I recently spent a few days in Astana, or Nur-Sultan (its new name), and decided to analyse whether a real estate investment in that part of Kazakhstan is worth it.

Kazakhstan got its independence from the Soviet Union in 1991, and has since been rebuilding itself from the ashes of communism, driven in large part by an astounding amount of natural resources. Kazakhstan, with a population of nearly 19 million, is home to an incredibly diverse population composed of 131 different ethnic groups. It is huge country boasting gorgeous landscapes of steppes, lakes, mountains and is larger than the whole of Western Europe.

Kazakhstan is definitely worth a vacation, but what about investing in real estate in its capital city?

The positive aspects of investing in real estate in Astana, Kazakhstan

- In less than two decades, Kazakhstan moved from lower-middle income country status to upper-middle income country status. Poverty was greatly reduced, and there is now a solid middle class buying everything from consumer goods, cars to real estate.

- Almaty, located in the south, is the commercial capital, and Astana is the political capital in the north. I generally avoid investing in places with a lot of government, especially in countries where the government is broke, as in many Western countries. That said, the government in Kazakhstan is far from broke; it’s debt to GDP ratio stands at less than 20%.

- It’s unlikely to end up at risk of going broke anytime soon, with natural resources stretching from the Caspian Sea to the endless steppes. Uranium, gas, petroleum, chromium, copper, zinc, lead, etc can all be found in massive quantities, and to be shared among only 19 million people.

- Driven by government spending. Astana continues to grow. Its population was a bit over 300,000 in 1999, and is now over a million 20 years later. It’s visible; there are cranes everywhere, and the urbanization strategy designed for scale.

- The population growth shows no sign of stopping, with a positive fertility rate of about 2.7 children per woman.

- Accelerating GDP growth: 1.2% in 2015, 1.1% in 2016, 4.1% in both 2017 and 2018 and similarly good numbers for the beginning of 2019.

- A pro-business government that has implemented reforms. In the latest 2019 report, Kazakhstan is 28th worldwide in the Ease of Doing Business ranking by the World Bank. What is amazing is that it is ahead of countries such as Poland, Switzerland, and the Netherlands. This is coming from the 86th place in 2006.

- The tax regime is not bad, but not exceptional either. The corporate income tax stands at 20%, which is high for a non-Western resource rich country. And its personal income and capital gains taxes are 10% and 15% respectively.

- If you are a Westerner, this market represents a geopolitical hedge as it is closer to Russia & China. In the case of further Eurasian to combat the dominance of the USD, it would be beneficial to have some exposure there.

And now the negative aspects

- One picture is worth a thousand words. Look at the endless steppes. There is land. An endless amount of land, which naturally puts a cap on prices.

- “Endless”applies not only to land, but also to height. The zoning restrictions on height seem to be rather loose.

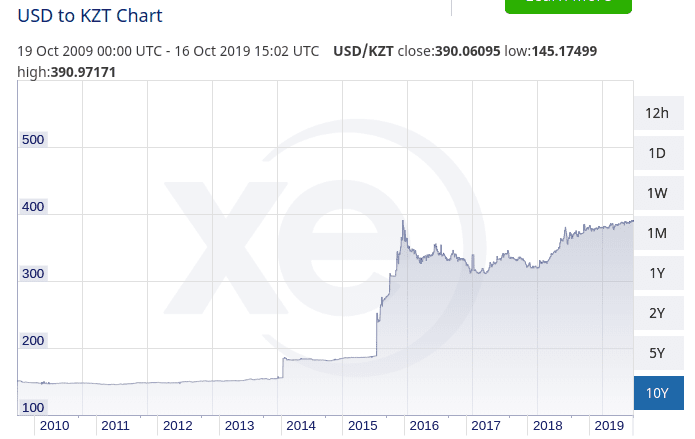

- The currency, the Tenge, is a worry. After substantial devaluations in 2014 and 2015, it has been on a downward trend. Properties are priced in Tenge, not in USD, though they seem to be tracking the USD. Having said this, the currency is one of the main risks.

- People like to mention a lack of full democracy, but I wouldn’t consider the political system a negative aspect from a purely real estate investment point of view. Political and economic freedom do not necessarily correlate.

- Finally, the legal structure to own property as a foreigner is not straightforward. Foreigners are not allowed to own immovable property in Kazakhstan, unless they have permanent residency which is very hard to get. Typically one must be of Kazakh origin or married to a Kazakh citizen to obtain it. Needless to say, this doesn’t apply to most people.

- One way to get around it, is by creating a local company without it being primarily for the purpose of buying real estate. For example, create a consulting company, bill some hours every year, and the consulting company can also happen to own some property. It’s a bit of a grey area, but typically nobody would bother you if you stay small enough. Maybe even add a brokerage account to its name and buy a few local shares. Just buy a few apartments, stay under the radar and don’t be greedy. But yes, there is some risk. Some lawyers say it’s OK, others don’t recommend it.

- Surprisingly, one can also buy investment real estate in Kazakhstan through a foreign company. This is the most straightforward way.

What can I expect of a real estate investment in Astana, Kazakhstan

Property can be found from $400 to $2000 per m2. $400 gets you a new-built building far from the center, in the outskirts next to the steppe. $2000 gets you extra luxury in the center that will quickly lose value – it’s overpriced. Most core downtown property is at around $1000 per m2. But core downtown means being close to monuments and government buildings. There isn’t much value add by being in that area, especially as driving around is easy due to massive roads.

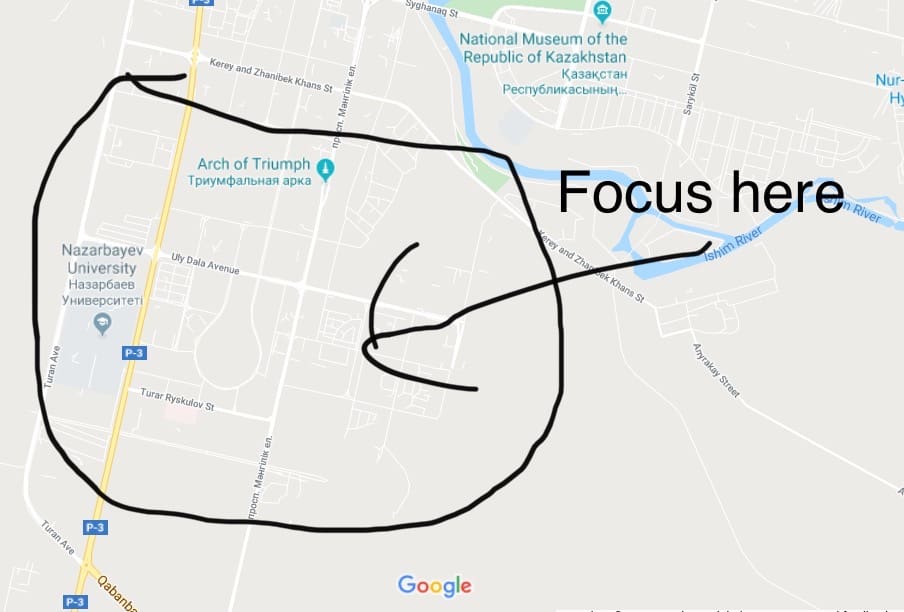

Instead, I recommend is being close to the center in an area with major universities, hospitals, schools, malls – places where the local people actually spend their time. The area below fits the profile, where property can be had at $700-$800 per m2.

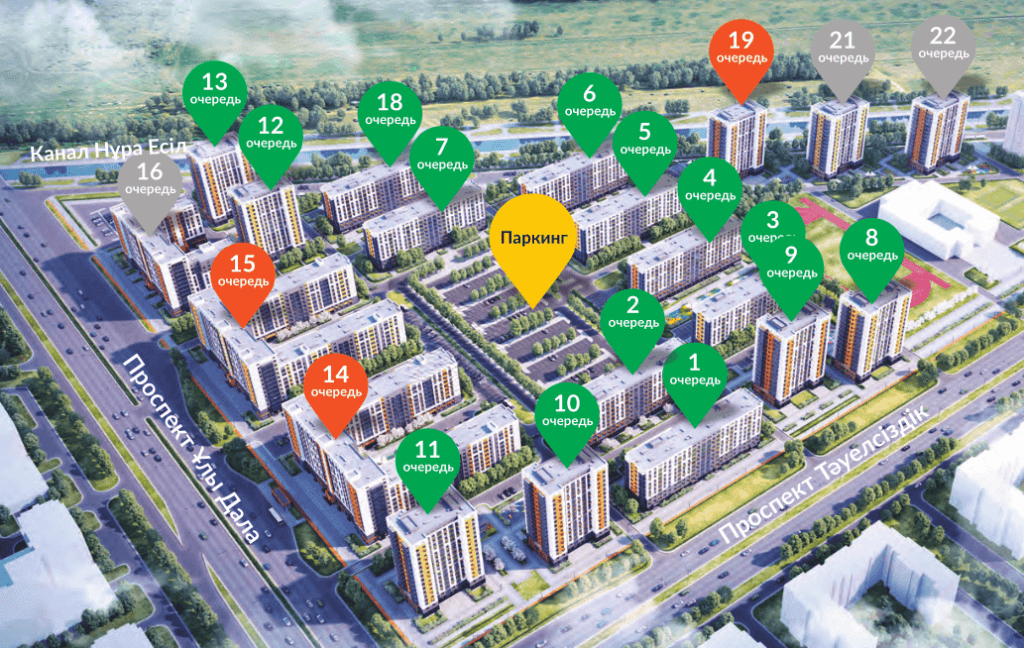

1 and 2- room apartments are the easiest to rent with about 36-40m2 being optimal. The new-built below, offers 36m2 1-room apartments for about $750 a m2. New apartments are all delivered as shells in this market, and are rented furnished. Accordingly, add about $130 for the finishings , kitchen and basic furniture. That gets you to a cost of about $880 a m2, for a total of about $32,000 including some lawyer fees to double check your contract. You can expect the key handover after 10 months.

For this one-room apartment, you’ll get about $220 per month, which adds up to a gross yield of about 8%. Take into account your agent, taxes, maintenance and empty months and and you’ll probably end up with about 4.5% depending on how many such apartments you buy, as you’ll have additional fixed costs due to the company & accounting fees.

Is a real estate investment in Astana, Kazakhstan, worth it?

It depends. If your net worth is under than $2 million and you can only afford to buy a few apartments in Kazakhstan as part of your portfolio, this market probably does not make sense because of the added bureaucracy and fixed costs related to managing a company. Also, the upside is fairly limited due to the geography.

If you are sitting on more than a few million USD, then it might be worth it to negotiate a deal with a developer and buy a whole floor of 10 small apartments. It’s a nice diversification outside of the Western world, and into the new Eurasian reality, with limited downside due to a healthy local market. I’d rather have 10 one bedroom apartments in Kazakhstan as a real estate investment than a 20m2 studio in Paris, or a single family home in San Antonio.

But no, this market will not make you rich. It’s just diversification with above average returns.

In any case, Kazakhstan is worth a trip. Next time you fly between Europe and Asia, consider Air Astana and set up a multi-day layover. It has interesting stopover deals.

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Thank you! Do subscribe to the Private List to not miss out on such posts.

Thanks for this very well written article.

Having lived in Astana for a year, I would like to add that despite the vast amount of land available, it is not economically feasible for the government to run utility supply connections and road infrastructure for miles. I suspect this may be one reason for having high buildings in a smaller land area as opposed to spreading out over larger areas of the steppe. In addition, there is a plan to build a green belt around Astana to improve the climate. If this succeeds, it will pretty much set the boundary limits of the city.

Very good insight. Thanks for sharing!