I feel the need to share this article because people constantly ask me about investing in real estate in Portugal. Here I will highlight three reasons why now is not the right time to be investing in Portuguese real estate.

I am simply laying out my investment thesis. This is not meant to be a hit piece on Portugal.

Table of Contents

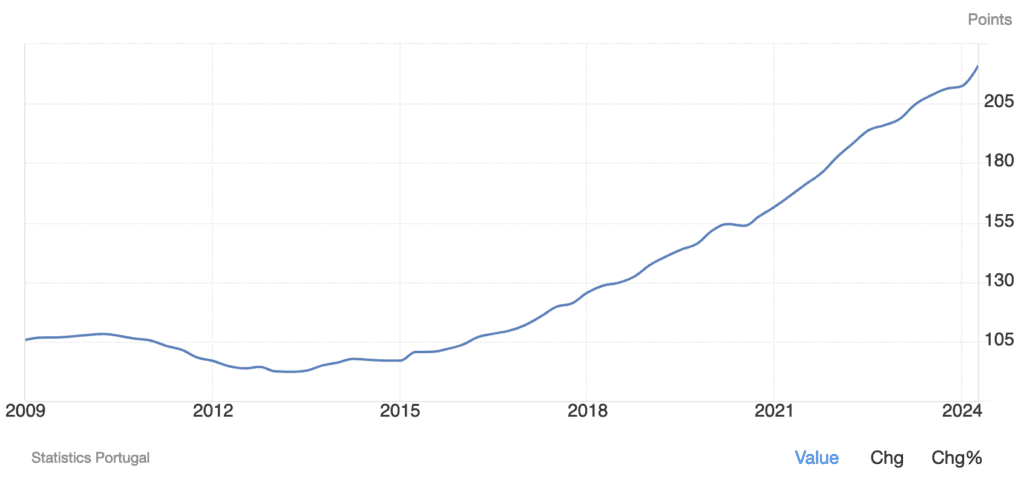

1. Prices have already risen a lot

Real Estate prices in Portugal have had a very good run, but the economic situation is changing fast with a a clear slowdown in the cards. I don’t see much upside here. The market needs to take a breather.

2. The massive immigration boom is set to end

There were less than 480,000 foreigners in Portugal in 2018. In 2022, the number of immigrants went up to 800,000 and then surpassed one million in 2023.

This has obviously had an impact on the housing market, just as it has in all Western countries that had very high immigration such as Canada, and the current government has decided to limit the amount of immigration to Portugal by forcing non-EU people to have a job and/or resources before moving. This will have a big negative impact on Brazilian, Angolan, and Mozambican immigration.

3. Courtesy of EU pressure, Portugal is killing its Golden Geese

Golden Goose #1: The real estate Golden Visa

The European Union absolute hates citizenship and residency by investment schemes. It forced Cyprus and Malta to eliminate and dilute their CBI pathways, and has put a lot of pressure on Portugal with regards to its Golden Visa program.

It was a great program. In a nutshell, non-EU people had to spend a few hundred thousand euros in real estate in Portugal, and they would obtain a golden visa for themselves and their family.

All they needed to do what to spend two weeks every two years in Portugal, and after five years they could apply for citizenship and obtain a great EU passport (in reality the process rather takes 7-9 years)

Needless to say, the program was a huge success and attracted substantial FDI. The EU did not appreciate it, and Portugal scrapped the real estate option for the Golden Visa in Q2 2023.

Why does this matter? Half of real estate purchases in Portugal used local financing, and the other half used cash.

All the Golden Visa cash purchases are now gone from the market. Also, amongst the cash purchases were a non-trivial amount of foreigners who managed to get bank loans from back home (English, German, etc), who are also suffering from inflation and rising interest rates. The actual cash market is smaller than these figures imply.

In any case, this Golden Visa cancellation is a big headwind for real estate prices in Portugal.

Golden Goose #2: Crypto friendly regulations

Portugal attracted tens of thousands of (mostly European) crypto investors due to its lack of capital gains on crypto. In early 2023 it changes the law to start imposing short term capital gains taxes of 28% on trades of less than a year. Long term crypto capital gains remain exempt. But nevertheless, expect thousands of young crypto entrepreneurial and traders to leave Portugal.

Golden Goose #3: the NHR program

The NHR program was what made Portugal a destination of choice amongst rich people. Essentially, if one moved to Portugal and applied for the non habitual residency status (NHR), then one would be exempt from taxes on most forms of foreign-sourced income, benefit from a reduced tax rate on employment and self-employment income, and get taxed only 10% on foreign pensions. This deal would last for a 10-year period from the start of the registration.

For Europeans, this was an amazing deal. People could leave high tax Northern Europe, move to Portugal and benefit from such an amazing deal.

For wealthy non-EU people, the NHR program combined with the real estate Golden Visa made Portugal a no-brainier destination.

The current socialist government decided to scrap the program. People can still get grandfathered in for their 10 years. However now many less wealthy people will be moving to Portugal as the normal tax rates are very high.

However, to be fair, there are a few positives for investing in real estate in Portugal

There are a few positive catalysts for Portuguese real estate, but they do not outweigh the cons. However, I want to highlight them here as they are quite thought-provoking.

1. Costs of living crisis in Europe

As millions of Northern Europeans will increasingly struggle to make ends meet due to inflation and rising energy costs, many will look South to reduce their cost of living. Portugal is a very affordable place to live in the EU context, and is overall very pleasant, to say the least. This is a trend that will go on for many years and which will be beneficial for the real estate investment market in Portugal.

2. Energy from North Africa

Northern Europeans cut themselves off from their cheap source of energy (Russia). The direct result is an energy crisis and prices that are surging. Many countries will try to print their way out of the situation, but unless peace is reached with Russia, at some point the money printing will not work anymore and normal people and companies will have to pay extremely high prices for LNG imported from the US.

Portugal has less of an issue as it is mostly dependent on hydroelectricity, wind, and North African gas from Algeria, which should enable it to remain competitive and who knows, maybe even attract some industry.

3. The bug-out market is a niche real estate investment trend in Portugal

This is a small phenomenon; I don’t mean to exaggerate its importance. A small but growing contingent of Europeans want a Plan B away from potential large scale war in Europe. Portugal has historically been a safe haven, and its islands of Madeira and the Azores even more so. I believe we’ll increasingly see Europeans buying such plan Bs in Portugal.

4. American liberals leaving the US

This is a very positive aspect for Portuguese real estate in niche areas where Americans like to invest and spend time in. Following Trump’s election, many US liberals are very disappointed and want to leave the country. One of the easiest places to obtain residency in Europe, and that is actually quite close to the US, is Portugal. It is traditionally a very liberal country from a policy point of view. And typically liberals are less turned off by higher taxes than their conservative neighbors.

I expect a resurgence of US immigration to Portugal which could positively impact some niche real estate markets in Portugal.

However, the overall real estate investment outlook in Portugal is negative

Discouragement of foreign investment and reduced immigration are too strong of headwinds for the time being. Prices of real estate in Portugal are very likely to stop going up in any significant way. You cannot make a real estate investment in Portugal right now and earnestly hope for good rental yields and capital gains. One is likely to get neither.

I prefer the outlook in other markets

In Europe I find that Hungary and especially Sicily offer much better value overall, and that some economies and real estate markets such as Ireland are healthier. Markets such as Montenegro, Colombia, and Kenya are interesting cash markets, but they each have their own set of risks which must be taken into consideration.

With regards to Portugal, I’ll be sitting on the sidelines. Maybe I’ll venture into this market in the future, at attractive valuations. It’s not without good reason that real estate in Portugal has been so attractive in recent years as there is much to love about the country.

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Please comment on your thoughts about Panama for investing and for retiring.

I’m in Panama right now. Low rental yields but great retirement residency programme and benefits.

Thanks for all your insightful work. Please consider doing follow up pieces including YT videos “a year later, what has changed” on Kenya, Montenegro and the others. Did you end up selling your property in Montenegro? I think there is a lot of good information we can learn from follow up pieces. Thanks, Wolf from New York metro area

Hi Wolf, Kenya is having substantial current account issues. I’m glad I didn’t buy property there. With regards to Montenegro, tourism is expected to slow down next Summer. Inflation, the cost of living crisis, and more expensive flights are not bullish for intra-European tourism in 2023. Hopefully high spending Americans will fill the gap, as well as Gulf Arabs and the Chinese if China opens up.

I did not sell my property in Montenegro. I had bought in an extremely low liquidity area. I wasn’t an investment, but rather a personal project. This is what happens when you buy personal projects in illiquid markets :). But I’m not too worried about it. It’s a decent land band in the context of an uncertain world. I sold all of my property flips in coastal Montenegro though. 2022 has been a good year in Montenegro from a real estate point of view. Lots of FDI.

Thanks for this article. My impression was also that the Portuguese real estate in big cities was way overvalued for the quality, and for the salaries there.

On another thought, I would love to read your thoughts on the real estate market in Greece.

Greece: Interest rates are going up. Its Golden Visa will also be under pressure. Property taxes are high, yields are low, tenant laws are strong, and I simply don’t see catalysts in Greece.

Where is Greece’s future growth going to come from? It’s an indebted, unreformed economy of old people dependent on the EU.

Its special tax programe for retired people is interesting, this is about it.

Why? Because it is expensive real estate, the country is poor and depressed, no work, no business, and it is impossible to get a visa to live there. That was east to answer!

The D7 visa is very doable.

What do you think of the Portuguese market now that it’s August 2023.

The Golden Visa program is back “on”…, not ending after all

They cancelled the real estate option for the Golden Visa. Overall, I am negative towards Portuguese real estate. Even more so than when I wrote the article. My thesis is playing out.

How do you feel about investing in real estate in Spain at this time? Are their parts of Spain that can be still interesting for renting out a property since house market is going up there also?

Or what about Italy or Croatia?

Spain and Croatia: rising interest rates are a no-no.

Italy is dirt cheap in some regions. Great lifestyle play.

Portugal’s real estate Market, in particular in the larger cities, is way over-valued ….. Asking property prices are far higher than Bank Valuations (for mortgage purposes), there is a very large Bubble in this market.

Portugal is experiencing a Property Crisis (Housing for locals), a huge majority of locals cannot afford to buy residential properties and even the rental markets are very expensive…

Watch this space…. the property market bubble will eventually pop!