The Sultanate of Oman, located in the Persian Gulf, is not your typical international real estate investment destination.

It is a relatively little-known, peaceful Gulf country of about 5 million souls, 40% of which are expatriates, mostly from South Asia.

There are many friendly camels too.

I write this article as someone who invested in real estate in Oman in the past, and who was a resident of tax-free Oman for a number of years.

Table of Contents

A bit of background on Oman

Oman was a typical Gulf tribal land until His Majesty Sultan Qaboos bin Said ascended to the throne in 1970. Thereafter, Oman experienced decades of renaissance on the back of economic and social reforms, not to mention lucrative oil discoveries.

If you believe democracy is the only appropriate system in this diverse world of ours, then look no further than Oman as a counter example. His Majesty was almost universally loved, and turned his country into a unified, peaceful haven in the Middle-East. Oman is known as the Switzerland of the Middle East for its neutral foreign policy.

In early 2020, His Majesty Sultan Qaboos passed away following a long battle with cancer, and contrary to many observers’ predictions, a peaceful transition followed with the nomination of Sultan Haitham bin Tarik.

The economy in Oman and its outlook

Oman transformed from a subsistence economy into a petrostate. Even though industrial production accounts for 38% of GDP according to the World Bank, oil & gas together represent between 68% and 85% of government revenue depending on commodities prices.

All was well and good until the price of oil plummeted in the mid-2010s. The government debt to GDP ratio then shot up from 15% in 2015 to 70% in 2020 due to fiscal deficits. Since then, the debt to GDP ratio has decreased substantially as the price of oil has recovered.

As I expect the price of oil to do well in the years if not decades ahead as the developing world continues to consume oil and as the energy transition takes much longer to implement in the West than planned, Oman’s debt issues will gradually sort themselves out.

This is a long term catalyst as lower debt levels will give the government more breathing space to invest in the local economy, thus driving the local real estate market.

The peg of the Omani Rial to the USD has held, and the Central Bank is committed to defending it. His Majesty Haitham bin Tarik is not a typical complacent Arab politician – he understands that his people depend on his leadership.

His Majesty is implementing four axes of reforms

Budget reforms when times were tough

Budget cuts representing 15% of government spending were implemented in 2021. Such tough, but much needed, austerity measures would be near impossible to pass in a Western-type democracy. This resulted in salary freezes for the public sector, less infrastructure spending, less subsidies, and job losses in the bloated public sector.

The fiscal situation is now much better as the price of oil has recovered, but what is important to note is that His Majesty had the courage to implement such austerity measures when needed, which is a very positive sign from a leadership point of view.

Extra taxes with minimal impact on the consumer

His Majesty understands the danger of his government budget being almost entirely dependent on the oil & gas sector. A VAT of 5% was implemented in 2021. This was obviously an unpopular reform. However, I know business in Oman well and I can tell you that businessmen are used to making insanely fat margins. The reality is that this VAT was mostly absorbed by businesses rather than passed on to consumers.

As for the much feared potential personal income tax, it keeps getting pushed back. Additionally, it would appear that it will be territorial in nature which means only on Omani-sourced income would be taxed. So for people of means wishing to relocate to Oman, it would be unlikely to impact them.

Encouraging foreign investment to diversify the economy

Such measures are typically a bit controversial, but the new Foreign Capital Investment Law now allows foreigners to own 100% of businesses in Oman without the use of local sponsors. This is valid only for specific, high value adding industries, which will be a net benefit for Omanis as it won’t make foreigners compete with locals in more pedestrian sectors of the economy.

A policy of Omanization

Expatriates represent 40% of the population. Most of them work in the private sector, while most Omanis are in the public sector. His Majesty’s objective is to reduce the number of expatriates so that Omanis can take jobs in the private sector. This is beneficial on multiple fronts:

- Less government money is spent on salaries.

- Locals are employed in the private sector, resulting in more local savings as opposed to foreigners sending their savings abroad. It is very beneficial for the current account balance.

His Majesty fully grasps the situation and is grabbing the bull by its horns. These reforms are not painless, but are much needed for his country and people.

The top developments to consider when making a real estate investment in Oman

If you want to invest in Oman, I suggest looking at developments near Muscat, the capital. The reality is that even though you can find cheaper developments in other parts of Oman, accessibility is an issue.

Muscat is equipped with a brand-new international airport, a reliable national airline (Oman Air), and extensive connections to Europe, the Middle East, Asia, and Africa.

Foreigners are allowed to invest in Integrated Tourism Complexes (ITCs) only. This results in a two-tier market comprised of the local, Omani market, and the ITC market in which foreigners can invest. Typically, I shun such markets as this is an inherent flaw. Healthy markets are free of government intervention.

In this particular case, while ITCs are much more expensive than the local market, there is substantial investment by locals in these ITCs as locals see the value in paying up due to their higher quality and better amenities. In fact, the majority of residents and owners in such ITCs are Omani.

Here are the four main ITCs in the Muscat area that foreigners can consider for investing in real estate in Oman.

Al Mouj (The Wave)

Al Mouj is the premier ITC in Oman. It is located right next to the international airport in Muscat, boasts a lovely marina, and is very popular with locals and foreigners alike.

It’s a liquid market, so it is easy to find tenants, as well as buying and selling if the price is right. As an actual investment, it is the best play in Oman. Villas and apartments of all sizes and configurations are available, and the Kempinski Muscat is within the development. Additionally, a St Regis will open its doors later 2023 right next to the Greg Norman designed golf course.

Muscat Hills

Muscat hills is inland, close to the airport. It hosts a nice golf course and housing there is much more affordable than in Al Mouj.

However, it is less appealing. Liquidity is low, prices have plummeted, and in many ways it has the looks of a development that is on the brink of having financial issues. I’d consider Muscat Hills only if I wanted a cheap property within Muscat itself, and wanted a low price point, knowing full well it’s a questionable investment.

Muscat Bay

About 30 minutes away from Muscat is Muscat Bay, a new ITC. It is cradled between two gorgeous cliffs, with a stunning view of the Gulf of Oman. It is close enough to Muscat to make it a viable option for people working in the capital, while still offering the peace and quiet of the coastal countryside.

A really nice Jumeirah branded hotel opened there late 2022.

Having viewed apartments there, I feel that many of the apartments are quite dark and have a style that could quickly become passé.

Overall, I wouldn’t invest there as I believe that Al Mouj offers much better value for money, as well as Jebel Sifah below.

Jebel Sifah

Jebel Sifah is located an hour away from Muscat, along a scenic little road.

It’s a development that took some time to get off its feet, but which has become a success. It is a bit far for people to commute on a daily basis, but perfect for people who just need to get to Muscat 2-3 times per week. The development is along a picturesque beach, hosts a lively beach bar, a well-groomed golf course, and a pretty marina. It’s actually one of my favourite weekend getaways. Many long-term expats have bought apartments here.

The relatively low price points of some of the units in Jebel Sifah make it an attractive option – you can find studios on the golf course for about OMR45,000 ($117,000).

Crucially, Jebel Sifah allows short term rentals, unlike Al Mouj. This is key as it allows you to own property in Oman, get residency, spend a few months a year in your own property, and let it out the rest of the year. The weekend rental market for Omanis looking to escape Muscat is surprisingly vibrant.

However, the long-term market is stagnant, and liquidity for sales is low.

The Oman real estate market is consolidating and the rental market is perking up

I have been monitoring the Oman real estate market for many years as I invested in the market. I saw prices drop by about 30%, for both sales and rentals, between 2015 and 2021.

Since then, both the real estate and the rental market have been picking up. Why?

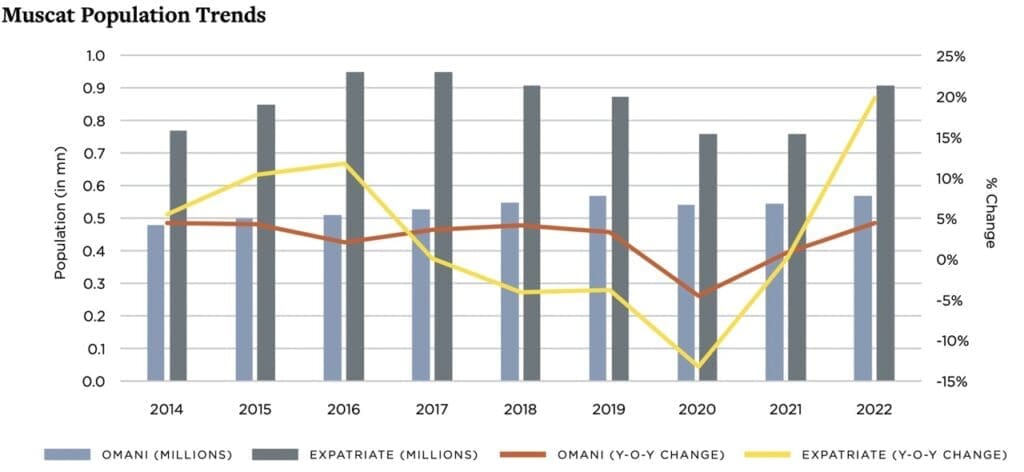

- On-going Omani population growth thanks to a fertility rate of about 2.5 children per woman

- Most importantly, renewed strong growth of the expatriate population after years of decline

The growth of the expatriate population is particularly important for real estate investors in Oman because they are the main renters. Omanis typically own their housing, while expatriates rent. They are your target market.

There are a few catalysts for investing in real estate in Oman

I feel that prices have bottomed in Oman, and that prices have been consolidating at the bottom for 2-3 years already. It’s healthy. In additional to the growing expatriate population, I see two main catalysts for potential real estate price increases in Oman.

The days of government austerity are coming to an end

Strong oil prices and a lowering of the national debt will inevitably lead to the government increasing its spending after years of austerity. This will absolutely drive the local market.

Booming real estate prices in Dubai will have some spillover effect in Oman

The Dubai real estate market is hot. Price increases are reaching decade highs. This will invariably spillover to Oman as:

- People look for the next speculation

- People want to live somewhere more affordable in the Gulf

Oman’s residency by investment scheme for real estate investors is much more affordable than Dubai’s. This is something that people will gradually start finding out about.

A concrete example of an apartment with full yield calculation breakdown

This 2-bedroom, 2-bathroom apartment is located in Al Mouj on the second floor with a gorgeous pool view. It is 125m2 and costs OMR120,000 ($312,000). It could probably be negotiated down to OMR 115,000 ($298,000).

| Price paid after negotiation down from OMR 120,000 | OMR 115,000 |

| Ministry of Housing tax – 3% of purchase price | OMR 3,450 |

| Total price | OMR 118,540 |

| Yearly gross rental income (OMR 565×12) | OMR 6,780 |

| Gross yield | 5.7% |

| Vacancy rate of 10% | OMR 678 |

| Rental tax of 5% (on OMR 6,102 once vacancy is removed) | OMR 305 |

| Maintenance of 5% of gross rental income | OMR 305 |

| Yearly home owners association charges paid by owner (OMR 93 x 12) | OMR 1116 |

| Tenant finder’s fee and property management (about 12% on base of OMR 6,102) | OMR 732 |

| Total yearly net, net income | OMR 3,644 |

| Net, net yield | 3.1% |

In this video, my realtor Nicole and I walk you through a one-bedroom apartment and do a yield calculation, as well as discuss what people like about Oman.

The Oman residency-by-investment and lifestyle play

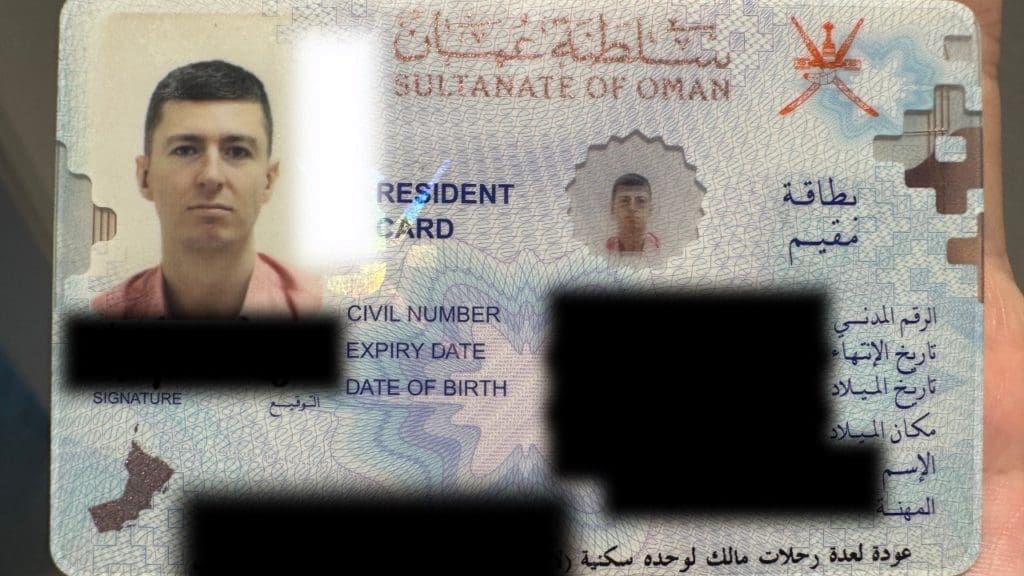

I don’t see Oman as a pure real estate investment destination. However, much is to be said for the amazing lifestyle that the country offers, as well as for the benefits of being a resident of Oman thanks to real estate ownership. Making a real estate investment in an ITC in Oman entitles you and your family to residency in Oman, renewable every two years, as long as you own the property.

The Oman residency by investment is valid for you, your spouse and either your children or your parents (one generation up or one generation down). It does NOT give you a work permit. But you can live there and work online.

Oman is not Dubai. Don’t expect a flashy lifestyle with 90% expatriates.

Rather, expect to be immersed in local Omani culture. It’s not like Dubai where you rarely interact with locals. In Oman, you will be dealing with Omanis on a daily basis, in English as it is widely spoken.

Omanis are friendly, peaceful, relaxed, and respectful of people’s privacy. The country also boasts plentiful tourism potential, from lovely little wadis, to sand dunes, quaint villages in the mountains, and a stunning, unspoiled coast.

Cars are cheap, gas is subsidized, the road and highway network is world class .

It’s not for single people, and don’t expect the bar and club scene to even remotely compare to hedonistic Dubai. That said, it’s a great destination for families, and retired people. International schools are plentiful, and your children are less likely to end up worshiping money than if they grew up in Dubai. Oman also offers quality, affordable private healthcare.

Uniquely, Oman is a great base for perpetual travelers, investors, and businessmen who need a tax friendly base with a great airport. Live in Al Mouj, drive 10 minutes to the airport, and be on a Gulf-airline-quality flight to Asia, Europe, or Africa.

Conclusion: should you make a real estate investment in Oman?

Would I buy real estate in Oman as a pure investment? Unless I lived there, no. Why? Because ultimately real estate prices in Oman depend on the price of oil, so I see oil companies as an investment with more torque. I’d say the same thing concerning Dubai real estate.

But I do expect real estate prices to increase in Oman.

That said, I view buying real estate in Oman to obtain residency as a great option for four types of people:

- Young families who want to live in a peaceful environment respectful of traditional values

- Retired people who want to live in comfort, with good quality healthcare, and year-long sunshine. The cost of living is not cheap, but is much more affordable than in many parts of Western Europe. Also, hiring full-time help costs a fraction of what it would in Europe.

- Perpetual travelers who have interests in many countries and who need a base with great flight connections somewhere between Europe, Asia, and Africa. In many ways this region is at the center of it all.

- Affluent South Asians seeking a Plan B, or who wish to situate their family in a low-stress, peaceful and unpolluted environment, a quick flight away from back home.

In my mind, investing in Oman real estate can provide the investor with an amazing ROI if he/she utilizes the tax-free residency.

Once you are an owner, feel free to get in touch with Hussain. He’s my trusted Omani fixer who helps people obtain their residency papers and with anything government related. (Hussain’s WhatsApp +968 9424 8689).

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Excellent unbiased advice

Great advice, thanks. I live in Oman having invested in an ITC. I have some business here, which keeps me busy a couple of days a week and we enjoy the ability to live here as well as fulfil our travel desires as well as lock up and leave for three months while we live in Italy for example. Short term renting is an option but we have found that the locals treat the property rather casually and things go ‘missing’ and even no smoking rules are ignored etc. Also if you have a booking for three people expect at least 6 – that way they save money – even if it is strictly against the law – much of which is ignored! It suits our needs at the moment, we will keep it but most likely shift to Dubai until the government has sorted out Covid-19. There has been very little compliance to the law and as at May 30th infection rate per million of population is worse than India. It seems there is no strategy/roadmap for dealing with it.

Thanks for your input David!

Great review, just forgot to mention that beside OmanAir there is an Omani low cost airline called SalamAir and they fly to many exciting destinations with new fleet and reasonable cost. Oman is one of top destinations for game fishing and diving, almost catching a big tune is guaranteed on each trip, both Al Mouj and Jabal Sifa have their own Marinas where you can have your own boat at very reasonable cost or rent a trip. There are freehold properties in Salalah as well

Very true. Thank you Mohamed!

Great reviews and advice! Not just talking about this article but all the ones I read (I binge-read today). Your blog is real find hidden in between all the voodoo bs sold by gurus you typically find on the web when you type real estate. Question though; why is it that you never talk about financing: ease of getting it and conditions, impact on your yield…

Thank you Dimitri. In most cases financing is not available to non-residents in these markets. And when it is, the interest rates are simply too high to make it worth considering.

Hello,

What is minimum investment for getting residency in Oman.

Also if you can make vlog on Salalah free hold properties.

Thanks

No minimum. Any property in these ITCs qualifies.

Hi

very interesting these informations, I have been 4 times in Oman Salalah is my best city I felt so good, muscat is nice but salalah is exactly what I am looking for, I would like to buy something there in salalah , a flat or I prefer buying a house, if someone knows something or if you have more informations about that could you help me in my researchs please. thanks in advance

balkis from France

Nice article indeed.

I was wondering if you’d also provide some information about the Residences Mandarin Oriental project in Muscat as well.

Great article, one question if I am investing there for an apartment and get a residency and settle with family, how do I make a living, apart from online business if I am not given a work permit?

No work permit. You have to make online money.

Hello,

I am planning to move to Salalah within couple of months. I don’t have work permit but planning to buy a property to get the residency. I have two questions:

1- Is there any limit price on the property in order to be eligible for the residency?

2- Do I have to live at that property or I can rent it out and rent another property for my family elsewhere? for example buying in Muscat and renting in Salalah!

Thanks in advance for your help

1. No. Any property qualifies, even a small office space, as long as it is in an ITC.

2. You can rent it out, and live anywhere in Oman.

Hi

Thanks for the information. I am a British national wishing to run a rice import business. I am of Pakistani origin (so that’s where the rice will come from). I know of someone running a small rice import business but are on a work related visa so running the business in partnership with an Omani national. But he wants to take his business to the next level so I will be providing finance for him to be able to do that. Is there such a thing as a business visa or will buying a property give me rights to be able to do that.

Are there any good websites where I can search for properties in ITCs. What is the situation with off plan properties?

Any help will be greatly appreciated.

Hello,

Excellent blog post, thanks a lot.

I am originally from Europe, but I bought a small 53 sqm studio apartment in Hawana Salalah and I am in possession of the Omani residency card now. I have the apartment on Airbnb and Booking.com and generate some passive income when not there. The occupancy this year is fantastic. During Khareef, it was 99% for two straight months.

Personally, I bought the apartment because of four reasons:

Behind the destination ‘Hawana Salalah’ is a company called Orascom Development. They build entire towns from scratch, also in Egypt, Montenegro, the UK, and Switzerland.

I find their vision and concept quite attractive since they really try to fill up the town with international and local events all year round. For example, in Salalah they are having an official IronMan now.

And in El Gouna (Egypt), they managed to create a proper film festival that attracts thousands of visitors each year. They managed to bring major sports competitions to the town that fill 100% of the beds for some period each year.

I have a bit of hope that, over the years, Salalah will also turn into a buzzing city as well and that my apartment will be well-positioned. The master plan is gigantic, containing a huge land bank. They are basically trying to replicate the success of El Gouna.

The final argument for risking buying the apartment was when I learned about the Khareef season. They have the rainy season (mainly attracting Arabs) and the sunny winter season (for the Europeans). Muscat doesn’t have cold weather, but the capital has all the big international events instead. If Hawana Salalah manages to add some events during the low months, I hope to be fine.

The government is investing a lot of money into the Dhofar region. They created a new airport, a new shopping mall, and added new infrastructure for some of the most popular tourist attractions (like Al Mughsail Beach, Al Haffa Beach, …). And, they try to push the Salalah free trade zone and the new port. Not sure if this helps my apartment, though.

In the last few years, some big cruise ships have started to make a stop in Salalah. The city is rapidly developing in a nice way.

Keep in mind that Hawana is still early-stage. For me, it is a long-term bet with a decent risk/reward ratio. I am happy to share my full story or even help you settle down in Salalah.

I just started my own blog about Salalah:

https://www.discover-salalah.com/

discover-salalah@outlook.com

HI,

Buying unit from ITC’s does residency allowed for family or for buyer only?

Residency allow to work or study?

thanks

Buyer + spouse and children OR parents. One generation up or one generation down. It does not give the right to work. You can still enroll at a private school or university if you pay.

Hi, thanks for this blog post!

I live in US and am looking to retire in Oman by buying a property to get a residency. My issue is that Oman do not allow people with just visitor visa to open a bank account where they can wire their money safely and start a property purchase transaction. I have been told once when i visited Oman 5 years ago that i have to bring cash to the country in order to pay for such purchase. That is absurd and illigal for some one to cary couple hundred thousands of dollars. Can you please explain to me the procedure that most people do to purchase a property in Oman. Thank you in advance!!

Hello Karim. It’s not an issue. Just transfer the money directly to the seller’s account or the developer from your US account. Easy. Just make sure to explain to your bank in the US, before leaving, that you will seek to make such a remote transaction. They’ll raise your limit and ask for the purchase contract when you send the money. If your US bank can’t do this, switch banks. Once you’re an Omani resident you’ll be allowed to open a local bank account.

Golden visa in Oman can I be out of the country for more than 6 months ? What’s the maximum time frame

No limits. You just need to come back for two weeks every two years to renew your residency

Hello

How much is the fees per person for the two year residency?

We can have a residency for a plan appartement or appartement must already exist?

How long the process take to have the residency ?

Thanks for your support

Hello Kais,

1. A few hundred dollars per person for the residency.

2. Both are options.

3. About 2 weeks of presence is required.

How much time do you have to spend in country to get and maintain tax residency?

Not everyone needs actual tax residency. It depends on your particular case. For Oman the official number is 183 days. But to just maintain residency, you just need to show up every two years to renew your card.

Do I have 6 month straight for tax residency?

Thanks

If you want actual tax residency, not just residency, 6 months in total during the year.

Can you point me to the official govt web page for this program?

Hello,

Is there an option to buy with 5-year payment plan, or “cash” only?

Thank you!

Payment plans are available. Feel free to ask Nicole: https://thewanderinginvestor.com/services/international-real-estate-services/my-favourite-real-estate-agent-in-muscat-oman/

Hi,

Thank you for that.

I’ve tried to contact Nicole through direct email as well as the form but with no response.

Any advice please?

Thanks

Hi Ladislas,

Thank you very much for all your wonderful content.

What is your take on the new AIDA development in Yiti Beach near Mascate?

I went there and was blown away by the beauty of the site.

Although it may take time to take-off (the nearby Nikki Beach is already 1 year late, or so, in its building), the potential seems exceptional : Sea, Golf greens, incredible views, on-site services, future hotels and quick access to the airport.

The developer succeeded in high-end projects in Dubai and seems reliable.

Prices are much lower than in Al Mouj, for a premium quality that should be as high.

The Jumeirah hotel and Shangri-la too are very close.

But there are many projects under development in the Muscat Bay Area. Maybe too many?

And the Trump brand for golf and hotel may be an asset…or not?

The area is not developed at all yet, and creating the infrastructures may take more time than the announced 3 years completion.

Thanks for your opinion!