There are many reasons why anyone with even a little bit of money should diversify their banking and learn how to open an offshore bank account in Mauritius. It’s a process I went through myself.

The original reason I opened an account remotely in Mauritius is because I was living in West Africa and most banks did not want to deal with me. However once I left Africa and moved to the Middle East, Europe and Latin America I kept this bank account in Mauritius and it was an amazing experience.

As a user of banks in Mauritius for 12 years, this is my assessment of the pros and cons of opening a bank account in Mauritius remotely.

Table of Contents

The Pros of opening a bank account in Mauritius as a non-resident

- A few banks in Mauritius accept non-residents, unlike most banks in most countries in the world.

- Even Americans are accepted, which is not that common due to FATCA.

- Higher interest rates on your USD deposits than in other countries.

- Multi-currency accounts including the EUR, USD, CAD, HKD, AUD, GBP, AED, SGD, CHF and even the Indian Rupee.

- Geopolitical diversification: a financial hub for Africa, the Middle East, India, and Europe.

- Multi-currency debit cards are available, with airport lounge access.

- No capital controls.

- Compliance departments that are accustomed to nuanced cases from all around the world.

- Mauritius is not a grey listed jurisdiction.

- Bank accounts can be opened remotely.

- Much better customer service than in places such as Panama, the Caribbean or various Fintech solutions.

- English is an official language of Mauritius.

- It is also possible to open accounts for corporate structures and trusts.

- Direct access to personal bankers.

The cons of opening a bank account in Mauritius as a non-resident

- Physical presence is required in most cases, unless if you use specific agents.

- The bank account opening requirements change on a regular basis.

- In many countries, you have to declare your foreign bank accounts to the authorities, which is fine, but if you add Mauritius to the list you might get a higher chance of being audited.

- Minimum balance of $100,000.

- If you are deemed “high-risk,” accounts can also be opened, but the minimum balance must be $1,000,000.

- These banks are not crypto friendly.

- Very limited deposit insurance scheme (practically non-existent)

How do you open a bank account as a non-resident in Mauritius?

Different banks have different procedures, but generally you need the following for those that do accept non-residents:

- Your physical presence or well connected agents who can open the account remotely for you.

- A copy of your passport.

- A copy of your CV.

- Source of income; a work contract, an income tax declaration, an inheritance document, income statement of your own company if you own your own business.

- A utility bill to confirm your address.

- A bank reference letter from your current bank mentioning since when you’ve had an account with them, and confirming that you are in good standing.

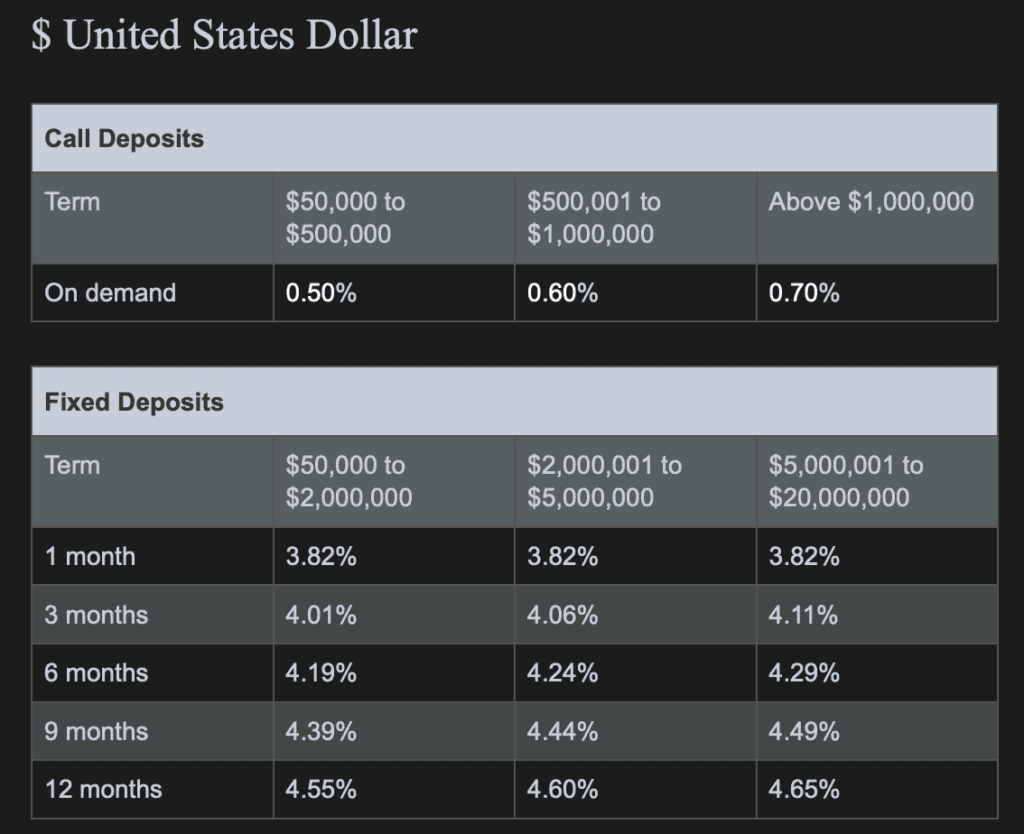

What interest rates should you expect on your term deposits in Mauritius?

Here were the rates as of October 2024 in the bank I would say was the most suitable for non-residents.

Should you open a bank account in Mauritius as a non-resident?

I find that Mauritius is an exceptional jurisdiction far away from all the geopolitical drama in the world. Additionally, the fact that English is an official language of the country results in much easier communication with bankers than in other financial hubs.

This geopolitical diversification is key nowadays. Mauritius is effectively the financial hub between Africa and India, but with first world infrastructure and services. Even without the banking advantages, Mauritius is absolutely worth a visit.

In summary, opening a bank account in Mauritius as a non-resident is viable. Unlike a Panama account, Mauritius is very viable as a main offshore bank account and entails even less paperwork than trying to open a bank account in Switzerland or Singapore.

Finally, it is one of the few good jurisdictions to accept Americans for remote bank account openings.

I request guidance on what the best route would be for my income to be paid into an offshore account since I do not require the majority of my income to be paid into an account in my Country of Residence.