In the video “Is Gold breaking out? Thoughts on gold miners, Africa vs Canada political risk and Silver” I invited Lobo over to discuss the following:

- Is this THE gold breakout we have been waiting for?

- Gold mining stocks have barely moved. Why?

- Individual stock picking vs ETFs for mining stocks

- Political risk in Africa vs. political risk in Canada for mining stocks

- Silver outlook for 2023

- What I’m doing now

Having a bit of precious metals in one’s portfolio is reasonable

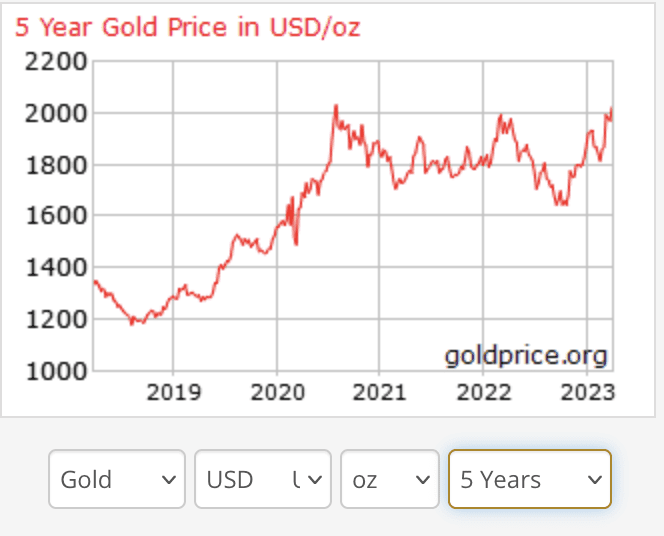

Is gold breaking out? I don’t know, but we have closed above $2,000 per ounce for a few days in a row.

Look, this is not financial or investment advice, and I’m certainly not telling you to rush now to get your exposure. I don’t know what the price will be in the next few weeks or months.

The way I look at things, seeing the general money printing, currency debasement, and decreasing amount of trust people have towards institutions, having some exposure to gold in the long run sounds far from crazy.

I’d actually say that it would be a little crazy to have 0% exposure to an asset class that has survived millennia, especially now in times of economic and political turbulence.

What I do recommend though is that you sign up to Lobo’s free newsletter on mining stocks. He sends out a weekly email analyzing the market. Personally, I have been a paid subscriber for a few years, and I will continue subscribing. But the free version is good too.

The most interesting mining stocks are not necessarily listed in New York. To get access to the most interesting mining stocks (and also the least interesting and semi-frauds) you want access to the stocks exchanges in Toronto, Sydney and London. Personally, I use IB as my broker for such access.

To a World of Opportunities,

The Wandering Investor

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

Video Transcript of “Is Gold breaking out?

LADISLAS MAURICE: Hello, everyone. Ladislas Maurice from thewanderinginvestor.com. So today, I’m very happy to have Lobo on the show, who is the independent speculator and who specializes in mining stocks. Lobo, how are you?

LOBO: Doing great, Ladislas. Good to see you again, my friend.

LADISLAS MAURICE: I’m pretty sure you’re doing great, seeing that gold is at around 2,040 today. So is this the breakout that we’ve been waiting for, for three years now?

LOBO: Well, you know me, that I’m both neither the one who promises doom forever or, this is it, it’s going to the moon, right? So, well, I just don’t like being wrong, frankly. And it’s so easy to be wrong making these bold clickbait headline pronouncements. But I think this is quite significant. I just posted a chart to my Twitter, as well as in last weekend’s newsletter showing the difference between the gold peak, so called last time and this time. I think this is very significant. We don’t have to beat it to death, but just I think there’s an important part of this. There’s a lot of sentiment out there, a thought, if you want to call it thought, I don’t call it analysis, that it looks like last time, there’s this peak in 2010, ’11, and then gold crashed after 2012. And therefore, there’s this peak.

Now, people just don’t believe it, they don’t think it’s going to last. They think it’s a peak. Right? And for a while, it was tracking sort of like the graph looked like last time, and that backed this point of view up. But now you can look at it and the lines are really quite diverged. The peak last time rolled over well before now, we’re clearly following a different path now. And my way of, I’m not a technical analyst, but my way of looking at it is instead of a peak, that’s a shoulder, and we are on our way upwards. Does that mean this is the breakout, is gold going to 5,000, 10,000, to the moon, whatever? I don’t know that. What I do know is that what’s happening right now is already significantly different. We’ve had a sustained, really record high level for gold for years now, not just a peak. And it’s breaking out higher as you and I speak.

And I know that not everybody in your audience is a gold bug, but just to put a bow on this, everybody used to say, “Well, if it’s breaking out, it’s too late. I missed it.” Right? “It’s high.” But no, that, well, maybe if you wanted to go buy ounces of gold, this might not be the most opportune time, you wait for the next fluctuation. But the gold stocks have been so beaten up by this sentiment that they’re relatively cheap. Many of them are nominally cheap. And if you price them in gold, they’re absolutely cheap. And that’s a fantastic opportunity. Now, the better ones, they’ve all started to move up. Of course, you can’t ignore almost 2,050. We’re actually looking at a new all-time record high nominally in gold is possible in the weeks ahead the way things are going. But the gold stocks are not up there.

So for anybody who is not already on board, I’m not saying you’ll miss it if you don’t buy now, I’m just saying the answer to the question, is it too late for gold stocks specifically, is no, there is still quality on sale. And I think that’s a fantastic opportunity.

Gold mining stocks have barely moved. Why?

LADISLAS MAURICE: The gold stocks are a lot cheaper right now at 2,000 an ounce than they were three years ago when gold peaked in 2020.

LOBO: Yes. On average, yes.

LADISLAS MAURICE: So why? Why is this happening? Is it just because of sentiment, or are there other reasons?

LOBO: I think it’s mostly sentiment. Markets are not efficient. Mr. Market is not rational, things overshoot. And I think there has been an expectation, maybe not amongst diehard gold bugs, who see all the money printing, or Austrian economics types who see that inflation is always in everywhere a monetary phenomenon, and they expect the other shoe to drop, but that’s not the mainstream. Most of your COMEX traders, they don’t think that way. And the pattern of last time is recency bias, I think, is very, very powerful there.

There are arguments that, oh, well, inflation is caught up with the miners, and their costs are high, the pool is higher, everything is higher. It costs more to build a mine. A lot of them were missing their budgets building mine, just huge cost blowouts. That’s a very rational point of view. And maybe for some of the institutional investors that actually do the math on how profitable is this company, that kind of analysis would hold back the gold stocks. But my experience is, I only have going on 20 years of it here, is that that never really holds Mr. Market back. When a flavor of the day hits, people don’t give a shit about that. Pardon my French. But it’s got gold in the name and it’ll run, or whatever. It’s lithium, it’s got lithium in the name, it’ll run. It doesn’t matter if that lithium is so low grade, it’ll never be mined ever, ever. The stock will still run with great promotion when everybody wants lithium.

I mean, just, dotcom, right? I’m not saying anything people haven’t seen many times before. So I would say, though, that there is an argument to pay attention to quality. I’m not saying everybody should go out and throw darts at the board, anything with a golden name will run. Well, I mean, it might. If gold hits a new all-time high, the rising tide may lift all ships momentarily. But what I’m saying is, some of these ships have huge holes in their hulls. The water will stir them around, lift them a bit, but then they’ll go right back down again. So I do think quality matters. I’m not saying Russia, or I’m certainly not saying buy just an ETF. That may work for a while, but I think you’ll underperform the opportunities here that a good stock picker can afford you by pointing out the ones that are legitimately undervalued, don’t have cost blowouts, they’re still delivering to the bottom line.

Maybe one last point here, and this isn’t gold specific, but more resource stocks and mining in general, is that there’s, I wouldn’t call it a conventional wisdom, but there’s a prevailing attitude out there that marginal producers are better buys when prices go up. Because, let’s say, you’re mining copper and you’re making 10 cents a pound, you’re scraping by. But there’s another guy that he’s mining copper, or she, and they’re making $1 a pound. Now, let’s say, the price of copper goes up 10 cents. Well, if you’re making $1 a pound and the price of copper goes up 10 cents, you’re making 10% more. But if you’re making 10 cents a pound and the price of copper goes up 10 cents, you’re making 100% more. So this is a very compelling sort of mathematical argument for why the crappy producers, the ones that are struggling, will do better when prices go up, because margins improve.

And like I say, mathematically, that’s true, but you have to ask yourself, why is it a crappy producer? Why is it struggling so much? Why are better companies making so much more money than they are? And whatever those problems are, they don’t just go away necessarily because prices go up. Price can help, does help, but it doesn’t substitute for excellent management, it doesn’t substitute for road blockades, or political problems locally, or, if you’ve got metallurgical issues. There’s lots of reasons to be, I think, judicious, and not just throw darts at the board on any resource, any flavor of the day, even. It does matter.

Individual stock picking vs ETFs for mining stocks

LADISLAS MAURICE: So I really agree with you that the markets are very inefficient, and why people should refrain from buying ETFs and should rather go into individual stock picking, though, in many cases, it’s riskier. I mean, and that’s why I’ve subscribed to your newsletter for a few years now. Because there are so many miners that are obviously bad investments, and some are outright frauds, just there in the open. That when you buy an ETF, you’re buying into the what is obviously a terrible investment like amongst the ETF holdings. And if you just do a bit of stock picking, obviously, not every stock pick is going to be good, but already by removing the 20%, 30% of obvious crap, you can really do better in the market–

LOBO: Yeah, I agree with you. That’s actually right. And a key point is like, well, but the guys that run the ETFs, they’re smart enough. If I’m not an expert on mining, then maybe I should trust an expert like these guys. The thing, though, is that I don’t think that all of those ETFs are constructed by the quality of the company. They have other metrics, size, liquidity, exchange. So you look at, I mean, okay, there’s GDX is a big gold miner. It’s a reasonable representation of major gold mine. But you look at the GDXJ, the so-called junior gold stocks. And I don’t think there’s a company on that list that’s less than a billion dollars in market cap. Those aren’t juniors, those are mid tiers, or, they’re larger companies.

LADISLAS MAURICE: Yeah.

LOBO: They’re selected by other criteria that I don’t think are necessarily what’s going to bag me the biggest capital gains. So if I knew absolutely nothing, and I had no time, and I thought the metal that I’m betting on is going to do a hockey stick, I might do an ETF, just as a lazy investor. But I do that knowing that I’m probably missing out on bigger wins. If I just, by a little bit of mental effort, to trying to pick better ones or find someone who can help me pick better ones. As you say, there’s so much crap out there, just getting that out of your basket can be a huge help. And if you don’t mind me tooting my horn a little bit, never mind the independent speculator, the flagship service, of course, do mind it, but we have my take, or I wouldn’t call it an introductory, it’s a different kind of scene. There’s no portfolio, it doesn’t have stock picks. It’s more like Consumer Reports.

And I don’t think people understand or realize the power of this. We cover over 600 companies, Ladislas. Now, it’s grown. I have a whole team. I can’t keep up with that many myself. But just, real quick, the point, though, is that it’s not just description, it’s not just reporting, it’s not just, “Here’s a spreadsheet, make your picks.” There’s human judgment there. Each one of the companies under my take has a thumbs up or a thumbs down and why. I tell you the story, I tell you the pros and the cons, and I tell you my judgment. I have my team, they all feed it into me. But, ultimately, it’s my judgment based on my experience. And there are some that are absolutely of a sell now, this is an active threat to your capital, sell immediately while there’s still a buyer. And there’s others that, not for me. And there’s others like, yeah, this looks good to me. And I don’t claim to always be right. What I do claim is that I work for my readers, that no company can pay me any amount of money to get a thumbs up if they don’t deserve it. So I just put that out there as a tool. It’s not terribly expensive.

LADISLAS MAURICE: No.

LOBO: It’s meant to help people with their own due diligence. And to my knowledge, there’s nothing else like it out there. People would expect a newsletter to be stock picks, or long form entertaining reading and that sort of thing. And that’s, my take is really just my take on as many companies as I can humanly cover.

LADISLAS MAURICE: Yeah, that’s the service that I subscribe to and pay for, and have been for a few years. I actively invest in mining companies. And before selling or buying a mining company, I do my own research, I reach my own conclusions, and then I log into my take, and then I see your take. And then, sometimes, it helps me avoid making big mistakes. Or, just when I’m looking for new investments, I can go through and say, “Huh, this one’s interesting. Let me do my own due diligence.” So I don’t even have an affiliate discount for subscribing to it.

LOBO: (laughs)

Political risk in Africa vs. political risk in Canada for mining stocks

LADISLAS MAURICE: We should actually discuss this, Lobo. But yeah, it’s a very valuable service. So let me ask you about, because I know that in the– Look, I lived in Africa for a long time. And it might take specifically often, but not always, you put thumbs down on African mining companies saying, look, it’s good, the numbers are great, but because it’s in Cote d’Ivoire, or in Ghana, or whatever, I’ll put a thumbs down.

LOBO: (laughs) You may choose the better ones.

LADISLAS MAURICE: But you can invest if you’re inclined to get, could give out risk, for example. So are you going to change this view of looking at things? Because increasingly, the way I look at the world, I feel that investing in Canada is a lot riskier than investing in many African–

LOBO: I get the question. And our friend, Rick Rule, likes to say that, somebody steals my money, it doesn’t matter what the color of their skin is, the money is still stolen. And whether they do it politely through Revenue Canada or something, or impolitely, it doesn’t matter. And, logically, that’s true. But if you’re driving home from the mine at Red Lake in Ontario, you’re really unlikely to be gunned down by a gang of militants bearing AK-47s, and you’re very unlikely to catch Ebola. So I don’t think that that’s the same everywhere.

Now, political risk is everywhere. There’s some small band of First Nations in Saskatchewan, that at least the headlines make it read like they’re claiming mineral rights over all critical minerals in all of Saskatchewan. It’s a ridiculous claim, or at least a ridiculous headline. I suspect that they’re actually only claiming it on their own lands, which are fairly small, but it’s unclear in how the story was reported. And a lot of people got all excited about it. So I get that political risk is everywhere. As Doug Casey likes to say, you can run but you can’t hide.

LADISLAS MAURICE: Like at least African companies have low valuations, so it’s built on–

LOBO: Yes. So there you go. That’s the part that Doug teaches, is that at some point, price trumps value, is the way Doug puts it. And so if you’ve got a similar near-service million ounces’ oxide gold heap leachable and it’s in Nevada versus Burkina Faso, well, if it’s in Burkina, I might buy it, but it’d have to be 10 cents on the dollar compared to the one in Nevada. If it’s the same price as the one in Nevada, forget it. From Burkina, if it’s 50 cents on the dollar compared to the one in Nevada, forget it. Burkina keeps having coup d’états.

So that’s the other thing, is that I don’t have a blanket policy against all Africa. And I absolutely encourage people to not think of Africa as a place, it’s certainly not a country. There are many countries in Africa that are quite different. And that’s why I was laughing when you gave your examples because Ghana is one of the best countries in Africa. Not only is it strongly pro-mining, where you can get permitted there, and Western companies have been able to permit mines and build them there, and they’re doing it now. Hasn’t had a coup d’état since I can’t remember when. And it’s got fairly decent, by African standards, rule of law. In fact, I think the last gold stocks that I owned in Africa were Ghana-based. So I like Ghana quite a bit.

Cote d’Ivoire is close until the debacle with Laurent Gbagbo refusing to concede the election and having to be ousted, and the turmoil in Cote d’Ivoire over that. That was another poster child of stable Africa. And the Gbagbo thing really kind of alarmed me, because that was, again, that was supposed to be stable and it turned out not to be so stable. But he’s gone, and since then, they really haven’t had anything like that. And they’re pro mining, you can work there. It’s a little bit closer, though, to some of the epicenters of Ebola. So I keep that in mind, too. It comes and goes.

But there are some, like Burkina and Mali right now with the coup d’état. I mean, Mali, how many coup d’états they have last year? Any place like that that’s that volatile, no fly zone for me. I don’t care how good the project is. If they shoot your employees working there, the stock is going to take a big hit, and you won’t recover. So forget it, too much risk. Farther south, Namibia and the uranium mining down there, when have you heard about Namibia in the news? Probably almost never. That’s a good thing. When you don’t hear about an African country in the news, that’s usually a very good thing.

So I’m selective about Africa. And my problem with the uranium place in Namibia is just that they’re low grade. If I can buy super high-grade Athabasca plays, still on sale because people still hate uranium, why do I even need to bother with something so marginal? If all the Athabasca plays were ridiculously expensive, a few of them are but not all of them. If I couldn’t get the super high-grade still on sale, then I would go down the food chain. But I’m still able to get high-grade uranium on sale, so I just don’t see any point in going there. Sorry, long story short, is–

LADISLAS MAURICE: It’s objectively less political risk in Namibia than in Canada. And Namibia, eventually, the exit strategy is a Chinese takeover. Because where else are they going to get uranium? Kazakhstan? Uzbekistan?

LOBO: Well, yeah.

LADISLAS MAURICE: And then that’s it. Africa.

LOBO: Well, political risk isn’t the only risk. But yeah, you’ve got execute– I mean, you’ve got Paladin, and I don’t normally talk stocks. Sorry, I shouldn’t even mention that. But you’ve got well-loved stocks or companies working in those areas. And it still remains, the current prices, those projects don’t work or their margin. Right? And that matters to me. If there’s a company that has a project that does work at current prices, and it’s in Africa, I would consider that. So it’s long story short is I think it’s too facile to just say, “Oh, well, there’s political risk in the US and Canada, too.” Well, there is, but there is rule of law. And, if you’ve got the right project in the right place, the right team, your odds are pretty good.

And usually, I’m betting on either the success and progress stage of exploration, at which point I’m not really worried about permitting a mine, or I’m betting on the pre-production sweet spot where you’ve already got your permits. So, permitting questions, are the First Nations going to be all up in arms about this? Those are either not relevant or already solved when I’m in, because I hate political risk. But I just I think it’s too simplistic to say, “Oh, well, there’s political risk everywhere.” I think you’ve got to be watchful everywhere. And if I am going to go to a riskier place, then I want a discount. Get me 5 cents on the dollar and sure, I’ll consider, you know, almost anyway.

Silver outlook for 2023

LADISLAS MAURICE: Sure. Yeah, and that’s what you do as well in my take. So tell us about silver as well, because silver seems to be looking up as well. It’s gold’s erratic little cousin.

LOBO: Yeah. So my friends in the Wall Street silver community have dubbed me Darth Silver because I had the temerity to suggest that silver might not go back into circulation if we ever do adopt a new gold standard. Completely side point, that’s theoretical argument for some time in the future, if that ever happens. My argument is just that, with Blockchain, there’s no need for a bimetallic standard. You don’t need silver to make change for gold anymore. That has nothing to do with what’s happening now. But people call me Darth Silver because I am saying that the use case for silver is changing. I think that does matter now. Its industrial side is clearly much more powerful. And not always, not over the long term, gold and silver do still have a very high correlation.

Silver is still a monetary metal, before you send me all the hate mail, you silver bugs out there, yes, I understand that silver is the word for money in many languages. But you just can’t stick your head in the sand on this. When we see there are times where it’s days or weeks where silver will track the price of copper or oil more than the price of gold. You can’t ignore that data. When silver is, it should be on the critical minerals list. You need it for the solar panels, virtually all of them. And yes, they’re reducing the amount of silver that it takes to build the solar panels. But pretty much all commercial solar panels take silver, and as that use of those explodes, even if each one uses less, the demand for silver goes up. And that’s been the case for years and people are worried, Oh, well, China’s pulling the subsidies on panels and so on. It’s still the case, it’s that demand case for silver still keeps going up.

And so the bad news is that on a year like this where I think the world is going into a deepening global recession, I think there’s still the Piper to be paid for all that was done, and these COVID lockdowns, and those chickens are coming home to roost. We’re seeing it now. The mainstream is even starting to catch on. Yeah, maybe soft landing isn’t all that likely anymore. Team Soft Landing has gotten awful quiet in recent weeks, if you haven’t noticed. So that’s going to weigh on the industrial side of silver. So my projection is not bearish on silver. My projection for this year is that silver is going to lag gold more than it usually does. Or, to put it in another way, the gold silver ratio, how many ounces of silver you can buy with one ounce of gold, that’s probably going to go up this year because of this industrial side. Now, they’ll both go up. If gold breaks to a new all-time high, silver will not get left behind, you will see silver go up. All I’m saying is that the alligator jaws on the chart will open, I think, over the course of the year because of silver’s industrial aspect.

Now, the bright side, though, is that if silver’s industrial side actually crimps supply, if the world goes into recession, and the miners pull back their horns, most silver is produced as a byproduct of base metal mines, particularly copper and lead and zinc. So if the prices of those go down, and the miners pull back, then the lion’s share of the silver supply, new silver supply coming onto the market drops dramatically. If that happens at a time where monetary metals demand goes up, safe haven demand, people are afraid, they want to buy gold and silver because it’s physical savings, if those things happen at the same time, then that’s the real silver squeeze, never mind a Reddit silver squeeze, that’s the real world silver squeeze that has historically cost silver to just go ballistic and more than catch up with gold in the past.

I’m not promising that will happen this year. I’m saying that the stage is being set for that kind of outcome and, as a speculator, that that’s very interesting to me. Finding quality silver plays right now is a top priority for me.

What I’m doing now

LADISLAS MAURICE: Very interesting. Lobo, thank you. So if people are wondering what I’m doing with my own portfolio right now, I already have a number of silver and gold positions both in physical and as well in mining companies. I’m not buying more but I’m not selling at this point. Especially my physical gold, I’ll hold on to it. I don’t buy physical gold as a speculation. I’m buying as a saving. Silver, I’ll probably sell at some point. And then my mining companies, I will sell. I view mining companies as a speculation, not as an investment. So I will sell at some point, not now. I don’t know when, but at some point in the future for sure.

Great. And if you are interested, really, I recommend people sign up to Lobo’s newsletter. There’s my affiliate link below. It’s entirely free. You can upgrade to other tiers, etc., which I have, but you could sign up to the free newsletter as well. It’s you send a weekly email with a full analysis. It’s very helpful, very insightful. So yeah, affiliate link below. Lobo, thank you so much for your time. I really appreciate it.

LOBO: Thank you, Ladislas. Good conversation.