I wrote a number of relatively optimistic articles on the Kyiv real estate investment market earlier this year (here & here) and was quite enthusiastic about the high yields.

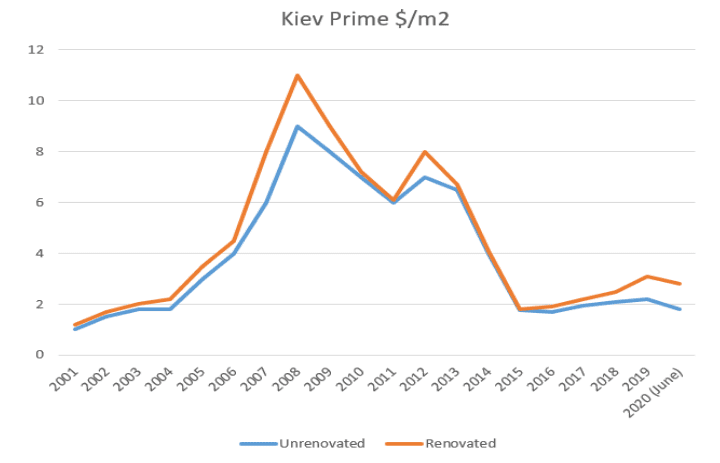

I’ve been monitoring a real estate investment fund in Kyiv for a while as its positioning is quite unique in Europe. It claims it can reach gross yields of 18% without the use of leverage, by buying in a market that is down 75% from peak.

A Kyiv real estate focused investment

John Suggitt, from Canada, has been active in Ukrainian private equity and real estate for 20 years.

Does 18% gross yields sound too good to be true? Or is it simply an undiscovered investment gem targeting a niche market in Europe?

Watch the discussion John and I have to form your own opinion. I asked many of the questions that needed to be asked, and dug into the numbers.

– Why Ukraine?

– Why a Real Estate investment in Ukraine?

– Why a Real Estate investment in Kyiv?

– A major catalyst: the mortgage market

– Impact of Covid on the real estate investment market in Kyiv

– Legal pitfalls when investing in real estate in Kyiv, Ukraine

– Case study 1 with yield calculation

– Key risk: the Ukrainian Hryvnia

– Case study 2 with yield calculation

– Case study 3 with yield calculation a

– Which auditor & fund structure

– Dividends of 10%

– Amounts raised

– Skin in the game

Watch the conversation John & I have here on investing in Kyiv real estate. Feel free to leave a comment and subscribe to the Youtube channel.

You can also sign up to John’s free Ukrainian real estate market updates here.

This is what I do at The Wandering Investor

I travel around the world, and find unique internationalization and diversification options.

To a World of Opportunities,

The Wandering Investor.

UPDATE March 2021: I did a market visit in Ukraine and met John in person: Highest Real Estate yields in Europe – Ukraine – $1250 per m2 with 19% yields in Kyiv

Other articles on Ukraine:

- Kyiv Real Estate investment – a case study with exact numbers

- Is a real estate investment in Kiev, Ukraine, attractive?

- Highest Real Estate yields in Europe – Ukraine – $1250 per m2 with 19% yields in Kyiv

- Investing in Historical Buildings in Kyiv, Ukraine

Available services in Ukraine:

- An Independent Real Estate Buyer’s Agent and Renovation Manager in Kyiv

- Real Estate Lawyer in Kyiv, Ukraine

- How to obtain Residency in Ukraine

- Easy Permanent Residency in Ukraine for IT Specialists

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

DISCLAIMER: This presentation is intended for information purposes only. It is not intended as an offer, or a solicitation of an offer, to buy or sell any product or other specific service. The services mentioned here are subject to legal restrictions in some countries and can therefore not be offered on an unrestricted basis throughout the world. Although all pieces of information and opinions expressed in this presentation were obtained from sources believed to be reliable and in good faith, neither representation nor warranty, express or implied, is made as to its accuracy or completeness. All information, opinions and services indicated in this presentation are subject to change without notice. EMRF V.C.I.C. RAIF PLC has not received authorization by the Cyprus Securities and Exchange Commission. The registration of this registered alternative investment fund with the Cyprus Securities and Exchange Commission and its admission to the Cyprus Securities and Exchange Commission’s register of Registered Alternative Investment Funds is not equivalent to a decision for authorisation by the Cyprus Securities and Exchange Commission. The Fund is exclusively addressed to professional and well-informed investors. Protection measures for retail investors do not apply. Investment in EMRF V.C.I.C. RAIF PLC involves special risks and subscription to shares should be considered only by persons who can bear the economic risk of their investment for an indefinite period and who can afford a total loss of their investment. Potential Investors should note the risks relating to an investment in EMRF V.C.I.C. RAIF PLC and its investment industry of focus (being the investment in real estate in Ukraine) and should read the Offering Document of EMRF V.C.I.C. RAIF PLC and consider carefully whether an investment is suitable for them in light of the information in the Offering Document. EMRF V.C.I.C. RAIF PLC strongly recommends to all persons to obtain appropriate independent legal, tax and other professional advice before investing in the Fund.

Dear Maurice, office sector now seems to be a better investment than residential (it is also more easily to find a reliable customer to rent it to), but could it be that office shortage is simply due to their still high price? I mean, I have seen in Kiev a lot of new tall buildings that are told to be quite empty due to their high rental cost.

I would also like to know Your opinion about RE outside Kiev, especially in Western Ucraine. I have been there this year and found a very nice environment. Lviv for example is becoming to lead the IT sector (a real economy one) and not only, which has increased direct contacts with foreign customers. Prices are quite affordable (about 1000$/sqm in Lviv, 600 in Ivano Frankivsk and so on). Could it be a long term more safe investment than Kiev market, or at least an alternative?

Thank You for interesting articles. Have a nice day!

Hello Sergio,

Thanks for your comment. In terms of the office market, I don’t know. Feel free to contact John directly if you are interested.

Concerning Lviv, yes you can buy apartments for $1000 per m2 outside the city center, same as in Kyiv. The beautiful historical center is as expensive as the center of Kyiv. The reason is that a lot of Ukrainian money went there because Lviv is deemed less likely to have massive civil unrest or war. However, the capital Kyiv, if things don’t take a bad turn, has much more upside in my opinion.

Lviv has less than 800,000 people, and Kyiv about 4 million.

I see Lviv as safer if you are worried about unrest, but the yields are lower, and there is less potential for price appreciation.

As for Ivano Frankvisk, lovely little town (go there in Summer, they have a cool festival), but why invest in a tier 3 city when tier 1 (Kyiv) and tier 2 (Lviv) cities are on sale?

Happy investing!

straightforward, clear and logical comment, thanks a lot!

The Kyiv market is 10x more liquid than Lviv.

100%