Imminent currency devaluation in Egypt

Egypt was already in a precarious state before the Red Sea crisis. Its current account deficit kept it in perpetual shortage of dollars.

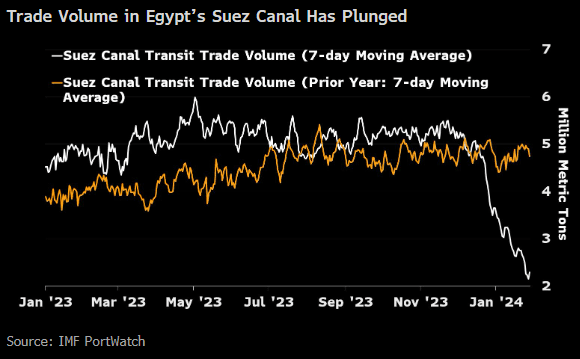

But this Red Sea crisis has made matters worse.

- Volume going through the Suez Canal has plummeted, which was a key source of forex revenue for the country.

- Tourism is down as people generally avoid the region due to what is happening

The result is that the Egyptian pound is under huge pressure and is seeing wild fluctuations on the black market.

However, Egypt is in many respects “too big to fail”. If Egypt were to implode, it would be a catastrophe for the Gulf monarchies, and Israel which has long tentacles in the IMF.

Already, an IMF package for Egypt is being discussed, on relatively lenient terms.

Inevitably, the IMF package will include a devaluation of some sort.

Cairo has some of the cheapest capital city real estate in the world

This graph below is far from perfect and I don’t agree with some of the numbers such as for Ankara, but the overall picture is generally accurate. Cairo real estate is dirt cheap.

Egypt is building a new capital city east of Cairo

Cairo with its 22 million inhabitants is crumbling and overflowing. The government therefore decided to embark on a journey to build a pharaonic new capital city east of Cairo.

Most people in the West have never heard of it, but it already boasts Africa’s tallest tower, the presidential palace, all ministries are moving there and housing for 6 million people (the size of Madrid) is being built.

It’s a huge undertaking.

Yet you can buy real estate there for very cheap and even get Egyptian citizenship for yourself and your family if you buy for $300,000 worth.

Back in November I went to Egypt to investigate on the ground.

However you must play this game right

First of all, investing in Egypt should not be your first overseas investment. It’s a high-risk play for more experienced investors.

Secondly, you must learn to navigate the official rate (30.9 Egyptian pounds per USD) vs the black market rate which fluctuates a lot. Currently it sits between 55 and 70.

What does this mean for investors?

When you wire money into the country you get the official rate, which is not great right now.

This means that you must time your investments. Developers have been partially anticipating the coming devaluation by raising prices in Egyptian pounds.

Here is how I would operate:

- If I wanted to invest in Egyptian real estate for the citizenship I would apply for the citizenship by investment program now and wait for the approval. Once the candidate receives his approval, he has one year to make the required investment in Egypt. So I would run ahead, apply, and wait for the devaluation to deploy my capital.

- If I was a cash investor not gunning for citizenship I would also wait for the devaluation.

- If I was an investor who wanted to short the Egyptian pound, I would sign for an 8 year payment plan from a developer. These 8 year payment plans are fixed in Egyptian pounds and are an amazing way to short the pound. Whether before or after the coming devaluation, the reality is that there will be more devaluations. In the video Mohamed the developer offers such payment plans. I have clients who bought from him a few years ago and they are now laughing seeing how small their installment payments have become following devaluations.

Historically, after a devaluation, the black market disappears for a while because policy caught up with reality and there is only one exchange rate left – the official rate.

So sure, the new capital will see some delays, because of the government’s cash crunch, but it is still moving ahead.

An amazing opportunity

Look, I think this Egyptian citizenship by Investment program is an amazing opportunity to obtain a BRICS passport which will offer many opportunities for Westerners in the long run.

Such a passport would enable Westerners, and their offspring and descendants, to do business in countries where it is complicated to do business as a Westerner.

And all you need to do is to invest $300,000 in real estate in a massive, growing city at ridiculously low valuations and keep it for 5 years.

But it’s very niche

To be clear, there are many risks; war, internal issues, foreign exchange controls, capital controls when you try to get your money out, low liquidity, etc.

Also, you won’t get interesting cap rates / rental yields seeing that on average you get about 3%-4% gross per year in Cairo. The play here is potential capital gains, and citizenship for yourself and your descendants.

Again, this is for people who can afford to play such games.

Whole analysis of the Cairo real estate market

I write a whole article on the real estate market in Cairo including where to invest, where not to invest, examples, etc.

If you are interested in Cairo real estate feel free to reach out to Hany or to Mohamed the developer from the video.

If you are interested in the Egyptian Citizenship by Investment, reach out to Hany. He has a whole legal team on board who help with exactly this.

To a World of Opportunities,

The Wandering Investor.

Services in Egypt:

Other articles on Egypt:

- Citizenship by Investment in Egypt

- Why the Egyptian Citizenship by Investment? Deep dive with the Egyptian government.

- Making a Real Estate Investment in Cairo, Egypt – a contrarian play

- BREAKING NEWS on the Egypt Citizenship by Investment: all Real Estate now allowed

- Now is the time to pull the trigger on Egyptian Citizenship

- Investing in Real Estate in the New Administrative Capital of Cairo in Egypt

- The New Administrative Capital of Egypt. Why, What, and how?

- Now is the time to pull the trigger on Egyptian Citizenship

- Red Sea real estate in Egypt with free citizenship

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “Investing in Real Estate in the New Administrative Capital of Cairo in Egypt”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. Today, I’m in Cairo, in Egypt, and we are going to go to a massive, massive project that the government is spearheading called the New Administrative Capital.

What is it? The government is building a new capital city in Egypt. Cairo has 20 million people, it’s just too much. The infrastructure is essentially crumbling. You can see open-air dumps. The housing stock is of extremely poor quality. There’s a lot of pollution, it’s completely overcrowded, there has been zero urban planning. The government is trying to fix this and they’re building a brand new capital city with a presidential palace, hospital, schools, a train, just everything, just like proper urban planning. And if you invest $300,000 in any real estate here in Egypt, you can get citizenship for yourself and your family.

We’re going to go there and have a look at real estate. We’ll meet up with Hany, who’s my Egyptian partner here. He has a firm with a number of lawyers and realtors helping people invest in real estate as well as helping people with their citizenship application.

HANY: Hello.

LADISLAS MAURICE: Hi, Hany. How are you?

HANY: Good to see you, Ladislas.

LADISLAS MAURICE: You’re taking us to the new capital?

HANY: Yes, today.

LADISLAS MAURICE: All right. Fantastic.

HANY: Let’s go.

LADISLAS MAURICE: Hany, I’m really impressed with the road network.

The road network in Egypt

HANY: Yeah. The new government actually did a very good job. And specifically during the period of Corona, we took the advantage that there was no traffic as much and we actually enhanced the network very much. You can see the road now, it’s an open road, very clean, the speed limit has increased, now it’s 120 kilometers/hour. Yeah, it’s taking everybody now very fast from one place to another.

LADISLAS MAURICE: When you see this, you compare the road to the new cities that the government is building, including the new capital, and you compare with what’s in Cairo, there’s a big difference. This is like a brand new five-lane highway.

HANY: Yeah, yeah.

LADISLAS MAURICE: It’s six, actually. It’s massive.

HANY: Yeah, it’s an international standard one. The lighting at night is very impressive, it’s like as if you’re having sun at night. And you can see, on the side there is some greenery and even a pleasant road to drive.

LADISLAS MAURICE: And I saw, I was reading online, the road network of Egypt was classified, I think, 29th or something in 2014 in Africa, and now it’s the second best road network in Africa as of 2023, just behind Namibia and ahead of South Africa. It’s quite impressive.

HANY: And also I would like to add that the government did a very good job in Cairo as well, because they came up with some creative ideas. They removed the railways of the old metro and substituted it with large spaces of roads and suitable roads for driving at better speeds than we used to have before. I would say that now the new roads are connected to this city, and even within the city now it’s way faster than it used to be, let’s say, five years ago.

LADISLAS MAURICE: Hany, what is this here?

Entering the new administrative capital of Egypt near Cairo

HANY: We are now entering the New Administrative Capital, and this is one of the entrances to the city.

LADISLAS MAURICE: And all the entrances look like this?

HANY: Yes, almost the same size, and it’s pretty much massive, so it gives you the gist of how big is the city.

LADISLAS MAURICE: This is like giving like UAE Abu Dhabi vibes.

HANY: Yeah, let’s call it Middle Eastern vibes, yes. But you can see that it starts with really nice roads and how massive it is. Yeah.

The monorail train in the new administrative capital of Egypt near Cairo

LADISLAS MAURICE: We were driving and we saw this. I asked for us to stop. Hany, I see these bridges everywhere in the new capital.

HANY: Yeah. These are not bridges. Those are the–

LADISLAS MAURICE: And I know it’s loud, I’m sorry, but this city, it’s 700 square kilometers of a massive construction site, so it will never be quiet.

HANY: Yes. Basically, this is not a bridge. This is going to be the monorail station, and it’s going to be the spine of the city. Basically, it will take you from anywhere in the city to another in just few minutes.

LADISLAS MAURICE: Into Cairo as well?

HANY: Yes. Yeah, it will take you inside Cairo as well and to other places. Now, you can see here, the big cathedral.

LADISLAS MAURICE: Few people know this but about 10% of the population in Egypt is Christian, so one of the first projects when the government started this new cathedral, two things, one, creating a big mosque and creating an equally big Coptic Christian cathedral.

The ministries have moved to the new capital in Egypt

HANY: Yeah. And this is one of the government developments, it’s called City Edge. And then we’ll go to the central business district. Yes, this is The Green River. It’s called The Green River. It’s a huge, massive park, and it’s basically in front of the ministries. Some of the ministries are already working and operational. I’m going now to the Ministry of Tourism, and I’ll get some documents from there, then we continue.

LADISLAS MAURICE: This is absolutely insane. It’s like, what, 15 lanes here?

HANY: Yeah.

LADISLAS MAURICE: It’s insane. All the ministries have moved here already?

HANY: Some of the ministries, yes, they start moving here.

LADISLAS MAURICE: And I think this is what’s interesting, because Cairo, historically, has created new cities around because the population’s growing so much. I mean, Cairo is like, I was checking online, right now, about 20 million people, and by 2050 the projections are 38 million. When you go in there and you say you’re creating a new capital city for 6½ million, and that represents just a third of the future population growth over the next 25 years, it’s not insane at all. And especially when the government is essentially forcing people to move here.

HANY: Yeah, you can see how big is the complex. Wow.

LADISLAS MAURICE: Yeah. Right now you have paperwork to do for one of your clients, right?

HANY: Yeah.

LADISLAS MAURICE: And you don’t have a choice, you have to come here.

HANY: Exactly.

LADISLAS MAURICE: You can’t just go to Cairo, because that doesn’t work anymore.

HANY: Exactly, exactly.

LADISLAS MAURICE: Okay. I would have preferred that we shoot outside but in Egypt, generally speaking, shooting in front of ministries is not something that people like, so that’s why we’re doing it in the car. Hany, this is really impressive to see all of this in the middle of the desert, really.

The central business district of the new administrative capital of Egypt near Cairo

HANY: Yes. Basically, this is the new financial district of the city. It has The Iconic Tower, which is the longest tower in Africa, by the way. It was funded with some Chinese investment. And you can see, like five years ago, this was not there. You can imagine how busy this will be after maybe one, two years from now. On the other side, you can see some developments, which is a residential compound that is going also to be occupied within the coming year. And the city is moving really quite fast. As we saw before, the government is already moving, a lot of ministries are already moving.

LADISLAS MAURICE: I saw headquarters of banks as well down there.

HANY: Yeah.

LADISLAS MAURICE: Is there government pressure to encourage or force local big companies to move their headquarters here?

HANY: Yes, sure. Automatically, when you have the central bank, when you have all of the banks in one place, automatically, most of the companies have to move and be around this area. The same goes for the part where the ministries are. It’s basically you have the ministries, and then the banks, and then you have, here, the financial district. No-brainer, most of the companies need to move here.

LADISLAS MAURICE: And there’s some universities that are already active. I saw there’s a big sports stadium which is being built.

HANY: Yes, sure. Yeah, yeah, yeah.

LADISLAS MAURICE: The airport.

HANY: So international universities, international schools, universities that is actually, for the first time in the Middle East, opening here, European universities. A lot of educational facilities, it’s all here. And this year, they already started, I think, some of the curriculums were already been in place this year. Yeah, if you are willing to move now, yes, it could be a good idea, but I’m sure in two, three years, you can see, it’s going to be very busy.

LADISLAS MAURICE: Because there have been some delays with the project.

HANY: Depends which project are you discussing, because some of the projects are actually ahead of their schedule. The government is pushing so hard, and they were successful in moving the ministries in the past few months. But I wouldn’t say a delay considering the scale and the magnitude of the city.

LADISLAS MAURICE: Yeah. And this is important for potential investors to understand. Look, it’s a massive, massive project, like 700 square kilometers or so. And the government needs money. The reality is Egypt has a problem with its current account deficits. It’s an ongoing issue. There are devaluations on a regular basis, so to attract capital inflows, the government is doing everything possible to try to attract foreign investment, including giving out now citizenship to people who invest at least $300,000 in real estate anywhere in the country. So you can choose here. This would be a capital gains play, I would assume.

HANY: Yeah. It depends why are you buying. If you are going to move to Cairo, then I would strongly recommend coming here. If you want capital gains, then the prices, yeah, are going up. There is only one direction for the prices here. If you are looking for something related to having a holiday or somewhere where you can get rental incomes in dollars, then we would go for the Red Sea or the Mediterranean Sea.

LADISLAS MAURICE: And you help people buy real estate there as well?

HANY: Yeah, of course. Of course. It’s an individual case by case. We sit down with the client, we understand what they’re looking for, and we recommend where they should go.

LADISLAS MAURICE: Cool. Right now we’re going to go see this project right here, which is essentially walking distance to the financial center. It’s a government project, middle class, upper middle class housing. It’s really cheap, it’s about like $650 per square meter. We’re going to have a look at it, which means that, for $300,000, you get a lot of real estate. You can easily get five apartments. And then we’re going to go check out more premium developments. Hany, tell us a bit about this development.

Visiting an affordable real estate option in the new administrative capital of Egypt near Cairo

HANY: This is a typical apartment complex. The ground floor is for retail. The average price per square meter is around $650 up to $800, depends on the payment plan. And this is a typical apartment complex. And it’s very close to The Iconic Tower.

LADISLAS MAURICE: So $650, that’s for cash purchases. Look, we went inside a bit earlier this week, I’m going to add some B roll. We had a look at the apartments, like, the finishings are not fantastic. I, personally, would budget an extra $50 a square meter, if I were to buy here, to make the finishings better after I receive the keys from the developer. But overall, I mean, it’s really cheap.

HANY: Yeah. Value for money, I would definitely do it.

LADISLAS MAURICE: Yeah, value for money, a bit of a no-brainer. Because, again, this city, this new city is massive, so being walking distance or two bus stops away from the CBD is a big, big plus, and to the monorail station as well. This is, I would say it’s a very low-risk purchase at these prices. Prices aren’t going to go down. I would be surprised if prices were below $1,000 a square meter in five years from now. What about rental yields, if renting to local tenants?

Rental yields and cap rates in the new administrative capital of Egypt near Cairo

HANY: Well, for now, the rentals, I would say between 3% to 5%.

LADISLAS MAURICE: Gross.

HANY: But again, this is a new place so you shouldn’t expect more than this now.

LADISLAS MAURICE: Yeah.

HANY: Maybe, in the future, this might change.

LADISLAS MAURICE: Yeah. Look, when you’re investing in Egypt on the local real estate market, you don’t come here for high rental yields. No one knows what the rental yields will be. This here, specifically, is a capital gains play.

Visiting an upper mid-ranges real estate option in the new administrative capital of Egypt near Cairo

LADISLAS MAURICE: What we’re going to do now is we’re going to go to another developer. He’s going to show us his project also in the new capital, but this one is a bit more premium with swimming pools and all of that.

HANY: Yeah. All right.

LADISLAS MAURICE: Let’s go. I met Mohamed, who’s a developer here, approximately three years ago. I came here during peak COVID.

MOHAMED: Yeah, I remember that.

LADISLAS MAURICE: [laughs]

MOHAMED: We went, everyone was at home.

LADISLAS MAURICE: Yeah. And I was randomly going around checking out real estate. And back then, the New Administrative Capital, they were building the CBD but there is pretty much nothing else.

MOHAMED: Only the town.

LADISLAS MAURICE: Just the church, the mosque.

MOHAMED: Yeah.

LADISLAS MAURICE: That’s it, really not much. Now, it’s really moved forward. And your development back then was just a plot of dirt.

MOHAMED: Yeah, yeah.

LADISLAS MAURICE: [laughs]

MOHAMED: It was desert, yeah. Completely. Now it’s really 70% construction are–

LADISLAS MAURICE: Yeah, so big difference. Back then, you were selling dreams, now you are selling actual real estate.

MOHAMED: Yeah, yeah. We deliver, already, the first phase.

LADISLAS MAURICE: Yes, okay. We’re going to have a look at Mohamed’s development because I want people to have a look at the range of available properties in The New Administrative Capital. I think let’s go here. Let’s have a look at it. Because it’s very different from City Edge.

MOHAMED: Yeah, yeah.

LADISLAS MAURICE: Which is government-owned. This here, you’re a private company. And give us the range of prices for cash purchases.

MOHAMED: Cash purchases, we’re talking about $550 to $600 per meter. It’s not fully finished. And if you’d like to add fully finished but with high quality, we’re talking about $200 per meter.

LADISLAS MAURICE: Okay. Essentially, City Edge, that we saw before, was $650 with finishings of very dubious quality. I would go in there, I’d budget an extra $50 a square meter to make things look better. And this is, with finishing, $750 to $800. Can you elaborate on, essentially, the differences between your project and City Edge so that people just understand the value offering?

MOHAMED: Sure. Sure. The difference at City Edge is a government company, which is deliver a separate building. It’s not a compound. And people who are living here know the difference between compound and a separate building. Compound, we provide for you security, and service for cleaning, and you have facilities like swimming pool, gym, and we have lakes, and even we have tracks for bicycles. This is make difference, we’re talking about that.

LADISLAS MAURICE: Yeah. It’s like another level of class.

MOHAMED: Yeah. If we say that City Edge we’re talking about Class C, this is between Class B and A.

LADISLAS MAURICE: Okay. Where is the project?

MOHAMED: This is the compound we are talking about. And we also have here, if we’re talking around, this is the CBD, and this is the highest tower here. And we’re talking in front of the compound we have a central park on 40 feddan, which is a huge space, as 1 feddan is equal 4,200 meters.

LADISLAS MAURICE: Okay.

MOHAMED: And if we back again to the compound, this is the shopping mall. We have a nursery here, we have a pharmacy, we have food courts, and shopping mall. And here is the compound is gated from here, and we have another gate is here.

LADISLAS MAURICE: Okay.

MOHAMED: This is lakes, and here is a clubhouse. The clubhouse you find the kids area and everything.

LADISLAS MAURICE: Yeah. When you compare, essentially, as an investor, I look at the two, I see City Edge. What do I see? I see slightly better location with City Edge because it’s so close to the CBD.

MOHAMED: It’s in front of CBD, yeah.

LADISLAS MAURICE: But what I see here is a much more upmarket offering with swimming pools, everything. When you take a step back and you look at getting this amount of value for $750 to $800 all-in with good finishings–

MOHAMED: And even the citizenship, you will get the same citizenship.

How to short the Egyptian pound

LADISLAS MAURICE: Yeah. It’s hard to find this anywhere in the world. I challenge people to find such nice properties anywhere in the world for this price per square meter. Really, it’s very hard to find. Egypt is one of the most affordable places in the world for real estate.

MOHAMED: And even if you would like for investment, not for citizenship, you can get plans on 10 years’ installment.

LADISLAS MAURICE: Okay. This is really interesting, because we’ve been working together for a while, and I know some people decided to go for the installment plan that you offer, over 10 years.

MOHAMED: Yeah.

LADISLAS MAURICE: So the $550 to $600 per square meter–

MOHAMED: This was cash.

LADISLAS MAURICE: Cash?

MOHAMED: If we’re talking about installment over 10 years, we’re talking about from $700 to $800. It depends on how many meters you will take.

LADISLAS MAURICE: And that is fixed in Egyptian pound, correct?

MOHAMED: Fixed in Egyptian pound. And even if having any inflation Egypt, the customer or the client doesn’t affect with that.

LADISLAS MAURICE: Okay. Look, interest rates are haram, so here, it doesn’t work with interest rates. It just works that the price upfront is higher, and then you pay it over the years in fixed installments. Essentially, it’s like a fixed interest rate but it’s not. It means, and this is really interesting, and this is where your clients made money, is buying real estate over a 10-year installment plan in Egypt is a great way to short the Egyptian pound. And looking at the current situation in Egypt, when you look at the current account deficit, etc., when I see this, I see that it is a currency that I want to short. By locking in a price over 10 years, essentially, Year 10 you probably won’t be paying much at all.

MOHAMED: And even you will deliver the unit after three years from now.

LADISLAS MAURICE: Yeah.

MOHAMED: And then he can use it, and he can resell it with a higher price.

LADISLAS MAURICE: Cool.

MOHAMED: He has options.

LADISLAS MAURICE: Look, if you want the citizenship, this does not work for you because you need to spend the $300,000 now.

MOHAMED: But it’s working this compound but if you paid in cash.

LADISLAS MAURICE: Yeah, which works as well. If you want the cheap cash price, this works. For people that are purely interested in investing in real estate in Egypt, then the 10-year installment plan is a no-brainer. If you have 10 Egyptian customers, how many go for the cash option versus the–?

MOHAMED: No one.

LADISLAS MAURICE: Okay, cool.

MOHAMED: No one.

LADISLAS MAURICE: No one goes. And it’s not because–

MOHAMED: Everyone is going about 7 years, 8 years, 10 years, the installment over 5 years.

LADISLAS MAURICE: And it’s not because they can’t afford cash, many of them, it’s because they want to short the Egyptian pound. Cool. All right, very interesting. Look, we’re going to go to another development. That one will be about $1,000 a square meter. It’s established. It’s in new Cairo, so it’s lower risk in the sense that it’s not in a new project in a new area, because this offers interesting potential capital gains. There, it’s more established. But if you’re interested in speaking to Mohamed about his project, there’s his email below. Mohamed, thank you very much.

MOHAMED: Thank you very much.

Investing in real estate in New Cairo

LADISLAS MAURICE: And now we are going to go check out the other project. We drove, approximately, from the New Administrative Capital, about 30 minutes.

HANY: Yeah.

LADISLAS MAURICE: Can you tell us about this complex and kind of the space that it occupies from a market point of view?

HANY: Well, this is kind of a central place between old Cairo and new Cairo. This compound is mid to high range, let’s put it this way. Average prices is around $750 per square meter up to $1,000 depending on the quality of finishing, whichever you choose. This is an easy rent, easy sell. So not much of a capital gain, let’s put it this way. However, it’s an established place where you can immediately come and live immediately here. It’s very safe. As you can see, security is all around us. There is nothing funny happening. It’s a very secure place. I’m, personally, staying here, so I like it here.

LADISLAS MAURICE: Cool. Okay. From a range point of view, established neighborhood, established compound, and so different story from the New Administrative Capital. If you want to get citizenship and you just want something that’s safe-safe with no risk but also no real potential upside, you just go for something like this. So it shows the range. We can go up to, and then there’s some really nice compounds here in Cairo that are a bit over $2,000 a square meter.

HANY: Yeah. Yeah. Again, this is like the middle between the top and the low. If we are talking about like high-end, on average, you can $2,000 on average.

LADISLAS MAURICE: Yeah. But then it’s like golf course and the–

HANY: Yeah, with a golf course and everything, and amenities, and like topnotch cuisines, everything you’re looking for.

LADISLAS MAURICE: Bars.

HANY: Yeah.

How to get the Egyptian Citizenship by Investment and get dollar income

LADISLAS MAURICE: And also, you’ve had a few clients of yours who wanted citizenship, and they wanted dollar income. Because here, everything we saw today is you can’t really do Airbnb because there isn’t really a market for it. For long-term tenants, you’ll get local tenants. Even if they’re expats, it’s still going to be an Egyptian pound contract. But if you want income, essentially, linked to the US dollar, you–

HANY: I would go for the Red Sea, because anything that has foreigners, tourists coming in, they are going to spend in dollars. So obviously, it’s better to go to a touristic area.

LADISLAS MAURICE: Okay, cool.

HANY: Yeah.

LADISLAS MAURICE: Look, Hany can also help you if you want investments in these areas. I’ll be coming back to Egypt in a few months from now. I’ll go to check out the Red Sea. I’ve been there before but I want to go back. It’s really nice. And something I haven’t done yet is the North Coast. Everyone keeps talking about the North Coast, so I have to go there. I’ll probably just bring my family with me for this one because it’ll be a nice holiday.

HANY: Yeah, you will love it there.

LADISLAS MAURICE: Yeah.

HANY: Yeah.

LADISLAS MAURICE: Cool, fantastic. Look, so I wrote a whole article on investing in real estate here in Cairo, on the whole market, the pros, the cons, the risks, everything you need to be aware of. There’s a link below. And also, if you want to get in touch with Hany for your Egyptian Citizenship by Investment Program, he and his team can help you, or if you’re looking at real estate generally here in Cairo, he can also help you.

HANY: My pleasure, of course.

LADISLAS MAURICE: All right.

HANY: Thank you very much.

LADISLAS MAURICE: Hany, thank you very much. I do appreciate it.

HANY: It was pleasure having you today.