Paraguay is gaining attention as a great location for those seeking a backup plan or “Plan B.” This interest has always existed, but has intensified due to the rise in global tensions. The most logical first step is to get residency in Paraguay. In addition, many are exploring the Asuncion real estate market not just for residential purposes, but for the diversification of their investments.

However, is buying real estate in Asuncion a good investment? Overall, the Asuncion real estate market appears to have a good potential for capital appreciation, starting from a relatively low point. However, it must be noted that the rental yields are in constant flux.

Table of Contents

My personal journey in Paraguay

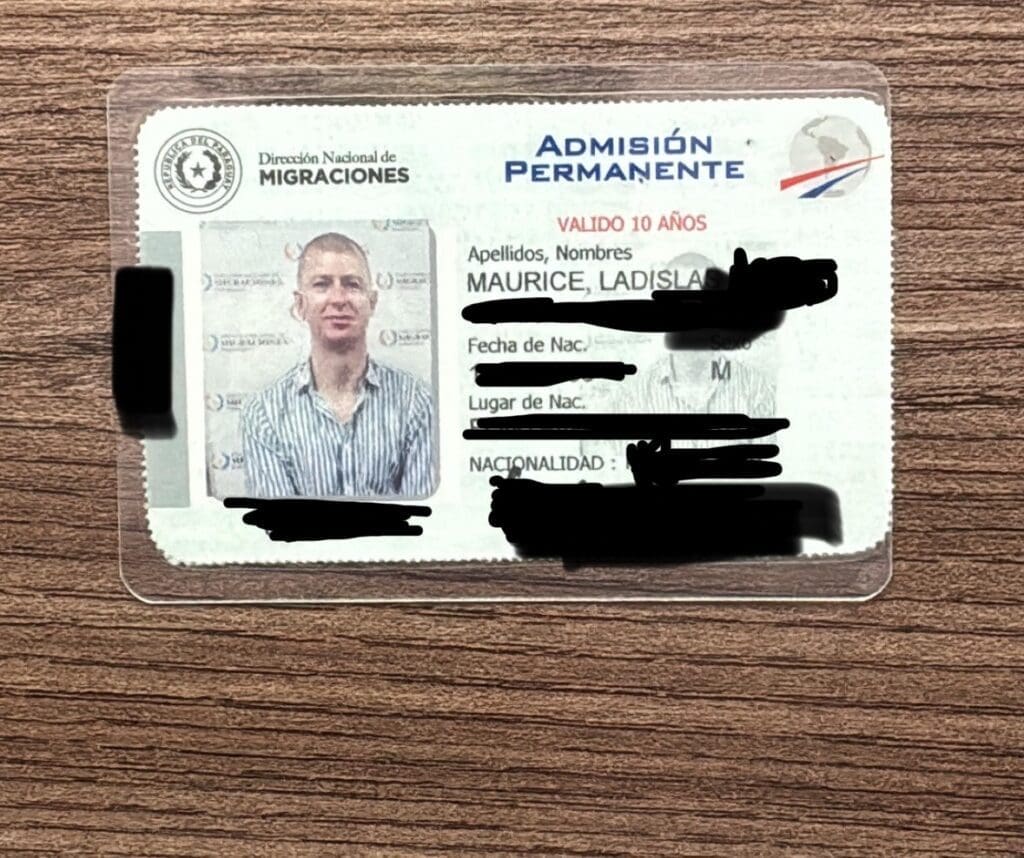

Naturally, the first thing I did was obtain residency in Paraguay. Aleksandr, who helps people obtain residency in Paraguay sorted it out for me. I gave him my documents on arrival, and two months later I received my temporary residency card. Two year later I used Matt to get my permanent residency. Both were very helpful.

I spent a few weeks road-tripping around Paraguay and went to Asuncion a few times specifically looking at real estate.

Macro Overview of Paraguay

Before going into the specifics of the real estate market in Asuncion, it is important to have a decent understanding of the macro landscape in Paraguay.

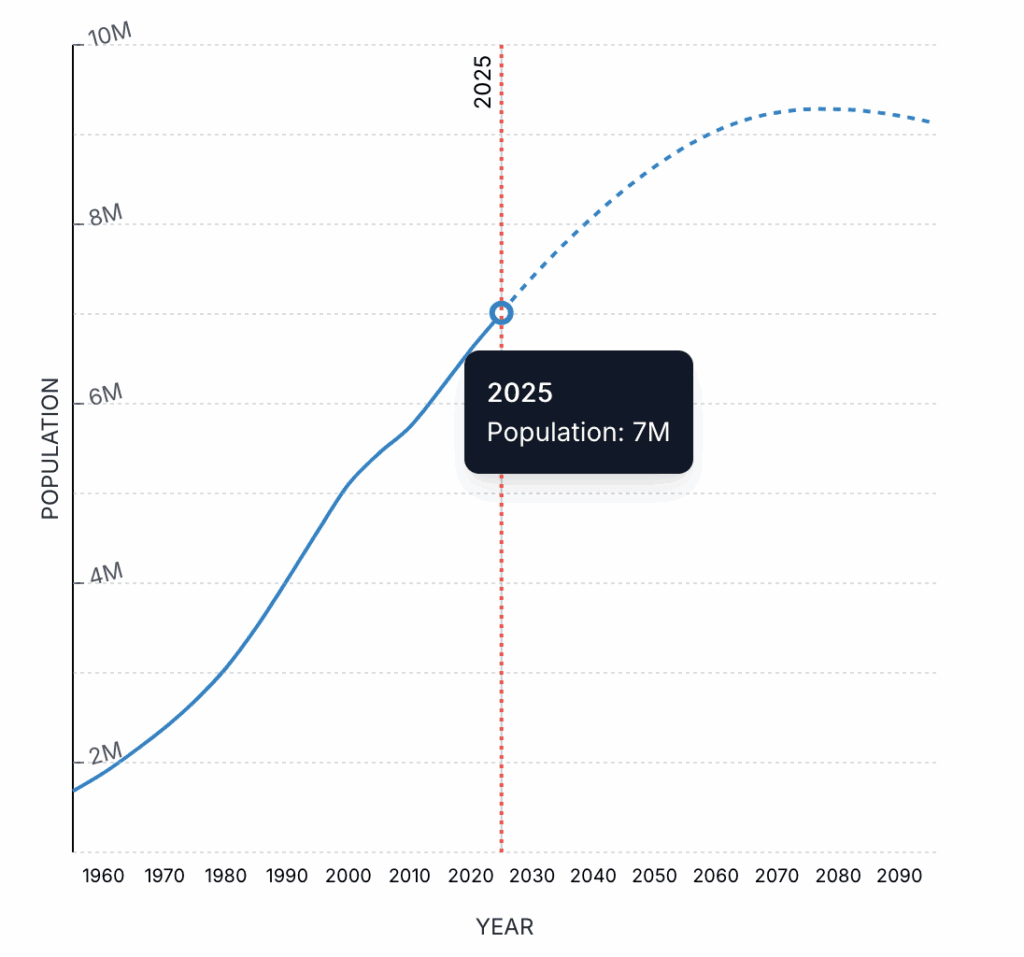

Booming Demographics

This booming population is a major long-term tailwind for the real estate market in Paraguay. It is entirely driven by births, not by immigration. The country boasts a high fertility rate of almost 2.5 children per woman.

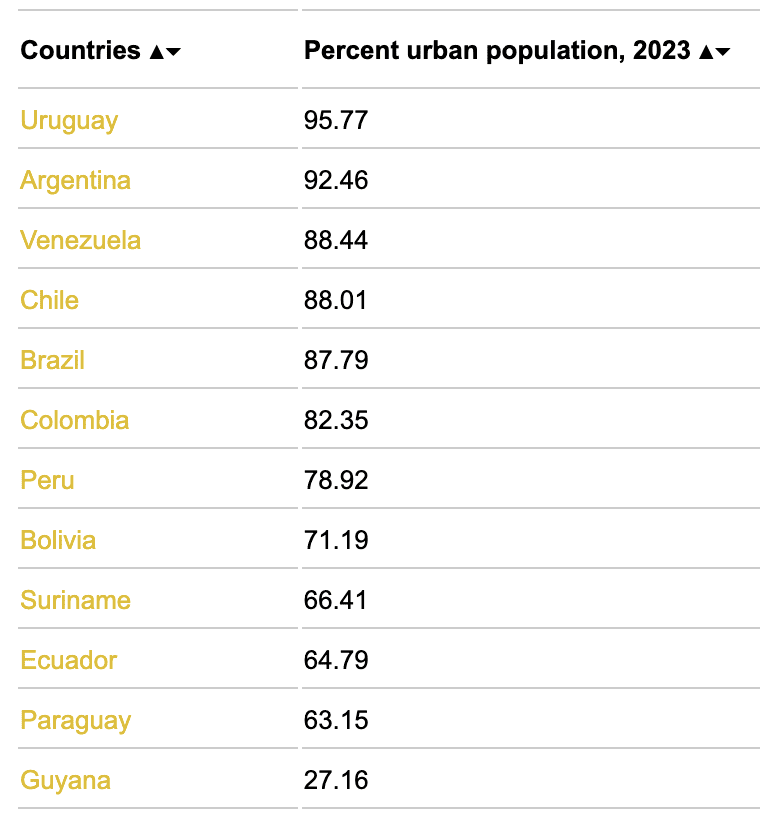

This is a very high rate, which will ensure continued demand for real estate in the country. Additionally, the urbanization rate in Paraguay is still comparatively low, which implies a lot of catching up for Asuncion.

When you combine booming demographics with a strong urbanization trend, the Asuncion real estate market is set to do well in the coming decades.

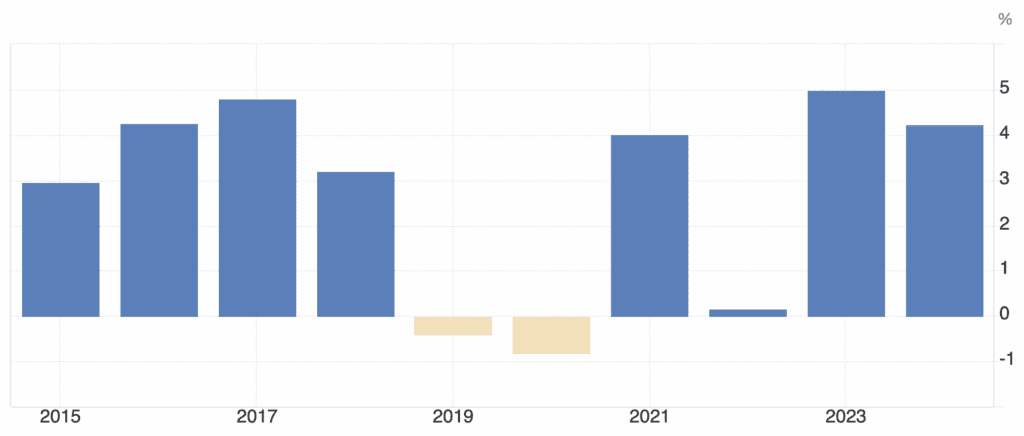

Strong Growth

Paraguay has seen consistent, strong growth for the past ten years with the occasional hiccup related to either Covid or a drought.

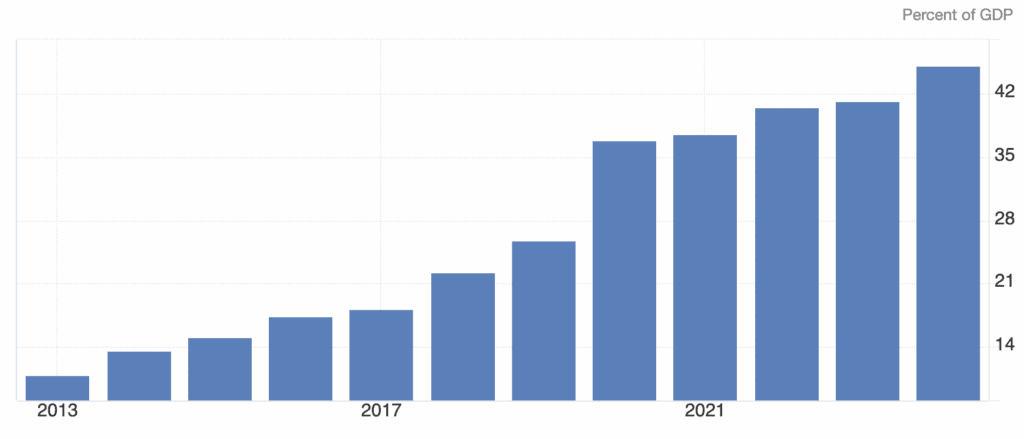

Decent Government Finances

These numbers would put most North American and European governments to shame. Paraguay is not over-indebted. Sure, debt levels have been rising, but the gross levels remain very manageable in spite of, or thanks to, a great tax system and minimal government involvement.

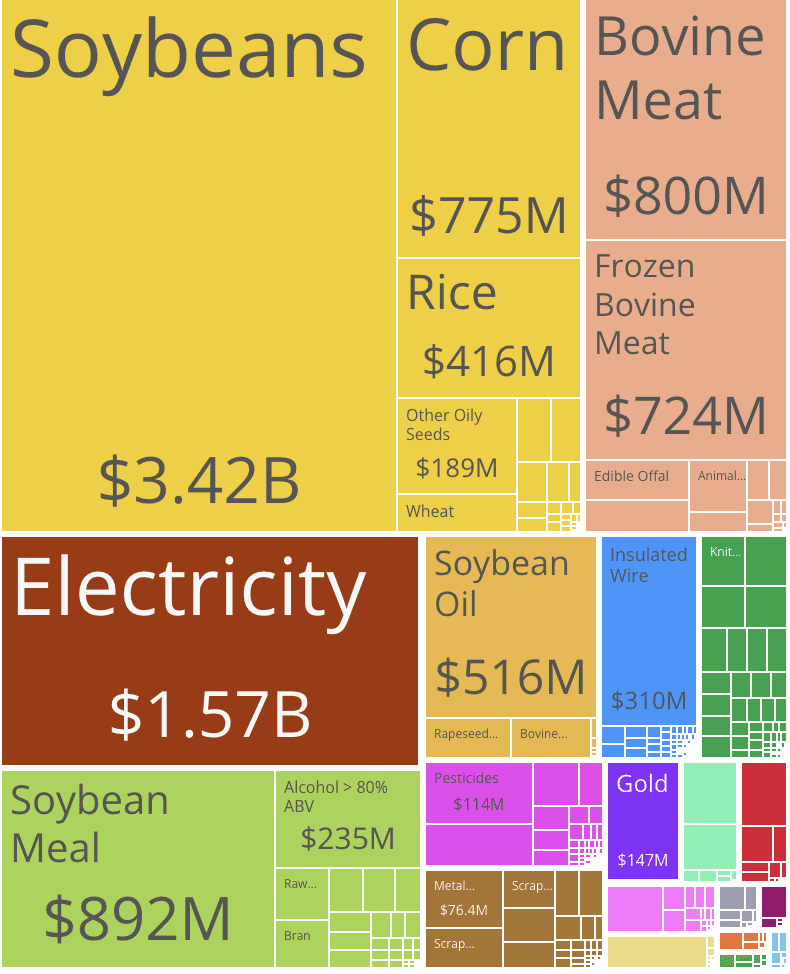

A net exporter of food and electricity

In a world of potential constraints with food supply, and Western countries increasingly limiting their production of meat, Paraguay’s export profile is a very positive one. It’s unfortunate that it does not have more manufacturing, but as a landlocked country with expensive logistics in its neighboring countries, it needs to continue focusing on what it does best: agriculture and being a safe haven for Argentines and Brazilians.

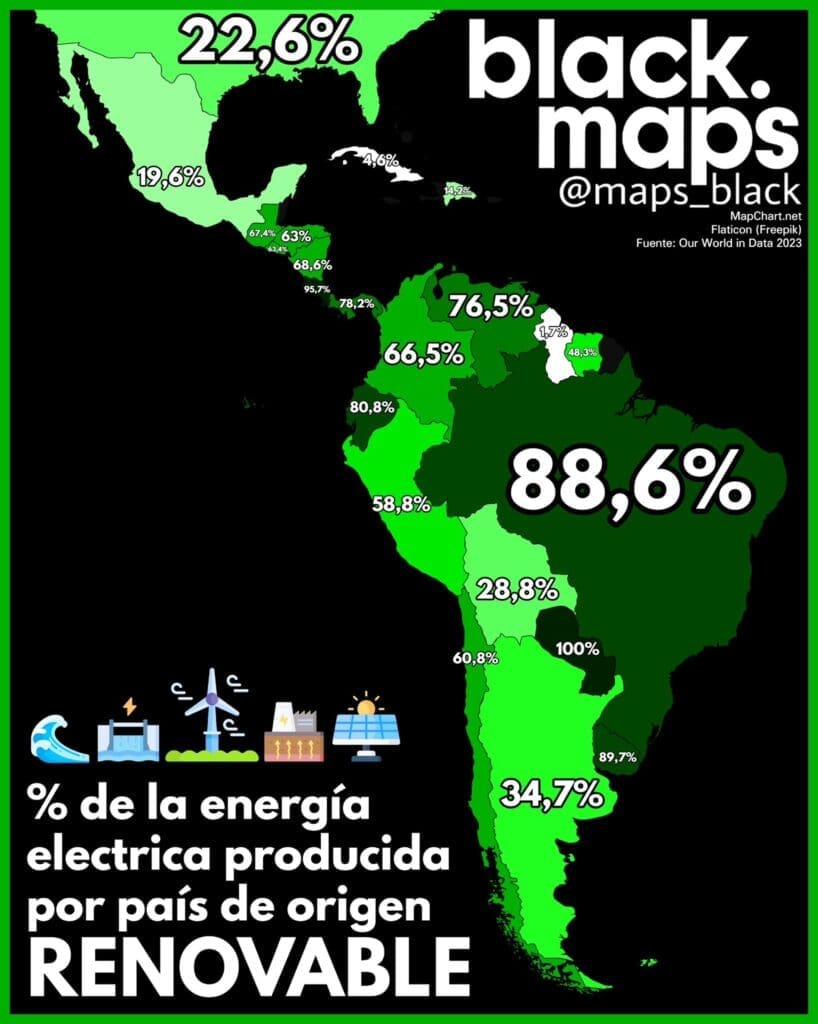

Paraguay is also sitting on of the largest aquifers in the world, and is a net exporter of electricity thanks to the Itaipu hydroelectric dam which not only earns export revenue but also results in Paraguay having low electricity costs. This is one of the reasons why many crypto mining operations set up shop in Paraguay, in spite of the warm weather.

Massive infrastructure development in Paraguay

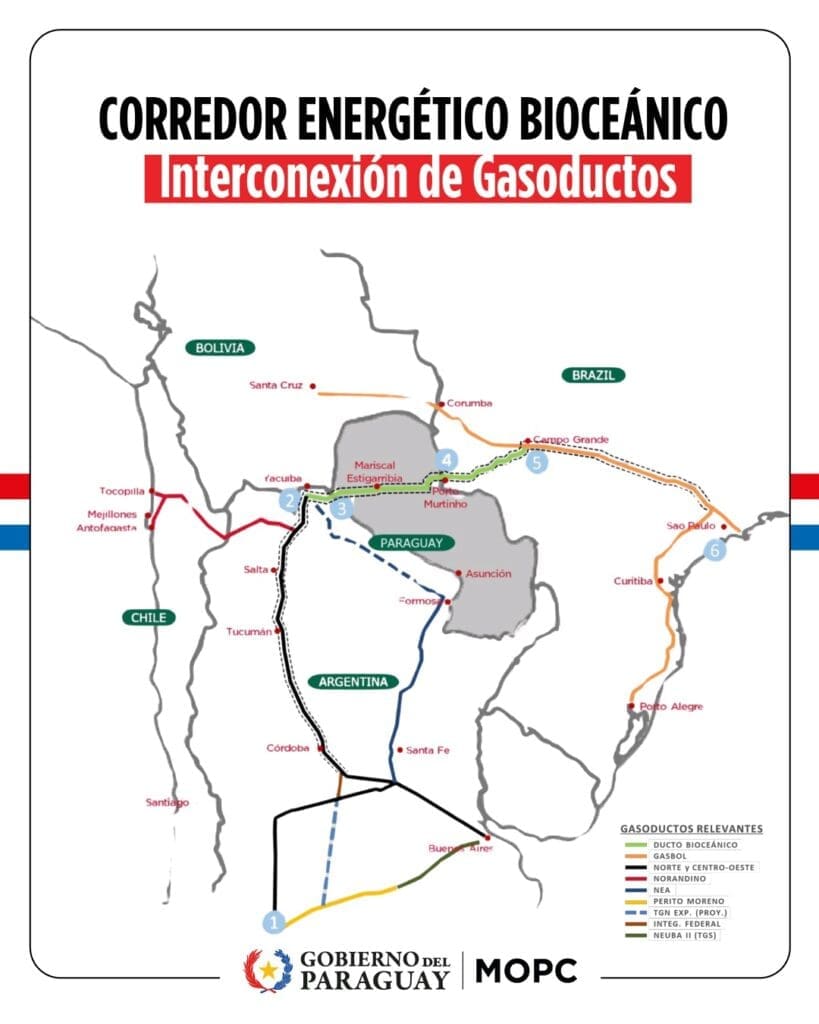

The Bioceanic corridor from Brazil to Chile

Of all countries involved in this China-focused coast to coast infrastructure project, Praguay stands to win the most. It will give the country many more options to export its goods and will make it less dependent on some routes.

Development of this road is well underway, and will prove to be a catalyst for the whole region and reduce some of Brazil’s dependence on the Panama Canal.

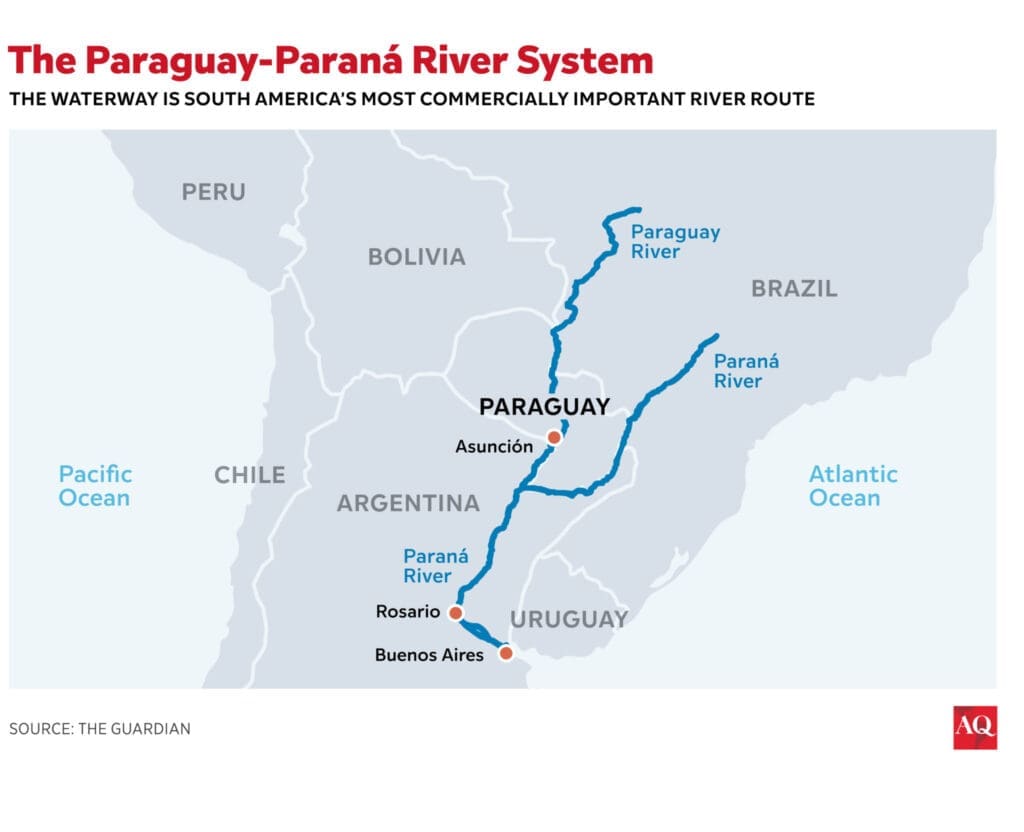

Paraguay-Paraná River System

Less discussed, but equally as important, in the Paraguay-Paraná river system which is central to South American logistics. Traffic volume is growing so quickly that it is expected to double by 2035.

Major dredging projects are being planned by Brazil, Argentina and Paraguay to increase capacity. Paraguay already boats the world’s third largest fleet of river barges, despite having a population of just 7 million people.

Infrastructure development everywhere

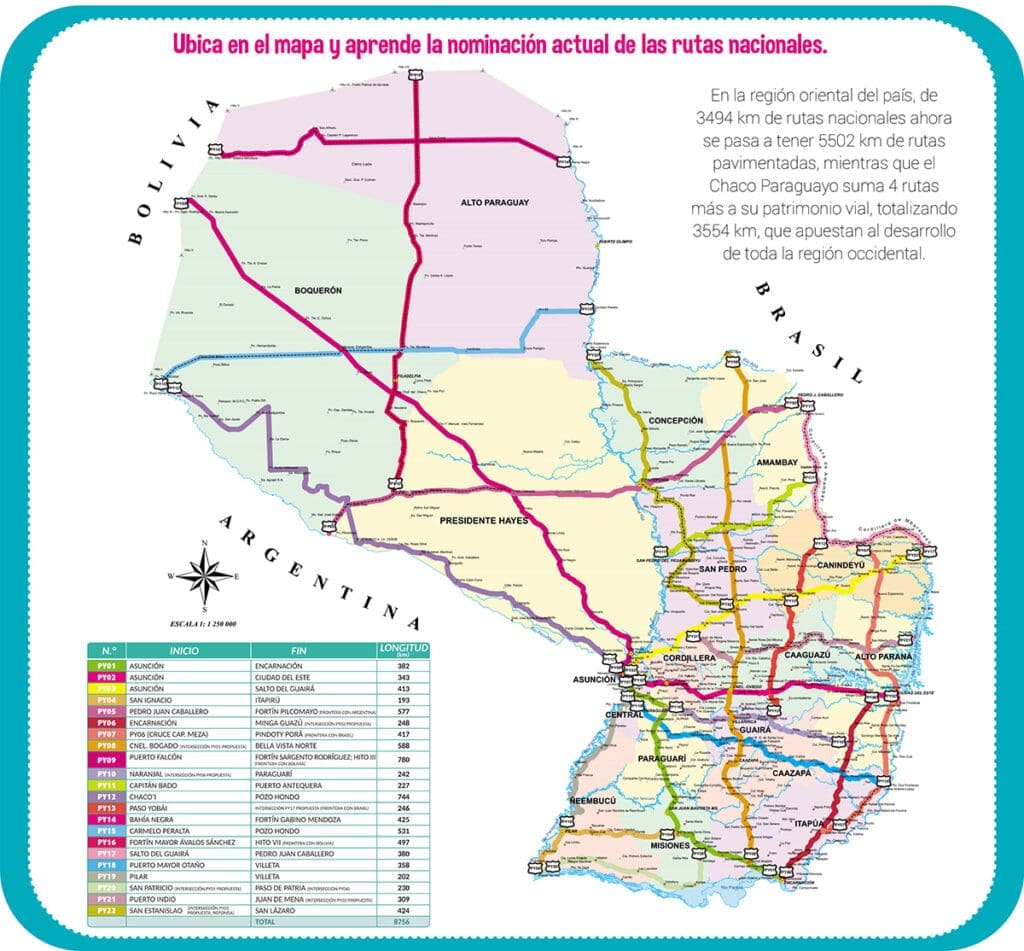

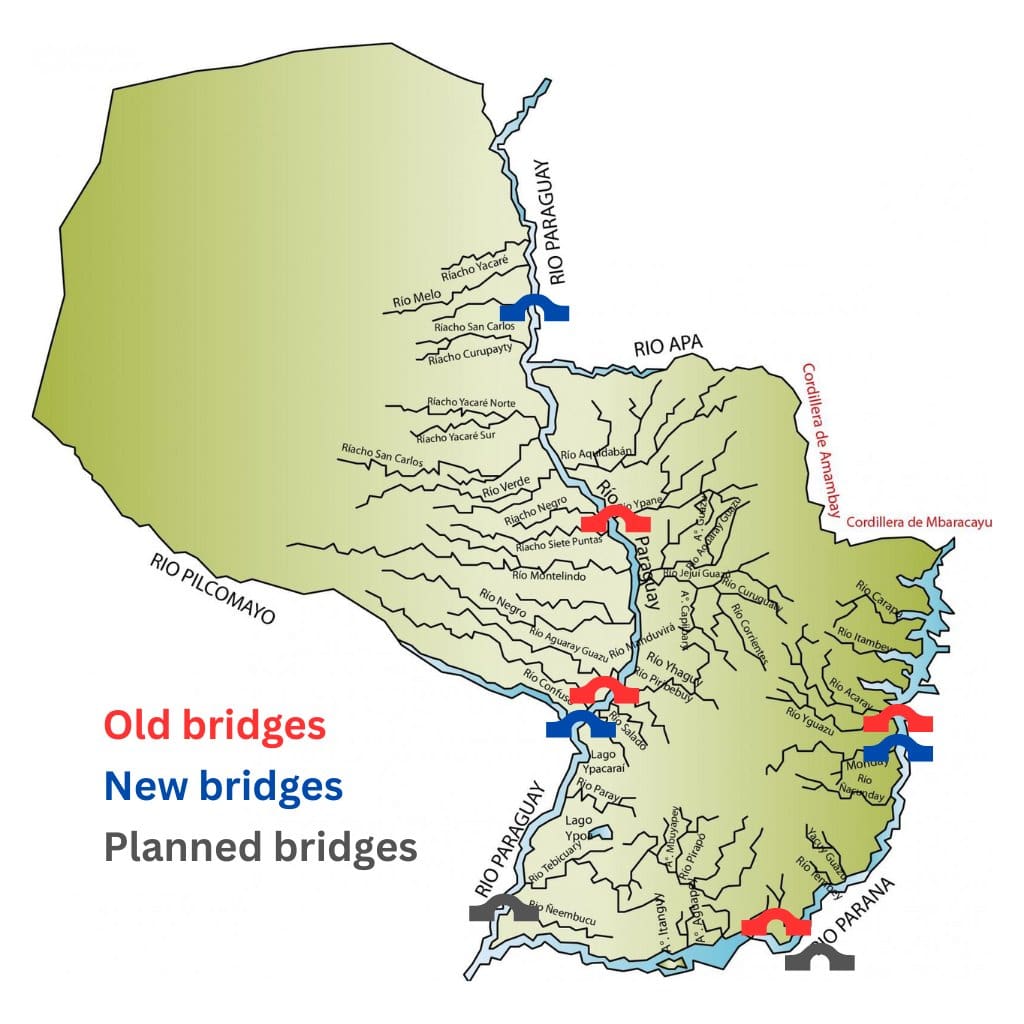

There are constant tenders out for infrastructure development in the country. All the major roads on this map are being gradually turned into viable highways. Bridges are being built, gas pipelines are being connected to Paraguay’s grid to lower the country’s energy costs…so much is going on. Billions are being allocated.

Key Drivers for the Asuncion real estate market

Asuncion is a growing city of 600,000, but including the adjacent cities it is a metropolitan area of 2.7 million people. You can expect to pay about $1,500 to $2,000 per m2 for apartments in the good neighbourhoods of Asuncion. Objectively, it’s not expensive for prime real estate in a capital city. However, there is a lot of space to build and the zoning laws are quite lax, so supply tends to appear quickly on the market.

Paraguay is one of the few countries I know of where real estate prices actually decreased after Covid and where rental yields increased. Why?

- Much more construction. Developers are competing on price.

- Much more full-time immigration to Asuncion and digital nomads spending a few months per year in Paraguay for tax purposes. This has significantly increased the demand for rental properties.

Foreign demand for safe haven real estate

Obviously the local market is one of the drivers, but objectively Paraguay is a poor country. The purchasing power of Paraguayans is generally low, so only a small middle class and elite can buy in the better neighborhoods.

However next door are two very large countries, namely Brazil and Argentina, that are in constant political flux combined with high taxes.

Little Paraguay, in between, has a history of being stable and low tax. In many ways it is a “more affordable Uruguay” from a capital allocation point of view. Brazilians and Argentines have started to recognize this and now invest in Asuncion as opposed to only in Punta del Este in Uruguay.

Either way, Paraguay is a winner for being so close to such huge markets (Brazil has a population of 215 million, and Argentina 46 million).

There are two scenarios:

- Brazil and Argentina grow; Paraguay benefits from large, growing neighbours and being able to trade with them

- Brazil and Argentina descend into chaos; Paraguay benefits from fleeing financial and human capital

Recently, Bolivians have been coming to Asuncion to invest due to the political chaos there.

As long as Paraguay remains a beacon of relative stability in the volatile region, capital will continue flowing especially into prime real estate.

Increasingly, Westerners are investing in Asunsion real estate for the similar reasons. They see Paraguay real estate as great diversification away from the increasing socialism and chaos in their home countries.

Migration to Paraguay as a net positive for the country and the real estate market

Overall, Paraguay has more emigrants than immigrants. Most go to Argentina, Spain, Brazil and the US. However, for the country, this is a positive. Why? People who could not be absorbed into the local labour market leave to earn money and send some back home in the form of remittances.

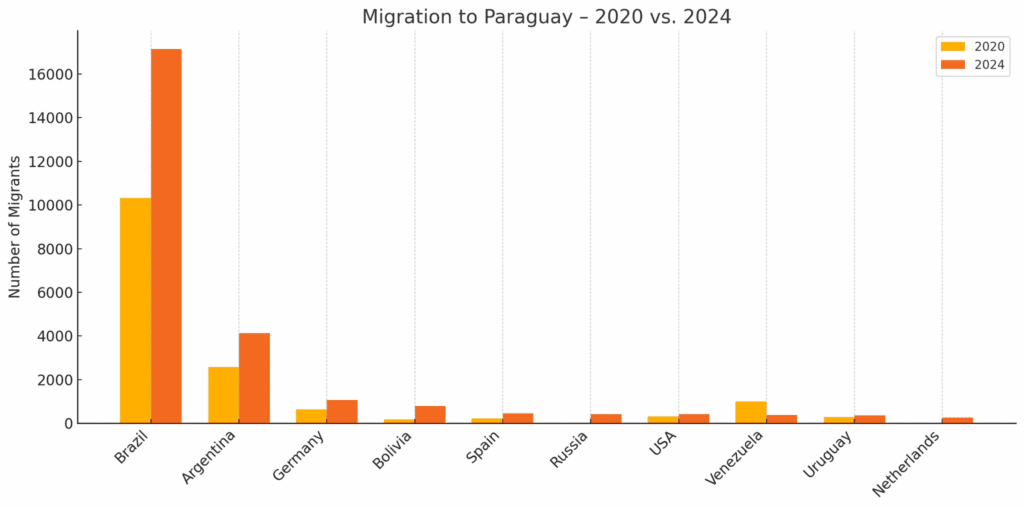

In return Paraguay gets wealthier incoming people flows, who generally flee socialism and want more freedom. The vast majority are from Brazil and Argentina. These immigrants typically earn money back home and live in Paraguay to benefit from lower taxes and less crime.

There has also been a surge in Westerners since Covid. Most come from Germany and the US, but the trend is generalized. They typically flee what they view to be abusive health, education, and immigration policies in their countries.

Also, since the Russia/Ukraine war many Russians have been moving to Paraguay.

Most of these immigrants to Paraguay are extremely positive for the country. Why? Because they don’t come for employment as wages are low; they have to sustain themselves. So either they live off income from back home, or create businesses in the country. Also, they are a regular source of incoming, quality tenants for the Asuncion real estate market and elsewhere.

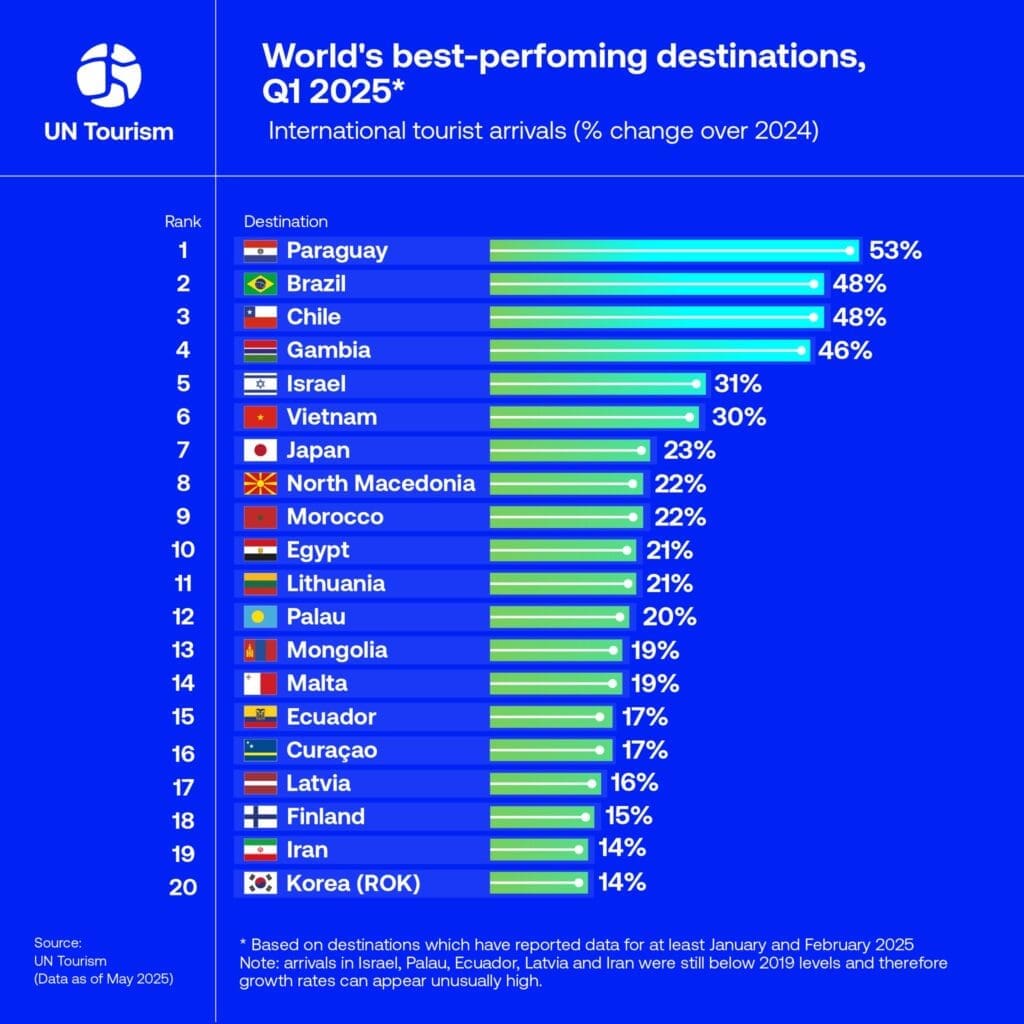

Booming tourism in Paraguay

Though objectively there isn’t much to see in Asuncion, tourism to Paraguay is booming due to people coming from Brazil, Argentina and Bolivia to Paraguay to shop (low taxes) and to invest. This is one of the reasons why Airbnb yields have risen.

Neighbourhood overview for Investing in Asuncion Real Estate

Asuncion is a city with heavy traffic, so location and access to main roads is extremely important. Also, during the rainy season, floods are a constant issue. This is why you want a good Asuncion real estate agent such as Matt to help you make your investment. Local agents are generally of very poor quality as they absolutely do not understand how foreigners think and view property. They will leave many things unsaid that need mentioning.

Villa Mora

Triple A location. Malls, restaurants, bars, cafés, etc. Villa Mora has it all. Rental demand will always be strong here. You can’t go wrong investing in this neighbourhood as long as your choose the right development. If you want a safe bet in Asuncion, this is it. And you’ll enjoy spending time there if you spend on spending time in your property.

Los Laureles

Los Laureles is one of my favourite neighbourhoods. Why? Because it is the first nice neighbourhood when coming from the South, so it is a natural frontier and people living in the South will aspire to live/ invest there. There will always be very strong local demand in this area.

It’s also very calm and green. There are some very nice houses next to some not-so-nice ones. One can tell the market will increase. Also, depending on where you are, you can be very close to the main malls, which is crucial in Asuncion.

This is a very investable neighbourhood. Matt himself invested in this neighbourhood.

Centro

Decrepit. Many government buildings. A few bars and restaurants. It comes off as slightly dodgy. It’s absolutely not where moneyed people want to live. Is there a case for long-term rejuvenation? I think so. It could be a decent long-term speculation for people who believe that as the city develops and the country becomes wealthier, more money will go into the historical center to rehabilitate it. In some Latin American cities this was the case, in others no.

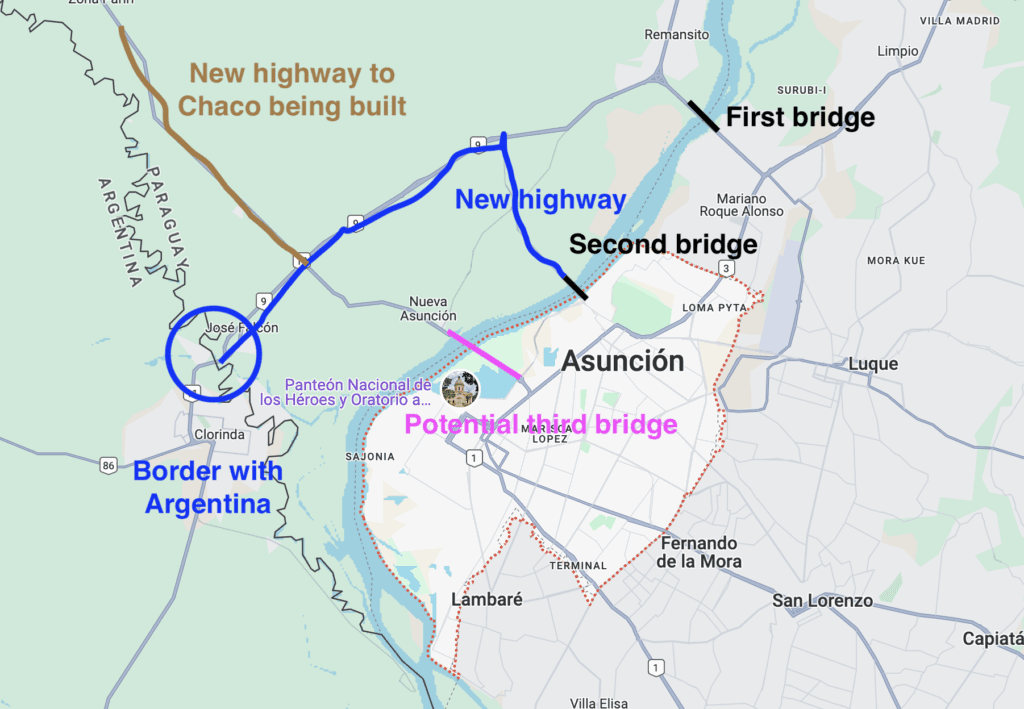

Also, the third bridge from Nueva Asuncion to Asuncion will most likely land nearby.

Centro is a speculative buy at this point.

This being said, there seems to be a gay scene developing in this area. This is usually a precursor to gentrification.

Las Mercedes

Middle class area with a few restaurants, bars, and universities. It’s tucked in-between Centro and the better monied areas of the East. It’s a decent place to live. IF Centro takes off then this area would also gentrify. It’s a nice place to live if you are a bit on a budget, but the best tenants don’t necessarily want to live here.

“Contrast”

The area I call “contrast” is interesting in the sense that some streets look great, but others really don’t. There are new developments and some of the best international schools are there (Lycée Français) or nearby (American school), thus driving the market for families.

Perseverancia

This is a new neighborhood that is being built with malls, new residential buildings, good infrastructure and urban planning etc. I think this area will do well over time. Probably not a bad place to buy off plan with a payment scheme.

The core development is in the middle, but invariably the whole area will gentrify over time as well. It’s close to the second bridge to new asuncion, which means it will be well connect over the years right between the new side of town and the existing nice areas.

But it does feel like an island of wealth of the middle of mediocrity for now.

“Oversupply”

Technically called Avenida Dr. Felipe Molas Lopez. I would not buy on most of this strip. There is clear oversupply of new condos and ever more construction. Closer to the “Shopping del Sol” mall is ok, but the farther away you venture the less interesting it becomes. Also, it is a loud road.

Mburucuya

Calm, green residential area. A lot of families live in the area. It is relatively close to the malls and also to the main road to the second bridge. This area is poised to grow in the years to come. It’s inevitable.

Las Lomas

I would dare to say that this neighbourhood is surprisingly run-down compared to it central location and inclusion of the biggest mall in the country (Shopping del Sol). The selection of cars parked at the mall are an indication of the type of money that hangs out in this area. Being walking distance to a large mall is a huge plus in Paraguay. This drives rentals and Airbnbs.

Ycua Sati

One of the prime residential neighbourhoods of the monied class of Asuncion. This area is very residential, and close to the malls. Many expats are based here. Barely any condo buildings have been built here yet.

Herrera

Herrera is essentially like Ycua Sati, but less premium. Also, not much has been built here in the way of large buildings. Just like Ycua Cati it is a safe play, but don’t expect high rental yields.

Recoleta

Recoleta is another favourite amongst expats. This area has quite a few newer buildings that do very well with digital nomads. It is central, close to one of the main malls, and has many cute restaurants and cafes. It a good place to invest.

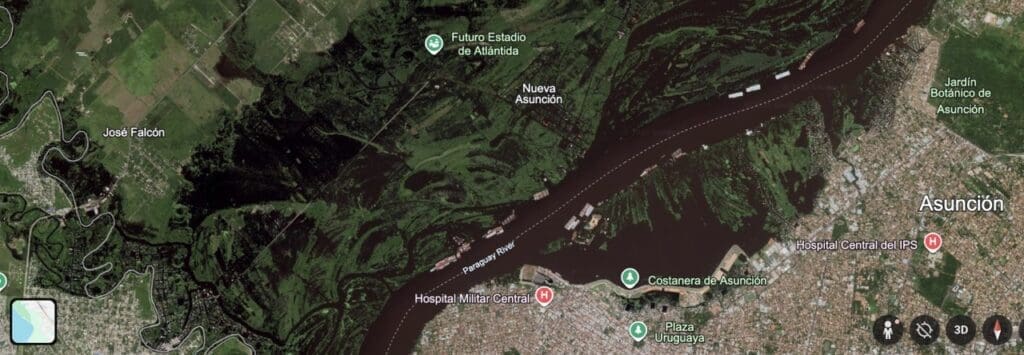

The case for investing in Nueva Asuncion

Nueva Asuncion, on the other side of the river, has a very strong investment case. As Asuncion becomes overcrowded and plagued by poor infrastructure, the case for development on the other side of the river becomes unavoidable.

At times, driving from the the nice areas of Villa Mora and Recoleta to San Lorenzo can take two full hours as this is the main road to get to Ciudad del Este near Brazil, one of the country’s main trading routes.

Accordingly, the government is building a ton of infrastructure on the other side of the river. Two bridges and highways have already been built. Not much housing is there yet at all.

However be VERY CAREFUL when investing in Nueva Asuncion

Right now two types of investments are being proposed by typical agent.

Affordable lots and land in Nueva Asuncion

The first type is raw land in lower end developments. Here’s you’re looking at anywhere between $25 and $50 per square mater. What they won’t tell you upfront is that you can pay in 5 years. If you pay upfront, you should get a large discount. Also, it is extremely illiquid. Many people bought these lots and are trying to sell them on the secondary market at discounts of 30%. So you are better off buying on the secondary market rather than directly from the developer.

Also, most of these cheaper developments are smack right in the middle of flood plains.

So effectively when you are being land at $25 – $50 you are potentially both overpaying versus the immediate secondary market AND buying into a severe floor plain.

Luxury developments in Nueva Asuncion

The first step to building a luxury gated community in Nueva Asuncion is raising the level of the land by between 3 and 8 meters depending on the area.

Some of the developments are superb on paper, but here you are looking at $200 – $300 per square meter. I think those would make for great living, but I doubt there is much upside from a price point of view.

Such developments are selling. One can live in a nice gated community with amenities a 20 minute drive from the nice area of Asuncion thanks to the new bridge. Lots are selling relatively fast in these developments.

Personally, I’m not a fan of the very high density of these developments.

Other developments in Nueva Asuncion for speculation

I am personally monitoring new developments in Nueva Asuncion and would like to pull the trigger on some lots once there is something on the market that I find appealing as an investment.

But to be clear, this is not for a quick flip operation. Nueva Asuncion is for the long term.

Video: ROI Case Study – Investing in Asuncion Real Estate in Paraguay

Matt my real estate buyer’s agent in Paraguay showed me two apartments for sale in Asuncion with rooftop pool and all amenities. We ran all the ROI numbers to get to a realistic return on investment / rental yield / capitalization rate.

Rental Yields from Asuncion Real Estate Investments

Rental yields have increased since Covid as digital nomadism has boomed and people move to Paraguay or go to Paraguay on a regular bases for residency purposes.

Brazilians are also a huge source of rental demand as many are moving away from Lula’s increasingly socialistic and tyrannical tendencies. Argentines are also moving in droves to Paraguay due to its much lower cost of living and general stability.

But to get rental yields, you should focus on furnished apartments, whether long term or short term, to accommodate these influxes.

Generally speaking individual homes give poor rental yields, but because so much of their value is due to the land they occupy, they have decent potential for capital appreciation.

The video case study goes into detail.

Can I buy real estate with crypto in Paraguay?

Yes, absolutely. Some developers accept crypto directly, and for other transactions Matt and his team of realtors in Asuncion can help facilitate the transaction. Paraguay is a great option to off-ramp crypto in decent real estate investments.

Also, as Paraguay is not part of CRS, you can collect your rental income without Paraguay automatically sharing your banking information with your country of origin (unless you are American).

Understanding Real Estate Taxes in Paraguay

What are the real estate taxes in Paraguay? Taxes on rental differ between residents and non-residents. Residents pay 10% but can deduct expenses. Non-residents pay 15% of 50% of the gross rental income.

In case of real estate transactions in Paraguay:

- Buyer: About 2.8% closings costs for the buyer

- Shares between buyer and seller: 0.8% tax divided between the buyer and seller

- Seller: when you SELL real estate, it is important to be a resident. Why? Because the tax regime differs. Residents just pay 10% on the capital gains, while non-residents must pay a 5% VAT on 30% of the value of the sale, and 15% income tax on on 30% of the value of the sale. This adds up to an “exit tax” of 6% for non-residents versus very little for residents. Also, expect to pay about 5% realtor fees.

Who Should Invest in Asuncion’s Real Estate Market?

- People who want geopolitical diversification

- Patient investors who want a mix of decent rental yields and capital appreciation

- People who have residency in Paraguay and want a legitimate address for KYC and substance purposes

- People moving to Paraguay

- Crypto investors who want to off-ramp discreetly into real estate and then have non-CRS bank accounts to collect rental income

How to buy real estate in Paraguay

The Asuncion real estate market is very fragmented. Using a competent real estate agent in Asuncion is critical. There aren’t many professional real estate agencies and their listings are often quite limited. You can look online but many of the deals are not listed as many sellers are traditional and “don’t trust the internet”. Matt my Asuncion real estate agent specializes in helping foreign investors and has an international perspective which local agents don’t.

Services in Paraguay:

- My Real Estate Buyer’s Agent in Asuncion, Paraguay

- How to obtain Residency in Paraguay

- How to obtain residency in Paraguay through investment in film production

Articles on Paraguay:

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

FAQ

Can foreigners buy real estate in Paraguay?

Absolutely. You just need to be aware of the fact that taxation of real estate is different for residents and non-residents. Because of this, many investors opt to get Paraguay residency first.

Why Invest in Asuncion Property?

Diversification far away from all the geopolitical hotspots, capital gains over the years, and decent rental yields if you invest in the right projects.

What Should I Know Before Buying a House in Asuncion?

The Asuncion real estate market has low liquidity. Selling can take months. Don’t invest money that you may suddenly need fast.

Can Americans buy land in Paraguay?

Yes, any foreigner can. But the taxation is different whether you are a resident of Paraguay or a non-resident of Paraguay.

What Kind of Investments Can I Make in Asuncion?

- Standalone homes which are interesting because of the land value

- Condos / apartments because they are easier to manage

- Plots of land and build a house.

What are the Latest Trends in Asuncion Real Estate?

Traditionally people all wanted a house with a small garden. As real estate prices go up, as urbanization continues, and as the country develops, people increasingly want condos with great amenities when investing in the Asuncion real estate market.

Again, get in touch with Matt to avoid making big mistakes.

Can I buy real estate with crypto in Paraguay?

Absolutely. Matt is well versed in this process and can assist you. You can either pay some developers directly in crypto, or exchange locally and pay in cash.

Hello. I am from the USA. I am looking for a plan B location in Paraguay. I have ordered the documents for temporary residency. I will book a visit once the documents arrive. What is my next step after getting the documents and before I schedule the visit?