El Salvador almost never attracted international attention until a few years ago. Whenever it made headlines, it was related to its sky-high crime rate. In 2019 a new president was elected, Nayib Bukele, who then proceeded to radically change the country. He made two key controversial reforms which transformed the image of the country and that will inevitably have an impact on the El Salvador Real Estate Market:

- He legalized Bitcoin as everyday currency / legal tender, though this was revised.

- He threw all supposed criminals into prison without due process, thus making El Salvador extremely safe.

El Salvador now makes headlines on a regular basis, which is impressive for such a little country. But does investing in El Salvador’s real estate market make sense?

As a full-time investor, I was quite intrigued, and as there is barely any information online about the Salvadoran market, I booked a one-way flight to El Salvador to gain on-the-ground insight into what is happening and what the opportunities are.

This report is the result of two trips. One of two weeks of tirelessly exploring the country and meeting with lawyers, realtors, local business people, government officials and expats who have made El Salvador their home, and another of a few days to zero in on specific locations.

I flew in from Cancun, took Ubers, walked around, rented a motorcycle, took the local bus, and left on a boat to Nicaragua. I got an authentic experience of the country.

Before going into the specifics of the El Salvador real estate market it is important to start with a macro analysis of the country.

Table of Contents

El Salvador’s Economy

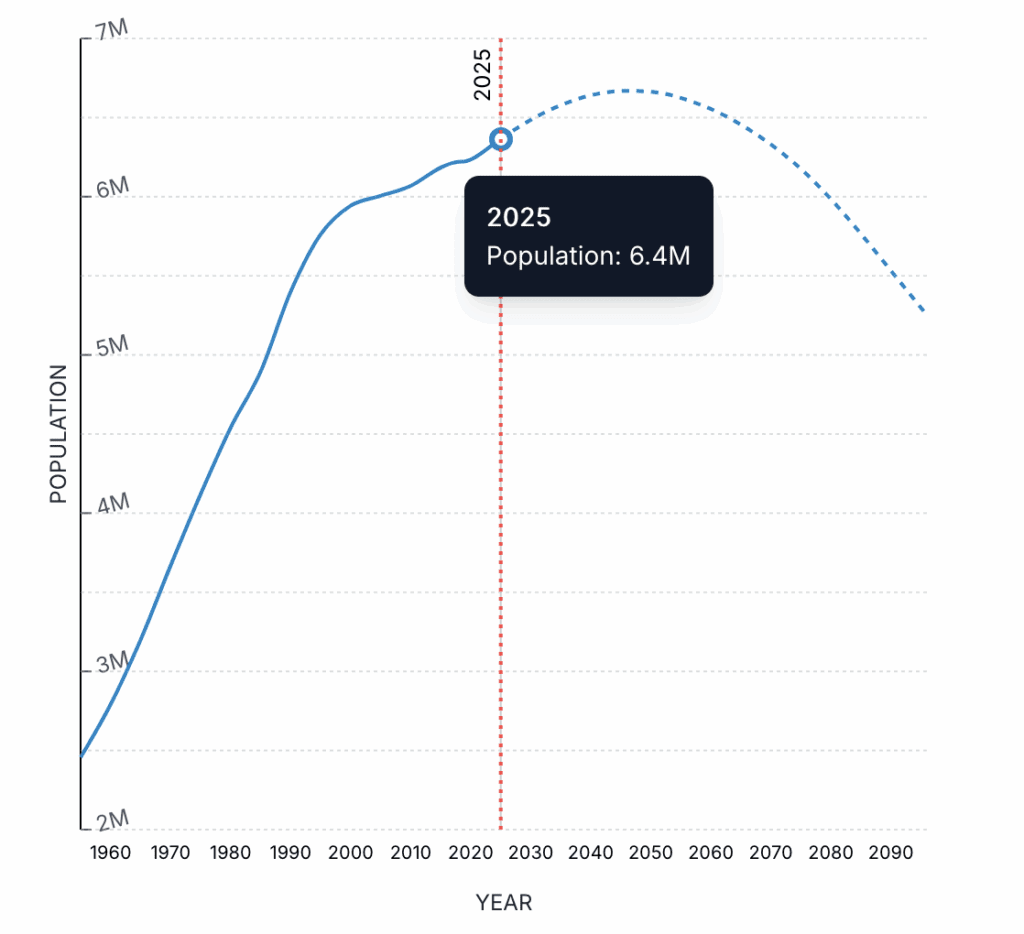

A complex demographic outlook

In many countries demographics are easy to figure out. Italy and Japan are becoming old, while Egypt and Africa in general are extremely youthful.

In El Salvador’s case the situation is more nuanced.

On the one hand the demographic outlook is somewhat respectable for the next 20 years.

On the other hand, the fertility rate of 1.82 children per woman is relatively low for the region.

However, these numbers fail to account for the massive emigration of Salvadorans to North America. If the thesis of investors is that Bukele will turn the country around, then emigration would theoretically slow down or even reverse, and the country could see inflows from other Central American countries. This would completely alter the landscape for the real estate market in El Salvador.

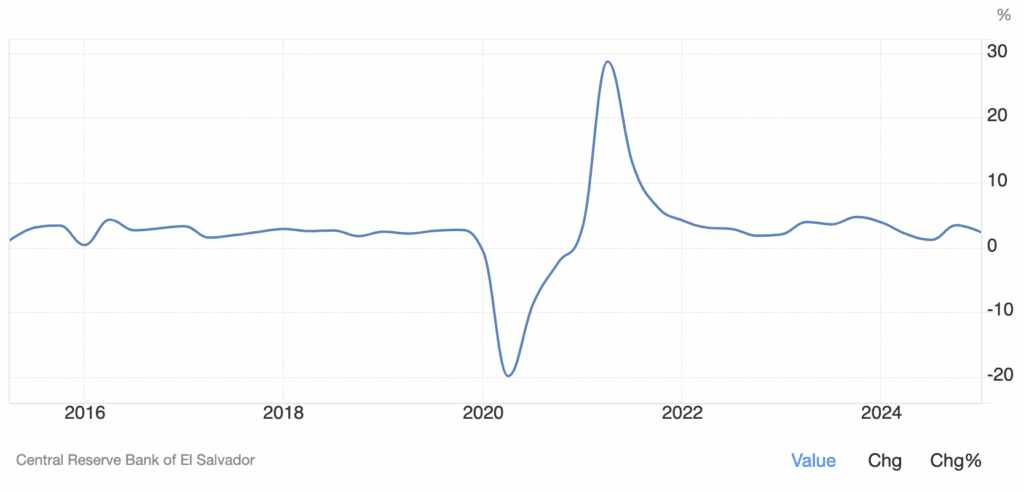

In spite of lofty headlines, El Salvador has demonstrated relatively lackluster growth

Bar Covid, El Salvador has been stuck in low single-digit growth figures, which is disappointing for such a poor country. The story for investing in the El Salvador real estate market is therefore a question of narrative, and whether president Bukele can turn things around or not.

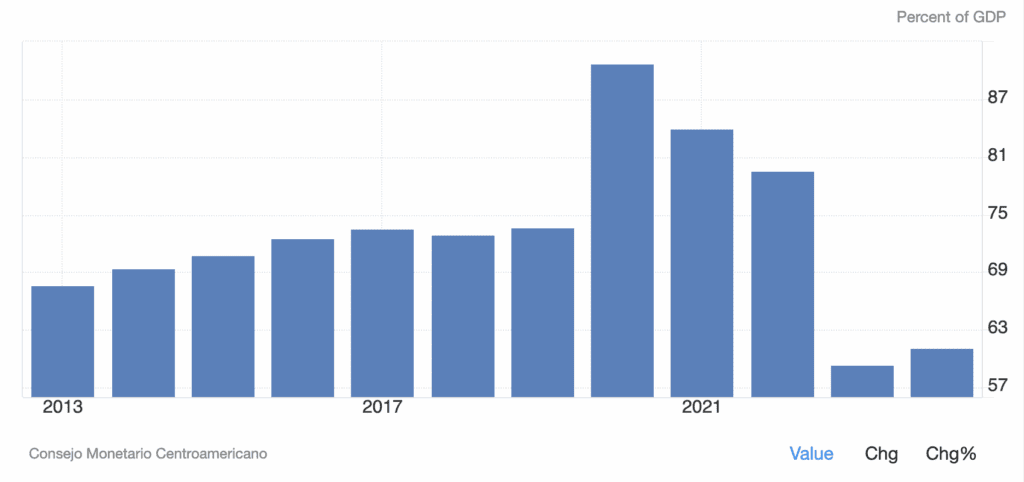

President Bukele has little wiggle room

El Salvador has a persistent issue with debt. It might not seem like much compared to countries such as the US, but El Salvador does not have the privilege to print dollars. For a country at this stage of development, it is an issue. Why is this an issue?

Because it limits what the government can get away with. It is hard for the government to borrow more on the international markets, and it thus often finds itself in negotiations with multilateral organizations such as the IMF concerning its debt repayments.

In 2022 El Salvador came close to defaulting on its debt. In 2023 Salvadorian bonds were some of the world’s best performing sovereign bonds as the outlook for the country improved.

Things are getting better, but investors must evaluate whether or not they are improving fast enough for El Salvador to get out of the woods.

Even though the debt to GDP ratio of El Salvador has been improving, last time it negotiated with the IMF it found itself having to drop Bitcoin as legal tender.

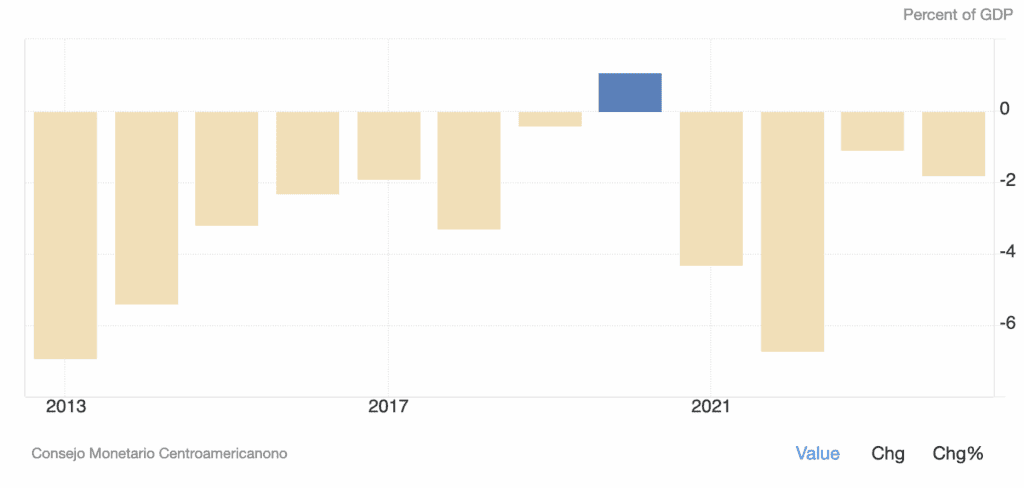

A manageable current account deficit

The task of balancing budgets and external creditors becomes ever harder when running large current account deficits. However thanks to foreign direct investment and remittances, El Salvador’s current account deficit it very manageable.

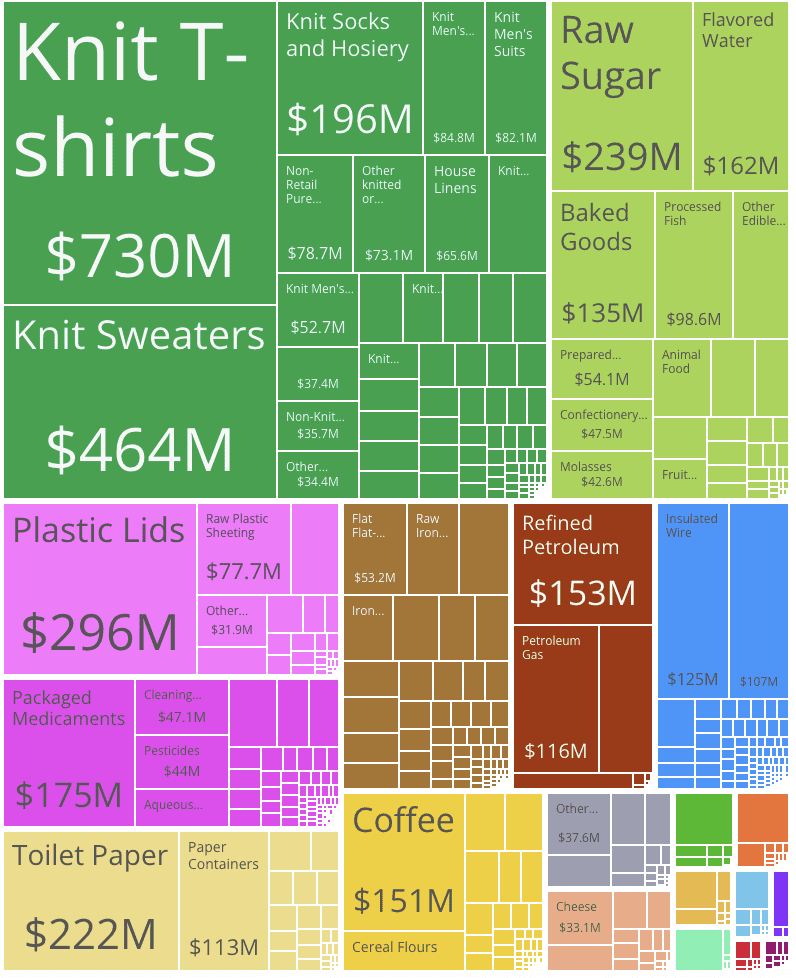

For all the talk of bitcoin and tech, the export mix of El Salvador is far from impressive.

El Salvador is essentially an exporter of textile and foodstuff.

The reality is that in terms of goods, El Salvador imports more than twice as much as it exports. It’s a scary number. In terms of services, it exports a bit more than it imports with the main driver being tourism which is a net positive, and booming. However, services don’t make up for such a negative trade balance.

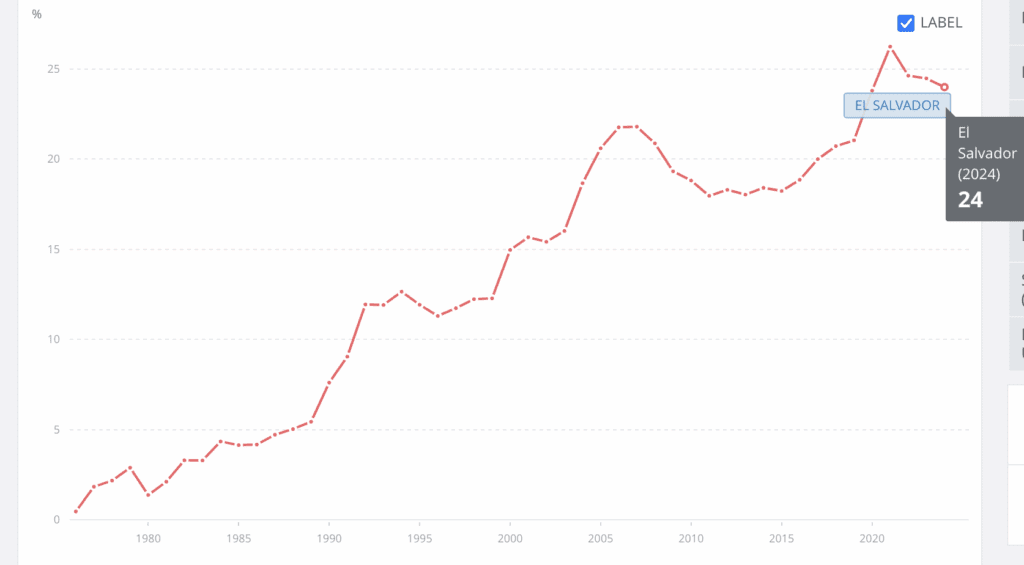

El Salvador lives off remittances from the US

El Salvador is entirely dependent on its diaspora sending money back home to drive the economy. Without them, the country would have gone bust a long time ago. Remittances represent an astonishing 24% of GDP.

It’s preferable to have 2 million citizens working in the United States and sending money back home every month than having an extra 2 million unemployed people sitting at home.

In many ways, the El Salvador economy is highly correlated to the US job market both due to remittances and tourism from the US.

So where is the economy of El Salvador headed?

As things stand, it is far from a robust economy. It all depends on whether president Bukele will deliver on his promises. That is the play here; investing in the El Salvador real estate market is a gamble on president Bukele.

Positives for the El Salvador Economy

All these catalysts would inherently be positive for the El Salvador real estate market.

1. Continued low crime levels

One of the reasons El Salvador did so poorly over the past decades was its horrific record on crime. It was one of the most violent countries on earth. President Bukele instituted a state of emergency and threw tens of thousands of suspected criminals in prison.

He threw 2% of the adult population into prison. He built a massive prison to contain many of them. The state of emergency remains in place.

The result is that violence and crime are down massively and the country has become investable once again from a security point of view.

Crucially, this has had a massive impact on the locals’ confidence in their country and economy.

2. Increasing foreign direct investment (FDI)

FDI hasn’t actually done amazing in El Salvador in spite of all the positive talk. It has just chucked along. However, larger players are starting to eye the country as the foundations for larger FDI are being layed out.

The recent $1.6 billion Turkish investment to completely revamp El Salvador’s two main ports is much more significant for the economy than crypto initiatives, and isn’t in the numbers yet.

3. Booming tourism

Thanks to all these headlines as well as safety, international tourism to El Salvador is now booming. It surged 17% in 2024 versus 2023 and grew 40% versus 2019. People are staying much longer as well.

The coast historically had overcapacity in terms of tourism infrastructure, but tourism is now growing faster than tourist arrivals, which is an important metric for real estate investing. In peak season there is a lack of capacity. The government is therefore working on attracting FDI into hotels. They want an additional 30,000 hotel rooms by 2030.

4. The price of Bitcoin

Let’s face it, one of the top reasons why El Salvador makes headlines is because it legalized Bitcoin as the country’s second legal tender together with the US dollar. Even though he then has to stop making it an official currency, the reality on the ground is that Bitcoin is widely accepted, especially for real estate transactions.

Bukele’s dictatorial tendencies and fight against crime also contribute to the headlines, but absent the Bitcoin move, the other matters would garner less attention.

El Salvador has notoriety with the crypto crowd. It single-handedly sparked a boom in tourism as crypto fans continue to descend on El Salvador to observe and part take in an economy that accepts Bitcoin in many places.

El Salvador is a short flight away from the US, making it accessible to a horde of crypto fans. As big money has been made in the crypto space, some of this money will inevitably flow down to El Salvador, which has positioned itself, from a PR point of view, as the most crypto-friendly jurisdiction.

In spite of this IMF-imposed changed to Bitcoin’s legal tender status, the reality is that blockchain companies are moving to El Salvador, including Tether and Bitfinex. Will this lead to more innovation and more tech investment within El Salvador? Most likely. The question is how much.

Also, in spite of IMF restrictions on El Salvador regarding crypto, the government continues to stack Bitcoin.

5. Ongoing reforms and fight against corruption

Bitcoin is not the core development that should motivate investors. It is more so about economic reforms and the fight against corruption. Three examples:

Reforms across the economy to make doing business easier

The Bukele government is doing everything possible to make business in El Salvador less bureaucratic. For example, I wanted a tax number to be able to do business in the country and went through the process myself.

All it took was $2, a copy of my passport, and 30 minutes (15 of which was queuing).

The government’s streamlined processes, reducing business registration times from 30 to 8 days and customs clearance from 40 days to 3 hours.

The Bitcoin move was never really about Bitcoin

The bitcoin generated free PR, which worked and continues to work as El Salvador makes headlines around the world. More importantly, it enabled remittances in Bitcoin, which is huge for El Salvador. Traditionally, remittances from overseas (about 24% of GDP) had to go through companies such as Western Union which charge exorbitant fees.

Now, workers in the US can just buy Bitcoin and send it to their relatives in El Salvador. These relatives can then spend the Bitcoin freely in the country or exchange it OTC at many places.

This results in more money for Salvadoreans. The foreign middleman got cut out.

The war against corruption

Corruption was a major issue but in the past year it has been significantly curtailed. It is not visible yet in international rankings such Transparency International. However, when speaking to people on the ground, it is clear that corruption has gone down dramatically. Why?

President Bukele announced a crusade against corruption, including the construction of a dedicated prison for white collar criminals, just as he did for gang members.

In effect, as a foreign investor, you can now do business in El Salvador without the threat of corruption. You’ll face bureaucratic hurdles as the reforms still have a long way to go, and because many bureaucrats are paralyzed for fear of being accused of corruption, but with time these issues can be worked through with your lawyer.

It is already having a significant impact in the country, in a way that statistics cannot capture. For example, if before there was a government tender to build a $50 million road, then maybe only $20 million worth of road would actually be built because of so much fat being baked into the numbers to keep everyone happy.

But nowadays, a $50 million road contract probably means close to $50 million worth of roads being built. You can’t see this in GDP figures, but objectively this is increasing the real GDP and capacity of the economy.

Key risks for the El Salvador growth story

- Not enough economic reforms, due to a constant focus on security and political matters.

- Bukele potentially losing popularity locally and internationally.

- Trump’s crackdown on illegal immigration to the US. Remittances represent close to a quarter of GDP in El Salvador. Instead of being unemployed or underemployed at home, these people move to the US and send money back to El Salvador. This is effectively free money for the country.

- A crypto bear market would not be positive.

- Tariffs and general uncertainty with regards to the US.

El Salvador Real Estate Market Overview

Observing all these catalysts, I was naturally attracted to the El Salvador real estate market. I thus traveled around the country and met a number of real estate agents. I got my tax number for this purpose; if I found a good deal I would be able to make an offer.

Here is a map of some key areas of the El Salvador Real Estate Market that are interesting for potential catalysts.

The real estate market in la Libertad, Surf City, el Tunco, El Zonte Bitcoin Beach in El Salvador

This was the most logical market to explore. Why?

- It was the only place foreigners could enjoy without much danger when crime was high

- The country’s best beaches

- Close to the capital city (an hour drive) which means that local money will also flow there as the economy improves

The three main towns to invest in are:

The real estate market in La Libertad, El Salvador

The first beach town coming from the capital city, it is currently quite ugly. However, the Chinese have built a big pier with restaurants, an entertainment center and other amenities. This city is set to improve. For now it is nothing to look at, but it is on the right path for sure and is going through an infrastructure building boom. Development here is inevitable. Foreigners don’t stay here though, it is more of a local play.

My issue with this market is that locals are so excited with the developments, that they are pricing their homes and land as if the development had already happened.

The real estate market in El Tunco, El Salvador

El Tunco is the cutest town I saw in El Salvador. It is clean, has a ton of food and bar options and a nicer beach than average. It also happens to be where most backpackers and tourists congregate. It’s been around for a long time, but since Bukele came to power it has blossomed.

As it is the nicest “beachy” resort in the country, this is where many Bitcoiners ended up buying property as it is livelier than the Bitcoin Beach nearby. Prices have already shot up a lot.

The real estate market in El Zonte aka Bitcoin Beach, El Salvador

This is the famous Bitcoin Beach with near 100% Bitcoin adoption. It is accepted everywhere. The infrastructure is very decent, and there are quite a few luxury options. It is much quieter than El Tunco. The target market here is surfers and Bitcoiners.

As for the real estate market? You guessed it, Bitcoiners bid up the prices to a point where it is a parallel market.

Construction is booming, with a number of new developments. Tourism is up a lot as well. Occupancy rates are high for newer construction, but may decrease as supply comes onto the market. But the term “construction boom” is relative, as we are talking of just a few mid-sized buildings that all got sold out at the pre-construction phase.

There are villages in between these three towns that are still extremely backwards and where things will inevitably improve, but it will take time. The reality is that even though tourism in El Salvador is booming, it is coming from a very low base.

The real estate market in the capital city of San Salvador in El Salvador

I was disappointed by the lack of obvious opportunities in coastal El Salvador, so I decided to explore the real estate market in the capital city of San Salvador. Generally speaking, the housing stock is of poor quality.

For new buildings with decent amenities in good neighborhoods you would have to pay $3,000 – $5,000 per m2 off-plan (or $270 – $465 per ft2). This is similar to decent neighborhoods in Panama City. I have a hard time making the case for investing at similar valuations in San Salvador.

I also looked at the historical center of San Salvador, formerly a crime-ridden hellhole but which now is being revitalized with a zero-crime policy and a lot of infrastructure development, including a brand new public library financed by the Chinese. A new mall has also been built.

So I contacted a number of agents. Two findings:

- Nobody is serious about selling

- Those that consider selling are doing so at ridiculous prices / trying their luck

As El Salvador is mostly a cash market, few people HAVE to sell.

Speaking to my broker and lawyer in the capital city, they did mention that real estate is going through a speculative fever as people are so optimistic about the trajectory of their country.

The real estate market in Berlín and Alegría in El Salvador

Having traveled a lot around Latin America, I noticed that each country has a cute colonial town tucked away in the mountains that eventually becomes a tourism magnet for both locals and foreigners. I thus set out to find El Salvador’s future cute mountain colonial town.

I settled on Berlín and Alegría as they locally have a reputation for being pretty, with great weather and views, while not being too far away from San Salvador (about a two-hour drive). Also, Berlín is known for having strong Bitcoin adoption with a whole team of volunteers on the ground driving it.

I took the local bus (or rather two local buses) to get to Berlín. What I found is a charming town in complete touristic infancy, with only one restaurant adapted to foreigners. The town itself is quite derelict, but has good potential. Same thing with Alegría a 15-minute bus ride away, though much smaller.

I got optimistic and contacted local agents and started talking to locals in shops and on the street asking what is for sale.

People just laughed at me telling me nobody is selling because prices can only go up. The local agent just pitched me some horrifically overpriced, derelict real estate.

Again, the real estate market has ran ahead of itself and is pricing in the success of Bukele’s reforms.

The real estate market in La Unión

La Unión is in the far east of the country, right on the Gulf of Fonseca which unites El Salvador, Honduras and Nicaragua.

For now, it is just a sleepy little town, with poor infrastructure. Its main attraction being the boat to Nicaragua which I took to go explore the real estate market there.

However, there are big plans for La Unión.

A new international airport is being built in the vicinity. Construction of the new “International Airport of the Pacific” started in 2023. It is expected to start operations late 2027 and to process 300,000 passengers per year.

There are also plans to build a railway from the west of the country up to La Unión. The designs are being worked on, and the government has already earmarked $700 million for this project. The goal is to connect the train to Guatemala’s network and even the Tren Maya in Mexico.

Recently, a Turkish company committed to investing $1.6 billion to revamp ports in El Salvador, with some of the investment being earmarked for La Unión port.

The ultimate vision is to develop the east of El Salvador with La Unión being the hub for trade and commerce within the Gulf of Fonseca together with Honduras and Nicaragua. Currently this Gulf is being utterly underutilized. The goal is to change this.

Overall, I think these projects will take longer to materialize than what is communicated by the government. But a massive transformation of this area is expected to take place over the coming decade.

This would be a good area to invest. I did not spend too much time in La Unión but there is definitely potential. I ran with the assumption that valuations had already run ahead of themselves, based on the fact that some locals told me people were angry too many foreigners came to invest and there is now an informal understanding among the locals that land should not be sold to foreigners for the time being.

This all sounds a bit too complicated and not worth my time, but I believe that if you are willing to spend a lot of time on the ground, you can probably make some decent long-term investments. For example, there are absolutely zero decent hotels in town, which needs to change if all the development and construction is to take place.

Video Case study of coastal real estate in El Salvador

Roman my El Salvador realtor and his team took me around to have a look at various properties along the coast. We analyzed them in detail.

Commercial real estate in El Salvador

As a clear sign that investment is coming into the country, the big international commercial real estate company Colliers reports that there is

“increased demand for industrial facilities, warehouses, and office spaces, particularly as companies seek logistics hubs and modern offices in San Salvador and La Unión. However, the current supply falls short of demand. In the industrial and office markets, demand exceeds availability by a ratio of 3:1, highlighting a critical investment opportunity. “

Taxes in El Salvador

Here are key facts of the El Salvador real estate market and its tax implications.

- Real estate transfer tax of 3% to be paid by the buyer for any amount over $28,000.

- Income tax of 30% on rental income receive by non tax residents (high)

- No property tax (great)

- Capital gains taxes of 10% on real estate held for more than 12 months. If less than 12 months, taxed at the normal income tax rate.

Objectively, the taxes on rental income are high, for those that pay them.

Real estate attorney in El Salvador

I interviewed my attorney Rodrigo on real estate transactions in El Salvador.

Feel free to get in touch with Rodrigo the real estate lawyer in El Salvador.

Conclusion

I was impressed with some of the economic reforms being implemented by the Bukele government, and the near-universal enthusiasm and optimism exhibited by his people. Objectively, it will be a volatile ride with inevitable setbacks but the trajectory is positive.

However, this optimism has led to real estate prices that reflect success of these plans, before they are actually realized.

This being said, some areas of the country have real estate prices that are more correlated to tech and crypto than to El Salvador economic reforms. It’s a quasi proxy.

The country still needs to develop the infrastructure it plans to build, continue the economic reforms, and improve the education of its population.

Who should invest in the El Salvador Real Estate Market?

- Individuals seeking residency in El Salvador.

- Crypto Investors.

- Salvadoran expatriates looking to invest in their homeland.

- Long-term investors with a specific interest in El Salvador’s potential.

- Expats who want to live in a Latin American country that focuses heavily on safety.

Get in touch with Lexi and Roman to invest in El Salvador real estate

Lexi is originally from the US and went to Bitcoin Beach for a random surf trip and never left. Together with her partner Roman, originally from El Salvador, they founded a real estate agency helping people find their dream property.

Services in El Salvador:

- How to get residency in El Salvador

- Real estate attorney in El Salvador

- Real estate agents in El Salvador

- El Salvador Citizenship by Investment

Article on El Salvador:

- El Salvador Real Estate Market: 2026 Investor Guide – is it too expensive already?

- El Salvador’s Economy: The next Singapore or just another emerging market?

- El Salvador Homeschool Hub – Educating Your Children While Traveling

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Very realistic report