I’m currently in Nicaragua doing some research and spending my Corona time here rather than Europe. The country has quite a reputation these days, but certainly not as an investment destination.

A bit of background

Nicaragua was a focal point of the Cold War, with America and the Soviet Union fighting for domination from the 1960s until the late 1980s. It involved a civil war which pitted left-wingers and right-wingers against each other that drove the country deep into poverty.

Things cleared up in the 1990s with the center-right winning elections and governing until 2007. That year, Daniel Ortega, one of the Cold War era left-wing heroes, democratically won the presidential elections. He has remained at the helm since.

He proceeded to consolidate his power by removing constitutional term limits, and taking control of the local media. Additionally, he aligned Nicaragua’s foreign policy to Iran, China, Russia, Cuba and Venezuela; a true affront to Uncle Sam.

A major turning point took place in 2018. There are two versions of the story:

- “Student protests erupted against environmental and social security laws. Ortega’s bloodthirsty militias fired on the unarmed protesters and killed many.” The West

- “Students, unwittingly fomented by the CIA to destabilize the regime (just as in Ukraine and in the Middle East) protested sensible reforms by the government. Police officers were attacked, defended themselves, probably too eagerly, and ended up unfortunately killing a few people.” Nicaraguan regime

Internal political matters are none of my business, so I’ll just mention two facts:

- People died, thus polarizing society.

- America absolutely loves fomenting revolutions in countries that do not align with its foreign policy interests.

Since then, the West has been piling sanctions on Ortega’s regime, with Nicaragua being called a member of the “Troika of Tyranny” by the then Secretary of State John Bolton. The other lucky members of the “Troika” are Cuba and Venezuela.

Every few months bills get passed in America adding sanctions. The latest came in the midst of the Coronavirus crisis as if American politicians didn’t have anything better to do.

Now that you have a basic understanding of recent history, let’s look at the economy.

The Economy in Nicaragua

- Though Nicaragua remains the second poorest country in the Western Hemisphere after Haiti, GDP growth was quite stellar throughout Ortega’s reign in power but the protests and subsequent sanctions of 2018 derailed the positive trajectory.

Nicaragua GDP Annual Growth Rate

source: tradingeconomics.com

- Concerning Nicaragua’s government budget, you will notice that the left-wing Ortega is actually better at managing it than most Western politicians. The deficits persistently remained below GDP growth until 2018’s protests and subsequent sanctions.

Nicaragua Government Budget

source: tradingeconomics.com

- This resulted in a very manageable debt burden, which for now ensures freedom from international creditors. It is hard to get the economy going when suffocating under ever-increasing sanctions.

Nicaragua Government Debt to GDP

source: tradingeconomics.com

- Nicaragua unfortunately imports more than it exports, and the economy is poorly industrialized. The main exports are consist of agricultural products. Big export categories include wires and textile, but the local value-add is not very significant.

Nicaragua Balance of Trade

source: tradingeconomics.com

- Luckily, incoming capital flows have been improving.

Nicaragua Capital Flows

source: tradingeconomics.com

- What saved the day during the 2018 crisis were the relatively high foreign exchange reserves, which the government used as a buffer, and which recently started growing again.

Nicaragua Foreign Exchange Reserves

source: tradingeconomics.com

- Ultimately, the real hero of the Nicaraguan economy is the migrant. Remittances from workers, mostly in America, are what keep Nicaragua going. The numbers are actually quite astounding.

Nicaragua Remittances

source: tradingeconomics.com

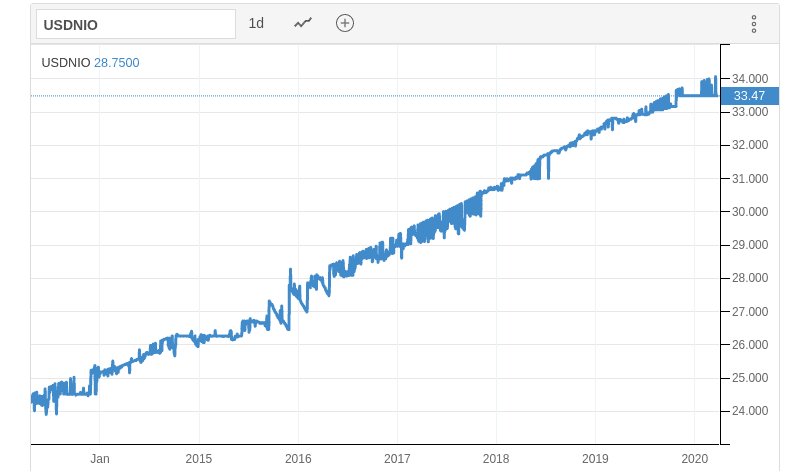

- The result of all these factors has been a gradual depreciation of the Nicaraguan Cordoba. You’ll notice that the smooth descent is clearly managed by the central bank.

So is Nicaragua a good investment destination? Looking at the macro picture, you will see not a country run by a free spending leftist, but instead a case of relatively sane macro economic management that was disturbed by political unrest and Western sanctions.

The saving grace has been remittances from migrants working in America. Nicaragua is therefore very vulnerable to external shocks, due to its multifaceted dependence on the very country that is piling sanctions on it.

The macro aspect is only one side, how about the demographics and business aspects?

Very healthy demographics

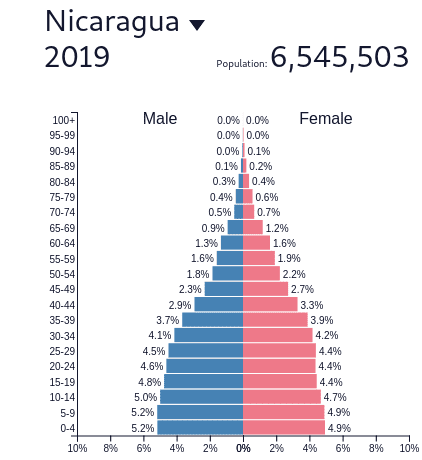

This extremely healthy demographic pyramid makes Nicaragua an interesting long-term investment play.

You’ll notice that it is growing fast enough to provide a lot of upside, but not so fast that it becomes hard to manage. Nicaragua is not dying like a European country, nor is it growing faster than it can manage like Niger. This is definitely a positive in the case for investing in Nicaragua.

Is Nicaragua Business Friendly?

Importantly, HOW the government has been spending its money is worth looking into.

Typically, countries spend about 4.24% of GDP on education spending and Nicaragua stands at 4.35%. This does not speak for the quality of the education, rather the attempt by the government to develop its human capital.

As for healthcare, Nicaragua ranks 40th in the world, spending over 8% of of GDP on healthcare. It is worth noting that healthcare is entirely free in the country. One just needs to pay for medicine. Sure, the quality of care is not as good as in Singapore, but the government is relatively efficient in its healthcare spending.

The government has been spending heavily on infrastructure, with the country’s World Bank road quality ranking being on par with countries such as Hungary and Poland. Finally, its murder rate is the lowest in Central America.

Other rankings such as the Ease of Doing Business by the World Bank, and Corruption Perception by Transparency International, give Nicaragua very poor grades. According to them corruption is rampant, and doing business locally is extremely complicated.

Having spoken to a number of expats on the ground, off the record, they all confirm that they very rarely encounter business-disrupting corruption. If anything, none of them had anything negative to say. A common theme was that doing business in Nicaragua is much easier than “back home” in Europe and North America.

So sure, there might be archaic rules on paper, but nobody cares enough to enforce them. Anecdotally, corruption seems to afflict local businesses more than foreign-owned ones, as the government strongly encourages foreign investment to develop the economy. As long as you don’t aggressively take on a powerful local businessman, you should be fine.

Friendly taxation

As a member of the socialist “Troika of Tyranny” Nicaragua taxes its citizens a lot less than supposedly the free countries of the West. The most interesting feature is that Nicaragua has a territorial tax system. This means that Nicaragua will tax residents on Nicaragua-sourced income ONLY.

So let’s say you live in Nicaragua, and you have tax free income in Dubai. You won’t have to pay anything to the Nicaraguan tax authorities. So much for extreme socialist policies.

Other taxation features:

- Corporate income tax of about 30%.

- Progressive personal income tax rate of up to 30%, with non-residents paying only 15% on Nicaragua sourced income.

- Capital gains taxes of 10%.

So while Nicaragua is not a low tax country, the numbers are certainly not extravagant. Furthermore, the territorial aspect can prove to be extremely advantageous with proper tax planning.

Is Nicaragua a worthy investment destination?

There is no straightforward answer. But we can look at some key facts:

- Short term, the economy is going to get hit hard due to the Coronavirus crisis. Tourism numbers are in free fall, and many migrant workers in the US will lose their jobs meaning remittances will dry up fast. The government foreign exchange reserves already took a hit due to the sanctions. Expect more currency depreciation.

- In line with the spirit of sanctions, the West is likely to make it harder for Nicaragua to access IMF support in case of need.

- Nicaragua is not Cuba or Venezuela, where sanctions just accelerated the inevitable due to poor economic policies. Nicaragua’s government has been making a genuine attempt at properly managing the economy, and will now struggle do to so because of sanctions. When things go wrong the West will again be quick to blame Ortega, though fundamentally they are the ones to blame. It’s an unfair world.

- That said, everywhere is going to get hit hard. Nicaragua offers an opportunity to freely invest in a non-aligned country. It is easy to open a business as a foreigner, and to obtain residency, unlike in some other non-aligned countries. So you can really diversify your assets, and protect them from the powers that be in the West.

- While counter-intuitive, Nicaragua is more fiscally responsible than most Western Nations, and its government has been making a genuine effort to properly manage the economy. Remember the 2018 protests?They were triggered by social security reforms. The government could foresee that social security was on an unsustainable path, so decided to enact some tough reforms in order to protect the system in the long run. Most Western countries, including America, have failing social security systems but barely any reforms are being implemented or even discussed.

A final word of caution on making an investment in Nicaragua

I know many people will find it odd that I reach the conclusion that an anti-West, socialist, revolutionary government is a relatively welcoming investment destination, but it’s my mission to remain objective.

There is no predicting how the government will manage the coming global crisis. But looking at its track record, and anticipating the trillions of Dollars and Euros that will be printed in the West, despite already failing social security systems and booming debt levels, Nicaragua is not a bad investment destination for a small part of your assets.

Just don’t over-expose yourself as the risk related to the coming global recession and existing sanctions remains very high. Timing is key. Maybe it’s worth waiting until the Nicaraguan 2021 general elections.

I’m happily stuck here for a while, so I will write more research articles on Nicaragua. Click here for my article on real estate in Granada and San Juan Del Sur. Feel free to get in touch with me if you want the contact information of a good buyer’s agent. There are currently real estate fire sales happening in beach towns and touristic towns.

Services in Nicaragua:

- My favourite realtor in San Juan del Sur, Nicaragua

- Create a company in Nicaragua

- How to obtain Residency in Nicaragua

- My Real Estate Lawyer in Nicaragua

Articles on Nicaragua:

- A Real Estate Investment in Managua or Gran Pacifica, Nicaragua?

- Investing in a Teak Wood Plantation, is it worth it?

- Full analysis of the San Juan del Sur real estate market

- Why buy a house in San Juan del Sur, Nicaragua – great value in Central America

- Low EMF housing in Nicaragua

- Pros and cons of living in Nicaragua

- $65,000 beachfront land plots near Managua, Nicaragua

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

hey my friend which coast are you on? everythng okay?

oh and maybe you might wanna adjust

nor is it growing faster than it can like a Niger.

liked reading it

cheers from holland

Mate, if you want to write this tripe, go nuts, but stop spruiking it on finance groups on facebook to try and drum up business.

“As for healthcare, Nicaragua ranks 40th in the world, spending over 8% of of GDP on healthcare. It is worth noting that healthcare is entirely free in the country. One just needs to pay for medicine. Sure, the quality of care is not as good as in Singapore, but the government is relatively efficient in its healthcare spending.”

It’s not good health care, if people can afford it they go to a hospital that you must pay. I have helped my friends their pay for the real health care that they need.

Good afternoon,

I have a couple observations/questions regarding your article.

1. You mention that a significant amount of Nicaragua’s income comes from migrants working in America. How much income does Nicaragua receive from migrants in Ortega’s “friendly” country allies such as Iran, China, Russia, Cuba and Venezuela? If America is mistreating the Nicaraguans so badly, why don’t the migrants just go to those 4 countries and send a lot of money home?

2. You mentioned that as a non-resident in Nicaragua you don’t have to pay income taxes on income derived in other countries. You then commented “So much for extreme Socialist policies” as if other Socialist countries tax non-residents on outside income. I did a quick search on just 2 countries many would consider socialist (Sweden and Norway) and neither one of those countries apparently charge you taxes on income earned outside their countries either. What Socialist countries actually DO tax non-residents on outside income?

Hi Thomas,

1. The point I demonstrated with data is that the reason the Nicaraguan economy is in free-fall since 2018 is because of US sanctions. Fact. If those other points you mention make you feel better about it then good for you.

2. Double check this. Sweden and Norway do tax their tax residents on worldwide income.

You were paid by Ortega to write this I presume.

The USA, Europe and the OAS should have been putting sanctions and pressure on Ortega years ago, he’s the reason the country is an a mess, I see you didn’t mention anything about him illegally winning elections and changing the laws so he can stay in power.

Business owners like myself both local and foreign do nothing but complain about the corruption from local government departments, one of the worst in the world.

Let’s face it you’re an ideologue who is anti-west, you don’t care about the Nicaraguan people you care about your left wing agenda.

If you cannot see the corruption now as the regime manipulates Covid 19 numbers you will never see it.

Hello “The Truth”,

“The Wandering Investor” would be a rather odd name for the blog of a left wing ideologue. As for your other concerns, I made it clear that I did an economic analysis of the country. I don’t discuss internal political matters, as it is none of my business as a foreigner and not the topic of this blog.

Hello Sir, in regards to the comment about: “The government could foresee that social security was on an unsustainable path, so decided to enact some tough reforms in order to protect the system in the long run.” It is the government that created the SS unsustainable path, they created this cataclysm state by mismanagement and corrupt practices, and then, they were imposing these unfavorable reforms to the citizens for a problem they created. They are many reports on this matter you can find in the web.