Create a corporation in Panama

Are you looking to create a corporation in Panama?

This is a topic that I am intimately knowledgeable about because I created a corporation in Panama to conduct business and obtain residency for myself and my family. If you are looking to get directly in touch with Giovanna and Wi Men you can do so here.

Apply Now

Why create a company in Panama? Pros of opening a Panama corporation.

1. You can apply for residency using the corporation through the Friendly Nations Visa program.

Many people obtain residency in Panama by making a real estate investment or term deposit in a Panamanian bank.

This is an alternative route whereby you create a local corporation in Panama, and then hire yourself as an employee and pay yourself a salary.

By doing so, you obtain a work permit due to your employment in Panama which can eventually convert into permanent residency, at which point you may dissolve the corporation if it no longer serves you any purpose.

This method is only available to a list of 50 “friendly nations” which can be found in my article How to Obtain Residency in Panama.

2. Take advantage of Panama’s robust banking system.

Panama is one of the banking hubs of Latin America along with Miami and is known globally for its versatile and accommodating banking services.

- Panama does not impose currency restrictions or capital controls so you can transact internationally with relative ease. It is easy to move capital in and out of the country in any denomination.

- Nonresidents are not subject to Panamanian taxes on banking transactions or investments. There is just a service tax of 7% on bank fees for transactions.

In most cases you need to be physically present in Panama to open an account, but my team in Panama also offers a remote bank account opening service for Panama corporations.

3. Open various investment accounts – equities, forex, crypto, precious metals.

A Panama corporation serves as an entity to carry out your investment and trading activities.

- You can open a crypto brokerage account with my associates Giovanna and Wi Men in Panama City.

- The corporation can also be used to trade stocks on various exchanges as well as to open precious metals storage accounts

- No tax on interest. Interest earned in deposits held in Panamanian banks is not subject to local taxes for non-residents. This is particularly beneficial for individuals and businesses looking to maximize the returns on their savings and investments (this of course does not mean you are not liably for taxes in your country of tax residency)

4. Minimize your corporate income taxes through a Panama corporation

Panama is a territorial tax regime, meaning they do not tax any income originating from outside the country if structured properly.

This includes any interest income or capital gains generated from the sale of offshore assets. Additionally, there is no legal requirement to file an income tax return in Panama if the entirety of your income comes from offshore.

Note however that corporate dividends distributed from foreign-sourced profits are taxed at 5%. But the only tax you are certain to have to pay annually is simply a $300 corporate franchise tax.

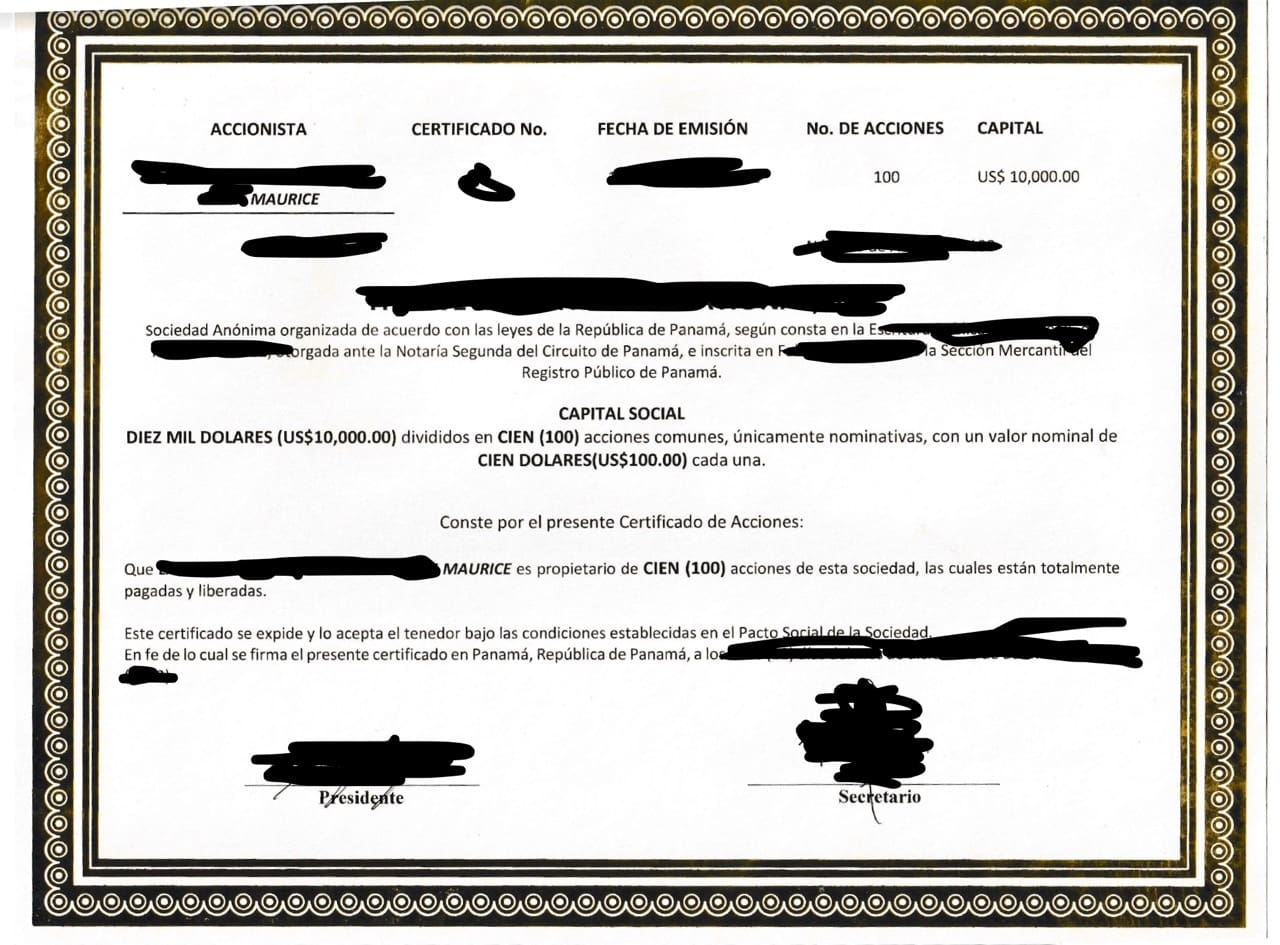

5. Privacy advantages of a Panama corporation

A Panama corporation offers distinct privacy and discretion for shareholders compared to structures available in other jurisdictions.

- Shareholder Secrecy – Panamanian law ensures that the identity of the corporation shareholders remains private. The publicly recorded Articles of Incorporation only list the identity of the directors at the time of incorporation.

- For even greater privacy a Panama Corporation can be held by a Panama Foundation, which is a trust-like local structure.

6. Strong asset protection

Panama’s banking system is often used inb conjunction with offshore entities to provide strong asset protection. This makes it an attractive jurisdiction for individuals and businesses looking to protect their assets from legal or political risks.

7. Creating a Panama corporation is easy

- Foreigners can fully own and control a Panama corporation. There is no requirement for local shareholders or directors.

- The process of incorporation a business in Panama is relatively quick and straightforward, with minimal bureaucratic hurdles.

- Panama corporations can have a flexible management structure, allowing businesses to tailor the corporation to their specific needs.

Cons of opening a Panama corporation

- Doing business with Europe is very restricted due to banking compliance departments in Europe, but much less of an issue with the US, Canada and all of Latin America.

- Moving assets to and from Panama can raise red flags in certain jurisdictions.

- Payment processors limit their services to Panama. There is no PayPal or Stripe. Wi Men and Giovanna can also help you open offshore companies to handle payment processing for you.

- Opening offshore accounts using a Panama corporation is also quite restricted. Very few countries allow you to use your Panama corporation to open an account. Most Panama banking solutions for a Panama corporation will be located in Panama and in the Caribbean.

- The process of opening a local corporate bank account for a Panama corporation can take a few months. Panama corporations are not adequate for people who want a quick solution.

Documentation required to open a corporation in Panama

A Panama corporation can be opened in a few days’ time with the proper documentation:

- Identity documents of the incorporator, such as a passport

- Registration of the corporation with the public registry

- Tax identification number (TIN)

- Business license from the Panamanian government

- Notarized Articles of Incorporation – A brief detail of the corporation’s activities and the names and addresses of the corporation’s officers and directors. This must be on public record with the Panamanian government, but the beneficiaries of the company do not have to be registered, providing a substantial privacy benefit for the owners of the corporation.

- Annual Corporate Franchise Tax (tasa unica): A $300 annual prepaid tax to the government, which is the only tax you’ll pay as a non-resident corporation.

This process can be done entirely remotely through power of attorney.

Video: Pros and Cons of opening a corporation in Panama

Wi Men and Giovanna helped me register my corporation in Panama and apply for residency. They also deal with my accounting, taxes, and helped me open personal and corporate bank accounts in Panama. I interviewed them about the pros and cons of Panama corporation.

Contact Giovanna

Get in touch with Giovanna and Wi Men to get the free brochure on Panama Corporations.

Services in Panama

- How to obtain Residency in Panama

- Real estate lawyer in Panama

- My Realtor in Panama City

- Create a corporation in Panama

Articles on Panama

- Panama City Real Estate Market: 2025 Investor Guide

- Affordable Tax-Free Caribbean Lifestyle and Real Estate

- The Pros and Cons of investing in the Boquete Real Estate Market in Panama

- How to Obtain the Panama Retirement Visa

- Panama Permanent Residency in ONE trip

- What is the Panama Travel Passport and how to get it?

- The Pros and Cons of living in Panama

- The Secret Third Way to Get Panama Residency – Company Formation for Friendly Nations Visa

- How to buy a gun in Panama – Gun rights in Panama

- Real estate for Friendly Nations Visa in Panama City – case studies

- Buying real estate in Casco Viejo of Panama City – Things to know

- Panama Tax Guide

- Remotely opening a bank account in Panama

Transcript: Pros and Cons of Panama corporations

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. Today, I’m in Panama City, and we shall be discussing the pros and cons of a Panama corporation, together with Giovanna and Wi Men who run a small family office helping people obtain residency here in Panama and run corporate structures. How are you?

GIOVANNA: Good. You?

WI MEN: Good. How is everything?

LADISLAS MAURICE: Fantastic. Great, so let’s start with the easy part. What are the pros of having a Panama corporation?

Pros of Panama corporations

WI MEN: Okay. Pros of having a corporation in Panama, of course, you can apply the residency using the corporation, the Friendly Nation Visa Program. It’s able also to open different investment accounts, such as crypto trading accounts, equities trading, forex, metals, etc. And the income tax, they have a lot of benefits, such as like offshore incomes and dividend tax here.

LADISLAS MAURICE: What are the taxes on corporate offshore income?

WI MEN: It’s actually 0% for offshore income.

LADISLAS MAURICE: Zero percent?

WI MEN: Yes.

LADISLAS MAURICE: And what about the dividend tax?

WI MEN: The dividend tax is 5% for offshore incomes.

LADISLAS MAURICE: Cool. Okay, so you can kill a lot of birds with one shot here. If you want residency, that’s the way I obtained residency here in Panama, they helped me with this. I created a corporation, I employed myself, and I now do business here in Panama and overseas using my Panama corp. I got residency. If I wanted to, I could have opened various accounts with this corporation. Right now, I’m using this corporation for both overseas and local income.

Cons of Panama corporations

LADISLAS MAURICE: What are the cons, though, because not everything is that pretty?

GIOVANNA: [laughs] Yeah, definitely. One of the cons will be doing business with Europe, it’s very restricted, and then you have a little bit of trouble also moving assets from Panama elsewhere to some countries that there might be a little bit limited or maybe Panama is red flag listed.

LADISLAS MAURICE: It works well with the Americas, the US, Canada, not an issue. Am I correct?

GIOVANNA: That’s correct.

LADISLAS MAURICE: Okay, but if you want to make a transfer to the UK, or to Germany, France, problem?

GIOVANNA: That’s correct.

LADISLAS MAURICE: Cool. Clear.

GIOVANNA: Another con would be payment processors. Panama is very limited to not being able to get, like, PayPal or Stripe. There is a local business that helps us get linked between Panama corporation and the payment processor, but it’s not a really good service and the service fees are really high. What we do is, usually, we get foreigner companies attached to Panama to help clients be able to get Stripe, or PayPal, or other payment processor they would like to get, and that way they can still take the advantages of the corporation and still have being able to collect payments from their clients.

LADISLAS MAURICE: Cool. Okay. Yeah, it just requires layering. And you do this by helping your clients open companies overseas for this to obtain the payment processing?

GIOVANNA: Yeah, that’s correct. We also linked our clients with partners we have to structure what they ever need to do together with Panama. The third con would be opening offshore accounts using Panama corporation. For other jurisdiction, you can take it and go to another country and open a corporate bank account. With Panama, it doesn’t happen that way, it’s very restricted. Very few countries you can actually take your Panama corporation and open an account there. That’s one of the main reasons also we link to other offshore companies that will help the client link everything together.

LADISLAS MAURICE: Cool. Yeah, because, ultimately, the reality is Panama does have a relatively bad reputation in the financial world, though they’ve really cleaned up their act and they’ve been taken off some of the lists and all of that. But just the history of it is just hanging in there, which just gives compliance departments at banks all over the world, especially in Europe, just a bit of a heart attack whenever they see transactions to or from Panama. But yeah, Canada, US, not an issue whatsoever.

GIOVANNA: That’s correct.

How to create a Panama corporation

LADISLAS MAURICE: Fantastic, thank you. Look, if you’re interested in creating a corporation here in Panama or in obtaining residency here in Panama, there are links below. You can get in touch with Giovanna and Wi Men, they helped me with this, and they’ll be very glad to help you from A to Z.

GIOVANNA: That’s right.

LADISLAS MAURICE: Giovanna, Wi Men, thank you very much.

WI MEN: You’re welcome.

GIOVANNA: Thank you.

WI MEN: Thank you.