This article was written from personal experience making multiple real estate investments in Istanbul and as I go there on a very regular basis. We’ll discuss the macro landscape in Turkey, how the Istanbul real estate market is a buyer’s market right now, which neighborhoods are interesting for investing, earthquake zones, as well as case studies with numbers and rental yields. What will emerge is a picture of a market that is fairly priced, has decent rental yields in some segments, and that give an amazing citizenship as a free kicker.

Table of Contents

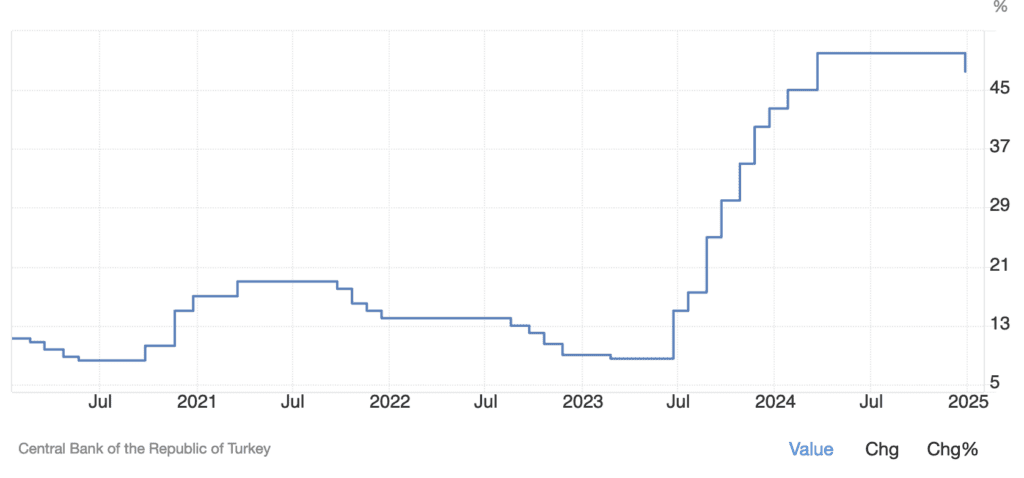

The state of the Turkish Lira

Before even attempting to discuss investing in the Istanbul real estate market, one must address the Turkish Lira.

By the time you read this article, it will inevitably be worse. But why is this happening?

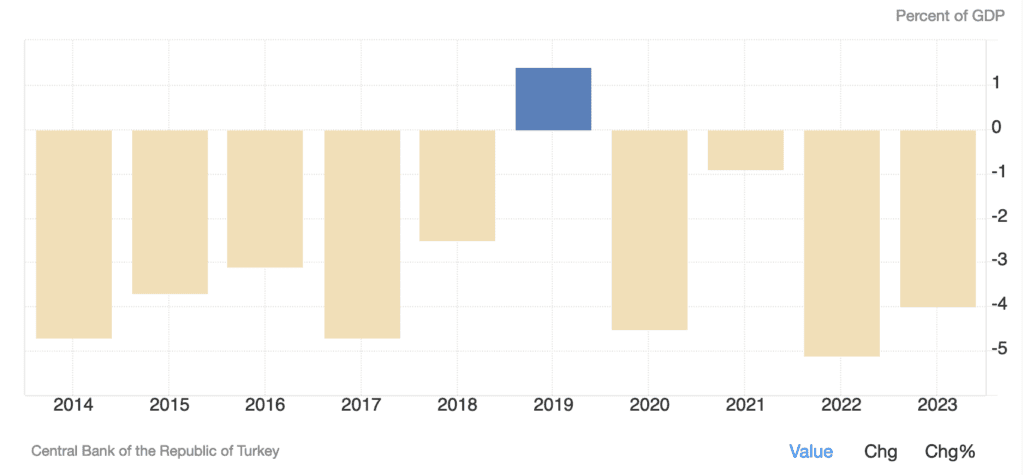

The crux of the issue is the current account deficit. In rough terms this means that the country imports more than it exports.

This gap must be plugged by financial flows to make up for trade being negative. This means a mix of foreign direct investment (FDI), and debt.

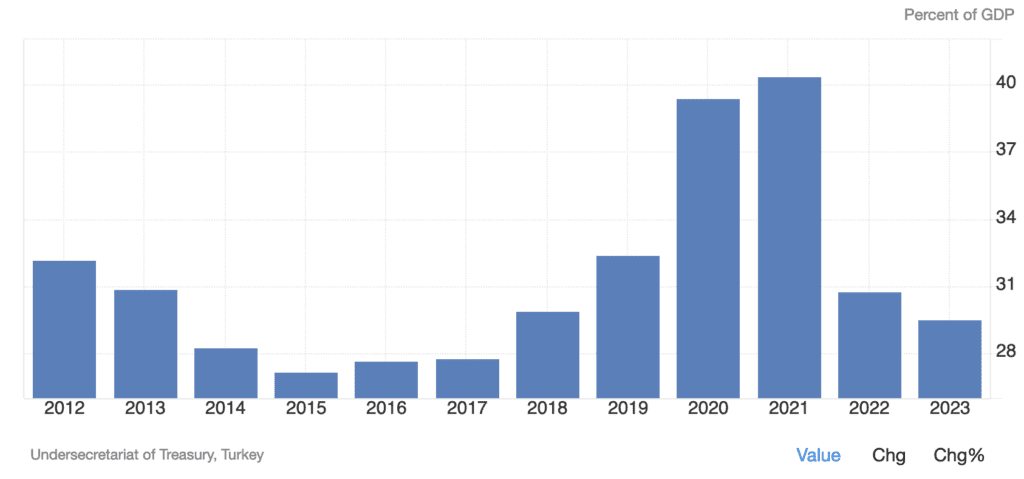

But it’s not the Turkish government that is on a borrowing binge. If anything, the Turkish government debt levels are much better managed than in most countries in the world. Essentially, Turkey used super-inflation to inflate its government debt burden away, which is something people should keep in mind, especially Westerners living in highly indebted countries.

The issue lies in the private sector which has foreign debts worth about 20% of GDP, denominated mostly in USD and EUR.

But again, at the heart of this dilemma is the current account deficit. And what drives this deficit?

This is the core insight.

Energy. Turkey would run a net current account surplus if it wasn’t for energy imports.

It’s all about energy. Turkey is a manufacturing and export powerhouse but imports all of its energy.

Turkey is making the right long-term moves to plug its current account deficit

President Erdogan understands that Turkey’s energy dependence is the core of his country’s issues. What is he doing about it?

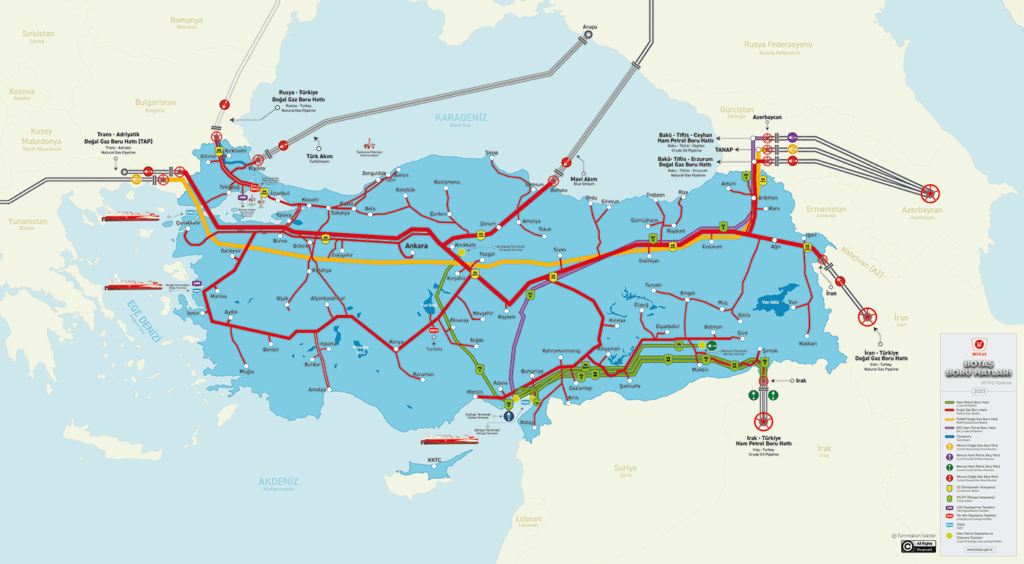

Turkey is positioning itself as an energy transit hub

If you don’t have energy yourself, what is the second-best scenario? Control its flows, take a cut from everything that transits, and get preferential access and pricing. Smart.

Not a year passes by without an announcement of a new pipeline project. This is one of the core reasons why Turkey cannot, and will not, become entirely pro West, as its energy needs and pipeline network depend on supplies from the East.

Turkey has made massive gas discoveries

In the past 4 years Turkey started exploring its section of the Black Sea and discovered 710 billion cubic meters of natural gas. To put this number into perspective, it represents 15-20 years of domestic consumption, both household and industrial.

This is an absolute game changer. And it’s not a pipe-dream as the first gas production was in April 2023. Also, as it continues to explore it is bound to find more reserves. And it is also prospecting in its share of the Mediterranean where the Cypriots, Greeks, Israelis, Egyptians, and Lebanese have found large reserves.

By producing all of its gas, Turkey will gradually reach the stage of becoming a net exporter. The implications for its current account and macro stability will be significant.

This is why the energy discussion is so important even for real estate investments in Istanbul and in Turkey in general

I’m not saying that Turkey has solved its issues. It absolutely hasn’t. But the core issue of the current account is being addressed strategically and with solid implementation. It’s something of a race against the clock.

As long as this policy continues, Turkey will be fine in the end. However this does not exclude substantial volatility and negative headlines along the way.

I myself have made real estate investments in both Istanbul and Izmir, with an understanding of the volatile path ahead. I don’t panic whenever I see a negative Turkey headline. It’s part of the deal.

Credit rating improvements

Turkey recently received its second credit rating upgrade in six months from Fitch Ratings, highlighting improved external buffers and a significant increase in reserves, Bloomberg reported.

Fitch upgraded Turkey’s credit rating to BB- from B+ with a stable outlook.

It’s still not investment grade, but the trajectory is positive.

The State of the Real Estate Investment Market in Istanbul

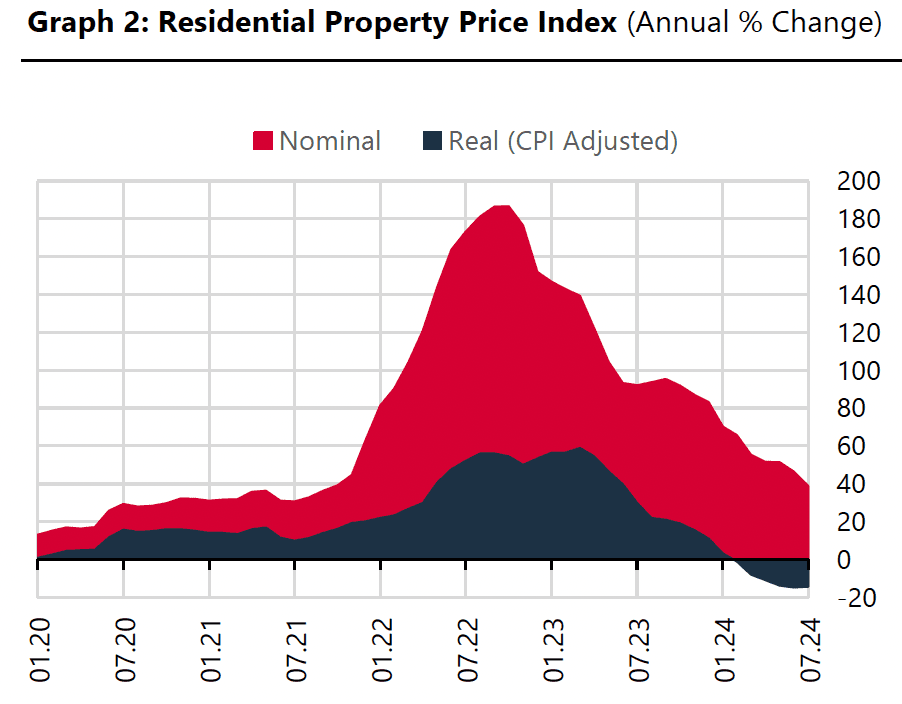

What is insightful is that real estate prices beat inflation in real terms.

Following years of declines in prices due to deleveraging, the Turkish real estate market boomed from 2020 to 2023 in USD terms. Since 2024 prices are slowly dropping and are now starting to consolidate. One of the key drivers for the slowdown has been extremely high interest rates, which has slowed mortgage lending, and made term deposits more attractive especially as the Turkish Lira has become more stable in the past year.

The reality is that the Istanbul real estate market has always been very volatile, and now is a good time to enter for long term investors as prices are affordable, it’s a buyer’s market, and rents are not dropping which means that rental yields are up.

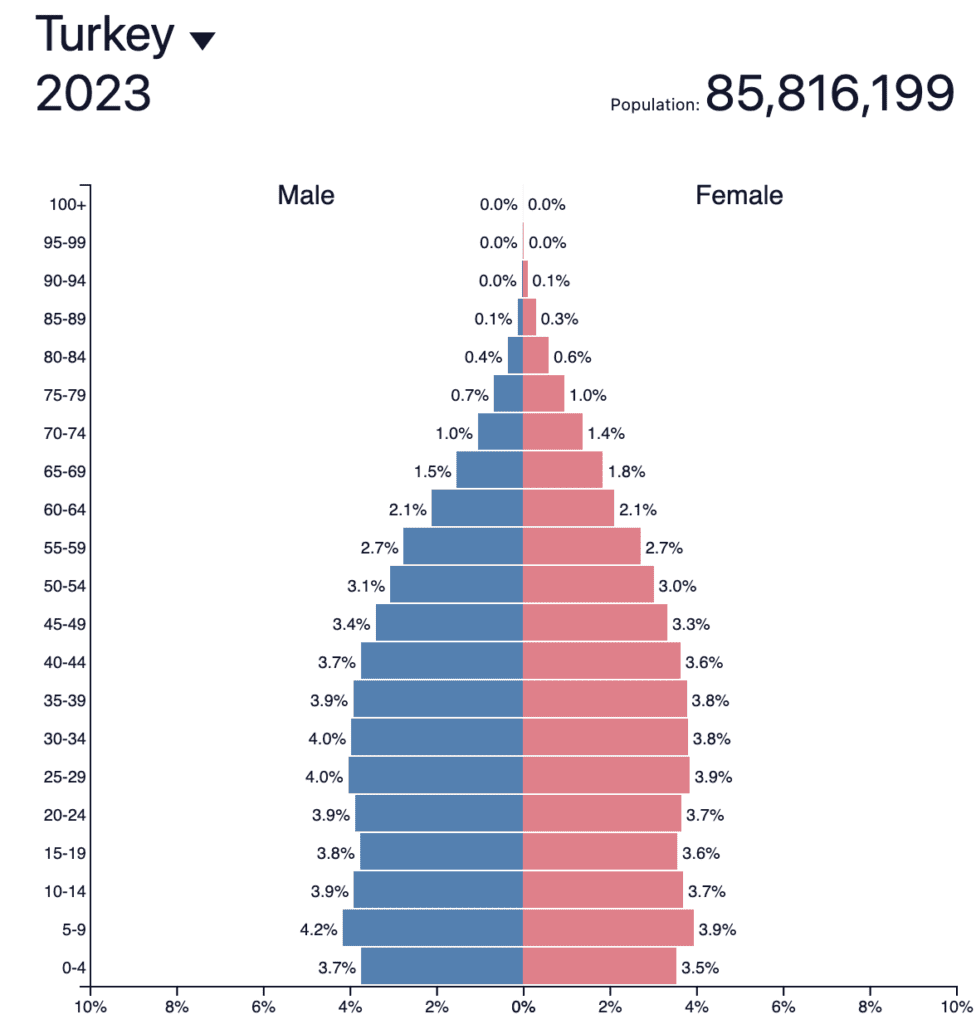

Demographic pressure adds to the appeal of this market. Istanbul is currently home to 15 million people and is expected to grow strongly over the years thanks to positive nationwide demographics and urbanization. According to the World Bank, Turkey’s fertility rate is approximately 2.0 children per woman. This compares very favorably to its neighbour Greece with only 1.3 children per woman.

The number one trap you should avoid when making a real estate investment in Istanbul

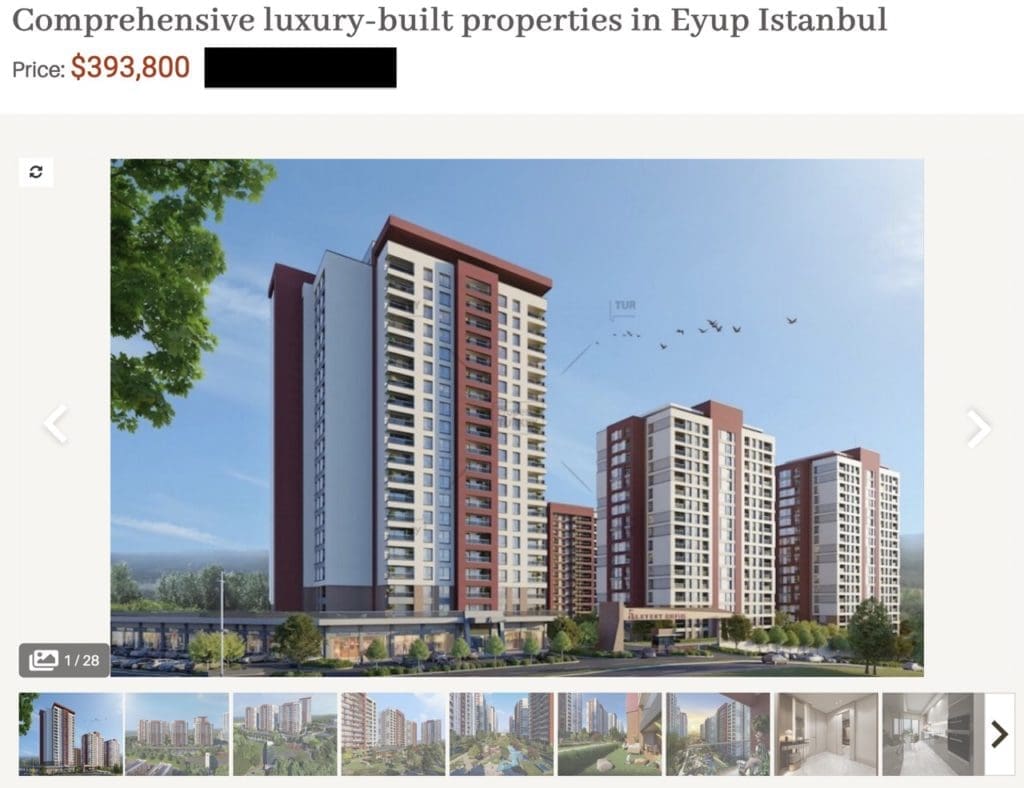

This below is a prime example of a listing I would run away from.

I must start with this, as it’s common for foreigners to get played this way. You found some great real estate website; the salesman speaks perfect English, offers to pick you up at the airport, and pitches you a bunch of developments with flashy brochures, rental guarantees, and promises of high future returns.

Run away. You’re about to get fleeced!

If a fancy development is being pitched to you, in English, with USD pricing, you are getting taken for a ride. Stay away at all costs.

Good investments are made in the secondary market, or with a select few smaller developers, offering much better pricing and importantly *better location*. These “luxury” developments typically being touted by major agencies are invariably very far away from the center. In this particular example a two-bedroom two-bathroom is being pitched for almost $400,000, but it’s far away from the center.

My realtor Keith can find properties on the secondary market in the core center for half the price, albeit without the amenities. But inevitably your rental yield will be higher, and you are much less likely to lose money when reselling versus the overpriced new development in the middle of nowhere.

There is a reason such developments are being pitched to you in English; the local market knows better than to buy them.

To make money in Istanbul real estate, invest like a Turk

Locals know that many of these developments are overpriced. The reality is that the best deals are to be found on the secondary market. You want to buy a secondhand property in a thriving neighbourhood and preferably renovate it up to Western standards. This is how you will likely obtain better yields and capital gains, thanks to the renovation work. But remember that you need to think like you were born here. So, if you want to make profitable real estate investments in Istanbul, you step into their shoes and think like a Turk.

There are two ways to play the market.

- You can buy top-notch real estate with a view of the Bosphorus. Once the economy improves again, these prime-location apartments will be the first to jump in value. However, expect low gross rental yields of about 2-3%.

- You buy in up & coming areas close to high-end neighborhoods. This way, you get higher rental yields (5%-6%), capital appreciation if the area continues to gentrify, and general appreciation if the overall market improves (though less than prime location).

Investing on the European or the Anatolian (Asian) side of Istanbul?

Istanbul is famously split across two continents; the Asian side and the European side. Though both sides are growing, many more of the major catalysts are on the European side.

- The new Istanbul airport which was launched in 2019 is the world’s largest. It is located deep in the European side.

- A massive new Canal will be built to replace the Bosphorus as a shipment route. About 48,000 ships pass through the Bosphorus every year. The result is overcrowding, and huge environmental risk. To reduce risk, and increase revenue, Turkey plans on creating a new canal on the European side.

These two projects are a massive draw for jobs, further infrastructure development, logistics hubs, manufacturing, etc.

It’s not to say that there is no dynamism on the Anatolian side, because there is action there as well. For example, a large international financial center is being built that side, which include the Turkish Central Bank, the main banking regulator, as well as the headquarters of a few of the major public and private banks.

While this is encouraging, the two other projects are massive and catalyze more economic activity. I’m not saying that there are no pockets of good investments on the Anatolian side, just that I see a clearer story on the European side.

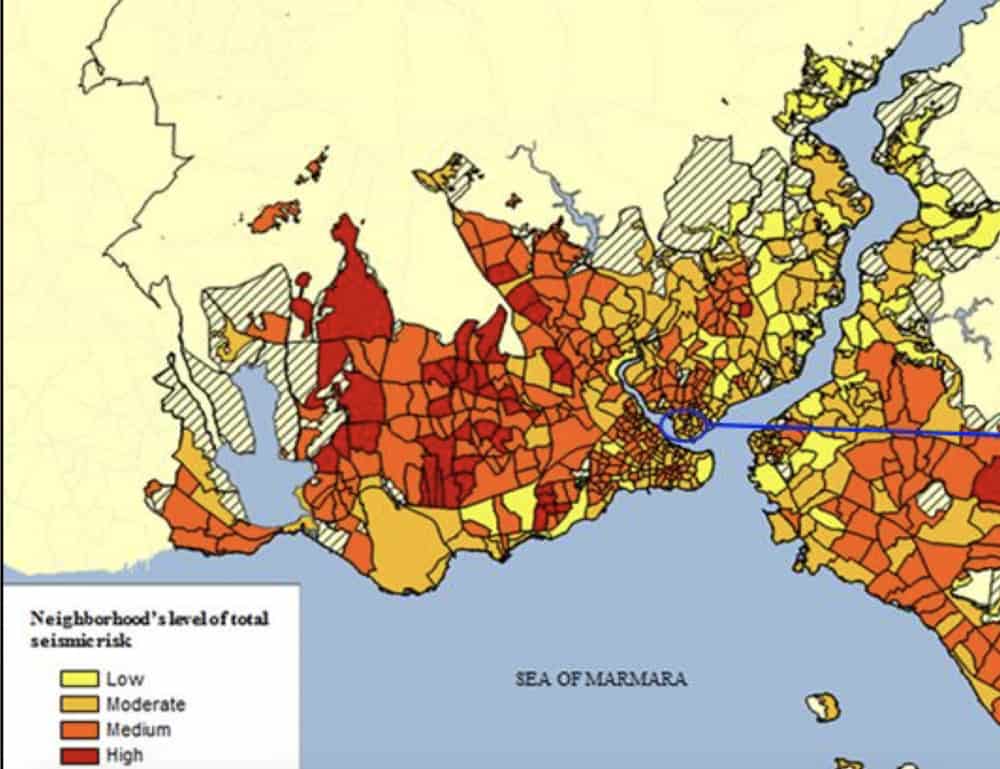

How to mitigate the earthquake risk in Istanbul when investing in real estate

First step, look at the seismic map and avoid any area that is dark red. Every homeowner is legally obliged to get earthquake insurance, so at least you are somewhat covered if it were to happen. Traditionally, when there are earthquakes in Turkey, it’s buildings of poor quality that collapse. Newer does not always mean better as building regulations are often disregarded by developers seeking to cut corners. Old and sturdy is sometimes preferred. Essentially, you need to make a judgement call on each building.

Which Istanbul Neighbourhoods are the best to invest in Real Estate?

Investing in Beyoglu Real Estate, AAA Real Estate in Istanbul

Beyoglu real estate is AAA-rated residential real estate. It includes famous districts such as Galata, Taksim Aquare, Cihangir and Karaköy. You will always have tenants here, and it is very easy to find USD contracts. The architecture is beautiful, there are many restaurants, bars, shops, history, great access to public transport, etc.

Will you have great occupancy levels? Yes. Will you have an easy-to-sell liquid asset? Yes. Will you make good rental yields? No. This is the capital safety play. It’s prime real estate.

Investing in Sultanahmet Real Estate in Istanbul

This is where the famous Hagia Sophia is located. It’s a very touristic area with lots of Airbnbs. Locals typically do not like living here as it feels like a museum or a Disneyland. It’s priced like prime real estate, which it is, but it is comparatively harder to find long term tenants. Also, though the Airbnb market is very strong, you typically get people who don’t stay as long. First timers to Istanbul think Hagia Sophia is the center of Istanbul but it’s not. When they come a second time, they typically opt for another neighbourhood.

It’s a beautiful area. However, I don’t find this area, at current valuations, to be a compelling real estate investment destination in Istanbul.

Investing in Southern Istanbul Real Estate

Very livable area with a long promenade along the Bosphorus. Quite a few interesting deals in new buildings, and decent deals with Bosphorus view. Airbnb won’t do well here, and you won’t get any USD contracts long term. What it offers is decent value for Bosphorus views. If this is your priority and your budget is not massive, you might want to look in this area.

Investing in Kadiköy Real Estate on the Asian side of Istanbul

If I had to pick purely lifestyle real estate, this is where I would make a real estate investment in Istanbul. I absolutely love the Kadiköy area on the Asian side of Istanbul, particularly the Moda neighbourhood. But why am I saying “lifestyle” only?

The reason is that though prices are the same as in similar neighbourhoods on the European side, rental demand from foreigners is weaker. The vast majority of tourists stay on the European side, so Airbnb is a lot weaker here, and most higher-income foreign long-term tenants stay on the European side. This makes it harder to get USD tenancy contracts on the Asian side.

This is not to say that there aren’t deals to be found here where the numbers add up. My buyer’s agent Keith occasionally find very interesting deals on this side. But it’s relatively rare. I personally was actively looking here with Keith when I was looking to invest, but we didn’t find anything at that point in time. I ended up investing on the European side. A few weeks later Keith found two deals I probably would have gone for.

Investing in Besiktas Real Estate

Anyone who has been to Istanbul knows how vibrant this neighbourhood is, and how poorly connected it is. One is always stuck in traffic, taxis are hard to get, and one must always wait for the bus. It’s frustrating, but is a very popular area with a ton of cool bars, restaurants, historical palaces and stunning hotels. That first picture of me at the beginning of the article is in Beskitas. Airbnbs do extremely well here, as well a long-term rentals. However valuations are very high and deals are hard to find.

In many ways it is also a AAA prime area, but with an interesting catalyst.

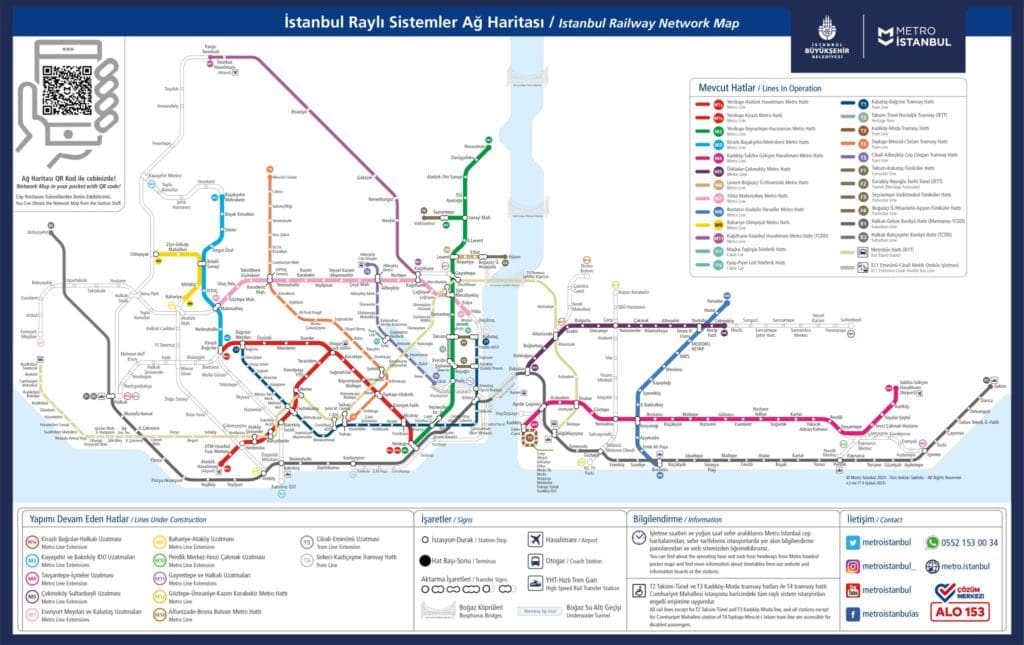

The government has already started building a metro line that will have a station in Besiktas. This will turn Besiktas from prime, very pleasant, and poorly connected to prime, very pleasant, and very well-connected. This will be hugely positive for the neighbourhood.

Investing in Real Estate in Sisli, the old European Istanbul

This is where I made my real estate investments.

It’s important to understand the nuances between the various neighbourhoods within Sisli. Nisantasi for example, is AAA. Rich Turks love living here, even more so than in Beyoglu. All the major luxury brands such as Luis Vuitton, Gucci, etc have flagship stores here. It’s a very expensive neighbourhood but USD rents are common, and Airbnbs do great here.

Then there are more “normal” areas such a Kurtulus which has a lot of middle-class Turks, but which is central enough to do well on Airbnb and with foreign tenants. Personally, I invested in the textile district. I bought former textile workshops and converted them into cool lofts. Video on the topic below.

I like this area of Istanbul because decent deals can be found, and there is very strong demand from foreigners who wish to stay mid- to long-term in Istanbul. The foreigners wishing to stay here are also more Eastern (Arab, Russian, Central Asian) than Western, which I like.

As Turkey increases trade with the East, and as purchasing power increases in the East and decreases in the West, I prefer to target Saudi and Kazakh tenants than German and UK ones.

Investing in Kagithane, an up & coming Istanbul Real Estate Market

This is an up & coming real estate market for those who have been priced out of Sisli. Prices are fair. However, the Airbnb market is not strong, and it’ll be hard to get USD rents. But the area is gentrifying, and most importantly the new direct metro line to Istanbul Airport, the 7th busiest airport in the world, was inaugurated right in this neighbourhood.

From being a bit of a backwater to Sisli, this neighborhood is now a fast train ride away from Istanbul airport. This will inevitably improve the neighbourhood’s dynamics and profile. Thumbs up. Keith is also very active in Kagithane.

A case study of a Real Estate Investment in Istanbul

This loft apartment is quite interesting. It is in Sisli/Osmanbey, a nice area on the European side. Its particularity is that it is located on a street of textile workshops. It is lively by day, though not noisy, and in the evenings it is extremely quiet, yet located a mere two-minute walk away from trendy, upmarket bars. There’s a certain cachet to this area.

This 90m2 apartment all-in (including furniture), would cost about $220,000. It would rent out for approximately $1,100 per month long-term, which is a gross yield of 6%. I’ll run with the assumption that the negotiation on the apartment would cover the agent and stamp duty costs.

| Price of apartment | $220,000 |

| Rental income $1,100 per month | $13,200 |

| Yearly rent at 95% occupancy | $12,540 |

| Property management fees 10% | $1,254 |

| Property tax | $300 |

| Maintenance allowance | $700 |

| Total costs | $2,254 |

| Net yearly rental income, pre income tax | $10,286 |

| Net rental yield or capitalization rate | 4.6% |

You’ll have to factor in seismic insurance, but the sums are negligible. One of the great advantages of making a real estate investment in Istanbul is that the landlord does not typically pay to find tenants. It’s the other way around; tenants pay the agents to find them an apartment. Also, the building common charges are paid for by the tenants. Importantly, tenant demand is strong, so finding a new tenant typically takes a week or so.

An advantage of investing in central areas of Istanbul, rather than in the outskirts where English-speaking agencies are desperate to sell you properties, is that it is possible to find tenants willing to pay rent in USD. It is not technically legal but still common practice.

In a far-lung, luxury development like those pitched by the English-speaking agencies? No chance.

A video case study of a real estate investment in Istanbul

Watch this video that I did with Keith, my real estate buyer’s agent in Istanbul. He showed me typical apartments that would be much better investments than all these flashy, expensive, new buildings promoted by these on-line agencies. Essentially, how to invest like a Turk.

I also made a video with my interior designer Angelina of my apartment renovation in Osmanbey.

This video below, in the gentrifying Istanbul neighborhood of Feriköy, demonstrates how easily attainable net rental yields of 5% are.

And you can even get a free passport out of it

If you buy $400,000 or more of real estate in Turkey, you, your spouse, and your children below the age 18 are entitled to Turkish citizenship. It’s a great plan B, and not a bad travel document. I wrote this article which details the Citizenship by Investment programme in Turkey, its timelines, exact fees, and traps to avoid.

I discussed why a Turkish passport is such a great geopolitical hedge together with Keith and my friend Brian.

Real estate taxes in Turkey

Personal income tax rates vary from 15% to 40%. If you invest the minimum amount for citizenship by investment, make a gross return of 5%-6%, and then deduct all allowable expenses (most), you will probably pay about 30%.

There are no capital gains taxes if you hold real estate for five years or more. If you sell it beforehand, the capital gains taxes get added to your yearly income (after a deduction of about $1,500) and taking CPI indexing into account. In the end, these capital gains taxes are minimal.

There is an annual property tax of about 0.2% of the assessed value for real estate in Istanbul, which is lower than in most Western markets. The key word here is “assessed”. In reality it is often half of the market value.

Finally, there is about 4% in stamp duty charges when you purchase real estate in Turkey. In many cases this 4% is divided between the buyer and seller, but not always. It comes down to the negotiations that take place when sealing the deal.

There is VAT in some circumstances, but it doesn’t apply to foreigners’ first real estate investment in Turkey. In most cases it can be avoided especially if you buy in the secondary market.

Is Airbnb legal in Istanbul?

Yes. Airbnb is legal in Istanbul. However you must get a license to do Airbnb, which is very much enforced by the various platforms. This license requires you to get a notarized authorization from all the other owners in the building and to pass an inspection. The inspection part is easy, but not collecting the signatures from all the owners in the building. You can run with the assumption that in most cases it will not be possible.

However Angelina manages to find such investments once in a while. Here’s a case study.

Your most likely course of action is renting your property out on the long term market.

Who should buy real estate in Istanbul?

- Turkish citizenship by investment applicants: at a $400,000 investment in any real estate, this citizenship program is an absolute no-brainer.

- Residency by investment applicants: $200,000 in Turkey real estate gets you and your family residency.

- Lifestyle investors: I don’t need to sell the lifestyle in Istanbul, one of the world’s premier cities with an incredibly rich history and central location.

- Long term investors who want property in a tier A international city in their portfolio, at what are objectively very competitive prices, especially on the secondary market. Now is a buyer’s market in Istanbul.

Summary

What has emerged is a picture of a market that is currently very weak and in which foreign cash buyers can negotiate and get very decent deals. Overall, Istanbul real estate is still very affordable for such an international city of over 15 million people, with decent apartments that can be bought for about $2,000 per m2 in core areas of Istanbul. The fast that one can obtain citizenship for basically free with the purchase of such property makes Istanbul real estate a complete no-brainer for the globally minded.

Keith can help you with your real estate investment plans in Istanbul, Turkey

Keith is my friendly buyer’s agent from Nova Scotia in Canada. He’s been living for many years in Turkey, speaks Turkish fluently, and serves as a real estate buyer’s agent in Istanbul and Izmir. You provide him with a brief, and he seeks out properties that fit your investment needs.

He can also put you in touch with the proper legal team to help you with your citizenship application. Keith is experienced so you don’t have to worry about your real estate investment in Istanbul; you are in good hands with him.

You can find out more about Keith’s Istanbul buying agent and renovation services here.

FAQ

Is it good time to buy property in Istanbul?

Yes, right now it is a buyer’s market in Istanbul. Prices were falling and are now starting to consolidate.

How is the real estate market in Istanbul?

The real estate market is very dynamic and historically goes from boom to bust. Over time though, there is a clear picture of long term capital gains and decent rental yields.

Can foreigners buy property in Istanbul?

Yes, almost all foreigners can buy real estate in Istanbul apart from some restricted citizenships such as Syrians for example.

How much is an average house in Istanbul?

Prices vary between $1,500 per m2 to over $10,000 per m2 so it is hard to say. But for $2,000 per m2 you will get a nice apartment on the secondary market in a centrally located neighbourhood.

Which area is best to buy in Istanbul?

It depends on what your objective is. Istanbul is a dynamic city of over 15 million people. There is a neighbourhood for everything and everyone. For ease of rental and decent rental yields, some historic neighbourhoods on the European side are interesting.

Other articles on Turkey:

- Making a real estate investment in Izmir? A value play within Turkey

- My Apartment Renovation in Istanbul – Case Study with numbers

- Why is the Turkish Citizenship by Investment Program misunderstood?

- I bought an apartment in Istanbul

- Citizenship by Investment in Turkey, its timelines, exact fees, and traps to avoid

- Turkish Citizenship Bank Deposit option – Central Bank guarantee explained

- Buying Izmir real estate for the Turkish citizenship by investment

- Net real estate rental yields and cap rates in Istanbul, a case study

Available services in Turkey:

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

What is the potential and what are the yields of the Airbnbs you mentioned?

Very nice analysis 🙂

I didn’t check, lockdowns are not conducive to doing a good Airbnb analysis 😉

Great insight! I have spent several months in both Istanbul and Kyiv in the past year and noticed that you have done analyses on both these markets. Really like the Osmanbey and Bomonti areas. What are your thoughts on Istanbul vs. Kyiv if you could only allocate capital to one?

Hello Larry, great!

The two cities serve very different investment objectives. It really depends on your personal situation.

Hi, Maurice. Thanks for these helpful articles. It was so hard to find information about the VAT online and several brokers wouldn’t answer my questions about it. It’s good to know that the VAT doesn’t apply to a foreigner’s first real estate investment here in Turkey! Is this regardless of paying in full(cash) or via a mortgage?

Hello Julie,

As far as I know it doesn’t matter. Feel free to ask Keith for a more definitive answer though. Be careful with mortgages in Turkey, interest rates can vary wildly. Happy house hunting!

Good article.

What’s the best area to buy and airbnb? And the average % return?