In my New Year discussions with friends, I was asked which are my top international real estate markets for 2021.

As always, there is no absolute answer to such a question.

Is your goal safety, a plan B, capital gains, yields, or a mixture of a few of these factors? Each individual has a unique risk profile and investment objectives which point him or her to specific markets.

In this particular article, I will mention my top 3 international real estate markets for 2021.

Finally, I will discuss Western housing markets and their near zero interest rates.

Here is the list, in no particular order.

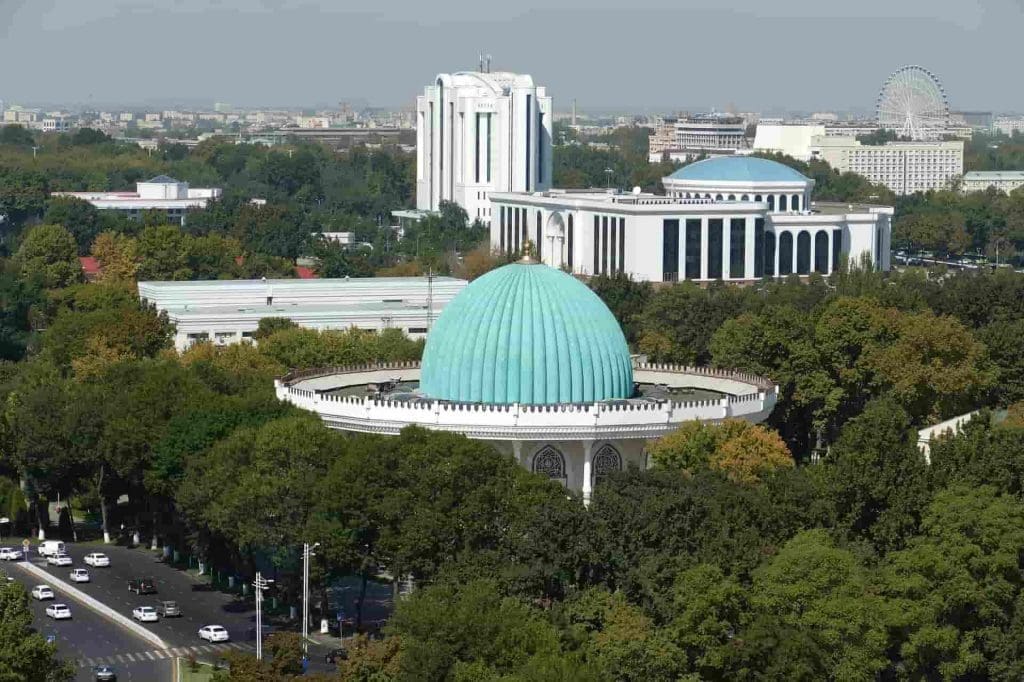

1. Tashkent in Uzbekistan

I know I talk about Uzbekistan a lot. But how can I not?

- Low government debt to GDP

- Very little leverage in the system, but that is changing as interest rates and inflation are both gradually decreasing, which will inevitably lead to a lending boom

- Great demographics; a young population which continues to reproduce

- Lots of natural resources, which will be very helpful in the coming commodities bull cycle

- Reforms, reforms, and yet more reforms. President Mirziyoyev ended 2020 with a three-hour speech highlighting a long list of reforms planned for 2021

- Growing FDI coming from all players in the region – Uzbekistan is at the heart of the new Great Game in Eurasia

And yet prime real estate can be found for about $1000 per m2. I wrote about the topic in late 2019 (here). The main issue with Uzbekistan is that apart from some specific areas targeting foreigners, investing in real estate is not clear cut legally speaking. You can create a local company and buy real estate this way, but it’s a legal grey area.

If you have the time and guts to do so, then Tashkent in Uzbekistan is a no-brainer international real estate investment destination for 2021. It will inevitably reach Almaty, Kazakhstan, levels of $1500-$2000 per m2 within a few years.

Personally, I chose to invest in the stock-market there (video here). For a good, easy-to-read, monthly summary of developments in Uzbekistan, I recommend AFC Fund’s free newsletter. You can sign up by sending them an email at uzbekistan@asiafrontiercapital.com.

2. Kyiv in Ukraine

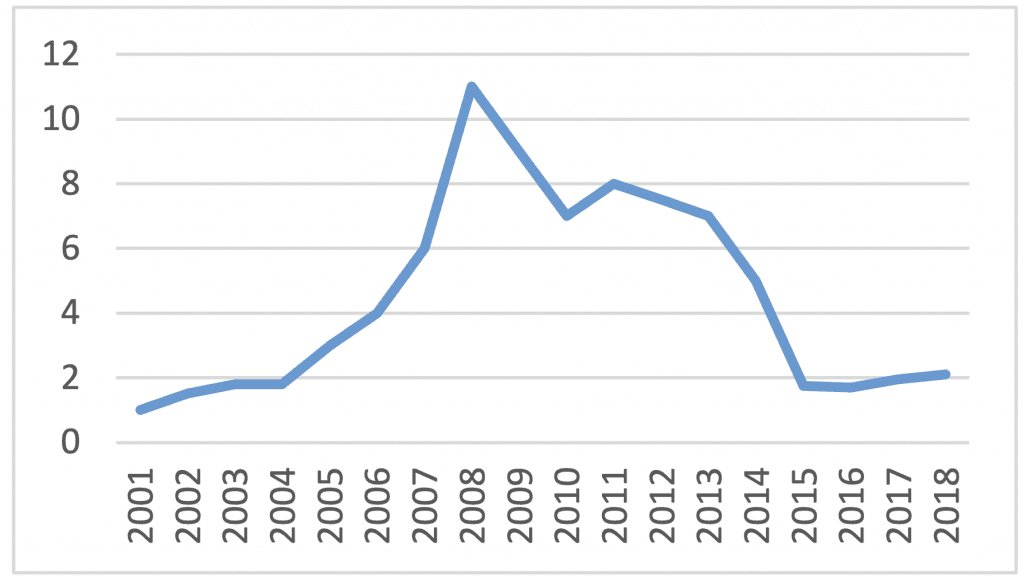

What’s not to like about this graph?

Prices dropped 75% from peak, and have since then been consolidating. Whenever I mention Ukraine following my article on the matter, people say “Oh, but it’s risky”.

Is it really that risky though?

Since the peak, Ukraine went through:

- Multiple bouts of very high inflation

- A few instances of strong currency devaluation

- Mass emigration of its youth to Western Europe

- War in the East

- The loss of Crimea

And yet prices are not going any lower. All the weak hands have sold, and everyone left in the market won’t sell for less. So unless the world blows up or the conflict in the East degenerates into a full-blown war, prices are unlikely to drop in any meaningful way.

And there is a major catalyst around the corner. Interest rates have been falling, and are likely to reach below 10% in the near future. This will unleash a wave of mortgage lending, in a market that has been cash-only for a decade.

And if the catalyst does not materialize? Well, it’s not that bad as you’ll be left with quality, affordable real estate with the best rental yields of any European capital city (7-9% gross).

If you’re interested in this market, feel free to get in touch with Alex, my Gibraltar-Straight-long-distance-swimming agent in Kyiv (here).

If you prefer a more hands-off approach, this Canadian-managed real estate fund in Ukraine is aiming for yields of 18% (video here). A very good source of information on the Kyiv real estate market is the fund’s free newsletter which you can sign up for here.

3. New Administrative Capital in Egypt

This one is really an odd-ball I was not expecting to see on this list until I went there in November and spent time looking at the market and meeting with local players.

Why Cairo?

- Fast growing population; from 20 million currently to 38 million by 2050.

- An economy, in spite of many on-going challenges, that is being reformed by the government

- Virtually endless demand as the current housing stock is derelict

- Interest rates that are falling fast, which will lead to a mortgage boom

- The government is building, and putting its full weight behind, a new capital called the “New Administrative Capital“. It is east of Cairo and will boast world-call amenities, infrastructure, and the type of housing people want

- Investing in developments there can cost as little a $500 per m2 (!) and comes with a government guarantee. So if the developer goes bust, the government commits to either reimburse the investors or complete the project.

- It is an interesting speculation, and 10 year installment plans, in local currency, are available to non-resident foreigners.

I discuss these points and the opportunities I saw in detail in my articles “8 reasons why the economy in Egypt is poised for strong growth” and “Making a Real Estate Investment in Cairo, Egypt – a contrarian play“.

Why did I not add Western cities in my top international real estate markets for 2021?

Obviously there will be growth in other markets as well, but seeing the current situation, these three options have either great fundamentals (Uzbekistan) or substantial catalysts such a interest rate dynamics which will lead to mortgage-led growth (Ukraine and Egypt).

Sure, you might find that some Western markets will boom due to low (or even negative) interest rates. It’s hard not to be tempted to borrow at 1% to then rent out at 2.5%. I’m not saying don’t play this game. All I’m saying is

- Don’t get too greedy by overdoing it. Socialist governments in the West seem to be bent on extending moratoria on expulsions for tenants who don’t pay.

- If you do play this game make sure to get fixed interest rates, in case inflation were to show its ugly head due to all the money printing.

- Will the result of money printing and the current crisis be a bust of housing markets in the West, or rather more price appreciation? Honestly, I don’t know. I can see valid arguments on both sides of the debate. Personally, I am happy to not be too exposed to such markets.

- Look to diversify into other markets such as the above, or others. Diversification is ever more important, in a world full of monetary and general craziness.

And diversify your investments in terms of asset classes as well

Real estate is great. I love it.

But I don’t do just real estate. Personally, I’m very bullish on gold, silver, and uranium miners. I think they will do very well in 2021. If you want some interesting guidance on the matter, do sign up to the Independent Speculator’s free newsletter here.

I’ve signed up for his paid services, but I must say that his free, weekly newsletter is very insightful.

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Hi!

I was so lucky to stumble upon your website. Unlike nomad capitalist and invest Asia, your content is more practical with calculation and all that. Plus, the fee for residency is more affordable. I will definitely get in touch with you once the pandemic slows down.

Really great material. Factual, to the point, really helpful