In the wake of all the reforms taking place in Argentina, I ventured to Buenos Aires for a few weeks to scope out the real estate market. I spent time meeting realtors, lawyers, expats, locals and other participants to get a good grip on the real estate market and made a number of offers myself.

We will examine the Buenos Aires real estate market that is showing very bullish tendencies, but that is tricky to navigate.

Key Takeaways

- The Buenos Aires real estate market is in a bull market, driven by recent economic reforms

- This is a capital gains play, not a cash-flow investment – rental yields are low except in some very local neighbourhoods

- Focus on gentrifying neighborhoods like Palermo Soho, Palermo Hollywood, and Villa Crespo for best upside. Puerto Madero is expensive but will still see price appreciation

- Navigating transactions is complex – having an experienced local agent like is crucial

- Seller behavior can be unorthodox, so patience and persistence is required

Table of Contents

Argentina Economic Summary

As far as its economy goes, Argentina is a legendary basket case. There isn’t much of a need to go into the history as most readers here are already keen observers of Latin America. You should already be loosely aware of the political tumult during the 20th century that led Argentina to dreadfully mismanage its many blessings.

Agricultural powerhouse

Argentina has been growing its agricultural sector consistently for decades and it accounts for more than half of the country’s foreign exchange revenue.

It produces magnitudes more food than it consumes, with top exports consisting of soybeans, wheat, corn, cattle, produce and wine. Argentine agriculture generally offers very competitive pricing, though the sector operates far below potential due to the instability of the peso and lack of investment in export infrastructure.

A country with such bounty would normally encourage exportation, but Argentina has historically applied a heavy export tariff regime to its farm sector. Farmers have had to pay about 33% to export their soy and 15% on other products like wheat and meat. While Milei pledged to eliminate export taxes, it remains an unfulfilled campaign promise. His administration has, however, made inroads in decreasing and streamlining import taxes on agrarian inputs that the sector needs to thrive.

Abundant natural resources

Argentina is energy self-sufficient and is a net exporter of petroleum products. The industry is currently fixated on Vaca Muerta, a shale extraction region in Patagonia. The region produces around 300,000 barrels per day, which pales in comparison to other sites that have similar levels of maturity and development. Increasing production has been inhibited by chronic government intervention in the market to control price and subdue domestic energy prices. There is the potential to quintuple this production if the regulatory environment improves, a concern Milei is intent on resolving.

Argentina is the 4th largest lithium producer in the world with the largest salt lake lithium reserves in the world, and also some of the lowest extraction costs. While they are bringing more mines online to satisfy EV battery demand, their current share of global production stands only at around 6%. The sector underperforms due to lagging technological ability as well as regulatory chaos.

The country was able to draw significant Chinese investment in the lithium sector through tax incentives which improved know-how in the space, but the Milei administration aims to align more closely with the US going forward, which will have mixed effects.

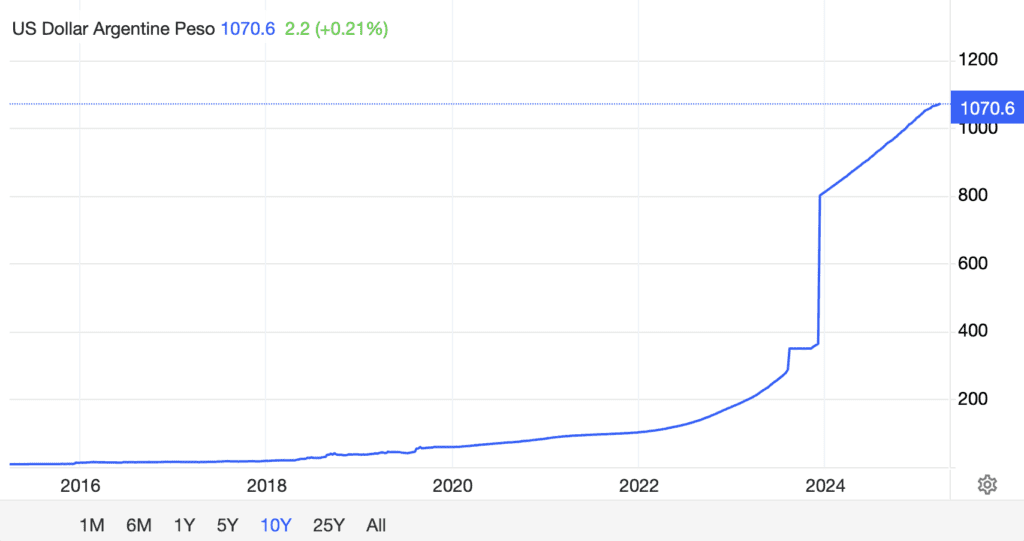

A spiraling depreciation of the Argentine peso

The Argentine peso has experienced a decades long debasement, resulting in horrendous inflation and a longstanding parallel market for foreign currency. As it stands, the currency seems to have stabilized but is soon due for another devaluation as it has become significantly overvalued.

The Argentine peso has not been a free-floating currency for decades, and the tangle of government controls to prop up their forex reserves has resulted in multiple exchange rates. The dolar blue is the only real floating market rate, which is the black-market cash rate given for foreign exchange already inside the country. But there are various other rates (as many as 19) that apply for credit cards, luxury purchases, stock and bond purchases and other specific purchases.

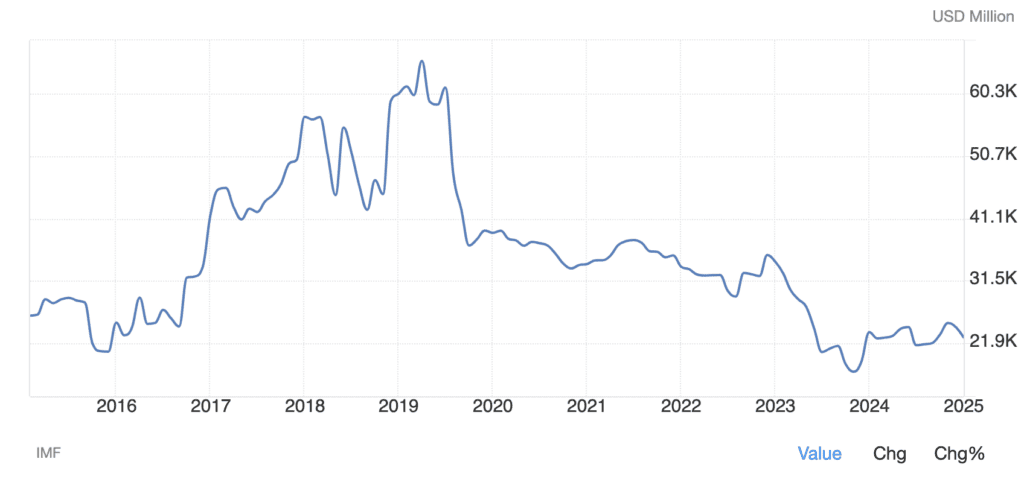

Improving Foreign Exchange Reserves

Argentina foreign exchange reserves are finally stabilizing after years of being drawn down under the previous administration, which gives the government a bit of breathing space.

Strong capital controls

Argentina has applied capital controls to stem outflows of forex reserves. Individuals have been restricted to how much foreign currency they can buy and how much they can use their credit cards abroad. Companies are subject to the same restrictions, as well as forced liquidations of their export incomes into Argentine pesos and restrictions on transfers of profits and dividends out of the country. The Macri administration attempted to abolish these controls but was forced to reimpose them in 2019. President Milei is committed to fixing the problem and has made substantial progress, though it looks like controls will remain in place for at least the rest of 2025.

Milei and his economic reforms

All eyes now are on President Javier Milei and the sweeping economic reforms he has pushed through the legislature. Ultimately, they should be positive for the real estate market in Buenos Aires, the country’s capital city. Here are some of the key provisions of his flagship reform bill:

No-holds-barred fiscal austerity

Milei has managed to reduce the budget deficit to zero by reducing government overspending and the nation’s substantial public debt. Public finances showing the first surplus since 2011. This is at the expense of public services and servants, who have made it no secret that they disapprove of these measures.

Investment incentives

The RIGI scheme, or Large Investment Incentive Regime, offers legal and financial guarantees to major international investors who make serious capital deployments in Argentina. Investors committing more than $200M USD in a selection of key industries will enjoy a corporate tax break of 10% and exemptions from future new taxation, in addition to duty-free importation of equipment, and only partial liquidation requirements of foreign exchange export income.

This should have a very positive impact on mining sector investment. The scheme could pave the way for Argentina to become a major global player in mining of lithium, silver, gold, copper, lead and zinc.

Privatizations of key industry

Milei has expressed interest in privatizing everything from state owned petroleum companies to football clubs. While he was pushed to make concessions on this front to get the reforms passed, there are finally eight major companies that will be either fully or partially divested by the government. They range from Energia Argentina, the main state-owned oil and gas exploration entity and electricity distributor, to the main public water company in Buenos Aires, to state nuclear energy, rail freight and airport ground services operators.

Labor protection rollbacks

Milei’s bill has made it easier to dismiss employees for underperformance or other reasons by increasing probationary periods and reducing compensation for dismissal claims. Employees under collective bargaining agreements now have less leverage against their employers. This has of course angered the working man of Argentina, but should certainly help attract foreign investors.

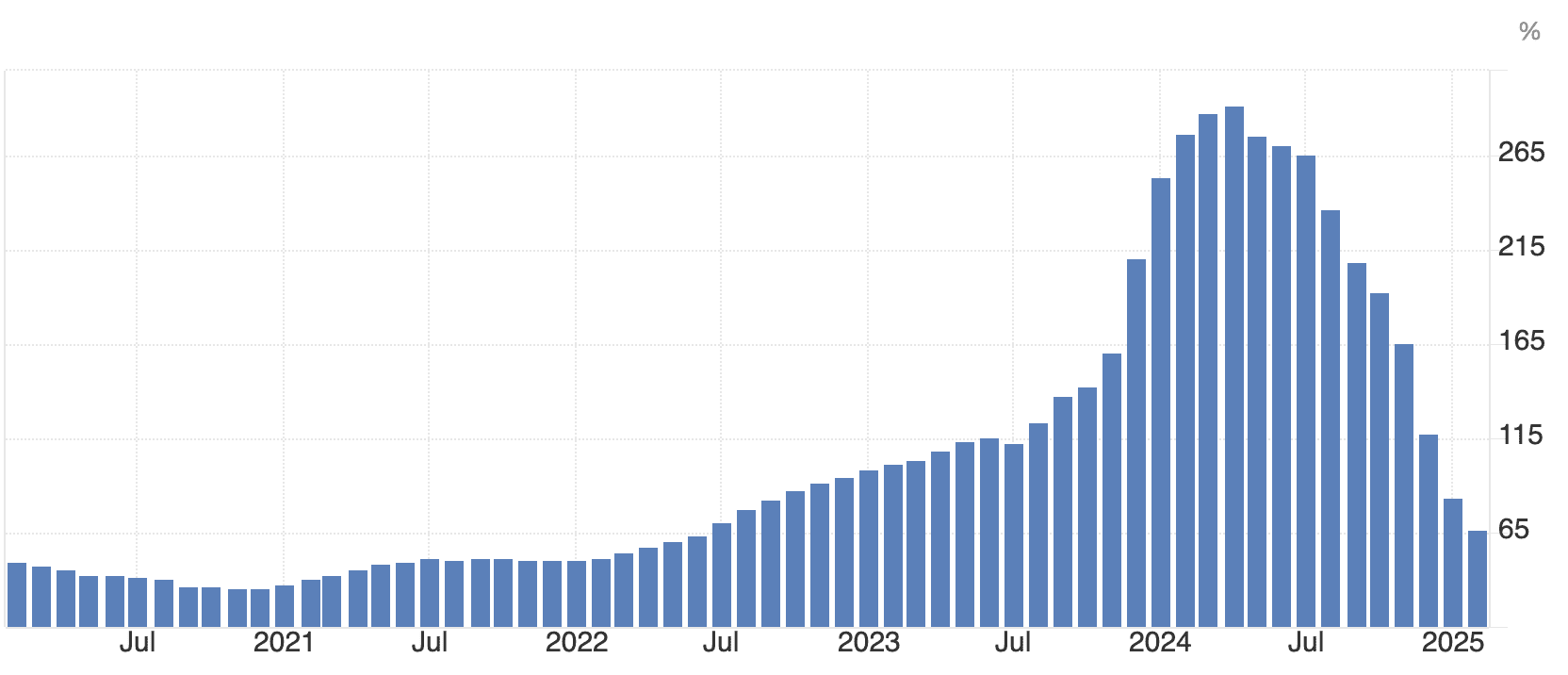

Fight against inflation

Argentina has traditionally led the world in inflation, with annualized headline inflation standing reaching 250% in early 2024. The astronomical number however has seen consistent decreases as Milei’s austerity takes effect.

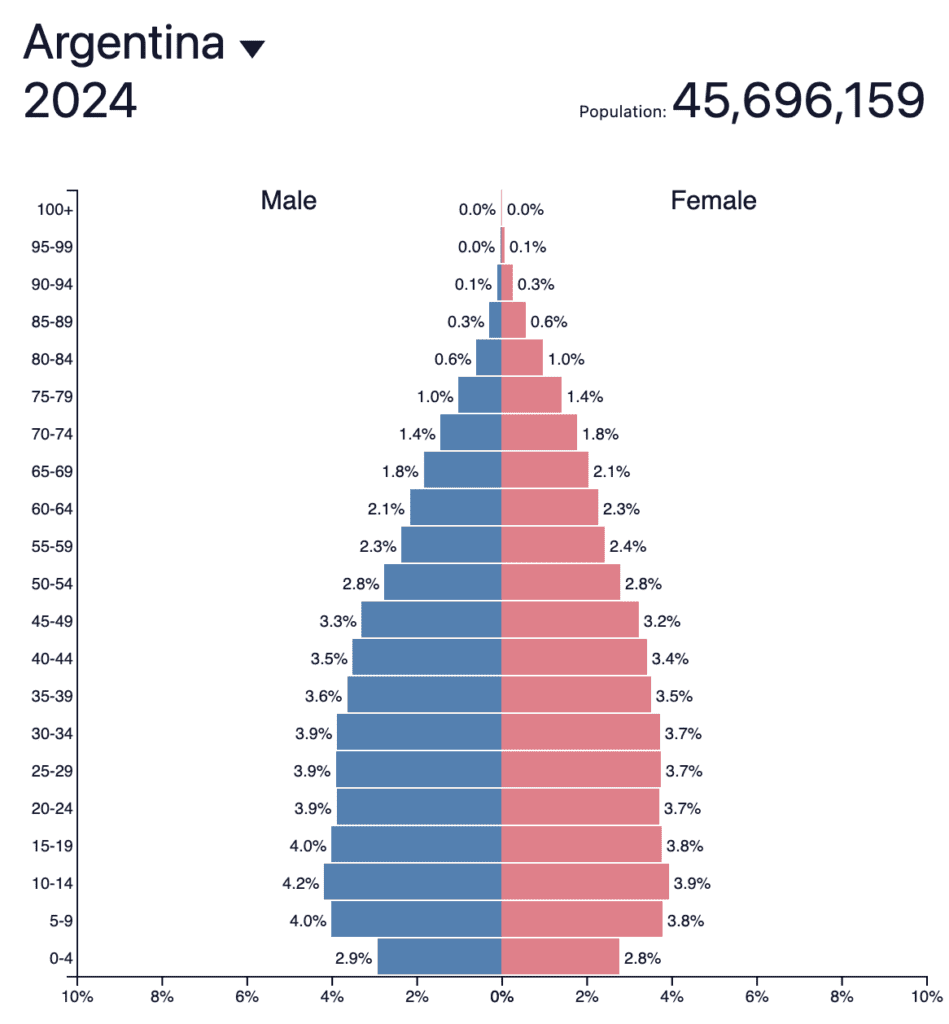

A youthful country for the time being

Argentina currently has a fertility rate of 1.88, but only in the last 6 years did it begin to fall below replacement rate. The result is that the country still has a sizable youth population that will support the economy and real estate in Buenos Aires in the immediate future. Problems concerning their demographics will not be felt for another generation or so. It’s anyone’s guess if reproduction in the country will gain steam again – these trends don’t easily reverse.

The Buenos Aires Real Estate Market

Buenos Aires and its surrounding cities form an agglomeration of over 15 millions souls, one of Latin America’s largest concentrations of people along with Mexico City and São Paulo.

Being that Argentina is a very centralized country from both a political and economic point of view, Buenos Aires sees the largest capital flows into real estate.

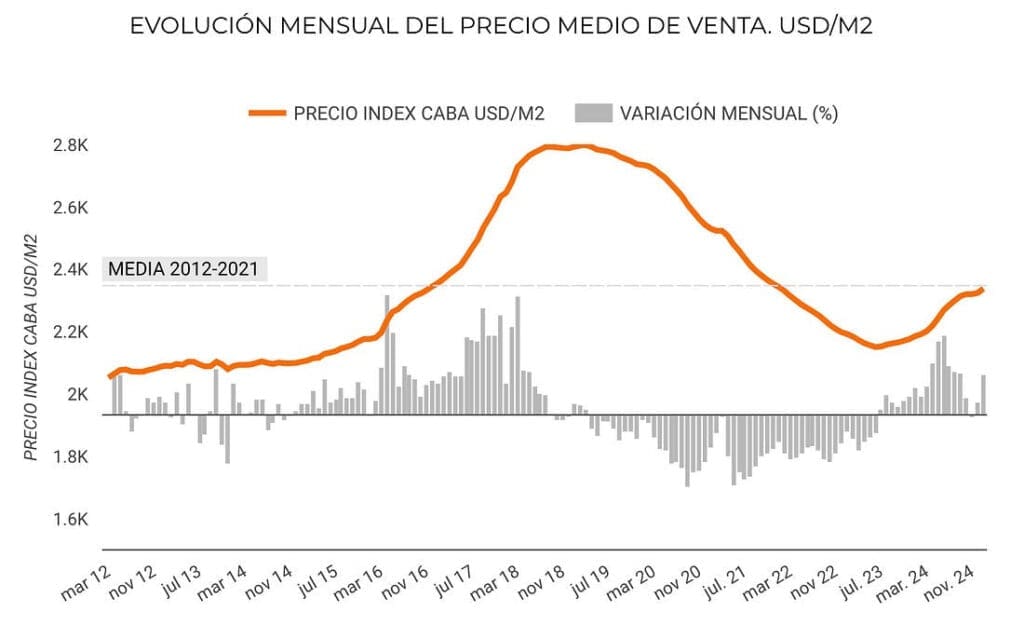

From 2018 to 2023 the market dropped almost 50% in real terms taking USD inflation into account. While the rest of the world was going through a real estate boom, particularly after Covid, prices continued to decrease in Buenos Aires.

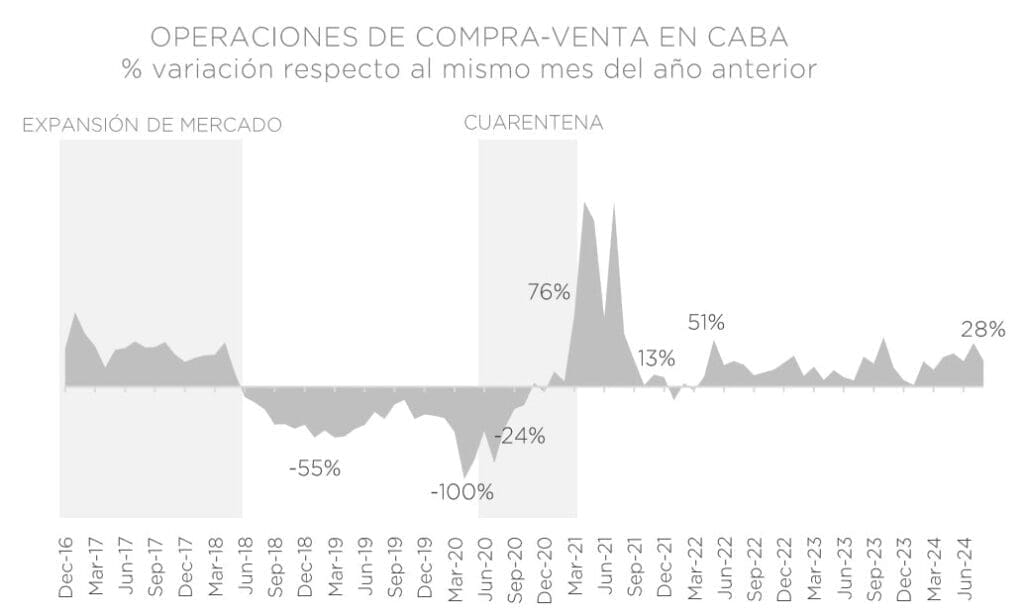

Capital has started flowing back into the Buenos Aires real estate market, thus resulting in prices going up again. Buenos Aires real estate is now firmly in a bull market.

This is driven is large part by an increase in transaction volume in Buenos Aires real estate.

Catalysts for the real estate market in Buenos Aires

1. Optimism in Argentina

Milei is far from revered by the whole population, but generally speaking people with capital are more optimistic than they were before. This means money that’s been sitting idle under mattresses is flowing back into the market. Additionally, wealth stowed away by Argentines overseas is slowly, but increasingly, trickling back into the country.

2. Reforms in the real estate sector in Argentina

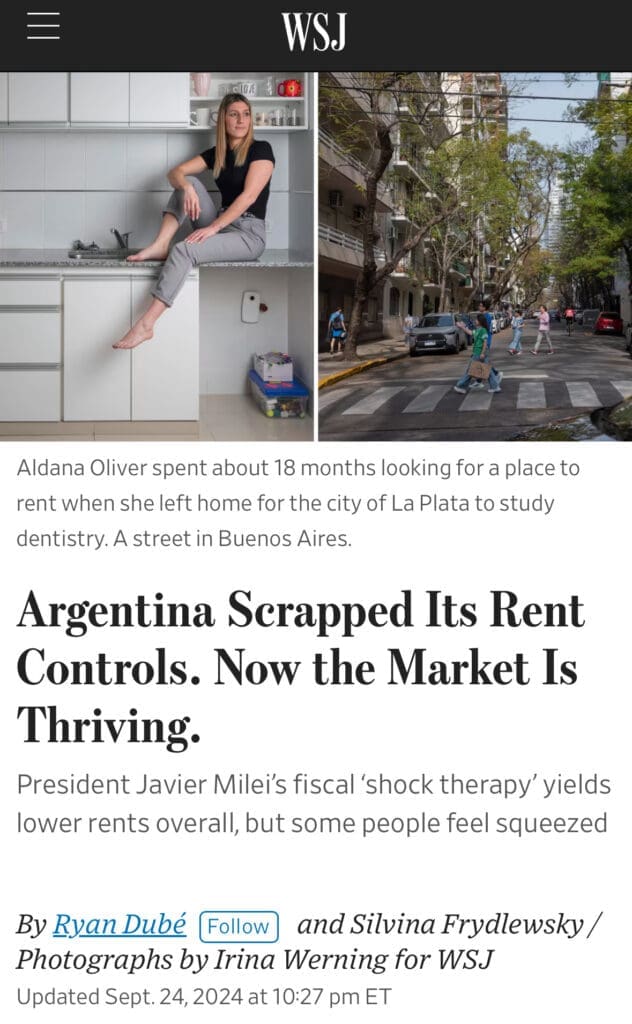

Milei has promised to massively deregulate the real estate market in Argentina. One of his first big reforms was to remove all rent control measures in the rental market.

These tough rent control measures resulted in one in seven properties in Argentina laying empty. People in Buenos Aires were struggling to find accommodation as no sane investor wanted to be locked in to a long term lease in Argentine pesos. As soon as this law was repealed, the supply of rental listings ballooned 184% and rents in real terms decreased 40% versus the year before.

Additionally, rents can be set in any currency, including the USD and Bitcoin.

Finally, in July 2024 Milei removed a 1.5% transfer tax on real estate, thus reducing overall transaction costs.

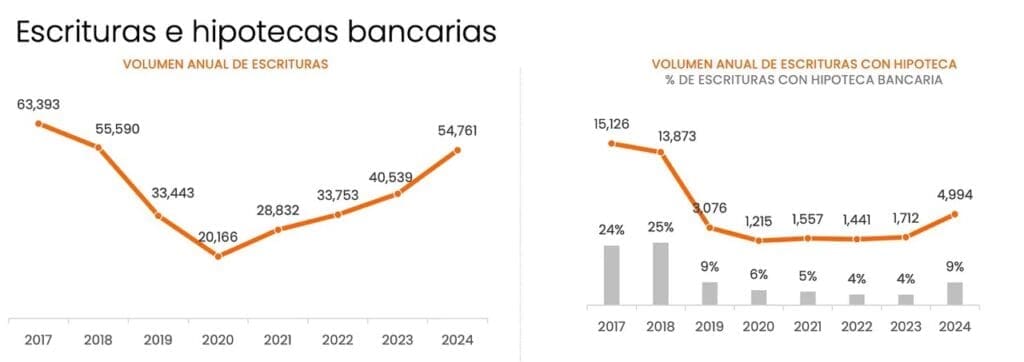

3. Mortgages are back in the Buenos Aires real estate market

For years there hadn’t been any new leverage in the Buenos Aires real estate market. This changed in June 2024 with a number of banks offering mortgages to local residents again (not available to non-residents). The numbers are still relatively small, but are increasing and will help drive the market going forward.

The onset of mortgage lending is always a massive catalyst for any real estate market in the world.

4. The tax amnesty

In tyrannical socialist systems such as Peronism, the name of the game to be able to survive is tax evasion. It was, and still is, a rampant phenomenon in Argentina. To help drive the economy, Milei has implemented a tax amnesty called the “Blanqueo“.

The goal is to legalize undeclared assets held in Argentina or abroad. The first $100,000 can be declared tax free. Above this amount there is a tax to be paid.

- Until September 30, 2024: tax rate of a 5%

- Until December 31, 2024: tax rate of 10%.

- Until March 31, 2025: tax rate of 15%.

A large percentage of these funds will invariably end up in real estate in Argentina, especially as people don’t trust the local banks. Physical cash, gold, crypto, local real estate and stashing money overseas are the main savings mechanisms of Argentines.

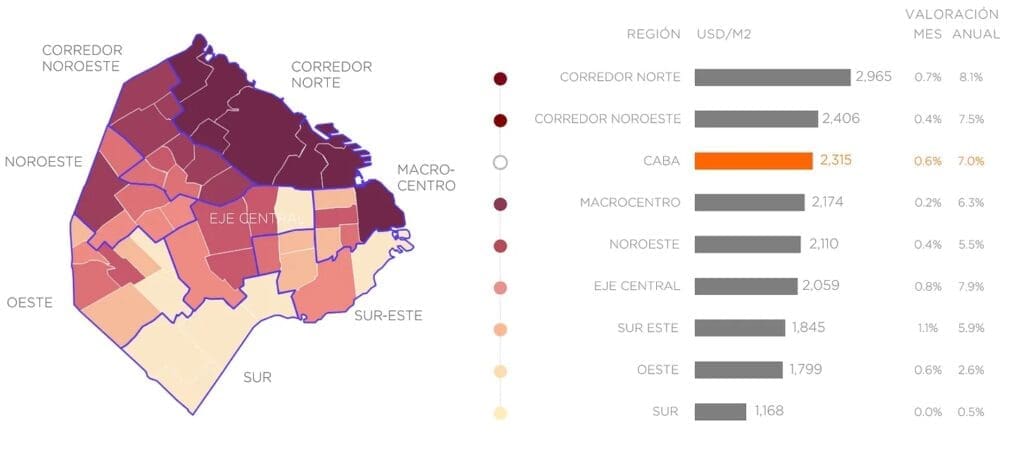

In which neighbourhoods to buy real estate in Buenos Aires?

Buenos Aires is massive, and is a relatively complex city to understand. It took me weeks of walking and driving around to get a decent grip of the city. Generally speaking, if you are a foreigner looking to invest in Buenos Aires you will primarily go for the Center and the North of the City.

For lifestyle, it’ll be the same, unless you want to stay somewhere in the in the suburbs

A more detailed list of neighborhoods:

Here is a list of some of the neighbourhoods that are worth discussing, in no particular order.

Investing in Palermo Soho real estate, Buenos Aires

Palermo Soho is undoubtedly one of the “coolest” neighborhoods in Buenos Aires. It is widely known for its nightlife, high-end restaurants, bookstores, and Bohemian vibe. It is a prime spot for expats and digital nomads who want to spend time in Buenos Aires, and one of the more expensive neighborhoods of Buenos Aires. There is strong demand for Airbnbs and rentals, especially from foreigners.

Investing in Puerto Madero real estate, Buenos Aires

Puerto Madero is an interesting emerging market phenomenon. To get away from crime and filth, this new district was created with luxury towers, stores and an attempt at a marina. Prices vary between $4,000 and $10,000 per m2, which is the most expensive real estate in the country.

I understand why Argentines like it. They get a semblance of Western luxury living (without great finishings) and are isolated from the masses and from crime.

However if you are a foreigner seeking to invest or spend time in Argentina, you will find this area lacks character and is certainly overpriced given its offerings. One does not travel all the way down to the Southern Cone to get an inferior copy of a modern Western city.

Objectively, from a pure investment point of view, the rental yields are extremely low, and vacancies are high as few can afford the price points. However, this being prime real estate, prices will inevitably rise along with the market, and even perhaps a bit more than the market.

Investing in San Telmo real estate, Buenos Aires

San Telmo is a short walk away from Puerto Madero, but feels miles away. It is a charming Bohemian area South of the Centro which is well-known as the home of tango dancing. It stretches along a main street with many delightful and inviting shops and restaurants, where on weekends local upper-class Buenos Aires residents get their Bohemian fix.

As the ultimate symbol of gentrification, a Starbucks opened near the central square which hosts an arts and crafts market.

From an investment standpoint, San Telmo is not a bad long-term bet, though I would expect other neighborhoods to increase in value faster. Also, security is a bit of an issue especially at night and on side streets.

I actually went to view an apartment on this very square together with Max my Buenos Aires realtor. We used this apartment as a case study and ran all the numbers.

I also ventured south of the Avenida Ricardo Balbin still in San Telmo because I kept seeing super cheap apartments in that area.

As soon as you cross that main avenue, the vibe changes. Within 3 minutes I had the police following me around for a few hundred meters (presumably to make sure I was safe), a bit later some people shouted at me telling me to hide my phone.

The area has a lot of LGBT and left-wing activism. Many of the buildings have good bones, especially around Parque Lezama. Real estate can be found for less than $1000 per m2 unrenovated.

If Buenos Aires were to take off, South San Telmo will invariably get gentrified. But for now it is too early. It is a neighbourhood I keep in mind for future speculation. There are much easier plays right now.

Investing in Palermo Hollywood real estate, Buenos Aires

Palermo Hollywood is similar to Palermo Soho in many respects, but more modern. The buildings are newer, and the people walking around a bit less Bohemian. You will find a multitude of bars, restaurants, and clubs. Personally, I found Palermo Hollywood much more pleasant than Palermo Soho. But both areas are great to find tenants and are optimal for Airbnb.

Investing in Villa Crespo real estate, Buenos Aires

Villa Crespo is one of the main Jewish neighbourhoods of Buenos Aires. There is a large number of Synagogues and Jewish schools in this area. Located just south of Palermo, it is in prime position to benefit from that area’s growth. One can already see hip restaurants, shops and bars popping up.

When I was in Buenos Aires I met some Jewish foreign investors who were specifically looking at Jewish areas of Buenos Aires. Their thesis was that:

- many Jews would leave Israel due to life becoming increasingly hard and toxic there.

- many Jews would leave Europe because they are increasingly the target of hate, as has happened in Europe throughout history.

Not all would make it to the US. Many would make it down to Argentina which is welcoming of immigrants, is affordable, and already has a very large Jewish population and institutions.

I find Villa Crespo very investible on its own. I guess this Jewish cultural aspect would be an incidental call-option.

Investing in Abasto real estate, Buenos Aires

My curious mind took me to this Jewish Orthodox neighborhood. It is not well-off like the other area aforementioned, with the core trade being textile. However it has the highest concentration of Synagogues and Jewish institutions in Buenos Aires.

I visited some really affordable apartments ($1,300 per m2, top floor, in decent condition, with balconies), but the market is literally upside down; apartments with views on top floors are actually cheaper than apartments on ground floors as the Orthodox can’t use elevators during Sabbath.

I felt I had zero edge in this market so I didn’t dig any deeper, but I enjoyed the mental exercise.

Investing in Colegiales and North Chacarita real estate, Buenos Aires

Similar to Villa Crespo, these two neighbourhoods are right next to Palermo and are set to see good growth in the years ahead, regardless of the market as a whole. Colegiales is more developed than Chacarita, but Chacarita has more upside.

Many of the artists and Bohemians are moving to these two areas as they got priced out of Palermo. With them they took theaters, eclectic bars, bookstores, etc. Digital nomads started moving in. Gentrification is just beginning here, but is happening at breakneck pace.

Investing in Palermo Chico real estate, Buenos Aires

Triple A prime real estate. It has it all; the gorgeous architecture, the embassies, the visible wealth, the trees, the parks, etc. This area is not going away. It will always be prime Buenos Aires real estate. This neighbourhood is a wealth preservation play.

Investing in Palermo Botanico, Palermo Norte, Palermo Zoologico, Buenos Aires

These are more established areas of Palermo compared to Palermo Soho and Palermo Hollywood. The residents are a bit older, and prices higher. Overall there is less upside. But it definitely feels more upmarket, quiet, and safer. I don’t see Airbnb doing too well with the neighbors in these areas, same as in Recoleta. The architecture is not the prettiest, but it is clean, the buildings are well maintained, and the restaurants and cafes are upmarket. This is a very family-oriented area.

Investing in Belgrano real estate, Buenos Aires

Belgrano ranks well in Buenos Aires for upper middle-class living. It is close to Palermo and main areas, but has a much more “neighbourhood” vibe though I disliked its inconsistency. Some streets very extremely pretty and calm, while others were quite ugly.

A lot of expats end up living here because it is decent and relatively affordable. More precisely, thousands of Russians have moved to Belgrano, fleeing war and coming down to Argentina for birth tourism. This is their main base. I would absolutely not do short term rentals here. You either buy for lifestyle or for the long term rental market.

Buying real estate in the center of Buenos Aires / San Nicholas / Montserrat

Beautiful historical real estate. This neighbourhood, along with Recoleta and Palermo Chico, represents what tourist go to Buenos Aires for architecture-wise. The only issue, and not a small one, is that well-off people don’t quite want to live here. Sure, they have offices and come here to work, but it is not the safest area and there isn’t much to do at night.

So yes, you can buy some amazing residential real estate, but you’ll have to take a cab every evening to go hang out in decent places. I can imagine some some specific streets getting better over time, but finding tenants would not be easy. However, if you want the maximum amount of square meters or square feet of beautiful historical real estate for a set amount of dollars, then this is where you should go hunting.

Avenida de Mayo, in front of Congress, is particularly beautiful. Nearly every single building there is absolutely stunning. But, it gets dodgy, especially at night.

Investing in Las Cañitas real estate, Buenos Aires

This area is almost never discussed by foreigners, yet I found it extremely appealing. It is just around the corner from the Polo grounds and is developing extremely fast. A massive luxury tower is being built. Public parks are being redone, and many restaurants and bars are opening.

This one of the areas where I made an offer, but the deal blew up.

Investing in Recoleta real estate, Buenos Aires

A classic of Buenos Aires. In some areas one could almost believe one is in Paris if it weren’t for how old everyone looks. The neighborhood is absolutely gorgeous, but the crowd has not evolved over the years in the sense that it is heavily populated by older people. It would be a terrible place to run an Airbnb operation neighbor-wise.

But this is the Buenos Aires that many people love. It is fairly expensive, and all these beautiful apartments require extensive renovations. As the market goes up, this area will inevitably go up as well. It is clearly a prime area. Your target tenants would be upper class locals or a foreign family.

Investing in Retiro real estate, Buenos Aires

I almost made an offer on an entire building with a group of friends, but we felt it was too risky going this big this early. But objectively, at just above $1,000 per m2 for an entire historical building, it was a steal.

Buying a normal apartment in Retiro comes at a small discount to Recoleta, but with the caveat that less people want to live there due to higher crime and proximity to the Centro. It’s unfortunate as the architecture is just as beautiful as in Recoleta.

Venturing North of Buenos Aires

Venturing north of Belgrano there are two neighbourhoods worth looking into.

Nuñez, still within Buenos Aires city limits

I see this neighbourhood as overrated. It is almost as expensive as Belgrano, but feels significantly inferior. Yes, it is close to town with the train. Yes, there are pretty streets. But overall it feels less premium, less well put together. Not that it’s a bad area at all, but the price difference between Belgrano and Nuñez should be greater to justify one investing in Nuñez.

Vicente Lopez, first city north outside of Buenos Aires proper

I went to visit some friends of mine there. They used to stay in Buenos Aires proper but then realized they could move to Vincente Lopez, live in a superb, calm area with parks and a nice promenade along the water, and not pay more in rent, yet still be very close to town thanks to the direct and regular train service.

This is a beautiful area in terms of lifestyle. I am sure prices will rise here as fast as they will in other areas of town. Why? Deregulation of the economy makes the rich richer fast, as well as helping the less well-off in the long run. If the reforms continue, big money will seek to bid up these beautiful homes. I wouldn’t expect interesting rental yields in such an area though.

What are the returns on Buenos Aires real estate market?

To be extremely clear, there isn’t any rental yield to be made in Buenos Aires. Especially after the rental reforms, the market is flooded with rentals which have depressed rental returns. There is also a oversupply of Airbnbs in Buenos Aires, especially of smaller units.

Investing in Buenos Aires real estate is purely a capital gains and geographic diversification play. The below case studies illustrate this point very clearly. This holds true for all the central or near central neighbourhoods that foreigners like to invest in, and spend time in.

However if you are willing to invest in very “Argentinian” neighbourhoods, the rental yields on long term rentals are a lot higher. Bear in mind that there isn’t any Airbnb market in such areas.

Full case study of two real estate investments in Buenos Aires

I went with my Buenos Aires real estate buyers agent Max to check out two apartments. One was in the center, and the other in Palermo Soho. We ran all the numbers to calculate a net ROI for both long-term rentals and short-term rentals.

Challenges of buying real estate in Buenos Aires

I feel I don’t need to mention all the risks associated with buying in Argentina because they are so conspicuous. Argentina is littered with the bodies of foreign investors who thought they would strike it rich in Argentina.

This being said, if Milei pulls off his reforms, then making substantial capital gains is near guaranteed.

The challenges of buying real estate in Argentina are rather logistical and administrative. 60 years of socialism have resulted in everything being more complicated than they should be.

The people (sellers) are also more complicated than they need to be. Socialism does not encourage pragmatism.

What are the steps to buy real estate in Argentina?

Step 1: Get a CDI (non resident) or DNI (if resident) which is essentially a tax number which is mandatory to buy real estate in Argentina. Having such a number does not make you a tax resident. It is purely administrative.

Step 2: Choose a realtor to work with. Whether you have a realtor representing you or no realtor won’t make a difference because in any case you’ll have to pay realtor fees. You are much better off having a buyer’s agent make the calls, do all the leg work, advise you, etc than being on your own. Personally I really enjoyed working with Max, my real estate agent in Buenos Aires.

Personally I gave power of attorney to my Buenos Aires realtor Max:

Step 3: You make an offer with a “Reserva” and a deposit of between $1,000 and $10,000 cash.

Step 4: Choose an “escribano” (a notary public) who will take care of the transaction. The escribano is in charge of checking the background of the property and doing all the legal due diligence. The buyer gets to choose the escribano, which is really important. You need a good one. Max has been in the business for decades and works with a team of competent escribanos to represent his clients’ interests

Step 5: Sign the Boleto, which is the purchase contract. At this stage the realtor also gets paid. Typically the down-payment is 30% of the price of the property, and if the buyer cancels the sale then the buyer owes the seller double that amount.

Step 6: The escritura takes place a few weeks later, which is the the title deed transfer. The rest of the money gets paid at this point.

How to transfer money for a real estate purchase in Argentina

This is a very complicated topic, with significant pros and cons to each method, and many moving parts.

Essentially, you can pay in crypto, in physical USD, by bank transfer.

You can bring the money into the country through crypto, through bank transfer, or through exchanges of bonds.

The rules and regulations keep changing, as well the way to bring money into the country as well as the various exchange rates.

My biggest piece of advice is to do it as legally as possible, including money transfers, so that you have a good paper trail of the transaction, which will most likely be needed when you sell the property later on and wish to minimize capital gains taxes.

When you are lucky, the sellers have an account in the US, Spain, Panama or Uruguay, which makes the transaction a lot easier, less stressful, and cheaper.

Taxes on real estate in Argentina

When you buy real estate you are expected to pay for:

- Realtor fees (Max charges 4%+ VAT),

- Escritura fees (typically 2% + VAT)

- City tax of 3.5% (for Buenos Aires) split between buyer and seller

- A national tax of 1.5% paid by the seller does not apply anymore since July 2024

- About 1% in expenses paid by the seller to the escritura

- Transfer and exchange fees paid by the buyer which can typically be 2-3%

Other notable taxes on real estate in Argentina:

- Capital gains taxes to be paid upon selling, of generally 15% taking into account expenses.

- Yearly property tax

- Taxes on rental income, at the standard personal income tax rates.

Who should invest in real estate in Buenos Aires right now?

This is a capital gains play based on the Milei reforms. The market is looking very bullish and now is the moment to enter. But this is not a market for the faint of heart; transactions are complicated and you need a very good realtor in Buenos Aires. I made multiple offers and all of them did not pan out because of various complications on the sellers’ side.

The market is best suited for:

- Speculators aiming for long term capital gains, who are patient and who understand the illiquid nature of the Buenos Aires real estate market

- Lifestyle investors – Buenos Aires remains one of the world’s prime cities

This market is not suited for cash-flow investors. Both the long-term and short-term let markets are over-saturated for now, resulting in generally low rental yields except in some very local neighbourhoods.

Get in touch with Max, my real estate agent in Buenos Aires

Max is Argentinian American, originally from Texas. He specializes in helping foreigners invest in the Buenos Aires real estate market and offers property management services through his full service agency. Frankly, there’s no good reason not to use Max. The alternative is risking a frustrating experience with local agents who lack the expertise to handle international real estate transactions.

Working with Max provides a major advantage over trying to navigate this alone or with a typical local agent. Invest in the beautiful Buenos Aires real estate market with his deep experience and local connections to the process infinitely smoother. You can find more information about his Buenos Aires realtor services here.

FAQ

Is Buenos Aires real estate a good investment?

Investing in Buenos Aires real estate is primarily a capital gains play right now rather than a cash-flow focused strategy unless you go into very local areas. The market is in a bull market thanks to recent reforms, but it’s not for the faint of heart – navigating the complexities of transactions requires patience and working with the right local experts. That said, for risk-tolerant speculators, the potential upside could be substantial.

What is the outlook for real estate in Argentina?

As far as the outlook for Argentine real estate, and specifically the market in Buenos Aires, I’d say the future is looking quite bullish overall. The economic reforms being pushed through by President Milei are serving as key catalysts to draw capital back into this market.

How much does a house cost in Buenos Aires Argentina?

There is a wide range of property values across different neighborhoods in Buenos Aires. Prices can vary from over $4,000 per square meter in premium areas like Puerto Madero down to under $1,000 per square meter in less developed parts of the city. There are investment opportunities across various price points depending on the location and property type.

Can foreigners buy property in Buenos Aires?

Yes, foreigners are able to participate in the Buenos Aires real estate market. The process involves obtaining the necessary tax ID (CDI for non-residents) and working closely with a local real estate agent and notary public (“escribano”) to navigate the administrative requirements.

Services in Argentina:

Articles on Argentina:

- Buenos Aires Real Estate Market: 2026 Investor Guide

- Real estate Bull Market in Buenos Aires – how to invest?

- Removal of capital controls in Argentina – impact on Buenos Aires real estate market

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.