The city of Siem Reap in Cambodia is a by-product of the famous UNESCO World Heritage Site Angkor Wat, considered by some experts to be the largest religious structure in the world. As an investor seeking exposure to the Cambodian economy, I ventured there to do some on-the-ground research with a focus on real estate.

We’ll see that the Siem Reap real estate market is a decent investment for people who want diversification, safety, and exposure to a growing economy, but not for those seeking strong rental yields.

Table of Contents

Why invest in Siem Reap?

Here are some of the ongoing catalysts I see for Siem Reap as a real estate investment destination.

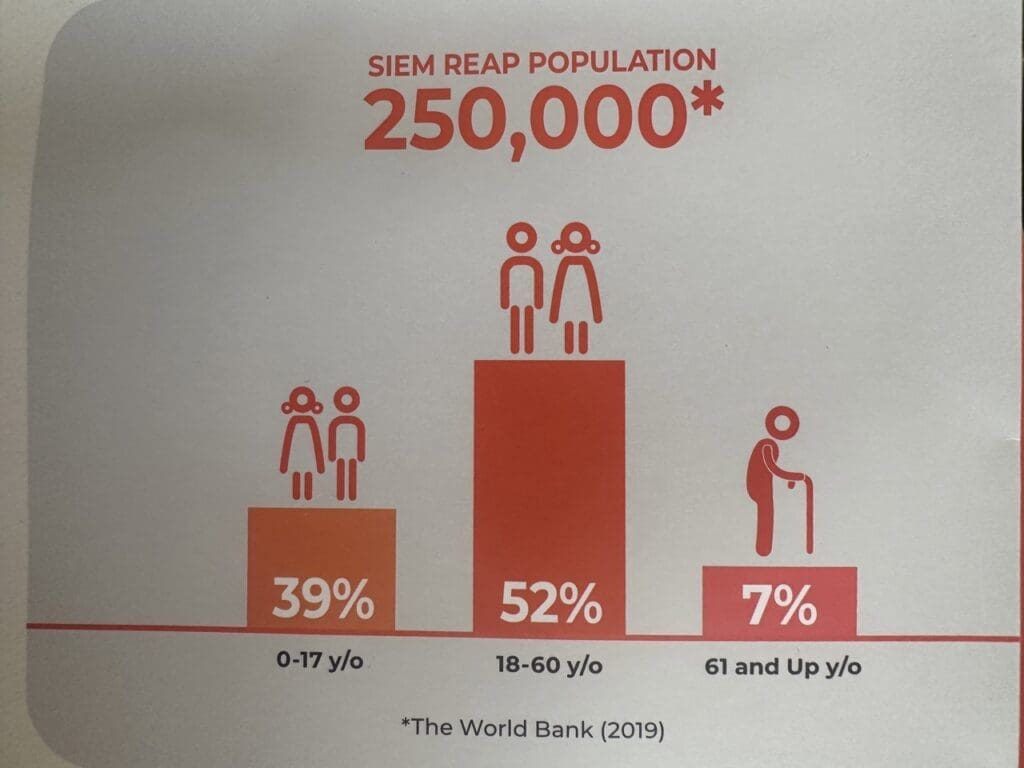

1. Strong demographic growth in Siem Reap

First of all, it is important to note that demographically speaking, Siem Reap is absolutely booming.

A few things to note here:

- The population pyramid is young, which promises good growth ahead.

- Siem Reap is effectively Cambodia’s fourth largest city, but is growing faster than the average. Its demographic growth is about 2.5% a year.

- Proper statistics are hard to come by in Cambodia, but extrapolating these 2019 census numbers with the ongoing growth figures gives us a current population of over 280,000.

2. Angkor Wat as a unique tourism driver

Angkor Wat is a world-renowned historical and religious tourism destination. It’s one-of-a-kind and an absolute must-see.

It’s been around for almost a millennium and isn’t going anywhere. It is a unique competitive advantage for Siem Reap.

Until recently going to Angkor Wat was still perceived to be slightly “dangerous” due to Cambodia’s reputation and past. This is changing fast. A trip to Angkor Wat is increasingly becoming a must-do for the monied class of this world. It’s one of those top “bucket-list” things to do before moving on to another life.

This is apparent when spending time in town. While Phnom Penh had a lot of backpackers, sex tourists, and businessmen, Siem Reap had not only the usual backpackers, but many affluent Westerners lodging in luxury hotels before moving on somewhere else in Asia.

For many, a trip to Cambodia means Siem Reap and that’s it – they won’t travel elsewhere. Almost half of tourists in Cambodia go to Siem Reap.

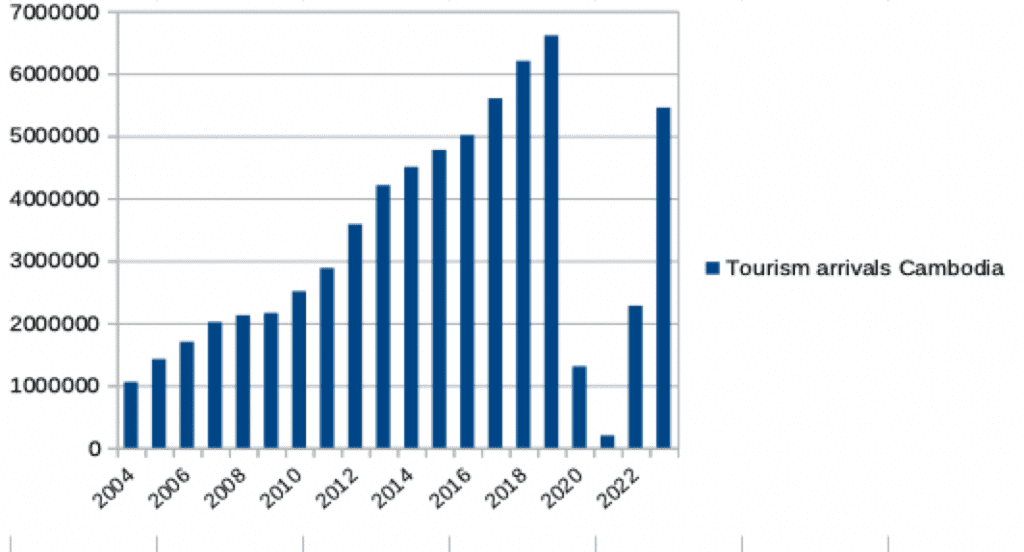

Cambodia is also gradually getting back to pre-Covid numbers, though the pandemic hit its tourism industry hard.

3. More diverse tourism

When I first traveled in South East Asia in the mid 2000’s, most tourism was Western.

In the mid 2010s, tourism was mostly Western and Chinese.

Now, tourism is Western, Chinese, other South East Asians, and increasingly Indian.

In my time in Siem Reap I came across groups of Indian tourists, a sight that would have been unimaginable just a few years ago.

Essentially, as Asia continues to grow and to develop, and as the younger Asian generation goes up Maslow’s hierarchy of needs by seeking to self actualize through cultural trips, Siem Reap is bound to massively benefit from this trend as one of Asia’s prime historical destinations.

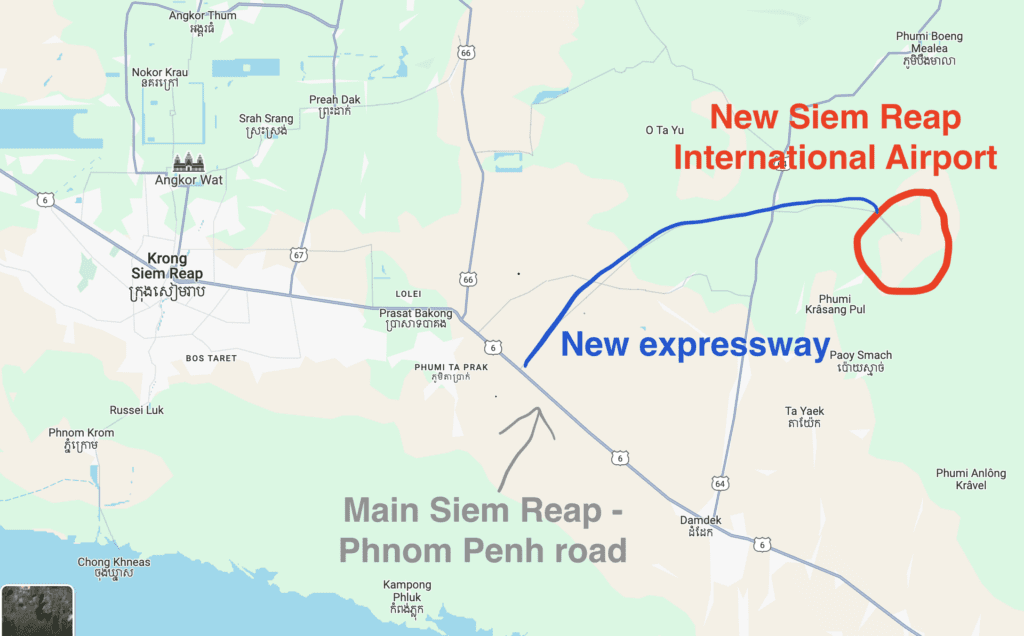

4. Big infrastructure development in Siem Reap

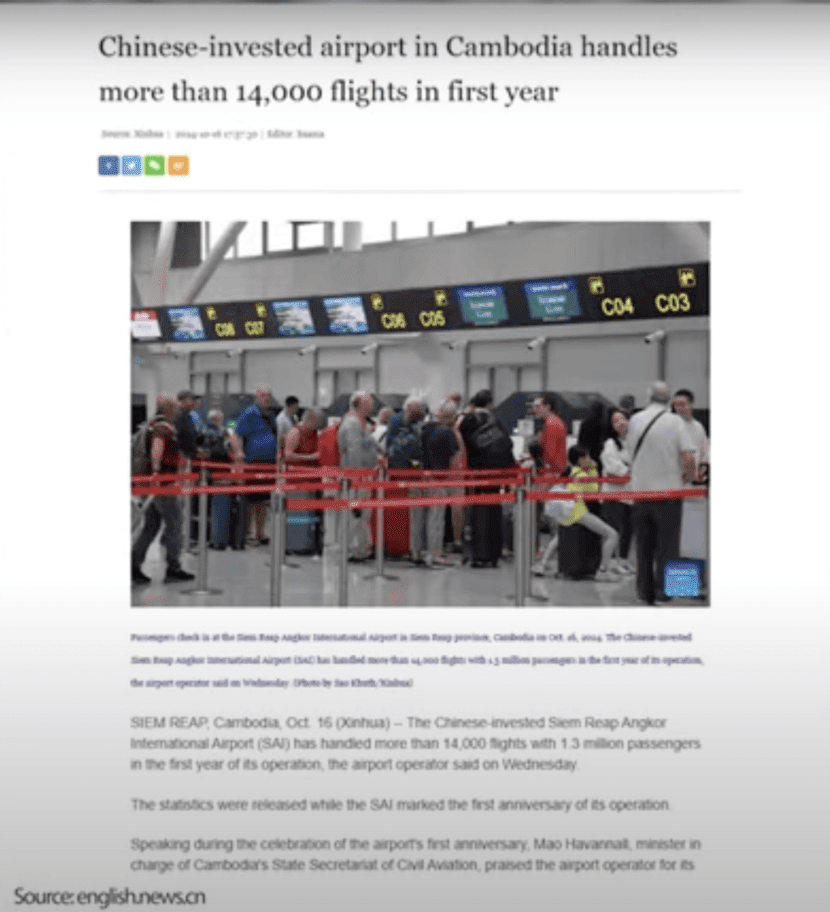

The government knows this, and is preparing according. A new Siem Reap international airport was inaugurated in 2024.

Yes, the airport is too big for now. But why? Because the government is planning for scale and for growth. This is visible even in some of the roads being built around town.

The government is actively pushing for more flights to Siem Reap by offering interesting deals to airlines.

If you go onto the website of Siem Reap International Airport you will see flights to Malaysia, Singapore, multiple cities in Thailand, Laos, multiple cities in Vietnam and a few cities in China as well. I fully expect this list of connections and flights to grow overtime.

This airport was built as part of China’s Belt & Road initiative, as well as the expressway currently built to link it to the existing network.

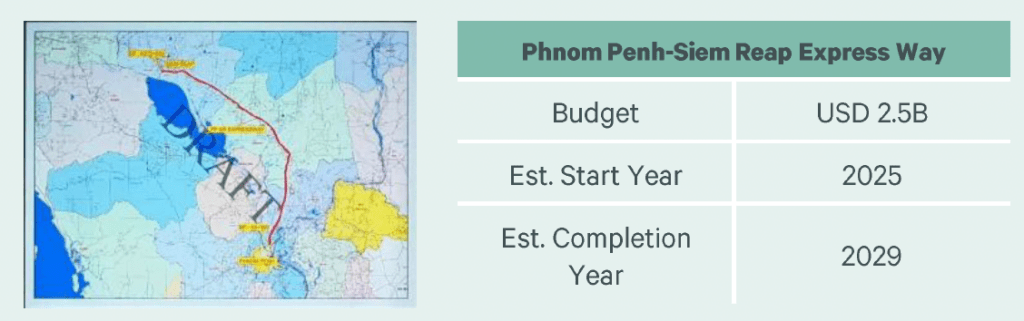

The government recently announced that a new highway will be built to replace the existing Phnom Penh – Siem Reap road. This should cut down the travel time from 6 hours to 3 hours. I doubt it will be finished in 2029 as such projects are typically delayed, but it will eventually be built.

5. Height restrictions for developers in Siem Reap

This is a big one. Traveling in Asia means realizing that supply of real estate can be nearly limitless due to very little height restrictions and zoning regulations.

Siem Reap is different.

The government mandated that no building may be higher than Angkor Wat. This means a cap of 5 stories. This will inherently impose a cap on supply of real estate in prime areas over time.

6. Siem Reap is becoming a lifestyle destination

When I first came to Siem Reap in 2018 it was still very rough around the edges, but the city has dramatically refined itself. There are cute shops everywhere, nice restaurants, beautiful roads and cycle paths all over town. There is an increasing amount of expats and digital nomads who base themselves out of Siem Reap because of how affordable and pleasant it is.

7. It is still early days

Eventually more major international hotel brands will move in, and with it they will promote Siem Reap as a destination to their client base. Then, the fancy international restaurants and chefs will move in…

It’s all inevitable. Angkor Wat is Asia’s Machu Picchu.

What real estate can foreigners buy in Siem Reap?

There are two types of real estate that foreigners can buy in Siem Reap and in Cambodia in general.

- Condos that foreigners can own. You can buy these in your own name (example below)

- Anything else, using a nominee or local company (not recommended) or a bank trust (very safe, more information below)

Video case study of Siem Reap real estate investments

I met with my Siem Reap and Phnom Penh real estate agent Untac. We ran the numbers in detail together.

Case study of a real estate investment in a new development in Siem Reap

My Cambodian realtor Untac took me around to see the few developments in town that allow foreigners to buy real estate directly in their own name.

There’s one development that stood out as it was very close to downtown, with really nice amenities such as a well-equipped gym, a convenience store, a spacious coffee and co-working space, a pool, decent finishings, parking, etc.

For example this was a 47m2 (net), or 505ft2, one-bedroom apartment being sold for the grand total $125,000, including furniture package.

There is quite literally nothing wrong with the product. The pricing is not “cheap” but isn’t outrageous either. So what is the ROI?

What is the ROI of Siem Reap real estate?

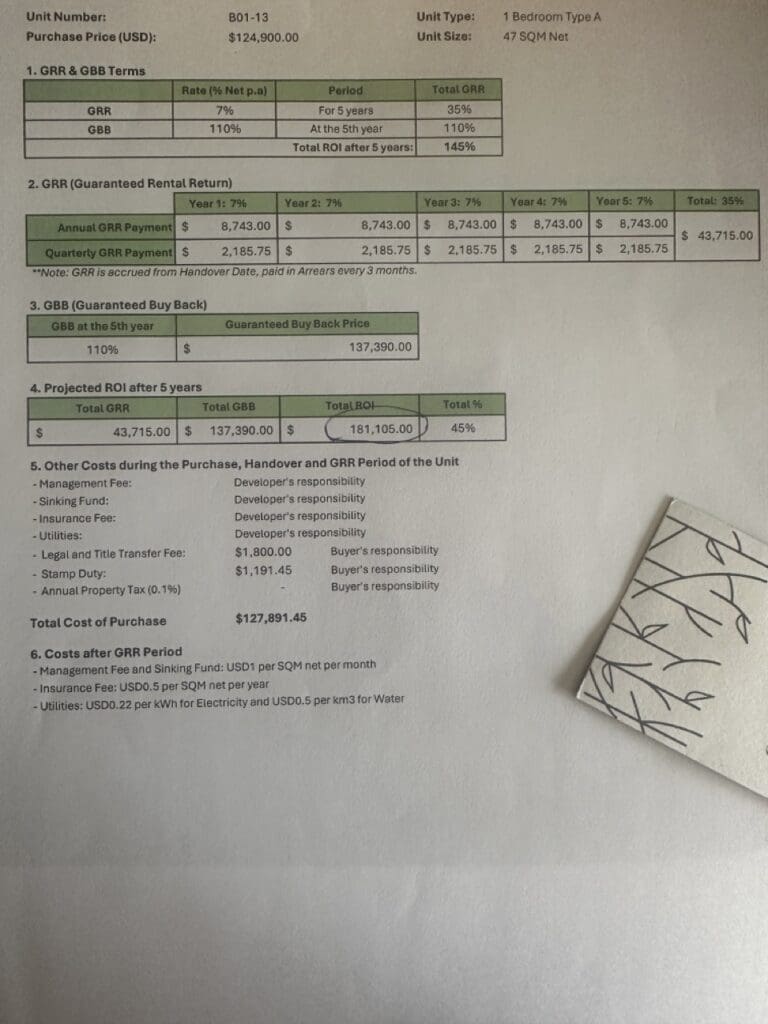

So we did the numbers. Interestingly, the developer offers a a rental guarantee (GRR) and buyback guarantee (GBB) scheme. Usually, I am quite skeptical of such schemes as it typically means that you are overpaying upfront.

The developer still had a few units for sale, and prepared a proposal.

So essentially the developer guarantees a net 7% per year as well as a buyback guarantee 10% above purchase price after 5 years (optional after 5 years, you can keep the property if you wish).

So in 5 years you are promised a 45% return, as well as 2 weeks of personal use per year. The developer deals with everything and sends you your money quarterly.

These numbers are quite decent. My immediate thought was “there must be a large discount on the secondary market”. My realtor Untac confirmed that there is a discount on the secondary market and showed me a unit that was for sale.

The listing price was 20% below the developer price.

So it is worth it?

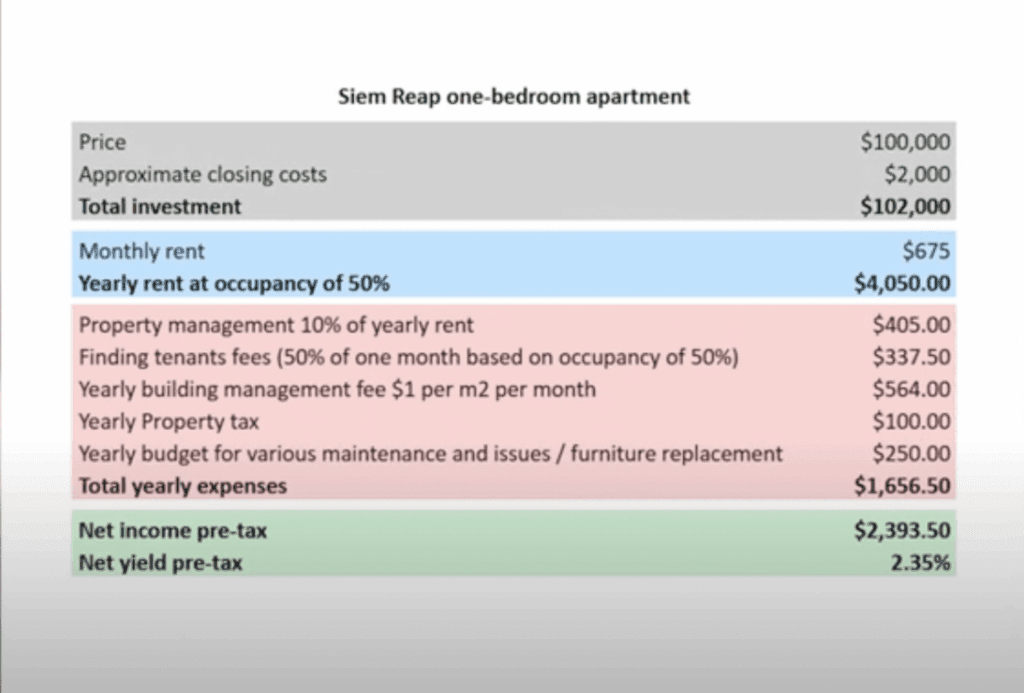

The reality is that the real net rental yields in Siem Reap are very low as there are a lot of hotels in town that are very nice and affordable. As I am writing this article I am staying in a 4-star hotel, with a very large room and breakfast, for $27 per night. So the market is only for people who want to stay mid- to long-term in Siem Reap.

I asked around and met an American who was renting a one-bedroom apartment there on a monthly basis, he said be was paying $750 per month.

Doing all the numbers, talking into account that the owner has to pay for HOA/Service charges, electricity, property management and will invariably have vacancy, a theoretical gross yield of about 7% turns into about 2% net.

| Price 20% cheaper than from developer | $100,000 |

| Closing costs | $1,800 |

| Total investment | $101,800 |

| Monthly rent (lowered the number to be conservative) | $650 |

| Yearly revenue @ occupancy rate of 50% | $3,900 |

| Property management fee 10% of turnover | $390 |

| Yearly HOA fee / Services charges / Maintenance fund $1 per m2 per month based on 47m2 apartment | $564 |

| Property tax | $100 |

| Incidentals | $400 |

| Total yearly expenses | $1.454 |

| Net yearly income before income tax | $2,446 |

| Net yield before tax | 2.5% |

Effectively the gap between the developer 7% net offering, and the 3% net that the investor receives if managing on his own, is 4%. Over 5 years it is a 20% gap.

| Developer | Developer intrinsic cumulative value without closing costs | Secondary market | Secondary market total cumulative value without closing costs | |

| All-in investment for 1 bedroom | $127,891 | $100,000 | $101,800 | $100,000 |

| Year one income | $8,743 | $108,743 | $2,156 | $102,156 |

| Year two income | $8,743 | $117,486 | $2,156 | $104,314 |

| Year three income | $8,743 | $126,229 | $2,156 | $106,468 |

| Year four income | $8,743 | $134,972 | $2,156 | $108,624 |

| Year five income | $8,743 | $143,715 | $2,156 | $110,780 |

Effectively, if the developer fails within 4 years you will have lost some money versus the secondary market. If the developer does not fail and if you go for the buyback guarantee then you make a decent 9% per year.

Essentially, this is a form of partially secured lending (initially 80%) made to a developer at 9% in USD per year, with two kickers:

- If prices rise substantially (they would need to rise by 37% to beat the rental guarantee)

- Two weeks of personal use per year

So effectively, the developer offering is more interesting for investors who don’t mind a bit of risk (not for people who want to live there). If you buy on your own, you have less upside, but you also have less downside risk.

Why is developer financing more interesting? What’s the trick?

It’s simple. A combination of:

- Economies of scale in management, which you don’t have as an individual

- Cash upfront for his financing needs for other projects (this developer is building one of the largest luxury towers in Phnom Penh)

Seeing that bank lending is very tight and expensive in Cambodia, this is a way for the developer to finance his next projects. What’s the worst case scenario? The developer fails and you don’t get to use the buyback-guarantees after a few years, but your apartment doesn’t disappear. It is in your own name from the get-go.

You only really lose a few % versus buying on your own if the developer goes bankrupt within 4 years of you buying.

So essentially,

- If you are an investor, buy from the developer

- If you want to use it for yourself, buy on the secondary market.

Can I buy a house or land in Cambodia using a trust or nominee?

Yes you can.

Traditionally, foreigners used nominees to buy land or non-hard title real estate in Cambodia. However it is very risky. Essentially the property is in the nominee’s name, and you have a side contract with them. But then you can absolutely get entangled in issues especially if the nominee did not declare everything upfront or ends up in divorce, or dies for example. It can become very messy and Cambodian courts are notoriously slow. The same applies for company structures where the foreigners owns 49% and Cambodians stripped of rights own 51%. Things can go wrong fast.

A new framework has emerged though; trusts. It is now possible to buy any real estate in Cambodia using a bank trust, a bit like in Mexico. Essentially the bank owns the property but within a segregated trust which you control. Bankruptcy of the bank would not result in your loss of the property. It’s a serious legal framework.

What’s the downside?

More paperwork and fees. For example buying a $200,000 house would cost about $6,000 for 5 years including set-up costs. The larger the investment the lower the fees as a percentage. My agent Untac can introduce you to a good trust company.

Case study of an Airbnb investment in Siem Reap

This 3-bedroom 3-bathroom villa is a 7-minute drive from the center of Siem Reap, in an area that is still developing. It costs $235,000.

You can expect an average nightly rate of about $110 with an occupancy rate of 30%.

| Price | $235,000 |

| Estimated price after negotiations | $210,000 |

| Approximate closing costs | $8,000 |

| Total investment | $218,000 |

| Yearly income @ $110 nightly rate with 30% occupancy | $12,045 |

| Property management 20% | $2,190 |

| Utilities & maintenance of pool $250 per month | $3,000 |

| Yearly trust fees | $1,200 |

| Property tax | $200 |

| Maintenance budget | $1,500 |

| Yearly expenses | $8,090 |

| Yearly net income pre-tax | $3,955 |

| Net rental yield | 1.8% |

Net rental yields of about 2% are typical in the Cambodian real estate market, though you can sometimes find better with some specific project.

Who should invest in Siem Reap real estate?

- People who want it for lifestyle

- People who want to buy a landed house or land using a trust as a form of diversification and long term investment

- People who want the developer financing option for higher returns

However as the market stands, it is not attractive for investors who want direct rental income or to make money on Airbnb.

Siem Reap represents great diversification and you can expect the city to boom in the long term, but it is a play for patient investors. It won’t be quick money.

Get in touch with Untac to invest in Siem Reap real estate

Untac lives part-time between Siem Reap and Phnom Penh, so he knows the market well. He can help you locate landed homes, bank repos, land, or introduce you to the better developers in town. He’s helped many foreign investors enter the Cambodian real estate market. More information on his Siem Reap real estate agent services.

Services in Cambodia:

Articles on Cambodia:

- Phnom Penh Real Estate Market: 2025 Investor Guide – Boom or Bust?

- Siem Reap Real Estate Market: Investor Guide

- Phnom Penh Real Estate in Cambodia ROI Breakdown & Rental Yield Case Studies

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “Investing in the Siem Reap real estate market in Cambodia – what is the ROI?”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice of The Wandering Investor. Today, I’m in Siem Reap in Cambodia, and we’ll be having a look at real estate here. We’re going to go check out some properties, do some numbers, go through some proper case studies. Before going into this, why Cambodia? I don’t really want to spend too much talking about Cambodia, why Cambodia? Essentially, the economy’s strong, it’s been growing a lot, there’s a lot of upside in this country, generally speaking, in terms of macro, and there’s a lot of stability as well.

Siem Reap is the city right next to Angkor Wat, the UNESCO World Heritage Site, which essentially guarantees millions of tourists now and in the future as well. It’s one of Asia’s most renowned cultural sites. The way I see it is, as Asia continues to develop, we’re going to see more and more tourism here, because it’ll become completely inevitable for the middle class of all of Asia to, at some point, come here to Angkor Wat for at least a few days.

I remember when I was backpacking in Southeast Asia, in the 2000s, most foreigners, most tourism, was still generally Western. And then, in the 2010s, it was Western and Chinese. And now, increasingly, what we’re seeing is not just Westerners and Chinese tourists, but a lot of other Southeast Asian tourists, and increasingly, Indian tourists. Yesterday, I just I went for dinner, then in front of me there was a whole family of Indians straight from India, and it’s something that would have been completely unheard of even just a few years back. The shift in tourism is happening in real time here in Southeast Asia. And Angkor Wat, due to its cultural significance, will invariably attract millions of these middle-class Asians, to come here to Siem Reap for at least a few days. That’s one.

Siem Reap as a lifestyle destination

LADISLAS MAURICE: I’m expecting a lot of tourism growth, specifically in the city. And not just that, I think a lot of people will come back, because it’s becoming increasingly a lifestyle destination as well. A few years ago, still very scruffy, but now the city is increasingly nice. There are all these cute restaurants, and cafes, and shops, etc. You even see random little yoga White girls with their little mats on bicycles, and they’re staying here, and there’s digital nomads working online. A few years ago, this would have been completely you would have never seen this. But Siem Reap is increasingly attracting a crowd like this. For now, it’s mostly a cost-conscious crowd, but increasingly, we’re seeing higher-end establishments and real estate as well, some of which we’ll go check out today.

Infrastructure development in Siem Reap

LADISLAS MAURICE: And importantly, the government realizes this and has spent massively on infrastructure.

In 2023, a new Siem Reap International Airport was unveiled with Chinese funding. It’s absolutely massive. It’s way bigger than what they need currently. But clearly, they are preparing for scale. They’re preparing for a big influx of tourism long-term. It’s good to see some good government planning in this respect. They’re also building all these highways around, so the city, from an infrastructure point of view, they’re really, really preparing it for a boom. Already, there’s a very good network of flights going to Singapore, Kuala Lumpur, many to Thailand, Vietnam, China, etc. Every year they’re just adding new flights here at Siem Reap International Airport, which will, again, drive more and more tourism. And it’s a lot of low-cost flights, so it’s not particularly expensive to fly here. From Singapore or Malaysia, you’re looking at $100 or so for a flight, so really affordable.

Population growth in Siem Reap

LADISLAS MAURICE: And finally, the population here in Siem Reap is growing fast. Generally speaking, Cambodia is a very young country, unlike a lot of countries around, like, Thailand, which is increasingly old, Singapore, a lot of East Asia, and Siem Reap, as a city, is growing much faster than the average in the country. We’re looking at yearly population growth of about 2.5% here in Siem Reap. The numbers in terms of population are a little rough, generally speaking, here, but probably between 250,000 and 300,000 people live in Siem Reap.

And finally, an important point in terms of supply of real estate, there’s a limit on how high one can build here in Siem Reap, which is absolutely not the case in most Asian cities, which tend to grow in height, which means that there’s almost an unlimited potential for new supply to appear on the market. Here, in Siem Reap, they do not want any new buildings that are higher than Angkor What. Generally speaking, this means about five stories. There’s a natural cap on how much supply there can be in the good neighborhoods of Siem Reap, which is important to take into account.

Now we are going to jump into a tuk-tuk, and we are going to meet with my agent, Untac, and we’re going to go through two case studies. We’re going to go check out a new mixed-use development which has interesting or surprising numbers, let’s put it this way. We’ll look at all of that in detail, in terms of ROI, and then we’ll go check out a villa with a pool, because it is now possible in Cambodia to buy not just approved real estate in condos for foreigners, etc., but also any house, land, etc., if you use the right structure. All right, let’s go.

Who buys real estate in Siem Reap?

LADISLAS MAURICE: Hello? How are you, Untac? Are you good?

UNTAC: How are you, Ladislas? How are you?

LADISLAS MAURICE: Good. Good-good. Untac is an agent here in Cambodia, and he’s helped a friend of mine make a few investments here in Cambodia over the years.

UNTAC: Yes.

LADISLAS MAURICE: Who are the main foreign buyers of real estate here in Cambodia?

UNTAC: The biggest market here for Chinese. But apart from the Chinese, we also got a bunch of other investors from all around the world. We’ve got European, we’ve got American, we’ve got Australian that are buying into this market for their investment or their retirements.

LADISLAS MAURICE: What about the Indian market, are you starting to see any outward investment from India?

UNTAC: Yes, frankly, we start to have a lot of Indians coming lately. Mostly Phnom Penh, but also other part of Cambodia as well.

LADISLAS MAURICE: Cool, interesting. And look, I came here in 2018 to look at real estate, and I had booked a one-month trip like now to look at the market, and then after just a few days, I just, I mean, prices were crazy, nothing made sense, and that month just turned into a vacation.

UNTAC: [laughs] Yes. Cambodia start to really boom around, say, after the crash around 2008, 2016, the market are crazy booming. The price are doubled and triple, especially land property. But then I think we reach the peak where it’s over supplied. There’s a lot of building all around and there’s not enough migration that moving to all the city that have been built. At the moment, it’s a bit of oversupply, especially Phnom Penh.

LADISLAS MAURICE: Cool. For how many years has the market been correcting itself now?

UNTAC: I think before COVID, around one year before COVID, we started to already see the slowing, and COVID kind of really make it all come together, make it really kind of collapsing or falling, in a sense.

LADISLAS MAURICE: Yeah, cool. If you’re a buyer now, you can negotiate interesting discounts?

UNTAC: Absolutely. Right now, it’s a buyer market, so you can go to any developer, you can come up with very creative structures and so on. And if you have cash, this is a really good time for you to come in and buy into something that 20%, 30%, even, 40% discount.

LADISLAS MAURICE: Even 40% discount?

UNTAC: Yeah. I mean, it’s hard to find. This kind of deal usually come up on the market for a few day, and then it’s gone. But you have to meet all cash ready.

LADISLAS MAURICE: Cool. It’s a clear buyers’ market. We’ll do all the numbers in terms of rental returns, etc. We’ll see. They’re not very high, so it’s a different investment thesis here.

Tour of mixed-use development in Siem Reap

LADISLAS MAURICE: Tell us a little bit about this project here in Siem Reap.

UNTAC: I don’t know if you’re familiar, but in Cambodia, you cannot own the land outright, so property can be limited, especially if you want to buy villas and lands, that you can’t. The alternative, anything from the first floor up, so you can look at apartments, and condo, and so on. And this is one of the projects that people can own outright here.

LADISLAS MAURICE: Okay, so when I hear this, my first reflex is to think that it’s a bit of a fake market. If foreigners can only buy in certain developments, then aren’t these developments a fake market in the sense they’re overpriced?

UNTAC: No, not in that sense, especially in this property, in this project, there’s over 35% Cambodian that buy into it because they see all of these finished touch and beautiful development. And it’s a real value, it’s a real market here.

LADISLAS MAURICE: Cool. This is like a big coworking space in the development?

UNTAC: Yes, this is a coworking space. Upstairs, you got the meeting rooms and so on. It’s really nice and really well done, really well made.

LADISLAS MAURICE: This is what I’m seeing here looking at Siem Reap, is, increasingly, a lot of digital nomads are moving here. They’re working from here, and they want amenities like this. And a few years ago, they didn’t exist, and now they do. Gym, pool, coworking, all that, fast internet. Interesting. Yeah, so 35% is Cambodian. Then it means it’s not a fake market, it’s a real market.

UNTAC: After this, we will go and see the other villas, where we’re going to talk through all the different title, because things have changed recently.

LADISLAS MAURICE: Yeah, and we’ll do all the ROI numbers as well.

UNTAC: This is a two-bedroom unit. It roughly around 80 square meters. It come with all the furniture here. And the price we’re looking at would be around $200,000. It’s not cheap for what it is here, but it’s a really nice finished touch.

LADISLAS MAURICE: Yeah. Look, not cheap. And then this is a recurring theme that we’ll see in the video, real estate in Cambodia is not cheap. Though it’s gone down, it’s not cheap. Cool, so what would be roughly the rental income on a unit like this?

UNTAC: We’re looking at around $1,200 per month.

LADISLAS MAURICE: Cool. Yeah. And again, this is with one can expect relatively low occupancy rates, am I correct?

UNTAC: Yes.

ROI calculation for Siem Reap apartment

LADISLAS MAURICE: Great. We’re going to do the exact numbers on a one-bedroom apartment, which is going for about $125,000, whereas when we’re sitting down with the developer, he came through with an offer of rental guarantee as well as a buyback guarantee. As I travel around the world, I, sometimes, come across such deals. I’m often quite skeptical of them. They’re not all bad, but in this case, it’s quite different. There’s something interesting in there. Can you take us through the concept? Because us in Western countries, we’re not really used to these schemes.

UNTAC: Well, potentially, these are a financial product, really what it is. The developer will give you 7% rental yield per year, and they give you a 10% guarantee buyback after five years. We’re looking at 9%. And if we add it up between the rental yield and the guarantee buyback at the end of five year, we’re looking at 45% return on our investment. That’s very, very interesting.

LADISLAS MAURICE: When I see this, my immediate thought is, am I overpaying for the apartment?

UNTAC: Generally speaking, yes. From developer to developer, usually, they add it up in some sense, yes.

LADISLAS MAURICE: If I were to buy this one-bedroom on the secondary market, the one that’s going for $125,000, how much could I get it for?

UNTAC: We’re looking at around $100,000 for the same unit.

LADISLAS MAURICE: Okay, so 20% discount?

UNTAC: Yes.

LADISLAS MAURICE: Okay. Effectively, if there wasn’t the buyback guarantee, if it was just the rental guarantee, it would be terrible, because you’re just paying upfront for the yield that you’re going to be getting over the next five years, generally speaking. Having said this, the buyback guarantee makes it interesting, because, like you said, it’s a financial product. You just go in there, buy the apartment, you know that the real value of the apartment is just 80% of what you paid for it. If the developer were to go bankrupt or whatever, I mean, you still have the apartment, it’s finished. It’s just you lost 20%, right, that’s pretty much it.

And then you get paid for those five years, and after the five years, you get the apartment plus 10%. It’s really important to actually sell the apartment after the five years, the market hasn’t gone up significantly. It’s partially secured lending to Cambodian developers at a US dollar fixed rate of 9% with a lock-in period of five years. This is the financial product.

UNTAC: Yes, it technically is. It literally is a financial product.

LADISLAS MAURICE: Cool. With, what, two weeks of usage per year?

UNTAC: Yes.

LADISLAS MAURICE: Okay. As a little gift, two weeks a year hanging out in Siem Reap in a nice apartment?

UNTAC: Yeah, you can use it or give it to your friend to use it two weeks out of a year.

LADISLAS MAURICE: People say, “Oh, this must be a scam.” It’s not a scam. The developer is just using the money for his next projects. Is the developer solid? Look, you were telling me this is one of the biggest developers in the country, they have a lot of projects, etc. I see the maintenance in the building is quite good. If they were really low on money, you’d start to see a bit of skimping on maintenance. Have I done due diligence on the financials of this Cambodian developer? No. Am I recommending this as an investment? No. But it’s just interesting to see that there are these possibilities out there. And for some people, for some of you watching, this might be what you’re looking for, 9% fixed a year for five years is objectively not bad when term deposits are paying, if you’re lucky, 5% in USD. So sure, why not?

Tell me about the secondary market. If I were to tell you, “Untac, I’m not actually looking for a financial product. I actually want to have an apartment for lifestyle purposes or whatever, spend more time than just two weeks a year here.” You said we could get it for about $100,000. We had a little bit of closing costs. Let’s try to do the rental yields, just so that we have an understanding of what the market is actually like. What would be the expected rental on a furnished one-bedroom apartment like this?

UNTAC: We’re looking at, realistically, $650 to $750, within this price range. Occupancy rate, we’re looking at probably around 50% out of the whole year, because there’s a lot of competition, there’s an oversupply here in this current market.

LADISLAS MAURICE: Yeah. Even though, at the beginning of the video, I was talking about tourism is going up, and they built the infrastructure, the new airport, blah, blah, blah, blah. The reality is, yeah, there’s oversupply. I mean, I’m staying in a four-star hotel, really nice, massive room, $27 a night with breakfast. I understand this is a completely different product, but yeah, there’s a lot of supply out there. It’s not that easy. I mean, you can’t get 90% occupancy rate. That’s never going to happen.

UNTAC: Yeah. But on the other side, if you’re looking at the secondary market, if you’re patient, and if you not rush, you can wait and get, like, say, 20%, could be 30%, sometimes, 40% discount. And the good things about this, especially if you want to buy it and live in it, or if you want to buy it and having come to visit, or having friends coming over to visit and stay at this place, that’s a perfect deal for you, because potentially you could rent five, six months out of the year, and the other rest of the year you can use it for your own.

LADISLAS MAURICE: Cool. And you could help people with this. If people want off market deals, bank foreclosures, they can just contact you, and you can let them know when there’s a deal that comes through?

UNTAC: Yeah, absolutely.

LADISLAS MAURICE: How much would the property management cost to have someone take care of things?

UNTAC: Generally speaking, it’s 10%. This apply to this project as well as everywhere in Cambodia, the standard around there.

LADISLAS MAURICE: Okay. And what about the service charges, HOA, all of that?

UNTAC: The management fee, once again, the standard price are $1 per square meter per month.

LADISLAS MAURICE: Okay. And what about property tax?

UNTAC: In Cambodia, it’s relatively very cheap. We’re looking at anywhere, say, between $50, $250 per year.

LADISLAS MAURICE: Okay, that’s a pleasure. And then a little bit of budget for incidentals, maintenance, whatever. People are looking at a net yield of 2.5%. It could be even lower, it’s hard to say. But I think the message here is you don’t come here and buy an apartment like this on the secondary market for rental yields. You come here for just the diversification, for the lifestyle. You come here for kind of crisis purchases. Buying it at 40% off or 30% is a lot more interesting than just at 20%, which is the standard secondary market.

Buying real estate in Cambodia with crypto

LADISLAS MAURICE: And then also crypto. I think this is an interesting thing about Cambodia, you can buy with crypto?

UNTAC: Yes.

LADISLAS MAURICE: Directly with developers as well?

UNTAC: Yeah. In the past 12 months, we see a lot of investors that want to invest with crypto, and the market have to adapt to this. We see a lot of developers start to accept directly or work with a local exchange, where potentially, investor can send the money to the local exchange, and they either can get all cash, like cash out and just use that cash to buy directly to the developer or the property owner, or they can wire to whoever you want to wire to.

LADISLAS MAURICE: Okay, so you’re telling me, if I want to buy this apartment on the secondary market, I just transfer the money or transfer the crypto, the local crypto exchange just wires the dollars to the developer directly or the seller, or I can just go get a bag of just $100,000 in cash and just go to the notary public get the signing with that?

UNTAC: Yes.

LADISLAS MAURICE: This is another function of real estate in Cambodia, and this is also what helps support a lot of real estate here in Cambodia. It’s a country where the AML regulations are not as intense as in a lot of Western countries. For example, let’s say, you’re a Westerner. You’ve been trading crypto for many years on all these different exchanges and this and that, and no bank wants to see your money because they’re just not happy with how messy your whole trading was, and you don’t have all the documents, etc., and you’re kind of stuck with a crypto. Cambodia is a solution.

You can either just buy a place like this, cash, whatever, make 2% a year, hang out here in Siem Reap, or you go with the developer option, which is kind of interesting. You turn your crypto into a 9% a year partially secured loan to a developer. And after five years, you can sell it. You get US dollars. And then when people ask you, what’s the source of funds, “Well, I sold real estate. I’ve had that real estate for five years.” In most cases, people will then be fine with it.

Buying real estate as a foreigner in Cambodia

LADISLAS MAURICE: Also, when we look at this apartment and we’re saying $650 for a one-bedroom, you can get villas for that price, right?

UNTAC: Yes, and that’s a very, very interesting things that later we’re going to go and see some villas, because for around the same price, we can get a really nice villa around town. But the tricky things here it’s we need to deal with the title, because as a foreigner, you cannot own land here or property here on land, like, house, villas, and so on. But there are ways to go around it. The traditional way that we see a lot of people use is through nominee. How it works is, if you know some Cambodian or friends that you know and trust, you can have a lawyer who do all the legal binding to get that done. But I’m personally not recommend anyone to go through that path, because it’s a little tricky, especially if the nominee is sick or have an accident and so on, that could be a very, very tricky situation that could potentially fall into your lap.

The second idea, or the other way that people can do and that I more recommend into, is the Bank Trust. We can do this through the bank or a holding company that potentially they buy it and hold it for you. But the downside is you need to pay fee.

LADISLAS MAURICE: It’s a bit like in Mexico, where foreigners cannot own property along the coast, but you just go through a Bank Trust, you’re fine. Now there’s this legal framework here in Cambodia for this, so it is possible, effectively, to buy villas and all of that.

UNTAC: Yeah.

LADISLAS MAURICE: It’s interesting to see that people can rent a whole villa for $650 or a one-bedroom apartment like this. A lot of people prefer the one-bedroom because they have the amenities, the gym, the pool, and all of that, so very different markets. Now we’re going to go check out a villa for sale, right?

UNTAC: Yeah.

LADISLAS MAURICE: All right, cool. Fantastic. Let’s go.

UNTAC: Yeah. Let’s go.

LADISLAS MAURICE: Nice car, Untac.

UNTAC: Thanks. Come in.

LADISLAS MAURICE: It’s a Chinese car?

UNTAC: It’s a Chinese car company with a Japanese engine, Mitsubishi.

LADISLAS MAURICE: Wow.

UNTAC: It’s very, very popular here in Cambodia at the moment.

LADISLAS MAURICE: Yeah, these Chinese cars are really increasingly nice. I mean, inside it’s nice and modern.

UNTAC: Yeah, we’re very happy with it.

LADISLAS MAURICE: Is it your first time owning a Chinese car?

UNTAC: [laughs] Yes.

LADISLAS MAURICE: Will you go back to European or Japanese cars later?

UNTAC: That’s an interesting question. Considering the price, this is definitely worth it.

Tour of Siem Reap villa with American expat

LADISLAS MAURICE: This is a nice villa, so traditional style, right?

UNTAC: Yes. Cambodia traditional house, beautiful.

LADISLAS MAURICE: Cool. Three-bedroom, I think three bathrooms. What price?

UNTAC: I think this is listed on market for $195,000.

LADISLAS MAURICE: Okay, in a good neighborhood of Siem Reap. And Conor here is the tenant. How are you, Conor?

CONOR: I’m good, thank you. Sok sabai. [laughs]

LADISLAS MAURICE: [laughs] How much rent are you paying for this place?

CONOR: $800 a month.

LADISLAS MAURICE: Cool. And you have a lease for how long?

CONOR: A year.

LADISLAS MAURICE: A year?

CONOR: Yeah.

LADISLAS MAURICE: And can you show us around?

CONOR: Absolutely, yeah.

LADISLAS MAURICE: Cool. The owner is Cambodian. She did the whole renovation, we were told. Conor is renting the place for a whole year, but the house is for sale with Conor inside, right? You’re included in the house, right?

CONOR: I mean, for supplement.

LADISLAS MAURICE: [laughs]

CONOR: Yeah. I come with foie gras.

LADISLAS MAURICE: Downstairs is the kitchen, all that. Why did you decide to move to Cambodia?

CONOR: We fell in love with Cambodia during COVID. We came here and stayed for a long time. We traveled all of Asia. And there’s an interesting dynamic here. The history kind of overlapping with the modern beauty of it, and being in a place where it’s primarily Buddhist people, so they’re very kind, and the world’s getting to be kind of mean, so it’s nice to be around kind people.

LADISLAS MAURICE: [laughs] Fair enough.

CONOR: Yeah, yeah. And we just love the history of the place, and it’s affordable.

LADISLAS MAURICE: Yeah?

CONOR: Yeah, absolutely. We sold our house in Hawaii. We were living in Hawaii for 15 years.

LADISLAS MAURICE: Wow.

CONOR: And so, we made some money off that. But that money wouldn’t have gone anywhere in America. We looked at our budget and it was like we were going to last, for two months, it was going to cost, like, 10 grand or something like that. Do you know how long 10 grand lasts here?

LADISLAS MAURICE: How long?

CONOR: A year. [laughs] Really. We go to Seattle for a month, and it costs $10,000. And it’s cold. And I lived in Hawaii, so I wasn’t looking to go back to the cold. I like the good weather. The weather is perfect here.

LADISLAS MAURICE: It is. It really is. And have your own nice pool here.

CONOR: I go in it four times a day.

LADISLAS MAURICE: Nice. Apart from rent, how much are your monthly expenses, roughly?

CONOR: The power we’re still kind of figuring that out. It’s probably $150 a month. It’s probably $150 a month. But we keep this room like a fridge, we keep it nice and cold because, sometimes, it gets very hot outside, and it’s nice to be able to go into the pool and then retreat into the room.

LADISLAS MAURICE: It is like a fridge.

CONOR: Yeah, we keep it nice and cold in here. We keep it like 22˚C or 21˚C.

LADISLAS MAURICE: Only Americans would consume air conditioning to such an extent. [laughs]

UNTAC: [laughs]

CONOR: Just in the one room. And then also, we keep our main fridge in here, and we keep our water cooler in here. And that’s, like, important, man. We have an outdoor fridge, too, and that thing it’s going to die. It’s just sitting outside. I’m a chef, so I know how it works to have machinery outside. [laughs] It’s better to have it cool inside.

LADISLAS MAURICE: And upstairs is the more traditional side of the home, right?

CONOR: Yeah, absolutely. That’s where our guests stay.

LADISLAS MAURICE: Do you often have people visiting you from the States, or is it a bit far for people to visit?

CONOR: Yeah, it’s a bit far. We have friends in Phnom Penh and Kampot, and we have friends from Thailand that come visit. The States is pretty far, but we do have nieces and, like, I have an aging mom that might travel and stuff like that.

LADISLAS MAURICE: Is it an easy place to make friends as an expat?

CONOR: I’m a weird expat. I’m kind of not like a normal person. I lived in Hawaii for 15 years. Hawaii, White people are a minority, at the very bottom of the social ladder, so I got pretty good at just making friends. Plus, I’m a chef, so it’s kind of my job to work in hotels, and I’ve always worked with people from all over the world. I gel more with people that don’t look like me than people that do look like me.

LADISLAS MAURICE: All right, fair enough. And what about the ingredients here for food?

CONOR: Yeah, absolutely. The markets are fantastic. Everything’s perfect here. I think it’s just amazing. There’s some of the best food, probably, in Southeast Asia here. And it doesn’t get the hype that Vietnam or Thailand does, so for a chef, it’s kind of neat.

LADISLAS MAURICE: Why did you choose Cambodia, not, for example, Thailand or Vietnam?

CONOR: Thailand’s twice as expensive. I came to do my dentistry in Thailand, and we thought we would stay here. You have to go back and forth. I have to get implants. Thailand’s crazy. It’s kind of in your face all the time. And Cambodia is kind of the opposite of that. It’s very reserved and very sweet and kind. I mean, if you go to Pub Street, you can be in the middle of that but out here in Svay Dangkum, it’s beautiful. It’s very quiet. There’s a temple over here that goes off a couple times a month.

UNTAC: [laughs]

CONOR: But we love it. It doesn’t affect us at all. Some Westerners, “Oh, the temples!” I think it’s amazing.

UNTAC: That’s so sweet.

CONOR: I like to integrate. Well, I want to love where I am, you know? I don’t want it to be like where I’m from. That doesn’t make sense. I would just go there. [laughs]

UNTAC: Yeah.

LADISLAS MAURICE: Cool. And then there’s a third bedroom here. The windows are shut, so it’s a little dark, but would be very [crosstalk 27:45].

CONOR: It’s a wedding or a funeral, too. I mean, those are both things that happen [crosstalk 27:43] it’s very important. What, are you going to yell at children for having fun, you know what I mean? Because they can only be children one time.

UNTAC: Absolutely.

LADISLAS MAURICE: Cool.

CONOR: This is where we have the guests stay. Yeah, this one’s kind of more done up for guests. And then there’s a little, kind of another bedroom, maybe. You could almost say this is like three-and-a-half.

LADISLAS MAURICE: Yeah, very nice.

CONOR: With a little office or whatever.

UNTAC: And an office?

CONOR: Yeah, kind of. It’s like a children’s bedroom or something.

LADISLAS MAURICE: Are you considering buying real estate yourself here or you’re going to keep renting?

CONOR: Yeah, we’d like to, but we’re just starting with the whole immigration process. We came and stayed a long time before, and then we came back, and then we’ve just extended our visas. And it’s just a process. I think I heard you talking about five to seven years, and you need to renew, and you need to do everything right, and be a good citizen. And so that’s we’re just starting that part of it. But we really love Cambodia. And it’s also a good jumping off point. We travel the world a lot, and this is a good hub to continue going, I guess, not East anymore. Start going West again.

LADISLAS MAURICE: Are you happy with the new airport, the new Siem Reap airport?

CONOR: [laughs] No, it’s terrible.

LADISLAS MAURICE: Why?

CONOR: It’s a beautiful airport, stunning. It’s an hour away. I’m afraid it’s going to be harmful to Siem Reap. That’s too far away. The old airport was right there. You could just come right, a tuk-tuk, $5 and you come into town, and it’s very easy. This one is a nightmare. I’m all about Cambodia tourism. I really want to uplift the tourism in this country. I think there needs to be 2 or 3 million more people come into this country every year. Right now, it’s maybe, like, 500,000 or something. It’s not enough. All these people need jobs.

The thing about the tourism here is we need to make it very easy to get through the airport. When people go to Thailand, it’s like, stamp, stamp, stamp, and you’re in. It’s not a problem. Here, you wait in line for an hour to get through the airport. It needs to be very easy for the high-net-worth people, people that have nice cars and extra money to come here. And then that airport’s so far away, it makes it very difficult for people to come to Siem Reap. And then when they get here, they just go to Angkor Wat, and then they go home. That’s about it. We need strategy as a community to keep those people here. Maybe three days, maybe five days. Requires world class restaurants, it requires ease at Tonlé Sap Lake, maybe more investment in talking about the other temples, Ta Prohm, Banteay Srei, all these are beautiful temples that are just as good as Angkor Wat, but people say, “This is the best one.” Comparing temples is crazy.

Anyways, I think there needs to be a concerted effort on behalf of the community and the government here to fix the little issues that make tourists not want to come stay here, and that airport’s a big problem. [laughs]

UNTAC: Yeah.

LADISLAS MAURICE: Cool.

CONOR: When you turn off the camera, I can tell you more, but I don’t want to say anymore. Aloha nui loa iā ‘oe.

LADISLAS MAURICE: Thank you very much, Conor.

CONOR: Thanks, man.

LADISLAS MAURICE: Untac, what are your thoughts on this?

Comparison of villa and apartment in Siem Reap

UNTAC: Comparing the two properties, this one looks a lot more appealing. If you are looking for investing in Cambodia or even live here part of the year, I think staying at the villa or a house like this is much more appealing.

LADISLAS MAURICE: Yeah, it’s just they’re totally different. One is you want the gym, the pool, the amenities. This is do you want to live in a more Cambodian neighborhood, in a Cambodian house. And you can tell the type of people are very different. Like, Conor is very different from the sort of people that were hanging out at the coffee shop in the other place. I guess, they each have their own market.

UNTAC: Yeah, absolutely.

LADISLAS MAURICE: And then the yield is approximately 4%, 5% on this?

UNTAC: Yeah.

LADISLAS MAURICE: That’s not too bad, actually.

UNTAC: Yeah.

LADISLAS MAURICE: Yeah, for Cambodia, that’s actually really good.

UNTAC: If you’re looking for something like this, the yearly rental yield is not as great, but we’re hoping or looking for appreciation. One of the things that we haven’t mentioned is Siem Reap all of the buildings cannot go high than Angkor Wat. The city spread out quite quickly, so potentially, the appreciation of land will go up.

How to contact Untac

LADISLAS MAURICE: I wrote a whole article on the real estate market here in Siem Reap, there’s a link below with more information. Untac, so you can help people invest in these kind of financial products, real estate, just secondary market, bank foreclosures, all that, correct?

UNTAC: Yeah. If you’re looking to invest through cryptos and stuff, we can help you do it here.

LADISLAS MAURICE: Okay, fantastic. There is a link below with more information on Untac’s services and how to contact him. All right, Untac, thank you so much.

UNTAC: Thank you so much, bye-bye.

What are these closing costs you list on these properties? Having bought and sold multiple properties here in Cambodia, it’s always the seller that handles all the official (and unofficial) fees. Only extra costs you might have is your personal lawyer fees, and that is typically anything between $250-$1000.

It really depends on primary market vs secondary market, and negotiations. I’ve also bought on the secondary market and had the sellers pay the taxes, and I just paid my lawyer. There is no clear-cut rule.