I’ve been talking about the Egyptian citizenship by investment program for months.

However, the biggest issue was the dual exchange rate – an official rate and a black market rate.

This meant that if you were to transfer a dollar to Egypt through official channels, you would get about 31 Egyptian pounds. If you exchanged a dollar on the street in Cairo you would get about 50 Egyptian pounds. As the Egyptian citizenship by investment program is denominated in dollars, investors would lose out.

Another issue was the risk related to the government running out of foreign exchange reserves due to the twin factors of tourism being down due to what is happening next door, and the Red Sea crisis.

I had predicted that Egypt would get bailed out by:

- The Gulf monarchies because they can’t afford for the most populous Arab country to blow up

- The IMF because Israel can’t afford to have its large neighbor blow up

I was right.

The UAE is investing 35 billion dollars on the Egyptian Mediterranean coast

The UAE has announced they will invest 35 billion dollars on the north coast of Egypt; transfers have already started taking place.

We all know what the UAE is capable of achieving with regards to real estate, so we will probably see some spectacular developments on Egypt’s stunning Mediterranean Coast.

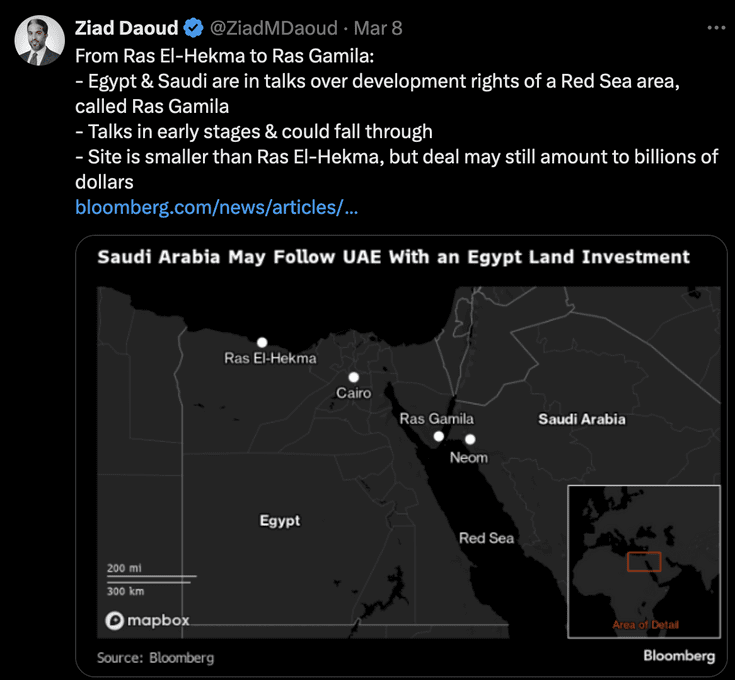

Saudi Arabia is also in talks to invest billions on the Red Sea coast across from its Neom project

The IMF bailout comes with an important condition

As Israel can’t afford for a heavily-armed neighbour of 110 million upset Arabs to blow up, the IMF was made to gather money from other countries to bail out Egypt to the tune of $8 billion.

Additionally, other international organizations and Western countries are being made to lend money to Egypt to the tune of 12 billion dollars.

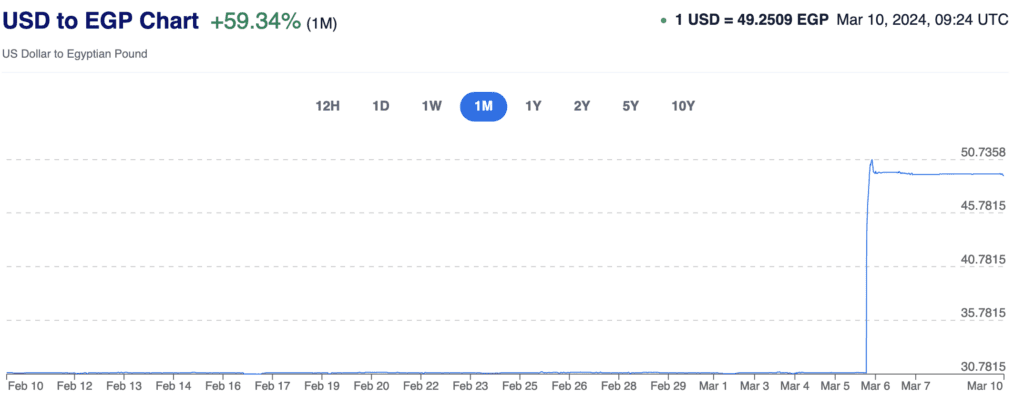

A key condition was that the Egyptian pound would have to float. Interest rates were thus raised to 26% and the currency was let loose.

The devaluation happened almost instantly. Down from 31 EGP to 50 EGP to the dollar.

Developers had been front-running the devaluation for a few months, which meant USD property prices had shot up based on the official exchange rate. However, you can now buy real estate in Egypt at its fair value, which remains some of the cheapest real estate markets in the world.

Get a BRICS citizenship for investing in cheap real estate at market value

All you need to do is invest $300,000 in any real estate in Egypt to obtain citizenship for:

- yourself

- up to four wives if you are Muslim

- one spouse if you are not Muslim

- all your underage children

But let’s be clear about something.

Should you get an Egyptian passport because it’s a great travel document? No

Should you get an Egyptian passport because of political freedom in Egypt? No

The point of an Egyptian passport is:

- It’s very affordable and the real estate is maybe a great investment

- Political diversification

- BRICS passport – as BRICS deepen their cooperation you will stand to benefit as a citizen

- All your descendants will benefit

- A call option on Africa’s development (visa-on-arrival to Nigeria, a big deal for anyone who does business there)

- Unrestricted access to banking and business in a growing market of 110 million people

- Surprisingly nice lifestyle

I think Egyptian citizenship is a very smart long-term play and the ultimate wild card.

Are there risks?

Of course, Egypt is not for the faint of heart; there are many risks:

- War

- Internal issues

- Potential capital controls when you sell your real estate later on

- Relatively low liquidity of real estate

I would recommend Egyptian citizenship only to people who can afford it, and who don’t over-allocate to the country. As always, be reasonable. This is a very long-term play with guaranteed volatility of al stripes along the way.

What am I doing?

First things first, a devaluation means good deals. So I will be flying to Egypt in a few weeks time with my family to enjoy a nice vacation on the Red Sea. I’ll then stay an extra week to explore the real estate market in that region.

If you’re interested in the Egyptian citizenship by investment program get in touch with Hany. He is helping a few of my clients go through the process right now.

I also wrote a whole analysis on the real estate market in Cairo.

Back in November I also interviewed the government official in charge of the Egyptian citizenship by investment program. It was a very insightful discussion with him and Hany.

To a World of Opportunities,

The Wandering Investor.

Services in Egypt:

- Citizenship by Investment in Egypt

- My favourite real estate agent in Cairo

- How to get residency in Egypt by real estate investment or bank deposit

Articles on Egypt:

- Why the Egyptian Citizenship by Investment? Deep dive with the Egyptian government.

- Making a Real Estate Investment in Cairo, Egypt – a contrarian play

- Now is the time to pull the trigger on Egyptian Citizenship

- Investing in Real Estate in the New Administrative Capital of Cairo in Egypt

- The New Administrative Capital of Egypt. Why, What, and how?

- Red Sea real estate in Egypt with free citizenship

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.