When I mention investing in historical buildings in Kyiv, I often get a strange look.

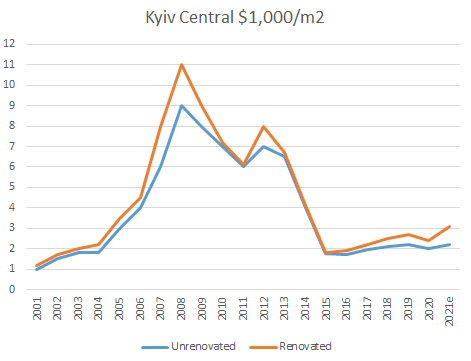

Just look at this beautiful chart of:

- a crash

followed by - a few years of consolidation and an uptick

Agricultural exports have been booming as well. Though this must be counterbalanced with the fact the country has a significant energy issue with Russia likely to reduce gas transits through Ukraine once Nord Stream 2 goes live.

Real Estate prices have been gradually going up, but high rental returns are still the norm. You can get anywhere between 7% and 23% gross rental yields depending on the type of real estate you invest in, and the size. In a leverage-free market, the more you invest, the higher the returns.

Cash is king in Ukraine.

Counterintuitively, there is not much construction going on in Kyiv. The reality is that there is barely any leverage in the market, so all projects have to be financed with cash. The result is that the rental market is extremely tight, and is not about to become any looser.

I love historical buildings in Kyiv

There are a few types, such as buildings from Tsarist times, and quality Soviet buildings.

When buying real estate in old European cities, I like to own a piece of their history.

This is what John does. Not only does he manage a fund (videos here, here, and here) focusing on Kyiv real estate, but he also helps individuals invest in Kyiv historical buildings.

In this video, he took me to one of his projects in a historical building, in one of Kyiv’s best neighbourhoods, that is currently being rented out to an EU embassy. You can watch the video here.

“But what about the Russian invasion?”

Nobody in Kyiv, apart from clown politicians, seem to care. People have heard this over and over for the past few years. Even if there was an escalation of the current issues, it is unlikely they would hit Kyiv in any significant way. If anything, it might send a wave of new internal migrants to the capital.

I won’t play the prediction game though. Clowns will be clowns.

But, what I do know is that Ukraine has already seen war, revolutions, devaluations, and real estate prices did not go below a certain level (see chart). We are barely above those levels, so downside is fairly limited.

As there is hardly any leverage in the system, when you buy real estate in Ukraine, you buy an actual hard asset. Buying real estate in Western countries is a different ball-game.

In many ways real estate in Western markets has partially become a financial asset.

Not in Ukraine.

So what you get when you invest in a historical building in Kyiv is:

- A true, hard asset

- A piece of history that is a pleasure to own

- High rental yields with a very tight rental market

- Potential for capital appreciation

- If you structure things properly, Ukrainian permanent residency

But yes, such an investment is not for everyone. One has to be able to stomach, and afford, political and economic volatility. Ukraine is never a smooth ride. Mouth-watering returns are not risk-free.

Make sure to subscribe to John’s free mailing list on Kyiv real estate

It great. He sends regular reports and analysis on the Ukrainian economy and the Kyiv real estate market.

You can sign up to it here. You can also send John an email: jdsuggitt@gmail.com. He only takes clients willing to invest at least $250,000.

If your budget is smaller, Alex is an option.

To a World of Opportunities,

The Wandering Investor

Articles on Ukraine:

- A real estate investment in Kyiv, Ukraine, with 18% gross yields?

- Is a real estate investment in Kiev, Ukraine, attractive?

- Kyiv Real Estate investment – a case study with exact numbers

- The office market in Kyiv, Ukraine – a unique investment opportunity?

Available services in Ukraine:

- An Independent Real Estate Buyer’s Agent and Renovation Manager in Kyiv

- How to obtain Residency in Ukraine

- A Real Estate Lawyer in Kyiv, Ukraine

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

“Clowns will be clowns” you say?

Hello, thanks for a great article.

I have a quick question about real estate in Kyiv if you have time to reply.

Do the prices have to be listed in Hryvnia?

When I search for apartments most are listed in USD and from what I can tell USD

seems to be the base currency. I’m trying to find out if the prices did go down

because of the devaluation of the currency (25%) or If the Hryvnia prices went up because USD was the base currency.

I have seen several different prices for the same apartment that’s why i’m asking.

People set prices in USD in central Kyiv. Prices are down about 10%-15% or so, in USD. They started going up again in the past month.

Thanks for the help. I’m not in a hurry to buy. I’m actually not sure if I’m going to buy an apartment or not. It seems to be a good value for money if you compare it to the top (about 2008)