Cambodia regularly ranks among South East Asia’s most dynamic economies. The local stock market is very limited, so real estate is one of the few options available to get exposure to this long-term growth story.

This report will make the case that though Phnom Penh and Cambodia have all the right long term catalysts in place, the country has been going through a bad real estate crisis and investing is risky. However, if you play your cards right and choose the right developers, very decent deals can be had. It is also a haven for investors who hold crypto.

Key Takeaways

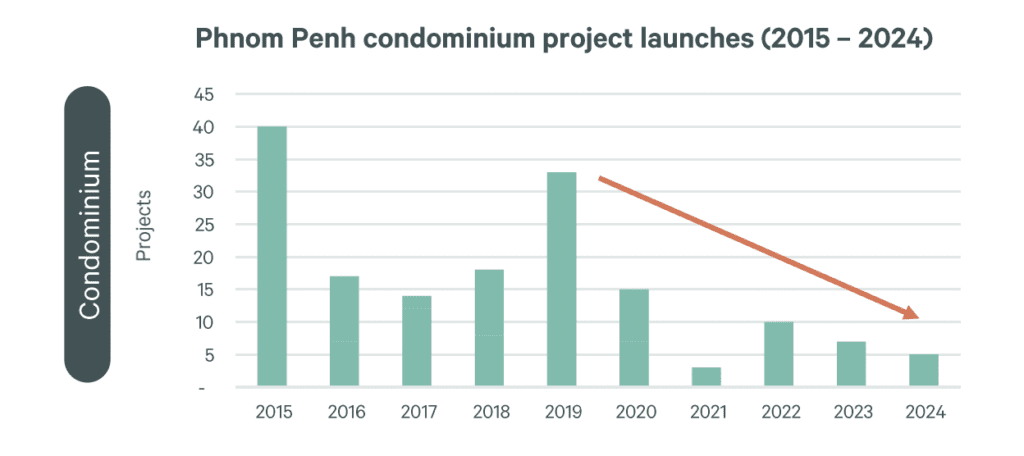

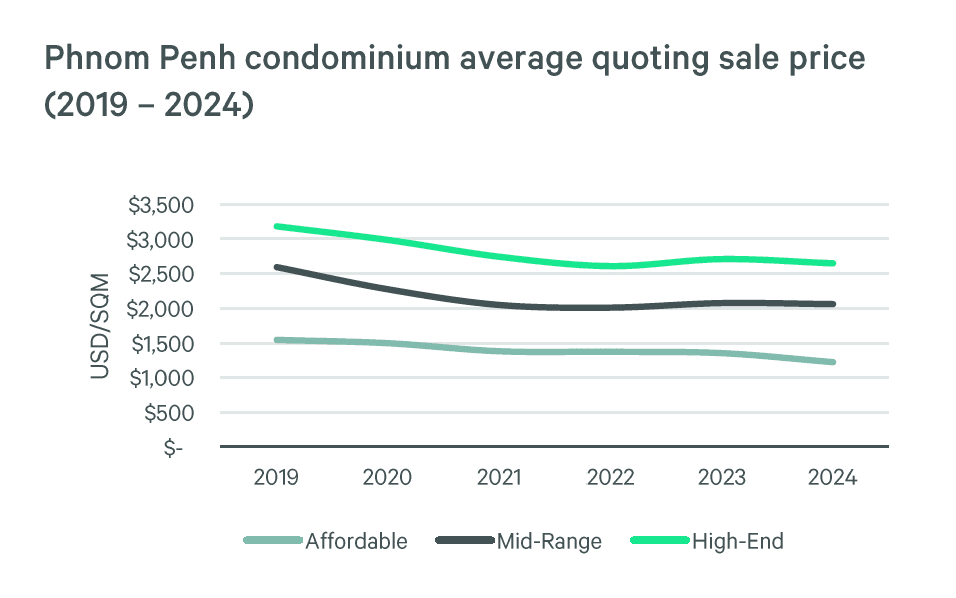

- The market has suffered from a crash since 2019 and the market has bottomed.

- There is oversupply in the market but this does not apply to all market segments.

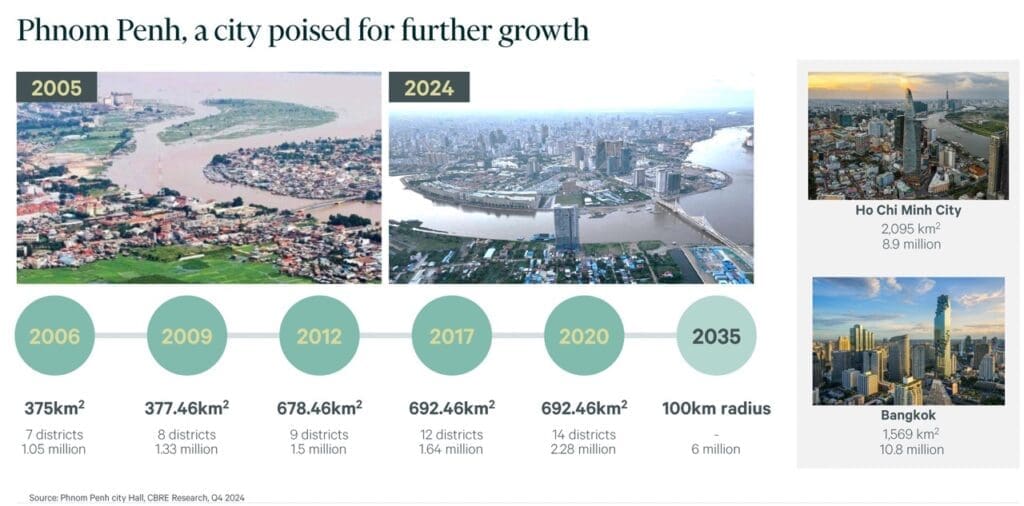

- Phnom Penh is absolutely booming with a flurry of very large infrastructure projects.

- These infrastructure projects are completely upending the neighbourhood dynamics in the city.

- Crypto and physical cash a widely used to invest in Phnom Penh real estate, making it a safe haven of sorts.

Table of Contents

Cambodia macro outlook

A young, gradually urbanizing population

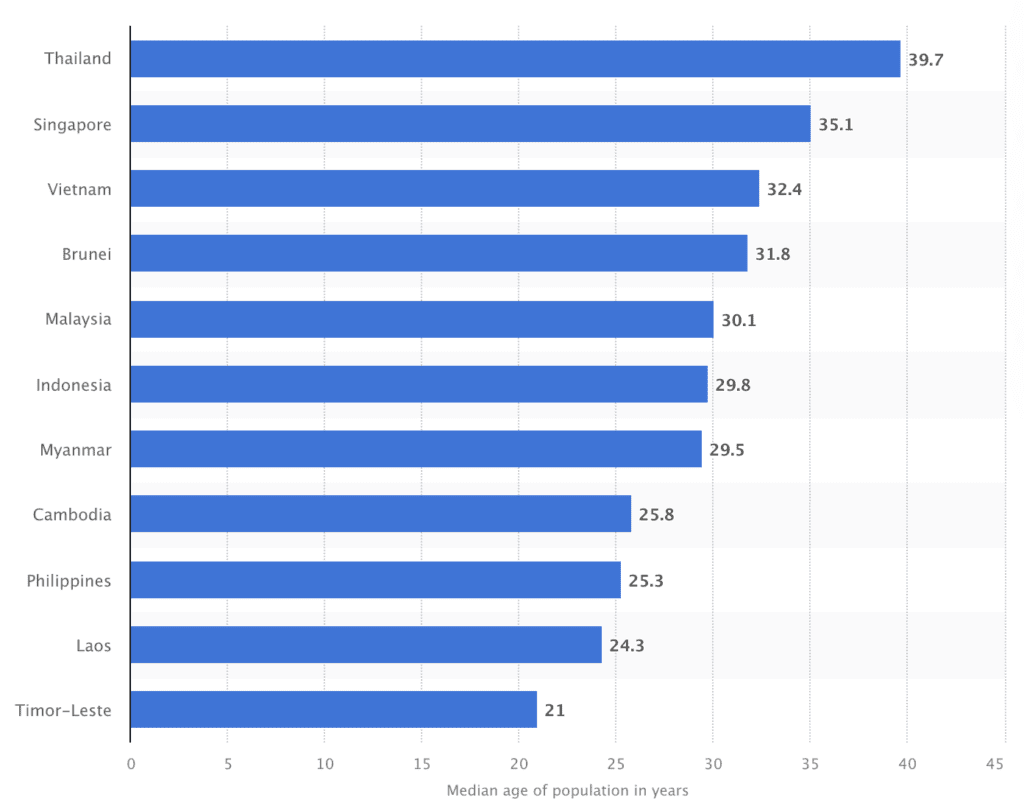

Cambodia experienced many decades of high, but always declining fertility rates. As a result, the country has a narrowing, bell-shaped population pyramid, reflecting a population that is youthful but whose growth is slowing down. Nevertheless, while fertility has declined consistently since the 1980s to 2.32 births per woman, it remains well above replacement and higher than all neighboring countries apart from Laos.

The country has tremendous room to urbanize, with around 74% of the country still living in rural areas. There is a positive, albeit very gradual trend towards city-living which may accelerate given economic trends.

By 2040, the working age population is projected to increase by 18% over 2022 levels.

This is in contrast to other countries in the region such as Thailand which will experience demographic collapse.

Debt to GDP is sustainable and doesn’t pose risk

Cambodia has been taking on additional debt in recent years, but at 35.2% of GDP, public debt remains sustainable and commensurate with economic growth. Loans from China account for about 36% of the country’s debt, with another third consisting of multilateral debt from development banks. The country has a reputation for respectful debt management and is making efforts to taper new loans down to near zero in the next years, though there remains the risk of external shocks disrupting the stability of their debt position.

But at least it’s visible what the debt is being used for; it’s all going into infrastructure development as opposed to going into broke social security systems and a bloated civil service like in Western countries.

A current account in surplus for the first time

Cambodia historically ran large chronic current account deficits. The export economy was always heavily reliant on tourism and as such was vulnerable to shocks, as seen during the Covid pandemic where the deficit ballooned to extreme levels.

But in 2023 and 2024, the current account posted unprecedented surpluses, reflecting the growing scale and sophistication of the country’s manufacturing exports as well as burgeoning investment from abroad.

Growing forex reserves providing a solid buffer

Cambodia has also seen foreign reserves grow in recent years due to increased FDI and exports, to around $27 billion USD. The growth in reserves has improved the country’s ability to resist external shocks and ensure stable imports of essential goods.

The Cambodian Riel has an informal peg to the USD and trades within a range that the Cambodian central bank is comfortable with. Though surprising to many people, this informal peg is a competitive advantage in South East Asia in the sense that it is the only country to operate this way. USD is accepted everywhere, even in daily life in Cambodia. This makes Cambodia uniquely attractive for regional investors (especially Chinese investors) that want USD exposure without going too far away.

Among the fastest growing economies in Asia

Cambodia is enjoying fast growth, with real growth in 4.9% in 2025, and expected to hit 5% in 2026. Total GDP stands at almost $50 billion. Tourism revival, manufacturing sector development and infrastructure investment should provide healthy tailwinds for the foreseeable future.

Booming manufacturing sector driving export growth, led by China

Cambodia is becoming a serious regional manufacturing player, with most finished products exported to other markets. Currently the country’s export profile is dominated by manufactured goods in the garment and travel goods sector, while agricultural and electronics output is also starting to tick up.

China is spearheading the push to make Cambodia a major manufacturing center to take advantage of its affordable labor and good connectivity. China now accounts for 47% of foreign direct investment in Cambodia, the lion’s share going into manufacturing concerns. No doubt, they will benefit massively from Chinese skill transfer and the technological sophistication of the sector should increase rapidly.

Exports in many categories enjoy duty-free access to several major markets due to various free trade agreements, and the government has been proactive in establishing Special Economic Zones to facilitate business activity and investment.

A third of exports are US bound

Over 36% of Cambodian exports are destined for the United States. Previously, Cambodia was on America’s Generalized System of Preferences list, a regime aiming to bolster local industry in developing countries by allowing them to import travel goods duty free to the US. They were removed due to human rights concerns in 2020.

Considering the rising Chinese influence and investment in Cambodia, the country could easily end up suffering collateral damage should tensions rise between the great powers. Already Cambodia got slapped with a 19% tariff on imports into the US, but it’s main competitors Vietnam and Bengladesh also got slapped with 20% tariffs, thus minimizing the impact.

Long term catalysts for the real estate market in Phnom Pehn

Apart from the aforementioned economic and demographic drivers, there are a few more catalysts in place for Phnom Penh real estate.

Ambitious infrastructure plans

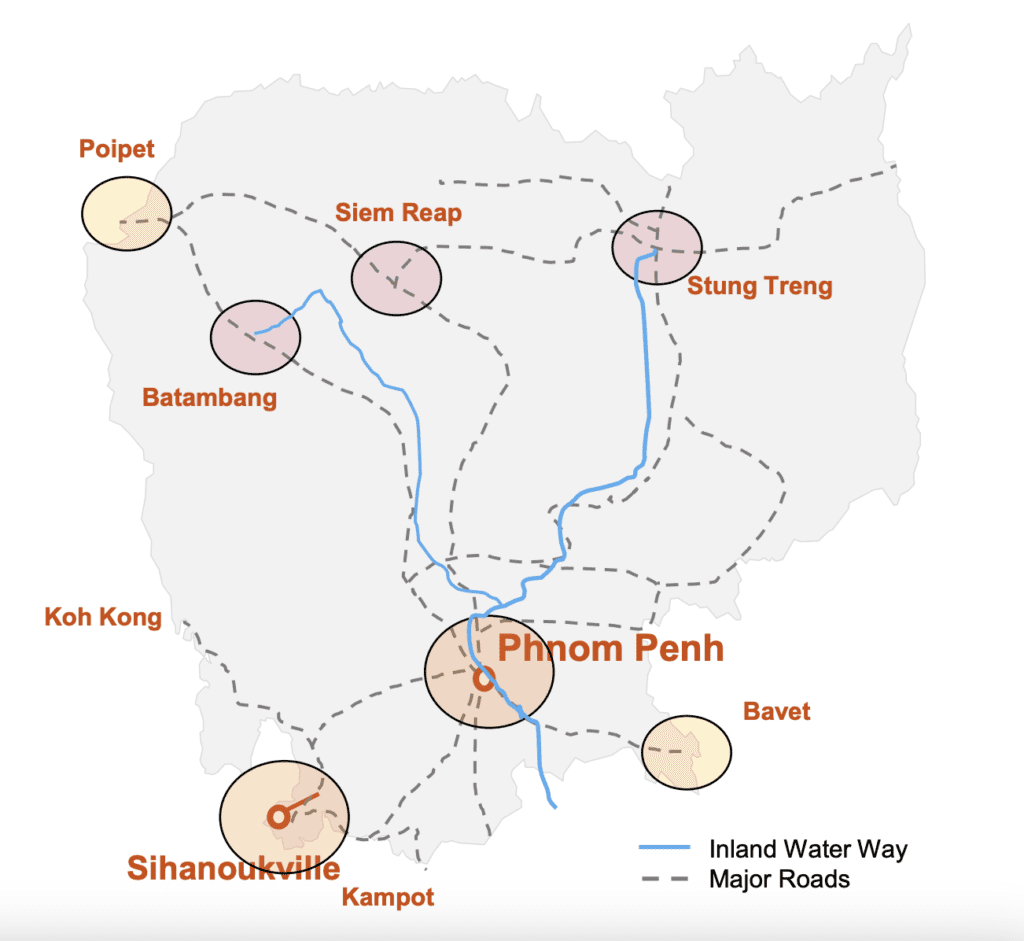

There is also growing investment (also led primarily by China) in projects to prepare the economy for growth and connectivity to global trade. The “Rectangular Strategy” of the last several years prioritized investment in physical infrastructure for transport, energy distribution and internet connectivity. Phnom Penh will be at the very heart of all this infrastructure development.

Given Cambodia’s low levels of public debt and breakneck growth, there is decent room to finance more public works without leading the country into a precarious situation.

New deep-water port at Kampot, development of roads and highways

Cambodia currently has one deep-water port that can accommodate large cargo ships at Sihanoukville. Efforts are underway to expand the depth of this port to accommodate ships with even larger payloads. A private company has also started work on a second $1.5 billion deep-water port at Kampot near the Vietnamese border.

Both ports will be connected by expressway to Phnom Penh and other major cities.

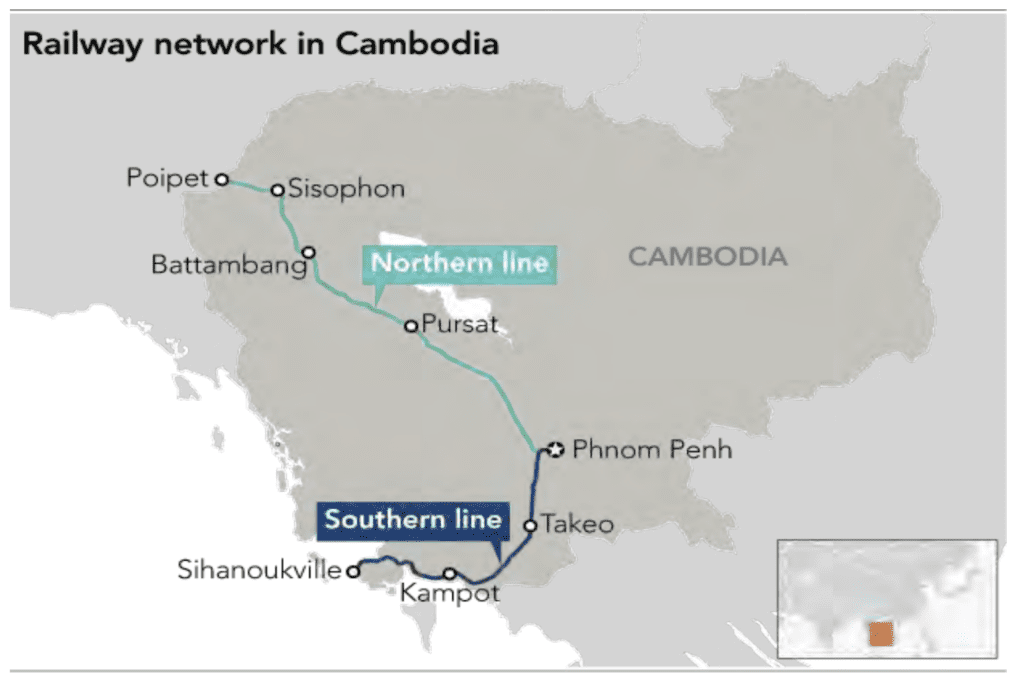

Unlocking potential of the rail network

Cambodia’s railways currently handle only 1% of the country’s freight.

The national rail network has undergone consultations with the China Railway Construction Corporation to expand and modernize. The national rail company has been actively acquiring cars and locomotives as well as upgrading existing rail lines and exploring feasibility of adding cities to the network.

Increasing rail capacity along this corridor is viewed as essential to reducing overland congestion and freight costs.

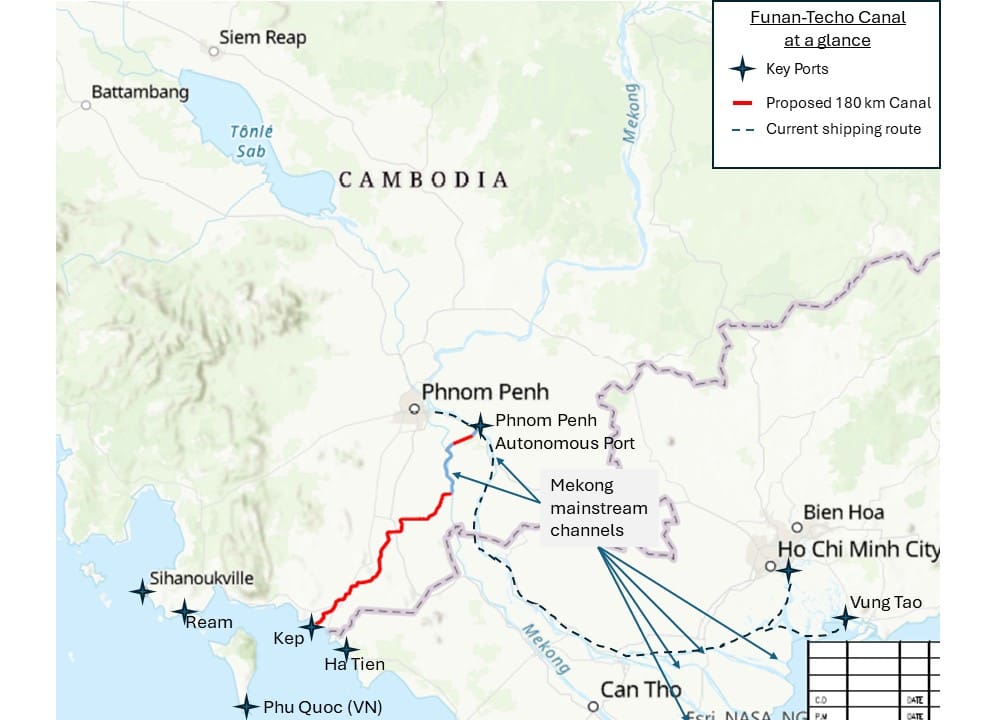

A new canal to Phnom Penh

Cambodia has started building a massive canal to the Mekong River near Phnom Penh. Why? To reduce dependency on Vietnam which controls access to the sea from the Mekong River.

At the same time as Cambodia is building a new highway from Phnom Penh to Vietnam to increase trade, it is also hedging its bets by seeking to reduce dependence on a neighbour that has been known to meddle in its affairs in the past.

Cambodia wants to be resilient.

A massive new airport in Phnom Penh

Opened in December 2025, the Chinese- financed Techo International Airport replaced the existing Phnom Penh International Airport. In its first phase it will be able to handle up to 13 million passengers a year, in its second phase up to 30 million passengers, and in its final phase which is planned for 2050, up to 45 million passengers a year.

It is truly a superb piece of architecture.

Cambodia has big plans and is implementing them.

Cambodia is seen as a dollar play and safe haven in Asia

This is an ongoing catalyst. As geopolitical tensions remain high in the world, many Asian investors are happy to buy assets in Cambodia which gives them exposure to the USD. Real estate in Cambodia is effectively USD denominated.

Also, Cambodia is very easy in terms of banking, and KYC requirements when purchasing real estate. This drives a constant flow of billions of dollars of inflows into the economy as they are welcome here, as opposed to questioned in other markets.

Buying real estate as a foreigner is easy. You can do so with crypto, just a passport, even remotely, and once you are in Cambodia you can get a non-CRS bank account which won’t automatically share your account information with your home country. In a world of increasing complexity and compliance, these aspects are a key competitive advantage for Cambodia.

As South East Asia and South Asia develop, Cambodia is also one of the few countries in Asia where foreigners are able to buy real estate / own full title deeds in their own name without restriction or having to buy into sketchy long-term leases. A non trivial portion of Asia’s new found wealth will end up in Cambodian real estate, it’s inevitable.

Also, Westerners fail to understand the psyche around real estate investing in Asia. People are not focused on cash flow. They are focused on wealth preservation and capital gains. Asians can bid real estate up to levels unimaginable to Westerners.

This could very well happen in Cambodia.

The real estate market in Phnom Penh

I remember going to Phnom Penh in 2018 to look at real estate opportunities. Quickly I realized that the market was in frenzy mode and that I should not invest there at that point in time. I was right. The market crashed and has since then been either been going down or started consolidating (recently).

This being said, the city changed so much in seven years that I barely recognized it.

Buying now is buying when the market is at its most negative. When I was meeting with local investors, bankers, and expats, everyone was negative – I like this. This is when you want to enter a market. Obviously, I am not saying it will be easy money or provide high rental yields, but it is not the worst time to enter Cambodian real estate to diversify.

You are not alone

The market for condos in Phnom Penh is very international.

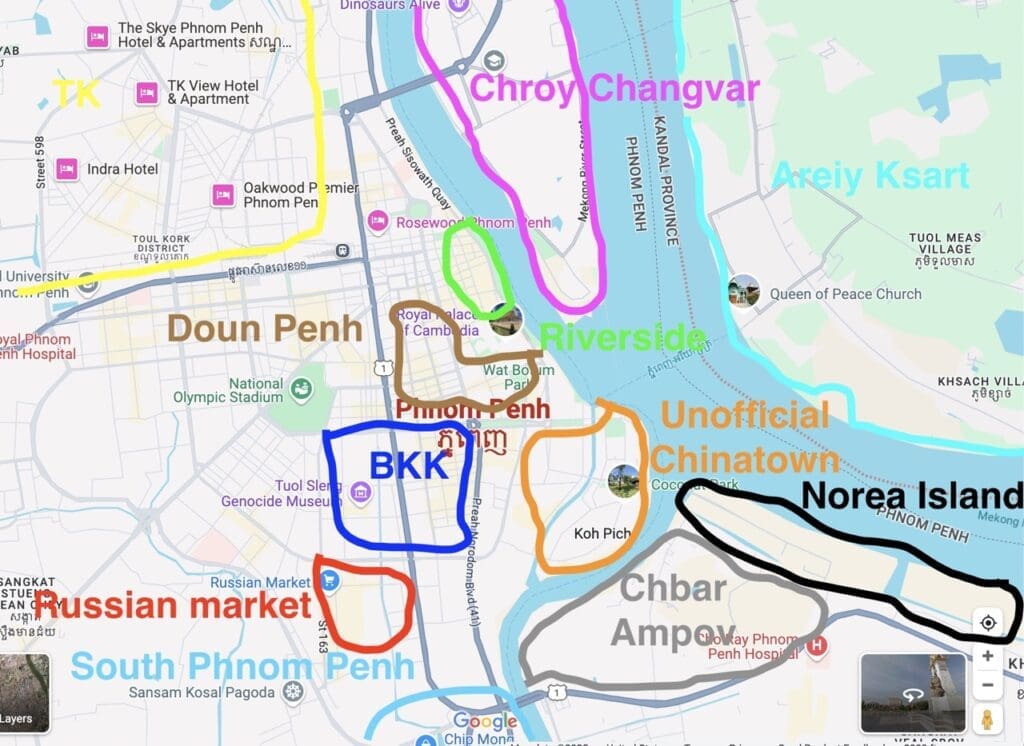

In which neighbourhoods to buy real estate in Phnom Penh?

Firstly, it is important to have a look at the major infrastructure developments in Phnom Penh to give us investors a good overview of where the growth will be.

The bulk of new infrastructure development is expected to be in the South, East, and North East. The old airport, which is to be discontinued later this year, is in an area that will be stagnant for a while. People with money, who tend to travel a lot, will probably look at these new developments when choosing where to move to. None of this happens overnight, but the trend is clear.

In this section we’ll be looking at each neighbourhood.

Real estate in Riverside, the French neighbourhood of Phnom Penh

This is the first place you typically arrive to as a tourist in Phnom Penh. It’s where most of the historical French colonial buildings are found. Investing here as a foreigner is a little complicated as most offer on the market is for old colonial “shophouses” that often have title deed issues. It’s far from impossible, but certainly complex.

Also, there are some new buildings on the river, but they are mostly leaseholds as opposed to freehold.

There is absolutely a market for expats. Europeans like to stay in this area, particularly the French, as well as other retired foreign men as this is one of the main areas for girly bars.

As an investment I find this area a bit over-complicated. But do check out the amazing French restaurants.

Real estate on and near Diamond Island, aka “unofficial Chinatown”

Chinese investment has taken over this area, as well as Chinese people. More Chinese people live here than Cambodians. It’s also visible in the selection of stores in the area, that mostly cater to Chinese people. The area is nice and modern, but one must be careful with build quality. Some nice looking Chinese-build buildings are of horrific quality, while others are fine. The quality issues are not always immediately visible. If you want to buy in an existing building, I recommend booking an Airbnb inside that build for a night or two to get a feel for it.

I don’t think this area is a bad investment, especially as it will become more central as the city develops East across the river. I would just advise investors to be a bit cautious as this area runs on its own Chinese dynamics, which are harder to understand. For example, vacancy rates are high because Chinese investors like to keep apartments “new”. So what could be a negative (no lights at night in a building), is not necessarily a bad thing if you understand the context.

Some of the developments are built like fake French Hausmaniens buildings, Arch of Triumph included. All of this right next to modern looking buildings. The whole area is an acquired taste.

Again, nothing wrong with it. But it’s just a bit more complex for a non-Chinese to understand.

Real estate on Norea Island, the future luxury man-made island

This artificial island is currently being developed. A few high end buildings are already present but many more will be built. With the highway to Vietnam being built and the bridge to Areiy Ksart to be built, this area will see strong growth in the years ahead. For now, there isn’t much yet, but the boom is inevitable.

Real estate in Chbar Ampov

This area is hit or miss. Near the Southern part is already developed, in an ugly way. In the North close to Norea Island is much more interesting but very little has been done apart from a single luxury tower. This area will take a long time to develop. If I were to invest there I would only do so along the river, in the North, or the East where urban planning will be good.

Real estate in BKK, the heart of Phnom Penh

This is classic Phnom Penh, where expats like to live, where the best restaurants are located, where the local elite likes to hang out as well, and where the best nightlife is situated. You can’t go wrong from a neighbourhood point of view by investing here. It’s walkable, it’s livable, and has all the conveniences one might need. Inevitably, it’s also one of the neighbourhoods with the strongest rental demand and liquidity. BKK 1 is the best, but BKK 2 and BKK 3 are also completely acceptable. The latter two come at a 20%-30% discount.

Real estate in Doun Penh, the palace and banking district

Hard to go wrong here. It’s a less “exciting” area than BKK but there are nice residential areas and buildings. Many of the HQs of local banks are also in this area, as well as the main palaces in the country. You see many tourists walking around here. It’s also a very decent area to invest in as the palaces are not about to go anywhere.

From an investment point of view, I still prefer BKK and Russian market as they are closer to the city’s southern development.

Real estate in Chroy Changvar

This quasi island neighborhood will inevitably see development as the new Siem Reap highway gets built and as the two extra bridges get built. For now it is a very random mix of luxury mansions, dilapidated homes, nice developments, not-so nice developments, and empty land.

It’s not a bad long term bet but finding tenants in this area is currently not that easy as it is still far away without this infrastructure in place. You need to balance the long term prospects of the area with the depreciation of your condo and the low yields. I’d invest here only if I found an amazing deal.

Real estate on Areiy Ksart

For now this area is composed of a small town and a lot of empty land. The speculation here is land until at least one of the two planned bridged gets built (one to Norea Island and the other to Chroy Changvar). For now one must take a ferry across the river. It’s pretty quick and cheap – about $1 for the crossing with a bike if I recall correctly.

I wouldn’t buy any real estate here, only land. But much of the growth is already priced in. I don’t think I’m that patient.

Real estate in TK

It’s one of the high-end neighbourhoods of the city with a lot of expats, offices, and wealthy locals. You even find Lamborghini, McLaren and Aston Martin dealerships in this area. Yet, I would not invest here. Why?

Because this area being premium made sense when it was close to the airport. Now that the old airport is about to close, people will overtime prefer to live closer to the new airport and not have to cross the whole city. It’s on the wrong side of the city’s development plans. Also, there is way too much empty land which will only cap upside.

In my mind TK is a complete write-off from an investment point of view.

Investing in Russian Market real estate in Phnom Penh, primed for growth

This is one of my favourite neighbourhoods from a real estate investment point of view in Phnom Penh. Why?

- It in on the path of development towards the airport but a 5 minute tuk-tuk drive away from core BKK

- There is already a significant expat population living there as the area is growing and increasingly has nice restaurants and bars

- It comes at a 30% discount to BKK

Real estate in South Phnom Penh on the way to the airport

The infrastructure is being built, as well as many developments. Many malls are being built. This area is a very decent speculation and I think will be easier to find tenants than in the developing areas the other side of the bridges because of how close it is to BKK and the new international airport.

This area can be a hit or miss. There are random developments of luxury homes going for a few million dollars that don’t look like much. It’s still very much in its infancy and the market is trying to find itself. But with proper due diligence this growing area is a good bet.

Video case studies of investing in Phnom Penh real estate

Average gross price per square meter per neighbourhood

Remember that these numbers are gross, not net. As the calculation methodology between gross and net is not regulated in Cambodia, both “gross” and “net” mean very different things from development to development.

The rental market is also very international

Most renters in the nicer condos (which these numbers track) are foreigners. Here are roughly the expected rents per neighbourhood.

Keep in mind that there is a massive occupancy variance between buildings. Some buildings are nearly empty, while others have near-full occupancy at all times.

Choosing the right condo building and developer is absolutely crucial. Untac my Phnom Penh realtor can help with this.

Ownership structure options for foreigners investors

There are a few types of ownership structures in Cambodia available to foreign investors.

Condos

Foreigners can own up to 70% of any given condo building from the first floor and up (not the ground floor). This is the most straightforward foreign ownership structure in Cambodia. Typically this is what these new condo/apartment towers offer.

This does not work for land or houses.

Buying real estate in Cambodia through a local company

This one is quite common as well. The structures work like this:

- A Cambodian owns 51% of the structure

- You the foreigner own 49% of the structure

- The Cambodian owner is stripped of decision making and of economic benefit rights

It’s much stronger than the nominee structure, but can be quite risky.

Using a nominee to buy real estate in Cambodia

This one is also very common, but very risky. Essentially you give the money to a local that buys the land in your name, and you have a side notarized contract with the Cambodian stating that you are actually the owner. This type of arrangement rarely stands firm in court, and even if your Cambodian partner is honest, if he/she dies, gets divorced, or gets sued, then you could lose it all. Absolutely not recommended.

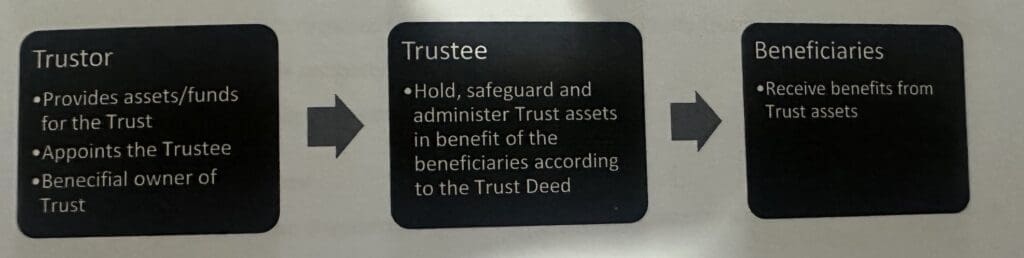

Using a trust to buy real estate in Cambodia

This is a new type of structure that appeared a few years ago but that very few are aware of in Cambodia. You can get a bank or law firm to buy land or a house (the trustee), but you ultimately control (trustor) and benefit (beneficiary) from the house. There are some set-up costs as well as on-going fees, but this ownership structure is iron clad. Cambodian trust law has been based on Australian trust law.

Feel free to get in touch with Untac, my realtor in Phnom Penh and Siem Reap, he can introduce you to a bank that does a very good job with trusts and can help you in English.

Type of title deeds for real estate in Cambodia

There are multiple types of title deeds in Cambodia. It can be quite complex initially to understand the various options out there. You must be very careful very buying.

Strata title

This is the most straightforward. It is essentially a full title deed for an apartment in a condominium association. You really own your apartment. This is what you want.

Leasehold

Sometimes you come across what you think are amazing deals for apartments in Phnom Penh. The location is amazing, the price is unbelievable, but then you find out it’s a leasehold. What does this mean?

If you are told the apartment is a 50 year leasehold then effectively it means that after 50 years the apartment will revert back to the landowner. Effectively, you are just renting for 50 years.

Points to be careful about:

- Even if you are being told it is a 50 year lease, maybe there are only 40 or 45 years left on the lease. Check the number of years left

- You will often be told that the lease is “renewable”. Sure, but you must check that it is actually renewable. I’ve come across developers that would tell me a lease is renewable but then could not show any paperwork proving it.

Generally speaking, leases are fine for foreign retirees that want to buy a place for a good price. But for investors it is tricky to make money on those.

Soft title

When you buy land in Cambodia, you can also come across “soft titles”. Soft titles are ownership titles at the communal and commune level. They are far less secure than hard titles. The issue with soft titles is because the ownership database is not centralized, they can be multiple concurring claims at times which would be very hard to find out about.

The objective of the government is to gradually turn soft titles to hard titles. When this happens, a fee is due for the conversion.

Essentially, soft titles are not a complete no go, but they are absolutely not risk-free. I’d be very careful.

Hard title

Hard title is what you want when buying land. It is land that is in the governments cadastral central database and the ownership is clear and without ambiguity. Many of these hard titles have QR codes. Banks will lend against hard titles, but hardly ever against soft titles.

What are the taxes on real estate transactions in Cambodia?

There are four types of taxes on real estate in Cambodia

Taxes on rental income in Cambodia

If you are a Cambodian resident, you are expected to pay 10% of gross rental income. If you are a non resident, you are expected to pay 14% of gross rental income. Enforcement is practically non-existent.

VAT on real estate in Cambodia

If you own your real estate through a company and decide to rent out, you are expected to add 10% VAT whether you rent out to a natural person or legal person. This actually gets enforced,

Property taxes in Cambodia

There are yearly property taxes. The rates vary but are typically very low. It’s a non issue.

Capital gains taxes in Cambodia

The government has been talking about capital gains taxes on real estate for many years, but still hasn’t passed a law to this effect. For now there aren’t any capital gains taxes.

Transfer taxes in Cambodia

The standard transfer tax to be paid by the buyer when purchasing real estate in Cambodia is 4% of the value, with an exemption for the first $70,000. There are at times further exemptions such as right now up to $210,000 for someone’s first property in Cambodia, if bought directly from a developer.

Case study of rental yields for a condo in Phnom Penh

This one bedroom apartment is being sold off plan with a 4 year payment plan in Russian Market. It’ll have full amenities such as rooftop swimming pool, tennis court, gym, private club, children’s area, etc.

Such a condo costs about $60,000, with 40% due at the end, which reduces risk. It can also be paid entirely in crypto.

| Price | $60,000 |

| Approximate closing costs | $3,000 |

| Furniture | $5,000 |

| Total investment | $68,000 |

| Monthly rent | $450 |

| Yearly rental income @ 75% occupancy | $4,050 |

| Property management 10% of yearly rental income | $405 |

| Finding tenants fees (75% of one month based on occupancy of 75%) | $337.5 |

| Yearly building management fee $1 per m2 per month | $564.00 |

| Yearly Property tax | $100.00 |

| Yearly budget for various maintenance and issues / furniture replacement | $250.00 |

| Total yearly expenses | $1,656.5 |

| Net yearly income | $2,393.5 |

| Net yearly rental yield pre-tax | 3.52% |

Typical agents and the developer will try to convince you that you can make 8% or 10% net yields. They are lying. Such high yields do not exist in the Phnom Penh real estate market. These numbers here are much closer to reality. In most cases net yields hover between 1.5% and 2%. This project is the best I found in Phnom Penh.

Who should invest in Phnom Penh real estate?

Cambodian real estate is not for everyone due to the low nature of rental yields. Asians are much more accustomed to such rental yields as they view property mostly as a capital preservation or capital gains play, not so much as a cash flow play. This is hard to understand for Westerners.

With this in mind, these are the people for whom Cambodian real estate makes sense as an investment:

- People with crypto who don’t want questions asked

- People who want minimal KYC and AML questions by banks when they buy real estate. They want to be able to buy real estate without the fear of having their funds frozen or rejected. In most cases Cambodian banks are easy to deal with and are quite understanding of people’s situations.

- People who want to live in Cambodia, for them buying can in many cases make more sense than renting

- Asians who want dollar assets in real estate without having to invest across the world

- Westerners who want deep diversification away from their own markets, in a market that has decent prospects for capital gains and some tolerable rental yields

Get in touch with Untac to buy property in Phnom Penh

Untac is my realtor in Phnom Penh and Siem Reap. He helped me analyze the whole market and can help you with you investment objectives in Cambodia. He can help you find interesting new projects with good payments plans, can assist you with creating trust structures, can help you convert your crypto into real estate and can put you in touch with good lawyers and property managers.

Services in Cambodia:

Articles on Cambodia:

- Phnom Penh Real Estate Market: 2026 Investor Guide – Boom or Bust?

- Siem Reap Real Estate Market: Investor Guide

- Phnom Penh Real Estate in Cambodia ROI Breakdown & Rental Yield Case Studies

- Opportunity after the Bust? Real estate in Sihanoukville, Cambodia

- Foreigners Can Own Land and Houses in Cambodia: How to structure your Cambodia real estate purchase

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

FAQs: Investing in Phnom Penh, Cambodia Property

Is buying property in Cambodia a good investment?

Investing in Cambodia is very decent for Westerners who want deep diversification away from their own markets, in a market that has decent prospects for capital gains and some tolerable rental yields.

Can a foreigner buy property in Cambodia?

Yes, foreigners can purchase real estate in Phnom Penh, Cambodia. The primary ownership structures include: direct ownership for some condominiums, through a local company, using a nominee or using a local trust. Some of these options are risky, while others are not.

How Much Does Phnom Penh Real Estate Cost?

It varies from $1,000 to $4,000 per square meter depending on the type of building and neighbourhood. Decent investments can be found for between $1,500 and $2,500 per square meter

What’s the Best Area to Buy Real Estate in Phnom Penh?

It really depends on your specific objectives, but currently most of the investment flows are going into BKK, Russian market, the south of Phnom Penh, and the east of Phnom Penh.