I’m used to it. Whenever I mention investing in Africa, people think I’m crazy.

People have so many misconceptions about the continent. It’s immensely vast and diverse, but in many people’s minds, it’s a single country.

Not to mention, there is pervasive bias due to Western media that only shows negative things in Africa.

The reality consists of dozens of countries with burgeoning economies and booming cities. When I think of Africa, I think of Nairobi, I think of Dakar, I think of Abidjan, I think of Accra. I also think of countries that have been havens of stability for many years such as Namibia.

I’ve been interviewing Tim for a few years, an Australian running an Africa-focused fund based out of Tanzania. His fund is up over 140% since inception a few years ago, even better than the S&P 500.

This comes at no surprise to me; I spent most of my twenties in Africa, working for Nestlé and traveling all over the continent.

This is also why I keep repeating that people should seriously consider getting the Sierra Leone citizenship by investment. It’s not that expensive, family members are easy to add, one can pay with crypto, and the process is quick. This citizenship gives you and your descendants full access to ECOWAS, a growing market of over 400 million people.

This is why we at The Wandering Investor became licensed agents of this CBI in spite of demand being low. We understand the bigger picture.

And yes, I understand the risks of investing in Africa. It comes with volatility, operational challenges and general ambiguity.

This being said, I like what I see in Nairobi.

The video below was made last year before I bought a handful of apartments in Nairobi, while I was still in the research phase. I initially bought one apartment, then I upped to three, and finally settled on a portfolio of four apartments in the same development.

The only difference is that since last year both prices and rents have increased about 10%. But prime real estate remains very affordable for a capital city.

I am going back to Kenya soon

I’ll spend more time on the ground looking at opportunities for myself and my family.

In the meantime, feel free to read the Nairobi real estate market investor guide.

You can also get in touch with Pratik, my real estate agent in Nairobi.

To a World of Opportunities,

The Wandering Investor.

Services in Kenya:

Articles on Kenya:

- Nairobi Real Estate Market: Investor Guide 2025

- Outlook for investing in African Stock Markets in 2025

- I bought 3 apartments in Nairobi

- High returns on Nairobi real estate – 3 case studies with ROI calculations

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “High returns on Nairobi real estate – 3 case studies with ROI calculations”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com, today, in beautiful Nairobi. I plan on buying one or two apartments here in Kenya’s capital city, and in this video, I’m going to explain why. We’re going to meet up with my agent, Pratik, and we’re going to go have a look at a few apartments and do all of the numbers in terms of ROI rental yields, etc., in detail.

Kenya macroeconomic considerations and public debt

LADISLAS MAURICE: Look, I understand that Kenya has its fair share of challenges, the biggest one being the high debt burden of the country. Kenya’s debt-to-GDP ratio is almost 80%, which is really high for an emerging market. And debt interest payments by the government represent over 30% of government revenue. Effectively, the country is probably heading into a debt crisis in the next few years. Is this concerning? Yes, but also, I’m not too worried about it, one, because I’m going to try to play it, and I’ll explain how a bit later in the video. But overall, because you can find a lot of value here in Kenya, in the center of Nairobi. You can find brand new real estate here for about $1,000 a square meter, or a bit less than $100 a square foot, which is quite impressive, and the rental yields are high. We’re looking at 10% to 12% gross.

Because the reality is, even though Kenya has its challenges, a lot of this debt was used to build infrastructure that increased the capacity of the economy here. A whole train was built, and all of Nairobi now has this, like, brand new highway, which really changed things for the city. And there’s just infrastructure development all over the country. Obviously, a lot of it was wasted. I mean, government is government, but overall, the capacity of the economy was raised. And it’s an economy that’s relatively well diversified for African standards. It’s got a big services economy, which is growing fast. Its agricultural side of the economy is also quite developed, with a lot of exports to Europe and to the Middle East. Tourism is thriving as well.

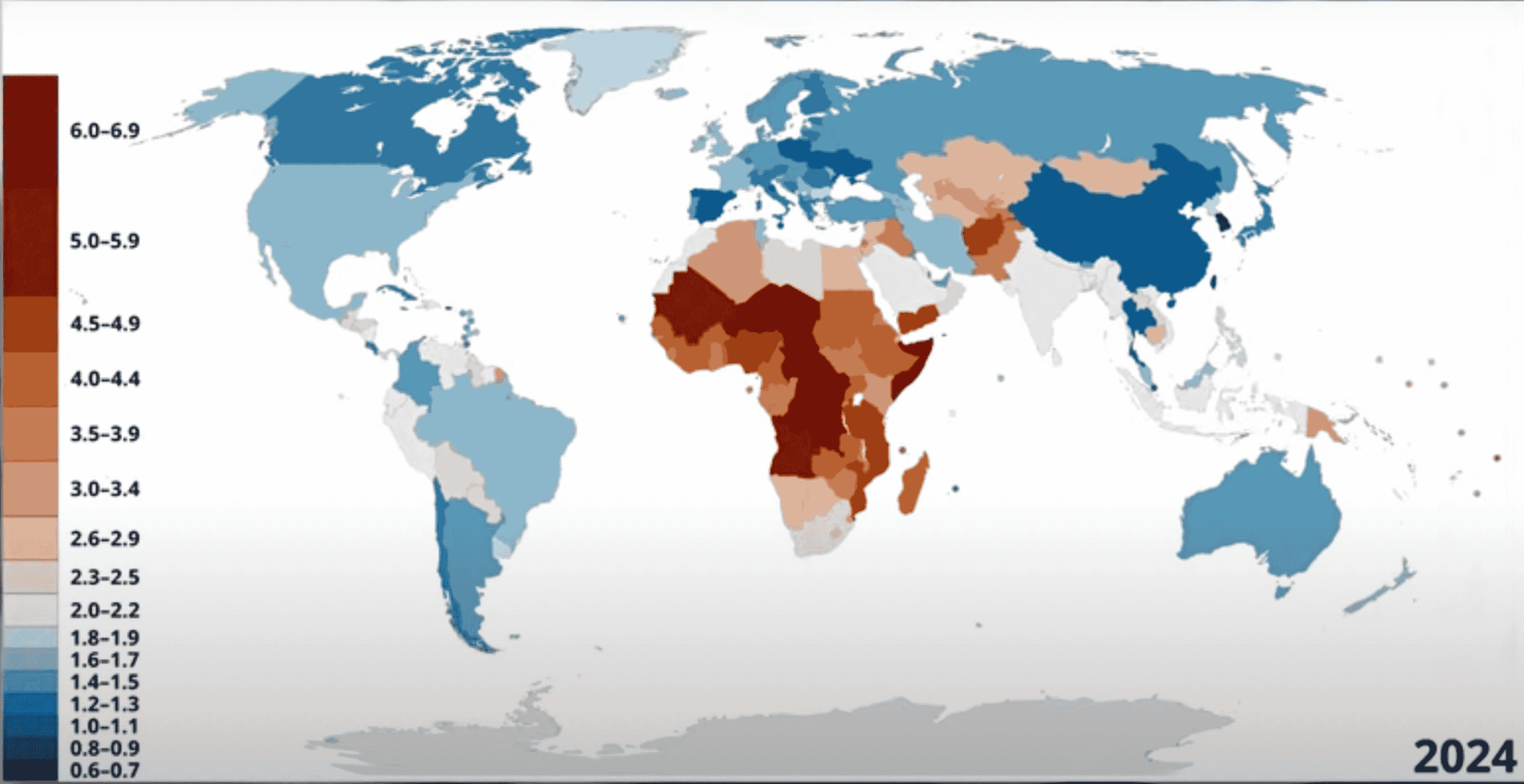

And generally speaking, Kenya is the hub of East Africa. Whenever big corporates want to expand in East Africa, first thing they do is open headquarters here in Nairobi, which you can see everywhere, all the big companies you can think of, they’re all here in Nairobi. They all have expats here, local employees, regional employees. Really, Nairobi, you can feel that it’s an economic hub. Also, the demographics are very positive compared to the rest of the world, where the fertility rate has essentially gone down below replacement level in most of the world, North America, South America, Europe, East Asia, Southeast Asia, increasingly, South Asia as well. But in Africa here, the population is still booming.

As part of a diversified real estate portfolio, having exposure to such booming demographics is definitely something I want to have.

Nairobi Metro currently has a population of 5.5 million people, and by 2050 it’s expected to almost double to 10.5 million people. I want exposure to this at these valuations, at these rental yields, even though I understand that there are challenges. But investing in Africa does not come without challenges, you just need to be able to ride it out and be patient.

Who is buying real estate in Nairobi?

LADISLAS MAURICE: Hello, Pratik. How are you?

PRATIK: Hi, Ladislas. How are you? Good?

LADISLAS MAURICE: Good, good. Let’s go check out some real estate.

PRATIK: All right, cool.

LADISLAS MAURICE: One of the things I really like about Nairobi is how green it is.

PRATIK: Yes. Nairobi is the city of many rivers, and the city under the sun.

LADISLAS MAURICE: When I hear rivers, I think flooding in real estate. [laughs]

PRATIK: It’s not necessarily the case. Again, you have to choose the right development. There are many rivers, but smaller in size.

LADISLAS MAURICE: How long have you and your family been in real estate here?

PRATIK: We’ve been in real estate for 15 years and over, and we are also third generation in Kenya.

LADISLAS MAURICE: Where are most of your clients from?

PRATIK: Most of our clients are local or just within this region.

LADISLAS MAURICE: You have people from outside of Africa?

PRATIK: Yes. Increasingly, there have been a lot of expats that have been coming into Nairobi, and they have also been investing.

LADISLAS MAURICE: These people, these expats, they’re buying, where are they from?

PRATIK: There’s a mix of different types of expats. There is Americans, Europeans, the rest of Africa, from Asia as well.

LADISLAS MAURICE: And what about diaspora Kenyans?

PRATIK: Yes, yes. Many diasporans as well, they are looking to send back money and, most importantly, invest in Nairobi once they leave the country.

LADISLAS MAURICE: Yeah, because going around, we were checking a bunch of developments together, and a lot of Kenyan Americans are buying here in Nairobi. They’re just comparing the returns they get in the US compared to the returns they get here in Nairobi. For them, it’s easy to buy here, they understand it, they can have people manage it. They’re not worried, they’re not scared, so they’re investing heavily here, back in their country, which is a good sign.

PRATIK: Yes, 100%. They feel confidence as well in investing here, as long as they pick the right investment, and like you said, get somebody good to manage it for them as well.

Chinese infrastructure in Kenya

LADISLAS MAURICE: Who built all these new highways?

PRATIK: The Chinese. Specifically, the Chinese have built these highways. There’s been an increase in public private partnership agreements that the government has gotten into, but most of the time we see that it’s the Chinese that they’re dealing with.

LADISLAS MAURICE: And when you’re here in Kenya on these highways, you see all the big brands here. You have Total from France, KPMG headquarters is here. Before that, Mugg & Bean, you had a bunch of South African brands. There’s KFC, Burger King, etc. It’s usually the first step of an international company’s foray into Africa, excluding South Africa, is, typically, Kenya.

PRATIK: Yes, yes, we see that a lot, and increasingly over the last number of years. I mean, if you see the number of KFCs that have set up, it’s quite a huge number. And it looks like it’s going to keep on growing as we go along.

LADISLAS MAURICE: Here you can see a lot of real estate developments, billboards. Ecobank is here. It’s a big West African bank. Look, just greenery everywhere. It’s a really pleasant city. I lived in Africa for seven years, so four years in South Africa, three years in Ghana. I traveled all over the continent, and I can tell you when it comes to quality of life, Nairobi is absolutely up there.

Tour of Kileleshwa, Nairobi apartment with amenities

PRATIK: We’ll see what actually people are interested in apartments, which is more like the amenities and things like that. Later, we’ll go and see the individual units, talk a bit about the numbers as well. I mean, as you can see, there’s quite a few good spaces here, pool tables, relaxation areas, table tennis, mini co-working kind of area, and all fully kitted out. This is where people like to hang out, do some work. There’s a nice, like, bar area kind of thing here.

LADISLAS MAURICE: And this is what people are looking for in rentals these days.

PRATIK: Yes, and developers are also offering the same. As you can see here, we’ve got a fully kitted gym. We’ve then got a heated pool on this side. It’s heated to a nice temperature. I mean, this is all you could want in a set of apartments.

LADISLAS MAURICE: Yeah, very nice. The swimming pool is very nice, the water is warm. Like, I really understand why people would want to live here. And there’s also a play area for children?

PRATIK: Yes, always. This is the children’s play area, and has got quite a few entertaining modules or nodes in it. And this is pretty standard in most new developments in Nairobi.

LADISLAS MAURICE: Look, I mean, this is one of the reasons I like investing here. Booming demographics, people have children, people value these things. Most people that live here, a lot of them have children, especially the two-bedroom units. A lot of them have nannies. They come here during the day, entertain the kids. And it’s effectively a standard product offering for such type of developments in Nairobi. Correct?

PRATIK: Yes, it is expected.

LADISLAS MAURICE: You’ll see the apartments. They’re really nice for ridiculously low price points, and all of these amenities. Let’s go check it out.

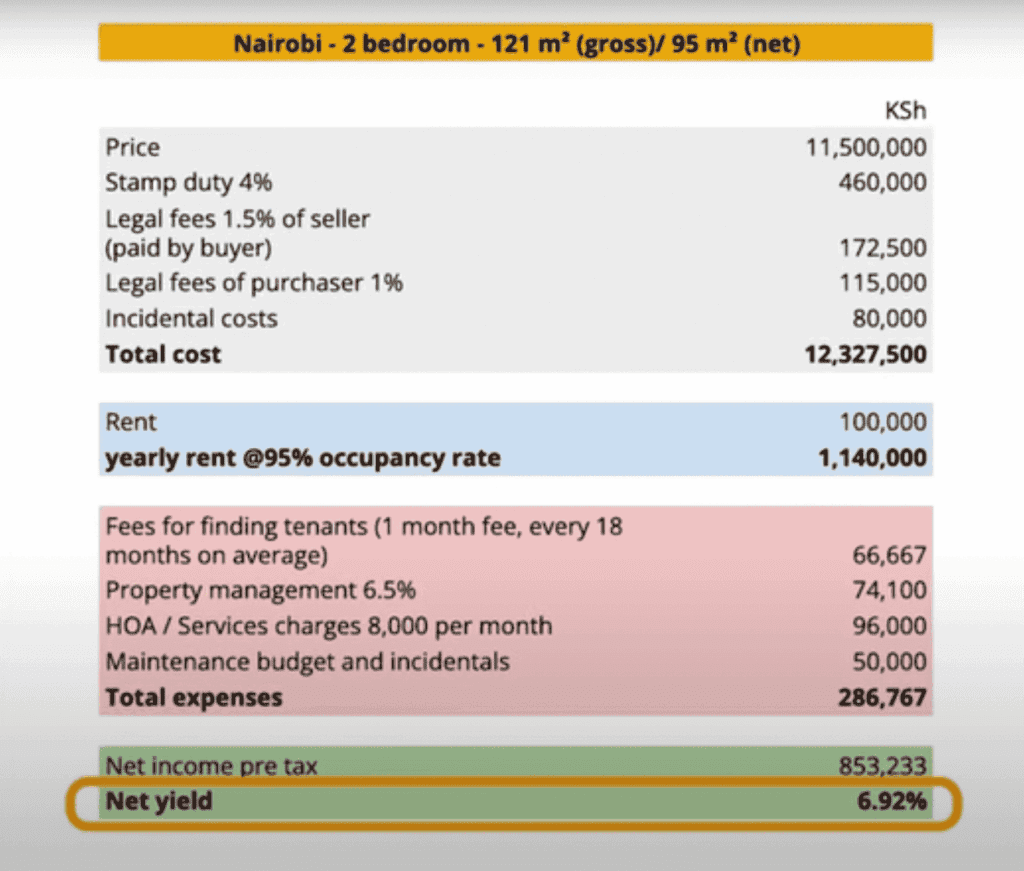

PRATIK: This is a two-bedroom, two-bathroom apartment valued at about KES 11.5 million, which works out, roughly, to $88,500.

LADISLAS MAURICE: Cool. So, $88k gets you a two-bedroom, two-bathroom apartment with these finishings that are, honestly, quite nice. There’s really nothing much to say about this. Square meters?

PRATIK: Square meters gross is 121 square meters.

LADISLAS MAURICE: Cool. It’s really important for foreign investors to understand when they invest in Kenyan real estate that all the figures are gross, so it includes not only the walls, but also a share of the common area.

PRATIK: Yes.

LADISLAS MAURICE: You need to use a bit of a factor. Here we’re going to use, I guess, about 20% to remove to get to an estimated net. If you really wanted net, we’d have to measure it. But no one really does this in this market. That’s not how the market operates.

PRATIK: Yeah, it’s based on gross value.

LADISLAS MAURICE: Yeah. If you were going to do net, taking about 20% off, just to compare with other cities in the world, not that it’s relevant to this market, but just to get an overall impression of value, you’re looking at, what?

PRATIK: About 95 square meters. In terms of values, it’s working out to be just over $900 per square meter. And in terms of square feet, just over $85 per square feet, in terms of US dollars.

LADISLAS MAURICE: Closing costs here are, roughly, 6.5%.

PRATIK: Yes.

LADISLAS MAURICE: How much should I expect in terms of rental income from this if I were to buy this?

PRATIK: From this unit, about KES 100,000 per month. That equivalents to about just over $750 per month.

LADISLAS MAURICE: Let’s say, Pratik, I buy this apartment, and I hand it over to your family agency to do all the property management, and to take care of everything. The rent is clear.

Property management costs in Nairobi

LADISLAS MAURICE: What is your fee for finding tenants?

PRATIK: The fee, usually in Kenya, is about one month’s rental as commission. But this is, on average, about every 18 months or so.

LADISLAS MAURICE: Okay, so people don’t just stay one year and they stay a bit longer?

PRATIK: Yes, yes.

LADISLAS MAURICE: Okay. And the leases are, typically, one-year leases, two-year leases? Because I heard of people signing three-year leases.

PRATIK: It’s open, again, on the tenant’s discretion, but usually more than one year is what the lease would be.

LADISLAS MAURICE: What about your property management fee for collecting rent and making sure things are fine?

PRATIK: For a full service where it’s all included, it’s around 6.5%.

LADISLAS MAURICE: And what about the HOA or service charge to take care of the swimming pool, the elevators, just everything?

PRATIK: For this particular two-bed unit, it works out to be about KES 8,000 per month.

LADISLAS MAURICE: Okay. Yeah, this is really not much at all. It’s, like, $55, $60 for all these amenities. And includes the property tax in there, right?

PRATIK: Yes, yes. And on top of that, there are a few incidental costs that you need to take care of.

LADISLAS MAURICE: If there’s a leak or whatever?

PRATIK: Yes.

LADISLAS MAURICE: Essentially, this gets us to a net yield, pretax, of almost 7%.

PRATIK: Yes, almost 7%.

LADISLAS MAURICE: Pratik, if I task you with finding such investments, is it relatively easy for you to find? Can you find something like that?

PRATIK: I mean, as you’ve seen in Nairobi, it’s almost everywhere, and yes, quite easy for us to get an investment and to match somebody’s needs, especially in this city.

Tour of one-bedroom apartment in Kileleshwa, Nairobi

LADISLAS MAURICE: Cool. Now we’re going to check out the one-bedroom. And apparently, the yield is even higher on that one.

PRATIK: Yes, high on that one.

LADISLAS MAURICE: All right, let’s go check it out.

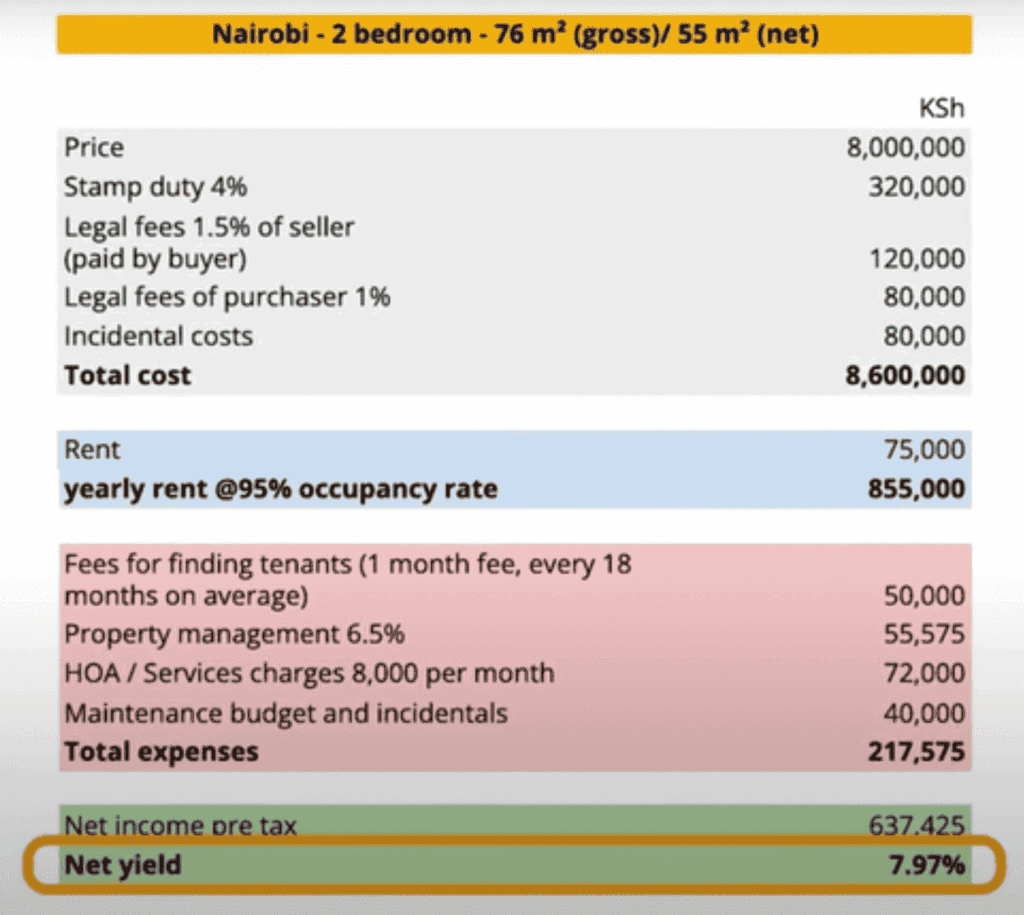

PRATIK: This is the one-bedroom, one-bathroom apartment, the same development. And this apartment, in terms of gross square meters, is 76. And that works out to be about 55 square meters in net terms.

LADISLAS MAURICE: And the price?

PRATIK: Price is KES 8 million, and in US dollars, that’s about $61,000, just over $61,000.

LADISLAS MAURICE: So, $60,000 gets you a pretty nice one-bedroom with heated swimming pool, full amenities. I mean, a nice view. This is objectively a nice view. It’s never going to get blocked. There’s buildings here that are not going to get destroyed. Yeah, this is interesting.

Rental occupancy rates in Nairobi, Kenya

LADISLAS MAURICE: How much would the rent be for this?

PRATIK: For this one-bedroom unit, we’re looking at about KES 75,000 per month.

LADISLAS MAURICE: And how easy is it to find tenants? How fast is it?

PRATIK: You can find tenants very quickly. I mean, these are rapidly-urbanizing areas of Nairobi, and people are looking to move into these areas almost every single day.

LADISLAS MAURICE: In the numbers, we put an occupancy rate of 95% to get to real net numbers. Using essentially the same metrics, and slightly lower service charges or HOA, we’re getting to net yield here of almost 8% pretax, which is really interesting for such an affordable place in a booming city. You have to get used to the quirks of emerging market investing. For whatever reason, I don’t know if it’s cultural or not, the sink is not in the bathroom. The sink is here. I don’t know, you emerge from the shower and you go brush your teeth and put your makeup and whatever here. Is this common?

PRATIK: You will find it in a couple of developments, very interesting. But I mean, it’s not stopping tenancy rates.

LADISLAS MAURICE: It’s not, yeah. I’ve seen a few developments with this, even two-bedroom apartments where one of the bedrooms has their sink almost in the living room. [laughs]

PRATIK: Yeah.

LADISLAS MAURICE: Look, there’s enough choice that you don’t have to buy this, but even if you do, it doesn’t seem to be an issue for the local market. If you’re trying to get expats, that probably won’t fly. But, I mean, there’s enough local demand. Who’s the target market for a building like this?

PRATIK: Building like this, I mean, it could be anybody, but mostly locals, they would want to move into this. And in terms of the rent being affordable as well, that’s mostly the market we would target.

LADISLAS MAURICE: Yeah. Cool, fantastic. All right, let’s go check out the next development.

Overview of Kileleshwa, Nairobi

PRATIK: Sure. Ladislas, we just saw a completed development. Now I’m going to take you to an off-plan development which is under construction.

LADISLAS MAURICE: Tell me about this neighborhood. It’s in the same neighborhood, Kileleshwa. Just tell me about the area.

PRATIK: Like I said, it’s rapidly urbanizing. There are many developments coming up. It’s still got green areas. And many people want to move to this area. There are a lot of corporates here. A lot of companies have set up. Really, prime neighborhood in Nairobi.

LADISLAS MAURICE: Cool. It’s not prime-prime, it’s just kind of prime?

PRATIK: Yes, kind of prime. There is still other neighborhoods that would go into that prime-prime region.

LADISLAS MAURICE: There’s a lot of liquidity in this neighborhood. People are constantly moving here, etc. It’s growing fast. I mean, there’s a lot of construction. Can you tell us, Pratik, about the tax situation, because when you look online, the withholding tax on nonresident individuals buying here is pretty high?

PRATIK: We don’t see that as much of a deterrent in terms of investors in this country. On top of that, we’re here to help everyone and guide them through the process. Like I said, not much of a deterrent when investing in Kenya.

LADISLAS MAURICE: Yeah. I’ve talked to a number of foreign investors here, no one seems to be worried.

PRATIK: Yes, the outlook is good. Things are fine.

Devaluation of the Kenyan shilling and payment plans

LADISLAS MAURICE: Pratik, tell me about the payment plans for these off-plan properties.

PRATIK: Usually, your payment plan is over two, two-and-a-half, maybe three years, with probably a percentage downpayment required initially.

LADISLAS MAURICE: And this is essentially the way I see it. Because, I mean, there are properties that are priced in US dollars, other properties that are priced in shillings. I like the ones that are priced in shillings, because I’m getting essentially a fixed mortgage, in many ways. I’m getting to short the Kenyan shilling. I’m of the view that, in the next two to three years, we’ll probably see a devaluation of some sort of the Kenyan shilling. Right now, as of the day that we’re recording this video, it’s about KES 130 to the dollar, but back in February, it went down to KES 160.

PRATIK: Yes. I mean, towards about a year, a year-and-a-half ago, we were at KES 105, probably. Yeah, it’s kind of stabilized but, I mean, the devaluation is a possibility, yes.

LADISLAS MAURICE: Yeah. I think it will happen. I’m not buying because I think it’ll happen. I just see the payment plan over two to three years fixed in shilling is a nice call option on a potential devaluation. If it happens, fantastic, my last payments will be a lot cheaper.

PRATIK: Yes, great. [To security guard] Lakini Council? Kanjo, watakuwa sawa?

GUARD: No problem. Si unaona hata hizi zote zetu ni nje.

LADISLAS MAURICE: I didn’t know you spoke Swahili.

PRATIK: Yes. Yes, yes.

LADISLAS MAURICE: You speak it fluently?

PRATIK: Yes, so we can have conversations with anybody.

LADISLAS MAURICE: How did you learn it?

PRATIK: Just growing up, it comes naturally. And to do business, obviously, you’ve got to make your way as well.

Tour of off-plan development in Kileleshwa, Nairobi

PRATIK: Ladislas, this is an off-plan project that we have got current investors in, and we usually send our clients to this. It is a two-bedroom, two-bathroom worth KES 8.8 million, roughly, around $68,000. And in terms of gross square meters, it works out to be about 86 square meters.

LADISLAS MAURICE: It’s like really small, I’m not too sure if maybe 60 square meters net, something like that, but super-efficient.

PRATIK: Yes.

LADISLAS MAURICE: Two-bedroom, two-bathroom in there. And what about rental returns?

PRATIK: Rental return is probably about KES 85,000.

LADISLAS MAURICE: In the end, we’d end up with net returns that are fairly similar to the other unit.

PRATIK: Fairly similar, yes, yes.

LADISLAS MAURICE: Okay, cool. And the amenities?

PRATIK: The amenities, they’re going to have a swimming pool, gym, social area, just the usual that they’re now providing in Kenya. But what’s different about this is you can add a smart home component on top of it for about $2,000, which will then control the entire house through Alexa and Google.

LADISLAS MAURICE: Cool. Obviously, this would be without the furniture. This is a little odd. I saw this in a few places.

PRATIK: The sliding doors.

LADISLAS MAURICE: I asked one of the developers. He said that half of people ask for these, for the separation between the living room and the kitchen, and half ask for it to be removed. I guess it’s very cultural, depending on which ethnic groups or wherever people are from, the type of cooking they do that they ask for this.

PRATIK: Yeah.

LADISLAS MAURICE: Okay. And there’s also a one-bedroom?

PRATIK: Yes, which is here. Ladislas, this is now the one-bedroom component. It’s about 61 meters squared gross, and it’s going for about KES 7 million, which is equivalent to just over $53,000.

LADISLAS MAURICE: This is not bad for $50,000.

PRATIK: Yes, very good investment.

LADISLAS MAURICE: Look, and this is the sort of thing that you need to watch out here in Nairobi. There’s a lot of construction. It’s pretty easy to get a building permit, and the neighbors will not hesitate to build. You see this here, the view is nice and green. There’s, like, a house, etc., etc. In my mind, if I buy this, I’m pretty sure that, within five years, there’s going to be a big building with also about five meters, so you’ll be about, like, 10 meters away from another building. I think this is fairly typical.

PRATIK: Yes, that’s a possibility.

LADISLAS MAURICE: Yeah. You just need to be aware of this, that it’s likely. Or, you need to get units that have an unblocked view, where you’re sure, like the other one, that one-bedroom, that one was really nice, where you know they’re not going to build in front.

PRATIK: Higher floors.

LADISLAS MAURICE: Yeah, higher floors. Cool, fantastic. And similar returns as the other one?

International property developers in Nairobi

PRATIK: Yes, similar returns. Ladislas, now I’ll take you to a sort of high-end development. Egyptian and Turkish developers have constructed this. And you can now see the contrast of difference between where we went before. In terms of the range of developers in Kenya, you’ve got the Chinese, you’ve got the Indian heritage, you’ve got the Somalis who have come in. You’ve also got Egyptians, Turkish, from Eritrea, Singapore. There’s a whole mix of developers that have now come in and are very interested in the Kenyan market.

LADISLAS MAURICE: The real estate industry here is very, very active. And they each have their own reputation, right? I noticed, when I speak to people, they’re like, “Oh, this is Indian, oh, this is Eritrean, oh, this is Somali.” And it just, if they say that, it implies something each time?

PRATIK: Yes. I mean, you’re looking at how the quality of finishing is, and you know how long the apartments will last for, and things like that. But yes, there is a sort of implication every different ethnicity of developer.

LADISLAS MAURICE: And this development we’re going to see is in which neighborhood?

PRATIK: We’re still in the Kilimani, Kileleshwa area, which is like before. Again, rapid urbanization and premium developments as well.

LADISLAS MAURICE: But a bit closer to the center, that one, right?

Tour of luxury development in Kilimani

PRATIK: A bit closer, yes. All right. Ladislas, this is an apartment. Actually, my family and I personally bought a unit in, a one-bedroom unit. And we chose it because of the reputation of the developer. We are interested in high-end finishing, and we came to a decision that this was the unit for us.

LADISLAS MAURICE: When is it going to be complete?

PRATIK: End of this year, three months. So almost finished. As you can see around us, works are still ongoing, but most of the units are actually done.

LADISLAS MAURICE: Cool. Let’s check it out.

PRATIK: Let’s check it out. Ladislas, this unit here is worth $81,000, equivalent to about KES 10.5 million.

LADISLAS MAURICE: It’s priced in USD?

PRATIK: Yes, you do get those units in Nairobi that are priced in USD. The monthly rental here, including service charge, is about KES 85,000. Yeah, as I said, including service charge. And that yield works out to be just under 7%.

LADISLAS MAURICE: Net-net yield, before income tax?

PRATIK: Net, yes.

LADISLAS MAURICE: Look, it’s probably about 30% more expensive per square meter compared to the Chinese development. How can you explain this?

PRATIK: Mainly it’s just the finishing. I mean, you get good solid doors, you get granite kitchen countertops, you get Bosch appliances, you get a heat pump, you get tiling everywhere. The flooring is good quality. And I think, personally, from our point of view, this is why we chose this unit to invest in. The gross square meters is 54, which makes it a bit more expensive per square meter, but you do get all the nice finishings and the top quality, which makes it a valuable investment.

LADISLAS MAURICE: Yeah. You can definitely tell the difference. And can you talk about the amenities as well?

PRATIK: More amenities than usual. You’ve got a heated swimming pool, you’ve got a basketball court, steam, sauna, social hall, a walking track as well, which is a few more amenities than what you would usually get.

Why I am investing in Kenyan real estate

LADISLAS MAURICE: I am going to buy one or a few apartments here in Nairobi. I’m still not sure exactly which ones. Pratik is taking me around, we’re checking a whole bunch of developments. I’m going to make a decision in the next few days. I know some relatives of mine are also going to buy something here. I understand Kenya has its challenges, just as I discussed earlier, but I’m comfortable with these challenges. What I’m paying these prices for city center real estate with very decent finishings, all these amenities, right next to the heart of the city, in a city that has booming demographics, and at the same time, I’m paying high rental yields, I just see very little downside in such an investment for the amount of diversification that it provides me with in my own portfolio. I really like the idea of investing here. Yeah, thanks a lot for showing me around.

How to contact Pratik

LADISLAS MAURICE: I wrote a whole article on the real estate investment market here in Nairobi, the neighborhoods that are interesting, the neighborhoods that you should avoid, some things you should be aware of before investing here. There’s a link below. And if you want to get in touch with Pratik, he and his family business, they can help you find the right investment properties, deal with regulatory issues, do the property management, etc., remit the money back to your country, so everything from A to Z.

PRATIK: Yes, 100%. Hopefully, we get you the perfect unit.

LADISLAS MAURICE: Fantastic. All right.

PRATIK: All right.

LADISLAS MAURICE: Thank you, Pratik.