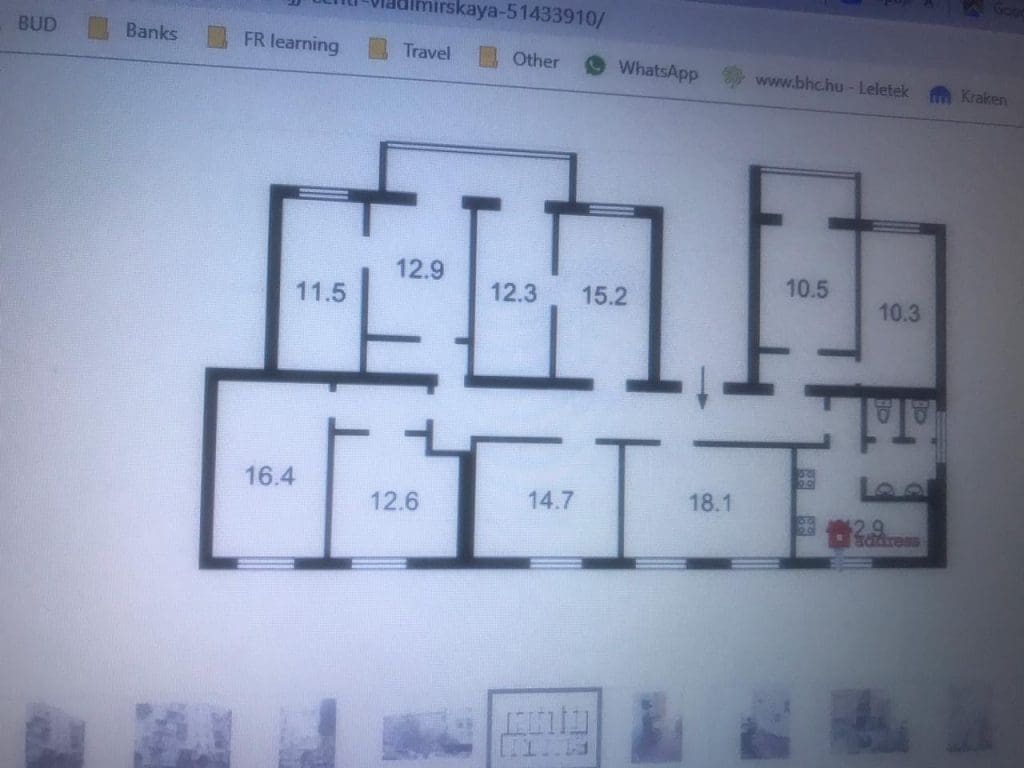

Here we can look at a very Soviet apartment; a komunalny. Essentially, it is a communist-era communal apartment. The bathroom and kitchen are the common area, and the 6 bedrooms belong to separate individuals or families or couples. In this particular komunalny, all the owners have decided to sell. So for your offer to be accepted, all 6 owners have to agree, which is no easy feat.

Not only is the building of the solid and architecturally pleasing Stalinist type, but the location is amazing too – right across the street from Kiev National University in the city’s most expensive neighbourhood. From the pictures you’ll notice two things:

1. Everything must be destroyed & rebuilt

2. Interesting layout

Priced at $230,000 for 189m2, you could potentially turn it into 7 individual studios and mini studios of various sizes. The fact that there is no elevator and is on the third floor is not much of an issue as you’d be targeting students or doing some Airbnb operation. The full renovation wouldn’t be cheap as everything would have to be redone, and as doing 7 bathrooms adds up. If you count a renovation cost of $680 per m2, you end up at a total cost of about $1900 per m2, max $2000 (not bad for a renovated place in central Kiev) or $358,000 total.

Assuming you’d get an average of about 10,000 UAH per studio for long term lets (depending on size), you also get around 9% yield. Alternatively, it could be set up as an apart hotel operation, where you could potentially get even higher yields. Or you do students from September to June, and then Airbnb in Summer.

It’s a big project, with a lot of headaches, and you as a foreigner will have many people trying to fleece you left, right and center. But if you pull it off, it’s an interesting little cash cow.

There are many opportunities in Kiev. I’m 100% sure that if I were to spend a few weeks on the ground, I’d find better deals.

Real Estate funds are also an option

There is one last option, if you don’t feel like doing everything yourself and have at least 125,000 euros, the Kiev Real Estate Recovery Fund is worth considering. It is a property fund that is currently raising cash and the team seems to be quite experienced in the Kiev market judging by their CVs and past funds. The fund is structured in Cyprus so all you need to do is sign a few documents from home, wire the money, sit back and enjoy the 10%+ dividends, and let them savour their 2% management fee + 20% carry.

Their projected numbers are impressive (30% IRR), and are doable in the current market with scale and the right network. There is always an inherent risk in funds, but if you do your due diligence and it turns out well, this could be the perfect 5-7 year play. I interviewed the managing director (here) and visited of his properties which yields 19% (here).

How to make a real estate investment in Kiev, Ukraine

The process of buying is fairly straightforward. First, get a good lawyer as a lot of title deeds can have claims on them or omit certain aspects of the property in question. Then you simply go to the notary public to sign, proceed with the transaction and pay a 1% state duty on the value of the property + some notary fees. An important point is that you need a tax identification number for almost anything in Ukraine, such as buying property and even opening a bank account as a non-resident. It’s not hard to get; you just need a notarized copy of your passport and to go to the tax office. You’ll get it in a week or two. Many lawyers offer to do it for a few hundred dollars, but you can also run with it yourself if you have time.

From a banking point of view, you will want to open a “foreign investment account” and show all the property purchase documents to the bank. When you sell the apartment, the money will go back to that account and they will check that it stems from the same property. Only then will you be allowed to repatriate your money. Do the paperwork properly to not run into issues. Ukraine is a country of capital controls, which also speaks to lack of solidity of its currency, which is your main risk going into this investment.

Lastly, agency fees are typically about 3% of the purchase price.

If you need a good, English speaking lawyer in Ukraine, click here for more details. My lawyer can help you with your real estate transactions and bank account opening.

Taxes on a real estate investment in Kiev, Ukraine

It’s pretty simple here. 18% tax on rental income + 1.5% military contribution (good yields but yes, a country at war). Rental expenses are generally not deductible. Capital gains taxes are also at a total of 19.5%. However if you hold your property for more than 3 years and make only one sale a year no capital gains taxes are due. There are some extremely minimal property taxes as well.

Should you make a real estate investment in Kiev, Ukraine?

Overall, the risk/reward ratio is relatively appealing. The main risks are the currency and geopolitical tensions. However, as prices have already collapsed 75%, the downside is relatively limited, except in case of full-out war.

Your rents are unlikely to increase much in USD, but speculative money should help drive asset prices up, at which point you can then exit. Transaction costs in Ukraine are low, so such a play is a distinct possibility.

If you need a competent independent buyer’s agent for your real estate investment in Kiev, I encourage you to speak to Alex who is based in Ukraine. He can find a property based on your investment objectives and can also manage renovation projects. You can find out more about his services here.

In any case, I absolutely recommend this book. It is a great source of information such as the exact neighbourhoods you should focus on, the exact purchasing process, mistakes you should avoid, details you should watch out for, taxes, banking, etc. I met the author as I had read his book. He is a former banker who invested his own money in Kiev real estate. You can buy it here.

Other articles on Ukraine:

- Kyiv Real Estate investment – a case study with exact numbers

- A real estate investment in Kyiv, Ukraine, with 18% gross yields?

- Highest Real Estate yields in Europe – Ukraine – $1250 per m2 with 19% yields in Kyiv

- Investing in Historical Buildings in Kyiv, Ukraine

Available services in Ukraine:

- An Independent Real Estate Buyer’s Agent and Renovation Manager in Kyiv

- Real Estate Lawyer in Kyiv, Ukraine

- How to obtain residency in Ukraine

- Easy Permanent Residency in Ukraine for IT Specialists

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

The Kiev real estate market is quite expensive actually if it’s compared with Ankara, another capital of a country with similar CDS, inflation etc.

The expensiveness of Kiev’s m2 prices are in 2-2.5 times range. Considering the just brick walls with no renovation delivery the difference can go easily to x3 to make it livable.

If prices fall by 50% in Kiev then it may reasonable to invest. Currently it’s balloon.

99% of markets in the world are expensive compared with Ankara :). It’s a different value proposition.

Hey! Great article 🙂 I’ve been in Kyiv last year and I think it has the potential for this kind of investments also.

GIven that Bucharest is just slightly more expensive with m2. How would you compare Bucharest & Ukraine?

All bets are off right now. But generally Ukraine has much less leverage in the system. Romania could fall further.

Since COVID-19 hit how do you think it affected the property market in Kyiv, I mean it was an event that no one expected nor was ready for.

The market is likely to drop less than other markets that had a lot of leverage.

For long term and short Term rental, is it good to invest in the historic buildings of kiev or new buildings?

Hello Maxim, personally I prefer to invest in historical buildings because in 30 years time they will still be historical, while the “new” building will now be an “old” building.

We are getting a consistent 15%/year across city center.

In terms of purchase price, October 2018 was the low, averaging $1200/meter for Kyiv wide and specifically $1800/meter in city center.

Currently prices are $1550/meter Kyiv wide and $2200/meter for city center.

This is the secondary market. You must renovate everything, Western style, otherwise cut the rent in half.

New buildings also cut rent in half. Average there is about 8% and you still must renovate as the styles are ridiculous generally if done by locals.

Thank you for sharing. Good numbers.

I wonder how much would you budget per sqM for a complete renovation of a new flat outside of the centre? Quality being good enough to rent western style but not flamboyant.

Hi Michael! Get in touch with Alex, he can help out.

Is the book you recommend still relevant or do you think there is a better one out there for someone who is just now wanting to invest in real estate in Kiev?

The one you recommend was published late 2019, so that’s why I’m asking.

Hi Toni, I’m not aware of another one. But for $10 you don’t risk much 🙂