Having spent most of my “peak” Covid time in Nicaragua, I have a soft spot for the country. I remember March 2020 vividly. I was exploring the San Juan Del Sur Real Estate Market as the world was locking down hard. Embassies in Managua were telling their citizens to go back home, and some were organizing free repatriation flights to North America and Europe. San Juan Del Sur quickly emptied.

I considered taking a free repatriation flight, but it was wintertime back home and everyone was under lock-down. In Nicaragua the weather was warm and sunny and president Ortega had declared that as Nicaragua is a poor country, it cannot afford lock-downs. People were told to take their own precautions.

I therefore spent about four months traveling all over Nicaragua, getting my tan on, enjoying entire beaches and hotels to myself, and even having fun at the carnival in Bluefields on the Caribbean side of the country.

What I found at the time was that the San Juan Del Sur Real Estate Market was very affordable. Now that I am back in 2024, I see substantial infrastructure development and a fast-growing expat community.

Table of Contents

What is the forecast for Nicaragua real estate?

Real estate prices in San Juan del Sur have not recovered since their 2018 crash. Prices are likely to gradually increase over the years because the price gap compared to neighboring Costa Rica and Panama is too wide and suggests good potential for appreciation in the coming years.

A bit of background on Nicaragua

Nicaragua was a focal point of the Cold War where America and the Soviet Union fought for domination starting in the 1960s until the late 1980s. A civil war pitted left-wingers and right-wingers against each other that drove the country deep into poverty.

Things cleared up in the 1990s with the center-right winning elections and governing until 2007. That year, Daniel Ortega, one of the Cold War era left-wing heroes, democratically won the presidential elections. He has remained at the helm since.

He proceeded to consolidate his power by removing constitutional term limits and taking control of the local media. Also, he aligned Nicaragua’s foreign policy to Iran, China, Russia, Cuba and Venezuela; a true affront to Uncle Sam.

Violent protests took place in 2018 which put Nicaragua in the spotlight.

Since then, the West has implementing sanctions, with Nicaragua being labeled a member of the “Troika of Tyranny” by then Secretary of State John Bolton. The other “lucky” members of the “Troika” are Cuba and Venezuela.

This means that Nicaragua is under (relatively light) US sanctions.

Now that you have a basic understanding of recent history, let’s look at the economy, which is doing much better than what Western media would want you to believe.

Why is San Juan del Sur popular?

San Juan del Sur offers an affordable lifestyle combined with great weather, beaches, and a fun expat community.

The Economy in Nicaragua

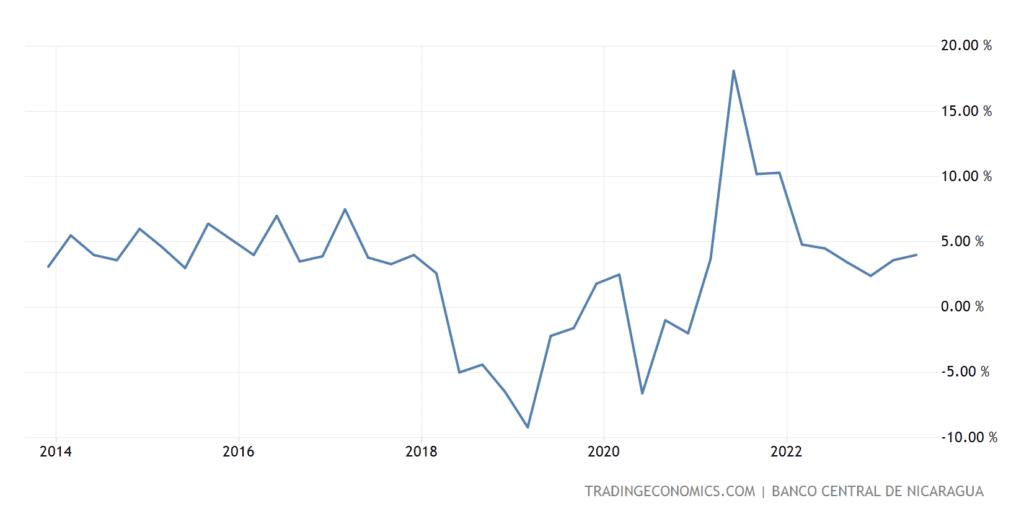

Though Nicaragua remains the second poorest country in the Western Hemisphere after Haiti, GDP growth was quite stellar throughout Ortega’s reign in power but the protests, subsequent sanctions of 2018, and Covid derailed the positive trajectory temporarily.

However, the situation has improved, and the outlook is positive. We’ll discuss this in detail.

Good headline growth

Even though everyone keeps talking about El Salvador, the reality is that Nicaragua is the Central American country with the highest economic growth. This barely ever gets mentioned in Western media because it goes against the mainstream narrative. We’ll see a bit below in this article why Nicaragua is experiencing such growth.

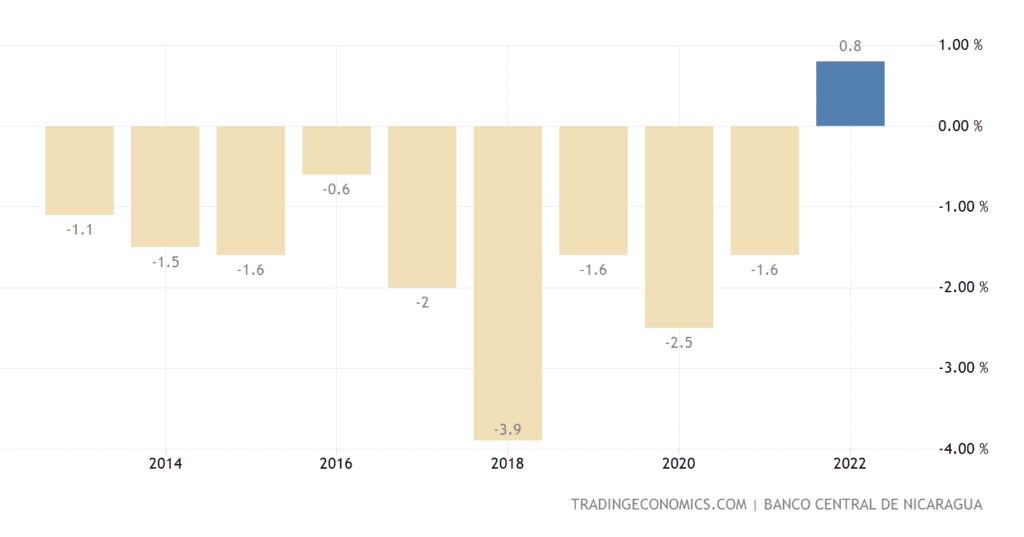

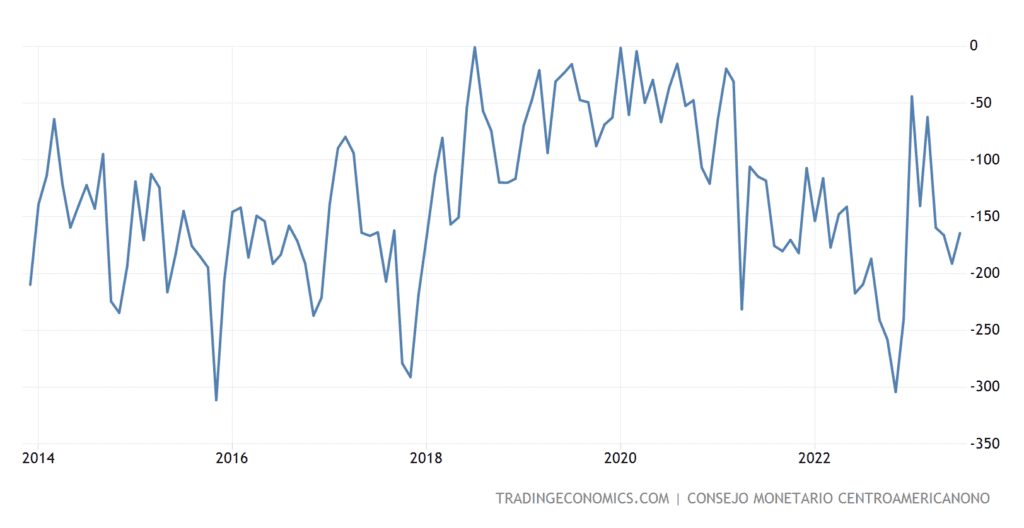

Well-managed and resilient government finances

Concerning the government budget, you will notice that the left-wing Ortega is actually better at managing it than most conservative Western politicians. The deficits persistently remained below GDP growth until the 2018 protests, subsequent sanctions, and Covid. Recently, the government budget has gone into surplus. Nicaragua manages its finances better than Uncle Sam, despite being under sanctions.

Counterintuitively, the 2018 protests were triggered by social security reforms. The government could foresee that social security was on an unsustainable path, and decided to enact tough reforms in order to protect the system in the long run. Most Western countries, including America, have failing social security systems but scarcely any reforms are implemented or even discussed.

Combining decent growth with a budget surplus is a great way to manage one’s debt burden and to ensure the country’s sovereignty, especially when facing sanctions which make access to the capital markets hard and expensive.

The Ortega government clearly understands the situation that it faces, and has learned from countries in similar situations.

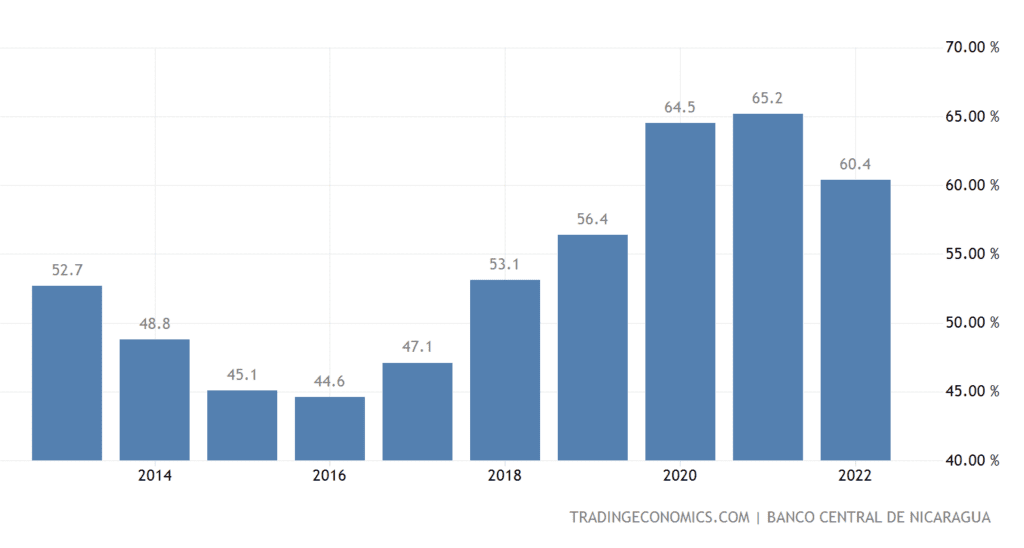

Typically, Western sanctions create chaos in an economy. However, what prevented Nicaragua from imploding is the same thing that prevented Russian from imploding: high foreign exchange reserves.

Since 2018, the government has prioritized resilience against external shocks. This means manageable debt levels, a tightly-run government budget, and high foreign exchange reserves.

An unsophisticated economy

Nicaragua unfortunately imports more than it exports, and the economy is poorly industrialized. The main exports consist of agricultural products. The larger export categories include wires and textile, but the local value-add is not very significant.

However, I believe that the Nicaraguan economy will become more sophisticated over time due to massive infrastructure development which we will discuss later.

Western Media lies about the state of the economy in Nicaragua

Western media likes to portray an image of a poor, crumbling country that has no prospects as long as Ortega is in power.

We just had a look at the actual numbers. The economy is doing just fine despite western pressure and sanctions.

Therein lies the investment opportunity in Nicaragua; the gap between the perception of Nicaragua’s economy and the reality of the economy.

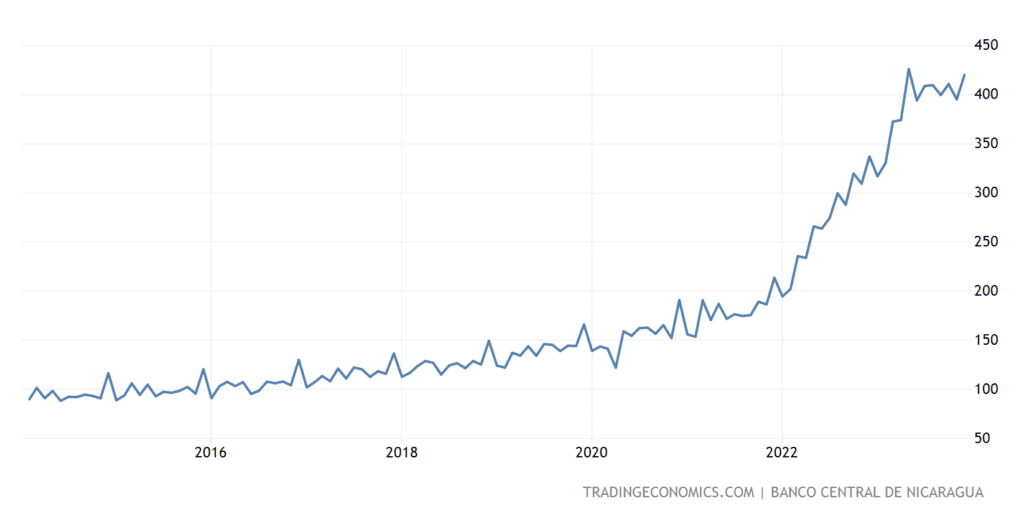

Remittances are a saving grace for the economy

Though it doesn’t appear in the numbers, Nicaragua’s main export is people.

Since the Democrats opened the border and the US labor market is relatively strong, Nicaragua has been fortunate.

- Many more Nicaraguans are trying their luck up North

- Wages have gone up substantially for low-income earners in the US due to a tight labor market

- More money is thus being sent back home to Nicaragua

Though lower than El Salvador’s 27%, Nicaragua’s remittance represent 20% of GDP. Instead of sitting at home and being unemployed or underemployed, hardworking people rather move to the US and send money back. For the Nicaraguan economy this is very positive. An estimated 6.5% of the Nicaraguan population moved to the US during the Biden administration.

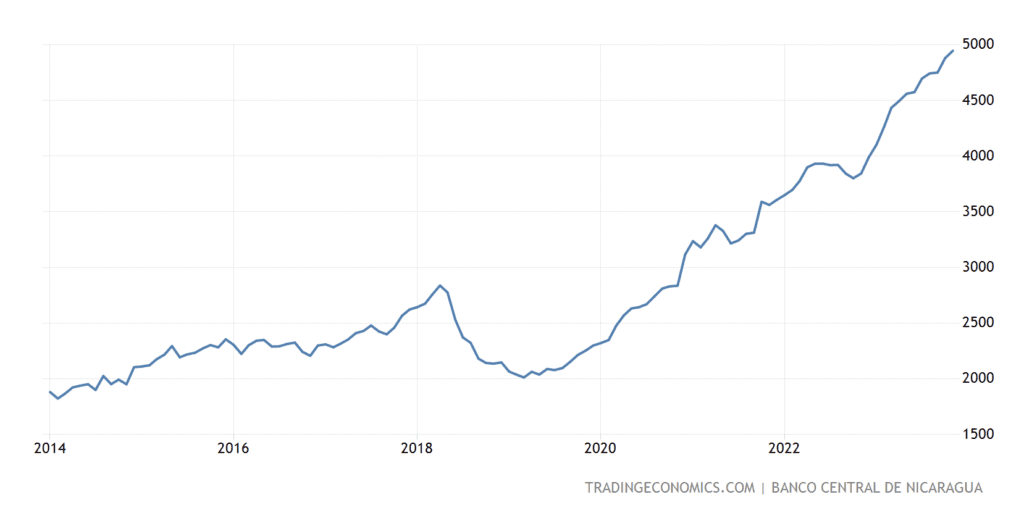

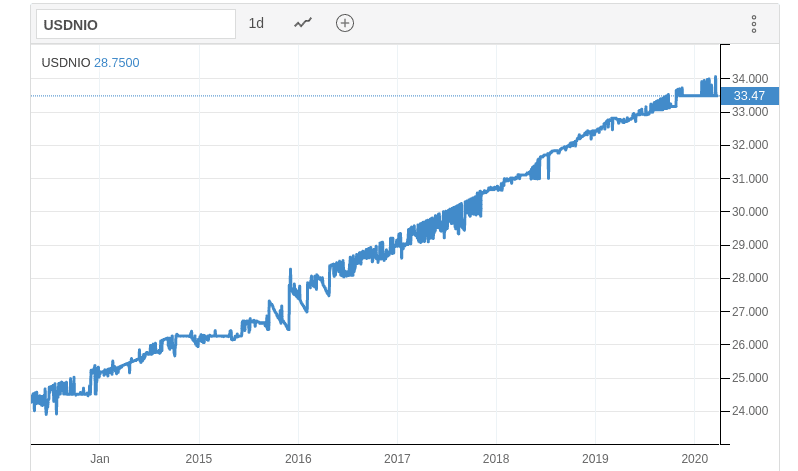

A gradual depreciation of the Nicaraguan Cordoba

The result of all these factors has been a gradual depreciation of the Nicaraguan Cordoba, which enables the country to remain competitive. You’ll notice that the smooth descent is clearly managed by the central bank.

Managing their own currency is a big plus. This becomes abundantly clear when traveling between dollarized El Salvador and Nicaragua. The cost of living is much lower in Nicaragua, thanks to this constant devaluation. Though El Salvador has a lot going for it, it is not competitive yet when it comes to input costs for people who want to invest there, due to the country’s dollarization.

What is the cost to live in Nicaragua?

The cost of living in Nicaragua is the lowest in Central America, and amongst the lowest in Latin America.

How much is a beer in San Juan Del Sur?

Typically $2-$3 USD per beer. It varies from bar to bar.

Catalysts for the San Juan Del Sur Real Estate Market and the economy in Nicaragua

Ultimately, making a real estate investment in San Juan Del Sur is tied to the health of the Nicaraguan economy. These are the key developments which I feel will be positive, in the long run, for the real estate market.

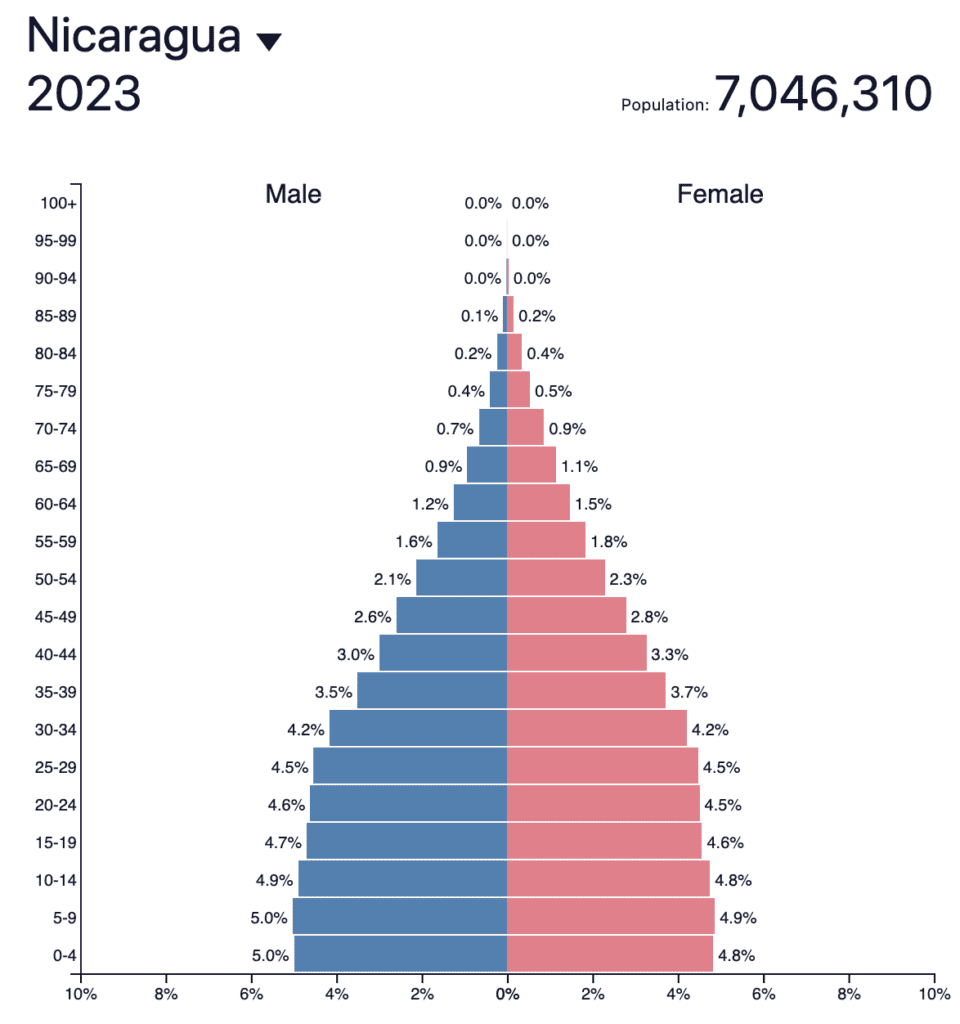

Very healthy demographics in Nicaragua

This healthy demographic pyramid makes Nicaragua an interesting long-term investment play. It is one of the few countries in Latin America with a positive fertility rate of 2.3 children per woman, which means long term population growth.

Also, with urbanization, more people will move to economic centers such as San Juan Del Sur, especially with foreign direct investment flowing in, which will inevitably put long term pressure on real estate prices in town and in the surrounding areas.

What is the population of San Juan del Sur Nicaragua?

The population of San Juan del Sur is about 16,000, half of which are in SJDS itself, and the other half in surrounding rural areas.

Much lower prices in San Juan Del Sur real estate market than in similar destinations in Central America

The Covid effect bolstered many real estate markets thanks to a deluge of North Americans and Europeans leaving their countries to work remotely, live a more affordable lifestyle, and look for more personal freedom.

Real estate in expat-focused towns in Panama, Costa Rica, and Mexico surged and have stayed high. In the San Juan Del Sur Real Estate Market, prices dropped about 30% following the 2018 elections, and have since been consolidating. The result is that San Juan Del Sur is now MUCH more affordable than comparable destinations in Costa Rica for example. Prices are almost half of what they are across the border. Eventually the market will reduce this difference.

Ongoing exodus from North America and Europe

People are leaving North America and Europe for all sorts of reasons:

- some just want more sunshine and a more laid-back lifestyle,

- others want to reduce their taxes and take advantage of Nicaragua’s very low taxes

- others want to flee toxic politics back home, whichever “side” they are on

- some want the ability to homeschool, which many expats do in Nicaragua

- some want a more affordable lifestyle

- some don’t want what they perceive to be forced medical procedures, which Nicaragua never imposed

Most people fit across a few of these categories. The fact that San Juan Del Sur now has fiber optic internet is a game-changer. When I was here in 2020 the internet was a little slow, but now remote work is a non-issue.

Back in 2020, most expats in San Juan del Sur were either surfers or retired people. Now, the crowd is much more diverse. A lot of remote workers moved down here, as well as a ton of families, especially Canadians.

Uniquely, San Juan del Sur boasts 2 international schools, and a third one is about to open. This is an amazing competitive advantage for San Juan del Sur real estate.

Essentially, if you have kids and want to live in Nicaragua to take advantage of the sun, freedom, and low taxes, you will have to choose between the capital city of Managua (ugly) or lovely San Juan del Sur.

Healthcare must also be mentioned; it is entirely free and of decent quality. In a world where US healthcare bankrupts people, and where service is increasingly poor in Canada, this will be yet another strong selling point for people to move to Nicaragua

Big coastal highway being built that passes right by San Juan del Sur

The government started works on a coastal highway in the second half of 2023. This highway will pass by San Juan del Sur and dramatically decrease the journey to and from Costa Rica, which should drive tourism.

Currently, the roads along the coast are mostly dirt roads, and people instead must go along the lake.

As Costa Rica is a tourism and expat powerhouse, the trickle effect will be significant.

Locals kept saying the highway would be built within two years, but I was a little skeptical. So I hired a cab to go check out the project.

Construction has started, there’s no denying this, but it is still very early stage. Most of the companies that got the building contracts are local and Costa Rican, which makes me think that there will be delays.

To be conservative, I think real estate investors in San Juan del Sur should keep a 5-year timeline on this specific project before expecting an impact. Having said this China is in talks with Nicaragua to join the project. If this were to materialize, I would immediately bring this timeline forward.

When China decides to build, it builds fast; I’ve seen it everywhere in the emerging world. China’s recent involvement in Nicaragua is very bullish.

China is investing in Nicaragua BIG TIME

In 2021, Nicaragua was left no choice but to dump its recognition of Taiwan and go for China instead. Being under US sanctions, it made zero sense to support Taiwan as it needed geopolitical and financial support.

Within three years the relationship with China has advanced at a furious pace, with Nicaragua included in China’s “Belt & Road Initiative” for infrastructure development. As such, a flurry of deals are being signed with Chinese private enterprises and state owned enterprises.

The second half of 2023 was the “unveiling” of what it means for Nicaragua:

China will build a new international airport in Managua

China has signed a deal with Nicaragua to build a new International Airport, which will be the country’s second. It’ll be located near the capital city Managua and will be built thanks to $400 million of loans from China, at preferential terms. The airport will have a capacity of 3.5 million travelers per year. Works are expected to start late 2024.

China will build new railways in Nicaragua

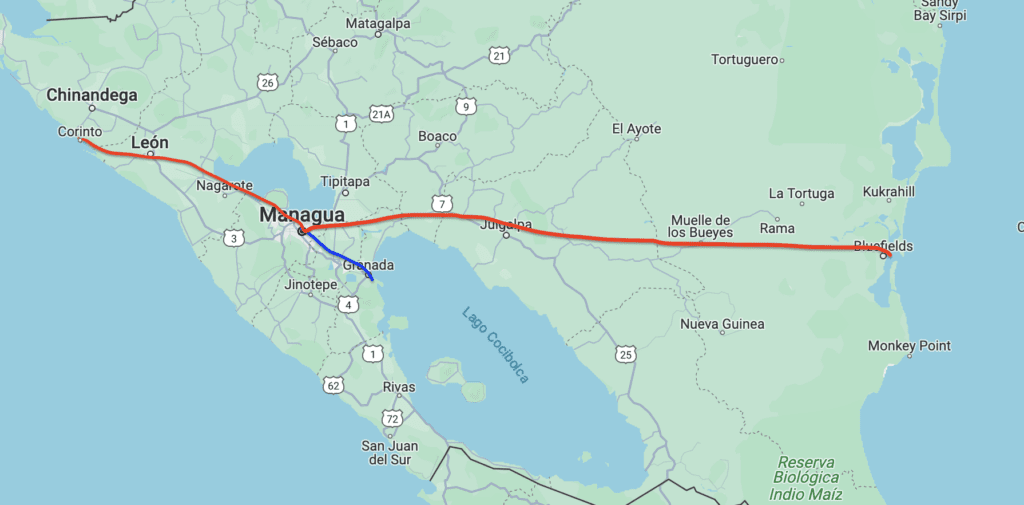

This will be a real revolution for Nicaraguan logistics. Contracts were signed to start the engineering studies, to be done by Chinese companies, to build two railroads:

- One connecting Managua, Masaya, and the historical town of Granada, effectively creating a “Greater Managua”.

- The second railroad is to link the Pacific Coast port of Corinto, to Managua, to the Caribbean port city of Bluefields.

This is huge. Effectively China wants to create a small alternative to the Panama Canal, in a pro-China jurisdiction. Obviously, the cost of transport will always be more expensive here than through the Canal, but China simply wants to establish alternatives and reach strategic depth in the region.

Plans for a new canal

Let’s be clear here, I have doubts that such a canal will materialize, especially with the new railroad being built. 10 years ago a similar plan had also been announced, but nothing came to fruition. None of my thesis on investing in Nicaragua is based on this canal, but nevertheless this topic has to be mentioned as a potential major catalyst if it were to materialize.

Increasing Nicaragua’s energy independence

A LNG / Gas storage and regasification plant will start operations later in 2024. This will be Central America’s third LNG terminal. Combined with a new hydroelectric project the Chinese are working on, this will vastly increase Nicaragua’s energy independence, and lower the cost of electricity, which is bullish manufacturing.

Nicaragua now has a free trade agreement with China

This is huge. Since January 2024 Nicaragua has a free-trade agreement with China.

Are you starting to see the picture now? China is making Nicaragua its main economic base in Central America and will continue to pour investment into the country. Already many Chinese are moving to Nicaragua, and Chinese private businesses are mushrooming everywhere.

China is building the infrastructure on lenient terms, is making Nicaragua much more resilient to external shocks, is increasing the capacity of the economy, is making it more energy independent, and is offering preferential terms to Nicaraguan exports.

This is very bullish the Nicaraguan economy, regardless of what Western media wants you to believe.

Where to buy property in the San Juan Del Sur Real Estate Market?

San Juan del Sur and the region are absolutely lovely, but the neighborhoods are all very different. Where should you buy? It depends on what you are looking for.

Is Nicaragua a good real estate investment?

Nicaragua offers some of the most affordable real estate in Latin America, in spite of being close to North America and having amazing nature and tourism opportunities. It is a deep value play as over time prices are expected to rise and the gap between Nicaraguan real estate and Cota Rican real estate is expected to diminish. Investors in real estate in Nicaragua should know that rental yields are not particularly strong though. Nicaraguan real estate is mostly a long term capital gains play.

Can foreigners own property in San Juan Del Sur?

Yes, foreigners can absolutely own property in San Juan del Sur, both in their own name or in the name of a company.

Having spent a significant amount of time in San Juan del Sur, this is how I break down the neighborhoods.

Buying real estate in el Centro, San Juan del Sur

The center of town is where most of the action takes place. This is where you will find all the cute shops, most restaurants, stores, services, and a few bars. It is very lively all day long. Importantly, this is where there is the most rental demand. If your aim is high occupancy, this is where you should invest. The issue is that not much is for sale.

That said, el Centro is starting to change. Most buildings in El Centro are one or two stories high. The municipality allows construction of up to three stories. So inevitably, and it is already starting to happen, additional stories are being built which will increase the capacity, of the Centro.

More people will live here. More businesses will open. San Juan del Sur will increasingly be a vibrant town rather than an oversized village. Already, old houses are being priced at $1,000 per m2 or $90 per ft2 of land.

“Loud”

This area is where most nightclubs are found. It’s acceptable during the day but at night it can get loud, especialy on weekends. If you live here and are into partying it’s fine, but for rentals you will either get bad reviews for noise if you don’t have the proper disclaimers, or attract a party crowd. Just be aware of this before buying in this area.

“San Juan del Sur hills”

This area has stunning views and features several high-end gated communities. Land lots have amazing views. It’s not a bad play for long term appreciation. The only downside is that you won’t get sunset views due to the orientation of the lots.

“Speculation”

This area is nothing to look at right now, and is relatively cheap. But from a speculator’s point of view, development here is inevitable. It’s walking distance from the Centro which will undoubtedly develop further and spill into this area.

Barrio Las Delicias “very affordable living”

This neighborhood is nothing special, apart from the fact that it is a short drive away from town and that it remains affordable. It’s still a very local area, but foreigners increasingly move here because it is pleasant, well located, and reasonably priced. The new highway will pass through here as well. I expect capital gains in this area.

“Locals”

This barrio is almost exclusively locals, and only very few foreigners move here. There’s no point in looking at this area when Barrio Las Delicias is so affordable and pleasant.

Buying real estate in La Talanguera, San Juan del Sur

This is “the other side” of San Juan del Sur. On the map it looks very nearby, just across the river. But there’s a catch:

- Yes, it’s close to town. You can walk to town through the beach or take a bike when the river is low.

- Otherwise, you must drive ten minutes all the way around to get into town, about $5 by taxi

Long term, the municipality plans on linking up the two sides of town through infrastructure development, which would be very welcome. But there’s no telling when this will materialize.

Currently, apart from the few beachfront properties, prices are at a discount to the Centro, but over time I expect prices to increase here. It’s a premium area where wealthy Managua families have holiday homes.

Pacific Marlin, San Juan del Sur

This is an iconic development on the Jesus hill boasting expensive homes, with full sunset views. Some of the most expensive real estate in San Juan del Sur is located here. You won’t get an ROI renting out properties here. It is a lifestyle play that costs a fraction of what it would in nearby Costa Rica.

Video: Quality, Affordable Seaview Real Estate in San Juan del Sur

My San Juan del Sur realtor Natalie showed me this really nice house, a short drive from town, with amazing sea views and an infinity pool. This is the type of house that expats and particularly families are looking for when moving down to Nicaragua.

Case Study #1: Long-Term Rental Property Cash Flow Analysis in San Juan del Sur (ROI / Cap Rates)

This 2-bedroom 2-bathroom condo is located in a well-kept gated community in La Talanguera with direct beach access. It is listed for $190,000 and includes all furniture. Though if I were to buy I am sure I could negotiate it down to $190,000 including closing costs, or less.

| Price | $190,000 |

| Closing costs of 6.5% | $12,350 |

| Maximum negotiated price WITH closing costs | $190,000 |

| Gross Revenue ($1300 * 12) | $15,600 |

| Revenue @ 90% occupancy | $14,040 |

| Property management $100 per month | $1,200 |

| Commission on finding tenants (10%) | $1,404 |

| Maintenance allowance | $750 |

| HOA, Insurance, Property Tax @ $450 pm | $5,400 |

| Total yearly costs | $8,754 |

| Total all-in price | $190,000 |

| Net yearly income | $5,286 |

| Net rental yield / cap rate | 2.8% |

Given the yield, this is not particularly interesting as a long term-rental. But for lifestyle the price is very attractive. A similar condo in Costa Rica, with pool and direct beach access would be much more expensive. Now let’s do the numbers for this San Juan del Sur property for Airbnb.

Case Study #2: Short-Term Rental Property Cash Flow Analysis in San Juan del Sur (ROI / Cap Rates)

| Price | $190,000 |

| Closing costs of 6.5% | $12,350 |

| Maximum negotiated price WITH closing costs | $190,000 |

| High Season mid December – end April $200 per night @ 60% occupancy | $16,200.00 |

| Low Season May – mid December $150 per night @ 50% occupancy | $16,875.00 |

| 20% average discount for extended stays | $6,615.00 |

| Gross Revenue | $26,460.00 |

| Property management $100 per month | $1,200.00 |

| Commission on finding tenants (20%) | $5,292.00 |

| Maintenance allowance | $1,000.00 |

| HOA, Insurance, Property Tax @ $450 pm | $5,400.00 |

| Electricity $250 per month | $3,000.00 |

| Internet | $500.00 |

| Total yearly costs | $16,392.00 |

| Total all-in price | $190,000.00 |

| Net yearly income | $10,068.00 |

| Net rental yield / cap rate | 5.30% |

The cap rates are noticeably better for short term rentals. What is important to note here is the 20% discount for weekly and monthly rentals. Realtors will be quick to point out high daily rental rates, but the reality of the San Juan del Sur real estate market is that it’s typical of guests / tenants to book for a few weeks or a few months. Generous discounts are typically given to such tenants.

Friendly taxation

As a member of the socialist “Troika of Tyranny” Nicaragua taxes its citizens a lot less than the supposedly free countries of the West. The most interesting feature is that Nicaragua has a territorial tax system. This means that Nicaragua will tax residents on Nicaragua-sourced income ONLY.

So let’s say you live in Nicaragua, and you have tax free income in Panama. You won’t have to pay anything to the Nicaraguan tax authorities.

Other taxation features:

- Corporate income tax of about 30%.

- Progressive personal income tax rate of up to 30%, with non-residents paying only 15% on Nicaragua sourced income (including rental income)

- Capital gains taxes of 10%.

- Minimal property taxes

So while Nicaragua is not a low tax country, the numbers aren’t extreme. Furthermore, the territorial aspect can prove to be extremely advantageous with proper tax planning.

Risks of investing in Nicaragua real estate market

Obviously, there are risks. As with anywhere on the Pacific coast in Central America, Tsunamis and earthquakes are a concern. If you want to mitigate this risk opt for houses in the hills that were recently built according to seismic standards.

There are also economic and political risks if the US were to foment internal chaos in Nicaragua.

There’s a reason real estate in Nicaragua comes at a discount, but I feel that the risks are substantially overestimated by people.

Who is San Juan Del Sur Real Estate Market right for?

Investors hoping for great cash flow should stay away from the San Juan del Sur real estate market. This is not the play. I believe that San Juan del Sur is much more appropriate for:

- Investors who target long term capital appreciation. It is some of the most affordable Central American, Pacific Coast, expat town real estate. And as the infrastructure and connections with Costa Rica improves, there will be a spillover effect.

- People who actually want to live in San Juan del Sur. This is a no-brainer as the territorial tax system alone will save them a lot of money. This is where the true ROI is. Sure life is affordable and pleasant, but the tax advantages are massive.

- People who want to live part time in San Juan del Sur. As lifestyle real estate, San Juan del Sur is great. Moreover, you can easily rent out your property when you are away, which will more than cover the on-going costs. And in the meantime, you have good value real estate overseas with decent prospects of capital appreciation.

- Investors who want to diversify away from a Western-centric portfolio.

Personally, I like it. I left my Power of Attorney to my real estate lawyer in Nicaragua and Natalie lets me know when there is a deal that fits my brief.

Connect with the right realtor in San Juan del Sur, Nicaragua

Natalie is originally from Pennsylvania and has been living in Nicaragua for close to 20 years. She is married to a local and knows the San Juan Del Sur Real Estate Market very well. She’ll be able to help you with all your real estate needs in and around San Juan del Sur.

Services in Nicaragua:

- My favourite realtor in San Juan del Sur, Nicaragua

- Create a company in Nicaragua

- How to obtain Residency in Nicaragua

- My Real Estate Lawyer in Nicaragua

Articles on Nicaragua:

- A Real Estate Investment in Managua or Gran Pacifica, Nicaragua?

- Investing in a Teak Wood Plantation, is it worth it?

- Full analysis of the San Juan del Sur real estate market

- Why buy a house in San Juan del Sur, Nicaragua – great value in Central America

- Low EMF housing in Nicaragua

- Pros and cons of living in Nicaragua

- $65,000 beachfront land plots near Managua, Nicaragua

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

I hope this finds you well. This was a very interesting article and very detailed. I have been to Nicaragua many times and continue to go down pretty frequently. My comment to you is more of a question. What are your thoughts on the Popoyo area of Nicaragua? From what I have seen, they are similar in ways of beachy, surf community that is cheap and attracts tourists and expats. However, I feel like the Popoyo area is not as developed and has a smaller population. This new highway being built will pass through this area as well, which i believe will grow the development and maybe the area as a whole. Do you have any thoughts on this area? Do you see it growing in the near future? Any information you might have on this area in Nica and its real estate market would be greatly appreciated.

Absolutely. I’m long-term bullish Popoyo. Natalie has some listings there, you can get in touch with her: https://thewanderinginvestor.com/services/international-real-estate-services/realtor-in-san-juan-del-sur-nicaragua/

Thanks for referring me to Natalie. I was wandering if the China loans to Nicaragua for infrastructure contained provisions in case of default that China would obtain ownership of land in Nicaragua? Like the IMF and debt for nature swaps.

In your opinion would China have such influence that they could implement a China social credit digital currency? Theirs is programmable so that everything can be monitored. The US is full steam ahead on the digital dollar, the US version of CBDC. Thank you!

I don’t know, the contracts are not publicly available. As for the CBDC scenario, most governments in the world like it. Luckily, some countries will be too weak for a while to implement it.

I have the same question as Elise above. Looking forward to your thoughts.

All I can say is WOW the potential is exactly what we are looking for, we are looking to leave the USA and the Philippines and I spent 2 years researching a place to live, Costa Rica, is a NO, then by accident after looking at Europe and Asia I found Nicaragua, first Granada then the Surfing area.

We are semi retired but prefer to do a business to stay active.

I spotted land for sale that boasts only water you have to install solar and windpower.

That is us.

We have another couple also coming with us. What sold me is CHINA investment in infrastructure. Great article.

Thank you. Just be mindful of the low liquidity of the market, and negotiate hard when buying.

Thank you. Feel free to reach out to Natalie. She’d be happy to help.