I’ve been talking about the island of Sark since 2020 on The Wandering Investor (here and here). It’s a tiny Channel Island between France and the UK. What’s interesting about it is that it has its own government and can set its own laws and taxes.

There aren’t any taxes on Sark island apart from a yearly tax based on the size of one’s dwelling. All other income is not taxed.

The result is that Sark is probably one of the world’s least-known tax havens. It is possible to live there, a few hours away from London, and pay practically 0% taxes.

Even Nomad Capitalist jumped on the bandwagon last month in a video called “The only totally tax-free place in Europe“.

I made an offer on a house there in 2020 or 2021 (I don’t remember when exactly) but the deal did not go through.

But finally, there is now a great opportunity to invest on the Island. My friend Swen Lorenz is launching a real estate holding company that seeks to buy 20% of the real estate on Sark in a distressed sale.

What is the current situation on Sark?

It’s relatively dire. Like in many places in rural Europe, it is gradually dying off. A bit over 500 people live on the island and the very sustainability of the island is at stake if the population decline does not reverse. As the population dwindles, there is less critical mass for infrastructure development and even basic services.

If nothing is done about it, Sark will gradually fade away.

What is the vision?

It’s pretty straightforward – to turn Sark into an attractive place to live. Seeing the successes of nearby Jersey and Guernsey, which are both booming, turning Sark into a success story should not be too hard. Citizens of the UK and Ireland can move to Sark without any paperwork. There is a huge market to capture of people wishing to leave high taxes and who want a more peaceful lifestyle (especially in the UK).

The vision therefore is to attract High Net Worth Individuals (HNWIs) and Ultra High Net Worth Individuals (UHNWIs) who will invest on the island, live there, and spend money on local services. This will in turn completely reinvigorate the economy, reverse the decline, create jobs and business opportunities for locals, and attract families who will move to Sark in search of work.

Essentially – turning Sark into an even more attractive version of Guernsey.

This Series A funding will be used to buy about 20% of the real estate on the island from a single family at distressed valuations. It will include a budget for renovations, refurbishing, and will have access to debt which will provide investors with leverage. Investors are not paying a premium. No management fees and carry are being charged. One of the key challenges on Sark right now is that there isn’t much housing available in good condition which makes moving there a challenge. This Series A funding sets to change this.

If things go according to plan, Series B funding will happen in a few years time to drive business and further reinvigorate the island with a number of initiatives, as well as buying up even more real estate on Sark with the goal being to own 40%-50% of the local real estate.

Eventually, the goal is to IPO on the London Stock Exchange.

I discussed all of this in detail with Swen.

Why am I investing?

1. Investing in Sark is a great way to short the UK. We all know the UK is heading towards some bleak times without any clear path to a recovery or turnaround. Labour will soon be elected on a far-left platform and even the Tories raised taxes and cancelled the Non-Dom program. HNWIs and UHNWIs will seek to leave. Sark just needs to capture a few hundred people for a full turnaround. The bar is low especially as moving to Sark is easy for such people (no residency restrictions).

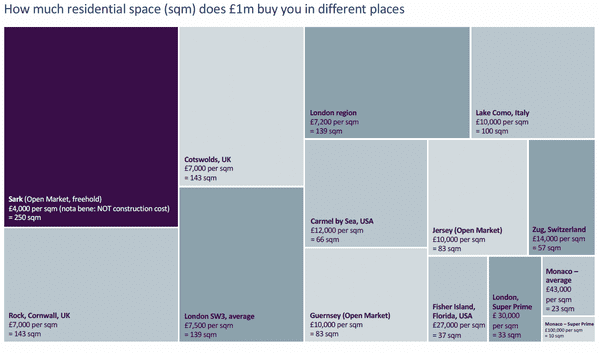

2. Real estate on the island is very cheap in relative terms.

If the vision materializes we could easily be looking at a 3-5x in the next 10-20 years.

3. Limited downside. The reality is that even if not as many people were move to Sark as expected, this real estate portfolio would do just fine and give decent high-single digit returns to investors. The biggest downside is the low liquidity nature of such an investment. People just need to understand that they are in for the long-haul.

4. In a world of debt, conflict, societal tension and ever-increasing taxes, owning real estate at distressed valuations on a peaceful island, with a strong rule of law, in a tax haven a few hours away from major financial centers is very interesting diversification to say the least. Again, I have to emphasize the rule of law. I am used to investing in jurisdictions where the concept of rule of law can be arbitrary at times; this is not the case on Sark.

5. Full backing of the current Head of State of Sark, the hereditary seigneur Christopher Beaumont. He is one of the directors of the real estate holding company.

6. The anchor investor is Harris Kupperman, better known as “Kuppy” for those on Twitter/X. He will buy 10% of the series A round at the same valuation as current investors such as myself. For those unfamiliar with Kuppy, he runs a hedge fund called Praetorian Capital which has 10x’d the money of its investors since 2019. He is widely acknowledged to be a brilliant investor. Knowing that he has done his due diligence and is willing to invest millions at the same valuation as me (with my much more modest investment) gives me comfort. This of course does not mean that I am not responsible for my own due diligence.

7. Marketing will be easy. Already, Sark is making headlines in the UK such as below on the print edition of the Financial Times Weekend (perfect target market)

Let’s face it, anyone who has been in touch with British HNWIs know how much they can be suckers for a good, quirky, eccentric story. “Sark the tax haven” absolutely fits the bill especially in the context of skyrocketing taxes.

Getting free PR for Sark will not be hard. It’s a great story for journalists, and that will engage their audiences.

Case in point, I’ve been talking about Sark since 2020 simply because it’s so interesting and full of potential.

Sark has also recently made headlines on The Times, and in another article in the Financial Times. Additionally, major international news outlets have started to contact Swen and there should be a lot more reporting about this in the mainstream media soon.

Overall I feel this is great diversification at distressed valuations. The risks are mostly execution risk and the inherent low-liquidity nature of the investment. It provides investors with a great way to short the UK, but by investing in safe real estate at distressed valuations.

This is not an invitation to invest

I am just sharing what I am doing with my own money and I am biased as I want this project to succeed. You are entirely responsible for your own due diligence.

The minimum investment is 100,000 British Pounds though on a case by case basis less can be invested. If you are interested you can get in touch with Swen directly: swen@sarnia-am.com.

And remember, the first time you heard about Sark and its potential is on The Wandering Investor.

To a World of Opportunities,

The Wandering Investor.

Articles on Sark:

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “I am buying real estate in Sark, Europe’s least-known tax haven”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. Today, we’re going to be discussing a very interesting topic, Sark, because I recently made the commitment to buy real estate in Sark. Swen, how are you?

SWEN: Very well. Great to see you again, Ladislas.

LADISLAS MAURICE: A little bit of background, Sark is a tiny island between the UK and France. I’ve been discussing Sark on this channel since 2020 was actually the first video on my YouTube channel. And since then we’ve done more content together with Swen. This tiny island is interesting because, one, it’s tiny, and, two, it’s an unknown tax haven. Swen, I’ll let you elaborate a little bit on Sark for people who aren’t too familiar with Sark, and then we can go into the property investment that I am taking part in.

SWEN: Great. Sark, as a brief introduction, is a place unlike anything else you’ve ever heard of. It’s an island of just 600 people, but it’s de facto like an independent country. It’s not, technically speaking, an independent country, it’s a so-called crown dependency, which is a very peculiar type of jurisdiction that exists in the shape of Guernsey, Jersey, and the Isle of Man. These are the better-known Crown dependencies. But Sark has the same legal standing, it has its own parliament, it has a head of state, a hereditary feudal lord, and it manages its own affairs except for defense and foreign policy. Other than that, it is literally like a country.

And it’s also a place where you have an incredible lifestyle. It’s car-free, that’s one of my favorite features. There are no cars on the island, no paved roads, everyone takes a bicycle or walks. And we are also, as it happens, famous for having a very light-touch government. Government in Sark doesn’t do that much, and that allows it to charge you a relatively low tax. The tax is essentially based on the size of your property, that’s slightly simplified, but that’s basically how it works. And the government budget this year is only £2 million, and that works out to every resident of the island paying £3,700 pounds in taxes on average, so that’s about $5,000. I pay more, I pay about £5,000 so other people will pay less. And that makes it a very attractive place to live from that perspective.

But very importantly, you also have no obligation to report income or assets, so your personal administration can be as light as you want it to be. You live in stunning nature, you’re surrounded by the sea, we’re not too far away from the coast of France. England is relatively easy to get to. We don’t have an airport but the neighboring island has an airport and you just take the ferry. It’s English-speaking, it’s in the center of Europe, so to speak, or at least in Western Europe, depending on how you look at the map, so it makes for a fairly unique lifestyle and lifestyle proposition.

How to move to Sark

LADISLAS MAURICE: Look, and we’re seeing all these things happening in Europe, high taxation, etc., issues, and Sark is right there. It’s easy to move to, specifically for people from the United Kingdom and Ireland. Correct?

SWEN: Absolutely. That’s the amazing thing, if you’re British or Irish, you can move here literally no questions asked. You don’t need a visa or permit or anything like that, you just need a place where to live. It used to be that EU citizens could move here with basically any kind of visa or permit, but with Brexit that came to an end. The Channel Islands were never part of the European Union, but they had an arrangement with the European Union, and that came to an end. Primarily, it’s interesting for British and Irish citizens, everyone else needs a visa, and that’s where it gets more complicated. And the visa categories here are not that attractive. So really, for new residents, the focus market here is British and Irish people.

LADISLAS MAURICE: Yeah. Look, we’ll go into the investment thesis a bit later, but I wanted to invest in Sark. Actually, in 2020, or 2021, I made an offer on a specific house in Sark that I liked, I thought was a good investment. But then the seller actually raised the price on me instead of [laughs] negotiating along, he raised the price on me, so that put that negotiation to a quick stop.

Investing in Sark real estate holding company

LADISLAS MAURICE: But now you’ve essentially come up with a real estate investment holding company that will allow people to buy real estate in Sark. Can you elaborate on the structure and your vision?

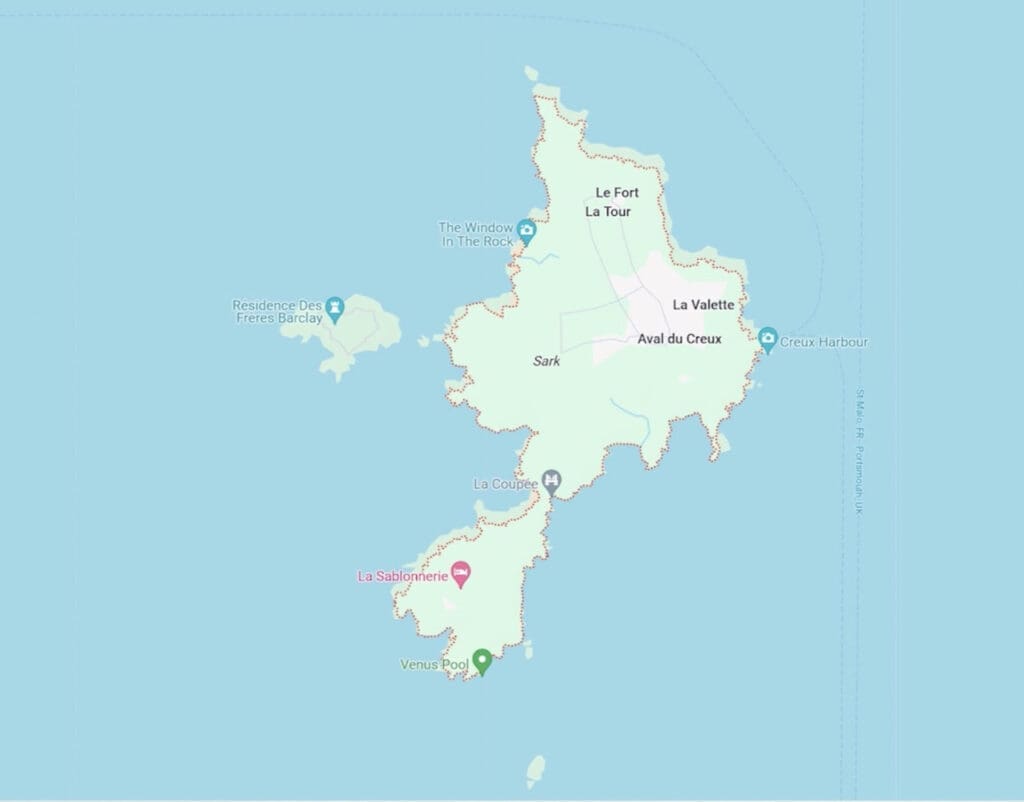

SWEN: Yes. For years, I’ve had lots and lots of interest from people who said, “I would like to own real estate in some shape or form in Sark.” The market here is very complex, it needs a lot of explaining, and it’s also not that easily accessible in the sense that on an island with 330 properties, how much is for sale at any given time. And unless you live here, it’s very difficult to just fly to the island from elsewhere in the world just to look at one property that has come onto the market. So there’s generally a lack of economies of scale with just about anything that involves Sark. And it just so happens that there is one family that does own 20% of the island, 20% in terms of the entire landmass of the island, of the surface area, and a slightly higher percentage of the buildings. They own 80 residential properties, four or five hotels. One burned down, so I’m not sure if you should count it. It is certainly a development site for hotel. Twenty commercial properties, a lot of agricultural land as well.

And the head of that family died in ’21, and it was passed on within the family. And it’s for sale. We’re in conversations with the professional advisors of the family that owns it. And we are now preparing a cash bid to purchase that portfolio. And that would give us a whole range of different investment properties in Sark. And for that, I’m doing a Series A funding round for an investment holding, a real estate holding that I’ve set up here in the Channel Islands using my own licensed fund management company. This is an extremely well-prepared project that we’ve worked on for three years. And it’s currently managed by a licensed financial services company, not just by myself. And we are entering Series A funding for that as of tomorrow.

You’re the first person to speak to me about this, because you were the first man to discover the story in 2020, and do a podcast, and I thought, when you asked me about it, you’d be the perfect person to discuss this with on the eve before it all goes public.

Sark investment case and process

LADISLAS MAURICE: And your pitch worked, I’m investing. [laughs] Essentially, it’s investing to get 20% of what is effectively a tax haven in the heart of Western Europe that people haven’t really discovered yet.

SWEN: That’s one way of putting it. Possibly, a more run-of-the-mill way to put it is that this is a distressed real estate portfolio. There had been, and this has been widely publicized in the media, there had been a conflict between that family and other residents on the island, which is why, in 2015, the family decided to close down a lot of their real estate here on the island, they shut the hotels and many of the commercial properties as well. And because these properties haven’t been used in many years, they are in bad condition. Not all of them, there are some in the portfolio that are in outstanding condition. Two of the hotels are currently open, and they’re very nice. I think they’re undermarketed, so they’re not properly utilized. But it’s a wild mixture of a portfolio. And it also includes some development sites. For example, someone started a small apartment building in 2008 and they only built the foundation. And that could be finished.

It’s a broad mixture and it will involve a lot of management to put this portfolio back into a truly productive state. And in the first instance, I like to keep investment cases as simple as possible because, for me, I also have to execute this. I’m the CEO of that real estate holding. And I will be on the hook with a very high-profile project that I attach my name to for delivering everything that we are now promising for Phase One. And for Phase One, we’re really saying we’re reconstituting the portfolio, everything is being put back into production. We’re finishing up some of these buildings, others will be completely refurbished. And that is step one of the case. It doesn’t stop there. And there’s a lot of exciting other stuff that we will talk about, but this is the first step we’re taking.

LADISLAS MAURICE: Okay. Before we go into the other steps, who are the directors?

SWEN: We are currently three directors. I’m designated as the CEO of this, and I set this up originally with my friend and colleague, Christopher Beaumont, who is the Seigneur of Sark. He’s an extremely important person to have on board as a director for a number of reasons. The most obvious one is that his family is the contractual counterpart for the Crown of England when it comes to the special status that Sark has. In 1565, one of his predecessors, he’s the 23rd who is holding this position, his predecessor signed a contract that states that Sark can govern itself, and this contract is valid for eternity. He’s now the 23rd to have stepped into that contract. His son Hugh, who’s 28, he will become the number 24, hopefully, in many, many years down the road, but we’ve involved him as well. He’s not a director, but he’s always been at the table to represent the next generation.

And the third director is Richard A. Johnson, who’s a very seasoned real estate professional. He used to run a real estate investment platform for UBS for 10 years for ultra-high net worth individuals. He has a background in hotels in particular, has worked all over the world, speaks at conferences everywhere, has nearly 40 years of experience in the sector and brings the real estate knowhow to the table. And he’s also been involved from inception. We only registered him as a director recently because he held another fulltime job elsewhere, but he’s been involved with this from inception.

Future vision for Sark

LADISLAS MAURICE: Okay. What’s the vision?

SWEN: The vision is very much to make Sark one of the best places in the world to live, and that counts for residents and visitors, tourists alike. And also, not just for rich residents, we are in the peculiar situation here that because we’re a small island, you have to run a sustainable and resilient community here. And with sustainable, I don’t mean it in the sort of fashionable sense with necessarily what sustainability is being used for right now, but in the sense that you have families living here, people with children, you have key workers living here, teachers, people who can run the doctor’s office. Sark could never and should never be turned into a place that only a few can live and afford. You always have to make sure that we have a broad representation of human society living here and being able to live here.

And we want to create a place where if you are a high net worth individual, or an ultra-high net worth individual, or maybe an international businessman, someone who runs a business remotely, this is an amazing base for you. But we also have visitors here, tourists. Tourism is the backbone of the economy right now, and that needs to continue, and it needs to be, in a way, rejuvenated, I think, is the right word, because tourism has been on a gentle decline over here. And you also need to have a population here that is what you would generally call the local population, who are living here, and who are enjoying this place, and who need to be very much part of this plan. And we want to make all of this come together and create a place unlike anywhere else in the world where, right now to give you just an example, not only do we not have cars, we also don’t have political parties here, we don’t have an overbearing government, we don’t have major intrusion of government into your life. And we want to keep it like that.

We have incredible nature that needs to be protected. We have a very broad plan for the island, which we hope will lead to a public discussion as well and to eventually a consensus where Sark should go in the future, because there are undetermined questions. And we would love to have a conversation with everyone about this and help to take Sark to a great future where it’s very resilient and just simply a great place to live.

LADISLAS MAURICE: Have these conversations taken place?

SWEN: Yes. Last year, we invited everyone to a workshop, a public discussion. And this was facilitated by experts that we brought on board, experts in town planning, building community, sustainability, resilience. And that happened to be, no coincidence, The Prince’s Foundation, which is an organization set up by, at the time, Prince Charles, and now King Charles. He’s very passionate about town development and town development done in the right way. He’s built a very famous new town in England called Poundbury, which is very much, in a way, a model case for us to learn from, and which was, to a certain extent, laughed at when he started it but now property prices there are at a high premium compared to surrounding counties.

The vision of the king has very much been one that has become the benchmark for town development and urban development in the UK. People affiliated with him are currently building another such town in Cornwall called Nansledan, it’s a bit of a surfer town. And we are working with the people who have the knowhow to do all have this. And they came over here, we invited to a public workshop, a discussion, more people turned up than to any other event of this nature in living memory turned up. And a report came out of this which summarized what the community thinks. And this is certainly a conversation that needs to be continued at the right time. We’re in no hurry because we will be busy with our own portfolio. And we’re not coming in here to tell anyone what to do or where the island needs to go. In the first instance, we’re now completely focused on reconstituting this portfolio, and we’d love to speak to any stakeholder who wants to have a wider discussion, but we’re also not pushing for this because it’s not the right time for us and it’s also something that needs to come organically out of the community.

Phase two and Series B fundraising goals

LADISLAS MAURICE: Okay, so Phase One is you’re buying all this real estate and you’re going to manage it, refurbish, etc., make it livable? What’s the Phase Two? How do you move from making it look nicer to actually implementing whatever vision will come out of all the discussions?

SWEN: Yes. If you want to speak about it in financial terms, that will be our Series B fundraising. The situation here is that we could probably purchase quite a few additional properties, not just the portfolio of this family, but more than that, because there’s a backlog of succession cases. The market here has been stuck for many years. Mortgages are not available in Sark, so all purchases need to be pure cash purchases. So far, we’ll change that but right now, anyone who buys here has to pay 100% in cash. And we believe that we could probably purchase another somewhere between 10% and 20% of the island to take the portfolio to somewhere between 30% and 40% of the island. And there are a couple of very targeted acquisitions that we would like to make.

For example, it sounds like, and I’m at risk of wading into politics here already, but it sounds like the electricity company is for sale. We would love to be of help with purchasing that and helping to upgrade and put in place new electricity infrastructure, which is a great investment project if you do it right, and it’s also something that absolutely needs to be done on the island. The island has been struggling with that subject for years. Lack of investment capital, as always, is one of the issues that the island is struggling with. And we’d love to help with that. We are currently focused on buying this initial portfolio, if or when that happens, then we want to have conversations about buying potentially other properties, potentially helping with some infrastructure projects, such as the electricity issue. But all of that is subject to Series B. And then you can also plan these aspects in more detail because then you have more visibility on them.

We don’t want to overpromise something that may not be deliverable, so focus on the core portfolio and everything else will then come at a later stage if it happens, which I think it will. But again, it’s a step by step process, and we have to be very careful to not overpromise and then we have to execute what we are promising.

Sark real estate valuation

LADISLAS MAURICE: Cool. The first round of financing, which is happening right now, I know the negotiations still need to take place with the family to buy that real estate, but what are roughly the valuations on that island from a price per square meter point of view to be able to compare with other tax havens or other islands in the region?

SWEN: The number one figure to know is probably, or there are actually two figures that I think are the most illustrative of what you’re getting here for your money. Sark is next to Guernsey. Guernsey is a well-known financial haven, it’s also a bit of a tax haven, and it’s just simply a great place to live, no crime, no political parties, a very low percentage of GDP goes to government. And Sark is currently valued at about 30% to 50% the prices of Guernsey. And we are going to purchase or we’re going to offer less than that for the portfolio because it’s obviously in distress. The other interesting figure to look at is Sark is currently priced at probably less than Zone 3 in London, if that tells you anything, so even though it’s extremely attractive, in some ways, at least to live in Sark, we’re far from being an expensive place to live.

I would say it’s somewhere between Zone 3 and Zone 4 in London, and that also goes to show some of the upside that you have. We’ve worked out that right now for a square meter of high-quality residential space in Sark, you’re paying about £4,000 a square meter, if you buy it on the open market, if you can find something of that kind.

LADISLAS MAURICE: Freehold?

SWEN: Freehold, yes. And in Guernsey, something like that would cost £10,000 to £12,000 already. That gives you an idea of the valuation gap that exists just between these islands here. I mean, you can always argue that Guernsey should be more expensive because it’s bigger and more attractive. My argument would be that Sark should be more expensive because it’s a higher quality place to live and it has less problems than Guernsey. In any case, there’s currently a huge gap between those two. And I think that gap will close and it’ll be by Sark moving up. And in international terms, if you look at real estate costing £4,000 pounds a square meter, Sark is not expensive in absolute terms, given that we are an English language jurisdiction in Western Europe with all the features that I mentioned earlier. Really, it’s a lot of upside and very limited downside, that’s how I see it.

Sark best and worst-case investment scenarios

LADISLAS MAURICE: Yeah. Can you talk us through essentially your worst case scenario and your best case scenario?

SWEN: We are always approaching investment cases from the perspective of what can I lose if this doesn’t work out. And we have modeled this in the following way. If Sark remains stuck in the somewhat difficult situation the island is in right now, it has some structural issues, if we don’t buy any additional property beyond that portfolio, and if basically we come to the conclusion that we can fix up this portfolio but we can’t do anything beyond that, then we’re looking at paying out to our investors a return of about 8% per annum from 2028 onwards, rising to about 10% per annum in 2030. And that’s what we’re returning to investors on an ongoing basis. If this doesn’t work out, then you basically have a high-yielding asset in a very safe English language jurisdiction. And I think for a worst case scenario, that’s not a bad case at all.

LADISLAS MAURICE: Let’s go into the best case.

SWEN: The best case scenario is that Sark becomes a truly unique high-profile place where to live, and where some of the housing will be valued at an extraordinary premium because it will just be so desirable to live there. Our portfolio will have to include a bit of a split between we need to keep some of it affordable, including, for example, for our own staff to operate hotels. Equally, we will certainly have some very high-end properties in our portfolio for which we will be able to demand premium prices, because there’s nothing else like it on Sark, at least not right now. If you compare Sark to other jurisdictions, the prices for the high-end properties could increase by a factor of three or a factor of five over, say, 10 years, 12 years, 15 years, or 20 years. And you can pick any of these numbers, depends on how ambitious you want to be. It’s certainly a multiple of current prices.

And then you can add to it, so we’re purchasing all of this using only equity. You can optimize your balance sheet and your funding structure, obviously, we could open up all sorts of additional businesses, like, there could be a membership type concierge service for residents that generates additional income, we may be interested in buying one of the other business on the island, so I would like to think of it as there is a blue sky potential available to us that will take a number of years to materialize but it’s also not a completely– Anyone who has come to Sark has always told me the potential here is obvious. It’s very interesting to have people visit, and I can only encourage all of your followers to visit Sark, eventually, it’s also a great place to visit as a tourist, people who’ve been here say it’s blindingly obvious to me that this could be an extraordinary place and also just simply demand a large premium for its real estate.

That will take a number of years to get there, but this is the blue sky potential for the early investors, or where the early investors will have the largest upside. We like to think of it as it’s limited downside, very large upside. And if it doesn’t work out at all, you have a high-yielding investment in a Western European English-speaking jurisdiction, and it’s a safe asset to own.

Management and performance fees

LADISLAS MAURICE: Tell me about the compensation of the directors. When I look at the prospectus, there is no management fee and there isn’t carry either. That’s particularly interesting as an investor. How are you paying yourself?

SWEN: Originally, we wanted to set this up as an investment fund with a management fee and a performance fee. But then in the very initial conversations with investors, we were very quickly told, “Guys, don’t do this as a fund, do it as a perpetual capital vehicle.” Why? Because this is a long-term investment that, frankly, once it works, you don’t want to sell. And a fund has this issue that once you wind down the fund then you need to sell all the assets before you can distribute the money. And why would you put yourself into the position of selling down 20% or 30% of the entire island just for the purpose of paying back your investors? Instead, we turned this into the concept of an operating company, this is just simply a holding company with permanent capital. And for that, we, obviously, can’t charge ongoing fees.

What we’ve done is the three directors have been working without compensation for the last three years. It took us three years to prepare this, so a lot of work and passion has gone into this already without getting paid for it. And we are going to get 5% of the company once fully funded, which we think is very fair. A lot of people advised us to take a bit more than that, but we’re leaving it at 5%. Our equity will be locked in, so we’re all committed long term and we’re going to take very low director’s fee. We’re going to take £25,000 each a year. And given the amount of work we’re putting into this on an ongoing basis, everyone else could charge a multiple of that, so we’re certainly, as directors, keeping the costs and the compensation for us very low. We do, do this as a commercial project, we need to make money of it, but we’re not pushing it. It’s also, to a certain extent, a passion project and something we just want to see happen.

LADISLAS MAURICE: Yeah, fascinating. Look, personally, I’m investing in this because I love the thesis, I love the very long-term outlook of it. I love the fact that the head of state is himself involved in it, so that’s a crucial stakeholder to have on board. Ultimately, the very existence of the island is dependent on this project, because if nothing happens, it’ll just die away, people will just leave, the population will continue to dwindle.

Leave the UK for Sark

I like to see that there’s a commitment to make a big change. And the reality is, I mean, I see it, it’s harder and harder for people to find attractive jurisdictions to move to, particularly for people from the UK. Before, when they weren’t happy in the UK, there were a ton of European countries they could move to, a lot of them were low tax. But now, UK people, when they want to leave, it’s a lot harder, going to Europe is a lot more complicated for them. And I believe that over the coming years, decade, decades, a lot of people based in the United Kingdom are going to want to leave the United Kingdom.

The whole place is not doing well at all, people are unhappy, the taxes just keep going up, they’re about to elect a really far-left Labour government in the very near future. So all of this leads towards more people leaving and specifically high net worth individuals wanting to leave the UK. And guess what, there is this little island a few hours away that is essentially British culturally, no big change whatsoever, and where you can just live there, essentially pay property tax, and that’s it, and be done with it. And then you can still go back to the UK on a regular basis to see family. I can absolutely see how doable it is to bring over a few hundred high net worth individuals to move to Sark, to live there permanently, to develop the island, and then with this, these people will ask for and will need a lot of services, and that will create jobs for locals, and will bring another class of people to help with all the services, and all the labor, and all that. I can really see how a turnaround for the island as possible.

And I get to essentially short the UK at very low risk, because we saw the worst case scenario, it’s high cash flow. The only cost ultimately is liquidity, low liquidity. Would I go all in Sark? Obviously, no. But as a portion of my portfolio, this makes absolute, absolute sense. I’ll be using actually a structure to invest in this for the long term, it’s not something I just want to buy and flip, because I mean, you’re hoping to do an IPO in a few years’ time, correct?

SWEN: Absolutely, yes. We believe strongly that, first of all, we like to be very transparent and, secondly, we’d like to democratize investing in Sark a bit. And what better thing to do than an IPO for this, besides raising money to develop what needs to be developed on the island. And I mean, adding to what you put very eloquently in terms of the attractiveness of the place, in a way, I’m investing in my own home here. I’ve been here since 2017. I have no other home elsewhere in the world, so I would very much like Sark to thrive and to be the best place where I really want to live myself.

I’ve thoroughly enjoyed here. Sark has issues, and I think Sark has some very serious issues, and they’re getting more serious by the year, including financially, but structurally as well, for example, demographics, not enough young people here, the school is struggling, and all the usual issues that you see on islands like this, it’s not that unusual a case. But all of them could be resolved, and they could be resolved in a way more easily and more quickly in Sark because of its special status. But it requires one big investor and a very responsible investor to be involved because right now, the island is struggling to break free from the situation that it has gotten itself in. And we’re very much hoping that we will work with absolutely everyone to not just focus on our portfolio, but to bring the entire island forward in a way that, to repeat myself, creates one of the best places in the world to live.

LADISLAS MAURICE: Yeah. Essentially, short the UK, long, very safe real estate that is being bought at distressed valuations. That’s the thesis, those are the numbers, and then in a structure that doesn’t have excessive fees or anything, so I’m in, Swen.

Contact Swen for prospectus

If anyone is interested, I guess, they can just send you an email, there’s the email below, and then you can send them the brochure that you sent me?

SWEN: Yes, absolutely. We have the advantage that because this is not a regulated fund but a fundraising for an operating company, it’s a little less burdensome in terms of regulations. Just send us your email. I will send you the deck in exchange. And right now, I’m building a book. I’m collecting non-binding expressions of interest from serious people. And once I have enough of those, then I will be sending out prospectus. The prospectus will be the legally binding document for this fundraising. That’s worked out by our lawyers who are the largest law firm in Guernsey, a firm called Carey Olsen. And with that comes a subscription form, and then we have to onboard you as an investor.

Minimum investment is, technically speaking, £100,000, but we can also take lower amounts under certain conditions. If you want to invest less than £100,000, send me an email, we have a conversation about it. Maximum investment is 10%. No one gets more than 10%. We have an anchor investor, maybe that’s worth mentioning as well.

LADISLAS MAURICE: Sure.

SWEN: The first investor who said, “I’m in with this,” is someone who many of your followers will probably know, it’s Harris Kupperman, widely known as Kuppy. Widely followed on Twitter. He is the founder of Praetorian Capital, a hedge fund that is currently world famous, I would say, for having returned its investors more than 10 times their monies since 2019. He is managing one of the best-performing funds in the world. And I spoke to Kuppy in Puerto Rico last year when I saw him there, and told him about Sark. That was in April. And he said, “I absolutely want to see this place.” And he came over in June for a couple of days with his wife, and they looked at everything in Sark. They also visited Guernsey to get a bit of context, because Guernsey is very important context for Sark.

And we are currently onboarding Kuppy’s hedge fund as an investor and we’re onboarding him as the fourth director of the company, which is very important. Kuppy will play an active role in this, and I expect that other investors will follow him, so I think there’s going to be quite some interest in this Series A placement that we’ve just discussed. And further news about this will also just simply be sent out through the email list on our website. We have a basic but informative website which is called sarkpropertycompany.com. If you register yourself with your email there, then you also get automatic updates about everything.

LADISLAS MAURICE: Cool. Fantastic. Swen’s update is right below in the description. Swen, thank you so much. Really interesting, and I’m looking forward to following this project very closely in the coming years.

SWEN: And visit. Please, do visit sometime, Ladislas.

LADISLAS MAURICE: Will do.

SWEN: Will be great to have you. Take care.

LADISLAS MAURICE: Cheers.

SWEN: Thank you.