I absolutely hate having to write this report, as South Africa is close to my heart. I worked full time in South Africa for 4 years, made many friends, worked with lovely colleagues and absolutely fell in love with the country. This analysis will offer a macro perspective on why the economy in South Africa is likely to crash in the short to medium term.

1. A bad trajectory relative to its African peers

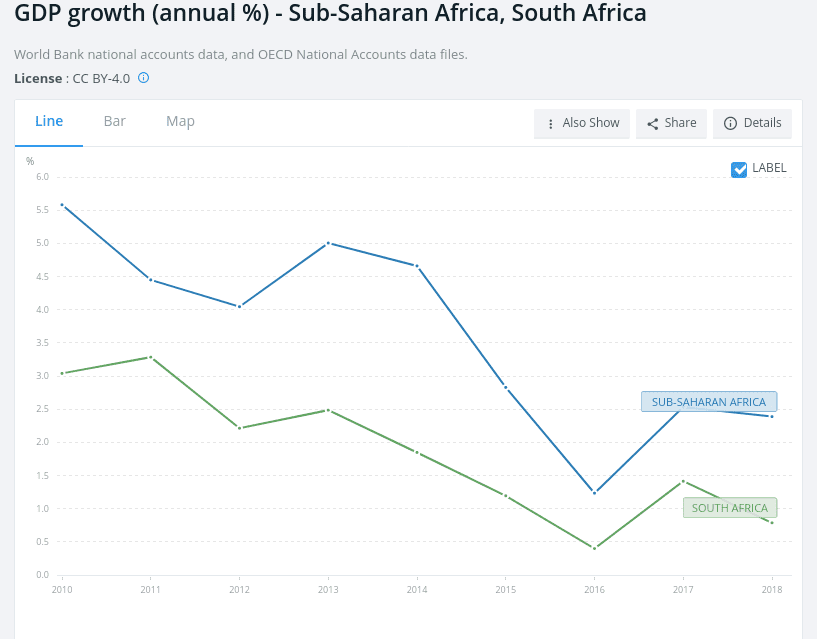

Whilst the world was “booming” following the 2008 Great Recession, South Africa’s economy just stagnated and barely grew.

Resource rich African countries such as Ghana, Nigeria, Angola, Zambia and many more rode the commodities boom of the early 2010’s. But what about resource rich South Africa? Apart from a successful 2010 World Cup, nothing much happened.

Once the commodities boom ended, more diversified African countries expanded, such as Tanzania, Rwanda, Ethiopia, Ivory Coast and Senegal. And the relatively diversified South Africa? Nothing.

In reality, these numbers are worse as South Africa was either the 1st or 2nd Sub-Saharan economy in those days (along with Nigeria). Therefore it weighed down the results of Sub-Saharan Africa, so the actual gap between the two is even bigger.

People might say that should be expected, as South Africa is more developed.

However, South Africa should be leading the continent as a source of inspiration and model for economic reforms, but it isn’t. Rather, it seems to be relying on its past achievements. Compare South Africa’s GDP growth to more developed countries in Central Europe, and you’ll see that there is no valid excuse for such paltry performance.

2. A persistent fiscal deficit

The government has been unable to properly manage its budget responsibly.

The deficit was invariably always above GDP growth, which can be seen in the debt/GDP ratio of the country. It has a single trajectory – up.

South Africa Government Debt to GDP

source: tradingeconomics.com

3. A worrisome government debt trajectory could be the cause of the crash of the economy in South Africa

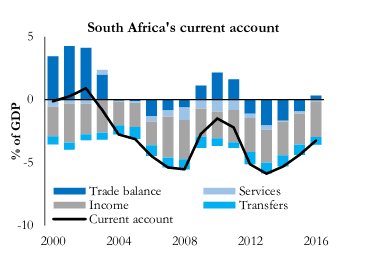

South Africa’s current account has been negative for years.

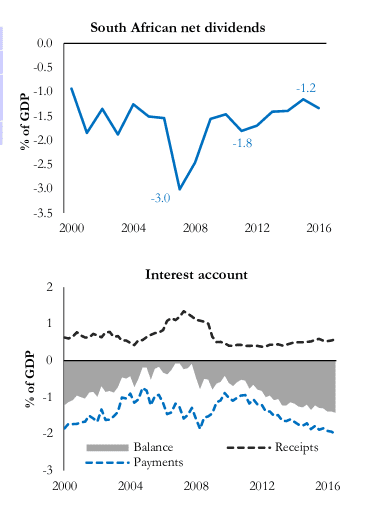

The biggest component is the income portion. Digging deep, we see the issue is not dividend payments, which have been decreasing, but interest payments.

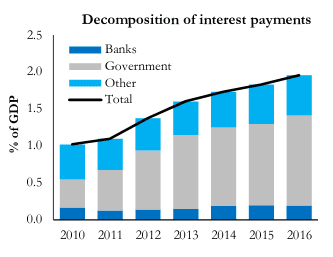

And who is responsible for these interest payments? Surprise, surprise – the government.

So the government, incapable of managing its budget, is single handedly responsible for the growth of South Africa’s current account deficit.

To top it off, South African sovereign bonds are now rated junk by all three major ratings agencies.

Also, about 37% of South Africa’s sovereign debt is held by foreigners, which is a rather high figure compared to its peers. Turkey, for example, is at 20%, and Brazil about 10%. If foreigners were to start feeling jittery, which is likely, refinancing the debt will become challenging.

This must be balanced with the fact that foreign currency denominated debt is about 20% of the total, which is manageable. Also, the debt is fairly long dated as the government and central bank prudently worked together in past years to extend the maturity of South African sovereign debt .

The picture of South African debt is a picture of slow decay, ultimately hitting a wall a few years down the road. However, the major external shock that is the Coronavirus brought that wall closer.

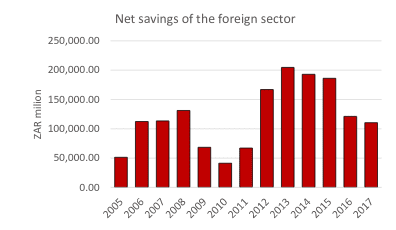

4. A financial sector that is prone to shocks

According to the World Economic Forum’s 2020 Global Competitiveness Report 2019, South Africa ranks 19th worldwide in terms of the development of its financial markets. The South African Rand (ZAR) is also the 20th most traded currency. And South Africa’s market capitalization to GDP ratio is the second highest in the world after Hong Kong, with an impressive 235% in 2018.

These are truly impressive numbers, but they highlight South Africa’s vulnerability to capital flows in the case of external shocks as the domestic savings rate is rather low.

The country was hit hard during the Great Recession when foreigners took their money out.

Foreigners came back into the market, but have since retreated due to political uncertainty and low probability of reform. This current crisis will see the same phenomenon take place, but more pronounced as South Africa is perceived to have become riskier.

South Africa is a “risk on” play. Even when risk was “on” and interest rates very low in the West, foreign money was busy decreasing its exposure to South Africa in spite of theoretically higher returns.

The world has shifted to a very risk off attitude with the Coronavirus, which could last for a while.

In the current credit and liquidity squeeze, don’t expect many to exchange their USD to buy ZAR denominated assets.

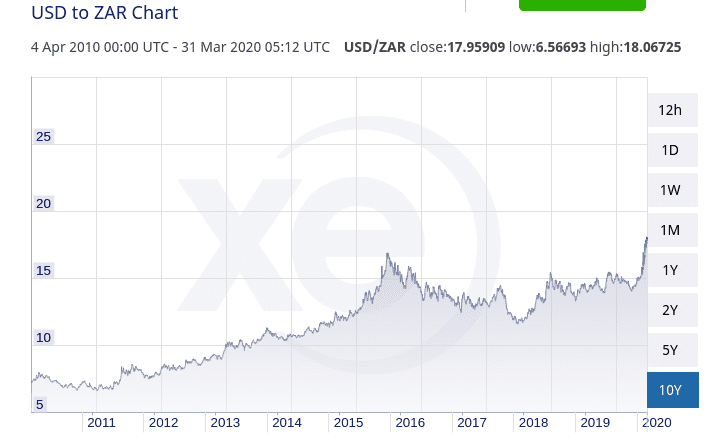

5. A basket case of a currency (a likely harbinger of the coming crash of the economy in South Africa)

This graph is self-explanatory.

While it must be balanced with the fact that South Africa sits on decent foreign exchange reserves of half a year’s worth of imports, here’s the reality:

- Risk is off as the world economy is falling into a deep recession.

- South Africa is on lock-down for at least few weeks, with even mines shut down.

- There is a liquidity and credit squeeze everywhere in the world with everyone rushing for USD.

- Nobody wants ZAR exposure right now. Funds, both foreign and South African, will flow out of the country.

- The South African Reserve Bank has started buying bonds as well as reducing capital requirements for banks. Pretty much every central bank in the world is doing this, but South Africa might not get away with it scot-free due to its higher risk profile. Life can be unfair.

What are we likely to see? More money printing and probably some attempts by the South African Reserve Bank to support the ZAR by eating into its reserves, which might not suffice.

Expect more devaluation of the ZAR.

6. Massive bail outs of state owned enterprises months before the Coronavirus

Countries everywhere are preparing bail-outs to save their national champions falling victim to the Coronavirus, but South Africa was at this stage even before the virus.

Its state electricity company, Eskom, was incapable of properly producing enough electricity for the country, resulting in rolling black-outs throughout the country for the last few years. Eskom is completely mismanaged, bloated, and a hotbed of corruption. Its debts of 420 billion ZAR are the equivalent of 8% of GDP. It’s a ticking time bomb.

South African Airways is also in terrible shape. The majority of its international flights were cancelled earlier this year (pre-coronavirus) and its debt stands at around 20 billion ZAR.

The coming recession will not help an already dire situation.

7. An unfriendly business environment

South Africa has many smart business people. I know – I worked with them. But the government hinders their potential. In the World Bank’s Ease of Doing Business report, South Africa ranks a paltry 84th in the world, down from being 36th in 2010.

In spite of unemployment hovering around 30%, employers complain of skills shortages. The government spends 6% of GDP, or 20% of its budget, on education, yet the results are pitiful. According to the OECD, the country ranks 75 out of 76 countries in education attainment.

According to the WEF, the country also ranks extremely poorly when it comes to labour market flexibility.

With crime being rife, security is a constant concern, adding to the cost of doing business. South Africa ranks 135th in the world in terms of security according to the WEF.

8. High Taxes

- Progressive personal income tax rate of up to 45%.

- Personal capital gains taxes of 18%.

- Corporate income tax rate of 28%.

- Corporate capital gains taxes of 22.4%.

- Withholding taxes on non-residents of 20%.

- VAT of 15%.

- High payroll taxes, inheritance taxes, import duties, etc.

The tax base is extremely narrow. 97% of personal income tax was collected from 5% of the population.

This 5% of the population pays Western European level tax rates, but gets very little in return. They still need to pay for private health insurance, private schools and private security. There are also capital controls in place that limit the amount that South African residents can invest abroad.

Squeezing the few has reached its limits. Squeezing more will just encourage further emigration of the country’s brightest. This begs the question, how will the government reimburse its debt?

9. Party politics are toxic

Corruption, patronage, incompetence, constant infighting and no zeal for reform. The only chance for South African politicians to actually get going with reforms would be under the auspices of an IMF bail-out.

A perfect example of political ineptitude is the Cape Town water crisis. In 2018, Cape Town made international headlines for being the first major city to nearly run out of water. This scenario had been predicted for over a decade, yet the required water management and infrastructure development measures were never implemented, with political parties trading blame.

The South African political class will be entirely responsible for the crash of the economy in South Africa.

Some predictable responses from people who believe the economy in South Africa will not crash

“South Africa sits on so many reserves of various precious metals and minerals”.

Very true. It’s what has kept South Africa going. South Africa is top 10 worldwide in reserves of 16 different commodities. It ranks first in terms of:

- PGM metals (platinum group metals) with 88% of worldwide reserves.

- Manganese with 80% of worldwide reserves.

- Chromite with 72% of worldwide reserves.

- Gold with 12% of worldwide reserves.

It’s a true blessing. Mining and precious metals account for approximately 40% of the country’s exports.

That being said, its gold production decreased from over 300 tons in 1994 to barely around 100 tons in 2019. Taxes, red tape, black-outs, and high labour costs due to fierce labour unions have driven investment away from what was one of South Africa’s core industries.

AngloGold recently sold its remaining South African assets earlier this year; a symbolic move for a business that was built in Johannesburg over 100 years ago.

South Africa has been treating the mining industry as a cash cow, and investment has been shrinking. Will investment come back during the next central bank induced commodities boom? Probably a bit, but investors will be very wary given the government’s rapidly deteriorating balance sheet, and that mining investments take years of CAPEX before reaching commercial production.

As an investor looking to invest in a greenfield mining operation, you must take into account jurisdiction risk. High jurisdiction risk means you must get a better deal from the government. This in turn limits the government’s ability to pay back its debt. It’s a vicious circle.

Only for PGMs and Manganese does South Africa have a strong hand to play.

“South Africa has a strong corporate sector”

Sure, South Africa has countless great companies across industries ranging from banking, to insurance, retailing, etc.

However, when a government’s balance sheet starts deteriorating heavily, with no upside in sight, then even local banks’ balance sheets will start looking wobbly, as they sit on significant amounts of local debt. A market in which:

- The government’s debt levels become hard to service, or are managed with money printing & inflation,

- Banks sit on that very debt, and become increasingly shaky,

- Foreign capital figures out that there are better alternatives out there.

This is hardly conducive to the corporate sector continuing to perform, or being able to “save the situation”.

Finally, along with mining and precious metals, vehicle manufacturing represents one of South Africa’s top 3 exports. Manufacturers are already complaining about high input costs. A local market in turmoil and a worldwide industry in the midst of chaotic change could very well result in rationalizations and cutbacks on far-flung, higher cost operations in places like South Africa.

Let’s not even discuss farming which is in free fall due to constant talk of government expropriation.

Where is the upside to cover all the downside?

Some people like to mention tourism as South Africa is truly gorgeous. However, the coming recession will hit the tourism industry hard and will reduce the inflow of foreign currency.

The creative and outsourcing industries are out-performers, but are too small to matter much, let alone cover all the downside.

What can you do before the crash of the economy in South Africa?

If you do invest in South Africa as a foreigner, keep your exposure limited. Wait for the crash, and then maybe scoop up some cheap assets or even property. South Africa is gorgeous and the ZAR depreciation will offer stunning properties for cents on the dollar.

Personally, I have SA exposure through internationally listed PGM and Manganese mining shares as avoiding South Africa is hard in these sectors. I enjoy that labour costs are ZAR denominated, and that the income is in USD. However, I am acutely aware of the risk of higher taxes which could hurt the bottom line.

If you are South African, it is important for you to prepare for the inevitable. I don’t mean that you should panic, but that you should be prepared in order not to panic when things do go downhill. Typically, things go downhill slowly, and then very fast. You want to act before.

Move money offshore, buy gold, invest in different jurisdictions, get a foreign residency, etc.

I have an increasing number of South African clients doing just this

If you are looking for another citizenship, or are looking to emigrate from South Africa, these two books are great resources:

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Great article. I’m curious as to most writers not mentioning the 2018 land seizure law as a negative factor driving disinvestment and insecurity. I’ve seen this trend across multiple articles. Is there any particular reason why it’s not a factor in your opinion?

Hi Mark, I did quickly mention how talks of land expropriation are killing the farming industry. But yes, it is probably an understatement and deserves more emphasis as farming used to be core to the SA economy. Yet another example of wasted potential. Thank You.

Can you perhaps direct us to somebody to invest $300,000 dollars This will purchase a farm an sustain our Recovery retreat for 10 years We will be able to turn 25 people’s lives around every 3 months and reintegrate them back into society The investor has a farm as collatoral Black people do not do drugs mostly white and coloured Greatfull for your it is the truth

Can you perhaps direct us to somebody to invest $300,000 dollars This will purchase a farm an sustain our Recovery retreat for 10 years We will be able to turn 25 people’s lives around every 3 months and reintegrate them back into society The investor has a farm as collatoral Greatfull for your article it is the truth

Hi, I am an ordinary working South African living in the country.

I have been worried for some time about the inevitability of our economy crashing and leaving me and my family in poverty, so I have considered emigration as one of the solutions. I have also been thinking of buying an investment property to get into AirBnB and a car to operate on e-hailing platforms – all these as means of supplementary income to my salary.

The coronavirus, however, has put a spanner in the works and I am now uncertain what steps to take.

What would you advise I do under current circumstances and how do you think businesses based on online platforms will fare after the virus?

Hello Mzimasi,

Yes, this crisis will hurt everyone, and not just in South Africa. I don’t give financial advice as I don’t know your specific situation, but essentially keep your overheads as low as possible. Anything that is not necessary should get cut out of the budget, etc. Live below your means and save whatever you can. If your budget is too small to start playing internationally, physical gold & silver have historically been a good hedge against inflation.

As for businesses based on online platforms, this is where the world is heading. The well capitalized ones with sustainable business models should do better than bricks & mortar businesses. Ideally nowadays, you would run a successful online business and could then relocate to a well run, low tax jurisdiction.

As for the Airbnb property, be very careful. I don’t know which exact market you operate in, but municipal and national governments worldwide have been raising taxes on them. So build this into your numbers. Also, if you were to get a mortgage to buy, be extremely careful. If there is runaway inflation and you signed a mortgage linked to the repo rate, you could be in for a major issue.

Great article thanks!

I have some spare money and would like to invest it in Canada as I have family on that side.

What is your prediction for a full on crash considering the country is in day 50 of a full out lock down and the rate we are seeing people losing their jobs and businesses closing. Do you think the above concerns in your article is accelerating? Do you think government is using Covid-19 to be able to bail themselves out using funds made available by the IMF in response and how will this impact our economy in the long run? Q

South Africa does have a decent amount of reserves – enough for a few months of imports. But yes, even though countries with reserve currencies are likelier to get away with money printing for a while, South Africa won’t. Additionally, much depends on for how long South Africa will be able to count on the support of international organizations and of the bond market.

Let’s be clear about something – the lock-down has only made the situation worse.

In a nutshell, unless drastic reforms are enacted by the current government, South Africa is heading for its day of reckoning. It’s just a matter of time.

Do you think that the South African economy can ever recover if the economy suddenly crashes? What kind of trajectory could one expect if this does happen? Situations cannot stay rock bottom forever. I have savings in a money market account that I should’ve transferred abroad years ago, but sadly I never did. Out of desperation to avoid an economy crash, I am thinking of transferring the savings now however, I’m still optimistic that even after a crash, the economy may improve. What do you think? I’m so close to transferring the money but cannot bring myself to do it as I still have hope that South Africa’s economy will improve. Am I just dreaming something that will never happen?

Hello Ana,

I don’t give financial advice nor investment advice. I’d just ask you to reflect on three points:

1. If all your assets and life are in SA, you have 0 geographic diversification. Not being diversified is rarely anything that would be recommended.

2. Are you hopeful, optimistic, or is it a case of wishful thinking?

3. If you believe a crash is inevitable, but are just hoping to ride it out, then it means you are accepting a big loss, even if temporary. Why not pre-empt the crash and protect your hard-earned savings?

Finally, do you have faith in your politicians’ abilities and will to change SA’s course?