Making a real estate investment in Tbilisi, Georgia, is increasingly making headlines in the “offshore” world. Georgia is being sold as a great place to do business as well as being affordable and populated by friendly people making delicious wine. Guess what, this is not a contrarian article as all these points are true. I’m a regular in Georgia.

However, the point that this article will try to make, is that a real estate investment in Tbilisi is not the quick road to riches often sold. It’s likely a good investment, but expectations must be managed.

The reality is that when you land in a country where the border guards hand out free wine on arrival, it’s easy to get carried away 🙂

The Georgian reforms and the economy

It all starts with former prime minister and president Mikheil Saakashvili when he enacted fundamental reforms in the 2000s which completely transformed Georgia.

Thanks to these reforms, Georgia now ranks 7th in the 2019 Ease of Doing Business ranking by the World Bank. It’s the sort of place where opening a business takes only one procedure, and where you can pick up your certificate of incorporation the next day at the drive-through, and immediately open a world class bank account.

Quickly skimming through economic data one finds:

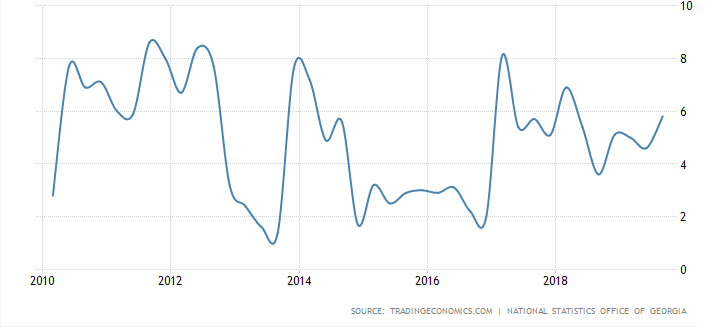

- Great growth over the past 10 years, over above 5%, though its volatility must be noted.

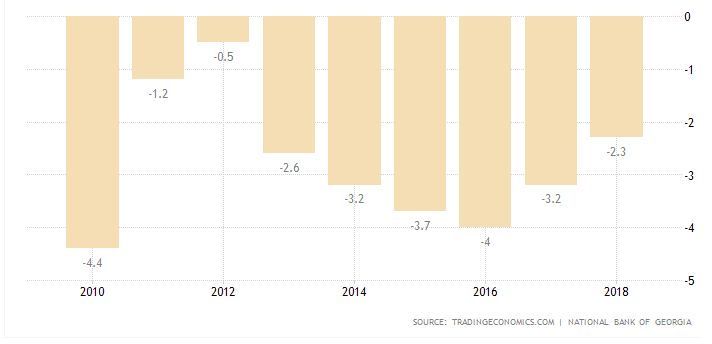

- A consistent budget deficit, which has been maintained in the low single digits.

- This budget deficit has not been too much of an issue as it was below the growth figures, and the debt to GDP ratio is manageable. Do note, again, the volatility.

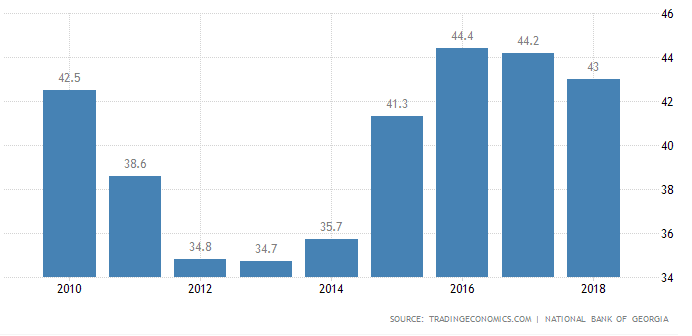

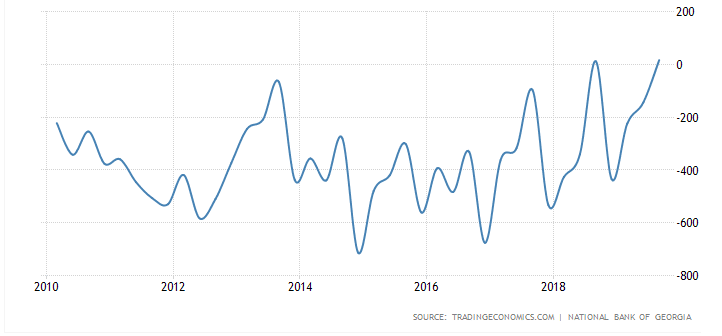

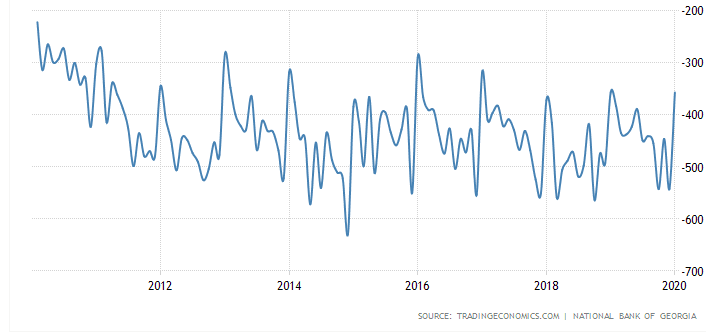

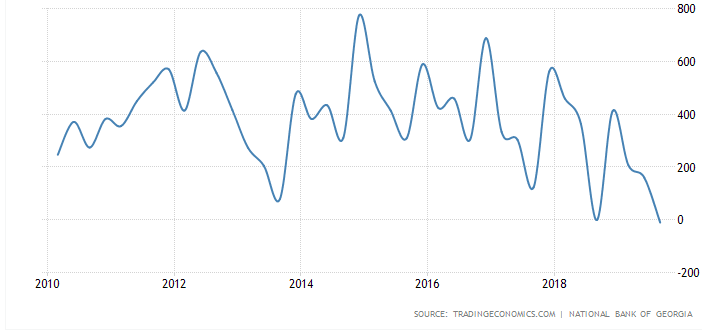

- A persistent current account deficit, even in the good times. It is driven by bad balance of trade.

- The saving grace is strong capital flows into the country.

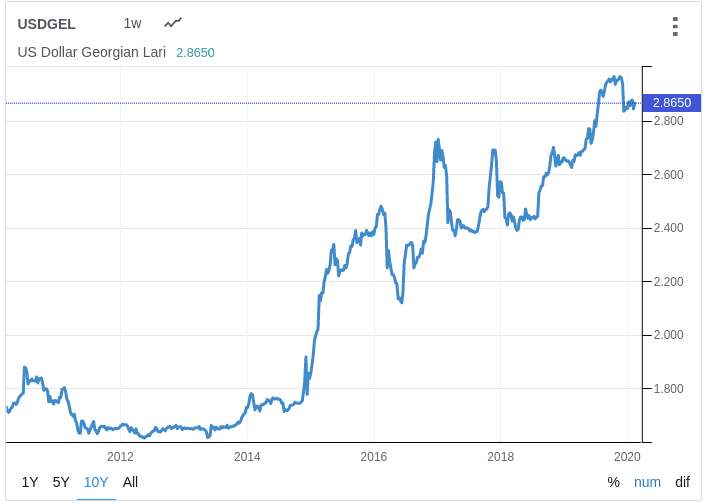

Being an open economy with no capital controls, these numbers are all respectable. However, the economy is very vulnerable to external shocks. This risk is well mirrored in the Georgian Lari.

This vulnerability to shocks is a major factor to take into account when investing in Georgia. The risk is real.

The shocks can be both internal and external

– A global recession which would mean a risk-off attitude, with funds flowing out of Georgia.

Long term though I’d still be optimistic IF Georgia kept it pro-business policies in place as the funds would come back in the aftermath of the crisis. They would leave Western countries (if they can) to places like Georgia which could be seen as safe haven.

– Further geopolitical tensions with Russia, following war in 2008 and regular sanctions from the big neighbour up north.

Tourism accounted for 7.5% of GDP in 2018, and has a lot more potential. The country has so much to offer. But skirmishes with Russia could not only reduce tourism inflows from Russia (the top tourist source), but also scare away other foreigners, thus hitting the tourism industry hard.

The Georgian economy has developed some resilience to negative happenings with Russia, but nevertheless, headline-making news could scare away capital.

To be clear, tensions with Russia could be enacted by Russia, by internal Georgian political squabbling, or by American influence. If any of these parties want to make it happen, they can.

– An increasingly volatile internal political situation. Georgia has seen massive protests over the last year, with people easily protesting en masse in the streets blaming foreign meddlers. Whether they are right or not is besides the point.

The point is that there is tension, unemployment is still high at over 12% and wages generally low. Further chaos or reform-reversing moves by politicians could dramatically alter the perception of Georgia by foreign capital.

The residential real estate investment market in Tbilisi, Georgia

Now that you understand the level of risk, you can have a better appreciation of the true value of the real estate on offer.

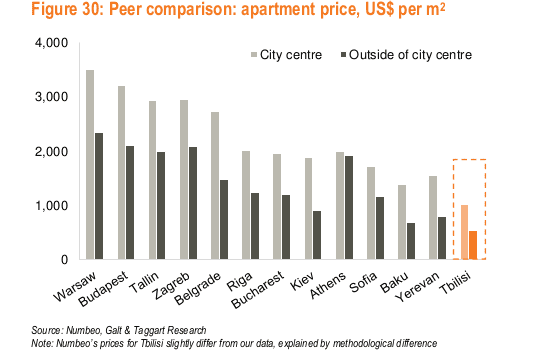

The first aspect that is always brought up is the cheap price per square meter (m2) in Tbilisi. Yes, finding real estate for less than USD 1000 per m2 in a capital city is a bargain.

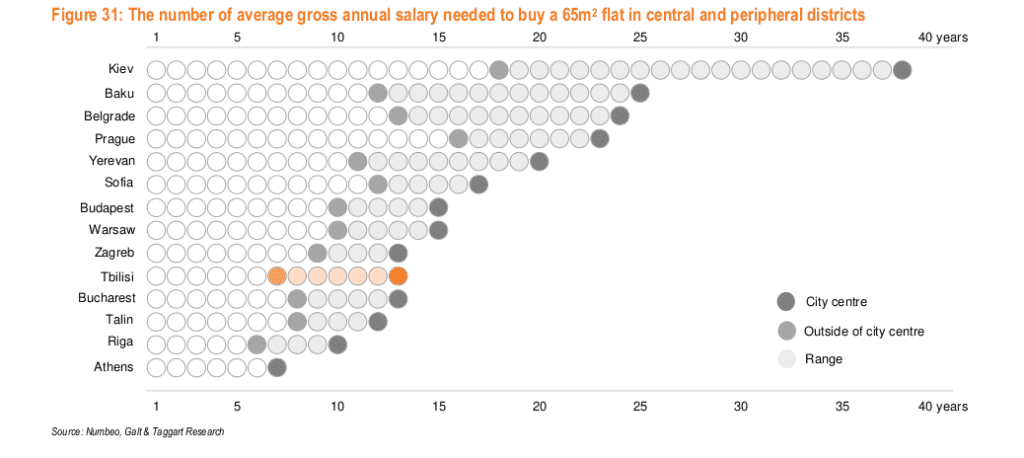

These prices are incredibly low in absolute terms. The immediate thought is that there is no reason for Tbilisi to be cheaper than Baku and Yerevan, the comparable regional capitals.

Wrong. Baku in Azerbaiijan has oil, which distorts pricing, and Yerevan in Armenia has a massive diaspora that pours money into real estate in the country. Both are also more corrupt, which lends itself to money being recycled in real estate.

This distortion is clearly visible in the price to income ratio. It’s not middle class locals that are pushing the prices that high in these two cities

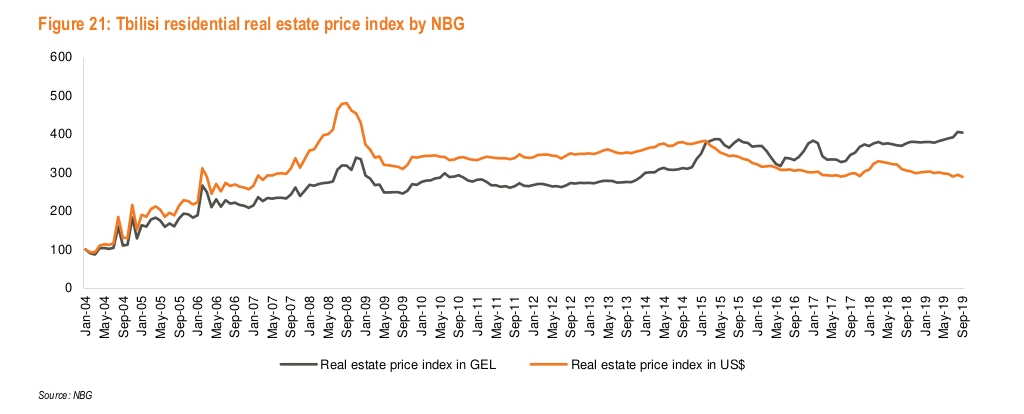

Still, you’d think prices in Tbilisi would catch up quickly. In fact, prices have been going down for the last few years in USD terms.

Tbilisi saw a massive run in prices up to the Global Recession. Since then, USD prices have consolidated on a gentle downward trend. It’s not necessarily a bad thing, as it removes the possibility of a bubble bursting. That said, there is anecdotal evidence that prices have been increasing in the core center, but the average is being pulled down by the outer districts.

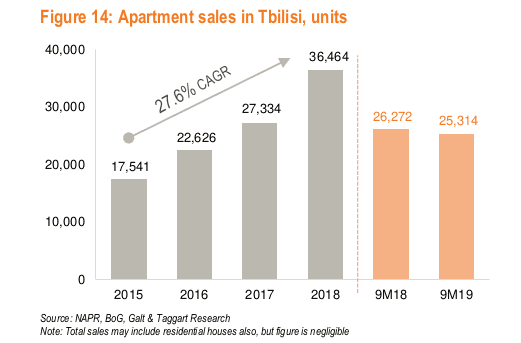

Though m2 USD prices overall have gradually gone down, apartment sales ticked up for a few years before falling a bit in 2019. So again, no signs of a boom here.

And if you were hoping for a speculative boom to drive prices up, it won’t come from the local market. Georgians already have a fair amount of loans from commercial banks. So if substantial speculation there is, it can logically only come from even more foreigners entering the market.

The overall picture is of relative stability; no imminent boom, nor any imminent crash.

The real estate investment rental market in Tbilisi, Georgia

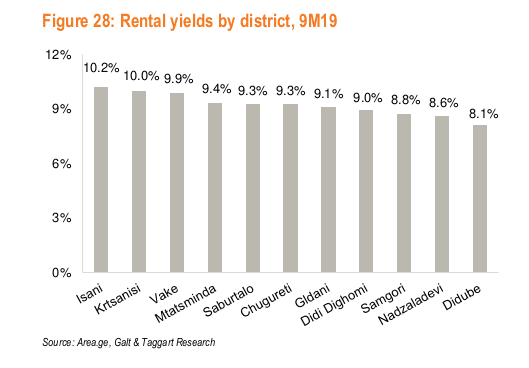

After seeing such great price points, one immediately asks, “what are the yields”?

The graph below is overly optimistic, as it doesn’t necessarily take into account that the average apartment must be either renovated, or completed in the case of a new building. In most cases, new apartments are sold as “empty shells”.

Once you add renovation & completion costs, it would be fair to say that these long term yields would probably drop by 150bps/1.5% to 200bps/2%.

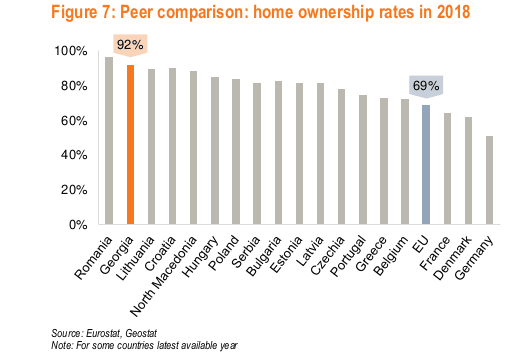

Though there is internal Georgian migration to Tbilisi, smaller household sizes, and construction numbers that appear to be lower for the next few years, a worry I have is the fact that the rental market is still quite small. The ownership rate in Georgia is a full 92% leaving a small portion of the population willing to rent.

So who will rent your apartment? Generally, only foreigners, or locals who can’t afford to buy, which is the lower income bracket. It’s quite a limited market overall. So if you want to buy a nice apartment in the center, you’ll have to fight with everyone else to find a long term tenant, or do Airbnb.

And you’re not the only investor out there. According to Galt & Taggart, the share of apartments sold to foreigners in Georgia jumped from 12.5% in 2016 to 23.3% in 2018.

Airbnb owners in Tbilisi are NOT doing well

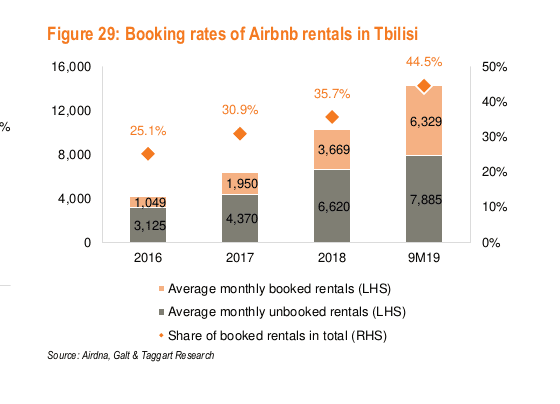

A very worrying sign, is the vacancy rates of Airbnb. Bear with me here because the numbers are quite incredible.

Again, according to Galt & Taggart, there were 15k flats listed on Airbnb in Tbilisi in October 2019 versus 12k in Prague, 11k in Budapest and 10k in Athens. Yet Tbilisi sees nowhere near as much tourism as these three cities, and probably never will.

The booking rate of Airbnbs was only 44.5% in the first 9 months of 2019. These are terrible numbers. I can attest to it on a personal level, whenever I go to Tbilisi, I end up paying just $13-$14 a night for recently renovated studios in the city center.

Once you pay for your property manager and various fees, how do you get a good return? You don’t. So guess what, many owners will start to realize this and shift to the long term market. Who will rent all of those units? It’s not clear. In any case, none of these facts point towards increasing rents.

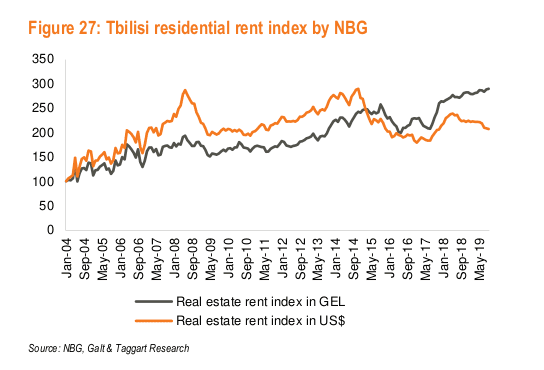

In fact, rents have been on a downwards trend in USD, which is likely to continue or just stay flat.

“What about all the gurus and agents promising me yields of 13-15% in Tbilisi?”

Don’t believe them. If they were early on in the Airbnb game and have tons of great reviews, maybe they are making these numbers. But you won’t.

Example of a real estate investment in an old building in Tbilisi, Georgia

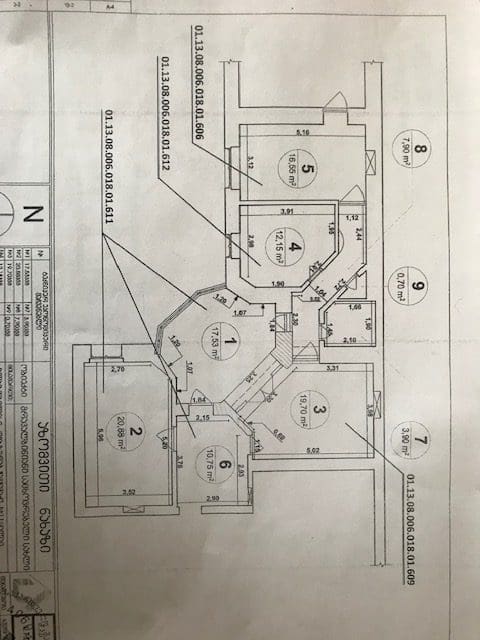

This apartment would be an interesting renovation project. It is located within a block of Marjanishvili metro, which is close to the center on the other side of the river bank. It’s not core center, nor the best neighbourhood, but it has potential to become better than to good transport links, proximity to the center, and historical architecture.

110m2 priced at USD 85,000. You’d probably want to add about USD 500 per m2 for a good renovation. You can take advantage of the great layout and two external doors (!!) to cut the apartment into two different units, to augment your yield.

One apartment could be a 1 bedroom apartment giving you $350 per month, and the other a 2 bedroom apartment getting you $600 per month.

| 1 bedroom flat @ $350 per month | $4200 |

| 2 bedroom flat @ $550 per month | $6600 |

| – 15% vacancy rate | $1620 |

| – Management fees & finders fees 15% | $1620 |

| – Maintenance & various 10% | $1080 |

| – 5% tax on gross rental income | $459 |

| Net net income | $6021 |

| Total yearly yield based on 85k purchase + 55k renovation | 4.6% |

It’s important to account for rather high vacancy rates in Tbilisi for the previously mentioned reasons. You can also check online and will see thousands of nice, furnished, renovated apartments for rent. When you ask agents how long it takes to find a tenant you get answers like “If the season is good it can be quite quick”. Read in between the lines and it’s not that easy to find tenants. Also, as you’re dealing with a lot of foreigners, expect high turnover.

This example is by no means a recommendation, nor is this particular neighbourhood. I saw quite a few apartments when I was there recently and this one stood out for it’s price per m2, and good structural and architectural fundamentals. You can go into the core center and find apartments that need renovation at about $1000 per m2.

As for new buildings, there are many such projects, and the yields are similar to what was discussed earlier. That said, even though it is often easier to deal with than an old building, the construction standards are quite low, especially in the outskirts, so expect your investment to look rather shabby in 15 years.

As for luxury buildings with good construction standards downtown, they are far from cheap and your yields will be considerably lower.

Should you make a Real Estate Investment in Tbilisi, Georgia?

The market has a lot going for it. It has unbeatable m2 prices, gorgeous historical buildings, low taxes, and is situated in a beautiful city with great people, food and banks. Buying a minimum amount of real estate also entitles you to various residency options in Georgia. You can find out about them here.

But you need to manage your expectations. These 13%-15% yields promised by gurus, agents and developers will not materialize under normal conditions. The rental market is small, and yet has a lot of supply.

Once you understand this, you can go there to buy an apartment, and low-ball the rent to get guaranteed rental income. All things being equal, over the years, prices should trend upwards along with Georgia’s growth.

If you do go ahead with a transaction and are looking for a good lawyer, my lawyer can help you for a reasonable fee.

Services in Georgia:

Articles on Georgia:

- One of the Best Structures for Digital Nomads: The Sole Proprietorship in the Country of Georgia

- The Pros and Cons of opening a Bank Account in Tbilisi, Georgia

- The Real Estate Investment Market in Tbilisi, Georgia

- 9 reasons to get Residency in the Republic of Georgia

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

I thought this article was right on. I have four apartments in Tbilisi and I really love the city and think it has a very good but relatively higher risk future. Things change in Tbilisi.

I have the apartments as part of my residency/citizenship process there. I agree on the returns and rents. They have gone down and I have had to be really competitive to keep them rented.

I made a 3 part video series describing my experience. https://youtu.be/i_aOU_bKGKQ

Great video series Dan. Fantastic information. Thanks for sharing.

Good article, I pretty much agree with everything you said accept one thing – western foreigners tend to put too much stock in AirBnB while Georgians mostly dislike / don’t trust it.

That means their properties are on AirBnB as a “second option” to capture western tourists, but that’s not their primary means of short term renting. Usually they fill their vacancies by word of mouth or booking.com. That “vacant” apartment (on AirBnB) is very often full of people from booking.com or other sources.

Personally now that I lived here 5 years, when I travel internally, I always avoid AirBnB, and I don’t know many Georgians or more regular tourists (eastern Europeans, Russians, Azerbaijanis, Armenians, Turks) that use it. So I would take AirBnB vacancy “statistics” with a grain of salt.

Good insight. Thank you Stephen.

I used to have 15 apartments daily rental business and managed annual average occupancy of 65%+ so numbers here are a bit low, however I would still recommend investing in Commercial real estate in Tbilisi vs. Residential

As a real estate investor in Tbilisi since 2012, I agree with your market analysis.

You have done a great job.

Great info, thanks for taking the time to put this together! I own two properties in Tbilisi (close to Biltmore hotel), but they are for personal use. I am beginning to research investing in Residential or Commercial real estate in Tbilisi. What are your thoughts on Commercial? So far it looks like rents on Commercial properties are taxed at 20%, is that right? Also, commercial properties capital gains are taxed at 20%, whereas residential capital gains are tax free if you hold the property for 2+ years, can you confirm that? If you are in Tbilisi, would love to buy you a beer or coffee sometime 🙂

Hi Andrew. For the capital gains on residential property, yes, last time I checked you are exempt from them if you bought in your own name and held the property for 2 years or more. Double check before making a decision as tax laws are likely to change fast everywhere. As for commercial property, I don’t know. I really didn’t look into this sector.

And thanks for the beer offer. I might take you up on this 🙂

Cheers

I am interested in a purchasing purely for the real estate residency program. Can anyone point me to more info on the “cc code” that is issued when purchasing a property. Things like when is that code issued that be used to qualify for residency. I bought one under development property and the code was issued upon purchase, not on completion. The second property I am struggling to get the code and it is beginning to appear as though I will only be issued that one on completion. Is there a way to get that code earlier as I would really like to begin my application for temporary residency.

I sent you an email

HI, thank you for this article ! Very useful info for me right now, as I just arrived in Tbilisi, from Paris. I came here with my wife who is Georgian.

I got very different info from Georgian real estate agents… And it seemed weird that they would say prices are not going down, especially right now ! I’m wondering if I should buy a flat or continue renting.

Do you live here ? Would you say things changed drastically since you wrote this article ?

Again, thank you very much for your work.

Bonjour Adrian,

Thank you for your comment. I wouldn’t trust these agents. Some people want to sell (their apartments have been empty for months) but there are no buyers around. If I were you I’d continue renting, get a good feel for the market, and take my time before pulling the trigger. There’s no rush. You’ve probably also noticed how great a deal you got for renting, and how many options you had.

Enjoy beautiful Tbilisi!

Great, article! I would love to own a flat in Vake to rent for 8 months and live there for 4. Now I am not so sure after your article 🙂

Great advice though!

Glad you enjoyed it Fab. Thank you.

Excellent article for someone who has been a real estate investor in the US for 30+ years but looking at moving into the Georgian market (and hopefully establishing residency … not sure if … at age 60 … it is worth pursuing citizenship). Wife and son (also an investor) going over shortly … I will follow in a few months. Definitely need to do some research on commercial. I could deal with the low yields (low, and they didn’t even include a mortgage) if there was good appreciation. Seems like there might be … or might not be. So like everything else, without a crystal ball, it will be a challenge. Thanks

Thank you Mike. Good luck!