Now is the time to buy in Argentina

but only for people who are comfortable with risk and an illiquid market.

A few months ago I went to Buenos Aires with my family and spent a whole month investigating the real estate market there. I even got a local tax number (CNI) to make offers. I made a number of offers and some were accepted but the deals did not materialize due to a variety of (very Argentine) reasons.

However the bullish case for Argentina remains:

- The reformist agenda of Milei is storming ahead, and he has wide support in Argentina for now

- Taxes on real estate were reduced since this video was made

- An amnesty for undeclared funds is resulting in money entering the Buenos Aires real estate market

- Mortgages are now available once again after a few years of the taps being shut off

Even if the reforms were to stop, the reality is that the market had formed a bottom with prices being down 50% in USD real terms since 2018. While the rest of the world was bingeing on Covid real estate highs, Buenos Aires was still going down.

Apart from a catastrophic situation such as a revolution, etc, I don’t see prices going now in any significant way; there is downside protection.

This being said, Argentina is littered with the corpses of foreign investors who thought that “this time is different”.

I think it’s a great market to enter for

- anyone who wants a lifestyle property that is complimentary with European and North American winters

- people who want to bet on capital gains while being exposed to a market in a completely different stage of the economic cycle from the West. Just don’t overexpose yourself.

I met Max, and Argentine-American realtor based in Buenos Aires. We did all the ROI and rental yield numbers for both the long-term and short-term markets in both historical and modern buildings.

I also wrote a whole analysis of the real estate market in Buenos Airesincluding a macro analysis, key catalysts, neighborhood trends, and which areas of the city to invest in. It’s probably the most comprehensive online report out there.

Feel free to get in touch with my Buenos Aires real estate agent Max.

He is also offering a free Ebook if you contact him and request it.

To a World of Opportunities,

The Wandering Investor.

Services in Argentina:

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Transcript of “Buenos Aires Real Estate: ROI Breakdown & Rental Yield Case Studies”

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. Today, I’m in Buenos Aires, with a broken voice, in Argentina together with Max. Max, how are you?

MAX: How are you? Nice to meet you. Nice to be here.

LADISLAS MAURICE: Cool. Today will be very interesting. We’re going to be looking at two properties on the secondary market, one historical apartment and one newer apartment. And we’ll be doing all the ROI figures, calculating the capitalization rates for both for both long-term and short-term rentals, to get a true idea of what the actual numbers are here in Buenos Aires, beyond people claiming random numbers online, which is quite common.

MAX: It is quite common. The numbers can be all over the place, and the process itself, and just what the market has to offer can also be all over the place. So it’s good that we’re able to see, I think, vastly different things. On the one hand, one is going to be furnished, the other one is not going to be furnished, and many other factors, not least of which is, one of them is going to be right by where we are now, which is the classic area of Retiro, and we are now, which is Plaza San Martin.

This is going to be an older building with high ceilings, hardwood floors, the antique elevator that you might spot in Europe, while the second one is going to be in the, already for a while now, up and coming, Palermo Soho in what is a new building completed about a year and a half ago, with amenities such as a pool, such as a multi-purpose room, completely wired electronically, almost even a smart home. So yeah, that difference, I think, is going to give an idea of just how varied the market can be. It’s a very old city, it’s a historic city, but by the same token, there is so much construction that you are able to find newer things and older things alike.

LADISLAS MAURICE: And the two also have very different price points. One is at around $1,700 per square meter, so roughly $160, $150 per square foot, and the other one is over $3,000 per square meter, so roughly $300 a square foot. So that’ll be interesting.

Catalysts for the real estate market in Buenos Aires

LADISLAS MAURICE: Look, in terms of the economy, we’re not going to turn this into a discussion around the economy of Argentina, because by that time I publish this video, things might have changed completely. Things just change too much in Argentina. But essentially, the gist of it is simply prices started going down in Argentina, of real estate, in 2018. They’re down about 30%, even a bit more than 30%. For the last year, they’ve just been bottoming. If anything, they started increasing just a little bit, but most importantly, volume has been increasing substantially. And since the month of May, there are now mortgages that are available for Argentines to purchase real estate.

So interesting catalysts. If Milei manages all his economic reforms, then I would expect prices to go back to 2018 prices relatively fast. You can just sense, when you’re in the market, everyone’s just waiting for prices to come back. Everyone I speak to is like, “Yeah, prices are bottom, prices are at the bottom.” People are just waiting for confirmation that the bull market is coming back. But at the same time, it hasn’t yet, right? And if the reforms don’t pass, then I just expect prices to just kind of stay where they are, maybe increase a little bit due to the mortgages and all of that. But look, the reality is, Argentina is a basket case, it’s been a basket case for the last 50 years, and it’s still a nice place. Somehow, it’s dysfunctional but very functional. You go in the nice areas, things just work. People lead normal lives. And guess what? The real state is still holds a certain value in this country.

So I really think we’ve reached the bottom, unless there’s some crazy revolution, I don’t know, anything’s possible in Argentina, I just don’t see prices going down more than this. I don’t know what your thoughts are.

MAX: Well, like you said, basket case, I think, is an adequate assessment. And as an Argentine, I can’t help but be–

LADISLAS MAURICE: Sorry.

MAX: You know, it pains me but it is the reality. Argentina, it’s worth remembering that Argentina is the eighth largest geography in the world. From a tourist standpoint, it’s got snow, and so skiing, it’s got desert, it’s got ocean, it’s got just anything that anybody might want. It’s got one of the largest lithium deposits and potable water deposits, so there’s business to be had. And real estate is, more often than not, coupled with that sort of thing. Now, when you add to that that we now have a neoliberal president, who, by the way, is the first economist that this country has seen as a president, which I think is not small potatoes, it speaks to what we are seeing in his mandate, which is trying to open up the flood gates of foreign investment.

And in terms of our line of work in real estate, we are seeing a barrage of people which, many times, have this fear of missing out, because Argentina is, once again, on everybody’s lips, which happens from time to time. Look, someone said to me once, Argentina is a place where, from one day to the next, everything can change, and from one decade to another, everything might stay exactly the same as it’s always been. So yeah, it does have that mercurial aspect about it, from an economic standpoint, to be sure, but real estate for us as Argentines has always been the silver bullet of investing. We know that it is something that, over time, will garner value, will not be taken from you. It is yours, and it is registered as yours, and nobody can oppose that.

The city of Buenos Aires has a lot to offer. It’s a beautiful city. It’s a big tourist destination. The dollar gets you a long way, and comparably speaking to other world-class cities, you can buy very, very interesting pieces of real estate.

LADISLAS MAURICE: Yeah.

MAX: There’s absolutely no question about that.

LADISLAS MAURICE: And it’s easy to call Argentina a basket case, but the reality is, it’s still one of the richest countries in Latin America, in spite of everything, on a per capita basis. So it’s easy to criticize Argentina, but at the end of the day, actually, people here live better than in most other Latin American countries.

MAX: Yes, very true. There is, obviously, it’s not without its problems socioeconomically, but we find what makes us or what makes our work easier or makes us happy, is that our particular niche are people who come to Argentina are many times surprised to no end, and they say to us, “I can see myself living here X amount of months a year.” And people who are motivated buyers in the market, which is a buyer’s market, we have clients that we have not met physically. We’ve had communications via email, via WhatsApp, via phone calls. They see properties remotely, which I know is perhaps more common in other cultures, not so much here, but they put that trust in what they feel is a good investment, and they go through the process.

ROI and Airbnb Case study of a historical apartments in Retiro, Buenos Aires

MAX: And as I said, in some cases, we haven’t even met these people. They go through us, they buy something, and they have the investment secured.

LADISLAS MAURICE: So Max tell us about this apartment.

MAX: This apartment boasts 114 square meters, and it has an asking price of $189,000. As we mentioned, it’s located in one of the older areas of Buenos Aires, very close to a lot of very interesting geographic hot spots, Teatro Colón, Galerias Pacifico.

LADISLAS MAURICE: Beautiful.

MAX: It’s an older style, as you can see, it keeps the high ceilings, the original hardwood floors.

LADISLAS MAURICE: It’s what people come to Argentina for, right?

MAX: And it’s been completely overdone, so it meets the old and the new, being a very comfortable place.

LADISLAS MAURICE: Okay, so Max, who’s the target market for an apartment like this?

MAX: I think predominantly the people that have an interest in the product such as this would be the North American crowd, i.e., United States, Canada, because it is the kind of product that is very hard to find in major American cities, to say nothing of finding them at a price point which would be reasonable. And as such, they find a product such as this with the appeal that it has and with the items that you would not find in modern American construction. And so they warm to that. They warm to that because it also has pricing which is not the European pricing. It’s the European flair and the European appeal and the European architecture without the European pricing.

LADISLAS MAURICE: Yeah. And especially when you seek to escape winters in North America, hello, Canada, and you want to go to Europe in winter. Well, guess what, Europe is not that nice in winter. [laughs]

MAX: Absolutely.

LADISLAS MAURICE: There’s either Cape Town or this here, but this here has the architecture.

MAX: That’s exactly right, the winters in BA can best be characterized as mild. I mean, as a Canadian, you might call a day like today barbecue weather. It’s not cold. You can get as low as 40s or 30s.

LADISLAS MAURICE: I meant for Canadians during winter, they come down here, it’s full-on summer. I mean, you have the architecture, you have the steaks, the wine, the same time zone for work, that’s a big one. So I guess that’s the appeal, right?

MAX: And the dollar getting you still quite far when it comes to a five star meal, or hopping on a cab, or to wit, buying real estate.

LADISLAS MAURICE: Cool, fantastic. So now we’re going to sit down and we’re going to do all of the numbers in detail to calculate the capitalization rates, the rental yields, the ROI for both long-term rentals and short-term rentals. Okay, great. So $189,000 for this apartment. If both parties are relatively reasonable, which isn’t always the case, but what would you expect, what would be reasonable to get to in terms of a negotiated price?

MAX: I think you could be thinking about anywhere between 6% and 8% below asking.

LADISLAS MAURICE: All right, so let’s just say $180,000 to be conservative.

MAX: Yeah.

LADISLAS MAURICE: Okay. What would be the closing costs?

MAX: For closing costs, you have to think all-in between realtor commission and notary fees, which include both his fees and taxes, more or less 10%.

LADISLAS MAURICE: More or less 10%, okay. What about the whole money situation? Because getting money into Argentina is a headache. How does that work? Because, sometimes, there are sellers, they take money offshore, in banking house overseas, in Panama, the US, worldwide, wherever, Europe, but some transactions take place here. Can you give us a 30-second rundown on how these things work?

MAX: Sure. Well, predominantly, it should be noted that transactions for real estate are done 90% of time in cash. And when I say cash, I mean cash with the money on the table. We try to play matchmaker to a buyer and a seller, both of whom will have a foreign account, and thereby making the transaction simpler, safer, and obviously, cheaper. Short of that, a person would have to think about opening up a bank account, wiring the money into their account here, which is the complete by the way book of doing it, or what a lot of people do, which we don’t necessarily agree with, which is the under the radar and wiring it here through a finance firm, which might cost them an extra 1%, 1.5%, sometimes, 2%.

LADISLAS MAURICE: But you get the real black market exchange rate as opposed to the government exchange rate?

MAX: Well, I would say the exchange rate is really not a factor, because it’s always going to be valued in dollars. So you’re always going to be paying dollars. Whether you send it to an Argentine bank or you send it to a finance firm, you’re going to end up getting US dollars because your seller is going to want US dollars cash.

LADISLAS MAURICE: Okay.

MAX: Real estate is valued in US dollars.

LADISLAS MAURICE: And again, like, these things are changing so fast right now that this topic might not even be a topic in, like, a year’s time.

MAX: Very true.

LADISLAS MAURICE: Things are extremely fluid in Argentina. Same thing with exchange rates, they change all the time. Same thing to bringing money into the country, whether dollar to dollar into the country, dollar to dollar out of the country, the spreads just are quite, well, changes from week to week.

MAX: And strictly from a negotiating standpoint, Argentina is a very negotiating-based culture when it comes to real estate. So everything is on the table when it comes to price, when it comes to conditions, when it comes to method of payment, everything can be discussed.

LADISLAS MAURICE: Yeah. I think this is why it’s so important to have someone who understands the market and understands foreigners trying to enter the markets. Because one thing is a green. Let’s say, you buy here. Here’s actually good because the owner is foreign, so foreign account. But let’s say, the person is Argentine. They want money locally. You agree on a price, $180,000. But then people are going to try to negotiate the price of that. They want in cash, how they’re going to get paid, how much they want to put on the title deed, etc. I mean, it’s just, it’s a can of worms. [laughs]

MAX: And not only that, but the fact that the buyer has to do a series of transactions to be able to buy real estate. He’s going to want to talk to an accountant, he’s going to want to talk, potentially, to a lawyer or a notary. There are a few things that need to happen before one can sit down and sign the deed. So many times a broker might not know or might not bother to say that, but these are factors which are very important.

LADISLAS MAURICE: Yeah, you want to have a professional by your side for deals in Argentina. Okay, cool. So that’s that. So let’s say, I buy this apartment. Max, you sold me this apartment. You’re, like, “This is great.” I’m, like, “Cool.” Then I hand it over to you, and I say, “Rent it out.” So let’s go for the long-term rental. How much can I expect, in its current state, to receive on a monthly basis?

MAX: I think an apartment such as this, in this location, the fact that it’s a three-bedroom apartment, you could be talking about $800 a month in rental.

LADISLAS MAURICE: Okay. What about the occupancy rate?

MAX: Occupancy rate, we could be talking about 92%.

LADISLAS MAURICE: Yeah, because, again, people tend to forget that Buenos Aires is a city of, like, a whole district of 16 million people. It’s a huge, huge city. So there’s, guess what, always demand for apartments in central locations. So it’s not hard to find tenants, it’s just a matter of having the right price point.

MAX: Correct. Exactly.

LADISLAS MAURICE: Cool. What about the HOA? Who pays the HOA, is it the owner or the tenant?

MAX: In a situation such as this where it’s a long-term, the tenant pays everything. Everything, HOAs, water bill, light bill, gas bill, internet. Traditionally, the one thing they will not pay is the city tax bill, which goes towards the owner paying it.

LADISLAS MAURICE: Which is a property tax?

MAX: It’s a property tax.

LADISLAS MAURICE: Okay. How much would the property tax be?

MAX: Woefully low from an international perspective, you might be talking about $100 a year.

LADISLAS MAURICE: Okay, so that’s nice. [laughs]

MAX: Nothing to write home about.

LADISLAS MAURICE: Yeah. And what would you advice your investors to put aside every year just for incidentals, maintenance, whatever?

MAX: I would say around $1,000 would be a good number to keep for a rainy day, just for any upkeep that needs to be done.

LADISLAS MAURICE: You find me the tenant. So what are your fees to find the tenant?

MAX: We will advertise the property, we’ll find the tenant, we’ll do all the due diligence. And by law, what the broker charges is 4.15% over the contract. So over a two-year contract of $800, $800 times 24, 4.15% over that.

LADISLAS MAURICE: What about your property management?

MAX: In case such as this, where we would make sure that the fees are being covered by the tenant and that the rental is being paid on a timely basis, again, by law, 5% monthly is what is commonplace. Over a rental of $800 a month, you’d be paying the firm $40 for that management.

LADISLAS MAURICE: Cool. Essentially, when we do all of the numbers, we get to net rental yield before income tax of a bit above 3%. So you don’t come here for the long-term rental yields, essentially, that’s not what investors should buy this for, correct?

MAX: No. No.

LADISLAS MAURICE: I mean it’s pretty clear. Cool. Now let’s do the short-term rentals to see if there’s a bit more alpha from a yield point of view here. So purchase, same-same. Because your agency also does short-term management, how much per night do you think we could get for this?

MAX: We do short-term, you could be talking about $80 a night, short-term.

LADISLAS MAURICE: And the occupancy rate?

MAX: I would say, in and around 40%.

LADISLAS MAURICE: Yeah. The occupancy rates in this particular area are not that high. Two factors. One, it’s quite seasonal in Argentina, concentrated on the southern hemisphere, summer, spring, and fall, but in winter, it’s a little dead. And then also, this particular neighborhood, Retiro, is not necessarily where people are really looking for short-term rentals. They prefer to go to places like Palermo, where we’re going to be going next. That’s why we put such a low occupancy rate. Tell me about your fee structure.

MAX: Well, our office charges, for the full management of the property, $200 a month, plus 5% over the contracts or the rentals garnered by our office. And that fee structure pretty much includes everything so that the owner living overseas doesn’t have to worry about anything happening in Argentina, that is everything from the contract drafting, to the due diligence of the tenant, to leaky faucets, faulty internet, so forth.

LADISLAS MAURICE: Cool. All right, so let’s talk about, so electricity, how much would you budget per month?

MAX: You might think about $20 a month.

LADISLAS MAURICE: Water?

MAX: About $10 a month.

LADISLAS MAURICE: Gas?

MAX: $25 a month.

LADISLAS MAURICE: Internet?

MAX: $45 a month.

LADISLAS MAURICE: Okay, property, the same. What about maintenance?

MAX: The HOAs can be in the order of something like this, $80 a month.

LADISLAS MAURICE: Okay, and maintenance?

MAX: A yearly maintenance, $1,500. You’re going to have to think about a bit more wear and tear when it comes to short-term rentals.

LADISLAS MAURICE: Okay, cool. Here we get to a net rental yield of, actually, that’s lower than for long-term rentals.

MAX: Correct.

LADISLAS MAURICE: I think the play here is a lifestyle property and, objectively, a deep value play. You’re buying in the center. Though, the center is not necessarily where things happen, but it’s still decent location, the center of a city of 16 million people in a historical building remodeled for $1,700 per square meter. You’re buying deep value, essentially, that’s the play. It’s deep value, and lifestyle, and geopolitical diversification.

MAX: Correct. Exactly. You’re playing the long game, essentially. And were you to do a Venn diagram, it has a lot to do with an appeal, for the foreigner, of being able to buy something of this quality and of this style which they would, otherwise, not be able to in other pockets of the world.

LADISLAS MAURICE: If you were going to go to an equivalent neighborhood in Paris, you would be looking, for a building like this, a floor like this, finishings inside, you’d be looking probably at around $12,000 to $13,000 a square meter, roughly, that’s what you’d be looking at. So big difference. But then again, Buenos Aires is not Paris, but just to give a perspective of why actually a lot of Europeans are investing in Buenos Aires because they see the deep value and a relatively similar lifestyle in many ways.

MAX: Correct.

LADISLAS MAURICE: Cool. All right, fantastic. Now we’re going to go to Palermo.

MAX: Palermo.

LADISLAS MAURICE: Cool.

MAX: Some 20 minutes away by cab.

LADISLAS MAURICE: All right, and that’s a completely different picture–

MAX: Completely different neighborhood, completely different unit, so let’s check that out.

Foreigners investors in real estate in Buenos Aires

LADISLAS MAURICE: All right, perfect. Let’s go. Since the election of Milei, have you seen more foreign investors coming into the country, or inquiring, because you’re there right here on the ground. How are you feeling the situation?

MAX: Yeah, the short answer is yes. In fact, we’ve seen even prior to his winning the election, because there was already a sense that there was potential change in the air. I would even say that, quite literally, the day after the elections, we started to get people asking more and more questions, happy with the general direction the country was going to start taking. So yeah. And since that moment, we’ve had several inquiries, several meetings, several people buying just straight up.

LADISLAS MAURICE: Okay, so are you having more inquiries or actually people pulling the trigger?

Buying real estate remotely in Argentina

MAX: Both. Both. The mindset when it comes to buying real estate, at least with foreigners, I am seeing is very measure twice, cut once. They do it [snaps fingers] very quickly. They see something they like, or we draw up a list, sometimes, they’ll come to see it, sometimes, they won’t come to see it. They’ll buy its site unseen.

LADISLAS MAURICE: What percentage of your sales to foreign buyers are done in person versus entirely remotely?

MAX: No. Most of them fly down for the sale, or, at the very least, fly down, see the place, leave power of attorney. But for sure, 80% do it in person or having seen the place.

LADISLAS MAURICE: And what percentage of people are doing it for investment versus a mix of investment and lifestyle?

MAX: Strictly for investment, I would say one in three, one in four. But at the end of the day, a lot of them end up determining that they want to use it themselves or just as a pride of ownership element of owning property in a Latin American country with European flair.

Who is buying real estate in Buenos Aires?

LADISLAS MAURICE: Interesting. And tell me more about the type of buyers. Is it like a just kind of the libertarian Milei crowd that are all bullish, or is it just more, I don’t know, normal, if I can put it this way?

MAX: No. No, no, no, there’s all sorts. There’s, I mean, from a political spectrum standpoint, you’ve got people who are tend to the right, tend to the left, people who, as you say, are very bullish. But I tell you, the common denominator is a surprise of somehow thinking it was going to be different when they flew down or started to learn more about Argentina and specifically Buenos Aires, and just being completely enamored with everything that it has to offer from a cultural, from an economic standpoint, and prominently, yes, from the possibility of buying real estate at a fraction of the cost of what you could buy in world-class destinations around other places in the world.

Liquidity of Buenos Aires real estate market

LADISLAS MAURICE: And tell us a little bit about liquidity. Let’s say, I buy an apartment like this. Because I think it’s important for Europeans and especially North Americans to understand the concept of low liquidity. Can you elaborate on liquidity here?

MAX: Well, as this is a buyer’s market, first off, it’s important to note you’ve got maybe 7% of everything in the market being sold. That’s an abysmal number, 7%, 8%. There is a lot out there, and overturn is not tremendously high at those numbers. And this is all information of public record, which anyone can access. And so, as such, a lot of units, a lot of pieces of property will be on the market for a while. And it’s not uncommon for a property to be on the market for three, four, six months, a year, two years. And that hardly ever speaks to the property being a bad product. Other cultures might interpret that as, “Ooh, why isn’t that selling?” And it can be very simply because the seller is waiting for the right person to come along. And ironically, the person who puts something up for sale doesn’t have an emergent or imperative need to sell, so they can wait.

Buying pre-construction or off-plan in Buenos Aires

LADISLAS MAURICE: Interesting. Because a lot of people seem to be buying new properties as well, off-plan developments. Here we’re just looking at the secondary market. There seems to be a lot more liquidity for properties that are off-plan, or even people flipping properties that are off-plan. Why this? Why this difference between the two markets?

MAX: Well, the construction, things which are purchased, things which are under construction are the predominant way that locals can buy real estate, because they are able to buy it with one initial payment and then, over a period of years, in Argentine pesos. Now that’s not without its risks, to be sure. And so because of the fact that, most of the times, buying real estate encompasses having the cash on hand, in US dollars, no less, in an economy which is peso-based, that creates this bottleneck to where there is so much supply in an economy which is, otherwise, not at a great place. So your average salaried worker who might make $200 a month, $300 a month and above that, but less so, they have a hard time at being able to get the money they need to be able to buy, cash on hand, a property valued and paid for in US dollars.

LADISLAS MAURICE: Cool. But these apartments we’re seeing is not that target market?

MAX: No.

LADISLAS MAURICE: Because I was reading online, to be in the top 5% of households in Argentina, you need to be earning about $4,000, $4,500 a month.

MAX: Yes, that sounds about right, upwards of 5 million pesos a month. Yes, yes. Put it differently, I believe, the last number that the city of BA published was that to not be considered poor, you had to be making more than 380,000 or 400,000 pesos a month.

LADISLAS MAURICE: Can we talk dollars? [laughs]

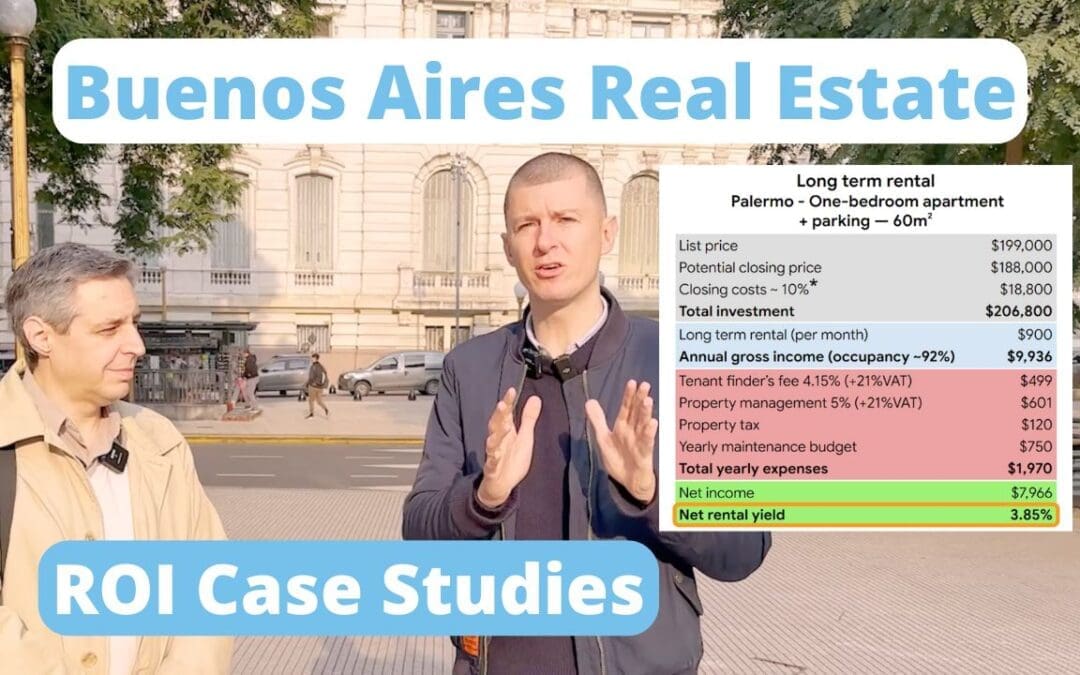

ROI and Airbnb Case study of a new building in Palermo Soho, Buenos Aires

MAX: More or less $400.

LADISLAS MAURICE: Okay, cool.

MAX: More or less $400.

LADISLAS MAURICE: Because if we talk pesos, by the time we publish– [laughs]

MAX: Yes. No, convert it into dollars at today’s rate is more or less $400, $420 to not be considered below the poverty line.

LADISLAS MAURICE: Interesting. All right. So what are the numbers here?

MAX: Here we’re talking about a one-bedroom, 60 square meters, and asking price is $199,000, which comes with a car space.

LADISLAS MAURICE: Okay, that’s a big deal here. In a city of 16 million people, having a car space, big deal.

MAX: Yes.

LADISLAS MAURICE: Underground or covered?

MAX: It is covered, not underground, street level covered, and it’s fixed car space.

LADISLAS MAURICE: Cool, all right. And very important, Argentina, this is worth a premium, the barbecue space. Cool. All right. And this building was finished how long ago?

MAX: This building was finished about two years ago, a little under two years.

LADISLAS MAURICE: Under two years ago. I’d say kind of medium quality, roughly.

MAX: I’d say they’re market standard. Also, additionally considering it’s got certain amenities, such as a multipurpose room, a pool, laundry area.

LADISLAS MAURICE: Okay, we’ll go check out the pool.

MAX: Excellent.

LADISLAS MAURICE: Can you tell us about the sort of people that are interested in Palermo Soho, because the profile is just so different from Retiro?

MAX: Absolutely, yeah. We’re talking here, I think, more about the younger crowd, the maybe 45 and below, the digital nomads, a lot of people who are interested in a night life. There’s any number of restaurants, bars, cafes, now more trendy cafes. This area has become very heavily gentrified, and so has become, as such, very popular.

LADISLAS MAURICE: The other place is, I find, more commercial during the day, and at night, it’s, I’d say, even a little dodgy.

MAX: Yeah, it can be. Sure.

LADISLAS MAURICE: Here, it’s just normal during the day, and at night, it really, I mean, there’s a lot of life here at night. It’s a fun place.

MAX: It’s lights up at night. It’s where people come, predominantly, for dinner, for drinks, for dates, for what have you.

LADISLAS MAURICE: Cool. All right, fantastic. Now we’re going to go to the rooftop, check out the pool, and do all the numbers.

MAX: Excellent.

LADISLAS MAURICE: Cool. So $199,000 in a reasonable negotiation, what would be, can we put as a price?

MAX: In the neighborhood of $188,000.

LADISLAS MAURICE: Okay, cool. Then all the other numbers are the same, closing costs, etc.?

MAX: Exactly.

LADISLAS MAURICE: So this would go on the long-term local market, unfurnished. How much do you think the investment–

MAX: I would say $900 a month.

LADISLAS MAURICE: Okay. And in terms of, all else being equal, maintenance?

MAX: Maintenance, on a yearly basis, you might be talking about, I would say, about $750.

LADISLAS MAURICE: Cool, so a bit lower than the other one.

MAX: Yes.

LADISLAS MAURICE: Yeah. Okay, cool. That gives us a net yield of a bit over 3% before income tax. Cool. Let’s do the short-term rental. The place will need to be furnished. What budget would you recommend?

MAX: I think an upper echelon of an amount there could be $7,000. You could do very, very well with $7,000. Fully furnished, turnkey, everything you would need in it.

LADISLAS MAURICE: Everything, okay. What would be the nightly rate?

MAX: I’d say $90 nightly rate.

LADISLAS MAURICE: And the occupancy rate?

MAX: About 50%.

LADISLAS MAURICE: Okay, so higher than the other one–

MAX: Yes.

LADISLAS MAURICE: but also not massive-massive.

MAX: No.

LADISLAS MAURICE: Cool. Well, there’s a lot of supply of real estate here on the short-term rental market, mostly because, historically, before Milei took power, when you were locked into a tenancy agreement, it was really hard to kick people out, and you were locked into peso contracts. Now you can have contracts in, what, dollars, even Bitcoin, I think, you said contracts in Bitcoin.

MAX: Yes, you can negotiate freely in whatever currency is best, yeah, which has allowed for the floodgates to be open in terms of contracting.

LADISLAS MAURICE: Cool. Now we’re seeing a lot of people who had Airbnbs they’re now gradually realizing that actually, potentially, the long-term market is better, in many cases.

MAX: Absolutely.

LADISLAS MAURICE: Cool. Let’s talk about the monthly expenses. What’s the HOA here?

MAX: Approximately $140 a month.

LADISLAS MAURICE: Electricity?

MAX: About $50 a month.

LADISLAS MAURICE: Water?

MAX: $10 a month.

LADISLAS MAURICE: Cool. Then internet, all that’s the same?

MAX: Yes, $45 a month for internet.

LADISLAS MAURICE: Maintenance?

MAX: Property tax, yearly, $120.

LADISLAS MAURICE: $120 property tax?

MAX: Yes. And maintenance, you’re going to be a bit higher there because there’s going to be more wear and tear, so you might think about $1,200, $1,250 a year.

Who should invest in Buenos Aires property?

LADISLAS MAURICE: Okay, cool. This takes us to a net yield of a bit below 3% net, so actually less than the long-term. This is a recurring theme.

MAX: Yeah.

LADISLAS MAURICE: What do you tell people who come here and want to invest in real estate in Buenos Aires, because clearly it’s not a yield play?

MAX: Well, yeah, I think that predominantly the first thing we tell them is that they play the long game. They are taking advantage of the fact that it is a buyer’s market, and working off of that, they can get something at a very decent price, at a very good price with everything that Argentina and specifically Buenos Aires has to offer culturally. And most people will also buy, not just net for the investment, but also for the pride of ownership, and again, the long-term yield of buying low selling high. It is a bit of a capital gains game more than a short-term or midterm return on your investment.

LADISLAS MAURICE: Yeah, I totally agree with this, it’s long-term play, capital gains. There are a few catalysts in place. Again, the catalysts could go bust, because it’s in Argentina, and nothing’s really predictable. But I just like the resilience of what I see here. This country has gone through decades of complete socialist nonsense, and yet here we are, prices have reached the bottom. Compared to Western countries, where we seem to be entering that phase, here, they’re trying to emerge out of it. In many ways, this place offers downside protection, which is a bit odd to say, but Argentina offers downside protection. It’s safe to buy real estate here. There’s potential alpha. One way to play it would be to buy stocks, but a lot of them have already doubled, tripled, some of them quadrupled in the past year. So that comes with a lot of volatility. At least here, at these levels, you can’t expect a lot of down volatility at all.

I find it interesting for Westerners looking to diversify into a market that has completely different dynamics, and it is at a completely different stage of their economic cycle compared to our countries. I think this, fundamentally, is the thesis. Now, would I go all in Argentina? Absolutely not, this would be insane. But having a small allocation to some nice real estate, affordable. If you look at really big international cities of 15 million plus in the world, there aren’t many of them where you can get historical, remodeled apartments at $1,700 a square meter, or relatively new apartments for a bit over $3,000 a square meter in the heart of the city. I can’t think of too many cities that offer this. I think this is fundamentally the thesis for investing in Buenos Aires. But if you’re hoping to come here and make some quick money without any risk, this is not it.

MAX: I would agree with that assessment, it’s not without its issues. But again, the long-term game, we feel, is where it’s at, and that is the first thing we tell our clients. Anyone who has the idea that they rent it and they put it on the market immediately thereafter and get a nice return short-term is going to be woefully mistaken. It’s not what it’s going to be about in terms of the investment.

LADISLAS MAURICE: I’m, personally, actively making offers here in Buenos Aires. I find this market interesting. I will not over-expose myself, but I’d like to have at least a foot here. I wrote a whole article on the real estate market here in Buenos Aires, the neighborhoods that are worth looking into, some of the mistakes you should avoid making, the process to buy, etc. There’s a link below. And Max, you’ve been in the game here for how many decades?

MAX: Well, quite a few. Thanks for making me sound old.

LADISLAS MAURICE: [laughs]

MAX: Quite a few. And predominantly specialized in catering to the overseas niche audience.

Get your free Ebook on property transactions in Buenos Aires

LADISLAS MAURICE: Cool. And you have a free e-book that you can–

MAX: Yes, we did a free e-book, and I’m happy to send to whomever would like it, or link below, or whatever. And it details the steps along with a lot of the cultural aspects and the minutia that you might be expected to run into in Argentina.

LADISLAS MAURICE: Everything in Argentina is complicated and different from other parts of the world, so the cultural aspects are definitely really important. There’s a link below. You can get in touch with Max, and then he’ll send you his free e-book.

MAX: Absolutely.

LADISLAS MAURICE: All right.

MAX: Absolutely.

LADISLAS MAURICE: Max, real pleasure. Thank you.

MAX: My pleasure, and thank you very much.