I’m often asked if a real estate investment in Kiev, Ukraine, is a smart move. From a peak of over USD 3500 per m2 in 2007, prices dropped for over a decade to slightly over $1050 per m2 in Q2 2019. I’ll examine the Kiev real estate in a future article, but in the meantime let’s focus on the macro aspects to assess how risky it is to invest in Ukraine.

A grossly mismanaged country

The drop in real estate values was not only driven by war, but also by a catastrophic political class that mismanaged and plundered the economy.

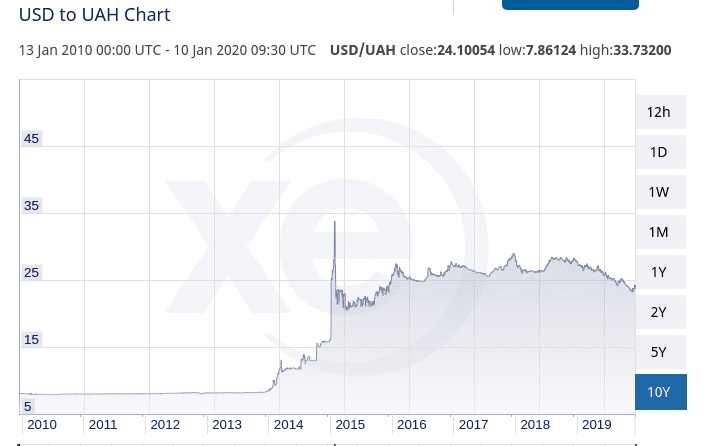

Look at the below graph, bearing in mind that in 2007, before the bubble burst, the Ukrainian Hryvnia (UAH) was trading at 5 to the USD. It then plunged to 7 to the USD and is now hovering around 25.

source: www.xe.com

That decade for Ukraine included not one, but two revolutions, an IMF bailout, the loss of one of its nicest parts of its territory (Crimea), war in the the East, and massive emigration of its youth to the EU.

The average monthly wage in 2016 had dropped to $200, less than in a number of African countries. This, in spite of having been the breadbasket and a core industrial center of the Soviet Union.

Optimism is back

Ignoring the impeachment proceedings, Ukraine is now front-line news in the business world as a market that is opening up again. Here goes the story being shared in international business circles:

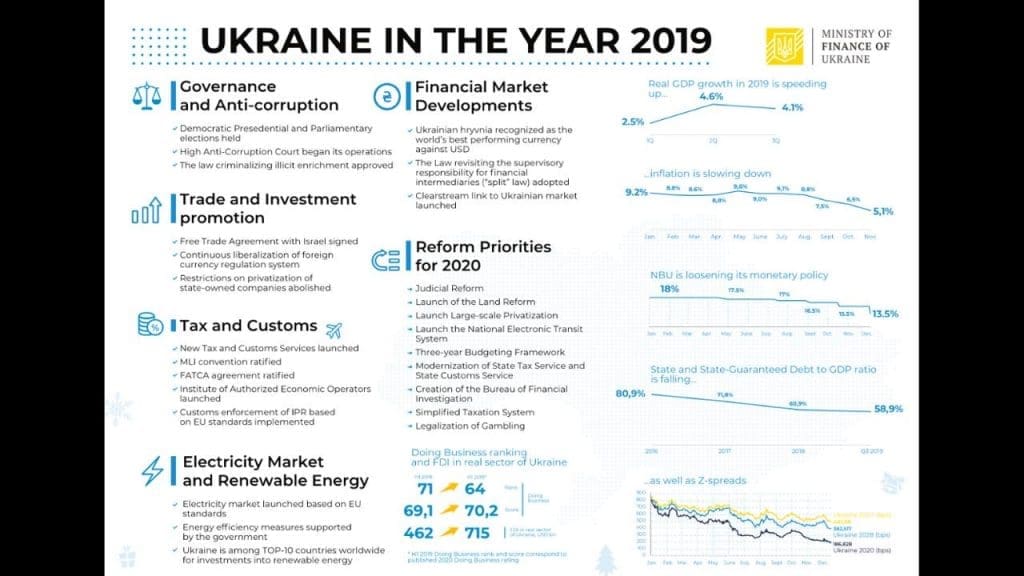

- A new, young president (Zelensky), democratically elected, with a strong mandate for change.

- The world’s best performing currency in 2019, gaining 19% on an already strong USD.

- A debt to GDP ratio that plummeted from 80% in 2016 to 52% in 2019

- Average monthly wages jumped to $450 in USD, thus anecdotally helping slow down the tide of emigration. Accurate numbers are hard to come by as the vast majority of Ukrainians working in the EU do so illegally.

- A budget deficit down to 2% and inflation is now in the mid-single digits, down from over 40% in 2015.

- Exports are up.

- A thaw in relations between Ukraine & Russia, including prisoner swaps and a 5 year multi-billion dollar gas transit agreement.

Put your head down, race ahead & invest in Ukraine?

The above optimistic story being sold in most Western media is, as always, only one side of the coin. Not everything is a clear cut as Reuters and Bloomberg would want you to believe. Let’s look at some counter arguments to keep a balanced view.

- The debt to GDP ratio collapsing from 80% to 52% of GDP is not due to the Ukrainian government suddenly being fiscally responsible. It is simply because the debt is largely denominated in USD, and as the UAH appreciated significantly, the USD debt now appears more manageable. That said, it means that the debt is still heavily. denominated in USD and is vulnerable to external shocks

- Speaking of external shocks, why did the UAH appreciate so much? Mostly because of hot money flowing into domestics bonds – over $5 billion in 2019. That money is almost entirely institutional, and hence very fickle. Should yields lose attractiveness relative to its risk level, that money could go out as quickly as it came in.

- The boom in exports was largely due to grain exports going up over 35% thanks to a fantastic 2019 crop. It does not mean that nature will be as generous in 2020. Inherently, all the other export sectors will be negatively impacted by the currency appreciation and the rise in wages. I help run a small family trading business on the side, and my exports from Ukraine are now taking a severe hit. My factory gate prices have increased over 10% in USD over the last year. Guess what, I’m now struggling to sell Ukrainian goods. The same will be replicated across the economy.

- Ukraine spends over 5% of its GDP on military & security. In spite of all the rosy news, it remains a country at war. Instead of young men working in factories, they are in the trenches. Instead of hospitals and schools being renovated, American and Israeli weapons are bought.

What about president Zelensky, the poster boy of Western media?

Zelensky’s main sponsor, and former boss of the TV station where he was an actor before becoming a politician, is Igor Kolomoisky.

A holder of three passports (Ukraine, Israel, Cyprus), in spite of dual citizenship being banned in Ukraine, Kolomoisky has such a track record that Putin calls him a “unique crook”. As the owner of Ukraine’s largest bank (PrivatBank), 97% of corporate loans went to companies linked to him and his partner. They defaulted in 2016, the bank went bust and required a $5.6 billion bail-out from the Ukrainian government which then nationalized the bank. He fled to Israel and claims to be innocent.

Kolomoisky was banned from Ukraine, but since Zelensky was elected is free to roam around.

Even with such characters around, Zelensky seems to be pushing a reform minded agenda.

Is it sustainable?

Overall, even though good things are happening in Ukraine, many of the reforms and goodwill are already priced in the currency.

If any of the following happens:

- The reforms agenda facing stumbling blocks or emerging as being mostly cosmetic due to the influence of some nefarious people.

- America, having lost in Syria, and generally not doing well in the Middle East, deciding to use Ukraine to provoke Russia again.

- Russia, having won in Syria, and generally doing well in the Middle East, deciding to put further pressure on Ukraine to get the Americans out.

- Some bad numbers emerging due to a low crop yield, or anything.

- A global recession meaning a risk-off attitude.

then you could easily see rapid outflows of funds, thus the UAH taking a plunge. Your UAH denominated rental and interest income would be taken along for a ride.

How to invest in Ukraine

My main point in this article is that there is significant currency risk, more so than one could be lead to believe. It doesn’t mean you should not invest in Ukraine. You must just be aware of the risk, choose asset classes that would be less impacted, and proceed prudently.

Then which avenues do you have to gain exposure to Ukraine?

- UAH bonds – though here you are probably late to the party and bear the full currency risk.

- Hard currency bonds – gain a few % points.

- Local shares on the stockmarket – not much of an option unfortunately. The market is not only extremely illiquid, but is divided into two different stock exchanges.

- Shares of businesses with high exposure to Ukraine, listed on international markets. Do your proper research and proceed very carefully.

- Private equity – there are many cheap assets in the country, and with further privatizations planned, private equity could prove to be a very profitable play. Ukraine has a lot of untapped human resources talent and good management can work wonders.

- Horizon Capital has a few funds, with a lot of re-investment from existing clients. It might be worth trying to sign up for their next round if you have significant capital.

- NCH Capital is active in Ukraine. With the land reforms on Zelensky’s agenda, their agribusiness core specialty could have good future returns.

- Real estate – attractively priced, often USD denominated, good yields and potential for upside.

Other articles on Ukraine:

- Is a real estate investment in Kiev, Ukraine, attractive?

- A real estate investment in Kyiv, Ukraine, with 18% gross yields?

- Investing in Historical Buildings in Kyiv, Ukraine

- Highest Real Estate yields in Europe – Ukraine – $1250 per m2 with 19% yields in Kyiv

Available services in Ukraine:

- An Independent Real Estate Buyer’s Agent and Renovation Manager in Kyiv

- Real Estate Lawyer in Kyiv, Ukraine

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.