I just returned to Europe after a five week trip to Africa, first to Sierra Leone and then to Kenya.

In Kenya, I was actively scouting investments on the Kenyan coast and in Nairobi to add to my existing portfolio there.

I came across this great deal that Pratik helped me buy into.

I bought East Africa’s highest duplex penthouse, a three bedroom unit priced at just $175,000. The developer also has one bedroom penthouses for around $78,000, right in the heart of Westlands, a premium neighborhood home to numerous corporate headquarters and 5-star hotels.

I’ll enjoy beautiful views overlooking the city. One story up, there will be a panoramic gym, and two stories up, an outdoor heated infinity rooftop swimming pool.

The value for money that can be found in Nairobi real estate is astounding

I’m expecting to get net rental yields of about 8.5% to 10.5% for such units, taking into account an occupancy rate of 90% and after all expenses.

In this video, I explain the thesis and go through all the numbers in detail with my Nairobi realtor Pratik.

Is it risk free?

Buying prime real estate at such valuations in what is gradually becoming Africa’s economic, business and lifestyle hub is quite a deal.

But is it risk free?

Of course not.

- Currency risk

- Debt crisis risk

- Political risk

- Pre-construction risk

- Over-supply risk

- Permitting risk

- etc, etc.

But in the end, I feel all of this is more than priced into these units which will surely benefit from being unique assets in the market. Most developers, for whatever reason, aren’t building proper penthouses for their top floor units. It’s a wasted opportunity. So there absolutely will not be an oversupply of such units on the market.

People think buying real estate in “Africa” is crazy

Have you looked at real estate in your own country?

Chances are:

- It’s a financial asset more than a hard asset because so much of its valuation is based on interest rates

- Taxes on both buying and renting it out are confiscatory and dutifully enforced

- It is far more expensive than what we are looking at here (about $1,400 per m2 net, or 130 per ft2)

- It doesn’t have all these amenities

- It is increasingly politically unstable

- It has rising debt levels (like Kenya)

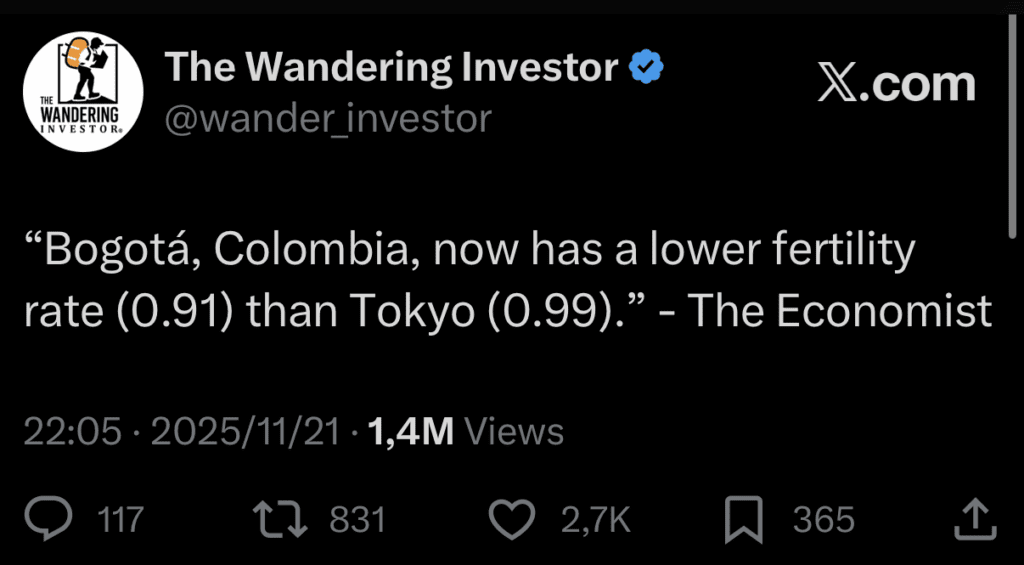

- It’s in a country with a collapsing birth rate

Even countries that traditionally had higher birth rates are collapsing demographically. Look at how this post on X went viral and clearly struck a cord:

I’m not saying that Kenya is risk free, but rather that people typically underestimate risk in their own jurisdiction. And again, I’m not telling people to sell everything back home to buy Kenyan penthouses. It just makes sense as part of a wider portfolio.

If you’re interested in finding out more, feel free to contact Pratik or reply to this email with your WhatsApp / Signal / Telegram.

To a World of Opportunities,

The Wandering Investor.

Services in Kenya:

Articles on Kenya:

- Nairobi Real Estate Market: Investor Guide 2025

- Outlook for investing in African Stock Markets in 2025

- I bought 3 apartments in Nairobi

- High returns on Nairobi real estate – 3 case studies with ROI calculations

- Why are Chinese Real Estate Developers Moving to Africa?

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “I Bought East Africa’s Highest Duplex Penthouse in Nairobi, Kenya”

LADISLAS MAURICE: Hello everyone, Ladislas Maurice from The Wandering Investor here in Nairobi in Kenya. So last week I bought East Africa’s highest duplex penthouse. I know it’s quite the statement. Today we’re going to meet with the developer as well as my realtor and I’m going to explain why I did this, the thesis and then all of the numbers behind it. Let’s go.

Why I bought a penthouse apartment in Nairobi

LADISLAS MAURICE: All right, so here we are. This right here is the penthouse that I just bought, $175,000 for a three-bedroom penthouse, 29th floor. It’s effectively East Africa’s highest duplex penthouse for $175,000. So, a bit later, we’ll do all of the numbers in detail in terms of return on investment, rental income, etc., to to get an to get an idea of the net rental yields and also the potential for capital appreciation, but that conversation will be for later. So, Patrk you’ve been helping me invest here in Nairobi real estate.

Overview of Westlands, Nairobi

LADISLAS MAURICE: Can you tell us a little bit more about the neighborhood where we are?

PRATIK: Yes, so this is effectively an extension of what we call the CBD in Nairobi, and it’s in the Westlands area. This is where a lot of now the corporate headquarters are moving to, from outside or outskirts of the city to here. And when we talk about corporate headquarters, we’ve got companies like Oracle, Xiaomi, big insurance companies, Stanbic, which is a bank, Standard Chartered, which is also a bank. Um, so they’re mostly getting headquartered in this area.

Nairobi as an African business hub

LADISLAS MAURICE: Yeah, so, look, this is one of the thesis for investing in in Kenya. Already in in just one minute you can tell, one, it’s very affordable and two, it’s increasingly becoming the hub for Africa, ultimately. Historically, you were looking more at Johannesburg, in some cases as well, West Africa, but that is just not the case anymore. Increasingly, companies when they choose to set up operations in Africa, Nairobi is the number one destination, not only due to geography, but because it’s an easier place to do business, and it’s also a lot more pleasant, especially to bring expatriates and there’s quite a large talent pool as well here in Nairobi, and it’s easy to bring expats to Nairobi, um, unlike unlike taking expats to places like Accra or Lagos, etc. And Johannesburg has gradually over the years, I mean, South Africa has been very inward looking, and they’ve been losing the status as the commercial hub of Africa over time, and increasingly businesses are just relocating here. Sure, Kenya has its issues, but the trajectory is very positive, and we’re talking of a city of about 6 million people that will probably double in population in the next 30 years, and that for a capital city has some of the lowest per square meter prices in the world. So, when I look at it from a global perspective, Nairobi is particularly attractive. So, Pratik, when we first came across this project, you you mentioned a red flag.

PRATIK: Yes, so what I mentioned was uh that this is the first development by this developer in uh Kenya.

LADISLAS MAURICE: Why is that a red flag?

PRATIK: Because you they they don’t have any prior experience to represent in the country. And uh most people who purchase are looking for that prior experience to exude the confidence in the development.

Introduction to the Chinese real estate developer

LADISLAS MAURICE: Right. So, Miss Lee is the chairwoman of the developer here, and her daughter Betty, they work together. It’s a it’s a family business. What do you have to say about that?

BETTY: What I should say is that this is very normal. Compared to other existing Chinese developer who have been here doing their business for over the past 10 years, we are quite new, and this is our first project in Nairobi. But however, our group company in China, Beijing, the capital city in China, we have established since 1999 and for already 26 years, and we have done so many bigger projects in China, different city.

LADISLAS MAURICE: So, Miss Lee, can you just tell us what are the projects that you’re most proud of that you did in China, so that we we can understand the kind of your your background and the type of projects you’ve done in the past?

BETTY: She said, “Among the many projects we’ve developed in the past, we can list some of our most successful representative works.

MISS LEE: Over the past 20 years, we’ve had more than ten projects with very large development areas. Recently, in the last two years, we’ve developed two projects: Botanical Garden Theme Park and Golden Manors in Jiangsu Province, and the other is the Flower Drum Players project, which is a representative work of our tourism real estate. It’s also quite large in area and scale. An d the third is the Lingfui Building in Zhuhai, which, as a high-rise commercial complex. This combination represents our current development level.

LADISLAS MAURICE: So, Betty, in the in the big scheme of things, how big a project is this for you as a group?

BETTY: You know, to be honest, this is the smallest project we have done in the past. And for this one, it’s only half an acre, but in the past of our project, those are all very big and over 100 acre each.

LADISLAS MAURICE: All right, so I I think it just gives an idea of of scale. Um, in the West, we tend to forget how how much scale there is in everything that that people do in China. So, this is just a test run for them. It’s a small project, but for East Africa, it’s, you know, literally the the highest duplex penthouses in in that part in this part of the continent. I understand that you have a a strong background, but people in this market, they don’t either trust it, or they don’t quite understand it. So, what are you doing to actually mitigate this concretely in the market?

Tour of one-bedroom unit in Westlands, Nairobi

BETTY: So, basically, we are at a level of 5% discount lower than the market. We are planned to have a better finishing, and let me show you this way.

BETTY: So, everyone, let me show you this is our biggest one bedroom, and then we’re selling at average price of $77,000. And then let me tell you, this is not the penthouse. This is just a flat, uh, one bedroom. This is our bathroom, and then this is our bedroom. And here we come to our living room and also the kitchen. This is the kitchen appliance we are using, which is Bosch from Germany, which is also including in the price. And everything for the furnishing, it is all from China. We’re not buying those furnishing from the wholesaler here in Kenya. We have been working with those very big and the reputable suppliers in China for the past 20 years. Everything we purchase, we understand and know it very well.

Quality of Chinese real estate in Kenya

LADISLAS MAURICE: This is why I’m really interested in this. This is one of the reasons. Chinese developers don’t have a great reputation here in in Kenya. They’ve been known historically for having lower than average quality. But what we’re seeing is that over time, they’re upping their game and they’re becoming better, and I’ve bought four apartments in a in a Chinese with a Chinese developer last year, and we went, you know, last week we went for an update and we can see like the the quality is going to be a lot better than what they delivered in the past. In this particular case, we’re seeing a large luxury developer from China coming, realizing that they can’t justify the premium from a from a marketing point of view. So, this is their marketing. Their first project, which is for them a small project, is their marketing. The finishings are supposed to be a lot better. I I would tend to think they will be better. In any case, whatever, it comes at 5% below market price. My thinking is, I’m getting a product that is lower than market price and that will have finishings that will be probably significantly better than than the average. And then on top of that, it’s a completely unique product.

Features and amenities of my Nairobi penthouse

LADISLAS MAURICE: Can you tell me about the ceiling height of the penthouse?

BETTY: Sure. For the penthouse, the ceiling height is 5.4 meters.

LADISLAS MAURICE: The windows will be floor to ceiling.

BETTY: Yes. So, it is a French window from the floor to the ceiling, and it’s about 5.4 meters high.

LADISLAS MAURICE: So, just imagine top, like highest in East Africa, massive windows like this, just imagine the views and the premium that will probably be able to command in in the market for for rentals or even just to flip it later on. Can you tell us about the amenities? Because this is important, increasingly in Nairobi, it’s an amenities game. What are the amenities in this project?

BETTY: We do offer a very good amenity service, which we have a rooftop heated infinity pool on the 30th floor.

LADISLAS MAURICE: How long is it?

BETTY: 23 meters long, and we also have a rooftop garden and also rooftop restaurant. And also, on the 29th floor, we offer a fully equipped gym, and also kids play ground. And at the reception lobby, we offer 24-hour 7-day service at the reception.

LADISLAS MAURICE: The gym will have full views of the city.

BETTY: Of course.

LADISLAS MAURICE: Look, in terms of net square meters, which is one of the metrics I like to use when I purchase real estate, though I understand that that’s not necessarily how every market operates, but it’s still it’s one of the indications.

Difference between gross and net square meters in Kenya real estate

LADISLAS MAURICE: Can you explain a particular little bit between gross figures and net figures here because it’s it’s a little confusing?

PRATIK: Most developers quote the gross figure, but that includes all the walls and items like that. And some people may want to know then what the net figure is subsequently. And you could say about a 10% deduction from the gross figure to arrive at the net figure.

LADISLAS MAURICE: So, in this case, we applied a a deduction of about 20%, so 80% of the the coded gross figure, that three-bedroom penthouse is 155 gross square meters, net works out around 127. Effectively, it’s an average across the whole building. It’s about $1,400 per square meter net for apartments with all of these amenities in what is becoming the central business district of Africa.

PRATIK: So, in this particular development, there are one bedroom to three bedroom penthouses. There are also additional normal units, which are one and two bedroom. The prices range from $58,000 to $175,000.

LADISLAS MAURICE: Now we’re going to go to the to the site, and we’re going to do all of the numbers in detail.

All right, let’s go.

Visiting residential development site in Nairobi

LADISLAS MAURICE: Great, so here we are on site. So, can you tell us when do you plan on actually starting to build?

BETTY: We are planning to start the building around two weeks later, at the beginning of December.

LADISLAS MAURICE: When is the completion date?

BETTY: Our completion date is in 2028 at the end of May.

LADISLAS MAURICE: And then the payment terms, people can pay over the time, right?

BETTY: That’s correct.

LADISLAS MAURICE: Do you have all the permits?

BETTY: So far, to be honest, we already paid the government fee for all the permit. We are still waiting. So, around one week, we are getting our approval letter for the floor plan. And then coming after will be NEMA and also NCA.

LADISLAS MAURICE: So, there is some element of risk in the sense that not all the permits have been issued yet. I just went ahead, I mean, last time when I bought an apartment here a few apartments here with another Chinese developer, they were under injunction, it got sorted out, all good. Um, I would just negotiate, essentially what I negotiated was, if you don’t get the permits, I want my money back. This is how you de-risk investing in something that sounds a little risky, you know, buying into a project in Africa that doesn’t have all the permits.

So, Pratik, there’s a lot of construction around here. What about the risk of oversupply?

PRATIK: Yes, that is definitely a risk, and I think it’s something we have discussed. But I think the risk of oversupply lies with particular types of units. Uh, what we’re looking at here is a unique type of unit. So, if you’re going to go for the standard units that people are building, as you can see, there’s a lot of construction and most developers are building those standard units.

Why a penthouse is a unique asset

LADISLAS MAURICE: Yeah, so the way I look at it is, it’s hard to go wrong with the penthouses, which is why when I sold this project, I was I was your first client, right?

BETTY: Yes, Maurice, you are my first client who purchased the penthouse, which is the three-bedroom penthouse.

LADISLAS MAURICE: Yeah, so I immediately went, I want penthouse, I want the best. It’s a unique product. Look, I travel all over the world looking at deals, looking at real estate, and I can tell you one thing, there isn’t a single market with an oversupply of penthouses. It’s that simple. There will never be an oversupply of penthouses. So, I have no problem buying into this market, buying a penthouse at these prices. I think it’s completely fair. As for the other units, I’m not comfortable sharing and we’re going to do all of the numbers in terms of what I expect in terms of return on investment from a rental yield point of view. I’m not comfortable doing the numbers for the normal one-bedroom and two-bedroom units, not that I think that the numbers will be bad in the end. It’s just it’s hard to know because of the market dynamics, because there’s a lot of supply, but the place is booming as well. A lot of businesses are moving here, a lot of people are moving here in Nairobi. So, not just a business hub, it’s also increasingly a lifestyle hub. I’m not going to speculate on those, but in terms of the penthouses, I’m very confident that those are are very decent investments. That’s why I’m putting my own money there.

Full rental yield calculation for Nairobi penthouse

LADISLAS MAURICE: Pratik, let’s do let’s do all of the numbers in detail here.

PRATIK: Sure.

LADISLAS MAURICE: Purchase price $175,000 for the three-bedroom penthouse. What are roughly the closing costs?

PRATIK: Okay, so there is stamp duty at 4%. Um, there is legal fees of the developer, which is paid by the purchaser, that’s at 1%. And then legal fees of the purchaser is 1.5%.

LADISLAS MAURICE: Okay. And then a few incidentals, etc.

PRATIK: Yes, there’ll be a few incidental costs thereafter.

LADISLAS MAURICE: Okay, so for this particular unit, I’m doing the numbers for furnished because I think it’s going to be a penthouse as a furnished market. What do you recommend in terms of the budget?

PRATIK: Around $19 to $20,000.

LADISLAS MAURICE: Look, it’s a penthouse. I’m not going to put IKEA, right? No IKEA here. You just put like just really nice furniture, you kit it out. In my mind, the target market is African. It’s a wealthy African businessman that either lives here full-time or that comes on a regular basis to Nairobi. It’s not necessarily going to be some expat family. It’s going to be a Nigerian who comes to Nairobi for a week per month or a few months per year, or some Sudanese business person that lives here. They want to impress. They want to be right in the center of everything. They want to be close to all the nightclubs. Uh, so it’s really about showing off. And the furniture will have to reflect this. That ultimately is my target market. There’s a lot of money in Africa. There’s a lot of money. And if you have the right product, you can tap into that. How much could I expect in terms of rental income?

PRATIK: So, in terms of rental income monthly, $2,500.

LADISLAS MAURICE: And that would be on a long-term contract?

PRATIK: Yes, long-term, uh, and looking at about 90% occupancy through a year, that works out to about $27,000.

LADISLAS MAURICE: This could go on Airbnb. Airbnb will be allowed in the building?

BETTY: Allowed.

LADISLAS MAURICE: Yeah. You could do Airbnb. Uh, that would be a few hundred dollars per night occupancy rate. Hard to say, honestly, it’s hard to predict occupancy rates for Airbnbs three years down the line. But for long-term, I feel comfortable saying this. I could potentially make even more money on on Airbnb, but I’d I’d rather be conservative here. Let’s go into costs. You do property management as well, Pratik?

PRATIK: Yes, and uh property management will be 6.5%.

LADISLAS MAURICE: Okay. What about finding tenants?

PRATIK: Finding tenants is one month’s rent commission.

LADISLAS MAURICE: And on average, how long do people stay?

PRATIK: 18 months. So you need a new tenant every 18 months. That’s that’s an average, yeah.

LADISLAS MAURICE: What about the service charges, the monthly service charges?

PRATIK: So, on this particular unit, it’s about $110 per month.

LADISLAS MAURICE: Look, it’s really cheap. Imagine $110 a month and you get a a fully kitted gym on the 29th floor, you get a an infinity swimming pool with views of the city on the 30th floor, heated, all the other stuff, kids playground. In my mind, maybe it’ll be more, but ultimately it’s it’s still going to be very low and it won’t really matter that much. It’s one of the advantages of operating in a in a market where labor is affordable as opposed to getting a penthouse in Manhattan.

PRATIK: I think in addition to that, you’re looking at maintenance budget increment all costs of about $1,000, and uh that leads you to a net return of 10.3%.

Taxes on rental income in Kenya

LADISLAS MAURICE: So, 10.3% net after all the expenses. I don’t want to talk about the tax situation because there’s a lot of ambiguity. Locals pay 7.5% on turnover, non-resident individuals 30% on turnover, there are structures that people use to minimize this. Enforcement generally speaking in this market is is very very low. You guide people through this, right? You guide your investors through this, right?

PRATIK: Yes, yes. These are a few uncertainties which we need to get over.

LADISLAS MAURICE: Just, you know, get in touch with Pratik if if you have any questions.

Pricing of other penthouse units

PRATIK: The other units are also two-bedroom penthouses which are duplex. That goes for about $158,000 US. In addition to that, there is two types of one-bedroom duplexes. The largest size goes for $98,000 US. The other one-bedroom duplex goes for $76,000.

LADISLAS MAURICE: Okay, so you can buy a one bedroom duplex penthouse for $76,000. How much rent would that be roughly if you furnish it?

PRATIK: $1,000 a month.

LADISLAS MAURICE: All right, net yield using the same methodology.

PRATIK: Working out to 8.5%.

LADISLAS MAURICE: I bought this apartment without even doing these numbers. I didn’t do these numbers. I we did them for the video. The reality is the value I’m getting is so good that I didn’t really care about the actual rental returns in the end because I’m quite certain that I’ll get a capital appreciation relatively fast. So, here your you the potential for capital appreciation is high, and the net rental yields if you furnish it correctly and you don’t do IKEA and you don’t cheap out is also high as well. Look, you need to be comfortable with Kenya risk, potential currency devaluations, potential political crises, potential instability, you know, it’s an emerging market with everything that comes with it. So, you just need to be comfortable with this, but I feel that it’s very much priced accordingly.

How to get in touch with Pratik to buy real estate in Nairobi

LADISLAS MAURICE: There aren’t too many penthouses that that are available, so I mean, just feel free to get in touch with Pratik if you’re interested. I also wrote a whole article on the real estate market here in Nairobi, the neighborhoods that are interesting, the neighborhoods you should avoid, some key learnings, etc. There is a link below. And Betty, you also offer some some furniture packages as well.

BETTY: For the furniture package, we can also offer to our investor and buyer. All our furniture is from China, and those are all high-end, good quality, A-grade, and very well priced. We can help you to do all the furnishing.

LADISLAS MAURICE: Look, if you want to buy East Africa’s highest duplex penthouses at these valuations of about $1,400 per net square meter, um there’s Pratik’s contact information right here. Thank you very much, eh?

BETTY: Thank you. Thank you. Thank you, Pratik. Thank you, Maurice. Yeah.

LADISLAS MAURICE: Make sure to download my free ebook, 12 Mistakes to Avoid When Investing in International Real Estate, which you can find on my website link below, and feel free to follow me on Instagram at the Wandering Investor. I look forward to hearing from you.