I recently decided to invest in the stock market in Africa. I worked and lived on the continent for 7 years, before becoming a full time investor, so I feel that I have a better-than-average understanding of the potential of investing on the continent.

I’ll start with five reasons why I decided to invest there, I’ll then mention some of the key risks, and will close off by mentioning how I invested in the stock market in Africa.

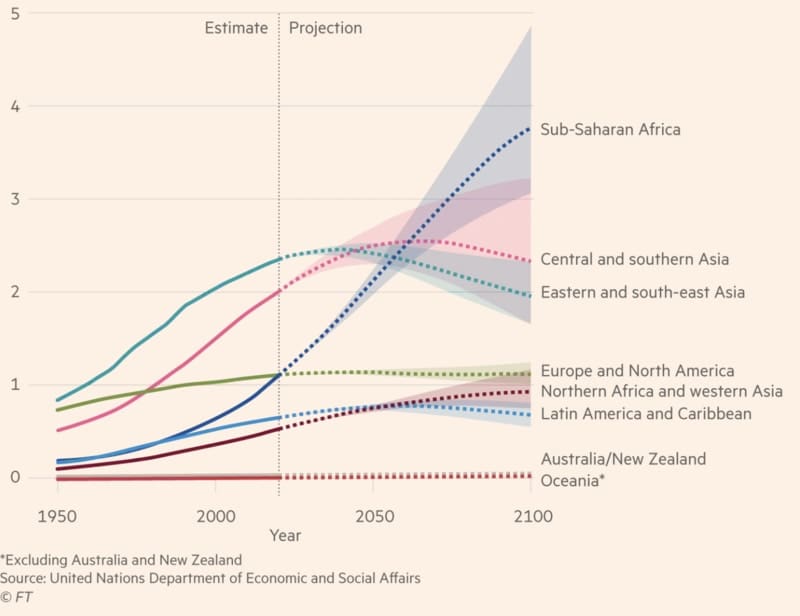

Reason 1: Demographics

Need I say more than this graph?

Africa’s projected growth is beyond comprehension. The numbers are absolutely staggering. What better way to hedge against ageing countries in the West and East Asia than by getting an early position in this growth story?

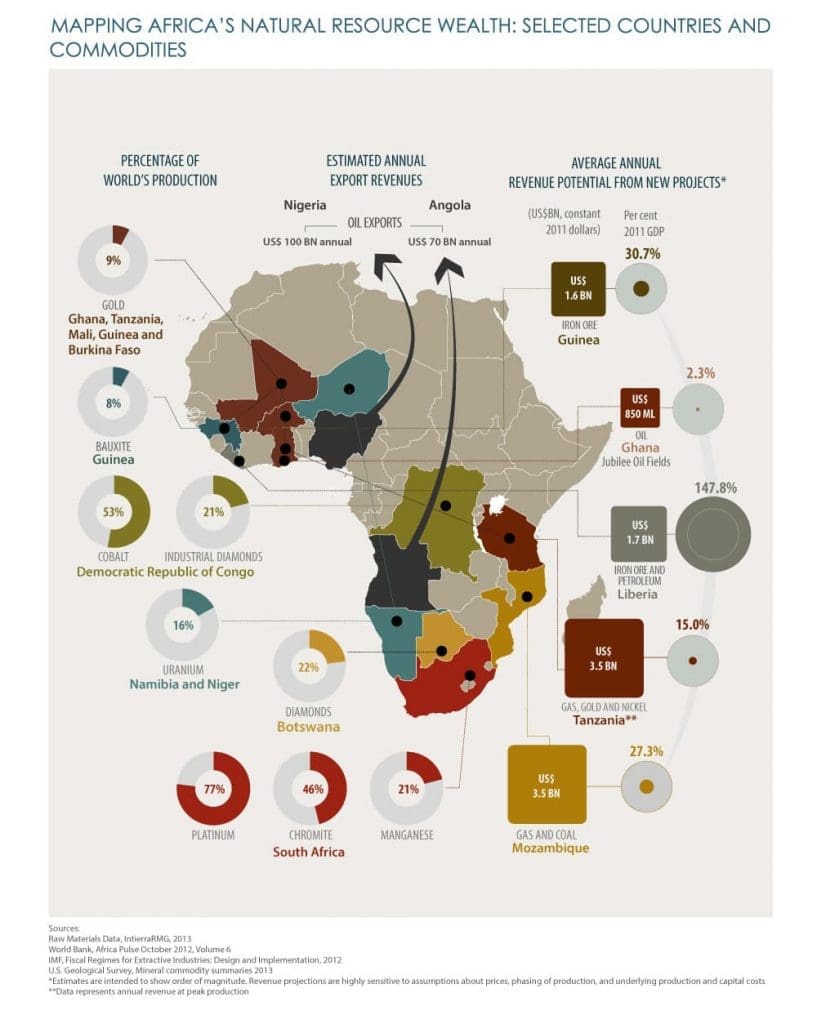

Reason 2: Massive amounts of natural resources

Africa is jam-packed with natural resources.

Contrary to popular belief, mining in Africa is great. Personally, I prefer investing in mining in a number of African jurisdictions than in the increasingly anti-mining West and in periodically communist Latin American countries. Granted, there is significant political risk, but it is often overestimated, whilst other jurisdictions’ political risk is underestimated.

Also, where are the Chinese going to get their natural resources from? Natural resources in rich countries such as the US, Canada, and Australia are increasingly off-limits from an investment point of view for them. Russia will gladly sell natural resources to China, but will always seek to retain control, whilst many African countries will gladly let the Chinese invest in, and develop mines in their countries. Expect more Chinese investment into Africa, and a plethora of Chinese acquisitions.

Reason 3 for investing in the stock market in Africa: An infrastructure boom

Highways, bridges, ports, and train tracks are being built all over the continent. This here represents Chinese plans for new railways across the continent. It excludes many of the existing railway lines that have already been built by them.

It’s easy to hate on China. Mass media and Western governments push us to hate China. At the end of the day though, while Western aid agencies build random wells (for which they pay substantially overpriced bills sent by contractors) and dish out gender studies classes in villages, the Chinese build what matters. They build infrastructure, hospitals, affordable housing, etc.

Granted, the quality is not always top notch, and why should it be at these prices? Nevertheless, this infrastructure drive is what these countries need to support their long term growth plans.

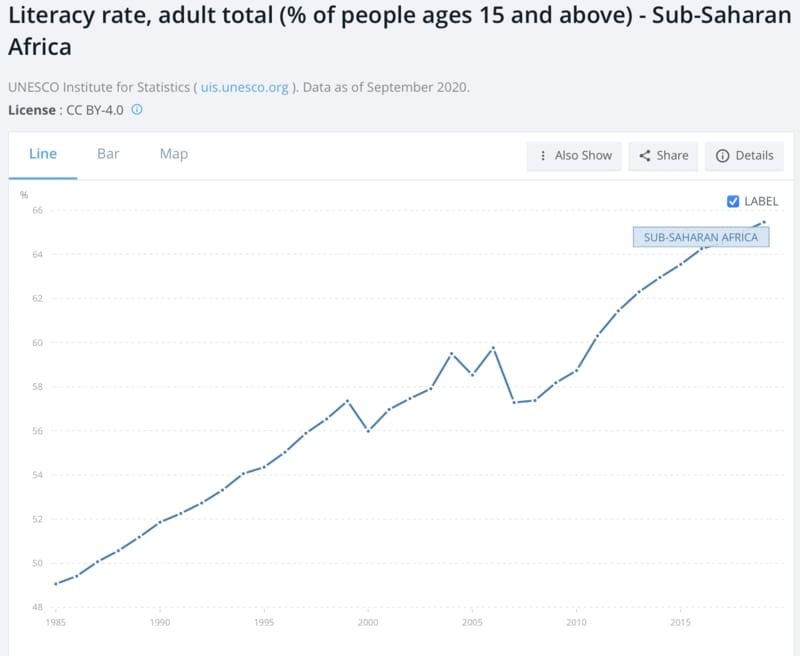

Reason 4: Education standards are improving in many countries

Apart from a few grossly mismanaged countries such as Zimbabwe and South Africa, education standards have been improving throughout the continent. We can use literacy rates as a proxy.

Apart from a few countries such as South Africa and Zimbabwe, education standards are generally improving across the continent. This has a huge impact on productivity and vastly increases the potential capacity of the economies.

Also, internet data prices are plunging across the continent. This is a great source of equalization with regards to access to education and knowledge. Drive around Accra, Abidjan, or Nairobi as night, almost every security guard can be seen on his Chinese smartphone reading or watching videos.

I can see it with my own content. When I recently published videos on real estate and the stock-market in Kenya, I had a wide array of Kenyans, across social and economic classes, get in touch with me to ask me questions. Just five years back, when data was still expensive, this would not have been the case.

Like it or not, believe it or not, Africa is moving forward. It won’t be a smooth ride, and all the naysayers will be glad to point out the many and inevitable setbacks, but the path forward is clear.

Reason 5 for investing in the stock market in Africa: Valuations have taken a beating

The NSE20 index (Kenya) is quite exemplary of what has happened to most African stock markets.

Most African markets took a serious hit after the previous oil and commodities bull-run ended, and as the Fed started tapering. Since then, valuations have remained depressed, but have recently started to break out.

I can therefore invest in solid market-leading companies, dishing out double-digit dividend yields, with almost zero debt on their balance sheets, and substantial growth prospects. What’s not to like? It’s the ultimate contrarian investment, with a number of catalysts.

What are some of the Caveats?

There are many:

- I’m excluding South Africa from this analysis as it is “developed” from a capital markets point of view, and I have zero confidence in its prospects. I wrote an article on this very topic last year, which has gone viral in South Africa.

- I’m also excluding North Africa as many of its dynamics are more closely related to Middle Eastern dynamics, though there is an interesting case to be made for Egypt which I documented here.

- It’s important to be diversified across jurisdictions as something will always be going wrong somewhere.

- When I say “Africa” I am over-generalizing. The reality is that it is an extremely diverse continent, in many ways more diverse than Europe. Some countries are completely uninvestable.

- Countries that I find very investable: Kenya, Tanzania, Namibia, Ghana, Ivory Coast, Senegal, Madagascar, Mauritius, Uganda, Rwanda.

- Countries that are investable but where one must proceed with extreme care, especially from a macro point of view: Mozambique, Nigeria, Zambia, Ethiopia, Botswana, Angola, DRC, and the Sahel (but only for speculative mining). Most other countries, I would stay away from as the risk reward ratio doesn’t make sense.

- Economic crises, political turmoil, ethnic violence, capital controls, IMF bailouts, wars, terrorism, devaluations are all part of the everyday landscape. By investing on the continent, you WILL have some of your investment go awry. Fact. If you cannot accept this sort of volatility, then do yourself a favour and stay away.

- Low liquidity of stocks. Many stocks are hard to buy, but it also means that once money starts flowing in the re-rating can be explosive.

How did I invest in African stock markets

I bought into a fund. Generally, I do not like funds, but in this particular case it made sense:

- The fees aren’t extraordinarily high (1.5% and 15%)

- I do not have the time to monitor 10 different local stock markets to look for opportunities. I simply let the fund manager take care of it, and I know that whatever stake I buy in the fund is very well diversified across the continent.

- Africa ETFs in Western markets do not have exposure to these smaller, local stock markets. And buying into the small stock markets is the play here – not buying into South Africa or the shares of Western-listed companies with high exposure to Africa. These typically trade at much higher valuations.

- The fund manager, an Australian, lives in Tanzania. He isn’t just some suit working in an office in London or NYC. He has local insight.

- Larger funds such as his can negotiate and buy whole blocks in companies, which retail investors cannot. This allows him to buy into companies that I, on my own, would not be able to. He can then flip these shares to other institutional investors later on, or create liquidity in the market.

The fund I invested in is called the African Lions Fund. I really encourage you to sign up to the fund manager’s free newsletter, in which he describes the investment opportunities he sees as he travels around the continent. You can sign up here.

I also made this video on why I decided to invest in the stock market in Africa

Other articles on Africa:

- Making a Real Estate Investment in Kenya, a smart move?

- Cheap, Chinese-built Real Estate in Nairobi, Kenya – A Good Investment?

- Has the Stock Market in Kenya bottomed?

- Outlook for investing in African Stock Markets in 2024

Services in Africa:

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Full transcript of “Why I invested in the stock market in Africa”

Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. So today, I am in beautiful Innsbruck, Austria. So approximately 30 kilometers away from the city. It’s one of my favorite places in the world. The hiking is absolutely amazing, as you can see. But today, I’m going to be talking about Africa and an investment I’ve recently made on the continent.

So as many of you know, I recently spent a month in Kenya looking at investment opportunities. I looked at real estate, I spoke to a bunch of investors and fund managers, I met with the CEO of the Nairobi Securities Exchange. And prior to that, a few years back, I lived in Africa for seven years. So I worked for four years in South Africa, in Johannesburg, and then three years in Ghana, in West Africa. My last role there was being on the executive board of Nestlé, so the big international Swiss food company. And there, I was in charge of the milk business for a few West African countries, so Ghana, Ivory Coast, Sierra Leone, and Liberia.

So throughout these seven years, I traveled all over Africa. I rarely went back to Europe. Whenever I had vacations, I would just take my backpack, hop on a plane, and go discover a new country, or go on really cool road trips. So I like to think I have a relatively good understanding of the continent. I’ve been in all the different parts, Southern Africa, East Africa, West Africa, Central Africa. So I really covered most of the continents.

Why did I decide to invest in Africa, and what did I invest in? So I decided to invest in a fund that focuses on Sub Saharan African equities on local stock markets. So all of Africa except North Africa and South Africa. So the reason I’m making this investment is that I love the fact that it is completely different to every narrative out there. When you buy into Africa, you buy into a completely different story. It’s a story of booming demographics, of governance that is gradually improving, of education levels that are improving, and of a continent that is packed with natural resources.

It’s unlike anything else you can find in any other market, really. Maybe some Southeast Asian countries can be compared but then again, often, they don’t have that amount of natural resources. So it’s really a unique investment opportunity. And I believe, so I’m making the blunt statement that I believe that every high net worth individual should have exposure to Africa.

So real estate is one way to go about it but often it’s operationally very complicated to manage real estate in Africa from overseas. Management is a problem in equities. Look, equities are completely bombed out. They peaked in 2015, and then once the Fed started tapering, they crashed. So stock markets all across the continent completely crashed. And since then, no one has been paying attention to them. So when you travel in these countries, and you speak to people about the local stock market, even to local high net worth individuals, they don’t even think about it. They’re all putting their money into real estate. So in many ways, buying equities in Africa is not only contrarian from a global perspective, but it’s also contrarian from a local perspective.

So I invested in the African Lions Fund, which is run by Tim Staermose, an Australian who’s based in Tanzania. And I was looking at some of the positions he took. And he’s invested in companies in Kenya, in Tanzania, in Uganda, Rwanda, in Francophone West Africa, in Ghana, in Botswana, Mauritius, and recently, he started entering the Nigerian market. It’s very diversified geographically, which I like, and some of these valuations are absolutely crazy.

Many of these companies are paying out high single-digit dividend yields, even low double-digit dividend yields. They have no debt on their balance sheets. They’re growing double digits every year. They’re market leaders in their respective niches in the countries, so strong, local companies. Some of them are actually multinationals, but the local subsidiaries are on the local stock market. So it’s really quite unique. But obviously, there are many risks associated with Africa.

Look, at any given point, one of these countries is going to be blowing up. That’s the hard reality. A country is going to have political problems, a country’s going to have economic problems, capital controls might show up, countries might be getting bailouts from the IMF, or might default on their sovereign debt. At any given point, one of the countries is going to be going bad. So which is good that that fund specifically is investing across different jurisdictions and is also very mindful of the whole macro elements, which is key because choosing good companies is good, but if you’re buying them in crappy jurisdictions, it’s going to lead to problems.

There’s definitely risk. But I’m of the opinion that if you invest for the long term, you’re going to ride out the volatility, and then eventually end up there, when you bought here. But along the way, it might be, it’ll be a ride. It’ll be quite the ride, honestly. And I’m comfortable with this, I’m not investing with a two to three-year outlook, I am investing with a five to 10-year view. At that point I’ll reevaluate. If the markets in Africa start looking a bit too hot, then I’ll get some of my money out.

When I said this to some people, they told me, “Oh, but Ladislas, you’re a full-time investor. Why are you paying fees?” Look, I understand. I do not like paying fees. The fees in this particular case are not very expensive, 1.5 in 15 in the big scheme of things is not too much. Look, and the reality is investing across all these jurisdictions would be extremely time-consuming. I mean, when I look at the list, he’s got four positions in Tanzania, one position in Botswana, two in Rwanda, two in Kenya, one in Uganda, one in Mauritius, two in Ghana, one in Nigeria, and two in Francophone West Africa. I do not have the time to be monitoring all these stock markets. I really don’t.

Look, the reality is, these markets aren’t very complicated. You just buy companies that have sound fundamentals, and you just wait for a rerating, and tag along their growth. These markets don’t have many companies, either, that are listed. So I can trust them to be able to choose the right companies, 100%.

So a few people asked me, “Ladislas, why didn’t you just buy into an index fund, into an Africa index fund?” And it’s a good question. But the reality is a lot of these indexes are mostly big Western companies that have exposure to Africa. So when you buy into an Africa index, in reality, you’re not getting pure Africa play. And, two, they are often more linked to commodities. And, three, the companies come at higher valuations. But when you invest locally on the stock markets, and go for local champions, the valuations are a lot lower and these companies are generally a lot more profitable. So it’s really a no-brainer from that point of view.

Now, there are multiple funds that offer investments in such markets. Why did I go with the African Lions Fund? Well, the guy actually lives in Tanzania. You don’t want to buy into a fund that is being managed from London, or from New York. These guys are absolutely clueless. And I know this from having worked at Nestlé, I was there on the ground, the job was very operational. And once in a while, we get emails from Switzerland from some person, sitting in a nice office by Lake Geneva, telling us what to do. And they had absolutely no context, they didn’t know what was happening. They were just looking at numbers without the local context.

And the reality is, in Africa, data is quite poor, the quality of data is quite poor. So if you’re sitting in London, just looking at spreadsheets, hoping that everything’s going to be right, and that you don’t really need to take into account the local context, it’s not going to work out. So the fact that the manager is living in Tanzania and is traveling across the continent was a huge plus for me. So obviously, none of this is financial advice, legal advice, investment advice. I’m just sharing what I am doing with my own money.

My friends have asked me, “Ladislas, how much did you invest?” The minimum investment amount for that fund is 25,000 USD. I, personally, have invested more than the minimum amount. I believe in the story. And I’m very happy to have a small percentage of my net worth invested in African equities. As soon as people start realizing the potential and the bombed-out valuations because of the low liquidity in these markets, which inherently is also a risk, just a little bit of money could have an outsized impact on the valuations of these companies.

Like, for example, Tim recently bought in some companies in Ghana, a country I know well, and that I really like. Since January or so they’ve gone up 30% in value, and at that point when he bought a bank there that was giving him a dividend yield of 17%. It’s hard to find deals like this anywhere else in the world. And he was able to buy it because someone was trying to unload a block. And, again, that’s an advantage of buying through a fund in such markets, is because there’s low liquidity, when you’re just a retail investor, you’re just buying whatever people are buying or selling in smaller quantities. But when you’re a bigger fund, you have the opportunity to buy whole blocks directly from directors and from other institutional investors that have stakes in these companies.

And, finally, what I liked is his local way of operating. So, for example, he recently bought into Nigeria. And Nigeria is a tricky one, because I mean, massive potential, it’s like close to 200 million people. For the last few years, they have very strict capital controls. So if you buy stocks in Nigeria, trying to get your money out is very complicated. You have to wait for months to get access to dollars to send them out of the country. So if you sell stocks, you, suddenly, get Nairas, and they have to sit on an account, and they’re gradually devaluating, hoping to eventually get some dollars. So that’s, you don’t want to get into this.

So what he’s doing is he’s investing only a small part of the fund into Nigeria. Because of those capital controls, the valuations are utterly bombed out. And if he were to sell, he would simply shift to a local gold ETF instead of keeping Nairas. And because he’s investing only a small part of the fund, the reality is if there were redemptions, it wouldn’t be an issue for him because he could sell some of the other stocks. So it’s really about trying to find a balance between getting into Nigeria at these valuations and doing it in a way that doesn’t impact the liquidity of the fund. And also of whenever he decides to sell, he’s got an alternative other than cash to put his money in.

So all of these things are really very local ways of operating, which he is doing from his base in Tanzania. I really recommend that you sign up to his free Africa investment newsletter. He travels throughout the continent and writes about the opportunities that he sees in the various countries. the link is below. Make sure to sign up to it if you’re interested in that fund. You can find the details below in the description as well as Tim’s email if you want to shoot him an email.

So this is it. I’m going to go for a little walk and then drink a nice beer. If you have any questions, feel free to get in touch with me. And as always, make sure to sign up to my private list on thewanderinginvestor.com. It’s entirely free. This way, you won’t miss out on investment, citizenship, and residency opportunities as I travel around the world. I don’t do just videos, I also write a lot of articles, so make sure to sign up.