They want to force you to spend big money on renovations by turning your real estate into a “stranded asset”.

What am I talking about?

The French government implemented a classification of all dwellings in France based on energy efficiency. If your apartment or house does not make the right “grade”, then you will not be allowed to rent it out, nor to sell it.

It’s an active French government policy to force people to spend money on renovations to make their real estate more “green”.

The IMF even has a terminology for this: “stranded assets“.

I expect such policies to expand fast into other developed markets as they are being pushed by bureaucrats at the IMF, the EU, etc.

In this video, I invited Pierre Ollier, who is a well-known French real estate investor to discuss these government policies, how they work exactly, how to arbitrage them, and what the implications are.

Pour ceux qui parlent Français

If you speak French, I highly recommend you follow Pierre Ollier on Youtube.

To a World of Opportunities,

The Wandering Investor

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Full transcript of “A very important trend all Real Estate Investors should know about”

LADISLAS MAURICE: Hello, Ladislas Maurice from thewanderinginvestor.com. So today, I’m with Pierre Ollier, who is an investor in French real estate. Pierre, how are you?

PIERRE OLLIER: Very good, thanks.

What is a “Stranded Asset”?

LADISLAS MAURICE: Good, cool. So Pierre has a whole YouTube channel focusing on French real estate. And today, I just want to have a quick conversation with him just to share some developments that are happening on the French market, not because I recommend the French market, but because I see that these developments are going to be spreading to other countries, and France is quite advanced in this regards. And I’m referring to energy standards for real estate.

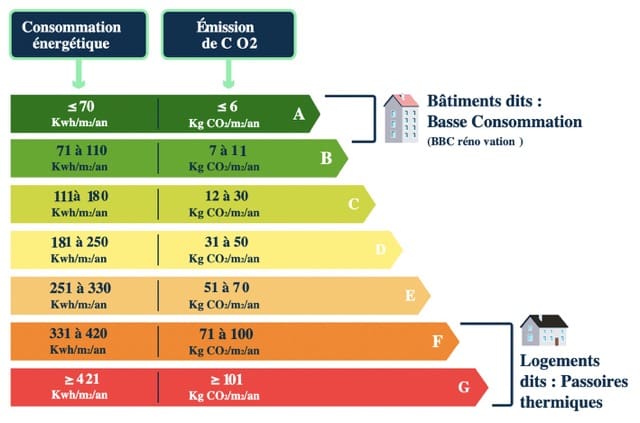

So essentially, what the French government has implemented is that each dwelling in France now has a Grade A, B, C, D, E, F, G, or whatever, it’s a long list of grades, and depending on the grade in terms of energy efficiency that your dwelling has, then there are certain things that you are allowed to do and that you are not allowed to do. So Pierre, can you elaborate a little bit on this?

PIERRE OLLIER: Yeah. So these grades, you’ll find them everywhere in Europe. I’m investing also in Hungary, and I have these diagnostic A, B, C, D, E, F, G. So basically, they’re going to look like how much energy your apartment is going to consume. So for example, it’s a very old apartment, you will have a letter G, which is like the worst one. And if you have the letter A, it means your apartment is like, well, I don’t know, has a very good level of energetic performance. So right now in France, they use this level A, B, C, D, E, F, G to put some restrictions.

So for example, now, if you have an apartment which is classified on G, it means that in the future, in the close future, in a few years, you will not be able to rent this apartment and you will not be able to sell this apartment, which is completely crazy, like when you realize about this. And for the letter G, it will be soon in a few years. For the letter H is going to be three years more. And step by step, they’re going to make restriction and they want, at the end, like just they want to force the people to renovate the flats in order to have good performance energetic level.

Stranded Assets are official government policy

LADISLAS MAURICE: Cool. And I think this is very important. Essentially, the depreciation of real estate in developed Western markets is set to accelerate. And it’s something that came out in a recent, I think it’s a recent IMF paper, where they were talking specifically about stranded assets, to encourage people to renovate and make them more green.

So it’s actual government policy encouraged by these worldwide organizations that are going to be encouraging their own way other governments to do the same, to say, “If your apartment is not green enough, if your house is not green enough, you cannot sell it, you cannot rent it. It’s essentially a stranded asset until you commit to spending all of that money to renovate it to the standards that we choose.” And then, every year, the standards are going to get tougher and tougher. So the core implication of this is a faster depreciation of your real estate investments in countries that are in go ahead with such laws.

Cars are well can become stranded assets

PIERRE OLLIER: Yeah. And you have, it’s not just in real estate. Like for example, I was in France for Christmas, and on the 1st January, now you need to use a sticker for your car. If your car is not classified A, B, or C, you cannot enter in the city center, because they consider that your car makes too much pollution. So basically, you cannot even drive your car. It’s the same for the real estate, and it’s the same now for the production of the car, in 2035, like you will have to drive an electric car. So yeah, it’s going to be tougher and tougher. So of course, you have to be really careful when you invest in real estate and be aware about this change of mindset.

LADISLAS MAURICE: Yeah. So you either embrace it and try to play arbitrage. So for example, we were discussing, right before, and what you’re doing is you’re looking at people who have like G-rated real estate, they’re panicking, they want to sell it. But you know, with not that much money, you can upgrade it from a G to a D–

PIERRE OLLIER: Yes.

LADISLAS MAURICE: which then gives you another 10 years, etc. And then there’s arbitrage to be played between people’s emotions. So perception of the rules and the impact and versus the reality. So there’s money to be made this way. And then another way is to simply look for emerging markets and for countries that absolutely don’t care about this, where you can just buy and not have to worry about such government regulations. But it’s something that is going to spread across the West like wildfire. To your point, the cars is a good example. I have family in Western Europe. You know, they live in a village, and they drive a 10-year-old diesel car. And they can’t go to the nearest city anymore.

PIERRE OLLIER: Yeah.

LADISLAS MAURICE: So when they go to the nearest city, they have to park outside of the city, then take a bus into the city. They’re just not allowed to use their car further than the city limits. So this concept of stranded assets is an active government policy. They want to strand your assets so that you’re always perpetually renewing them and consuming and consuming and consuming.

PIERRE OLLIER: Yeah.

Accelerated depreciation of Real Estate due to the push for “Stranded Assets”

LADISLAS MAURICE: So the impact is very negative from a depreciation point of view.

PIERRE OLLIER: Yeah, they try to slow down, to the maximum, the economy. I mean, you can see like every bad decision that can be made, they will do it. For right now, you pay the price of the energy is super high because of the politics. In France, there is a big crisis, in the real estate market it’s very hard to find an apartment to rent, and the government came with this law. So basically, we have very nice flat that the people can use, but you cannot rent them because the government decided, Oh, that’s a letter G, so the apartment has to be empty. So you have some people who cannot find apartment, which it’s stupid, it’s better to have someone in an apartment letter G than someone in the street. I mean, that’s my opinion.

After when you are investor like me, of course, you take advantage of that, because Ladislas was saying it, like, basically, I take apartments which are letter G, and if I can correct the problem for, let’s say, €10,000, for me, I will just buy the flat. I will negotiate like the price like really, really low. And I will make a profit on that and sell the apartment later under letter E or D. So this is something that you can change, sometimes, pretty easily. And sometimes, you cannot. So you have to be aware about that. Basically, if you have to make the insulation from outside of the wall, it means like you need to make collective decision from the building. And if the people vote against this decision, basically, you will not be able to correct this problem.

So I just choose apartment where I can fix the problem and I make money. I take advantage of that, because the people are literally panicking. But of course, you have to be careful because it’s a dangerous game, because the rules can change very fast. And this came in one, two years, like they put these rules and you know, the market changed. So you don’t know what will be in the future. So always diversify when you invest in real estate, and when you invest your money, of course.

LADISLAS MAURICE: Cool. And again, it’s the key concept of stranded assets, governments want to strand your assets. So just, it’s a new factor that you have to take into account whenever you make a purchase, whether it be a car, or an apartment, or whatever. What are the odds of this asset becoming a stranded asset? And how long can I keep this asset until it becomes stranded? So this is really a new concept, we’re still early on in this, but it’s definitely something that they’re going to push forward. So think about it now in your investments, always think about it because it’s going to be a thing.

Great. So Pierre, thank you very much. If you speak French, Pierre has a really good channel, a really good French YouTube channel. The link is below.

PIERRE OLLIER: Yeah. Thank you.