Cairo, Egypt, is not a typical investment destination for international real estate investors. To be frank, when I went to Cairo I was pessimistic about the market. After having spent time on the ground, talking to many people, and doing more research, I now see fantastic value for people for can afford to stomach the inevitable volatility. Real estate is cheap, and you can even get citizenship for buying cheap real estate.

Table of Contents

Egypt has a troubled economy

First things first, the white elephant in the room needs to be addressed. There is a reason real estate in Egypt is cheap and that the government is encouraging foreigners to invest by handing out citizenship.

The reason is that Egypt desperately needs inflows of hard currency.

The Egyptian Pound is a disaster

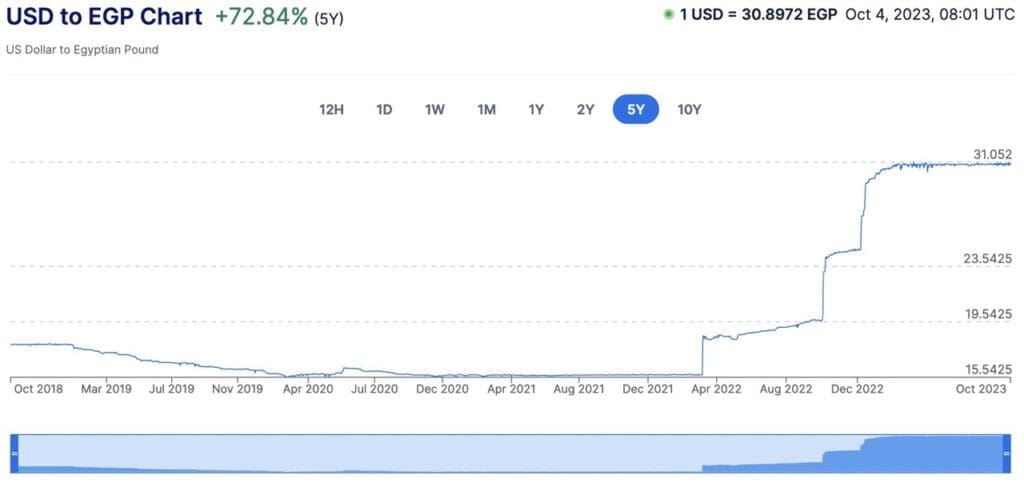

The Egyptian Pound is very much managed by the Egyptian central bank. It does not float. We can observe this in the chart where the devaluations are sudden and brutal.

The past year has seen consolidation at 31 Egyptian Pounds to USD, but inevitably this shall change seeing that the black-market rate is about 40 Egyptian Pounds to the Dollar. Expect further devaluations as long as the country’s current account deficit does not get solved. The next one is imminent.

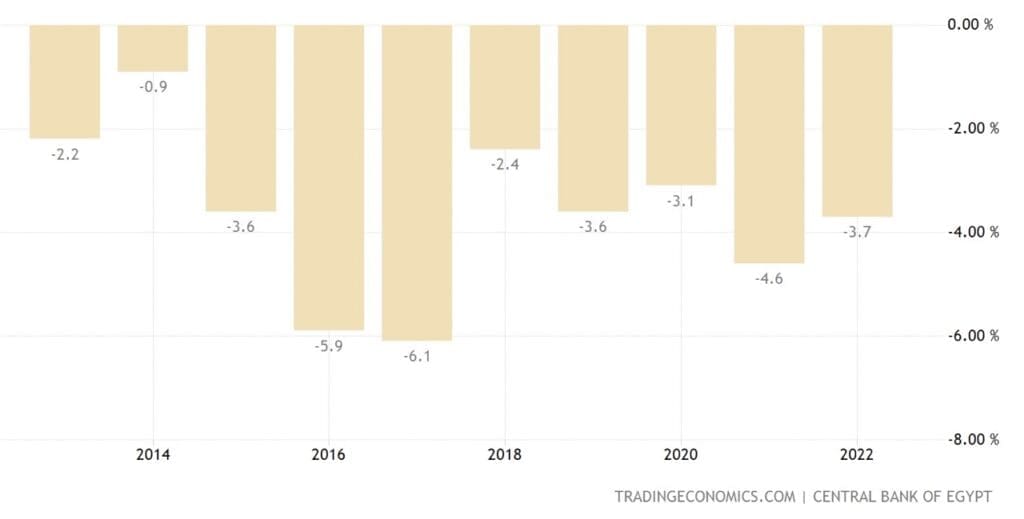

Egypt has a big current account deficit problem

Year after year Egypt has a current account deficit. It would not be too much of an issue if most of the gap was spent on capital investments.

A lot of the deficit was invested in infrastructure. For example in 2014 Egypt was classified as 29th in Africa with regards to its road network quality, but is now ranked second after Namibia as of 2023.

Unfortunately, most the deficit is due to two factors:

- Imports of food, mostly grain

- Imports of energy

Egypt became a net exporter of energy in 2022 due to the extremely high price of LNG itself due to the Russia / Ukraine conflict, but as the price of gas went back to semi normal levels this side of the deficit started popping up again.

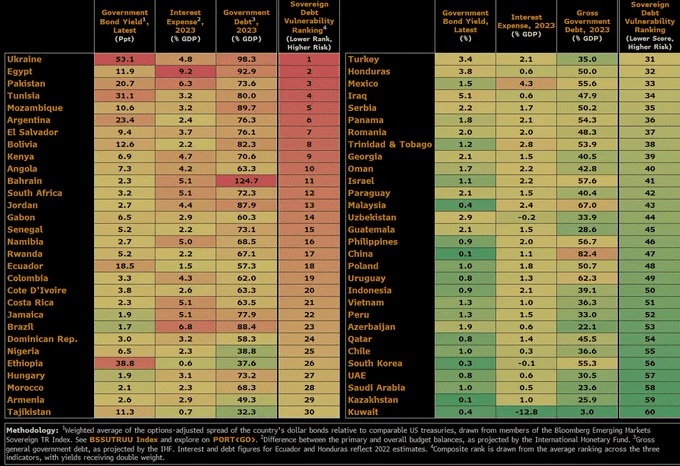

The result is ballooning debt levels

The government of Egypt has a debt to GDP ratio of 97% as of end of June 2023. It’s very high. 36% of its loans are denominated in foreign currencies and the non-oil economy has been in contraction for 33 consecutive months.

Egypt is extremely prone to external shocks

According to Bloomberg, Egypt is second in the world in terms of sovereign debt vulnerability, right behind war-torn Ukraine and even ahead of Pakistan and Argentina.

This is important for real estate investors in Cairo or elsewhere in Egypt to understand; Egypt is in a very tough spot and will need to go through painful restructuring or reforms. It’s inevitable. If you cannot stomach volatility and negative headlines, investing in real estate in Cairo, Egypt, is absolutely not for you

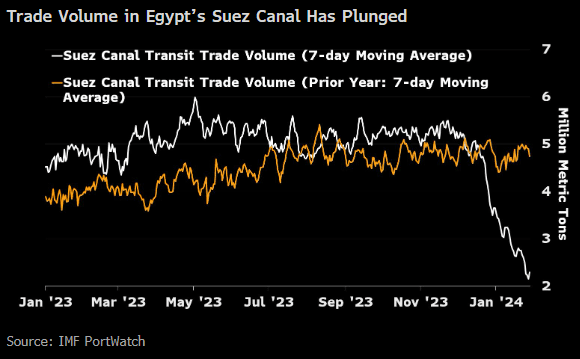

The Red Sea crisis is very problematic for Egypt

Due to all the Red Sea issues, volume has plunged at the Suez Canal. The Suez Canal is a major foreign exchange earner for Egypt.

For a country with a substantial current account deficit this is a big negative. Its other big forex earner is tourism, which is also down as people are staying away from the region.

So what can the Egyptian government do?

1. Hit the wall

Egypt could default on its foreign debt and join Zimbabwe, Venezuela, and Argentina and be a country functioning on the very basics. Do note that in such circumstances, real estate typically just drops but to reasonable levels if you buy in core areas.

- Real estate is Harare Zimbabwe is similarly priced to Johannesburg in South Africa

- Core real estate in Caracas is about $2,000 dollars per m2, which is above construction prices.

The reality is that even if Egypt were to have a sovereign debt crisis but maintain social peace, the downside would be limited over time. The reality is that Cairo already has some of the cheapest real estate in the world for a capital city.

To be clear, I don’t agree with this chart. Such rankings of pricing typically miss subtleties. For example Ankara is definitely more expensive than $400 per m2 but the point I am making here is that Cairo real estate is cheap. It’s a value play. There isn’t a real estate bubble.

I would dare say that buying in a nice new development in Cairo, with swimming pools, etc. for less than $1,000 m2 has less potential downside than Toronto or Lisbon real estate for example.

In light of the current explosive situation in the Middle East, nobody can afford to let Egypt implode. I therefore believe the next scenario to be likelier.

2. Muddle along

This is another possible scenario. In this scenario the government manages to:

- Do just enough reforms to keep the IMF partially happy

- Be neutral enough towards Israel to please the West

- Keep the EU happy by supplying it with LNG and preventing migrants from leaving

- Pull the right geopolitical strings to keep the Russians happy to get affordable grain

- Play its soft power and the biggest Muslim Middle Eastern country card to keep the Gulf happy. Nobody in the Gulf wants Egypt to implode as due to its sheer size (105 million people) it would reverberate across the region.

- Be mercantile enough to please the Chinese and get infrastructure funding.

Egypt is already showing that it is doing a lot of this and its admission into BRICS is a huge geopolitical move that should result in better terms from fellow members such as Russia, China, the UAE, and Saudi Arabia.

Would this be enough for a boom in Egypt? No, as the reforms need to be massive and the government does not seem to exhibit much appetite for this. However, in this scenario your real estate targeting the privileged classes would do alright.

I believe that this is the most likely scenario because:

- Russia wants Egypt in its orbit.

- Both the EU and the Gulf cannot afford for Egypt to implode. The Gulf has big pockets again now that the price of oil is high.

- BRICS cannot have a full implosion of one of its new members just as its joins.

The IMF, BRICS and Gulf monarchies will come to the rescue and inject money into Egypt, yet again. This is my base case.

However, this means that you can expect a devaluation of the Egyptian Pound.

3. Full reformist agenda

In this scenario, which is not the likeliest, big reforms would take place. The economy would be liberalized and most importantly implementation on building energy independent would improve.

Egypt sits on a ton of gas. It keeps making huge discoveries. It should be able to become a net energy exporter, which would solve its current account issues.

Yes, because of bureaucracy and forex restrictions, foreign companies with the technical know-how to exploit these fields are very hesitant to invest in Egypt.

The government did spur a big increase in mining exploration, albeit from an extremely tiny base, by liberalizing mining regulations. So yes it can do it. The will and implementation just hasn’t been there for now.

I would bet on scenario 2.

The real estate market in Cairo generally tracks the USD over time

Due to the constant devaluation of the Egyptian Pound, it is hard to make capital gains in USD, unlike in Turkey where USD prices were going up in spite of a plunging currency due to heavy foreign investment into real estate as well as a lot of cash sitting on the sidelines.

In Egypt, unless you go for an off-plan property, you are generally unlikely to make USD capital gains, but chances are your investment will track the USD. The typical scenario is that as the Egyptian Pound sees sudden devaluations, real estate prices rise in Egyptian Pounds to track the USD, albeit with a lag.

The more central and core the real estate, the shorter the lag

Two factors are specifically bullish for the real estate market in Cairo

1. Massive population growth in Cairo

The population of greater Cairo is expected to jump from over 20 million currently to 38 million by 2050.

2. A derelict housing stock

This building below is in Zamelek, one of Cairo’s most central neighbourhoods. It is objectively better than 95% of buildings in Cairo. It was built in Socialist times and is clearly outdated. People with money will not want to live in such buildings anymore. If this is what rich people housing looks like in the core center, can you imagine what it is like for middle class and poor people?

I saw something which is rather uncommon in real estate markets I’ve been to. Many buildings do not have windows on entire sides of their facades, and owners randomly choose to add windows. Again, this building is in the heart of Zamelek and is better than 95% of Cairo buildings.

The city of Cairo, excluding the new coumpound-living cities which encircle Cairo, has a housing stock of extremely poor quality. Think Eastern European blocks of the 1960s, in worse quality and much dirtier.

There is virtually limitless potential demand for new, better housing.

Which neighbourhoods should you consider investing in Cairo Egypt?

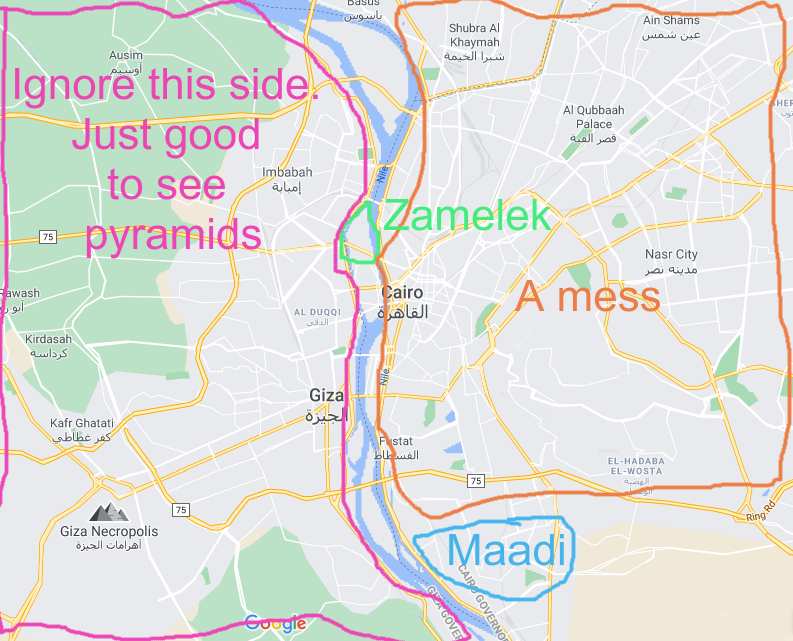

Left of the Nile: Nothing to report there. Mostly lower-end neighbourhoods with horrible construction standards. Also, ignore the new cities being built on this side of the city (more on this below).

Zamelek: The historical “expat” center of Cairo. At one point, over half of the British population of Cairo lived in Zamelek. It is where the vast majority of embassies are currently located (though they are gradually moving to the New Administrative Capital). This is also where Cairo’s nightlife is concentrated, with a number of cool bars and restaurants. Finally, being the center of the former British colonizers, stunning historical buildings can be found, albeit in various states of condition.

Zamelek is one of the greenest neighbourhoods in town, but the pollution levels are nevertheless overwhelming. I hate to say this, but objectively Zamelek isn’t that nice. However, seeing how much of a hell-on-earth main Cairo is, whenever I came back to my hotel in this neighbourhood it felt like a little island paradise. This is how most local residents feel as well.

In spite of a few leafy roads, the reality is that it is nevertheless fairly ugly. Just walking around the neighbourhood, one can tell that it went through better days. In colonial times, it must’ve been very nice for those living here, and in the 1970s and 1980s as well. Have a look at these buildings from those years:

Now they just look old in a bad way. Yet, they are worth too much to demolish and build something new.

In other words, Zamelek has a feel of past glory.

With that said, it is nevertheless in the middle of Cairo, has some beautiful historical buildings, and will always remain better than the vast majority of neighbourhoods. As an investment, I don’t see any immediate upside. Rather, it’s a safe Cairo play if you are in it for the long haul. I visited an apartment in the area – more on this below.

Maadi: The other expat area. It’s a bit far from the center but is leafy, a bit more affordable, and more spacious. Along with Zamelek it is the top area in Cairo. However, it also suffers from a slightly ageing housing stock. A positive point is that it is close enough to New Cairo and the New Administrative Capital thanks to a network of highways. It is also a fair, safe, long term play.

A Mess: Old Cairo, slums, working class neighbourhoods. There is everything in this area, from historical buildings near Tahrir Square, to century old houses, to middle class neighbourhoods, markets, and slums. However, they are have three things in common: crowds, dirt, and pollution. This area, along with the West side of the Nile, is illustrative of why people want to move OUT of Cairo.

Example of a real estate investment in Zamelek, Cairo

The way the real estate market operates in Cairo is a bit different from most places. Yes, there are real estate agencies and online services. However, a common way for people to hunt for deals is to go around to the specific buildings they like and ask the men who work in these buildings if there are any apartments for sale. Typically, most buildings have an older man sitting on a chair who takes care of maintenance, helping people in the building, and informing on them to the security services.

They know everything about the building (and their inhabitants) and act as middlemen for real estate transactions.

I went to visit apartments and this one is an example of a typical long-term Zamelek play. If I were to invest in Zamelek, I would invest in historical buildings of character, as that is what Zamelek symbolizes. I wouldn’t touch any of the 1970s-1980s buildings with a ten-foot pole.

The apartment is 200m2, boasts 3 bedrooms, 2 bathrooms, a 4m high ceiling, nice views, and is on the 4th floor (not the top floor). Its list price is the equivalent of $382,000 or about $1915 per m2. The average price in Zamelek is about $1460 per m2, so this apartment comes at a premium, but bear in mind that the Zamelek average includes all these poor quality buildings I mentioned, which represent the majority of housing stock in the area.

The views are pretty, the building has charm, it’s bright, and the apartment is on a good floor. This building is in the ”good” (North) part of Zamelek, as opposed to the ”bad” (South) part.

Clearly, it needs a revamp. I’d estimate the renovation costs at $300 per m2 for quality finishings as the wooden floors and windows look ok.

Say you negotiate the price down 10% (haggling is expected in Egypt), you’d end up with a total price tag of about $400,000 including renovation costs and purchasing costs.

Rent-wise, you could expect $1,450 per month renting it to expats. That would yield you a gross 4.5% – nothing fantastic. But it’s not surprising, as after years of exchange controls and inflation, wealthy Egyptians ploughed their savings into prime real estate.

Low yields are a feature of making a real estate investment in Cairo, Egypt. The game here is all about capital gains.

This apartment has extra potential for capital gains seeing that a mere one minute walk away, the city is building a new subway station.

As much as I see the allure of Zamelek as a safe Cairo long term play, my speculative side discovered a Cairo play with much more potential upside.

Objectively I wouldn’t even bother with properties on the secondary market in Cairo. Too many properties have too many issues, and everyone aspires to live in new compounds,

Most people that can, head East of Cairo

Even though I traveled a lot across Africa, including to many of the continent’s massive cities, I must say that nothing was as unpleasant as Cairo due to the pollution, traffic, and overcrowding.

Most people from Cairo would agree with me, and are moving to shiny new cities which encircle the capital. These cities have proper infrastructure such as wide roads, good urban planning, new housing, large malls, new hospitals, schools, universities, and most importantly residential compounds.

It is an absolute no brainer why all the growth of this city of 20 million inhabitants in concentrated in these areas.

Cairo has become all about the compound life

I know I said enough negative things about Cairo by now. Let me change my tone completely and make this statement.

Compounds in Cairo make European city living look backwards

Many of these compounds are absolutely amazing. The housing stock is brand new, the schools, hospitals and universities have state of the art facilities, they are leafy with many parks and pools, they are safe, and there is much less pollution in the air.

Most of them include private clubhouses and restaurants, and all the facilities an urbanite could dream of.

Why would anyone ever want to live in Cairo when there is such a superior lifestyle a few kilometers down the road? Most don’t actually, it’s just a money and availability constraint.

Compounds will become ever more of a magnet as Cairo’s population mushrooms from 20 million to 38 million by mid-century.

My North American, South American and African audiences will understand. My European audience will have a hard time understanding the attractiveness of the compound life. Yet, this insight is key to making a good real estate investment in Cairo, Egypt.

Make a real estate investment in the East of Cairo, Egypt

Some developers will try to sell you apartments in the new cities of “6th of October City” and “Sheik Zayed City” West of Cairo. Don’t invest there.

The reality is that there is nothing wrong with these new, modern, clean cities. The only issue is that they are not where the growth is concentrated. The New Administrative Capital and the International airport are on the complete opposite side of the city. Therefore, the West or Cairo will see much less growth and demand going forward.

Egypt’s New Administrative Capital

Egypt’s New Administrative Capital is a game-changing development project for Africa and the Middle East

Cairo is hell-on-earth and most Egyptians will agree with me. To remedy this, a visionary project was launched by President Sisi: The New Administrative Capital.

Located a mere 35km east of Cairo, it is a gigantic project. The new capital of Egypt aims to house 6.5 million people (the size of Madrid), and will be Africa’s first, real smart city. Think Dubai, but built by Egyptians for Egyptians, with actual demand for everything they will be building.

It will be made up of campuses, compounds, financial centers, a new international airport and will boast world class amenities and infrastructure. All ministries have relocate there and government employees are being made to move as well. A monorail line will link the New Administrative Capital to the rest of Cairo.

The business district will host Africa’s tallest building, and the city will have Africa’s biggest expo center.

It’s hard to imagine the scale of the project until you go there.

It is not a pipe dream; It’s happening (photos)

The city is being built – fast. Schools are already operating as well as several universities such as the Canadian University. Students either drive there or are bussed to campus.

It’s a priority project for the government as it is President Sisi’s pet project. He wants, and needs it, to be a success. People, businesses, and ministries will be forced to move there, whether they like it or not.

This is a key point that will make this project a success. Unlike with the other new cities around Cairo, the authoritarian government will force people to transition to the new capital.

This massive project is being undersold. Very few people from outside the Middle East have heard about it, and even fewer understand the scale of it. It’s a game changer.

I went to see a number of developers to discuss the project with them. One of them had a nice view of my former employer 🙂

For all developers I spoke to, their highest priority projects were in the New Administrative Capital. Why? Because the government is sitting on them. Every few months they have a government delegation show up and follow up on the projects’ Key Performance Indicators (KPIs). Between signing for the land, and handing over the keys of a completed compound, developers have four years. If they are late by even a day, the government charges them brutal penalties.

Nowhere else in the country are developers under such pressure. As a real estate investor, I love it when developers are under pressure to deliver on time, and are held accountable.

Large 2 bedroom apartments for about $76,000

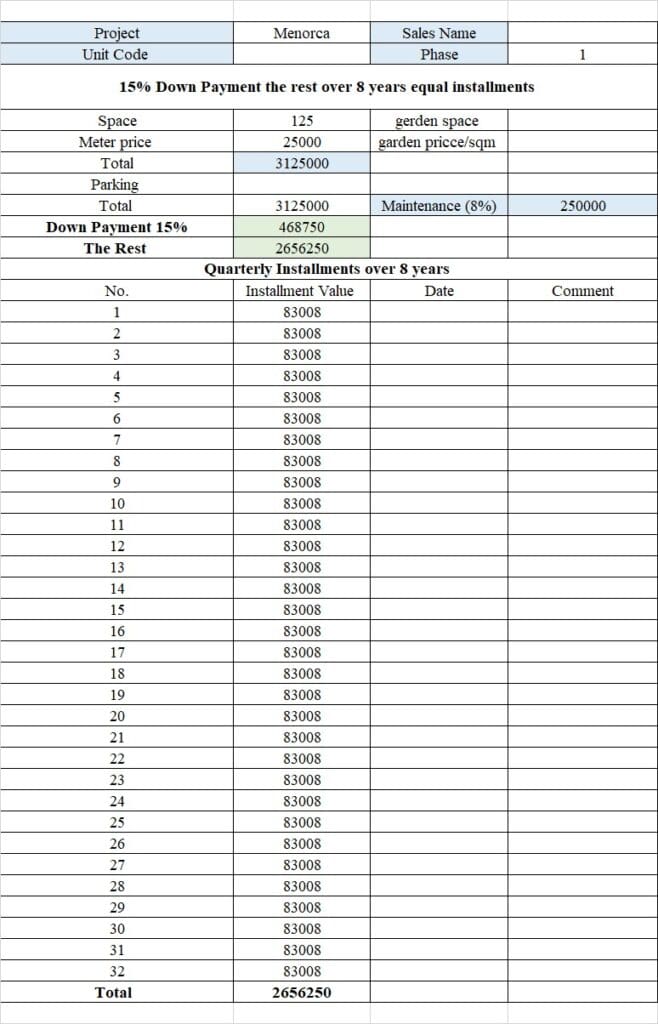

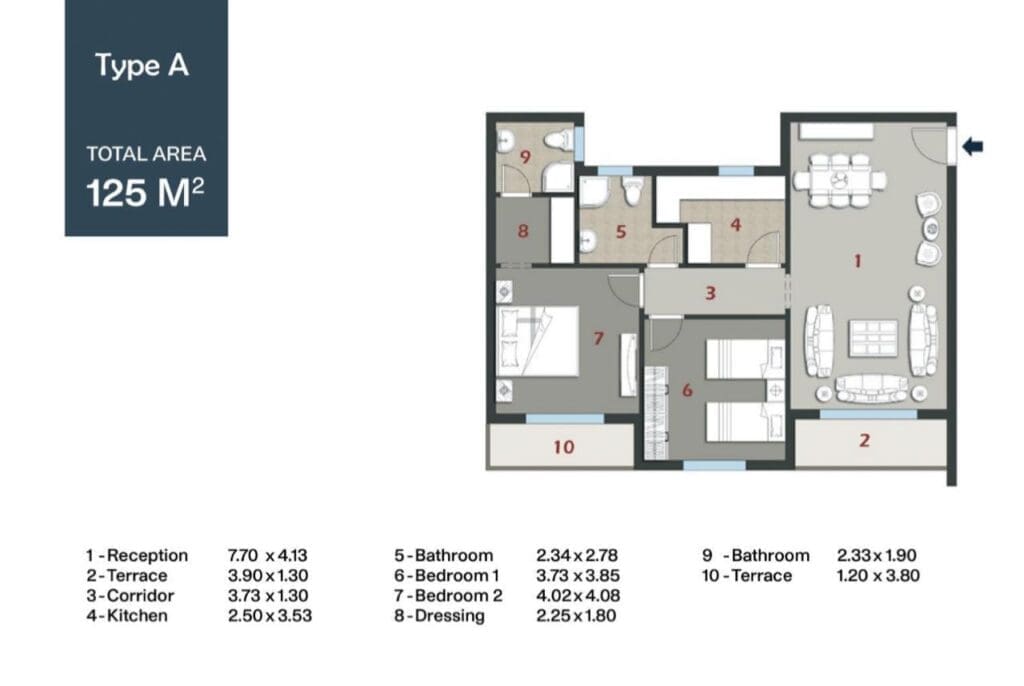

Large 2 bedroom apartments can be had for about $76,000 (!) – less than $610 a m2. Yes, these numbers are very appealing. This is one of many developers but gives investors a good example of what to expect.

This project is priced for the middle class, has pools, offers safety, and even has a clubhouse. It’ll be close to schools, malls, and everything anyone would want.

There are multiple apartment sizes available. I’d recommend 2 or 3 bedroom apartments. The reality is that people have large families so demand is strong for this segment.

There are various payment plans and the price per m2 changes between apartment sizes, floors, and buildings.

The typical price for payments over 8 years is about $810 per m2 and if you pay cash now, upfront, you can get discounts of 25%-35% depending on the units. If paying cash upfront, this apartment would amount to less than $610 a m2.

Granted, these numbers are for brownfield construction. This means you need to do the bathrooms, kitchen, paint the walls, add the tiles, etc. The developer can do this for you for about $200 per m2, with a possible payment plan over 4 years.

A parking space is an additional $6,400, which I recommend due to the car culture.

Here is an example of September 2023 pricing for a large 2-bedroom apartment, with a 10-year payment plan. The numbers are in Egyptian Pounds. I explained in USD terms to make it simpler for people to understand. But to be clear, pricing is in Egyptian pounds.

8 reasons why I find such developments interesting

I find such developments interesting particularly for investors who want citizenship…

- If you pay cash, it’s dirt cheap. Prices could hardly be any lower. Construction costs and land prices in the area are bound to rise.

- If you pay over 8 years, you are effectively taking a 8 year fixed loan in Egyptian pounds. If the currency devaluates, which is very likely, you’ll be paying less and less every month. This option is available to non-residents as well.

- Even if the currency devaluates, it is likely the price of real estate will tag along with inflation, especially at such low prices. When prices are that low, it means the developers don’t make thick margins, so you are not paying that much more above land and construction cost.

- As soon as more people start living in the New Administrative Capital, and the tallest building in Africa is complete, expect international awareness and even more locals wanting to move in. You’re likely to see a re-rating of property values.

- In case you cannot afford the installments anymore, according to Egyptian law you can only lose 10% of the price of the apartment. The developer must reimburse you the rest.

- The reservation agreement and paying the deposit and installments can be done entirely remotely – no need to go to Egypt. You’ll just have to come at the key handover to get the apartment registered in the cadastre. Also, why wouldn’t you want to come for this? It’s the fun part 🙂

- The developer can help you flip the apartment through his resale department.

- This New Administrative Capital is being totally undersold abroad. Right now, pretty much the only foreign investors are from the Gulf region, though this developer has sold some units to a few Europeans.

If you want to find out more about this specific project, feel free to get in touch with the CEO directly at mohamed@thewanderinginvestor.com and include your WhatsApp number.

Mohamed did his undergrad in Poland and completed his postgraduate studies in the UK, so he can help you in English. It’s also great to have direct access to the CEO when making such an investment abroad – you’re bound to get better service.

Get Egyptian citizenship with your real estate investment

The best part is that buying real estate in Egypt can get you Egyptian citizenship for you and your family

Ultimately, I feel that this is the real play. You can buy very nice, luxurious real estate for pennies on the dollar compared to other countries, and get Egyptian citizenship for yourself, your wife or wives, as well as your dependent children under the age of 21.

All you need to do is invest $300,000 in Egyptian real estate and hold it for 5 years. You can buy any real estate anywhere in Egypt, except for the Sinai Peninsula. It really is an amazing deal.

I’m not going to state with a straight face that an Egyptian passport is a good travel document, it’s not, but it offers unique geopolitical diversification thanks to its BRICS membership. It is also an inter-generational move as your children, grand-children etc. will all be entitled to citizenship as long as they get registered properly at Egyptian consulates abroad.

Video: Egyptian Citizenship by Investment (Updated)

You can find all the information on the Egyptian Citizenship by Investment program. You can also use this link to contact Hany, who runs a legal firm and real estate agency specializing in the Egyptian citizenship by investment. His team can help you from A to Z and present you many different developments that qualify.

Mohamed’s development which I mentioned above, qualifies. You could work with both Hany and Mohamed. I just wanted to give a concrete example with Mohamed’s development.

Even if you are not looking into the citizenship program, Hany’s team of real estate agents can help you find properties.

Case Study Video: Investing in the New Administrative Capital of Egypt near Cairo

Are Home Owners Association (HOA) fees expensive?

Egypt is quite unique in this regard. When you receive the keys to the apartment, you are expected to pay 8% of the value of the property into a “maintenance fund”. The plan is then for the HOA to use the interest payments on these funds to pay for the maintenance costs. Most developers will essentially tell you that you pay 8% once and then nothing ever again. More honest developers will let you know that you will be expected to pay any gap between the interest received and the actual HOA fees,

At 9% interest per year, it amounts to almost 0.8% of the property value per year for HOA fees, which is fair. I don’t see this system as sustainable long term due to inflation. But still, it ensures that there will be good maintenance for quite a long period of time, even if other owners stop paying.

Risks of investing in off-plan properties in the New Administrative Capital.

A few risks must be highlighted:

- You want to make sure what you are signing is a proper contract. As always, even with a developer contract, get a local lawyer to review it for you. You can find one through your embassy, or one of the foreign chambers of commerce in Cairo. If you use Hany for the Citizenship by Investment, his legal team reviews everything for you.

- Rental yields will probably be low as a lot of supply would come just as people start moving in. This is a capital gains and diversification play. It’s hard to conceptualize how such apartments could cost less than $1,000 per m2 in a few years from now.

- The government’s fiscal position is poor, which means it might have to cut back on infrastructure development in the area, thus delaying projects.

- Currency risk. If the economy were to take a turn to the worse, then getting dollars out of the country could be problematic.

It’s not for everyone. I wouldn’t buy my first and only property there. This is more adequate for people who already have assets and are looking to diversify.

But again, I feel that the real play here is the combination of abnormally cheap property according to global standards + free citizenship

Legal aspects related to making a real estate investment in Cairo

Here are a few points you should know when making a real estate investment in Cairo:

- The registration process for second hand properties is quite bureaucratic. It can take anywhere from 6-8 months to complete, which a lawyer can do for you with a power or attorney.

- Many second hand properties in core Cairo are not legalized, so it is important that your lawyer performs proper due diligence.

- There is no capital gains tax on the sale of real estate in Egypt. However there is a 2.5% tax that the seller must pay on the value of the sale .

- There is a yearly, non extravagant property tax.

- No inheritance tax.

As always, check in your country of tax residency for the local tax implications of such an investment.

In any case, make sure to hire a lawyer to help you navigate through the purchasing process, even through the much simpler route of buying directly from a developer. It’s important that your contract be both in Arabic and English for banking purposes back home.

Who should consider investing in Cairo’s real estate market?

- Middle Easterners who can easily navigate the environment.

- HNWI Westerners for whom this represents a small position. This should not be your first overseas investment.

- Individuals from countries under sanctions who want a new citizenship

- Individuals who want Egyptian citizenship for a BRICS passport that goes down the generations and who are ok with holding value real estate through volatility.

As much as I recommended real estate on the secondary market or from small developers for the Turkish Citizenship by Investment program, I feel that the dynamics are very difference in Egypt and there I would rather go for new buildings from large developers.

Invest in the New Administrative Capital

If you want to find out more about that real estate development in the new capital, feel free to get in touch with Mohamed, the CEO of the developer, directly at mohamed@thewanderinginvestor.com. Include your Whatsapp.

Buy property in Cairo, Egypt

Discover the right investment property in Egypt with Hany. You can get in touch with Hany to buy property in Egypt or to learn more about the Egypt Citizenship by Investment program.

Services in Egypt:

Other articles on Egypt:

- Citizenship by Investment in Egypt

- Why the Egyptian Citizenship by Investment? Deep dive with the Egyptian government.

- Making a Real Estate Investment in Cairo, Egypt – a contrarian play

- BREAKING NEWS on the Egypt Citizenship by Investment: all Real Estate now allowed

- Now is the time to pull the trigger on Egyptian Citizenship

- Investing in Real Estate in the New Administrative Capital of Cairo in Egypt

- The New Administrative Capital of Egypt. Why, What, and how?

- Now is the time to pull the trigger on Egyptian Citizenship

- Red Sea real estate in Egypt with free citizenship

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Frequently Asked Questions

Is Egypt a good place to invest in real estate?

Egypt offers some of the most affordable real estate in the world in spite of a booming population, however it is not a market without risks

Is it a good time to buy property in Egypt?

Egypt is a volatile market. It is therefore very important to have a long term outlook when investing in property in Egypt, and to be diversified. Nobody should be all-in Egyptian investments.

What is the New Administrative Capital of Egypt?

The New Administrative Capital of Egypt is the new capital of Egypt which is meant to replace Cairo. All ministries and headquarters of major Egyptian companies are moving there. This new capital is being planned for 6 million residents.

Why is Egypt building a new capital?

Cairo is overflowing with people and its infrastructure is crumbling. The government is building a new capital city with proper urban planning and to have space for a fast growing population.

Can a foreigner buy real estate in Egypt?

Yes, foreigners can buy real estate in Egypt.

What is the name of the project you recommend in the article? The name of the project is no where to be found

Hello Sam! You can get in touch with Mohamed directly (the CEO), and he will share all the details with you.

Very nice article 😉

Thank you Karym

Hi, what rent do you expect to get for example at the 115m2 unit?

Very interesting article. Quite a long time ago I had the same experience with the city – the most dirty, loud and crowded area Í have ever seen!

Hello Peter, thank you. Honestly, I don’t know. I wouldn’t count on high yields with all the supply coming up and people will move in gradually. I prefer to see it as capital gains play that offers unique diversification.

You sound like a clueless, pretentious twit who is encouraging gentrification and the ego stroking of a dictator. Egypt doesn’t need colonizers again.

I have had a look. It looks interesting, but the project is at the very East of the new city. Isnt that a downside?

What I would like to ask the crowd. Is it possible to draw some conclusions by looking at similar projects and how they have fared in the past?

To me this capital in Myanmar and in Kasachstan come to my mind.

Anybody has experience with how the development was in these cases.

Last but not least, amazing insight here. Kudos 🙂

Interesting. i have no idea what to think of this. i was there in s2008 and cairo was a complete mess. sounds like it still is by your article lol.

Thank you for the article! We went there in March for 3 months due to lockdown in Europe. We were gobsmacked by what is happening in Egypt! We are involved in property and we had no idea this was happening so close to home. From our social media, our friends thought we were in Dubai. Will be interesting to dig more 🙂

Exciting times indeed for Egypt!

Will there be long term demand apart from investment?

Are there enough wealthy Egyptians to fill the supply?

From a European perspective, it just looks too good to be true.

It’s a long term investment. It will take time for the city to fill up.

I’m an Egyptian with USA passport and an Egyptian passport I’m looking to retire in Egypt I love it I have lots of relatives that reside there I need a a nice 2 bedroom apt just for me

Great plan. Look into El Gouna.

Did you investigate commercial real estate as well? The Egyptian foreign-investment real estate laws that I found look residential-specific, so for various reasons besides legal protection, I’m wondering if forming an Egyptian LLC to purchase the property is the standard strategy or perhaps only way to purchase commercial real estate in Egypt. Would a single-person LLC vs multiple-person LLC affect how these laws affect a foreign investor? Unsure about this.

Also, as a foreign investor, I’m wondering if it would be required to hold the property (commercial or residential) for a period of time (years?) once it is government registered, or not register it so that the builder could resell and charge an extra fee most likely. I suspect this would depend on the contract and government regulations requiring this registration before delivery.

I have not talked to a lawyer yet, although I did get a quote and their rate was unreal even compared to big city rates in the west. If you know of a good Egyptian lawyer and are willing to share their contact info, that would be helpful.

Sorry I cannot help with this. I did not dig into commercial real estate. There are the contact details of a lawyer in Cairo in the article, he was very helpful but I don’t know his fees.

Thanks for the inspiration. I have formed my own opinion on this matter.

Egypt’s laws state that foreigners can buy property only for themselves or family members (for the first 5 years). The law would allow an Airbnb play as the law’s definition is not 100% clear, but renting out on the open market is not possible afaik.

For the new capital, it is essential to remember that prior Governments tried to establish new cities outside Cairo before. The occupancy rate of these cities circles around 25% today.

In my opinion, investing in the new capital is not interesting for me (I don’t have Egyptian relatives) due to the reasons mentioned above.

Thank you Hannes. I agree that a lot of these new cities have not been successes, but this one is different. The whole government is being forced to move there, as well as headquarters of many state owned companies. This project is on a different scale. But it’s for patient investors for sure. It won’t be an overnight success.

Hi Ladislas

Impressive work and fast. Thorough overview of the Egyptian Market and drilled down to find value. I hope to take advantage of the opportunity for diversification.

Thank you David

Hi Ladislas,

A very good article! I was wondering about buying something in Cairo but didn’t know how to get such kind of information by myself. So thanks a lot for providing them!

One question I would have: after the Gaza conflict started and Egypt turned to the economy of war, which means also that all the big projects stopped, plus the risk of war, do you think it is a good idea to buy a property in such times?

I’ve made some deposits in the local currency that is devaluting a lot and I was thinking if this would be a good idea.

Thank you!

Property is definitely safer than money in the bank in Egyptian pounds. The next devaluation is around the corner.

Who are the top 5-10 real estate investors in Egypt now a days?

I have only come across one – ADI

Katameyaprimelocation@gmail.com

is sharm el sheik a good place to buy real estate? thinking of a residence for part-time living and rent out the balance. also interested in the residency by investment for the one year. I understand it’s now $50,000. sounds like they’re giving 27%, but what happens if the Egyptian pound the values after a year? do you get less than 50,000?

I would seriously question ROIs of 27%….sounds a bit too good to be true…