In a world of plummeting demographics, one part of the world is still experiencing booming demographics combined with strong urbanization. Africa, though scary to most investors, presents an extraordinary opportunity in its rapidly growing real estate markets that should not be missed. The Kenya real estate market, particularly in Nairobi, stands out as a prime example of this potential.

In this report, we will analyze the Nairobi real estate market and Kenya’s housing market trends, focusing on one of Africa’s most accessible and dynamic capital cities. It is a market I know well, having myself invested in real estate in the upmarket districts of the Kenyan capital.

Whether you’re interested in buying a house in Nairobi or exploring broader real estate investment opportunities in Kenya, this analysis will provide valuable insights into this emerging market.

Table of Contents

Kenya macroeconomic overview

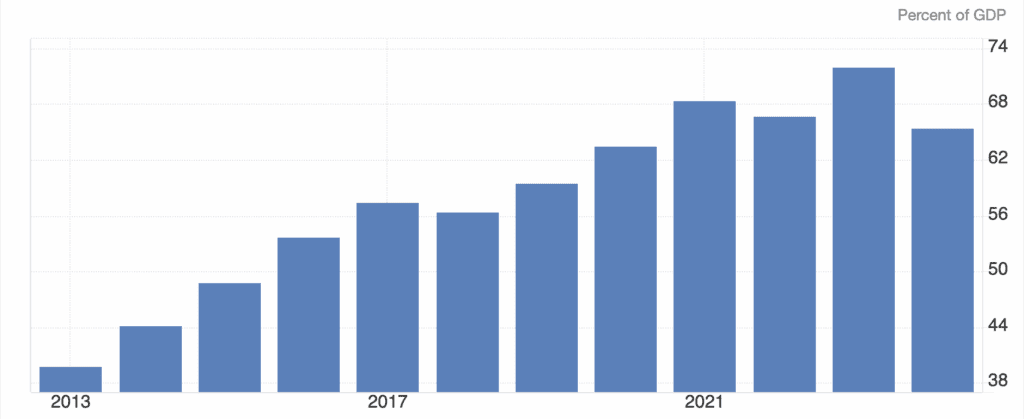

A high Debt to GDP ratio for an emerging economy

Since the 2010s, Kenya has seen public debt rise well above sustainable levels due to its leaders’ appetite for cheap financing of large public works. The country used debt to venture into ambitious infrastructure projects to bolster growth in the country, but they quickly took on more than they could manage. Notably, Kenya took on over $6 billion of USD denominated, floating interest rate debt to China to finance a railway linking the port of Mombasa with Nairobi, a project that has not generated revenue anywhere near expectations. That’s not to mention tens of billions more in multilateral debt to parties such as the IMF and World Bank.

Debt to GDP has now doubled after ten years. Such a deep hole is proving onerous to climb out of, especially given the higher borrowing costs Kenya is now facing and a depreciated Kenyan shilling. Kenya now spends a third of government revenue on debt service. But the situation seems to have stabilized.

Unwelcome austerity measures

The Kenyan government under President William Ruto started immediately enacting austerity measures to keep debt under control and stay in the good graces of the IMF. Such measures have been met with violent popular backlash, some of which recently succeeded in reimplementing previously canceled food and fuel subsidies.

Tax increases are a new measure the government is trying to push on the populace, who are reluctant to accept it when government expenditures remain so bloated.

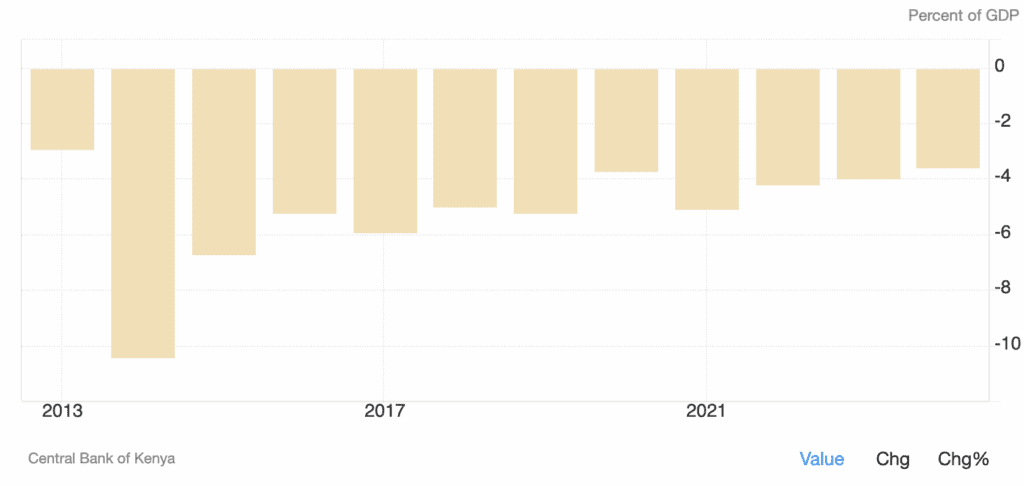

A chronic current account deficit

Kenya runs a chronic current account deficit that has somewhat improved in the last couple years due to lower imports. Much of the Kenyan media say this reflects greater self-reliance on domestic services and manufacturing, though it is more so that the weak shilling makes it hard for Kenya to import as it used to.

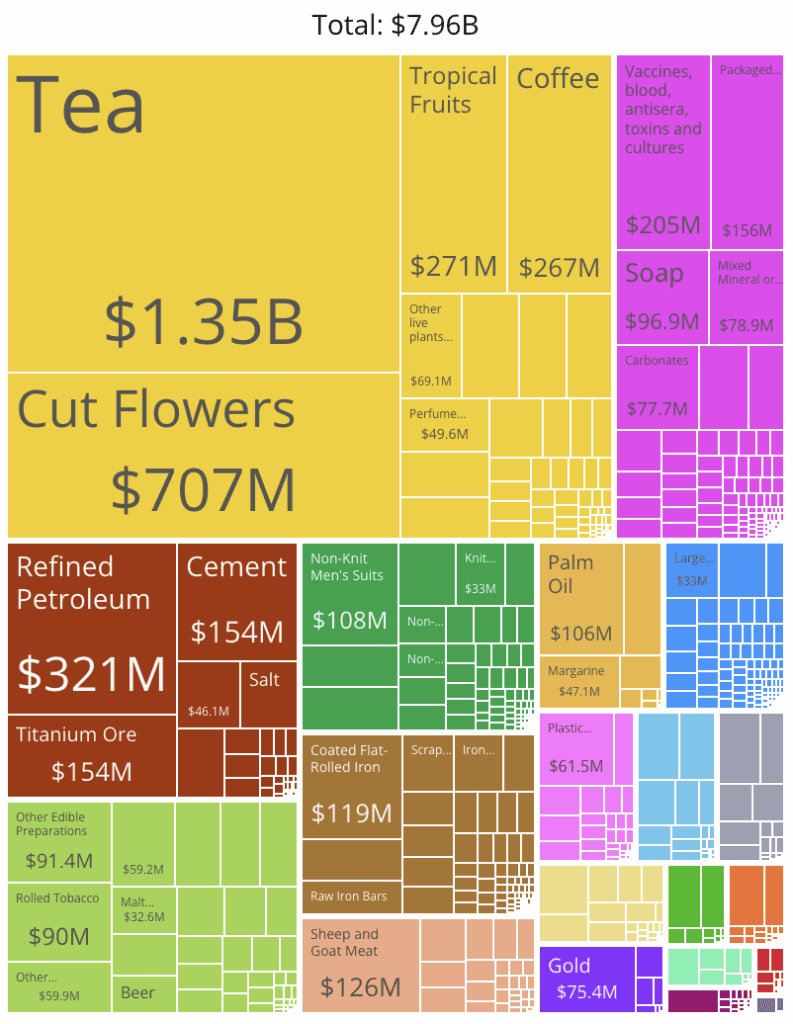

Kenya has a fragmented export sector with goods and services totaling around $14 billion, or 11.87% of GDP.

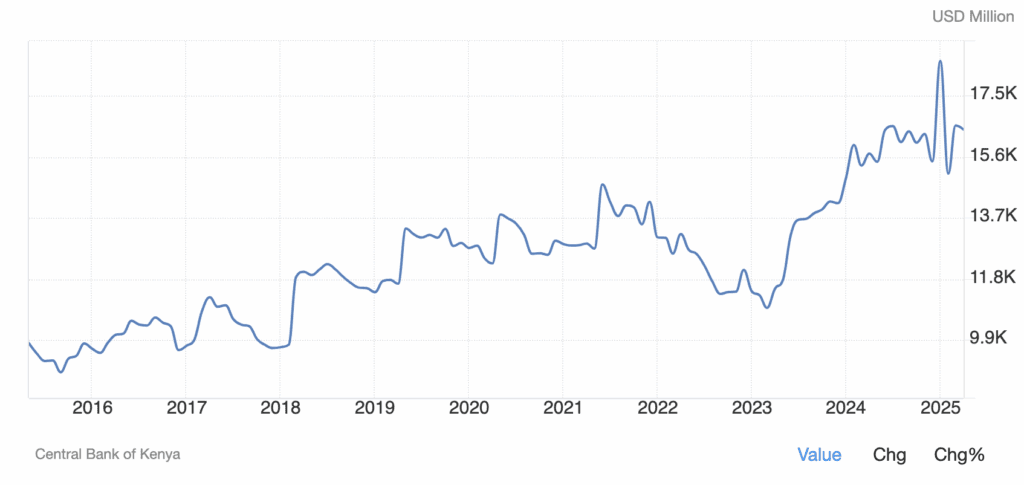

Improving forex reserves and recovering Kenyan shilling

In 2024, with the help of the World Bank, Kenya was able to refinance the balance of urgent Eurobond debt which allowed the foreign exchange stockpile to recover from its precarious situation.

Also, Kenya converted $3.5 billion loans from China into yuan to cut interests back in October. This will save the country $215 million per year.

The Kenyan shilling has responded by stabilizing over the course of this year, ending a long bout of depreciation that started with the pandemic.

Kenya is likely heading for a debt crisis

Ongoing current account deficit, a managed currency, relatively high debt levels, and over a third of government being spent on interest payments alone do not bode well for the country’s debt situation.

A debt crisis and devaluation in the next few years are a high risk. However, I am not too worried about it, not just because it is part of the African frontier market development path, but because Kenya has strong fundamentals.

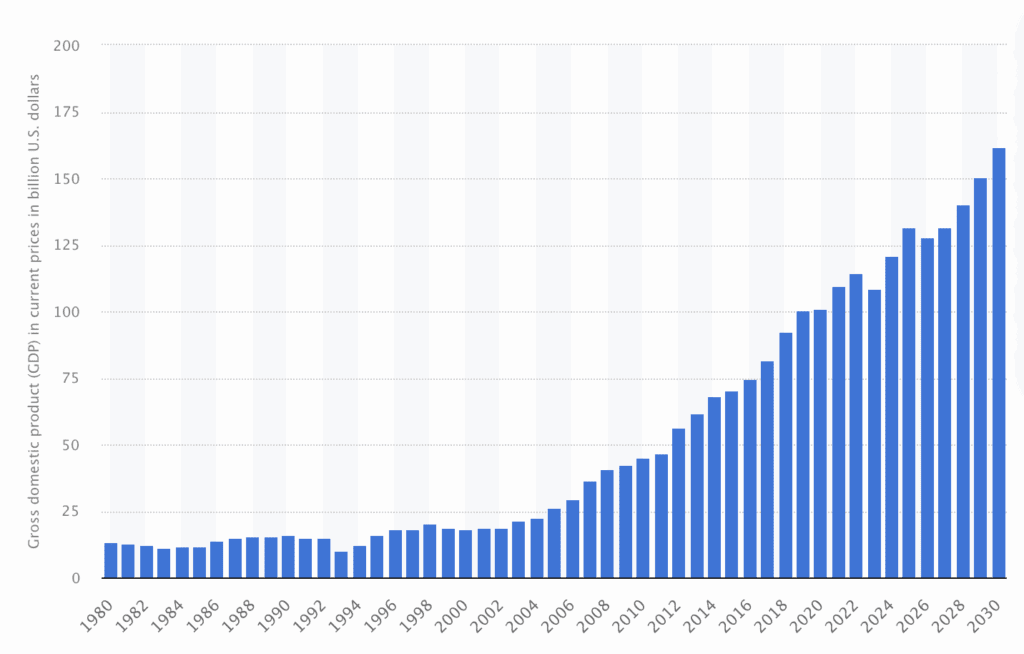

Steady GDP growth

Kenya’s economy has grown on average roughly 5% annually in the last decade. This falls short of the country’s 10% target in Vision 2030 and constitutes an expansion that has not made a significant reduction in poverty, nor grown employment.

The economy remains vulnerable to external shocks stemming from instability in neighbors like Somalia and Sudan, difficulty in securing financing and severe weather events.

However, the reality remains that the country is making steady progress and that Kenya now on average is much wealthier than the Kenya of 10 years ago.

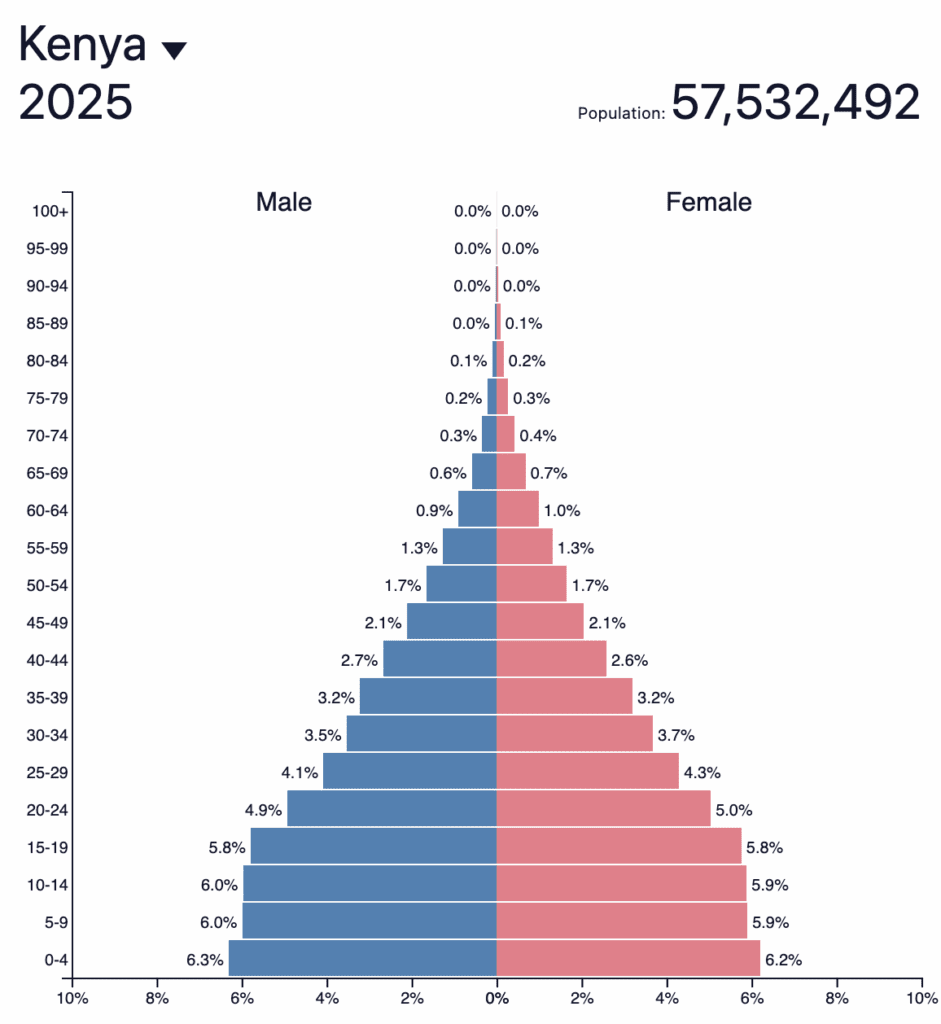

Booming demographics

Like most of Africa, the Kenyan population is growing at a steadfast pace of around 2% annually with a sizable youth population.

The population pyramid is about as expansive and bell-shaped as they come and reflects the high fertility and middling life expectancy in the country.

5 trends with Nairobi real estate market for investors

The first thing to understand about real estate in Nairobi is that it is a data poor environment. You can search as much as you want online but the same, largely irrelevant data just gets rehashed.

The reality is that the real estate market in Kenya has stagnated for a few years. The result is that as prices have risen everywhere in the world, prime real estate in Nairobi has become very affordable relatively speaking. $1,200 per m2 or $110 per ft2 can get investors a really nice apartment in a great part of town.

For a growing capital city, this represents tremendous value compared to other capital cities in the world.

It’s not just a value play. I see Nairobi real estate as offering good cash flow if you focus on some trends.

Nairobi real estate trend #1 : Amenities

Unlike in Europe where such amenities barely exist, Kenya is firmly in the emerging market bloc where amenities are becoming increasingly important for tenants and owners. Though there may be some oversupply in some segments, demand is always extremely strong for any development that offers a decent gym, security, a swimming pool, etc.

The fact that the weather in Nairobi is amazing – never too hot and never too cold, means that people actually get to use the amenities.

Nairobi real estate trend #2 : affordable housing

Kenya has a massive housing deficit running in the millions of homes, which keeps getting worse every year. Affordable housing can offer amazing returns for investors who are fine dealing with the tenant quality that goes with it. For example, this development near the CBD has 1-bedroom units being sold for less than $20,000 and rental returns of gross 15% at full occupancy.

Would I recommend such an investment? Only for people living in Nairobi, or for diaspora Kenyans who understand the environment and have family that can chase down tenants for rent. I can’t recommend such an investment to a non-Kenyan who would just not understand what they are getting themselves into.

Here is a case study of such apartments.

Let’s be clear; the brochure looks a lot nicer than what the reality will be. But still, for people who are equipped to handle it, this is an attractive investment.

Nairobi real estate trend #3 : housing in premium areas

Seeing all the development in premium areas of Nairobi such as Westlands could lead one to think that oversupply will be a concern. I see it very differently for two reasons:

- Kenya has a very high Gini coefficient, which is a measure for income inequality. The unfortunate result is that most of the GDP growth gets captured the by wealthy, who themselves will only invest in prime areas. Thus prime areas will rise in value faster over time than run-of-the-mill middle class areas.

- Corruption and conflict in the region. Money needs to get laundered. As KYC and AML processes become ever stricter in Western countries, the next logical countries to buy real estate for people trying to launder their money or just extract it from zones of conflict is real estate in the Middle East and in the region. Nairobi, as the economic and political hub of East Africa, is a prime destination for such funds. Already Somalis have their own developers in some areas and attract a lot of funds from there, but also money from the Democratic Republic of Congo (DRC) and Sudan finds its way to the Kenyan capital city. Such people don’t buy affordable housing. They tend to buy premium housing in good areas as they can afford it. Also, their goal is not capital appreciation or rental yields as much as it is capital preservation. However such mentality leads to an increase of prices in core, premium areas.

Nairobi real estate trend #4 : housing close to the expressway

Traffic in Nairobi is bad, and in many ways unavoidable. However, the government worked with the Chinese to create a massive expressway that cut right through Nairobi, thus decreasing traffic. As such, being situated next to one of its entrances runs at a premium.

Nairobi real estate trend #5 : the increasing quality of property management

It used to be that most developers would complete a building, hand over the keys, and then disappear. Increasingly developers understand that this can result in chaotic home owners associations (HOA), neglect and then ultimately negatively impacts their brand.

Developers now offer building maintenance services, HOA services, as well as property management for investors. This, combined with technology, makes investing in real estate in Nairobi much easier than it was before.

Real estate to avoid in Nairobi

The worst would be to buy a random building of mediocre quality, without amenities, in areas with a lot of constructions such as some areas of Kilimani, Ngong Road etc. Here you would be buying into the very segment that has oversupply, and that isn’t unique enough to attract quality tenants.

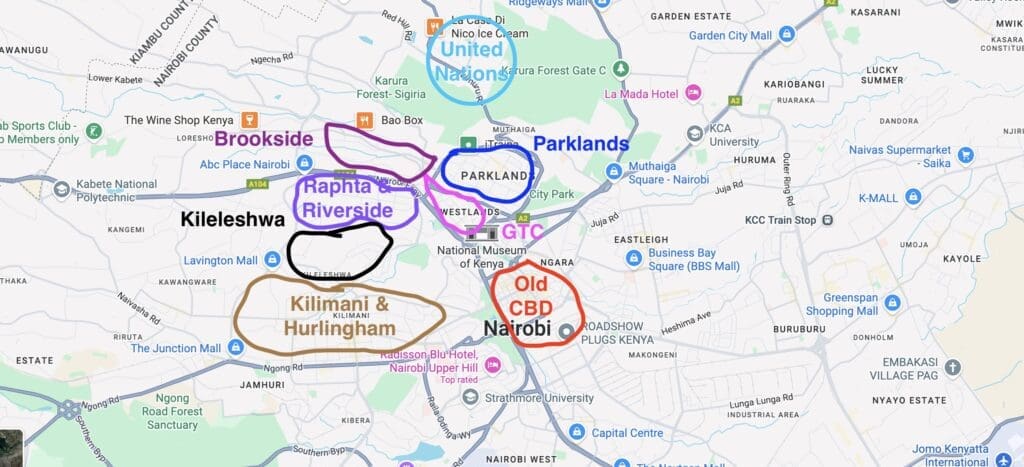

Neighbourhood Overview: Best places to invest in real estate in Kenya (Nairobi)

I drove all over Nairobi. Here are just a few of the neighbourhoods and some of my thoughts on them.

Kileleshwa

An emerging area that is starting to look a bit overbuilt in some corners. But it is close to the center, and the quality of buildings is increasing as well. Property prices are low relative to quality. I saw some small two bedroom, two bathroom apartments going for less than $75,000 off-plan, with some amenities. It would not be hard to find tenants for such units.

Kileleshwa offers good balance between Kilimani level prices and proximity to Westlands (more details on these neighborhoods below)

In this video below, my Nairobi real estate agent Pratik and I checked out some apartments in Kilileshwa and ran all the ROI numbers.

Old Central Business District CBD

The CBD has seen better days. While not particularly unsafe and home to some legacy businesses, the area is past its prime. Money has moved away. However there are some decent opportunities in affordable housing developments in the area for those that are comfortable managing such tenants. Not a bad play for the local experts. If I lived in Nairobi, I’d be sniffing in the vicinity. But I don’t.

There are plans for a new tower, with a focus on commercial. This should help revitalize the area, which is much needed.

GTC (within Westlands)

The GTC is effectively the new central business district of Nairobi, and therefore the new central business district of East Africa, and increasingly the new central business district of Africa.

The main malls and the best supermarkets are all located here. It’s not without a reason that large hotel chains such as the Radisson, the Kempinski, and the Marriott have chosen the GTC for their prime Nairobi establishments. Many international companies such as Emirates, BASF, Standard Chartered, and many more are headquartered in this area, which ensures a constant stream of well paid local and expat tenants.

The GTC itself is very investable. Right now it looks a bit chaotic with all the construction, but it clearly is becoming the new economic heart of the city. There are some very well priced developments in this area as people still don’t quite understand how premium it will eventually become.

Is there the risk of oversupply? In the near term, yes. But if you choose the right units, you will be able to find tenants.

Personally, I bought a penthouse in the GTC.

Raphta and Riverside (within Westlands)

This is a classic locale in Nairobi. I invested here as well. Why? Because it is premium, and will always be premium. Even if they continue to build, I will always be able to find tenants, and prices are likely to increase here and in the GTC more than in other areas.

Why? It has nice boutique malls, is walkable, safe, green, well connected and close to some of the best schools.

If you want to play it safe, you cannot go wrong here.

I bought a few apartments in this neighborhood as well. I show my investment and break down the numbers below in the case study section.

Parklands

Parklands is an interesting case study. It used to be an Indian area, and still is in many respects. But gradually the demographics are changing with many Somalis moving in. As a foreign investor, I am a bit uncomfortable with such demographic change as it’s hard for me to grasp all of the many implications, so I chose to stay away. But it is a premium area, and for people who understand the dynamics better than I do, it could be a decent play.

Parklands is quite visibly undergoing significant growth.

Kilimani & Hurlingham

Kilimani is hit or miss. Some areas are nice, green, leafy and close to Westlands. Others are overbuilt with cheap construction and infrastructure that has not aged well. It’s important to choose the right area within Kilimani.

Overall though, I would skip this area. For a bit more money you can buy a apartment in Westlands where the risk of oversupply is lower. Also, developers compete a lot more on price in this area, as demonstrated by the quality of the buildings. Kilimani is a risky area in terms of development quality. I would particularly avoid Ngong Road due to oversupply and pollution.

Personally, I don’t see the point in investing here, though decent deals can definitely be found.

Brookside and General Mathenge Road

This road/area is an expat favourite. It’s a low risk way of playing Nairobi. I dare say that even though General Mathenge has a stronger expat concentration, some areas of Westlands are comparatively undervalued.

Many buildings of much higher quality can be found here, $2,000 per m2 ($180 per ft2) and demand is strong. The United Nations headquarters are a short drive away, which is a huge source of quality tenants. The United Nations Population Fund is also set to relocate hundreds of their New York staff to Nairobi in a bid to reduce costs and be closer to their areas of work.

It borders Karura Forest, which is a lovely place to go for a walk on weekends. Some apartments even have full on forest views, a highly premium feature. Such units will quite obviously gain in value as the city grows.

Another advantage is that you can access GTC and all the big malls from here without having to cross the highway. International schools are around as well for all the expats and wealthy Kenyans.

This is another low risk way of playing Nairobi. Brookside is very investable.

Investing in other neighbourhoods of Nairobi real estate market

Of course Nairobi is much bigger than this, and there are other investable areas in this growing city. There are some absolutely lovely green, leafy neighbourhoods such as Karen and Nyari. Real estate there is already expensive, and yields much lower.

It is crucial to understand that the city will almost double in population in the next 25 years. The question you must ask yourself is how do you want to position yourself?

Video: My personal real estate investment in Nairobi

My Nairobi real estate agent Pratik took me all over Nairobi for two full weeks and I ended up buying in this development in Westlands. I liked it so much I bought three apartments and my friend Sascha who lives in the areas also bought one.

In this video I explain my thesis as well as all the expected return on investment (ROI) numbers for my Nairobi real estate investment. As you can see, it ticks many of the boxes; full amenities, premium area, close to expressway, management solutions in place, as well as a 2.5 year payment plan.

Case Study: Real Estate Investment ROI Analysis

2 bedroom 2 bathroom apartment in Nairobi

This apartment is a 2 bedroom 2 bathroom apartment in a new Chinese development in Kilileshwa. The amenities are really nice, and even include an indoor heated swimming pool. Here are the expected ROI numbers.

| Price | KSh11,500,000 |

| Stamp duty 4% | KSh460,000 |

| Legal fees 1.5% of seller paid by buyer | KSh172,500 |

| Legal fees of purchaser paid by buyer 1% | KSh115,000 |

| Incidental costs | KSh80,000 |

| Total investment | KSh12,327,500 |

| Monthly rent | KSh100,000 |

Yearly rent @95% occupancy rate | KSh1,140,000 |

| Fees for finding tenants (1 month fee, every 18 months on average) | KSh66,667 |

| Property management 6.5% | KSh74,100 |

| HOA / Services charges 8,000 per month | KSh96,000 |

| Maintenance budget and incidentals | KSh50,000 |

| Total expenses | KSh286,767 |

| Net income pre-tax | KSh853,233 |

| Net yield | 6.92% |

Such rental yields are typical of real estate investments in good neighbourhoods of Nairobi in new developments with amenities. Generally speaking, the smaller the unit, the higher the rental yield.

People make much more on Airbnb, but I see the supply of Airbnbs increasing fast, to the point that they have raised normal rents by 10%, so I wouldn’t base my investment thesis solely on this.

Investor Guide: Nairobi Real Estate Market

Taxes for real estate investors in Kenya

Capital gains are taxed at 15%.

Rental income received by resident individuals is taxed at 7.5% of gross rental revenue. Rental income received by nonresident individuals is taxed at 30% of gross rental revenue.

Enforcement and compliance are weak. Corporate structures can be used to minimize taxes.

Real estate transaction costs in Kenya

Who pays what? It’s important to understand the transaction costs and responsibilities when buying property in Kenya.

- Stamp duty is paid by the buyer: 4%

- Legal fees of the buyer: between 1% and 1.5%. For foreigners I recommend a lawyer that understands the process for, and concerns of, foreigners to buy real estate in Kenya. A very local lawyer will not understand. Safina is the real estate lawyer in Nairobi Kenya that I used for my transactions.

- Legal fees of the seller are almost always paid by the buyer when the seller is a developer. Typically 1%.

- Agency commission when selling: between 3% and 5%

- Various incidental costs borne by the buyer: ~$600

Buyers must obtain a Kenyan PIN, which is a Kenyan tax number. My Nairobi lawyer Safina can help you with this, as well as register online for an Ardhihasa account which is the online platform of the land registry.

Banking in Kenya: Can foreigners open a bank account in Kenya?

Yes, foreigners can open a bank account in Kenya as a non resident quite easily if you show the bank your title deed. I would also recommend signing up for M-Pesa, the Safaricom e-money that is more widely used than cash even. The reality is that you can get away with just an M-Pesa account and crypto to send money back if you want. Your property manager can also send the rental income to your foreign account every quarter, so you can theoretically do without a bank account.

Kenya does not have any exchange control laws. All funds related to investment can freely be sent in and out of the country

Ideal Investor Profile: Who should invest in the Nairobi real estate market?

It’s rare to come across a market that offers both good rental yields and potential for capital appreciation.

- Anyone who wants such a mix in their portfolio, but that is comfortable with the ambiguity and volatility that comes with investing in an emerging market like Kenya.

- People who want to diversify and invest in real estate on the African continent to take advantage of the demographic tailwind.

- Diaspora Kenyans who understand the local environment and who will get much higher returns than wherever it is they live in the West or in the Middle East.

- Regional Africans who want to invest their savings in a safe jurisdiction that lets them do it easily.

- Crypto investors who want to convert their crypto into real estate. Pratik can help with this.

Final thoughts: Is now a good time to invest in Kenya real estate?

People must not mistake Nairobi real estate as a pure “value play” because of how affordable it is, even high-end developments. Property prices are likely to increase over the coming years as Nairobi is disproportionately affordable compared to other capital cities. And while investors wait for a rerating of prices, they get paid very decent rental income. For investors who are comfortable with frontier market risks such as political, economic and social instability. I believe that Nairobi real estate is a great play. Investors must also be comfortable with the ambiguities of operating in such markets.

Make sure to contact Pratik, my realtor in Nairobi

Pratik and his family agency helped me find my own investment properties. They will also be doing the day to day property management and sending me my rental income. I am very happy with the service I received. Feel free to find find out more about Pratik’s Nairobi real estate agent services.

FAQ

Is Kenya a good place to invest in real estate?

Yes, investing in Kenyan real estate is good if you focus on the right neighbourhoods. Property prices are generally more affordable in Kenya than in most other African countries, yet the country is more developed and has strong tenant demand.

What is the future of real estate in Kenya?

Real estate in Kenya will likely see more capital appreciation than rental price appreciation as the current high rental yields are unlikely to exist forever and absolute prices of real estate remain very affordable.

How much does a house cost in Kenya in USD?

Anywhere from $500 per square meter ($45 per square foot) for affordable housing to $2000 per square meter ($185 per square foot) for high end luxury.

What is the ROI on real estate in Kenya?

If you invest in the right developments you can expect gross yields of 10%-11% for long term rentals as well as potential capital appreciation.

Services in Kenya:

Articles on Kenya:

- Nairobi Real Estate Market: Investor Guide 2025

- Outlook for investing in African Stock Markets in 2025

- I bought 3 apartments in Nairobi

- High returns on Nairobi real estate – 3 case studies with ROI calculations

- Why are Chinese Real Estate Developers Moving to Africa?

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Looking to invest in real estate in kenya

Bafra çekici ihtiyacınız olduğunda hızlıca ulaşabilirsiniz. Bafra oto yol yardım, yolda kalan araç sahiplerinin en büyük güvencesidir. Bafra oto kurtarma, her türlü araç için güvenli taşıma sağlar. Bafra oto yol yardım ekipleri her zaman hazırdır.