Paraguay is a well-known destination for plan B residency. It produces enough food for its own population, has endless fresh water, and is far away from conflict.

Europeans fleeing persecution and prosecution have been fleeing there for centuries.

Last year I got temporary residency in Paraguay through Aleksandr and I am looking forward to upgrading it to permanent residency.

However, people often ask me about the capital of Paraguay, Asuncion. Is it a good investment from a real estate point of view?

Full breakdown of the real estate market in Asuncion, Paraguay

1. If this rather niche topic is of interest to you, you will enjoy reading my macro analysis of Paraguay and full analysis of the real estate market in Asuncion.

2. I also did a video case study of a typical condo in a good neighborhood of the city. This will help you manage your expectations

Unfortunately, you can’t expect massive rental yields / cap rates in Asuncion, in spite of what agents and developers will try to promise you. The play here is rather diversification and gradual long term capital growth.

If you are interested in buying real estate in Asuncion, Aleksandr can help you with his real estate buyer’s agent services in Asuncion.

In any case, residency in Paraguay is still very easy to obtain for Europeans, North Americans, Latin Americans, South Africans, and people coming from OECD countries.

Maybe worth looking into as an insurance policy seeing all the crazy things our politicians are up to these days…

To a World of Opportunities,

The Wandering Investor.

Services in Paraguay:

Other opportunities in Paraguay:

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “Investing in Asuncion Real Estate in Paraguay – an ROI case study with numbers”

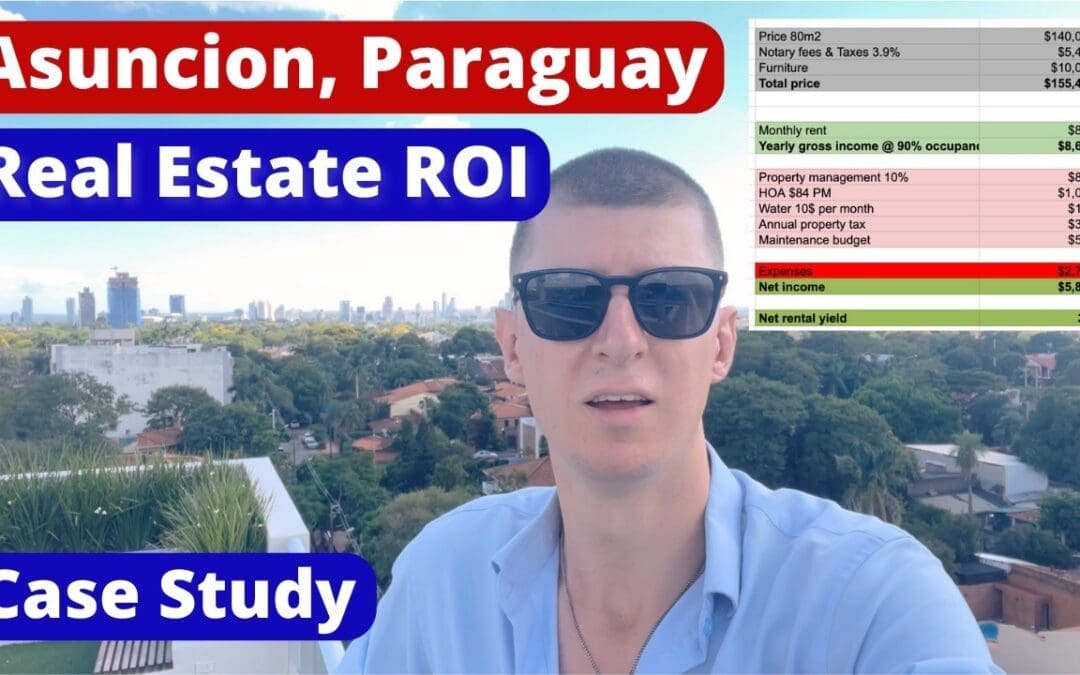

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. Today, we’re in Asunción in the capital of Paraguay. And we’re going to be looking at a typical real estate investment here. And we’re going to go through all of the numbers in terms of how much we can rent out that apartment for, all the costs involved in being a landlord, etc., to reach a net rental yield or a net capitalization rate, so that you have a better idea of what the average investment returns are here in this market, okay? We’re not going to be looking at a fantastic investment, the best investment, etc., etc., but just what you can expect when you go on the market and you buy something decent and reasonable at market prices.

Viewing on condo in Asuncion

Right now, I’m in Los Laureles. It’s a very decent neighborhood in Asunción, very close to the prime areas of de la Mora and Recoleta. It’s a new building that was finished about a year ago. And it’s got really nice amenities. You can see it’s got a nice rooftop pool. The water’s clean, everything’s well-maintained. Aleksandr is with us. Aleksandr is my buyer’s agent here. He helps people find investments in Asunción. And then you can see the whole area, very green, a lot of houses, not too many buildings. There is also a bunch of parking downstairs, there’s 24 security, which people like in this part of the world. And then you can see kind of the skyline of Asunción here. So very peaceful neighborhood, very calm, pleasant.

The rooftop is cool. It is here a culture where people have a lot of guests, and they entertain, and all of that, so it’s important to have such amenities, people really value these. Have got the whole barbecue area, which is huge. I mean, I don’t need to say that in this part of the world, people adore meat. There’s even some, like, kitchen here. We’ll go into the apartment in a bit. And we’ll go down there, and it’s on the fifth floor. Cool. And then there’s the other part of the terrace, so really big terrace. And as you can see, everywhere green. I mean, Asunción has a terrible reputation. People think Paraguay is not nice, blah, blah. Like, this is the city. It’s totally green. Everything’s green. It’s very pleasant. Very pleasant.

Now, is it a good investment? Now, that’s a different story. We’re going to go there, we’re going to do all the numbers. Cool. Great. Aleksandr, can you give us a few metrics here?

ALEKSANDR: It’s 80 square meters. It costs $140,000.

LADISLAS MAURICE: Okay, and it’s a two-bedroom, right?

ALEKSANDR: Yeah, two-bedroom.

LADISLAS MAURICE: Okay, and it comes with the kitchen, it comes with the air con, it comes with all of that? Okay, cool. It’s nice and bright. Again, the goal here is not to do some property tour. The goal is just to go through the apartment really quickly to see what we get for this sort of money, and then Aleksandr and I will sit down and do the numbers, the costs, and the net rental yields. I mean, it’s nice. Bathroom number one. Cool.

ALEKSANDR: Second bedroom, the bigger one.

LADISLAS MAURICE: Okay, the master bedroom.

ALEKSANDR: And you have the second bathroom.

LADISLAS MAURICE: Okay, cool. All right, looks like the wardrobes are built in. Cool. All right. Look, the finishings are quite good, I have to say. For an apartment, I’m used to finishings, in a lot of these countries, that are not that good, so pleasantly surprised. Cool. Fantastic. We’ll go back upstairs, we’ll discuss all the numbers. It was finished how long ago?

ALEKSANDR: One year.

LADISLAS MAURICE: One year ago and it’s still for sale by the developer. We’ll have to have a serious discussion about liquidity in this market, because this is one of the key points. Cool. Thank you very much, Aleksandr.

ALEKSANDR: You’re welcome.

Short-term letting or long-term letting in Asuncion?

LADISLAS MAURICE: Let’s say, if I were to buy this apartment at this price without negotiating, which, obviously, people should do, and then I hand over the apartment to you, right? And because you do property management here as well. Your task is to help me sweat this asset and try to make as much rental yield as possible. What would be your recommendation in terms of approach for this market with such an apartment?

ALEKSANDR: With this price, I think I will focus on foreigners, to rent this apartment to foreigners. Because, usually, you have problem here with locals that they don’t want to rent to foreigner or to someone who doesn’t have a local tax residency. And if you don’t show them an income about the last 6 or 12 months from Paraguay, they will not rent you the house or the apartment.

LADISLAS MAURICE: So local income?

ALEKSANDR: Yeah, local income. They don’t care if you have contract abroad, or you have income abroad, they want just a local tax declaration.

LADISLAS MAURICE: They’re like the Paraguayan tax authorities that don’t care about your income overseas. [laughs]

ALEKSANDR: Yeah. [laughs]

LADISLAS MAURICE: They only care about the income in Paraguay.

ALEKSANDR: Yeah.

LADISLAS MAURICE: Okay, cool.

ALEKSANDR: For that reason, people have problems with that. And the other thing is that they want you guarantors. And they want the guarantor should have double of income than the price for the renting. If you’re renting something, like, for $1,000, you need a guarantor who is earning $2,000 minimum.

LADISLAS MAURICE: In Paraguay?

ALEKSANDR: In Paraguay. It’s ridiculous. If you rent this apartment, and you don’t ask foreigners these requirements, you will have a higher rate of occupancy of the apartment, because you are making it very easy to the foreigner. You will publish in Instagram, in Facebook, typical here, you will use Marketplace, some local pages like Clasipar, InfoCasas, and if you publish that, usually, foreigners will try to check through those pages. If you do well with that thing, and you don’t ask them many requirements, you have guarantee pay rent.

Is Airbnb a good investment in Asuncion?

LADISLAS MAURICE: And why not Airbnb?

ALEKSANDR: Because the country is not a touristic zone. Not many people come here to make some business trip or whatever. For that reason, in this area, especially, Los Laureles, you don’t have people who, for tourism, are renting for several days. Basically, many apartments here are empty if you check Airbnb. Usually, people on Airbnb, who are focusing on Airbnb, they are more closer to the malls and to the airport.

LADISLAS MAURICE: Yeah. Okay. And to be fair, you don’t really come, to your point, Asunción for tourism. There’s, objectively, nothing to see here. It’s a very pleasant city, the city you want to live in but you don’t want to just come as a tourist for, like, three, four days.

And also, there’s not that much business tourism either. It’s not a business hub. All the regional headquarters are either in Brazil, in Argentina, or in Uruguay. There aren’t really any regional headquarters in Paraguay, so not a lot of business trips and not a lot of tourism, but you do have a lot of foreigners who come here to obtain residency and live here for at least a few months every year. And these people are not really being catered to, essentially. Because there just aren’t that many people either that are moving here, though it’s increasing, but local landlords make it complicated. So essentially, make it easy and you’ll be able to rent it out easily? Okay, cool.

Rental yield and cap rate and ROI for real estate in Asuncion, Paraguay

LADISLAS MAURICE: How much would be the furniture budget, roughly?

ALEKSANDR: I think around $9,000, $10,000, depending what kind of quality of the TV or fridge you want to put there.

LADISLAS MAURICE: Cool. All right, $10,000. What would be the monthly rent? I buy it, I furnish it, I give you a budget of $10,000. You go, you furnish it, you run with that. How much rental income could I get?

ALEKSANDR: Around $800 per month.

LADISLAS MAURICE: Okay. And what do you think my occupancy rate would be?

ALEKSANDR: Should be around 90%.

LADISLAS MAURICE: 90%. Okay, sounds fair. It’d be rented out a bit less than 11 months per year, which is fair for an apartment like this, in a decent location, brand new, all the amenities, decent price. Cool. What is, typically, the management fee? As the landlord, what do I have to pay in terms of management? Do I have to pay so that you find tenants? Do I pay for management? How does it work here, typically, in the market?

ALEKSANDR: The owner of the apartment pays around 10% if he wants me to manage his properties. The one who is seeking for the rent, he pays half of the month rent.

LADISLAS MAURICE: Okay. Let’s say, I’m the owner. You bring a prospective tenant that you found online or through the network work with other agents, etc. The tenant has to pay roughly two weeks of rent to you?

ALEKSANDR: Yeah.

LADISLAS MAURICE: But I don’t have to pay anything for finding tenants, essentially?

ALEKSANDR: No.

LADISLAS MAURICE: Clear. Okay, that helps with the numbers. What about the homeowners’ association here on a monthly basis? Because I’m assuming it’s the landlord that needs to pay for this?

ALEKSANDR: Yeah. It’s around $84 per month.

LADISLAS MAURICE: Okay. A bit over a dollar per square meter, roughly.

ALEKSANDR: Yeah.

LADISLAS MAURICE: All right. What about utilities, who pays what?

ALEKSANDR: Water, usually, pays the landlord because it’s so cheap.

LADISLAS MAURICE: How much would that be?

ALEKSANDR: $10 per month. And the one who is renting, he pays for the electricity bill. It’s around $50 per month, depending how much you’re using your air conditioning and other things. The property tax will be like $300 per year.

LADISLAS MAURICE: Okay, so not a train smash.

ALEKSANDR: Yeah.

LADISLAS MAURICE: And in terms of the maintenance budget, if there are issues, there’s a water leak, you need to send the plumber, you need to do all that, how much would you put in these numbers per year, roughly?

ALEKSANDR: I think it will be $400 or $500 per year.

LADISLAS MAURICE: Cool. I mean, labor is extremely affordable here in Paraguay. The minimum wage is how much per month?

ALEKSANDR: $350.

LADISLAS MAURICE: Okay, cool. You can get a lot done with not much money, essentially. Cool. Essentially, once we actually go through everything, we end up with a net rental yield or a capitalization rate of a bit over 3%. Again, this is before negotiating. I would definitely go and negotiate before buying something like this. Look, it’s not a great number. It’s objectively not appealing. If you want to be a yield investor, there are other markets that are more interesting than Paraguay. But we’ll go into why people could potentially be interested in investing here.

Liquidity in the real estate market in Asuncion, Paraguay

LADISLAS MAURICE: But before we do this, so this building has been completed one year ago. And there’s still, roughly, four or five units that are for sale. And it’s not like they’re random units without windows, or ground floor, or something. I mean, the apartment we saw was nice. Why does it take that long for the developer to sell?

ALEKSANDR: The price is pretty high for the local people. And Paraguay still is developing. Paraguay, in the last 10 years, was improving very well but, still, there are not so many people who have that amount of money to buy for $140,000. It’s expensive. For that reason, I think, the majority of people who like here, these kinds of apartments, are foreigners, like, Argentinians, Brazilians, Chile, maybe, and other countries, and middle class or rich people from Paraguay.

LADISLAS MAURICE: And I think this is very important for people to understand. When they enter the market here in Paraguay, it is very illiquid. A brand new apartment like here, nice area, nice building, good amenities. I mean, it’s not like the price is too much, it’s the market price, but just the market is super slow. If you were to buy this, even just selling it would be very complicated, even though it looks like something that everyone would want, and that’s not too expensive, etc., but for the local market, it’s a lot of money just in aggregate, so very low liquidity. When you make a real estate investment here in Paraguay, it can take definitely months, potentially years to sell.

Who is buying real estate in Paraguay?

LADISLAS MAURICE: Looking at this investment, I mean, the price per square meter is not atrociously high, it’s $1,750 per square meter. In square foot, it’s about $160 per square foot. Who is actually buying these apartments and why? Because yield is not the reason.

ALEKSANDR: No. At least, this building, let’s say, that many young Paraguayans bought this apartment. For me, it’s impressive, from where they got that amount of money, if you take that they’re young Paraguayans. But usually, in the capital of Asunción, usually, Argentinians are buying apartments, or Brazilians, or other countries where they have economic problems, the government with high taxes, and all that stuff. Many Argentinians try to save their money, so they came to Asunción, and they’re buying many apartments. Like, from every building that I was, when I was asking who are buying these apartments, it’s always Argentinians that they say. Even in the newspaper, I know if it’s an official statistic, because there are not such thing, so there is private statistic of some companies, and in one newspaper, they said that 7 of 10 sold apartments were bought by Argentinians.

Why do foreigners buy real estate in Asuncion, Paraguay?

LADISLAS MAURICE: Interesting. And I think this is something that people really need to understand when they come here, because this is very insightful. This is a safe haven market, okay? I know that Paraguay is, in most people’s minds, is this like little country in the middle of–

ALEKSANDR: Nowhere.

LADISLAS MAURICE: nowhere, far away from everywhere. But actually, regionally, Paraguay is perceived to be a safe haven, which, objectively, it is. It’s surrounded by countries that are all extremely high tax with very socialistic governments. Whether it be Brazil, Argentina, or Bolivia, they’re horrible places to do business. It’s complicated, extremely high taxes, and some level of political instability, to say the least, in all of these countries. Paraguay is actually seen as safe. And whenever you enter a market that is perceived to be safe, especially in a region where there is not a lot of safety, or perceived safety, prices invariably get inflated versus the local incomes, because foreigners who come and purchase here, they’re not looking to make yield, they’re just looking for safety. For them, having money here is essentially like having a bar of gold somewhere. It’s just stashed away here in Asunción.

When you come and invest here, and you’re trying to make good rental yield, it’s hard because you have these other buyers that are not thinking the same way, so they just essentially inflate prices. Now, does it mean the prices are going to go down? No, because it’s wealthy people stashing money away. They don’t need to sell. This is their really extra savings that they put overseas. There’s not that much of a mortgage market here, either, so prices are unlikely to go down much at all, unless there were a political crisis or something. But they’re also not likely to just suddenly boom. It’s just whatever you put in you’ll probably get out. Prices will gradually increase over time. I mean, the country has very good demographics as well. It’s one of the few countries where the population is really increasing, and fast.

But there are a few catalysts in the sense that could the situation get worse in Brazil, potentially. We’re seeing more and more political instability. In Brazil, people hate each other increasingly, so that could lead to the issues. Argentina is a perpetual mess. As long as these two countries continue having issues, and they probably will, and Paraguay does not change its business friendliness and its friendliness to foreign capital, then it will continue to be perceived as safety. Just like Panama is Central America’s, and Colombia’s, and Venezuela’s safe haven, here, this is Brazil’s and Argentina’s safe haven with a potential tailwind being an increasing amount of immigration coming here.

Why are people moving to Paraguay?

LADISLAS MAURICE: Because, I mean, you help people obtain residency here in Paraguay, and you’ve seen a lot of people moving here and obtaining residency here. Can you speak a little bit about this? Because, I mean, these are the tenants, essentially. Because, I mean, you do immigration, so you also find the tenants easily.

ALEKSANDR: Especially after the lockdown, there were many waves of people from different part of the country. The lockdown in Europe, in United States, in other countries obligate people to find other places to live where they can be safe.

LADISLAS MAURICE: Cool. Most immigrants right now coming to Paraguay, the ones with money, that could afford something like this, where do they come from these days?

ALEKSANDR: Usually, Germans, because, I think, it was like, not a tradition, but usually, there were many Germans in Paraguay already the last century, so I think Germans know about Paraguay, because people talk about Paraguay. Many people have friends there. For that reason, Germans were the first big community here. And during the lockdown, we had a massive amount of Germans coming to Paraguay. Then the second will be like other countries from Europe, France, Canada, and United States, too. Canada, United States, France, Ukrainian, Russians, many people around the world. Even from Asia, but for them it’s more difficult to get the residency, so not a lot of them are in Paraguay, but they want to go here.

LADISLAS MAURICE: So it’s mostly Europeans more than North Americans, right?

ALEKSANDR: Yeah, mostly. Yeah, because usually, with them, Paraguay has a [Visa purchasing 20:51] relationship, so many Europeans can easily come to Paraguay to apply for the residency. After, for example, the problems that South Africa had during the protest in the last year, or it was two years ago, I don’t remember, where animals were burnt, all that stuff.

LADISLAS MAURICE: In Durban, yeah.

ALEKSANDR: Yeah. And I saw, in immigration, some farmers from South Africa. Like, you see from their look and how they talk in English that they’re from there. So South Africans moved from there.

LADISLAS MAURICE: Cool. Essentially, the thesis, again, is, if you think we are going into a world of issues and problems and where mostly people from Europe will look for someplace to immigrate to, Paraguay will be a big beneficiary of this immigration. This is a potential positive, a potential catalyst for your investments here. But it’s nothing that’s really truly immediate, but it’s just something that will essentially guarantee a steady stream of people coming into the country and renting out nice apartments like this.

And talking about the Germans, when I was driving around the country, we went to a little German-majority town called Hohenau, and we’re staying in some Airbnb there. And it was a Russian lady that owned the Airbnb. And when we arrived there, she asked us if we spoke English, Spanish, or German. [laughs]

ALEKSANDR: [laughs]

LADISLAS MAURICE: And then she was saying that her kids were actually learning German and Spanish in that town. It’s quite interesting. There really are these little towns with like these Germans everywhere.

ALEKSANDR: And they have their own German schools. Like, some colonies that are very isolated, and very, like, they don’t want to, like, they have only their community and they’re living only within that community. They have their own church, their own German schools, all of those things. And people, they’re creating their little Germany within Paraguay. [laughs]

LADISLAS MAURICE: Real estate here could be a way of shorting Germany. [laughs] Cool. Okay, fantastic. Great. I think this gives an interesting overview. I also wrote an article, and Aleksandr helped me with some of the research, in terms of where to invest in Asunción, which neighborhoods, etc. There’s a link below, you can read that whole article. And if you want to get in touch with Aleksandr, so Aleksandr offers some buyer’s agent services to help people here make investments in the capital city. And I think what’s interesting about this, about your service, is that it’s not like a typical real estate agency. You don’t just look online or call the other agents. If a buyer is serious and is pretty clear in terms of what he wants–

ALEKSANDR: Yeah, we will go offline to serve the clients. Especially if it’s a big land, usually, the landlord doesn’t publish he’s selling on internet or other places. It’s usually it’s all by contact, or by real estate agent, or just offline they’re putting their–

LADISLAS MAURICE: Sale signs.

ALEKSANDR: Yeah, sale sign.

LADISLAS MAURICE: And same thing not just for agricultural land but, let’s say, I want to buy a house or something here in the capital city.

ALEKSANDR: Capital, people here are more into technology, so usually, they put their sign on internet and all the thing. But there are still people who don’t use those things, so you have to go to those places and to search for the optimal land that you want or optimal house that you like.

LADISLAS MAURICE: Cool. Essentially, driving around and calling?

ALEKSANDR: Yeah.

LADISLAS MAURICE: Cool. All right, fantastic. Great. Aleksandr, thank you.

ALEKSANDR: Yeah, thank you. You’re welcome.

Your comments are right on the spot, I belive there are too many new buildings in the proccess of being build and that will make the market even more iliquid, but as you pointed out, many foreingners are using these units as a way to save their money, the problem will be if they ever need to sell it, will be stuck for a while and more likely will have to sell them at a discount.