Is investing in contemporary Uzbekistan a viable option? Maybe you haven’t heard much about Uzbekistan, or can’t really place it on a map. But back during the early silk trading days, you would have. Cities such as Bukhara and Samarkand were at the core of the silk trading, and were the subjects of many tales of endless wealth.

Since then, Uzbekistan has plunged quite low. It borders countries such as Afghanistan, Tajikistan, Kazakhstan, and Turkmenistan and got its full independence from the Soviet Union in 1991.

The world’s only double landlocked country, along with Liechtenstein, had a rather rough time after independence with the iron-fist rule of Islam Karimov. The economy was closed off, and essentially under complete state and oligarchic control. Let’s just say that it wasn’t much of an environment for honest foreign investors :). Karimov passed away in 2016 and was replaced by Shavkat Mirziyoyev who promised a new course for the country.

Having worked in Central Asia for a while in the past, I always followed the political developments in the region. I remember telling myself 12 years ago that when Uzbekistan would open up, I’d want to be there to sniff out opportunities.

The government has been making progress over the last 2-3 years. For instance, it abolished exit visas for its citizens. Some political prisoners have been freed, special economic zones are being created, and virtually every sphere of government and legal codes are being reformed. Below is a list of why I believe Uzbekistan should be on your radar.

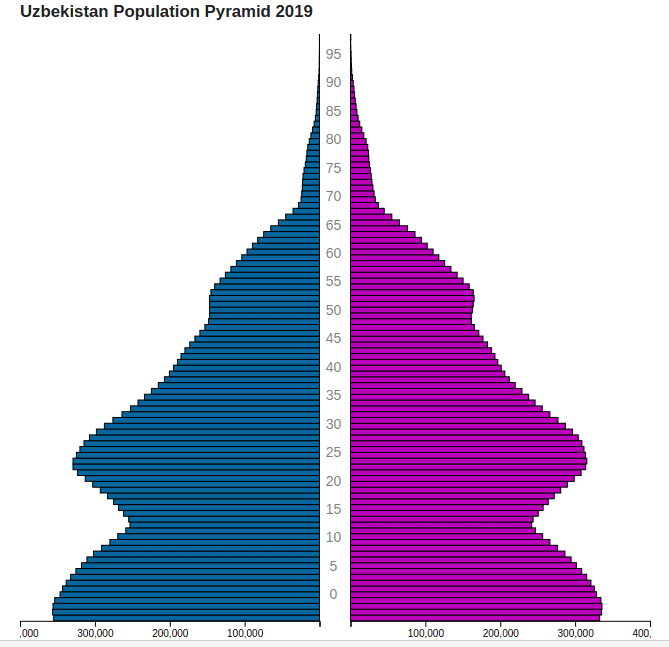

Investing in Uzbekistan – the Demographics

- Except for a dip due to hard post soviet days, the population graph is very healthy, and promises many years of growing labour force. European and East Asian countries can only dream of such a pyramid.

- The country has a fertility rate of 2.4, which ensures population growth. However not so much that it becomes overwhelming like in many Sub-Saharan countries.

- Many people have heard of the riches of Kazakhstan; but Uzbekistan with its 33 million people is almost twice as populated.

The Geopolitics

Let’s face it, “World Power” is shifting from the North Atlantic to the East. Central Asia is in the middle of all the action. Uzbekistan is right there, ripe for the taking. Everybody is rushing to the capital Tashkent in this high stakes game.

- China: Uzbekistan is at the heart of the Chinese Belt & Road initiative. Tens of billions of Chinese investment in everything from infrastructure, to manufacturing, mining, etc, can be expected over the years. The Chinese are acutely aware of their history. How can they ignore the center of the former Silk Road in their own Belt & Road Initiative?

- Russia: Needless to say, as a former Soviet Republic, the Soviet deep state is still active in Uzbekistan. The elite speaks Russian, as well as a third of the population, and there is still a sizable Russian minority of 5% in Uzbekistan. Russia has always invested there, and will continue to do so. It considers Uzbekistan to be its backyard.

- Gulf Money: Being a Muslim majority country, Uzbekistan is attracting substantial Gulf money. Contracts worth billions have been signed with the UAE . Furthermore, Oman’s sovereign wealth fund invests there. And Saudi Arabia is sniffing around.

- Naturally, the West, as always, is present. Billions in deals were signed with America. The European Union does mostly aid & development.

- Turkey considers Uzbekistan to be within in sphere of influence as Uzbek is a Turkic language. Uzbekistan has recently become a member of the Turkic Council, and Turkish business is already very present in Uzbekistan.

- Lastly, India is also active. As always politically close to Afghanistan in order to corner Pakistan, India is glad to have influence in Central Asia.

Investing in Uzbekistan – the Reforms

- The local currency, the Som, is now free floating. Some of the main remaining restrictions were removed in August 2019.

- Capital controls were abolished in Q1 2019. Accordingly, foreign investors can now repatriate their money.

- Climbed from 166th place to 76th place in the Ease of Doing Business rankings, from 2012 to 2018

- Since early this year; visa free access for citizens of many countries. Moreover, Uzbekistan recently added India & China to the list. It’s quite a dramatic shift from what used to be a hugely restrictive system. It’ll do wonders for tourism, for which the country has a lot of potential.

- Corporate and personal income tax rates of 12%.

Investing in Uzbekistan – the Macro & Fiscal aspects

- A low debt to GPD ratio of about 22%.

- Real GDP growth of 6.7% between 2013 & 2018.

- Comfortable foreign reserves worth 13 months of imports.

- A literacy rate of 99%, which bodes well for the services industry.

- A GDP per capital (not PPP) of about USD 1,500 versus Kazakhstan’s USD 9,300.

- Lots of Natural resources. Agriculture is huge, and will stand to gain massively from the coming mechanization. Additionally, the country is also the world’s 7th gold producer, and has substantial reserves of copper, zinc, uranium, lead, gas and oil.

- A very under-leveraged economy as per this graph from The Economist.

Uzbekistan sounds like a great investment destination but

Some people will tell you:

- “It’s not a democratic country”. Sure, just like Monaco, China, Hong Kong, Vietnam, etc. A lack of democracy does not mean a bad economy. Having said this, yes, just as quickly as reforms are being passed, they can be undone. Same things with capital controls; they could come back and your money would be stuck there. The risk is real.

- “Inflation is high”. Yes; inflation is high, this is one of the main risks, but already the inflation numbers are coming down and the World Bank is optimistic.

- Instability related to Afghanistan and Islamic terrorism. The government is acutely aware of the risk, and it is a top priority. Having said this, good reforms and economic growth are the best breaks to any sort of extremism.

- “It’s risky”. No pain no gain. And quite frankly, as I see the frantic pace of extreme socialist rhetoric in many Western countries, along with their high debt burdens, risk is underestimated there. But indeed, investing in Uzbekistan is much riskier than in Singapore 🙂

In conclusion, should you go to Uzbekistan?

I know I am. The growth story is too compelling. Everyone is starting to take notice, and it is still very early in the game. Moreover, hedge funds and private equity funds such as Hong Kong based Asia Frontier Capital and London based Sturgeon Capital have started Uzbekistan focused funds this year.

The Wandering Investor will be heading there for a few weeks to see it for himself. Maybe he’ll see that the reality on the ground is completely different, or not. Expect more posts on the matter.

More articles on Uzbekistan:

- How to obtain a Residence Permit in Uzbekistan

- Investing in the stock market in Uzbekistan – a high-growth frontier market

- A Real Estate Investment in Tashkent, Uzbekistan?

- How to start a company in Uzbekistan as a non-resident foreigner

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

CBD, or cannabidiol, has been a meeting changer an eye to me. https://mjcbdd.com/products/delta-8-joints I’ve struggled with hunger for years and have tried assorted various medications, but nothing has worked as well as CBD. It helps me to crave calm and relaxed without any side effects. I also obtain that it helps with nod off and pain management. I’ve tried various brands, but I’ve bring about that the ones that are lab tested and take a high-minded repute are the most effective. Comprehensive, I importantly plug CBD in behalf of anyone who struggles with worry, be in the land of nod issues, or inveterate pain.

So glad I stumbled upon this.