One of the few, truly global cities, Paris has been the “capital” of Europe for centuries. Surely, making a real estate investment in Paris is wise and would count as a great store of value.

Paris is beautiful and well connected. Paris is a center of culture and education. It has it all right? Maybe it does, but not for the non-resident real estate investor.

Here are 14 reasons why your hard-earned capital should stay away from Paris.

Table of Contents

1. Unaffordable market for locals

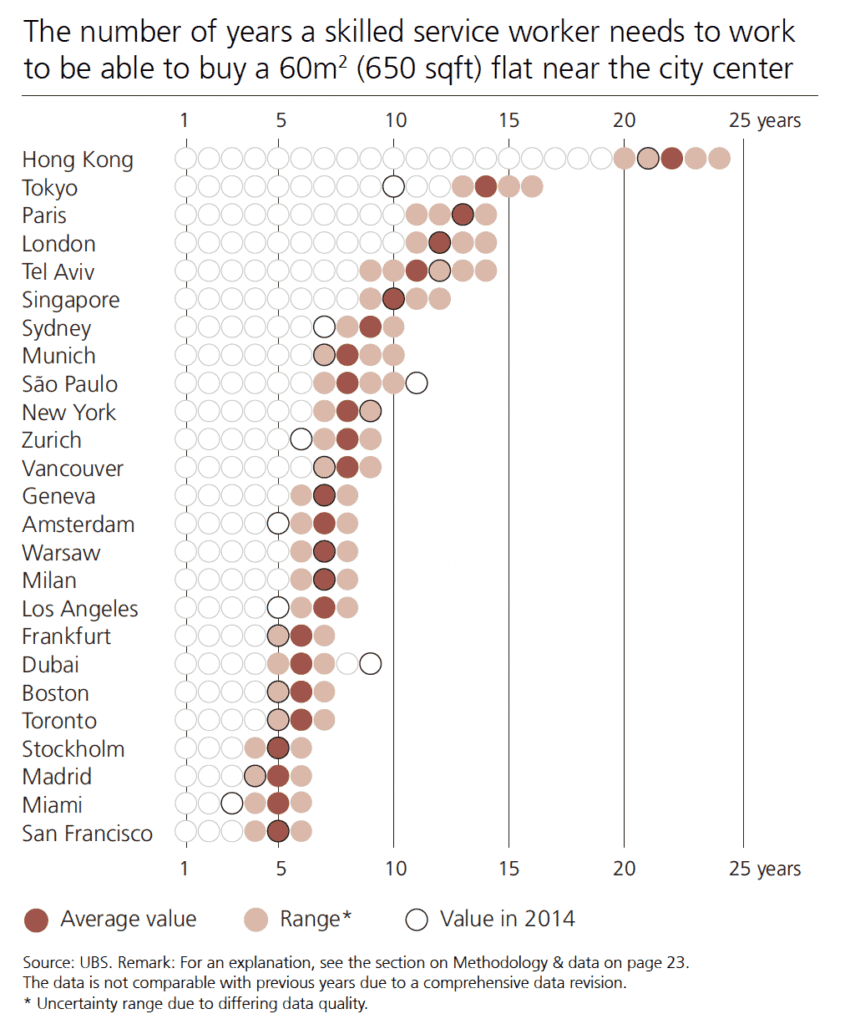

A typical 60m2 apartment is the equivalent of almost 14 years of average salary, which is a terrible price/income ratio. New York for example, hardly a cheap real estate market by any measure, stands at about 8 years for the same ratio. If local people cannot afford to buy, who can? Only speculators and people willing to pay more than the other guy.

2. Extremely low interest rates for locals

For close to a decade in the ’10s Locals had access to fixed sub-1% interest rates with, in some cases, 0% down, so leveraged up to 110% to include buying costs. Non-residents could also get leverage but interest rates were typically two times higher and one must provide at least 30% down.

Prices increased substantially as a result and now the market is deleveraging, and has been for the last two years or so. I expect this phase of consolidation to last for a few years.

3. A high price point

At over 10,000 euros per square meter, you’ll need a large cash outlay, for not much. Typically a 30m2 studio in a good area would easily be 13,000 euros per m2.

With 390,000 euros my money can go much further in other markets internationally. You can find a “deal” in Paris at 8500 euros per m2, but you’ll end up in an area with crime and refugees camping out on the streets. 8500 euros per m2 gets me a view of the Budapest parliament on the main square, a true triple A location. What would you rather get? What is a better store of value?

4. Low gross yields for long term rentals

In the cheaper arrondissements, you’ll get about 3.4% to 3.6% gross yields, and in the better arrondissements between 2.8% and 3.2%.

5. Extremely low net yields

Pay for your property tax (easily one month of rental income), your building common charges (the landlord pays for these), agency fees to find tenants & manage them, as well as maintenance costs, insurance, and you can slash your gross yield by half. Expect to earn about 1.4% to 1.8% net yield before income tax.

And I’m being nice here, in reality labour is extremely expensive (due to taxes of course) so your maintenance costs will shock you. Redoing a bathroom can add up to a year’s rent for the average place.

6. Yields that are likely to become lower for your real estate investment in Paris

- Property taxes in Paris went up 83% between 2014 and 2023. The “taxe d’habitation”, which is a tax that occupiers of accommodation pay, was recently phased out by the government. Instead, they plan on “reevaluating” the property tax over the coming years. The burden of taxation on property will further shift to the property owners.

- The government is working on various schemes such as a centralized system for tenant deposits. You won’t control your tenant’s deposit anymore; a government institution will, and will charge you for the privilege.

- More green laws on insulation, etc, which owners will need to pay for. One must now also pay for a “regulatory check” in between tenants, imposed by the government. Some company comes into your apartment and points out all the features in the apartments that are not in line with the ever changing regulations. And of course, need I even add, you will be charged for that privilege.

- Rent control is now in place in Paris since 2019.

7. A city that is run by Socialists

All the above was enacted by Socialists, and Paris is staunchly Socialist. As the Paris Government increasingly spends on social housing, more voters aligned with Socialist values move in.

Think what you want of European Socialists, but they have never been a real estate investor’s friends.

8. Bad demographics

The city of Paris is actually losing inhabitants, as skyrocketing housing has pushed normal tax payers away. The city lost almost 100,000 inhabitants in the last 12 years and is expected to lose of to 200,000 people by 2040.

This does not take into account the influx of social housing tenants moving in, so the shift is even worse in reality. If taxpayers cannot afford to live there anymore, how is this going to be good for your yields long term? Something will need to take place. Either people will become richer, or landlords will get squeezed. Do you reckon people will become richer in a country with 100% debt to GDP and trillions of Euros in unfunded liabilities?

9. Transaction costs are very high for a real estate investment in Paris

Notary public costs and various taxes amount to about 8% of the purchase price, paid for by the buyers. Then, when selling, you’ll also have to pay 3% or so agency fees and capital gains taxes. Just to get your money back you’ll need prices to increase by 11%.

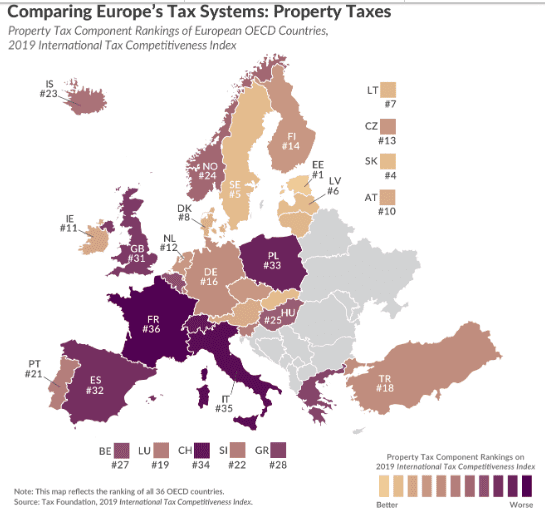

10. The highest tax burden on real estate in the OECD

Let me quote the Tax Foundation:

France, by contrast, ranks lowest in the ITCI’s property tax component. In addition to relatively high real property tax collections, France imposes taxes on net real estate wealth, inheritances, real estate transfers, equity of banks (so-called systemic risk tax), and financial transactions.

11. Non-resident real estate owners get plundered by taxes

Expect to pay a flat tax of 33% on net income.

So now

| Gross yield | 3.3% |

| Divide by half to count running costs |

|

| Net yield | 1.65% |

| Pay your 33% flat tax |

|

| Best case scenario net yield | 1.09% |

- And what if you have a month in between tenants? Lower your yields.

- And what if your tenant stops paying and you can’t kick him out (a possibility in France with its strong tenant protection laws)? Lower your yields.

- And what if any of the yield depressing trends due to the socialists materialize (which they will): lower your yields.

In reality you can probably expect your yields to hover around 0.7% or 0.5% for the nicer arrondissements. If you want to leave your apartment empty, there is a special tax on secondary homes.

12. Airbnb is public enemy number one

The long term yields are too low for you, so you want to do Airbnb with your real estate investment in Paris? Tough luck, the government keeps raising taxes on short-term lets and even limits the number of days per year (120 days) that you can rent out your place on Airbnb.

The city has a special task force dedicated to catching delinquent landlords and handing out punitive fines.

13. And in the event you make capital gains on your real estate investment? You’ll get taxed to death

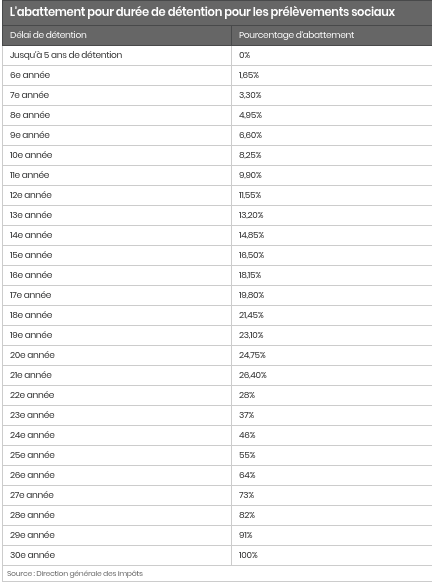

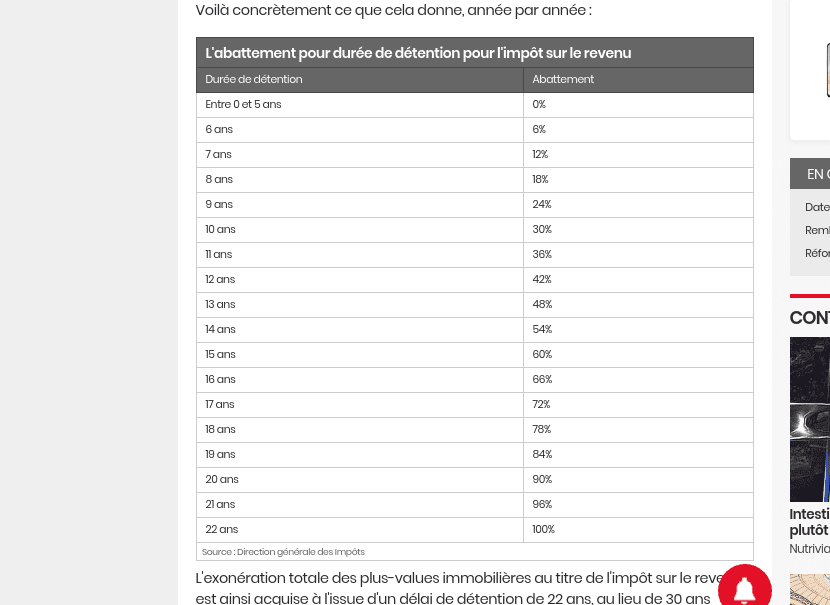

Capital gains taxes on property in France are extremely high, and phase out over 22 years, but weighted towards the end. And don’t forget the social security taxes on your capital gains, you have to pay those too, and they get phased out over….30 years, also geared towards the end. Right now there are discussions to remove the phasing out period and to impose a flat tax of 33% on capital gains.

14. And guess what? Even more taxes

You thought those terrible yields and taxes are the last of it? There’s more!

- France has the world’s 3rd highest inheritance taxes which you will have to pay as the real estate is located in France.

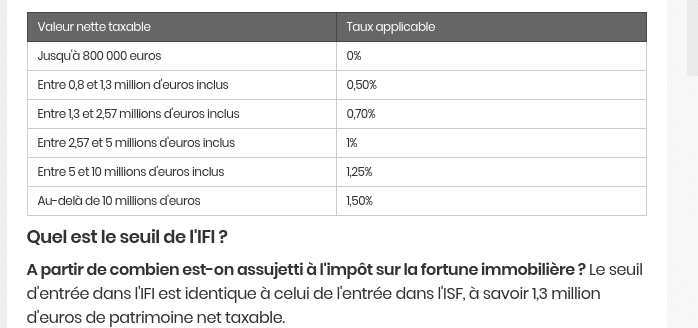

- There’s a wealth tax for those who have over 1.3 million Euros of real estate in France. If you pass that threshold, you will have to pay a wealth tax of the equivalent of 0.5% of the net value retroactively from 800,000 euros to 1.3 million euros, and from there 0.7% and even more.

So yes, if you buy expensive, luxury real estate in Paris and have to pay the Wealth Tax, you easily end up making close to 0% yield.

Conclusion: should you make a real investment in Paris as a non resident?

With yields like this, the only reason to invest is for:

- Speculation for capital gains. Sure the European Central Bank can continue printing money and prices can continue rising, but you’ll start making money only after prices rise 11%, and after that you’ll have very high capital gains taxes.

- A store of wealth because “Paris is Paris”. Apart from a debt fueled bubble none of the metrics are positive. And why would you want to store your wealth with European socialists? Historically, this has been a terrible mistake. People also invested in London as a store of wealth, but prices have been dropping since 2016.

Objectively, the only reasons to own real estate in Paris are for lifestyle purposes, and to own legacy property without a core focus on returns.

So what should you do instead of a real estate investment in Paris?

There is a World of Opportunities out there. Higher yields, higher capital gains, welcoming governments and much better value. Just be open. My blog mentions many such opportunities.

If you want to read more such articles on other real estate markets in the world, go to the bottom of my International Real Estate Services page.

Subscribe to the PRIVATE LIST below to not miss out on future investment posts, and follow me on Instagram, X, LinkedIn, Telegram, Youtube, Facebook, and Rumble.

My favourite brokerage to invest in international stocks is IB. To find out more about this low-fee option with access to plenty of markets, click here.

If you want to discuss your internationalization and diversification plans, book a consulting session or send me an email.

As a Paris resident i’d say you got very good points. We are very likely in the midst of a massive bubble fed by overseas investors and over leveraged local households. I’ve indeed witnessed number of people around me getting 35 years mortgages with 0% down payment which calls for caution.

A couple of points you didn’t mention which are essential are rent increase and capital appreciation. Appreciation has been around 70% over the past 10 years which is decent but subpar compared with major US or Chinese metros. Rents have only increased about 20% which is basically the inflation, resulting in extremely low yields.

Considering the overall poor performances, the very high taxes and the government’s hostility toward real estate, i agree with your analysis and don’t see any valid reason for a foreign investors to invest in Paris.

Very good points. Thank you for sharing Cedric.

I certainly hope you and your readers stay out of Paris for our sake –– the people who live here and love the city. Our clients, who have invested in Paris, have done so much more for the pure enjoyment than for the investment, although their investments have paid off royally in spite of your naysaying. Just like you don’t come to Paris for the weather, you don’t come to Paris to get rich. So, if that’s all you want to do, get rich, then stay away from Paris and her socialist democracy, her taxes (property taxes are 1/10 of what they are in the US) and her strict property laws. But, if you want to have a rich cultural life and enjoy the money you have made, then Paris is as safe an investment you can make. My own property in Paris is worth 6 times what I paid for it in 2000 and as a result, was able to leverage buying four more properties based on my initial investment. Where else can you do that and have so much fun doing it?

The forecast regarding the Green Laws and minimum required insulation was spot-on, it’s actually causing a housing crisis in France and especially in the Paris area. About 30% of rental properties are forbidden from being rented out unless landlords make expensive renovation work. As usual Socialists are completely clueless and running the place into the ground. I expect the authorities to backtrack on that rule though, because it has made it too hard for people to find accommodation and is causing an uproar.

France will have to sink much deeper before it can even hope to recover.