Making a real estate investment in Tashkent, Uzbekistan, is an attractive proposition. One can find core downtown properties at about $1,000 per m2, and gross yields that can reach 8-11%.

In a world of negative interest rates and low yielding real estate, the opportunity to buy low into the capital of a booming country (read this article), with great demographics and prospects is alluring.

It’s certainly one of the reasons that made me fly over to Tashkent to wander about and try to figure out how to make a property deal. Accordingly, I noticed some arbitrage opportunities.

1. Not a big difference in price between Soviet buildings & new construction

What’s interesting is that there isn’t much of a difference between the Soviet buildings and the new construction prices. In core downtown you can get an unrenovated Soviet apartment for about $650-$800 per m2. A full renovation, which implies destroying everything and re-doing the piping, electricity, removing/adding walls, etc would set you back about $250 per m2.

Compare this with a normal off-plan building in the center or right next to it a short walk away to the metro, at $1000-$1,200 per m2.

What is important to know is that as interest rates are very high (over 20% in local currency and +-6% in USD), paying cash upfront gets you great discounts. Typically, for a project due for completion in 18 months, you can get 15%-20% off. Of course, this means taking on developer risk, but choose your developer carefully and you should be fine.

In this part of the world new apartments are handed over as empty “boxes”. You need to add the bathroom, kitchen, tiles, etc. Pretty much only the windows and doors are there. In some cases, even the walls within the “box” are not. To complete your “box”, add in about $150-180 per m2. So you can end up with an apartment in a new building for about $1000, per m2. However, do bear in mind that there is the opportunity cost of waiting for 2 years including the renovations. That said, your opportunity cost is not that great with treasuries yielding barely above 2% and decreasing.

So, for a small premium, you can end up with a brand new building of good standing as opposed to a dilapidated Soviet building.

If you want to do anything other than a small cash cow Airbnb, go for the new building when you make a real estate investment in Tashkent, Uzbekistan.

2. Most new construction is weighted towards large 3-4 bedroom apartments

A lot of the developments seem to focus on large apartments. The story the salemen will tell you is that “We Uzbek people like big apartments”. Sure. We all do. But for now, only the rich Uzbeks can afford to buy apartments cash so yes they are going to buy large apartments for themselves.

However as the country grows, the expanding middle class will seek to buy apartments that they can afford. Expect to see much stronger demand in the future for studios, 1 & 2 bedroom apartments. Even the 1 bedroom apartments on the market are large, at amount 50-60 m2. Currently, you can get the small apartments for almost the same m2 price as the large apartments. That premium between the two will grow over the years, and you’ll get better yields with smaller surfaces.

3. City center real estate comes at a smaller than usual premium

Construction costs are about $400 per m2. Add in the land cost & margin. Consequently the cheapest you’ll get in Tashkent is about $600 per m2 cash upfront very far away from anywhere. But somehow, new “box” apartments that are 3-4 metro stops away from the center can be priced a $700-$800 per m2 cash upfront, and their equivalents in the center or 1 stop away are at $800-850 cash upfront.

Over time, the gap will increase between core & non core.

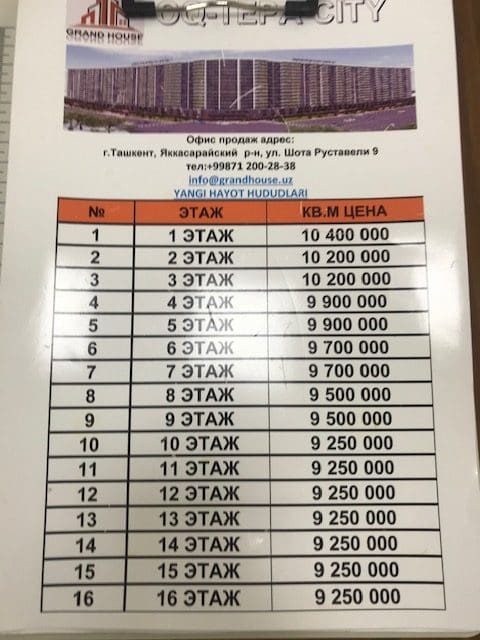

4. Ground and first floor apartments are more expensive than top floor apartments

Typically the higher you go the higher the m2 price. But not here in Uzbekistan. People pay a premium to be on the lower floors. When asked why sales people will tell you “because Uzbek people like the land”.

Sure, but that will change. At some point people will realize that having a view of the city is nicer than being on the first floor without any view and with added noise/smell from the streets.

What about luxury developments?

There is a massive project going on with the full support of the government. It is called “Tashkent City” and is located in the center. The Hilton & multiple other hotels, a large conference center, a massive mall, the future financial center, a big public park, and loads of luxury developments are part of the plan. You can get luxury “boxes” for about $1,500 – $2,000 per m2. Add in the usual renovation costs, maybe a bit more to keep the standards – $200-$250 per m2.

At this price you’ll get amazing quality, in a futuristic environment. However your yields will be poor as there just isn’t any enough demand for such an amount of luxury rental property. It sounds expensive for Tashkent, but objectively it’s not for the quality and location you’re getting. I seriously doubt prices will go down. You won’t make great money with such an investment, but you’ll have a great apartment and good capital preservation.

What real estate investment should I make in Tashkent, Uzbekistan for the best combination of capital gains & rental yield?

Get small 40m2, 1 bedroom apartments, off-plan, near the city core, in one of the top floors. That said, don’t buy the top as you don’t want roof issues. Overall, urbanization and increasing incomes will result in you always having tenants and the headline price of the apartment will make it liquid.

Expect such an apartment to reach $1,500 USD per m2 within 5 years in line with Almaty in Kazakhstan.

In the meantime, you’ll be making gross yields of about 8-11%

Great, let’s do this. I want in. How do I get started?

This was also my reaction. Unfortunately, the government does not make it easy to make a real estate investment in Uzbekistan as a foreigner. Here are your options

- Buy an apartment worth at least $400,000 and you can not only get it in your own name, but also get a residence permit. At this price you’ll get some massive apartment in Tashkent City. Expect very low yields.

- If you are already a resident, then you can buy an apartment worth at least $150,000 in your own name. However, this comes with a special government stamp duty tax of 10%.

- Create a local company and buy the real estate through it. As a foreigner, you must deposit a starting capital of at least +-$42,000 (400 million Som). Creating a company solely for the purpose of real estate holding is not permitted so claim you are starting a consulting company and get some hours billed, or if you want to do Airbnb say it’s a tourism business. Easy, right? Not so fast:

- If your turnover is less than 1 billion Som – about $100k, you qualify for the simplified tax regime and get taxed 4% of turnover. This is fine for Airbnb (for which you need a license), however, if you want to switch to long term rentals you get taxed 30% of turnover (!). On top of this you have to pay taxes & social contributions on your director fees. You must also pay non resident dividend taxes and your accounting fees.

- Also, there is the usual corporate tax regime of 12%, but apparently one cannot simply elect it. All accountants & lawyers I spoke to were clear that if the turnover is under 1 billion Som one must go for it. I’m a little skeptical still.

- Importantly, the whole tax & VAT system is being reviewed, so things are changing very fast. Some accountants say one will have to pay VAT for Airbnb. There is also the possibility that a company would have to pay VAT on sale of immovable property (!). To top it off, there are rumors of the government wanting to ban Airbnb.

- If Airbnb gets flooded with apartments and yields drop, or the government bans it, and you must revert to long term rentals, the 30% tax would be a killer.

A real estate investment in Uzbekistan is doable. But it’s risky in many ways.

– buying through the company is possible and is done, though is in a bit a of a grey zone.

– the option of buying A LOT of property to have a rental turnover of 1 billion Soms to quality for the corporate tax rate of 12% is a possibility, but then it would be hard to argue that your company is not a real estate holding company. You could get away with it if you did only Airbnb as it would be a tourism business, but if you must revert to long term rentals you’d find yourself in a very uncomfortable situation.

– The tax & VAT system are undergoing a massive overhaul. It keeps changing. It could get better, or worse. The government doesn’t seem keen on Chinese speculators impacting the local market so things could very well get worse for non resident real estate investors.

– So, sure, the gross yields and capital gains prospects are good. But in the end the taxes are unfavorable to foreign investors in the sector, there is a lot of uncertainty, and maintaining a company in Uzbekistan is additional paperwork.

If you’re willing to go through all the loops and face the uncertainty to chase the numbers, go for it. If not, rather invest in the Tashkent Stock exchange for good yields and potential capital gains without any of the headaches. Get in touch with me if you want the contact information of a good English speaking broker.

If you’re Uzbek, go for it. Real estate in Tashkent, Uzbekistan, though up over the last few years, is still a great investment compared to all large capital cities worldwide.

More articles on Uzbekistan:

- The Case for Investing in Uzbekistan

- Investing in the stock market in Uzbekistan – a high-growth frontier market

- How to obtain a Residence Permit in Uzbekistan

- How to start a company in Uzbekistan as a non-resident foreigner

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

I am curious what new buildings you recommend in the new Taskent city? What do you think of getting in the Nest one and which floor/units will be most desirable.

Thank you for your time

Hi Pat, there isn’t much rental demand yet for luxury apartments. So to have the highest odds of getting a respectable yield, aim for a small 1 bedroom apartment or studio, in the development with the lowest price per m2, and middle to top floors. Bank on the “snob effect” of people wanting to live in Tashkent City, and offering those entry level units .

Thanks for the informative and interesting article. What about buying a flat to live in for a few years and then selling it?

Hi,

Thanks for the article, what applications or websites are good for finding properties in Samarkand?

Hello Carlos, check out недвижимость самарканда on Facebook. Many listings there.

Can a United States citizen buy property in Tashkent uzbekistan? is the procedure the same as local buyer

Good Evening

what about if I’m a Real Estate investor that wanna expand in Uzbekistan?

Are there any Investment attraction packages offered by the government?

And what are the laws governing the investment regarding Profits fund-transfer, taxation, credit facilities, ..etc.?

Is there a mortgage law facility in Uzbekistan?

what about setting up a business/company rules and regulations?

From the figures you provided; it’s not feasible for any investor to extend his investments to Uzbekistan in the Real estate … It’s a maximum 10 % ROI which doesn’t cover the least EBITDA for any capital investments .. Are your numbers accurate ?? Kindly advise ..

Hello Sherif,

If you want a consulting session feel free to get in touch with me:

https://thewanderinginvestor.com/internationalization-and-diversification-consulting/

Hi, Thanks for your writings. They’re great!!! Finding you blog really interesting and mostly very useful.

Can you guess approximately what is the annually returns if we’re establishing a company in Uzbekistan, paying the 30% tax on the turnovers and paying (all!) the other taxes and fees (accountant, lawyer, property management, etc.)

I understand that the turnover should be around 8-12% but I’m curious about the net.

Do you think it’s something like 4-6%? Something else?

Thanks

Thank you Michael. Build 15% property management fees (management and finding tenants) and $80 per month for accounting into your ROI calculation. That should give you a better estimate.

Hi, Thanks for your answer.

I did the math quickly.

Does it make sense? Is it correct?

Price $40,000

Yearly Rent $4,000

Monthly Rent $333

Monthly Tax (30%) $100

Monthly Accounting Fee $80

Property Management (15%) $50

Net Monthly Rent $103

Net Yearly Rent $1,240

Yield 3.10%

If so it’s so bad due to the high risk in the investment.

Thanks.

Using the tax system as of the date the article was published, yes, the net yields are not particularly attractive. That’s why I invested in the local stock market instead: https://thewanderinginvestor.com/alternative-investments/investing-in-the-stock-market-in-uzbekistan-a-high-growth-frontier-market/