Fundamentally, this article is not only about investing in a teak wood plantation, but also about various types of such packaged investments. Maybe you’ve stumbled upon in-flight magazines or websites that promise high returns for agricultural and forestry investments.

The schemes invariably work this way:

- You buy a parcel within a plantation or field.

- The operator plants the trees for your wood, mangoes, avocados, coffee, walnuts or does something similar for aquaponics.

- The operator takes care of the everything for you.

- The returns kick in after a few years once the trees are grown and start producing. You are generally promised (very) high returns.

I was always very skeptical of such schemes. This skepticism stemmed from two factors:

- The numbers seemed too good to be true.

- My own biases; I have very little understanding of agriculture and forestry, and my investment outlook is typically shorter than the 25 years teak wood requires.

I went to a teak wood plantation investment project in Nicaragua

Following my articles on investing in Nicaragua and on real estate in Granada and San Juan Del Sur, a property developer contacted me and asking me if I was interested in checking out his ocean-front development near Managua. Whilst doing a bit of background due diligence, I found out that this developer also owns a teak wood plantation in which investing is possible.

I had happily been in Nicaragua for three months because of governments shutting down the world. Objectively, I had time to kill and was quite intrigued by the opportunity to finally see one of these projects.

Disclosure: The developer offered me a return trip from Managua to his development (one hour drive each way), and two nights of accommodation in a lovely ocean-front apartment. He mentioned that he would like me to write about his projects. I accepted, with the condition that I would write whatever I want to.

A bit of background on the teak market

Teak is historically native to South East Asia. The British empire then “disseminated” it across its colonies in India, Africa, and the Caribbean. Teak is predominantly used for home construction and high end furniture that can last for centuries. It is an extremely solid wood, particularly known for its properties that lend it to being used in boat manufacturing.

Teak’s core qualities are that it is resistant to termites, fire, rot and fungus. No wonder it is in such demand.

Teak’s two biggest markets are India and China, with India being the number one importer in spite of having a substantial local source of teak.

In 2014, the Burmese government started imposing drastic policies to restrict the logging, and export of teak. As Myanmar represented 75% of the export volume, this resulted in extreme tightness in the global teak market. This meant that new sources of teak had to be found, mostly stemming from plantations rather than the natural type found in Myanmar.

Latin America is now a large “producer” of teak wood, mostly driven by private businesses, with Brazil and Panama taking the top two spots. The weather and climate are perfectly adapted to teak trees.

Teak trees typically get harvested after 25 years. So when investing in a teak wood plantation, you are looking at a (very) long term investment.

What is the pitch of the Teak Wood Plantation operator?

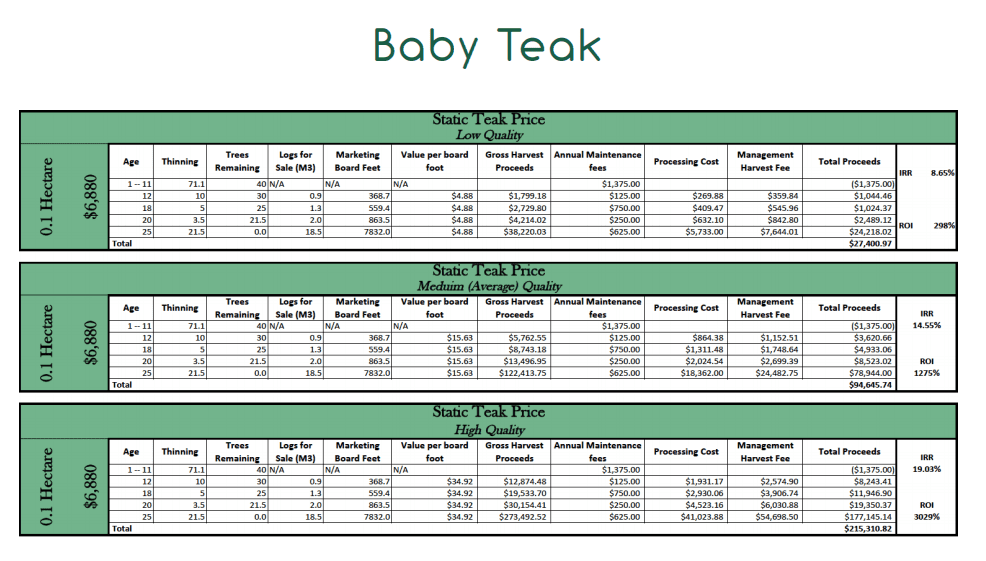

Teak prices have grown 5.5% per year on average over the past 40 years. If you were to invest $6,880 to get a 0.1 hectare parcel of teak wood, these are the projections according to the operator.

It is a very “different” type of investment. You pay upfront for your parcel and trees, and you are then expected to pay $500 on a yearly basis for the maintenance of your parcel. “Thinning”, which means removing the weak trees to make space for the good ones, takes place on a regular basis but starts earning money in year 12. The bulk of the money is made at year 25 when all the trees get chopped and sold.

Depending on the quality of the teak which emerges from your parcel, you can expect returns of between 298% and 3029% over the 25 year lifespan of the investment, for an initial investment of $6,880 per 0.1 hectare. These numbers are in constant dollars, so should be higher in nominal terms taking inflation into account. It’s noteworthy that you don’t buy a share in the project, but rather actually own the land in your name.

Sounds promising?

I was intrigued and jumped onto my horse to go learn about investing in the Teak Wood plantation

From the Gran Pacifica resort, the horseback ride took about 45 mosquito-infested minutes. The plantation is part of the massive land package that the developer owns along the coast.

Once we reached the plantation, I saw…trees.

This is great, but to be completely honest with you I have no idea about trees. I’m not a tree expert. All I can say is that the trees were there, and that they didn’t look like they were falling apart. Additionally, I noticed that security was going around, and that the path to the plantation was well trodden.

So what did I learn from this?

- Security is a must. People could sneak in at night and cut down the trees for cash.

- You are VERY dependent on the operator. If he goes bust, you end up with land in the middle of nowhere with trees that are vulnerable. You’d have to gang up with the other parcel owners to find a new operator. Good luck.

- The investment is in the middle of nature, and the mosquitoes are there to remind you of this. These trees are vulnerable to fire, fungus, insects, diseases in their first few years. Is it likely that bad things happen to your trees? Not really, but you must take this risk into account. A competent operator can mitigate these risks.

- Trees are good for the environment, and this teak plantation creates local jobs.

Most importantly, I learned that I know next to nothing about the teak market. It is not a very transparent market due a lot of illegal logging happening in many places. Additionally, data from the biggest market, India, is notoriously unreliable.

There are so many known unknowns, and unknown unknowns.

We can have a fairly good appreciation of what the teak market is like currently, or next year, but in 25 years from now? Anyone’s guess is as good as mine. There are so many trends that could impact it, that it is impossible to know or even estimate.

On the one hand:

- India, the biggest market, is growing both economically (though not this year) and demographically.

- Environmentalists might like trees as a source of construction material, as it is renewable.

- More countries could impose export bans on trees thus driving prices up.

- Owning real assets in turbulent times is great. Actually, if high inflation were to show its ugly face within the next 25 years you’d be very glad to have such an investment.

- and so many unknown unknowns.

But

- Indians might stop being that interested in teak, or the Indian government could ban teak imports to drive the local forestry industry. India is well known for its self-defeating protectionist measures.

- The historically biggest source of teak, Myanmar, could start officially exporting again which would result in a massive supply increase.

- Environmentalists might not like teak trees because transporting them far away requires CO2-heavy transport and chopping trees is generally not cool.

- Nicaragua could ban the export of teak trees, which would mean you’d be restricted to the local market which would drastically lower the value of your investment.

- and so many unknown unknowns.

The lists for both positive and negative developments are endless.

In other words, I don’t know, and nobody knows

What is within our control as investors is making sure the operator is honest. So sure, the operator makes good money upfront when selling the parcels. Planting 70 trees and a 0.1 hectare parcel in the middle of nowhere doesn’t cost that much, but one has to take a step back before accusing the operator of price gouging.

Organizing such an operation is not easy, and takes a lot on constant effort. Also, as individual investors, investing in forestry projects is hard. If you want fatter margins then go ahead and buy your own hectares, get someone to plant your trees, other people to maintain them and ensure there is security, and finally get competent people to do the thinning and selling for you.

This particular developer and operator has been operating all over Central America since 1996 and has ambitious plans for its community at GP. He owns a massive 1100 hectare land bank on which both GP and the teak plantation are located, including 3.5 miles of prime beachfront land.

You just need to make sure the operator will be around in 25 years time, as you are dependent on him for your investment. That said, this particular developer has a solid track record, and also owns communities and developments in Panama (450 hectares) and Costa Rica (105 hectares).

Should you be investing in a teak wood plantation?

To be honest with you, it depends on your particular situation. I see this investment as interesting for 3 types of people.

- You are in your thirties or forties, do not need liquidity, and want an investment that matures when you are about to retire. I’d say this is for people that have at least $500,000 of investable assets overall, as having money locked in for 25 years can become an issue. Buying a $6,880 parcel for a 1.4% allocation to such an investment is not unreasonable. Diversification is key, and this is definitely something very different. Just don’t overexpose yourself to such investments. For someone who just wants to buy something and forget about it, this could fit the bill.

- You want to leave a legacy to your grandchildren. Having an investment mature in 25 years, and that thoroughly lacks liquidity, is potentially adequate to ensure your grandchildren don’t blow their inheritance on alcohol, women, cars and other frivolous pursuits.

- The Nicaragua investor visa. You are expected to invest at least $30,000 in an active business to obtain this visa, which is granted for 5 years and is great on many levels (I’ll write an article on this). Typically, just buying a house and claiming to be running an Airbnb operation is enough. But, for $30,000 you won’t get anything interesting so you’d have to spend more money. If you don’t want to spend more money your options are quite limited. You can make a private placement with a business that needs money (which will take time to find), or just buy a few parcels of teak wood. The operator offers resale services, at the hefty commission of 15%. But if you wait 5 years until you’ve applied for citizenship, the teak should have appreciated so you should still turn a profit. That said, liquidity is low so you’d have to be patient. Buying into such a Teak project is probably the fastest way to obtain residency in Nicaragua.

Overall, I see quick and easy residency in Nicaragua as the main use-case of such an investment.

There are a lot of scams taking place in such alternative investments

Just make sure you choose your operator wisely.

What I like about this particular developer is that he has skin in the game as his main business is the massive communities he is developing all over Central America. The teak wood plantations are just a side business, so he wouldn’t want this side business to cause him reputational damage.

Don’t overexpose yourself and manage your expectations. But overall, such an investment does have a place in some portfolios.

You can find the developer brochure and a lot of information on investing in teak wood, and on the residency program by clicking here.

The developer also has Teak Wood investment options in Panama, which can lead to residency as well. If you prefer Panama, just ask the developer about that when getting in touch with him.

Services in Nicaragua:

- My favourite realtor in San Juan del Sur, Nicaragua

- Create a company in Nicaragua

- How to obtain Residency in Nicaragua

- My Real Estate Lawyer in Nicaragua

Articles on Nicaragua:

- A Real Estate Investment in Managua or Gran Pacifica, Nicaragua?

- Investing in a Teak Wood Plantation, is it worth it?

- Full analysis of the San Juan del Sur real estate market

- Why buy a house in San Juan del Sur, Nicaragua – great value in Central America

- Low EMF housing in Nicaragua

- Pros and cons of living in Nicaragua

- $65,000 beachfront land plots near Managua, Nicaragua

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Australian teak can grow in India….and which variety…tell me all details…

Well

1. You don’t have to wait 25 years to get your return. You may settle the contract in such a way you can sell all your share or part of it at any time.

So, if before the final harvest you want to get some of your return, you may evaluate your share based on variables like land valuation an the volume of living timber already on the forest and sell it.

2. With my due respect, but this plantation was indeed very badly managed by the time of the picture.

That weed sized the legs of the horse should have been controlled either by chemical or mechanical means. It’s robing water an nutrients from the trees and hindering their development.

3. What age and variety are that plantation? Is it clonal or done by seeds? Who is the provider? Those tree canopies seems skinny for me. Although the color of the leaves don’t look that bad, they should be blocking and using a lot more of sunlight.

Any operator must make this very clear to you.